Dollar slides, gold shines after soft US labor market data

Softer US jobs data fuels rate cut hopes

Global markets are set to close the trading week in a cheerful mood after another round of incoming US employment data pointed to an ongoing softening in the labor market, fueling hopes that the Fed might cut interest rates sooner than anticipated.

Applications for unemployment benefits in the United States rose sharply last week, which is usually an early sign of workers being laid off. This is another indication that the jobs market is losing momentum, following an uptick in the unemployment rate last month and warnings from business surveys that companies have started to reduce workforce numbers.

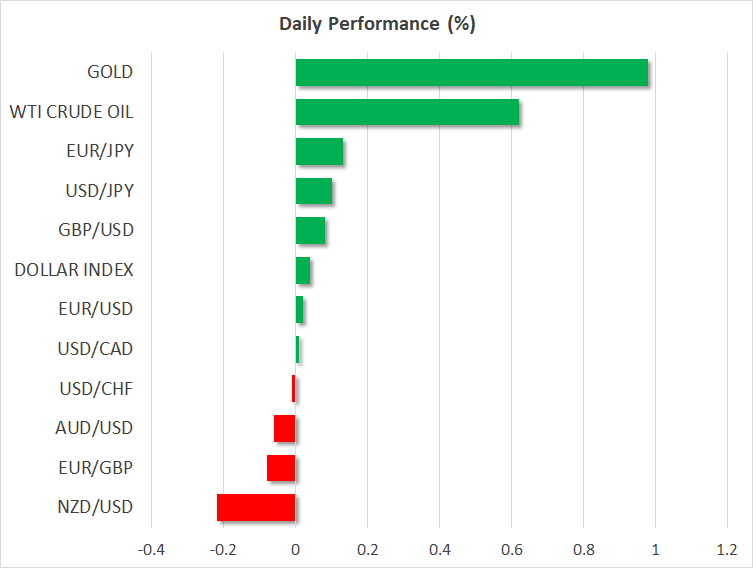

The dollar was slammed lower as traders interpreted the cracks in the labor market as a harbinger of cooler inflation ahead, which in turn would allow the Fed to cut interest rates faster. Markets are currently pricing in almost two rate cuts for this year, starting in September.

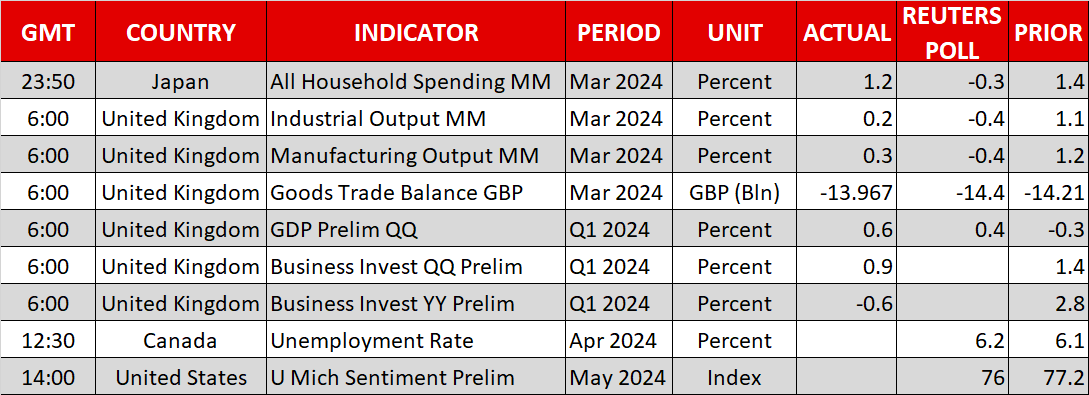

Looking ahead, next week will be critical for the US dollar, featuring the simultaneous release of the latest retail sales and CPI inflation prints on Wednesday. It is a rare phenomenon for two top-tier US economic datasets to be released together, which sets the stage for heightened volatility in the markets.

Gold and stocks advance

Gold prices resumed their winning streak as investors became more confident that Fed rate cuts are back on the menu for this autumn. The precious metal is headed for weekly gains of over 2.5% and is currently trading at a similar distance from its record highs.

A perfect storm is brewing for gold. Speculation of Fed rate cuts has returned and central banks continue to buy the precious metal at a relentless pace, with sovereign purchases in the first quarter being the strongest to start any year on record. As long as these forces remain in play, the outlook for bullion remains bright.

Shares on Wall Street also advanced as rate cuts came back on the radar, with the S&P 500 closing less than 1% away from its own record highs. Corporate earnings have also surpassed analyst estimates so far in this reporting season, which alongside the retreat in yields and juicier buybacks, has helped calm concerns around stretched valuations and paint a rosier outlook for equities.

Sterling goes on a rollercoaster ride

The Bank of England kept interest rates unchanged yesterday, as widely expected. Sterling fell in the aftermath as the vote count was 7-2, with one more official voting for an immediate rate cut. In addition, the Bank revised down its inflation forecasts, which was taken as a signal that rate cuts are drawing closer.

Nonetheless, Cable managed to recoup all its losses to trade higher once the dust settled, with some help from a falling dollar and the risk-on mood in equities. Adding more juice to the rebound was the GDP print for the first quarter earlier today, which came in stronger than expected, confirming that the UK economy has escaped the shallow recession it fell into last year.

As for today, the spotlight will fall on the latest round of Canadian employment data, the US University of Michigan consumer sentiment survey, as well as a litany of Fed speakers that includes Bowman, Logan, and Barr.