Edit Your Comment

EUR/USD

Apr 30, 2015 at 08:36

會員從Apr 08, 2014開始

1140帖子

Since the start of April the EURUSD rose more than 3.0% and is in a recovery phase since late April, trading well above the 10-day moving average. Yesterday the pair rose with above average volume and close in the middle of the daily range. Stochastic is showing an overbought market but even with the pair well into overbought territory, we should not fight the strong upward correction just yet.

"I trade to make money not to be right."

Apr 30, 2015 at 12:08

會員從Apr 09, 2014開始

832帖子

honeill posted:

Since the start of April the EURUSD rose more than 3.0% and is in a recovery phase since late April, trading well above the 10-day moving average. Yesterday the pair rose with above average volume and close in the middle of the daily range. Stochastic is showing an overbought market but even with the pair well into overbought territory, we should not fight the strong upward correction just yet.

I agree, with mixed Euro results already behind, now we are waiting for the US data.

會員從Nov 21, 2011開始

1601帖子

Apr 30, 2015 at 15:21

會員從Jun 07, 2011開始

372帖子

EUR / USD rose to the weak US GDP report.

It broke above the main resistance line (now turned into support) 1.1045 and hit resistance near 1.1180.

The short term trend is positive.

On the daily chart, the break above 1.1045 marked the conclusion of a possible double bottom something that could represent broader bullish extensions.

It broke above the main resistance line (now turned into support) 1.1045 and hit resistance near 1.1180.

The short term trend is positive.

On the daily chart, the break above 1.1045 marked the conclusion of a possible double bottom something that could represent broader bullish extensions.

會員從Jul 10, 2014開始

1114帖子

會員從Nov 21, 2011開始

1601帖子

會員從Jun 08, 2014開始

454帖子

會員從Oct 11, 2013開始

769帖子

會員從Oct 08, 2011開始

135帖子

May 01, 2015 at 07:30

會員從Oct 08, 2011開始

135帖子

As I have mentioned earlier this week, it takes a price-bar on the daily chart where open and close price are outside the high of the measuring bar (1.1040) in order to nullify the trading range.

Yesterday's bar has both (open & closed) outside, so the range can be disregarded.

After this fact, a hook on the daily chart can be expected.

A hook (in an up-trend) is generated by a price bar, that fails to trade to a new high as compared to the preceding bar.

Many professional traders (fund managers) prefer to trade the first hook after the range breakout - as it is a confirmation of the new trend direction after the major entry signal (that I posted last week), inside the trading range.

The first hook is also called "trend-confirmation-hook" and historically has more thrust than all other major entry signals.

The entry I posted this week off the weekly chart, in the meantime is already 200 pips plus.

Yesterday's bar has both (open & closed) outside, so the range can be disregarded.

After this fact, a hook on the daily chart can be expected.

A hook (in an up-trend) is generated by a price bar, that fails to trade to a new high as compared to the preceding bar.

Many professional traders (fund managers) prefer to trade the first hook after the range breakout - as it is a confirmation of the new trend direction after the major entry signal (that I posted last week), inside the trading range.

The first hook is also called "trend-confirmation-hook" and historically has more thrust than all other major entry signals.

The entry I posted this week off the weekly chart, in the meantime is already 200 pips plus.

"a little bit of knowledge is a dangerous thing"

會員從Oct 08, 2011開始

135帖子

May 01, 2015 at 08:00

會員從Oct 08, 2011開始

135帖子

Count "price bars" instead of "time passed" when trading.

Any decent and successful trade lasts about 4 to 8 bars as an average, regardless of the chart time-frame.

If this is done on the 5 min chart, the trade lasts only about 20 to 40 minutes.

When it is done on the daily chart, it means 4 to 8 days, or 4 to 8 weeks on the weekly chart.

This is very important to realize!

Traders who are not aware of this, often close good positions much too early and leave a lot of money on the table.

This is also very important to realize when in a losing position (called "time-stop")

If one is in a losing position and prices do not return back to the entry price within 3 to 4 bars, it is almost always a good decision to close the position with a small loss, rather than waiting - and hoping - that prices will turn back into the trade-direction.

Traders who are not aware of this often create these massive "draw-downs", and sometimes are lucky enough, not to get a margin call.

This is the simple concept to

KEEP YOUR LOSSES SMALL AND LET YOUR PROFITS RUN!

Any decent and successful trade lasts about 4 to 8 bars as an average, regardless of the chart time-frame.

If this is done on the 5 min chart, the trade lasts only about 20 to 40 minutes.

When it is done on the daily chart, it means 4 to 8 days, or 4 to 8 weeks on the weekly chart.

This is very important to realize!

Traders who are not aware of this, often close good positions much too early and leave a lot of money on the table.

This is also very important to realize when in a losing position (called "time-stop")

If one is in a losing position and prices do not return back to the entry price within 3 to 4 bars, it is almost always a good decision to close the position with a small loss, rather than waiting - and hoping - that prices will turn back into the trade-direction.

Traders who are not aware of this often create these massive "draw-downs", and sometimes are lucky enough, not to get a margin call.

This is the simple concept to

KEEP YOUR LOSSES SMALL AND LET YOUR PROFITS RUN!

"a little bit of knowledge is a dangerous thing"

forex_trader_236107

會員從Mar 10, 2015開始

88帖子

May 01, 2015 at 08:27

會員從Mar 10, 2015開始

88帖子

PERPETUUMMOBILE posted:

Count "price bars" instead of "time passed" when trading.

Any decent and successful trade lasts about 4 to 8 bars as an average, regardless of the chart time-frame.

If this is done on the 5 min chart, the trade lasts only about 20 to 40 minutes.

When it is done on the daily chart, it means 4 to 8 days, or 4 to 8 weeks on the weekly chart.

This is very important to realize!

Traders who are not aware of this, often close good positions much too early and leave a lot of money on the table.

This is also very important to realize when in a losing position (called "time-stop")

If one is in a losing position and prices do not return back to the entry price within 3 to 4 bars, it is almost always a good decision to close the position with a small loss, rather than waiting - and hoping - that prices will turn back into the trade-direction.

Traders who are not aware of this often create these massive "draw-downs", and sometimes are lucky enough, not to get a margin call.

This is the simple concept to

KEEP YOUR LOSSES SMALL AND LET YOUR PROFITS RUN!

Thank you for showing us examples. Now all you have to do is be the example and upload one of your accounts which reveals that you are doing what you have just mentioned.

May 01, 2015 at 09:26

會員從Apr 08, 2014開始

1140帖子

On yesterday session EURUSD initially fell but found enough buying pressure at 1.1097 to turn around and closed near the high of the day, close to a daily resistance at 1.1232. A break to the upside of the daily resistance at 1.1232 would suggest another push higher to the next daily resistance at 1.1459. Today in most countries is Bank holiday due to the Labor Day so we may expect light trading volumes.

"I trade to make money not to be right."

會員從Jul 10, 2014開始

1114帖子

May 01, 2015 at 13:31

會員從Jul 10, 2014開始

1114帖子

honeill posted:

On yesterday session EURUSD initially fell but found enough buying pressure at 1.1097 to turn around and closed near the high of the day, close to a daily resistance at 1.1232. A break to the upside of the daily resistance at 1.1232 would suggest another push higher to the next daily resistance at 1.1459. Today in most countries is Bank holiday due to the Labor Day so we may expect light trading volumes.

EUR/USD did break above 1.1232 and I too think that the pair will continue climbing at least until it reaches 1.1459, although I would not be surprised if it continues moving to the upside until it reaches 1.1700.

會員從Sep 06, 2013開始

145帖子

會員從Nov 21, 2011開始

1601帖子

會員從Nov 21, 2011開始

1601帖子

May 01, 2015 at 15:08

會員從Nov 21, 2011開始

1601帖子

PERPETUUMMOBILE posted:

explanation as to how we trade out of a closed trading range

Now I know why I vouched for you 2 days ago!

Thank you for the time taken to do this.... I'm not the only one anymore posting nice picture.

*MB... I use to call it MC (Mother candle)

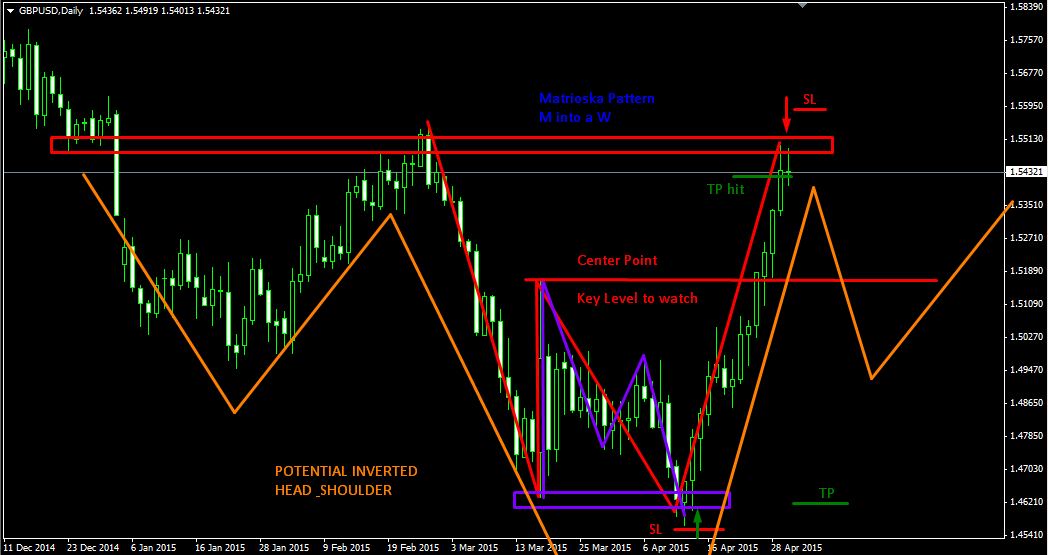

By the way with M Pattern, Long signal is set from point 1 : )

*商業用途和垃圾郵件將不被容忍,並可能導致帳戶終止。

提示:發佈圖片/YouTube網址會自動嵌入到您的帖子中!

提示:鍵入@符號,自動完成參與此討論的用戶名。