Strong PPI pushing Fed to do more

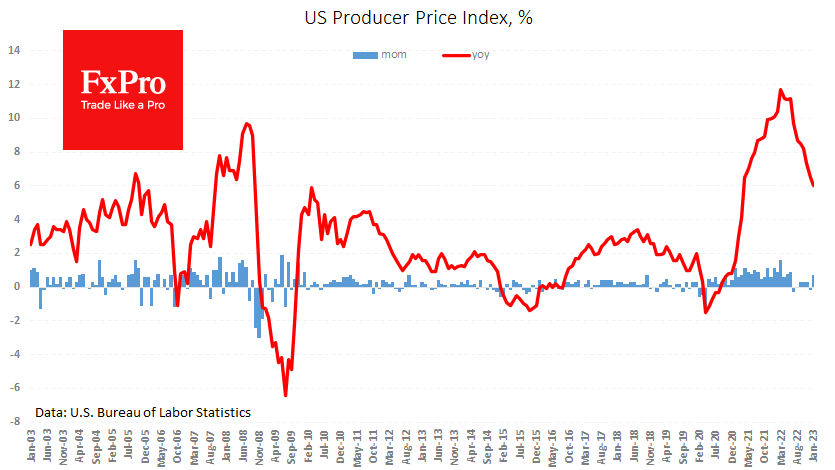

After consumer prices, US producer prices delivered another hawkish surprise. PPI rose by 0.7% in January, impressively stronger than the expected +0.4%. The annual price growth rate slowed from 6.5% to 6.0%, against expectations of 5.4%.

It is worth disregarding the slowdown in the annual inflation rate, as it is due to the high base effect of the previous year, while the monthly increase remains above the historical average.

Producer prices are a couple of months ahead of consumer prices, so today's release is a crucial hawkish signal for the Fed to continue raising rates without letting inflation expectations hang in the balance.

Aside from high inflation, the labour market also needs more reasons to take a breather. Initial jobless claims remained below 200k for the fifth week in a row, complementing the 3% rise in retail sales in January.

Overall, this mix of data suggests that the economy is in good shape. Still, it now risks triggering a reassessment of the monetary policy outlook, which is harmful to the markets.

The FxPro Expert Analyst Team

-11122024742.png)

-11122024742.png)