Gold: Correction is fuel for growth

Gold lost over 1% on Tuesday, its first daily decline after nine days of gains, six of which were all-time highs.

Signs of consolidation were already evident on Monday and Tuesday, which began with a moderate decline, accelerated by the release of US inflation data. While the rush out of risk assets on this news was very short-lived, the sell-off in gold was more sustained but did not go beyond a short-term fixation.

A number of factors suggest that this is a corrective pullback rather than a reversal.

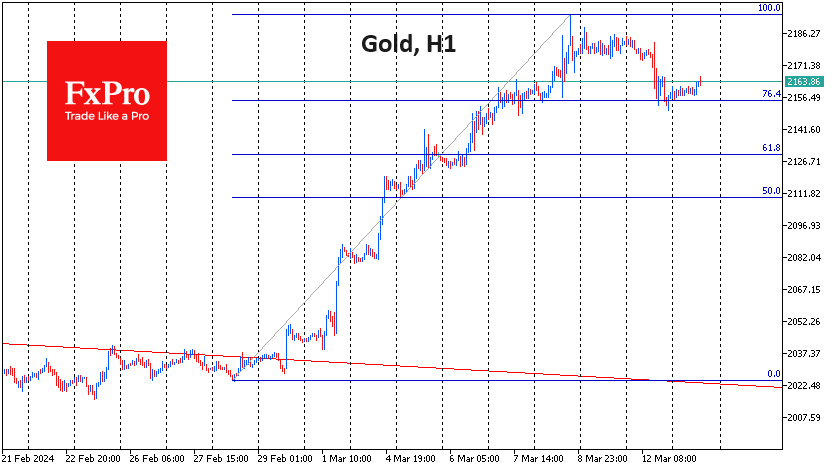

Firstly, the sell-off has come to an end near $2150, where there was a consolidation at the end of last week before the latest upside momentum. This level also coincides with the 76.4% Fibonacci retracement of the $175 rally of the last fortnight, when gold broke out of a bearish trading range. Such shallow corrective pullbacks are a sign of a strong bull market.

Second, gold's weakness is not supported by a general decline in risk appetite. Bitcoin briefly lost 6.5% during Tuesday's sell-off, but by Wednesday morning, it was already at all-time highs. As I write this, the Dollar Index has given back all the gains from the CPI release. The S&P500 closed at a new high on Tuesday, and the European indices are moving further into their all-time high territory on Wednesday. The correlation between European indices and gold has become very high since the second half of December.

Separately, we note the break of multi-month resistance in copper and the rise in oil, pointing to increased risk appetite, which is also favourable for gold.

All of this suggests that we may have seen a quick recharge of the bulls yesterday, allowing them to build up liquidity - fuel for further buying and renewal of all-time highs.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)