Gold's 4200 Level as Bulls and Bears Battle for Control

Discover the latest XAUUSD insights for December 9, 2025, with Ultima Markets' in-depth analysis.

Is the Bull Run Over?

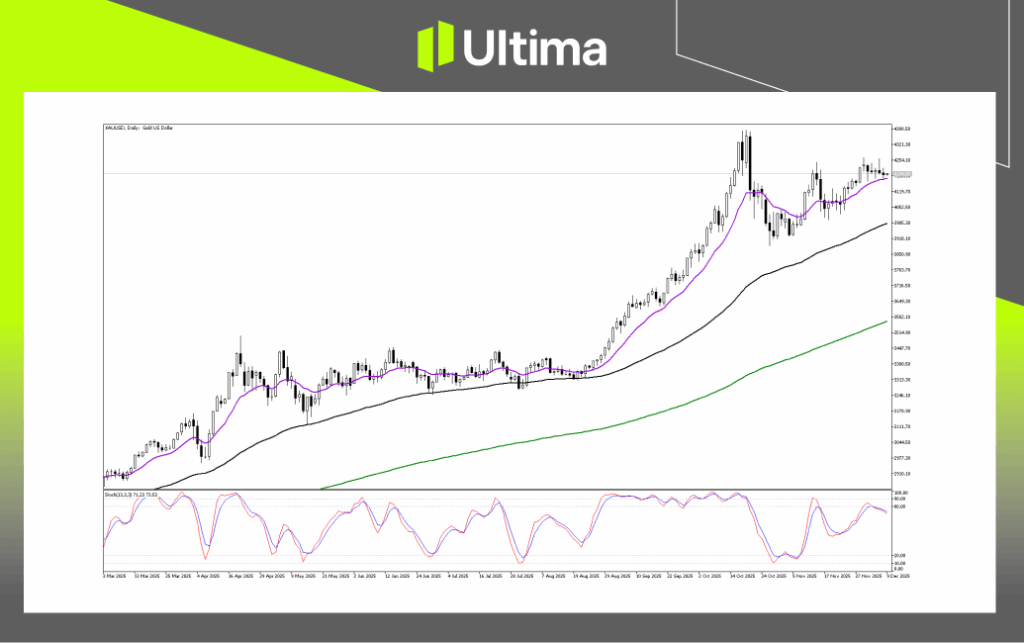

While the overall trend remains bullish, the daily chart signals a need for caution. The Stochastic sell signal, coupled with price stagnation, suggests the easy gains on the upside have already been realised. Traders might wait for a pullback to the 4000-4050 range to re-enter, rather than jumping in at the current level of 4194.

Key Levels

Immediate resistance is at 4254.10, where the market has recently faced rejection. A daily close above this level is essential to reignite bullish momentum. The price is currently hovering just above the dynamic support zone between 4120 and 4140, defined by the Purple Moving Average. While strong trends often follow this line, a close below it would signal potential weakness.

Key Levels that Could Spark the Next Move for Gold

The Stochastic Oscillator is currently in the lower range between 34-40 and heading upwards, indicating a possible small bounce, although momentum remains weak as it stays below the 50 mark.

Breakout Scenarios

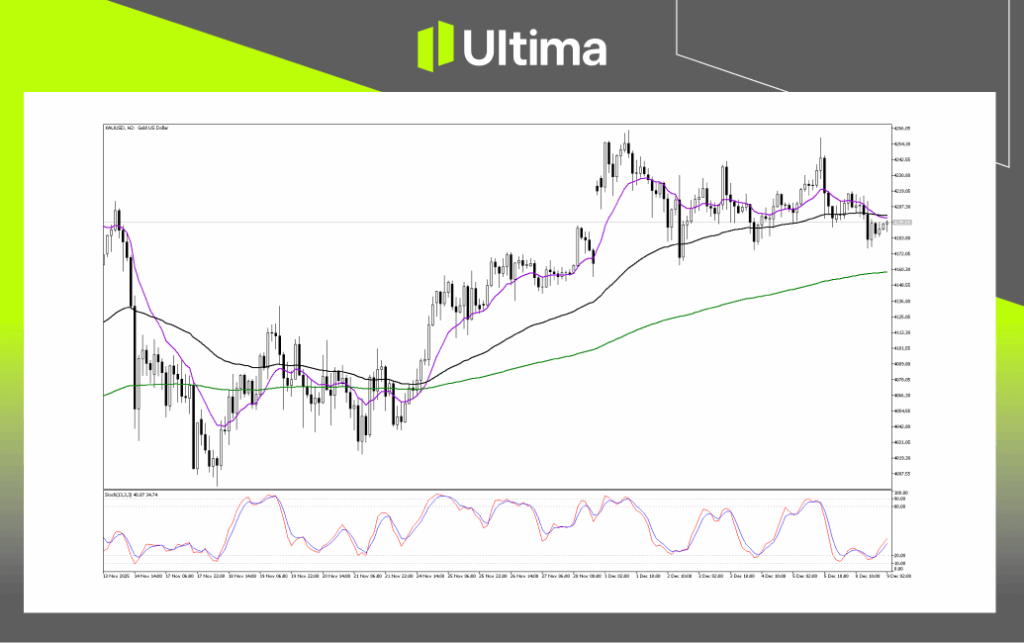

The key resistance zone at 4207-4210, where the Purple MA and recent breakdown level meet. Bulls need to push the price above 4210 on a 2-hour close to take control. The next resistance is the recent lower high at 4242.55, and breaking above it would invalidate the short-term bearish trend. The local swing high at 4266.05 marks the upper limit.

On the support side, the immediate structural level at 4183-4185 has acted as a "neckline" for the current range, with price bouncing off this area several times recently.

If this support fails, the price could move toward the key target zone of 4150-4155, aligning with the rising Green Moving Average for long-term support, with previous lows at 4130 offering additional support.

Will the Next for Gold Break or Bounce?

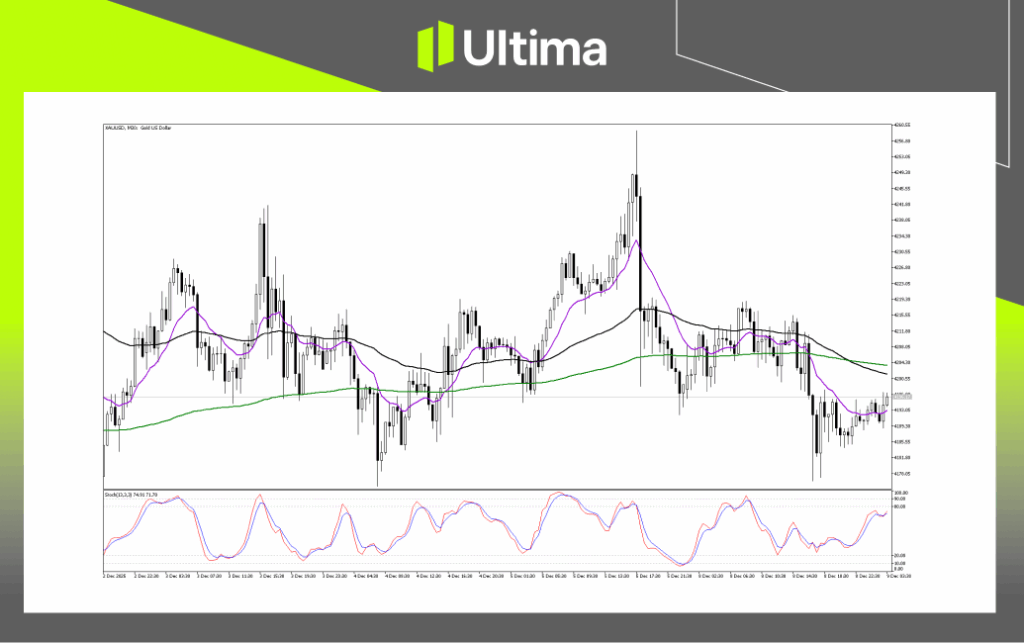

The M30 chart shows a bearish intraday trend, with Lower Highs and Lower Lows shaping the market structure. The current bounce towards 4200 appears to be a correction within the downtrend, presenting a potential selling opportunity. The key level to watch is 4185, which acts as critical support.

Bearish Rejection

In a likely bearish rejection scenario, the price is correcting upwards toward the resistance zone. Traders should look for a touch of the 4200-4204 area, where a downward-pointing Stochastic crossover could create an ideal "short the rally" setup, targeting a move back to 4185.

Downside Breakdown

In the breakdown scenario, a strong 30-minute close below 4180 would signal a bearish shift, with confirmation from the Purple MA diverging further to the downside. This could trigger momentum selling, driving the price towards 4160 or lower.

Bullish Reclaim

In the less likely bullish scenario, the price would need to break through the strong resistance at 4205 and close above it. This would negate the bearish outlook, suggesting the decline was a "bear trap" and setting the stage for a potential retest of 4215 and 4230.

Navigating the Forex Market with Ultima Markets

Navigating the world of trading requires up-to-date knowledge and strategic decision-making. Ultima Markets is committed to equipping you with the insights you need to succeed in forex, commodities, shares, and indices. Whether you're a seasoned trader or just starting out, our platform offers personalised support and guidance for your unique financial goals.

Join Ultima Markets today and unlock a robust ecosystem that provides all the tools, resources, and expertise necessary for your trading success. With the UM Academy and expert analysis at your fingertips, you'll always be prepared for the next market opportunity. Stay connected for more expert insights and updates from Ultima Markets.

—–

Legal Documents

Trading leveraged derivative products carries a high level of risk and may not be suitable for all investors. Leverage can magnify both gains and losses, potentially resulting in rapid and substantial capital loss. Before trading, carefully assess your investment objectives, level of experience, and risk tolerance. If you are uncertain, seek advice from a licensed financial adviser. Leveraged products are not intended for inexperienced investors who do not fully understand the risks or who are unable to bear the possibility of significant losses.

Copyright © 2025 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.