The S&P 500 has cooled off. What are the signs of an upturn?

Futures on the S&P500 are rising early Monday after a correction last week. Markets are gearing up for a week of important events, from releasing the US Treasury's borrowing plans to the FOMC's comments on interest rates and the monthly employment report.

The S&P500 index lost over 10% from its late July peak to last Friday's close, which is informally considered the beginning of the correction.

Technically, the sell-off in equities intensified after the S&P500 failed to break through resistance at its 50-day moving average in mid-October. A quick pullback to the 200-day followed, but we saw only a brief consolidation, not a rebound.

This week has a good chance of setting the market dynamic for the rest of the year for several reasons.

Firstly, the concentration of top events in the financial world. Wednesday will see the release of the US Treasury's quarterly borrowing plan. The Treasury's appetite could set the tone for the bond market, and Bloomberg says this release is more important than the Fed's comments.

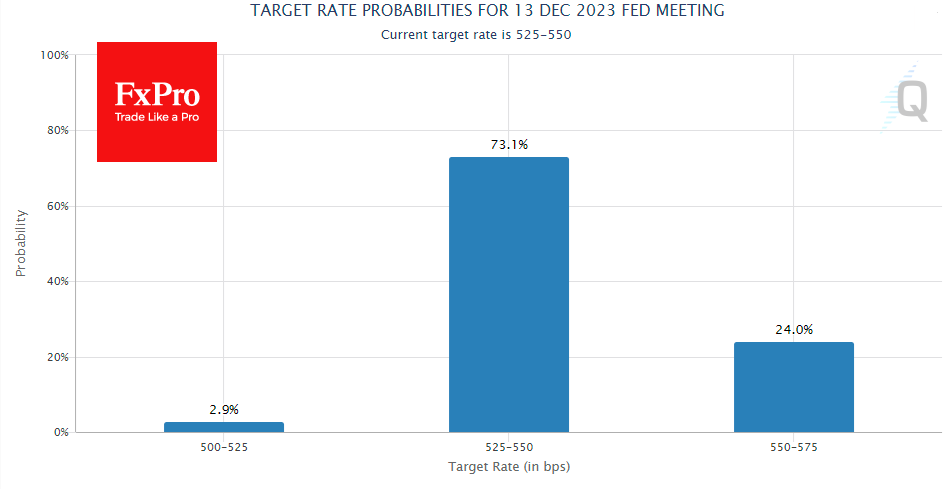

The official FOMC statement and Powell's remarks at the press conference are a chance to shake up rate expectations. The market focuses on the odds of a December hike (now at 24%) and guidance on when the central bank might start cutting rates.

On Friday it will be the labour market: the September report was robust on job growth and weak on wages. Which will become a trend?

Secondly, the market looks technically oversold in the short term, which opens the possibility of a bounce. The popular technical oscillator RSI touched oversold territory at Friday's close. A bounce before regular trading brought the market back out of oversold territory. This could be a repeat of what we saw in early October. Last September, a return from oversold to normal levels also led to impressive inflows into equities.

Thirdly, after almost three months of declines, the market has pulled back from the extremes to prove attractive to buyers, paying attention to the exceptionally healthy consumer demand in the US.

Hypothetically, a dip below the 200-day could prove as false a break as in March. But buyers were encouraged by the Fed's determination to support regional banks. To confirm this hypothesis, however, we would need a clear signal from the Fed that there's no point in raising rates further despite solid data.

Even better, if there is confirmation on Friday in the form of a further slowdown in wage growth with further employment growth, it is risky to jump the gun, as we are formally in a downtrend. From a technical point of view, a significant (more than 2%) rise in the daily result on Wednesday or Friday could be an important signal.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)