Edit Your Comment

Fundamental Analysis Quantified

會員從Nov 14, 2013開始

8帖子

Nov 14, 2013 at 13:35

會員從Nov 14, 2013開始

8帖子

Hi all,

I've attached my works on fundamental analysis.

Hope it is comprehensive and helps in bettering everyone's trading.

Suggestion welcome, appreciated.

Cheers.

* Due to timing lapse and sensitivity of market, latest, real-time limit price suggestion can be found at my auto-trader.

http://www.forexfactory.com/kokhaiang

There's 2 category of reports:

(1) Currency Report (AUD, NZD, CAD, CNY, USD, JPY, GBP, EUR)

Report contains overview, indicator charts of the performance of the individual economy.

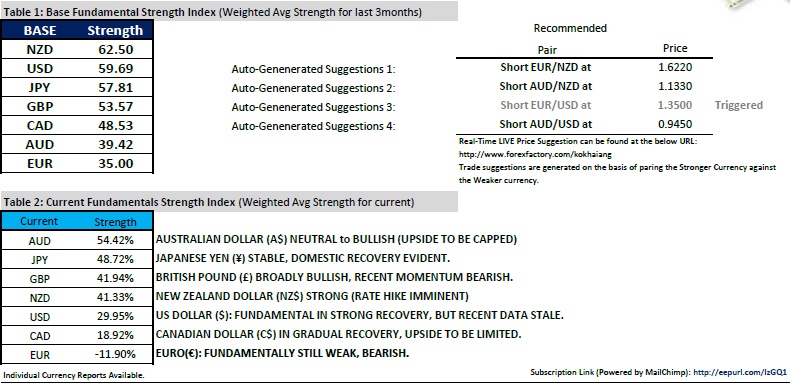

(2) Summary of currencies

Contains quantitative scoring of the individual currencies; then the STRONGEST score is paired with the WEAKEST currency to generate trade suggestion (automated process).

Please kindly read the disclaimers and exercise caution while using the report.

I've attached my works on fundamental analysis.

Hope it is comprehensive and helps in bettering everyone's trading.

Suggestion welcome, appreciated.

Cheers.

* Due to timing lapse and sensitivity of market, latest, real-time limit price suggestion can be found at my auto-trader.

http://www.forexfactory.com/kokhaiang

There's 2 category of reports:

(1) Currency Report (AUD, NZD, CAD, CNY, USD, JPY, GBP, EUR)

Report contains overview, indicator charts of the performance of the individual economy.

(2) Summary of currencies

Contains quantitative scoring of the individual currencies; then the STRONGEST score is paired with the WEAKEST currency to generate trade suggestion (automated process).

Please kindly read the disclaimers and exercise caution while using the report.

會員從Nov 14, 2013開始

8帖子

Nov 15, 2013 at 08:42

會員從Nov 14, 2013開始

8帖子

Have posted 15-11-2013 report at http://www.forexfactory.com/showthread.php?t=457213

會員從Nov 14, 2013開始

8帖子

會員從Nov 14, 2013開始

8帖子

Nov 17, 2013 at 07:28

會員從Nov 14, 2013開始

8帖子

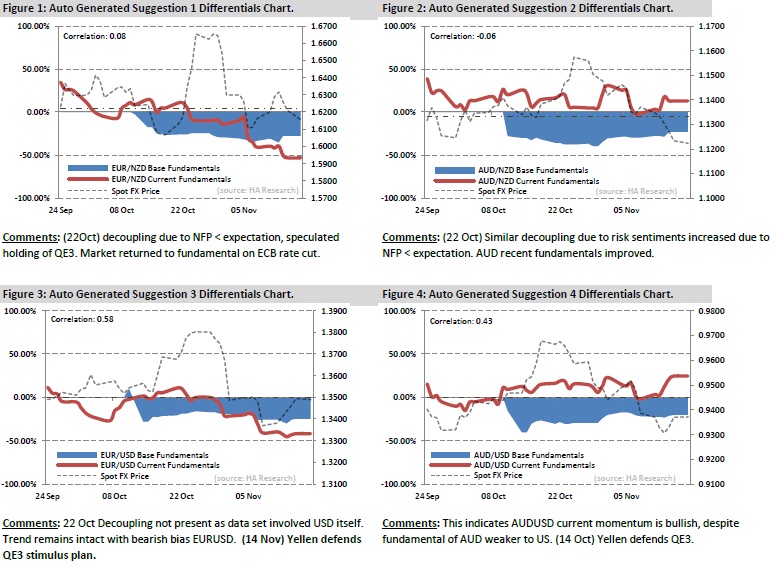

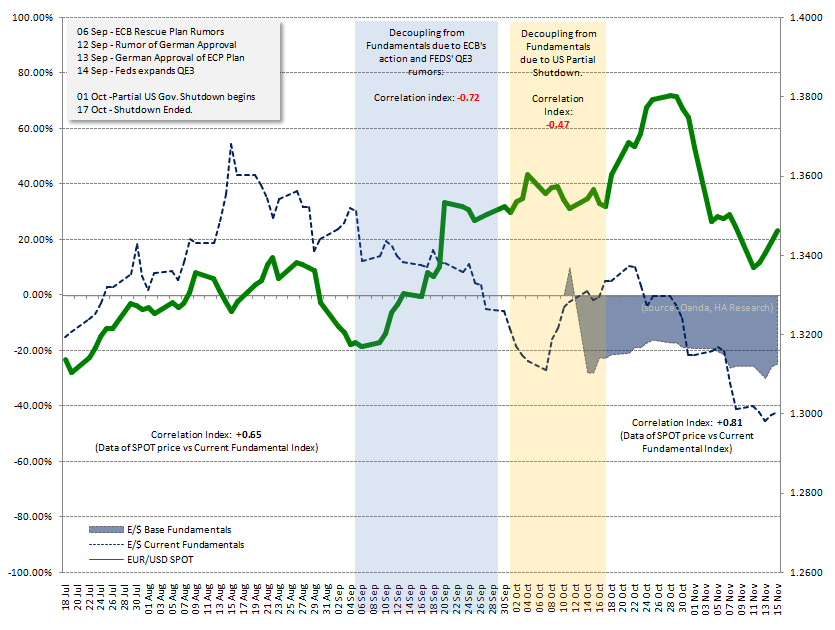

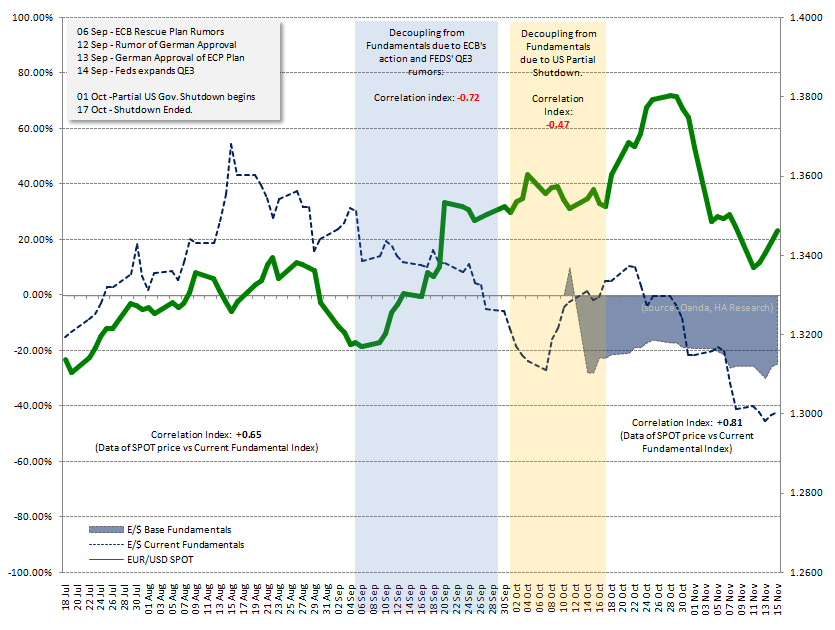

Brief studies on how Market news affected Price action and causing currencies to decouple from it's fundamentals - for subject: EUR/USD.

Suggestions for improvement welcomed, much appreciated.

Disclaimer:

-NEWS TIMELINE & DETAIL MIGHT NOT BE ACCURATE, OR BRIEF AT BEST, AND DATE DIFFERENCE MIGHT BE DUE TO TIMEZONE DIFFERENCES.

- CURRENT FUNDAMENTAL STRENGTH is calculated by computing the results of fundamental data of the associated currency, with strength graded based on (1) if over or below market consensus / forecast, (2) if data is over or below it's 36months average, (3) if data is over or below market benchmark / or CB defined benchmark or (4) combination of either factors.

- CURRENT BASE STRENGTH is calculated by computing set of fundamental data of the associated currency, with data from up to 2008 is weighted by 3 months average vs 12months average vs 36months average, using the same weighting criteria as Current Fundamental Strength. Its formula is derived on Early October 2013, therefore the limited data history.

Suggestions for improvement welcomed, much appreciated.

Disclaimer:

-NEWS TIMELINE & DETAIL MIGHT NOT BE ACCURATE, OR BRIEF AT BEST, AND DATE DIFFERENCE MIGHT BE DUE TO TIMEZONE DIFFERENCES.

- CURRENT FUNDAMENTAL STRENGTH is calculated by computing the results of fundamental data of the associated currency, with strength graded based on (1) if over or below market consensus / forecast, (2) if data is over or below it's 36months average, (3) if data is over or below market benchmark / or CB defined benchmark or (4) combination of either factors.

- CURRENT BASE STRENGTH is calculated by computing set of fundamental data of the associated currency, with data from up to 2008 is weighted by 3 months average vs 12months average vs 36months average, using the same weighting criteria as Current Fundamental Strength. Its formula is derived on Early October 2013, therefore the limited data history.

會員從Nov 14, 2013開始

8帖子

Nov 17, 2013 at 07:29

會員從Nov 14, 2013開始

8帖子

Hi all,

Will be sending the attached revised Summary Report template going forward, to the subscription lists:

Added:

- SPOT RATE of the auto-generate suggestions pair,

- ENTRY LEVEL LINE in dash dot lines in,

- Correlation rate of SPOT RATE vs generated FUNDAMENTAL INDEX

- Comments to include any potential decoupling of price action (P.A) from fundamental due to external events, so traders can react accordingly.

Additional Information:

CURRENT FUNDAMENTAL STRENGTH is calculated by computing the results of fundamental data of the associated currency, with strength graded based on (1) if over or below market consensus / forecast, (2) if data is over or below it's 36months average, (3) if data is over or below market benchmark / or CB defined benchmark or (4) combination of either factors. Strength of individual currency, it's components and relevant charting can be found in Currency Reports.

BASE FUNDAMENTAL STRENGTH is calculated by computing set of fundamental data of the associated currency, with data from up to 2008 is weighted by 3 months average vs 12months average vs 36months average, using the same weighting criteria as Current Fundamental Strength. Its formula is derived on Early October 2013, therefore the limited data history. Strength of individual currency, it's components and relevant charting can be found in Currency Reports.

Correlation is computed into what is known as the correlation coefficient, which ranges between -1 and +1. Perfect positive correlation (a correlation co-efficient of +1) implies that as one security moves, either up or down, the other security will move in lockstep, in the same direction. Alternatively, perfect negative correlation means that if one security moves in either direction the security that is perfectly negatively correlated will move in the opposite direction. If the correlation is 0, the movements of the securities are said to have no correlation; they are completely random. (source: Investopedia). In summary, the more positive it is to value 1, the better.

Will be sending the attached revised Summary Report template going forward, to the subscription lists:

Added:

- SPOT RATE of the auto-generate suggestions pair,

- ENTRY LEVEL LINE in dash dot lines in,

- Correlation rate of SPOT RATE vs generated FUNDAMENTAL INDEX

- Comments to include any potential decoupling of price action (P.A) from fundamental due to external events, so traders can react accordingly.

Additional Information:

CURRENT FUNDAMENTAL STRENGTH is calculated by computing the results of fundamental data of the associated currency, with strength graded based on (1) if over or below market consensus / forecast, (2) if data is over or below it's 36months average, (3) if data is over or below market benchmark / or CB defined benchmark or (4) combination of either factors. Strength of individual currency, it's components and relevant charting can be found in Currency Reports.

BASE FUNDAMENTAL STRENGTH is calculated by computing set of fundamental data of the associated currency, with data from up to 2008 is weighted by 3 months average vs 12months average vs 36months average, using the same weighting criteria as Current Fundamental Strength. Its formula is derived on Early October 2013, therefore the limited data history. Strength of individual currency, it's components and relevant charting can be found in Currency Reports.

Correlation is computed into what is known as the correlation coefficient, which ranges between -1 and +1. Perfect positive correlation (a correlation co-efficient of +1) implies that as one security moves, either up or down, the other security will move in lockstep, in the same direction. Alternatively, perfect negative correlation means that if one security moves in either direction the security that is perfectly negatively correlated will move in the opposite direction. If the correlation is 0, the movements of the securities are said to have no correlation; they are completely random. (source: Investopedia). In summary, the more positive it is to value 1, the better.

會員從Jan 18, 2012開始

28帖子

*商業用途和垃圾郵件將不被容忍,並可能導致帳戶終止。

提示:發佈圖片/YouTube網址會自動嵌入到您的帖子中!

提示:鍵入@符號,自動完成參與此討論的用戶名。