Eurozone industrial production: a meaningful boost in September

Eurozone industrial production: a meaningful boost in September

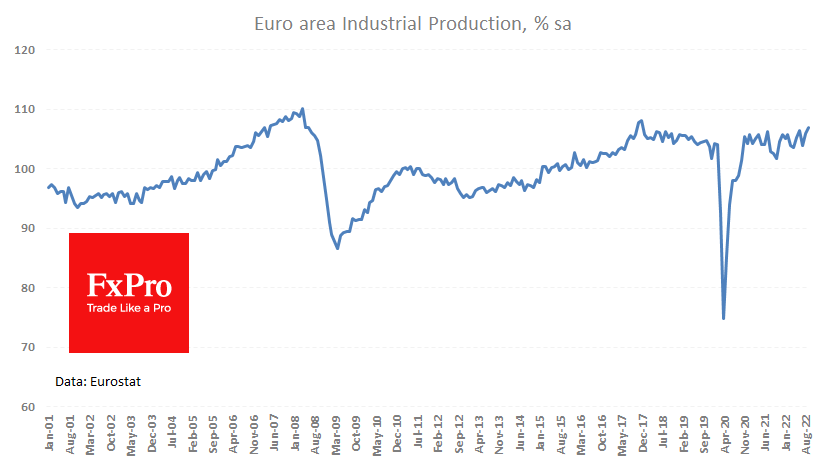

According to the latest estimates, Eurozone industrial production added 0.9% for September and 4.9% y/y. The figures are much better than the expected +0.1% m/m and 2.8% y/y, showing that the euro-region economy is in no hurry to slip into recession despite high energy prices.

The seasonally adjusted index was at its highest level in almost five years, remaining within the framework of multi-year global stagnation. The apparent reason for the sector's resilience is the massive backlog of orders formed on the back of the easing of pandemic restrictions.

There are two sides to the solid industrial production figures in the Eurozone. The strong figures for September create a high base from which a further decline may seem particularly deep and painful. On the other side, they show the relative vitality of the European economy and its positive reaction to the collapse of the euro.

In absolute terms, the Eurozone recession may not be as deep as feared a few months ago, despite high energy costs and a sharp rise in the ECB rate.

We note that commodity prices have fallen significantly in recent months. A relatively strong economy by the start of the extreme hike cycle forms more room for an ECB rate hike, which is suitable for the euro.

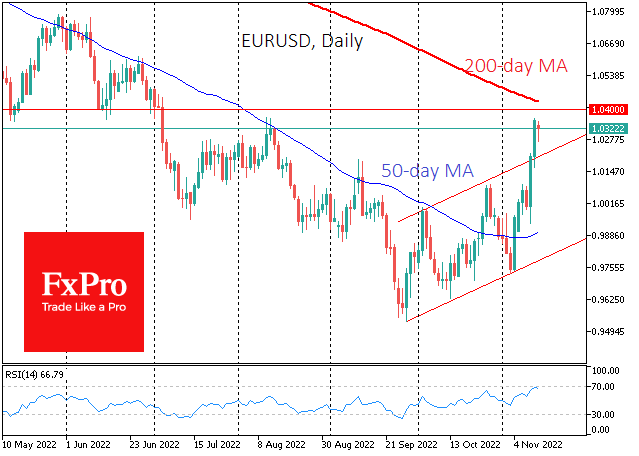

The EURUSD will likely face a few obstacles for the upside up to the area of 1.0400-1.0430, where the 200-day MA and the support of the pair in May-June are concentrated. Here, the pair could face local profit-taking, and there will be a fierce tug-of-war between the dollar bulls and the bears in the markets.

By the FxPro Analyst Team