New signs of slowing inflation in Switzerland

New signs of slowing inflation in Switzerland

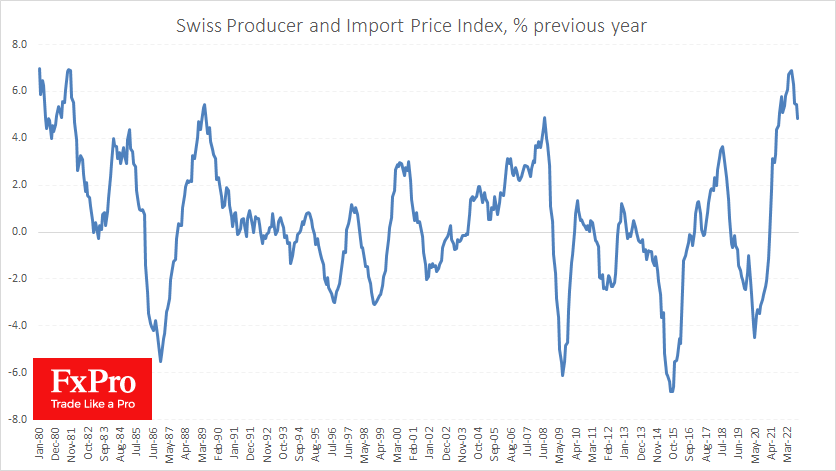

The Swiss Producer and Import Price Index was virtually unchanged in October, slowing down in annual terms to 4.9% against 5.4% a month earlier and against a peak of 5.9% in June.

In contrast to its larger eurozone neighbours, the producer and import price index is at the same level as in June. The USA has the same result, while in the Eurozone they rose by 10.5%, Germany by 16%, and the UK by 2%. From this point of view, Switzerland’s inflation is the least problematic among almost developed economies with popular currencies.

However, it is noteworthy that members of the Swiss National Bank remain hawkish, warning yesterday of a willingness to intervene further in the market and noting that they continue to write inflation down as a threat.

Historically, Switzerland has been characterised by low domestic inflationary pressures for various reasons ranging from capital inflows into the domestic banking system to a chronically substantial trade surplus and a high standard of living. And we can see that the central bank has not abandoned its values.

Indirectly, the rhetoric with the monetary watchdogs' concern about inflation pushes the markets to buy the franc in anticipation of further currency interventions and an interest rate hike in the middle of next month.

By the FxPro Analyst Team