NZD Tumbles After RBNZ Meeting: Further Decline on the Horizon?

In its February meeting, the Reserve Bank of New Zealand (RBNZ) opted to keep its key interest rate (the Official Cash Rate or OCR) unchanged at 5.5% - their highest level since the 2008 financial crisis. However, due to the bank's adoption of a more dovish tone than anticipated, the NZD has experienced significant selling pressure. Let's delve into the reasons behind this decline and explore what to anticipate for the NZD moving forward.

Why did the NZD fall after the RBNZ meeting?

In its latest meeting, the RBNZ signalled a more cautious approach towards further interest rate hikes aimed at curbing inflation, which has subsequently exerted downward pressure on the New Zealand Dollar (NZD).

Market expectations reflected a 25% chance of a rate increase in February and a 50% chance in May before the meeting. Earlier in February, the ANZ bank anticipated that the RBNZ would resume hiking interest rates, projecting a potential increase to 6% by the end of the year, with one hike expected in February and another in April.

However, it's important to highlight that even if the tone adopted by the RBNZ was slightly less hawkish than expected, this doesn't necessarily indicate the end of a high-interest-rate environment. The central bank did acknowledge the importance of maintaining elevated interest rates for a certain period to ensure that inflation steadily progresses towards its target in its statements.

What to expect from the NZD now?

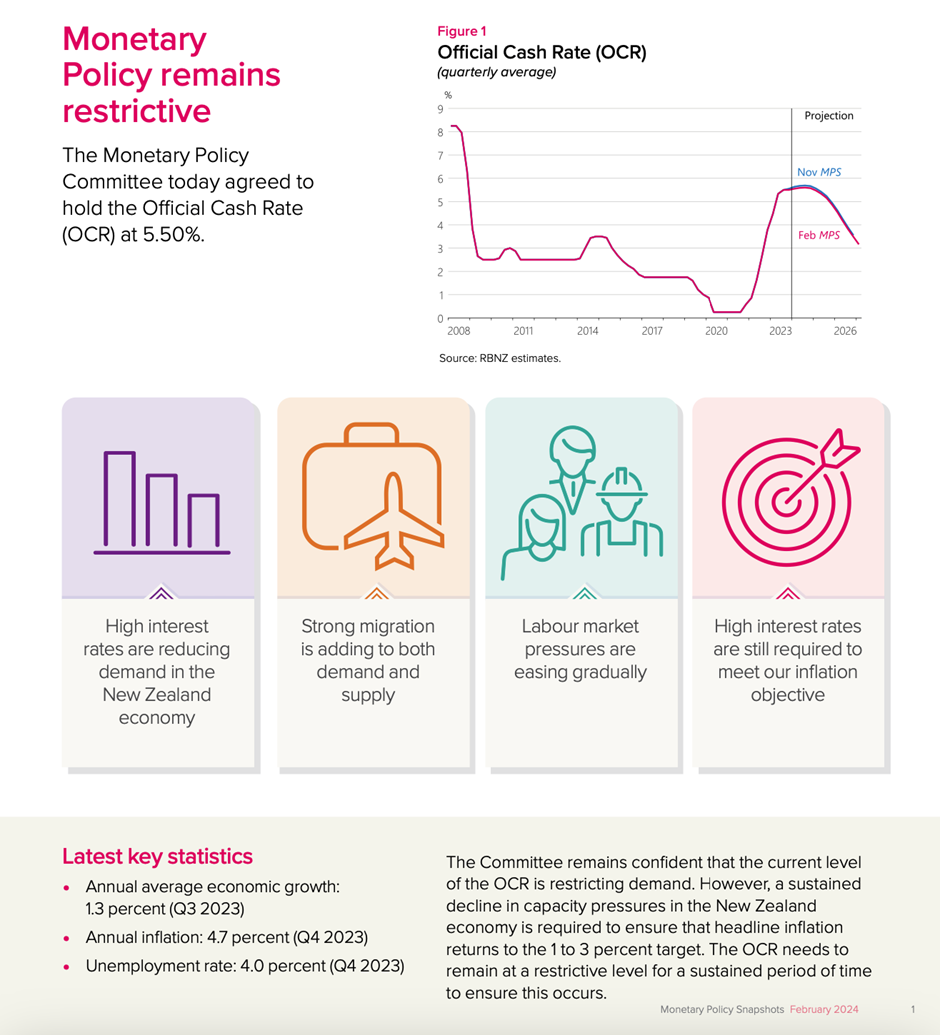

The following February monetary policy snapshot released by the RBNZ sheds light on the various factors that play a role in shaping New Zealand's monetary policy trajectory, thereby impacting the trajectory of the NZD.

One of the primary considerations is the state of domestic indicators, which provide insights into the health of the New Zealand economy. Traders should pay close attention to metrics such as local immigration trends, as population movements can have significant implications for consumer spending, housing demand, and overall economic activity. Additionally, monitoring wage growth is essential, as it reflects the strength of the labor market and can influence inflationary pressures.

Furthermore, global economic trends play a pivotal role in shaping New Zealand's economic outlook and monetary policy decisions. Factors such as fluctuations in energy prices and its influence on inflation levels, as well as interest rate differentials between New Zealand and other major economies, can impact investor sentiment and capital flows, thereby influencing the value of the NZD.

Source: RBNZ

Will the RBNZ be the first one to cut interest rates?

Investors are increasingly considering the RBNZ as a bellwether among other central banks from developed countries, because it was among the first central banks to decide to increase its key rates late 2021 to fight increasing inflationary pressures in the country post-Covid. Now, market participants are trying to determine the timing of the first-rate cuts in the most significant economies to best determine which assets and asset classes to invest in when monetary policy trajectories change.

While some believe that the RBNZ might be the first to vote for a rate cut, others bet on the Swiss National Bank (SNB) being the first to cut interest rates as inflation figures from January were lower-than-expected, which is likely to push inflation well below what the central bank had expected for 2024 if it keeps easing. In its latest growth and inflation forecasts, the SNB expected inflation to move 2% in 2024 (at 1.9%) after registering an average inflation of 2.1% in 2023.

Technical analysis snapshot of the NZD/USD

Between November and December 2023, the NZD/USD pair experienced a notable gain of over 8%. However, this momentum faltered in January, as the Forex pair declined by 3.21%. Throughout the volatile month of February, the pair remained relatively flat, closing at 0.61056. The month saw quite big fluctuations, with the NZD/USD reaching its highest level at 0.62173 and its lowest at 0.60373.

Daily NZD/USD Chart on the 29/02/2024 - Source: Online Trading Platform ActivTrader

After the RBNZ's meeting on February 28th, the NZD/USD pair experienced its most notable daily loss since the beginning of the month, declining by 1.17%.

On the daily chart that you can see above, prices failed to sustain an upward trajectory above the Ichimoku cloud after crossing the chart's twist on February 22nd, following a nine-day winning streak. The recent decline pushed prices below the cloud, as well as below the Kijun and Tenkan lines of the Japanese indicator. Additionally, the Relative Strength Indicator (RSI) moved downward, falling below its neutral level of 50.

It's also interesting to take into account sentiment indicators such as the one provided by ActivTrades if you're using the regulated Forex and CFD broker. As displayed on the left part of the chart, its trader community appears divided on the NZD/USD currency pair, with 47% of traders holding long positions and 53% holding short positions. In the event that the NZD/USD continues to decline, potential support levels to watch for include the zones around 0.60456 and 0.58668. Conversely, if the FX pair moves upward, potential resistance levels to monitor are the zones around 0.61978 and 0.62927.

Are you positioned to take advantage of the next NZD/USD move?

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66-83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ActivTrades Corp is authorised and regulated by The Securities Commission of the Bahamas. ActivTrades Corp is an international business company registered in the Commonwealth of the Bahamas, registration number 199667 B.

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

-362025100.png)

-362025100.png)