Panic helped the dollar

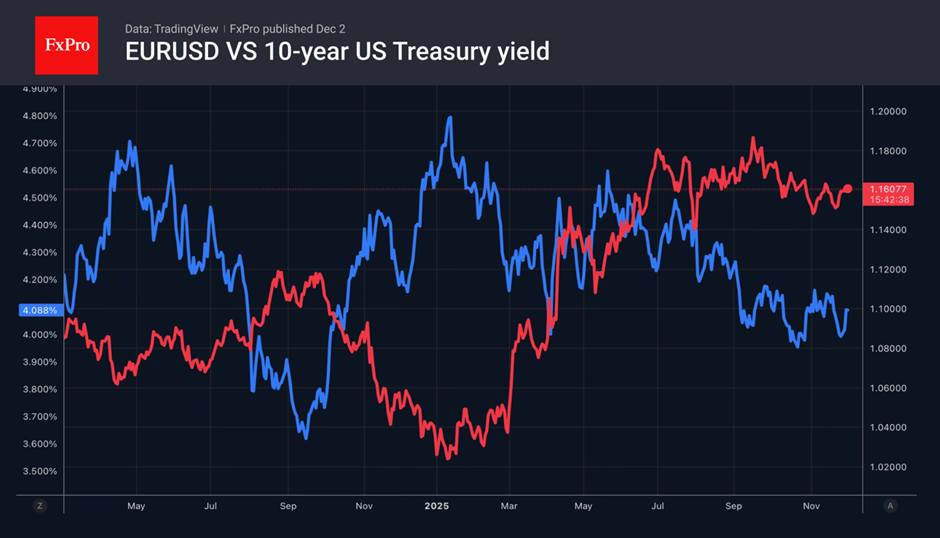

Kevin Hassett's growing chances of becoming Fed chair and weak manufacturing activity statistics have dragged down the US dollar. However, the rally in Treasury yields amid expectations of monetary policy tightening by the Bank of Japan has cooled the enthusiasm of EURUSD bulls. Investors fear that the repatriation of capital to the Land of the Rising Sun, as local assets become more attractive, will lead to a sell-off of US Treasury bonds.

The director of the National Economic Council is closest to Donald Trump and has the best chance of becoming Fed chair. Kalshi gives Kevin Hassett an 82% chance of winning. Kevin Warsh and Christopher Waller are estimated to have a 10% and 4% chance, respectively. As a result of the FOMC being flooded with doves, the risks of aggressive monetary expansion are increasing. The futures market gives a 74% and 45% probability that by the end of 2026, the federal funds rate will fall to 3.25% and 3%, respectively.

The US ISM manufacturing PMI published on Monday went below 50 for the ninth month in a row, indicating a decline in activity, which is a reminder of the negative impact of tariffs on the economy. The damage was less than expected due to large-scale investments in artificial intelligence technology. Europe is unable to compete with the United States in this area. The cost of electricity required for AI in the Old World is approximately twice as high as in the New World. Only a dramatic reduction in this gap could radically change the outlook and encourage EURUSD buyers.

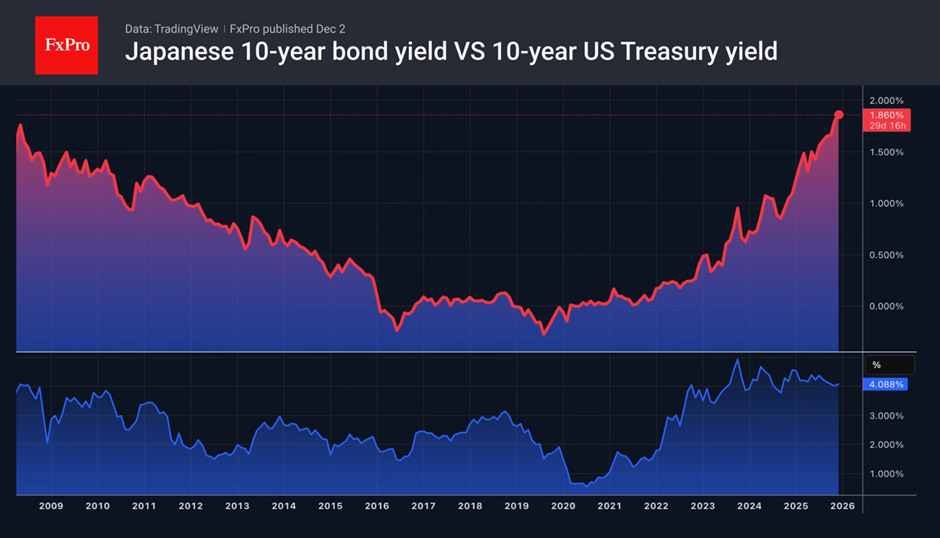

The retreat of the main currency pair from two-week highs is attributed to the rally in 10-year US Treasury yields, which have risen above 4%. Investors fear that Japan, which holds $1.2 trillion in Treasuries, will begin to dump them as local assets become more attractive and capital repatriates to its home country. The growing likelihood of a rate hike by the Bank of Japan in December amid hawkish comments from Kazuo Ueda supports this. As a result, yields on 10-year Japanese bonds have soared to their highest level since 2008.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)