Edit Your Comment

Making sense of a rise in price (AUDUSD)

Membre depuis Jan 10, 2015

posts 3

Jan 11, 2015 at 09:34

Membre depuis Jan 10, 2015

posts 3

Firstly, I'm a new comer and I'd like to say hello to everyone on this forum.

I know the question I'm going to ask is very broad but I'm hoping that there is something simple I'm missing that someone can point out to me.

On Friday (9 Jan 8:30am) AEST the US data for unemployment was released and it showed the unemployment rate dropped but strangely the AUDUSD rallied at the exact same time - can anyone please explain this?

I've been trying to make sense of why AUDUSD went up and not down given such good news from the US?

Any help would be appreciated.

Thanks

I know the question I'm going to ask is very broad but I'm hoping that there is something simple I'm missing that someone can point out to me.

On Friday (9 Jan 8:30am) AEST the US data for unemployment was released and it showed the unemployment rate dropped but strangely the AUDUSD rallied at the exact same time - can anyone please explain this?

I've been trying to make sense of why AUDUSD went up and not down given such good news from the US?

Any help would be appreciated.

Thanks

Membre depuis Nov 21, 2011

posts 1601

Jan 11, 2015 at 10:40

Membre depuis Nov 21, 2011

posts 1601

yo,

I'm going to save you time.... You may not get it right away but hoppefully it will make sense later on.

=> Any financial market is irrational.

Secondly, don't start to think, simply look at your chart.

Once you get this, it's like you have 2 years experience into Fx world.... Good luck

I'm going to save you time.... You may not get it right away but hoppefully it will make sense later on.

=> Any financial market is irrational.

Secondly, don't start to think, simply look at your chart.

Once you get this, it's like you have 2 years experience into Fx world.... Good luck

Membre depuis Jan 10, 2015

posts 3

Jan 11, 2015 at 12:50

Membre depuis Jan 10, 2015

posts 3

Thanks for your reply.

It's so annoying to watch the market react like that lol I would be so much comfortable understanding why things happened even if it was retrospectively.

I have some experience in Fx but I decided I would try to make sense of the fundamentals - I guess that's not such a great idea.

Thanks again

It's so annoying to watch the market react like that lol I would be so much comfortable understanding why things happened even if it was retrospectively.

I have some experience in Fx but I decided I would try to make sense of the fundamentals - I guess that's not such a great idea.

Thanks again

forex_trader_106622

Membre depuis Jan 15, 2013

posts 12

Jan 11, 2015 at 13:15

Membre depuis Jan 15, 2013

posts 12

@phenomenon90, US avg hourly earnings -0.2% vs +0.2% exp The headline figure in US jobs report was good but if you dig a bit deeper US avg hourly earnings was down. This means less money in everyday peoples pocket a headwind for US economy.

Other factors would be strong $ buying all week meaning most of the market would be short AUDUSD meaning retail short selling too low & market due a squeeze higher to shake out weaker shorts.

Also the big psychological level of 0.80 was close this week, fresh buyers waiting here when it held.

Gold rallied late into this week which is highly correlated with AUD because of AUD Gold exports to emerging markets especially China higher Gold price helps AUD.

The market might often initially impulsively move in the direction of the headlines as algo's are triggered & traders are trapped in false break outs, then the market with make its real move an hour or 2 later as large players move in to crush smaller over leveraged traders that chase price and sell to low or buy to high. The big boys wait and use news releases to gather supply for their demand. Here the banks & hedge funds intended to take fresh longs on AUD taking advantage of the + carry trade and waited for the market to get short on the headline NFP before buying at a better lower price for them.

Also some long term shorts would close & take profits on shorts heading into the weekend on a Friday.

Hope this helps Phenomenon

Other factors would be strong $ buying all week meaning most of the market would be short AUDUSD meaning retail short selling too low & market due a squeeze higher to shake out weaker shorts.

Also the big psychological level of 0.80 was close this week, fresh buyers waiting here when it held.

Gold rallied late into this week which is highly correlated with AUD because of AUD Gold exports to emerging markets especially China higher Gold price helps AUD.

The market might often initially impulsively move in the direction of the headlines as algo's are triggered & traders are trapped in false break outs, then the market with make its real move an hour or 2 later as large players move in to crush smaller over leveraged traders that chase price and sell to low or buy to high. The big boys wait and use news releases to gather supply for their demand. Here the banks & hedge funds intended to take fresh longs on AUD taking advantage of the + carry trade and waited for the market to get short on the headline NFP before buying at a better lower price for them.

Also some long term shorts would close & take profits on shorts heading into the weekend on a Friday.

Hope this helps Phenomenon

Jan 11, 2015 at 13:20

Membre depuis Dec 12, 2014

posts 109

phenomenon90 posted:

Firstly, I'm a new comer and I'd like to say hello to everyone on this forum.

I know the question I'm going to ask is very broad but I'm hoping that there is something simple I'm missing that someone can point out to me.

On Friday (9 Jan 8:30am) AEST the US data for unemployment was released and it showed the unemployment rate dropped but strangely the AUDUSD rallied at the exact same time - can anyone please explain this?

I've been trying to make sense of why AUDUSD went up and not down given such good news from the US?

Any help would be appreciated.

Thanks

Most of the times big news are included in price before they are released. Marked makers have superior acess to information and they are able to incorporate them into the price based on weakness/strength in the background.

Next thing is acummulation and distribution.

To Acumulate capital ,market makers need to use negative/positive news - they are either fabricated or taken advantage of. This way they can buy from wide public when they start panick sale at negative news/frantic buying at positive news.

So it goes like this: You see a news that strongly suggest selling. However market makers see strenght in the background so they begin to buy from the masses . At that point demand overcomes supply and price will rally.

therefore news alone are not sufficient - you need to read them in context.

Smart money / market makers never fight crowd, they are just taking advantage of it when they see slightest chance

Also you will not gain two years of experience by looking on chart without thinking - this mus be the dumbest thing I have read this weak.

Best regards

Marian

Get investors and get paid 15 percent of theyr profits. More on my website.

Membre depuis Nov 21, 2011

posts 1601

Jan 11, 2015 at 13:31

Membre depuis Nov 21, 2011

posts 1601

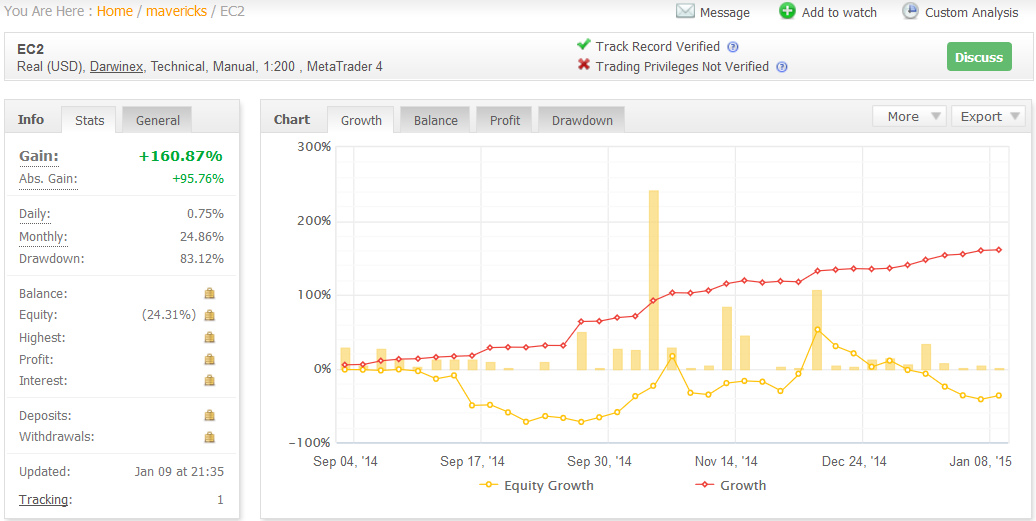

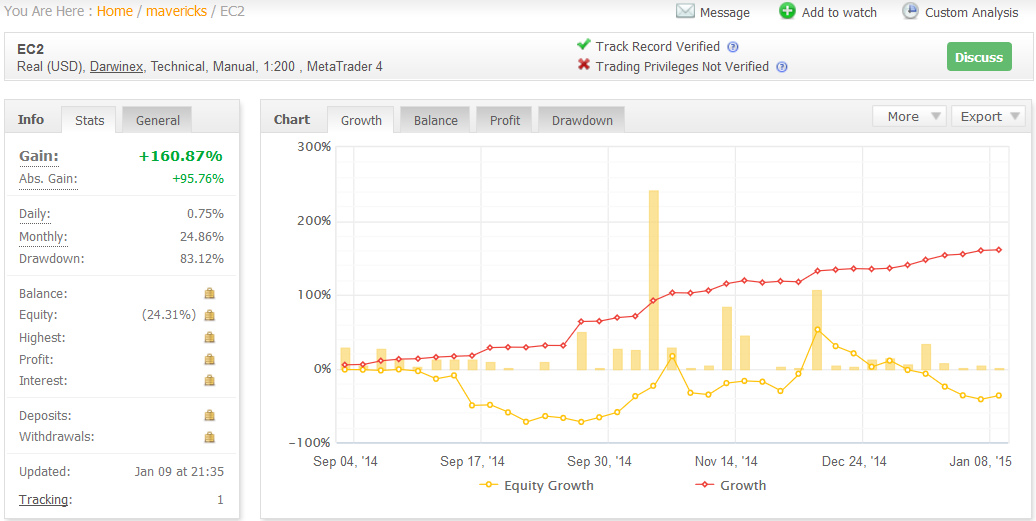

The noobest chart I have seen since ages:

That's why noobs need to understand that they have to look at charts and notice the trend instead of bullshitting how does brokers/market makers behave.

Anyway, I need noobs to upload their live accounts into here to be able to open trades against them when they all are on the same side.

That's why noobs need to understand that they have to look at charts and notice the trend instead of bullshitting how does brokers/market makers behave.

Anyway, I need noobs to upload their live accounts into here to be able to open trades against them when they all are on the same side.

Jan 11, 2015 at 15:36

Membre depuis Dec 12, 2014

posts 109

CrazyTrader posted:

The noobest chart I have seen since ages:

That's why noobs need to understand that they have to look at charts and notice the trend instead of bullshitting how does brokers/market makers behave.

Anyway, I need noobs to upload their live accounts into here to be able to open trades against them when they all are on the same side.

Hey Crazyperson

To have right to call somebody noob you neeed to have at least one live account ever in profit - which is not your case

You are playing on demo like a 13 year old, cant make even one pip in live account.

Where are your retarded M and W patterns ? Your genial theory ?

Do the world a favour and leave your useless knowledge to yourself you : ,,respected member of comunity,,

Yo do not become expert by spamming forums.

Even your website is retarded :)) is that a robot firing a laser from eyes ? really ???? :DDDD

Get investors and get paid 15 percent of theyr profits. More on my website.

Membre depuis Nov 21, 2011

posts 1601

Jan 11, 2015 at 16:24

Membre depuis Nov 21, 2011

posts 1601

You are the only noob talking about me in every post, even on different thread.

You both now are on my ignore list... keep going your bla bla.

You both now are on my ignore list... keep going your bla bla.

Jan 11, 2015 at 22:10

Membre depuis Dec 12, 2014

posts 109

CrazyTrader posted:

You are the only noob talking about me in every post, even on different thread.

You both now are on my ignore list... keep going your bla bla.

After you make your first live pip, you can come back and throw noob bombs at kids playing with demo accounts, inventing new patterns, drawing silly charts and using ,,impressive,, EAs.

Untill then get to work and stop pretending to be pro.

Get investors and get paid 15 percent of theyr profits. More on my website.

Membre depuis Nov 21, 2011

posts 1601

Jan 12, 2015 at 06:30

Membre depuis Sep 20, 2014

posts 342

@phenomenon90

It doesn't help to try do fundamentals in markets that's this openly and heavily manipulated. Normal market forces are not at work and is unlikely to ever be unless people start going to jail, and that's unlikely to happen.

Do you know why your car runs ? Do you really need to know ? You put fuel it goes....

Fx is a bit like that. I don't know why AUD is moving I don't really care either. Just doesn't matter. You can't predict fx, you can't read it. Your average hedge fund life span is about 5 years, so neither can the guys who spend millions hiring the best minds they can afford to try predict it.

So don't worry why stuff happens. Just go with whatever is happening.

It doesn't help to try do fundamentals in markets that's this openly and heavily manipulated. Normal market forces are not at work and is unlikely to ever be unless people start going to jail, and that's unlikely to happen.

Do you know why your car runs ? Do you really need to know ? You put fuel it goes....

Fx is a bit like that. I don't know why AUD is moving I don't really care either. Just doesn't matter. You can't predict fx, you can't read it. Your average hedge fund life span is about 5 years, so neither can the guys who spend millions hiring the best minds they can afford to try predict it.

So don't worry why stuff happens. Just go with whatever is happening.

Membre depuis Jan 10, 2015

posts 3

Jan 12, 2015 at 07:53

Membre depuis Dec 12, 2014

posts 109

CrazyTrader posted:

Don't be jealous like that...

There is nothing about you to be jealous about....you are just overconfident kid with absolutely nothing to show ,faking to be expert, .....

....actually Iam sorry for you

Get investors and get paid 15 percent of theyr profits. More on my website.

Jan 12, 2015 at 07:59

Membre depuis Dec 12, 2014

posts 109

theHand posted:

@phenomenon90

It doesn't help to try do fundamentals in markets that's this openly and heavily manipulated. Normal market forces are not at work and is unlikely to ever be unless people start going to jail, and that's unlikely to happen.

Do you know why your car runs ? Do you really need to know ? You put fuel it goes....

Fx is a bit like that. I don't know why AUD is moving I don't really care either. Just doesn't matter. You can't predict fx, you can't read it. Your average hedge fund life span is about 5 years, so neither can the guys who spend millions hiring the best minds they can afford to try predict it.

So don't worry why stuff happens. Just go with whatever is happening.

Actually there is a method to read the markets. Its called VSA (Volume spread analysys).

Most sucesfull trader I know is using it.

It basically compares volume of candle with range and type of the candle.

Premise is that smart money cannot hide themselves because of super high volumes on some candles. Range of candle and subsequent movement, will tell you about they intention.

Method is very effective and works even better on stock.

But guess what ?

True volume is one of the most hidden info on the market ever.

This guy I know figured out a way to read it from futures volumes.

Cool stuff

If you are interested in method PM me

Best regards

M

Get investors and get paid 15 percent of theyr profits. More on my website.

Jan 12, 2015 at 13:33

(édité Jan 12, 2015 at 13:58)

Membre depuis Sep 20, 2014

posts 342

Your premise is flawed mate. You can hide most activity by simply spreading it out over time. That's before Bernanke or banker of the day wants a market move and then talks it into the direction he wants or dumps 500T of gold they don't have early Monday morning.

And as you pointed out there are no accurate volumes for fx.

No mambo jumbo big word this, big word that, is going to help in current market conditions.

And as you pointed out there are no accurate volumes for fx.

No mambo jumbo big word this, big word that, is going to help in current market conditions.

Jan 12, 2015 at 14:52

Membre depuis Dec 12, 2014

posts 109

theHand posted:

Your premise is flawed mate. You can hide most activity by simply spreading it out over time. That's before Bernanke or banker of the day wants a market move and then talks it into the direction he wants or dumps 500T of gold they don't have early Monday morning.

And as you pointed out there is no accurate volumes for fx.

No mambo jumbo big word this, big word that, is going to help in current market conditions.

Mate, no mumbo jumbo

First of. Its not my premise, not my theory, unfortunatelly I didnt came up with it. Its a fact.

You are correct , you hide your activity by spreading it over time - its called accumulation and distribution.

There are differnt ways to do it, every one of them will be expressed differently.

I will tell you example: Imagine long lasting uptrend. Suddenly smart money notice weakness in the background (this may be anything, that wide public has no clue about) . At this point is good time to sell the assets - distribution. They will use positive news regarding instrument to get the public buying into uptrend while liquidating they positions in profit. This takes time based on size of trend. But it cannot be completely hidden despite the best efforts. There will fakeouts, shakeouts and plenty of meoney making maneuveres to remove people trying to get short. Afterward price will fall like a brick.

They cannot hide that there is an efford in form of volume and no candle range in new hights -result.

Kapish ?

Get investors and get paid 15 percent of theyr profits. More on my website.

Jan 12, 2015 at 15:10

(édité Jan 12, 2015 at 15:13)

Membre depuis Sep 20, 2014

posts 342

I also know people who do things. They all swear by their things. Doesn't mean they have any idea better than the next guy.

I saw it years ago, get a few guys in a chat room, get them to make calls, different methods, different calls, often apposing, you come back few years later they're still there calling against each other and everyone of them is making money and they'll all swear by their calls, even though it's derived from different methods.

Reality is it's not their calls that's making the money. Investec proves this every year, guy in a monkey suit throws darts at the newspaper to select the shares for the portfolio and every year the monkey beats the best minds in the industry.

So your buddies methods, the next guys method, the guy in the monkey suit's method, all the same more or less. It's a reason to get in and then the work starts.

Sure you can get futures volumes, but that isn't the whole fx market is it ? It's just another derivative on the underlying.

I saw it years ago, get a few guys in a chat room, get them to make calls, different methods, different calls, often apposing, you come back few years later they're still there calling against each other and everyone of them is making money and they'll all swear by their calls, even though it's derived from different methods.

Reality is it's not their calls that's making the money. Investec proves this every year, guy in a monkey suit throws darts at the newspaper to select the shares for the portfolio and every year the monkey beats the best minds in the industry.

So your buddies methods, the next guys method, the guy in the monkey suit's method, all the same more or less. It's a reason to get in and then the work starts.

Sure you can get futures volumes, but that isn't the whole fx market is it ? It's just another derivative on the underlying.

Jan 12, 2015 at 17:45

(édité Jan 12, 2015 at 17:47)

Membre depuis Sep 20, 2014

posts 342

I saw an alien once.

Point is for @phenomenon90 's benefit and not your ego, that he doesn't really need to understand or even know why something's doing what it's doing to make money from it.

Why is oil down so much ? Who knows, but it's cheap, get some. Simple as that.

Point is for @phenomenon90 's benefit and not your ego, that he doesn't really need to understand or even know why something's doing what it's doing to make money from it.

Why is oil down so much ? Who knows, but it's cheap, get some. Simple as that.

*Lutilisation commerciale et le spam ne seront pas tolérés et peuvent entraîner la fermeture du compte.

Conseil : Poster une image/une url YouTube sera automatiquement intégrée dans votre message!

Conseil : Tapez le signe @ pour compléter automatiquement un nom dutilisateur participant à cette discussion.