Bitcoin holds below $70,000: Bearish reversal or bullish refuelling?

Bitcoin is currently trading below $70,000, retracing from last week's highs of $70,762. This dip is largely attributed to a market reaction to the U.S. nonfarm payrolls report, which significantly surpassed expectations, signalling a robust labour market.

The surprisingly strong jobs data tempered hopes of an immediate interest rate cut by the Federal Reserve, a stark contrast to the previous week's speculation of a potential rate reduction. This shift in sentiment has also affected Bitcoin's liquidity outlook, with Friday witnessing a massive shorting spree of up to $200 million, as per Coinglass data.

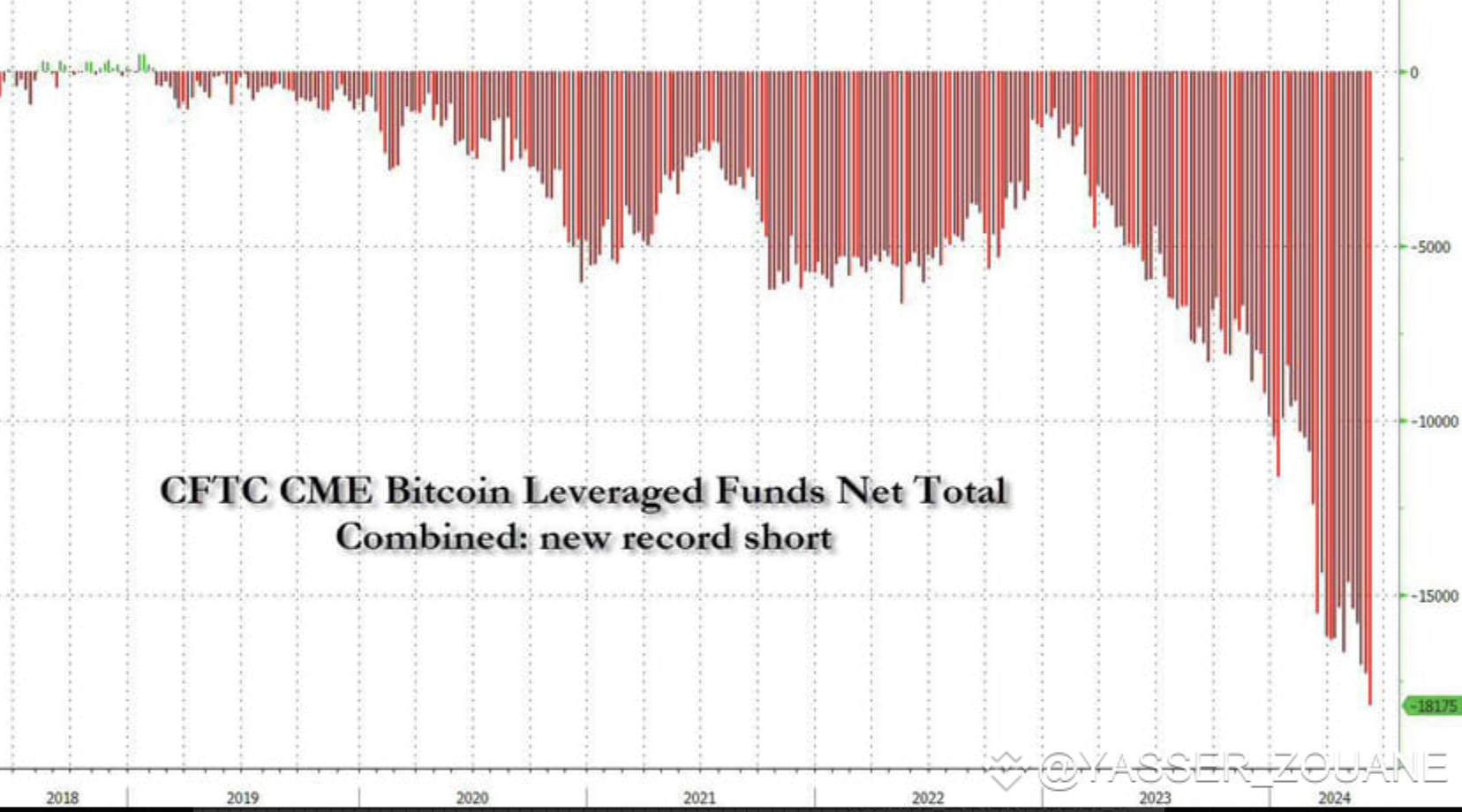

Furthermore, the "CFTC CME Bitcoin Leveraged Funds Net Total" chart reveals a notable increase in short positions, suggesting that hedge funds are offloading BTC in anticipation of a price decline.

Source: CFTC

This is a significant development given Bitcoin's price sensitivity to liquidity conditions.

Though analysts foresee a significant retracement, Bullish sentiment persists. On Sunday, Michael Saylor, founder and chairman of MicroStrategy (MSTR), disclosed the Bitcoin holdings of various global spot Bitcoin ETFs - revealing that 34 Spot Bitcoin ETFs hold 1,031,973 BTC (about $71.5 billion) .

There also hasn’t been reported massive outflows from Spot Bitcoin ETFs, after a week that recorded 17 consecutive days of positive inflows - breaking a previous record set back in February. June 4th alone saw inflows reach an extraordinary $886.6 million—nearly double the previous day's $488.1 million.

Interestingly, the observed shorting activity might not be entirely bearish. Some analysts propose that it could be part of a broader hedging strategy, where hedge funds are simultaneously accumulating Bitcoin through spot market purchases and ETFs while shorting futures contracts.

If this theory holds true, closing these short positions could ignite a powerful upward price movement, potentially propelling Bitcoin towards new historical highs. This scenario suggests that the current downturn might be a temporary setback, a prelude to a longer-term bullish trend.

BTC price analysis

If Bitcoin’s pullback continues, sellers could find support at the $66,693 mark, an area that has held before, with a further drawdown likely testing May 16 lows of $64,593. On the upside if BTC resumes its rally, buyers could face resistance at the $70,819 price level - with a further move north likely to test last week’s highs of $72,112.

Source: Deriv MT5

A move up however, could be hamstrung in the short-term as the 14-day Relative Strength Index (RSI) is pointing down sharply around the 50 midline - an indicator that buy momentum is being overcome by selling pressure. This could lead to a further price slide. It could also mean that the up move could be taking a pause before going again since prices are still above the 100-day EMA. Also of note is the contracting of Bollinger bands, an indicator that volatility is decreasing - often seen as a precursor to a significant price breakout in either direction.

Disclaimers:

The performance figures quoted refer to the past, and past performance is not a guarantee of future performance or a reliable guide to future performance.

This information is considered accurate and correct at the date of publication. Changes in circumstances after the time of publication may impact the accuracy of the information.

The information contained within this blog article is for educational purposes only and is not intended as financial or investment advice.

No representation or warranty is given as to the accuracy or completeness of this information.

We recommend you do your own research before making any trading decisions.