Uncertainty remains high at end of rollercoaster week for the dollar

Trump’s tariffs are back on, for now

Just a day after a US court for international trade blocked most of the tariffs imposed by President Trump since his return to the White House, a federal appeals court yesterday reinstated them, confusing markets even more in a week where there’s been plenty of back and forth.

The US Court of Appeals has given the plaintiffs until June 5 to respond and the government by June 9. The case is likely to head to the Supreme Court if the appeals court does not grant the Trump administration a permanent stay against the initial ruling.

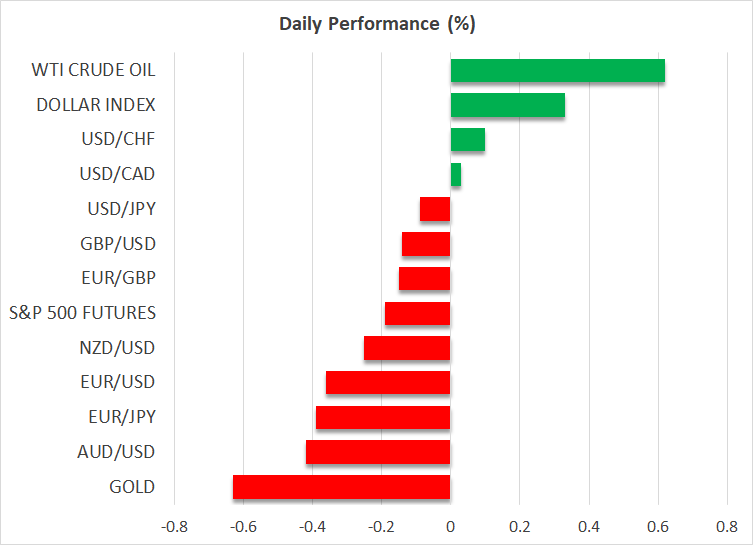

Dollar takes the brunt of tariff confusion

The US dollar reversed sharply lower, more than reversing its earlier gains on the back of the trade court’s decision and risk assets also retreated. Even before the appeals court paused the ruling, investors were questioning whether this would mark the end of Trump’s trade tirade as the White House hinted it could use different laws to implement new tariffs without the consent of the Senate.

In the end, the efforts by the small businesses that filed the lawsuit to put a stop to Trump’s tariff war only added to uncertainty in the markets, briefly generating false hope.

Interestingly, most of the court ruling-driven volatility has been centred on the US dollar, with stocks taking a somewhat more longer-term view on the situation.

Fresh doubts about US economy

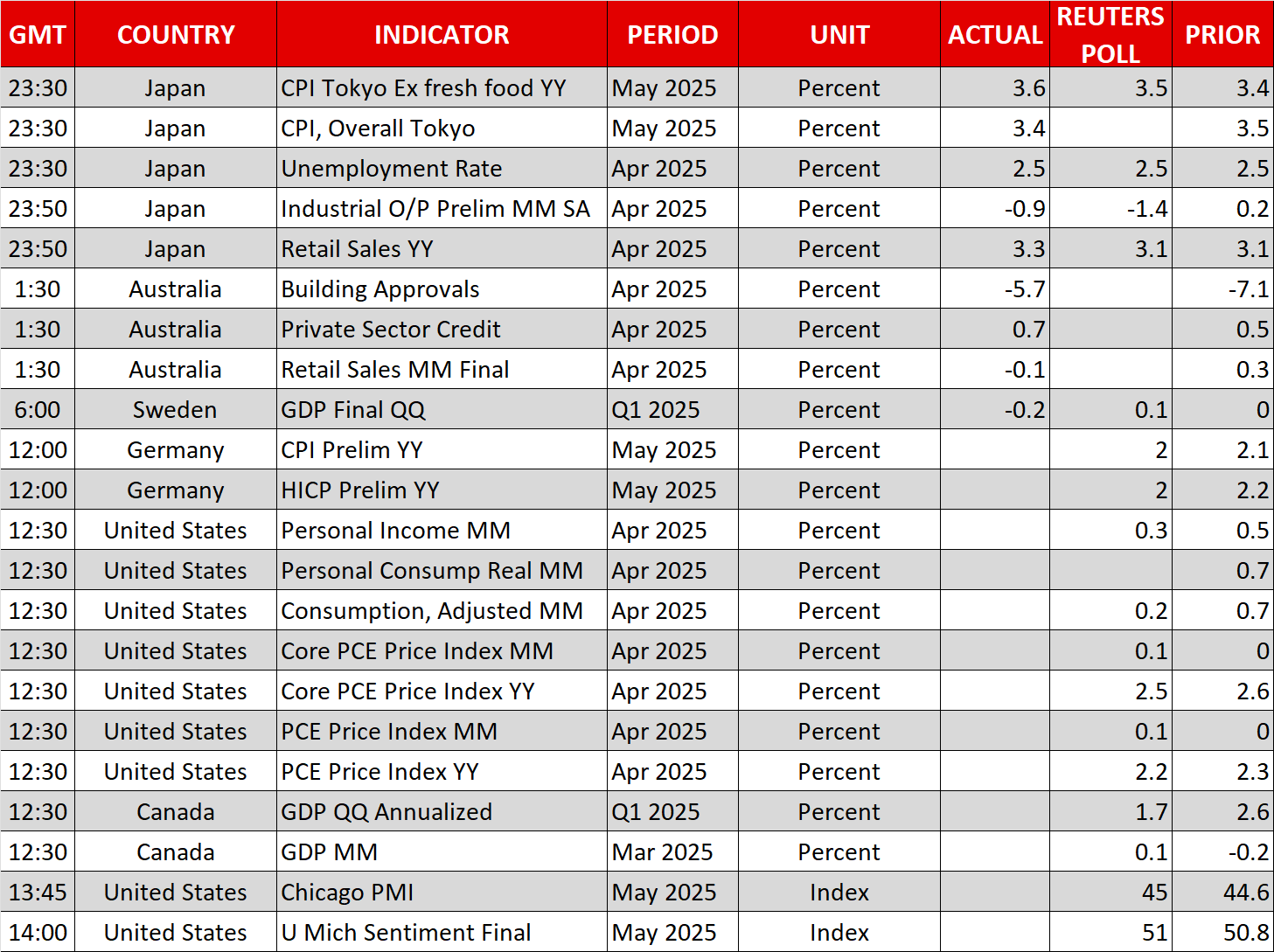

However, the tariff decisions weren’t the only headaches for the US currency yesterday. The dollar came under pressure after revised GDP readings for the first quarter showed that consumption slowed more than initially estimated and core PCE was also a touch softer. Moreover, weekly jobless claims jumped unexpectedly and pending homes sales slumped in April, raising speculation that the Fed may have to cut rates sooner than expected.

Although there doesn’t appear to be any change in the rhetoric coming from the Fed as of yet, with San Francisco Fed chief Mary Daly describing the labour market as being in “solid shape” yesterday.

The focus now is on the PCE inflation and personal consumption numbers due at 15:30 GMT, as well as more Fedspeak from the likes of Bostic and Goolsbee. Any weaker-than-expected prints in either core PCE or personal spending could set the dollar on course for a fifth straight month of losses.

Yen firmer on data, US trade talk progress

With hopes of a quick resolution to the trade war more or less dashed, there was further disappointment for the markets on Thursday after Treasury Secretary Scott Bessent told Fox News that trade talks with China are “a bit stalled”.

However, negotiations with Japan appear to be going better, with Bessent due to meet with Japanese officials on Friday for more talks. Any surprise announcement of a deal in the coming days would likely bolster both the dollar and the yen, though more so the latter as it would boost the prospect of a rate hike by the Bank of Japan.

The yen is broadly higher today after preliminary CPI data for the Tokyo region pointed to an uptick in underlying inflation, which rose to a two-year high in May. Remarks from BoJ Governor Ueda about strong wage growth earlier today further suggested that a rate hike remains firmly on the table.

Still, long-term Japanese yields edged slightly lower and sovereign bond yields globally were also subdued on Friday.

Wall Street survives tough week

The pullback in yields has offered some relief to equity markets this week, potentially helping Wall Street to shrug off the latest tariff drama and head for a positive close to the week and the month.

Upbeat earnings by chip giant, Nvidia, contributed to the recovery, particularly for the tech-heavy Nasdaq, and there could be a further boost by Dell today after the company impressed with its earnings outlook overnight.

Gold remains on the backfoot

Despite the rollercoaster week led by the tariff headlines, overall volatility has been surprisingly contained and equities have maintained their cautious optimism, and this is weighing on gold.

The precious metal looks set to finish May with just marginal gains and is trading slightly below $3,300 today.

Although gold remains above the latest uptrend line, it’s also been forming lower highs since April. Investors would probably have to see a much more serious escalation in trade tensions or some fresh trade deal announcements to snap gold out of its consolidation phase.

.jpg)