Edit Your Comment

Trading Journal

Sep 27, 2018 at 00:03

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note – 26 Sep

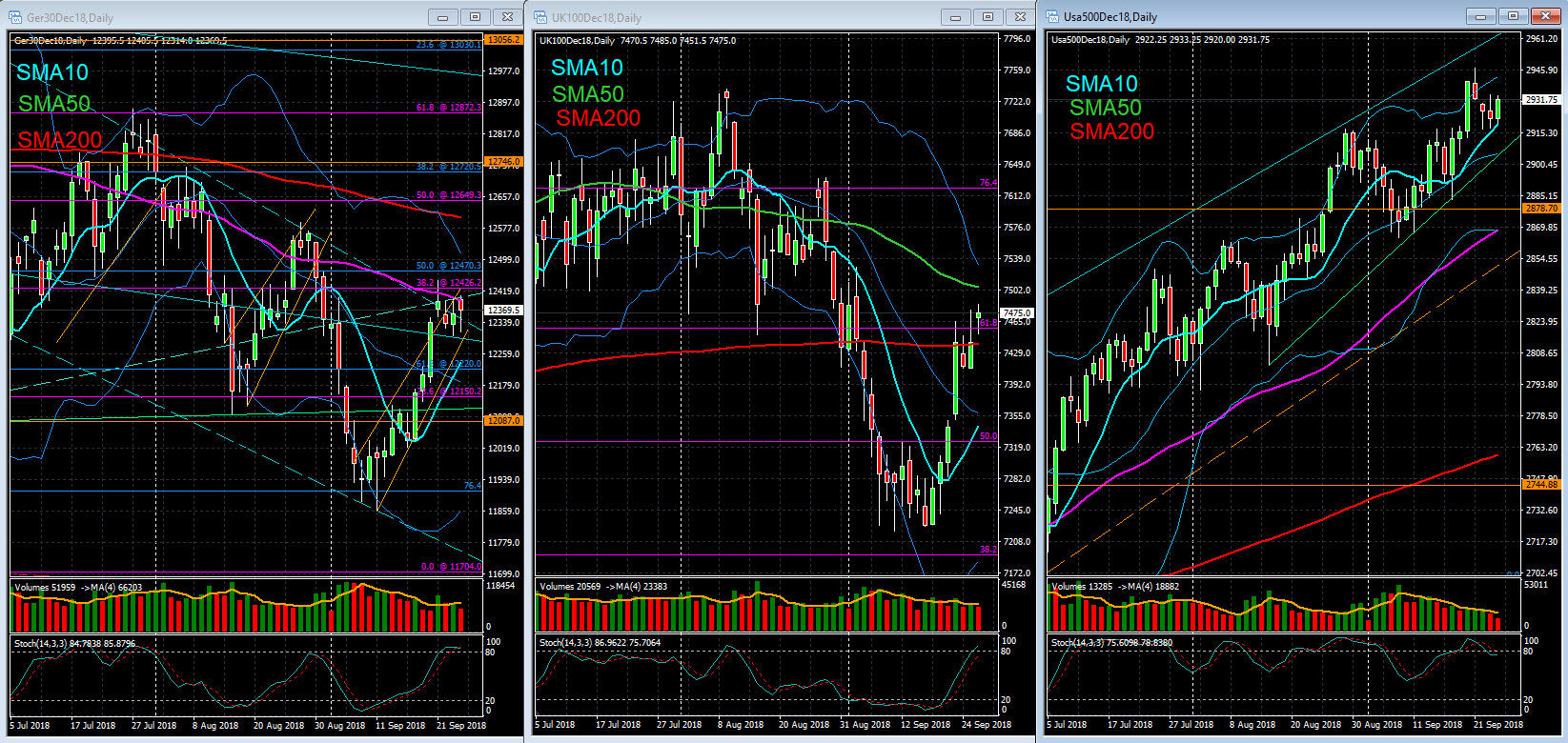

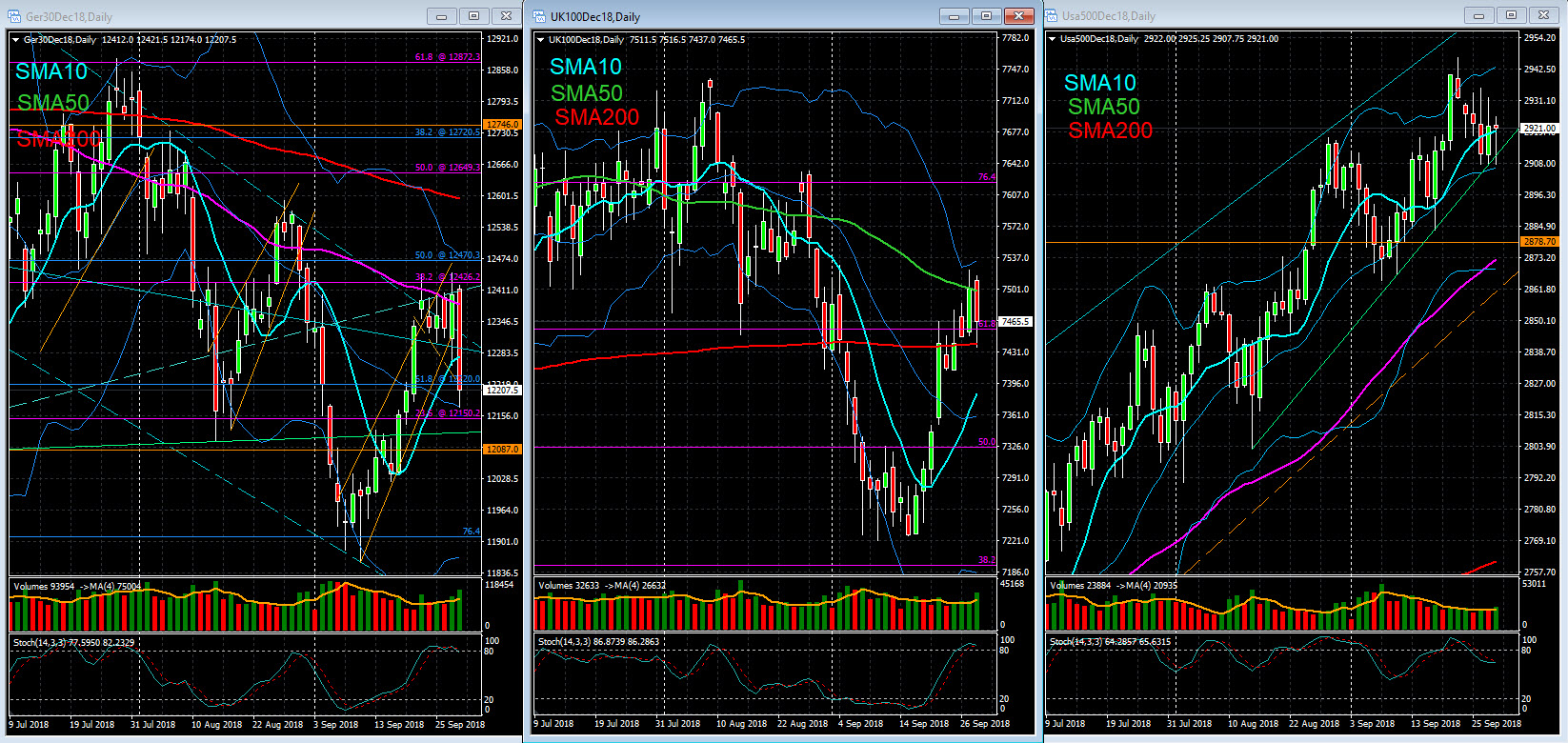

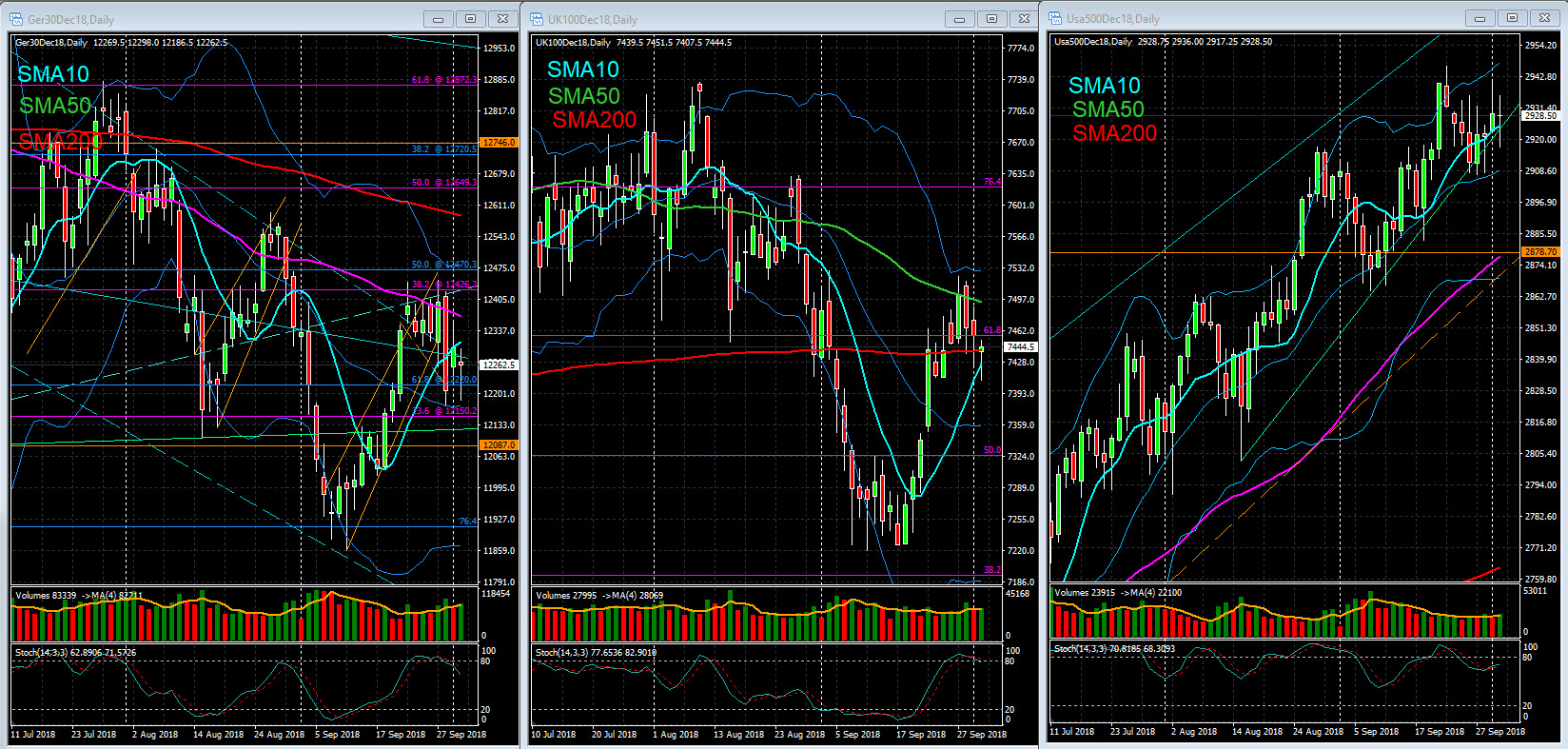

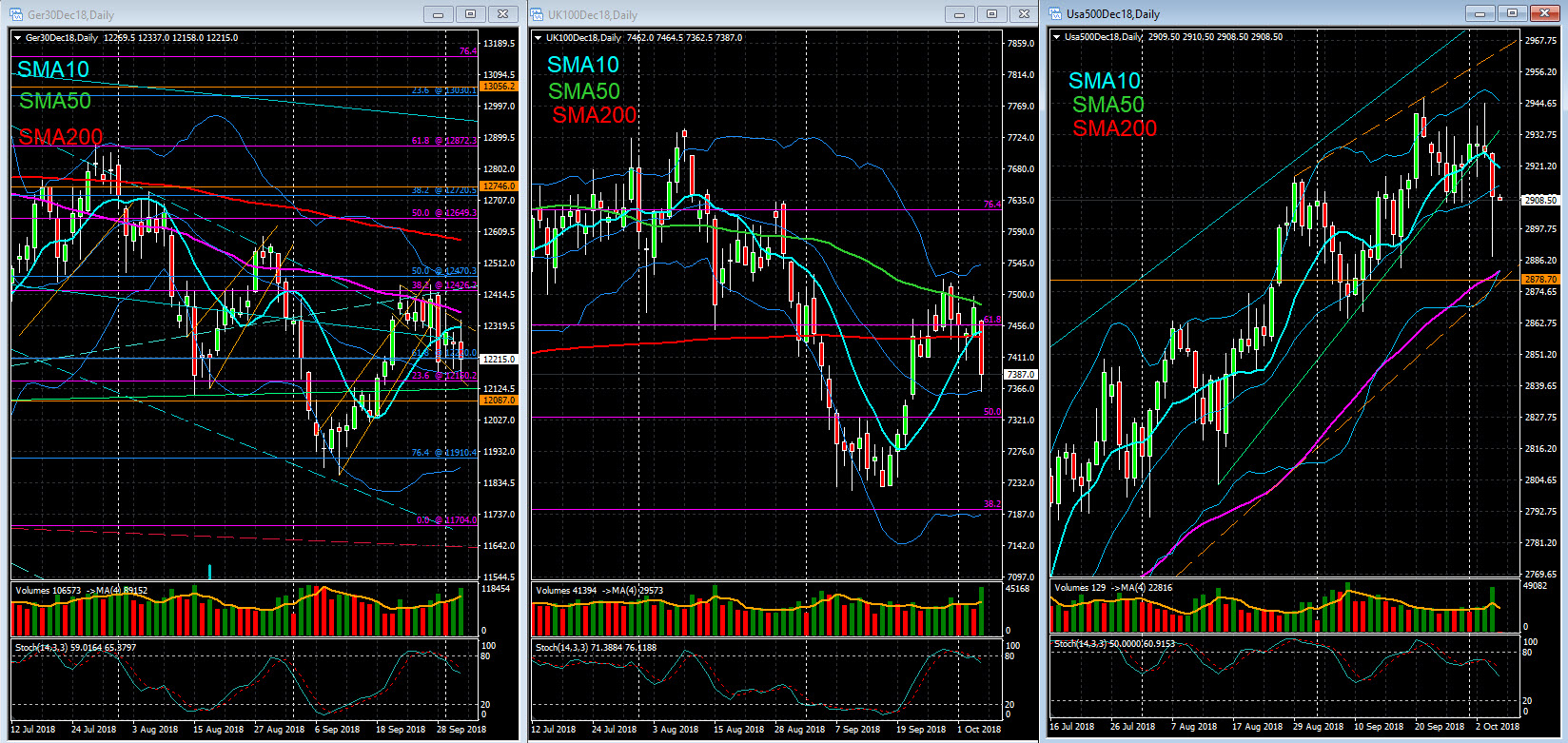

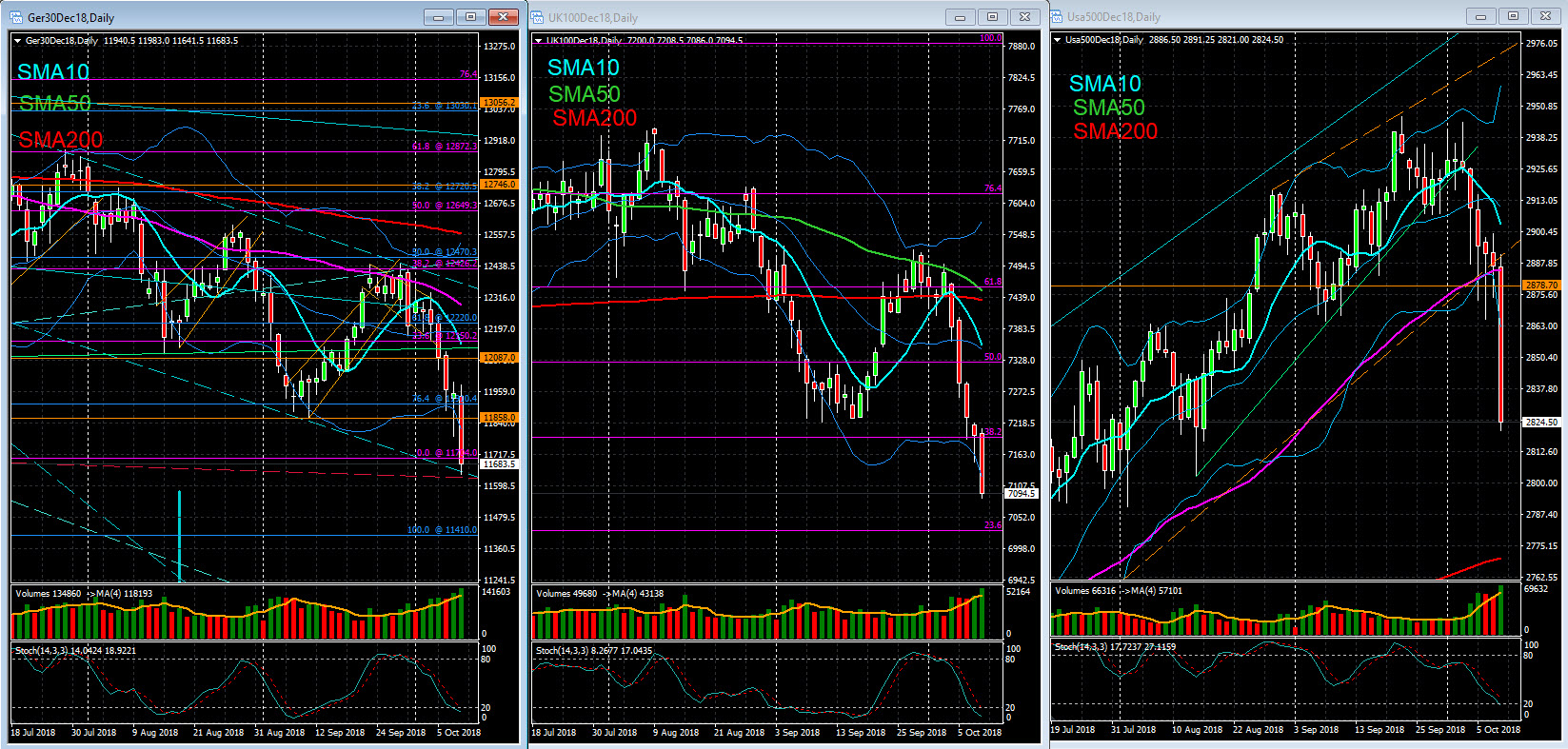

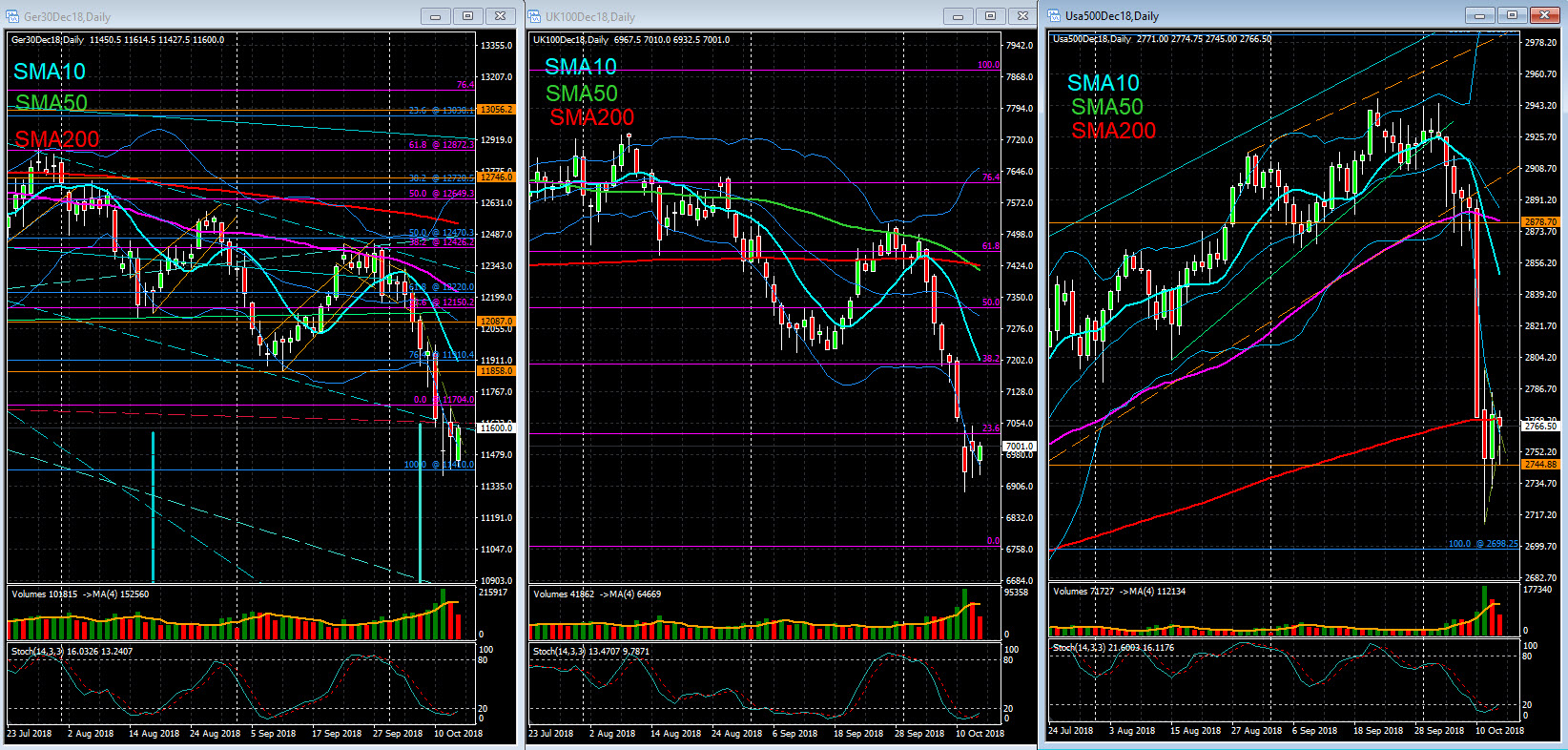

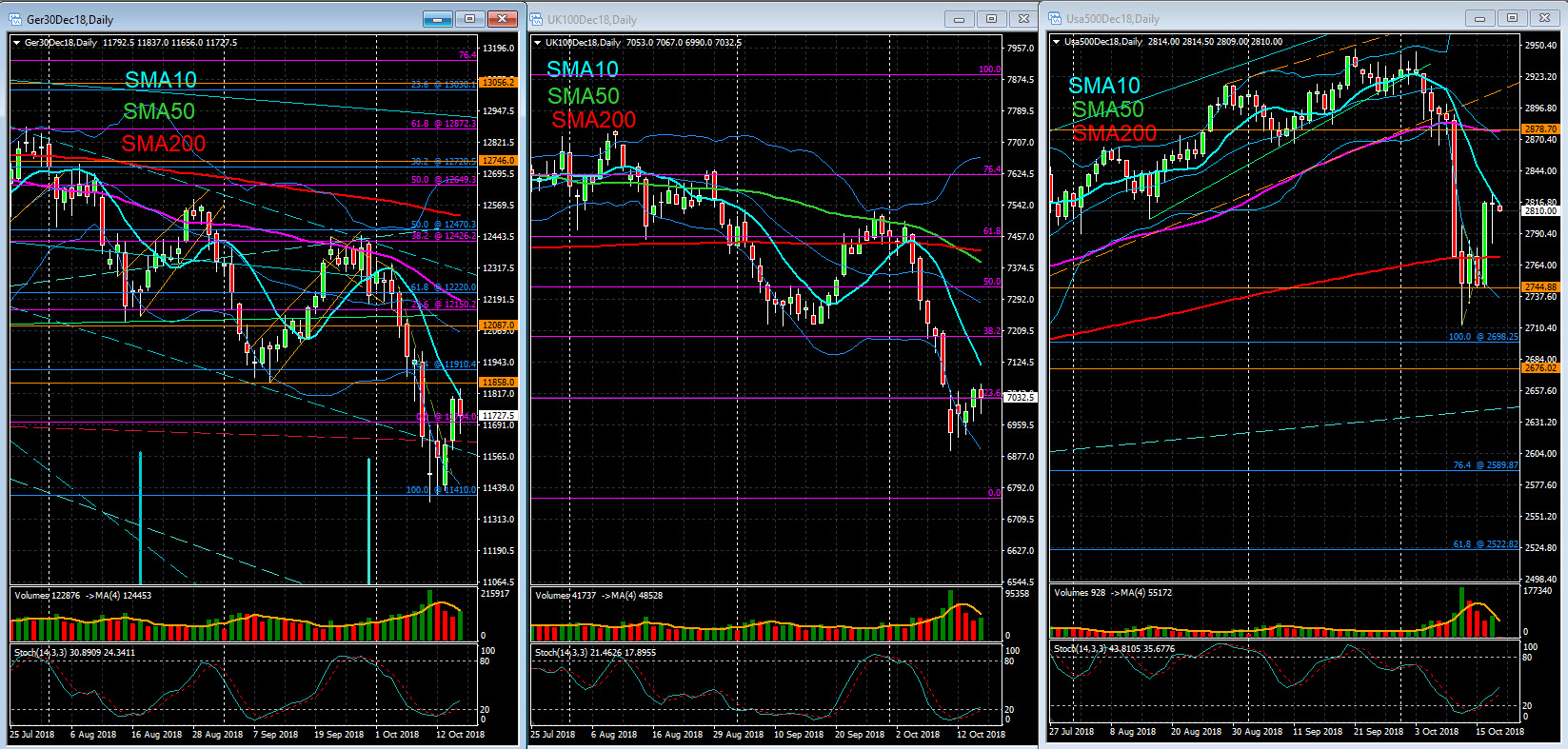

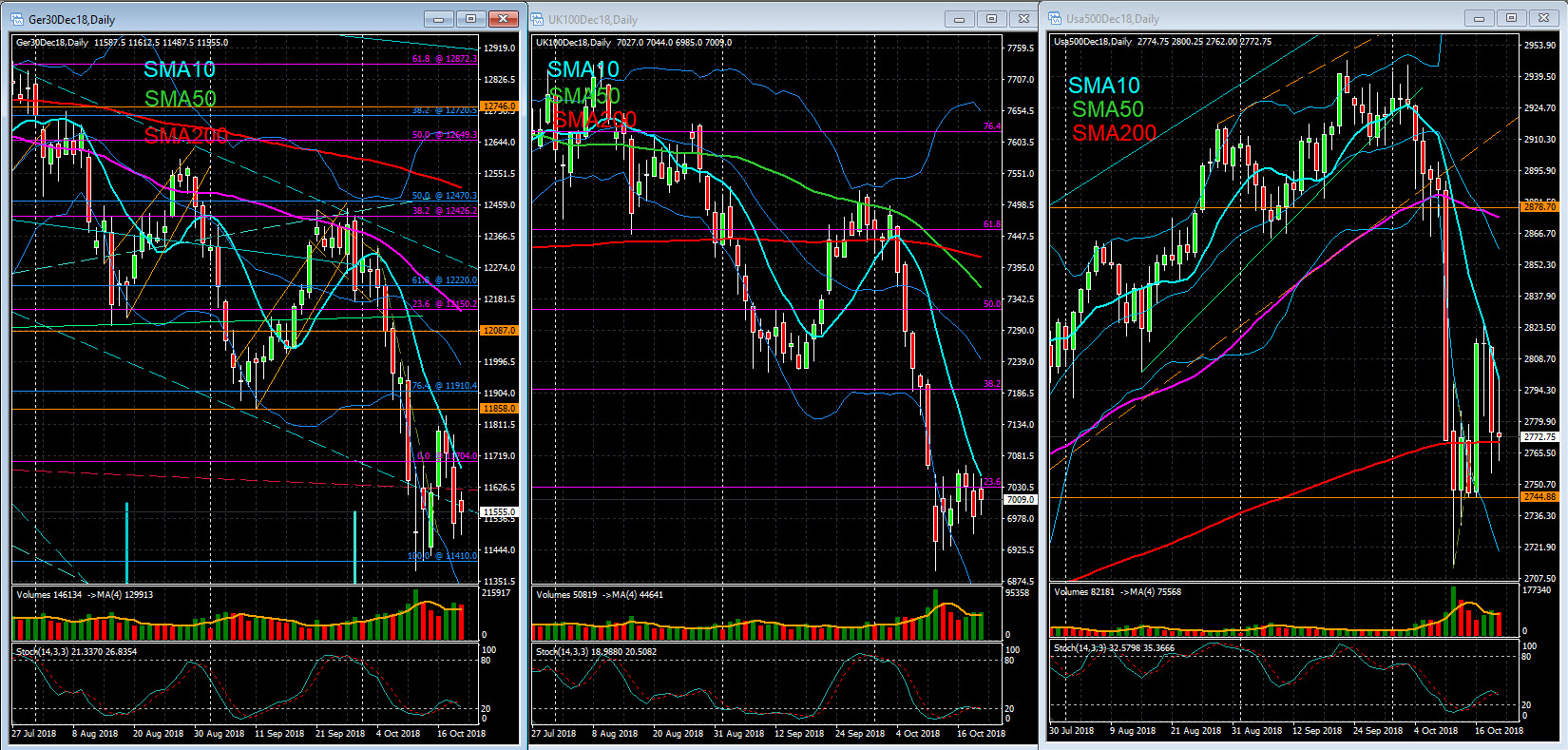

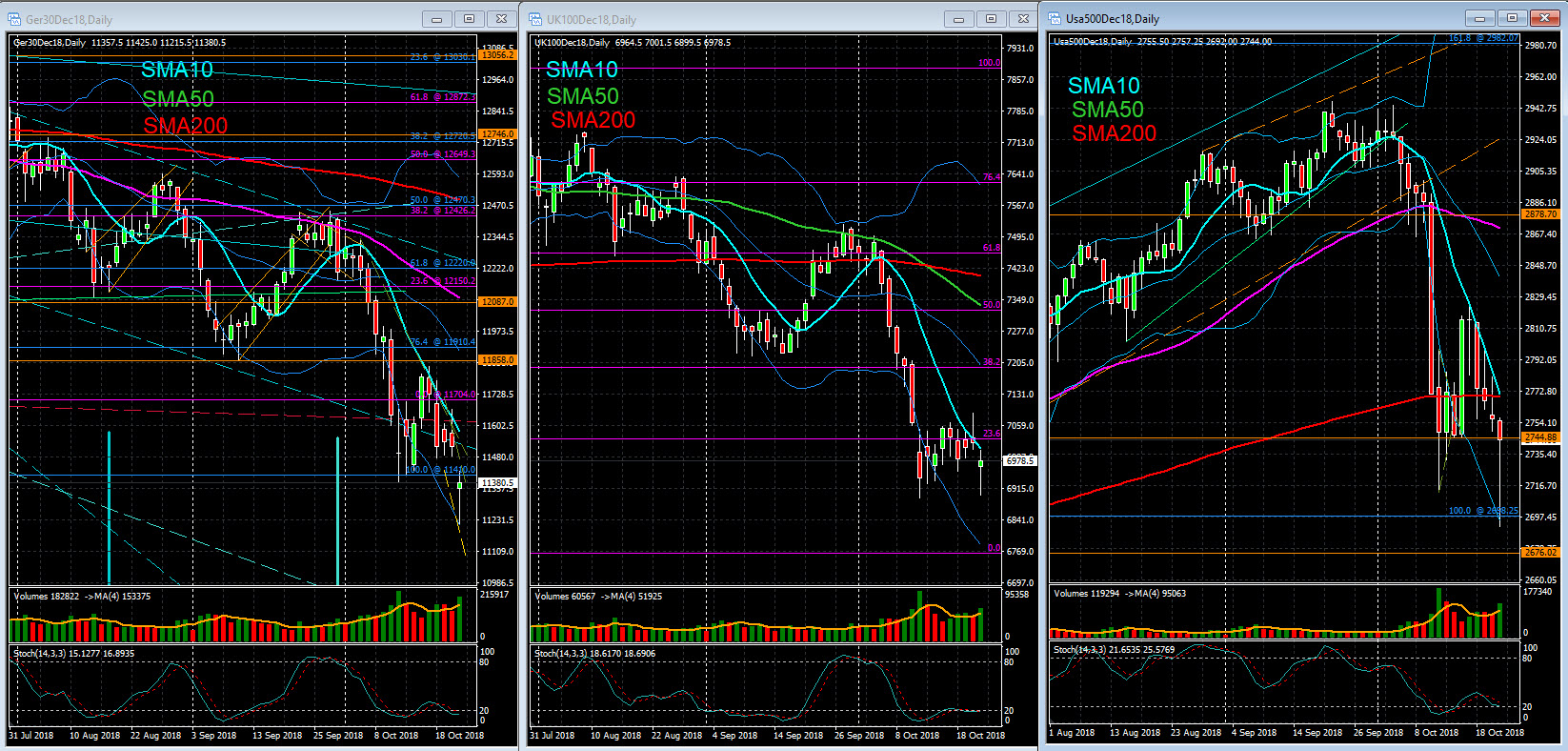

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets ended in different directions as investors waited for the US Federal Reserve meeting. On the eve of the deadline for the presentation of the first draft of the State Budget for 2019, the Italian market closed at a low, although OT yields were not reacting negatively. Remember that the contrasts between Deputy Prime Minister Di Maio, leader of the 5 Stelle Movement, and the Minister of Finance Tria intensified in the last hours, and Di May threatened not to support the State Budget. In Frankfurt, BMW remained unchanged after the profit warning. The German company reduced its projections for future profits partly due to uncertainties regarding the customs policy in the main economic blocs, which distort the view of economic agents and aggravate selling prices. Other automakers, such as Daimler, also closed lower. Dieter Zetsche, president of Daimler-Mercedes for 12 years, will give up the German brand's executive command, becoming chairman of the board of directors. In Paris, Bouygues rose 2.66%, after J.P Morgan raised its recommendation from 'neutral' to 'overweight'.

Wall Street was trading at a slight high, with the focus mostly on monetary policy. At today's FED meeting, the Central Bank raised benchmark rates by 0.25% to the range of 2% to 2.25%. Officials’ projections for the future path of rates steepened, even as the Fed acknowledged inflation shows no signs of accelerating. This Fed decision comes at a time of renewed fears about trade tensions after Mr Trump's intervention at UN headquarters yesterday. In the Assembly of this institution, Donald Trump reiterated the position of his Administration on world trade, warning that his country "will no longer tolerate the abuse of other nations that harms American workers." In addition, the American President has stated that OPEC is displeasing other nations with a policy that artificially raises oil prices. In the macroeconomic field, IBM shares rose more than 2 percent after UBS raised its "neutral" recommendation to "buy", as it expects the company to report better than expected next year.

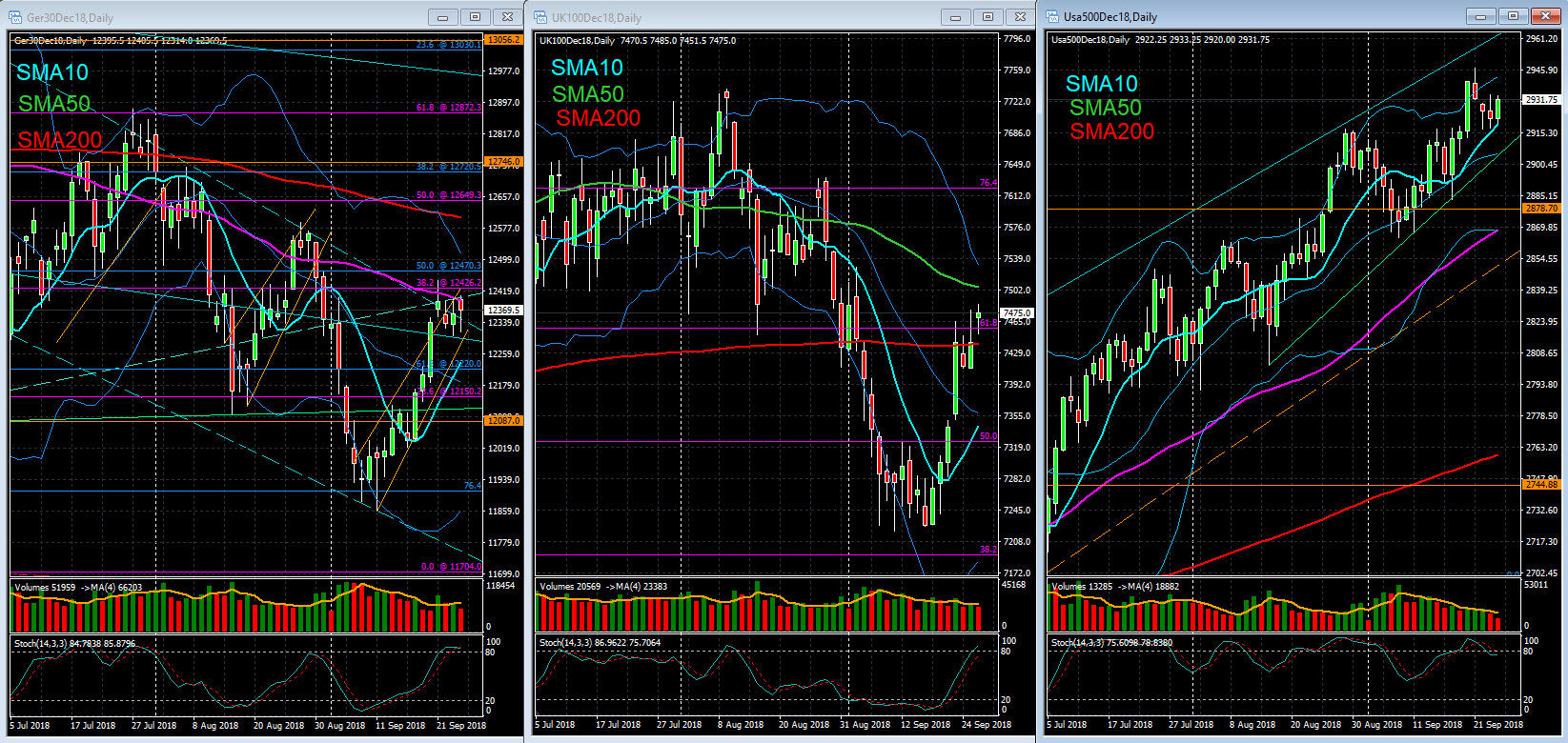

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets ended in different directions as investors waited for the US Federal Reserve meeting. On the eve of the deadline for the presentation of the first draft of the State Budget for 2019, the Italian market closed at a low, although OT yields were not reacting negatively. Remember that the contrasts between Deputy Prime Minister Di Maio, leader of the 5 Stelle Movement, and the Minister of Finance Tria intensified in the last hours, and Di May threatened not to support the State Budget. In Frankfurt, BMW remained unchanged after the profit warning. The German company reduced its projections for future profits partly due to uncertainties regarding the customs policy in the main economic blocs, which distort the view of economic agents and aggravate selling prices. Other automakers, such as Daimler, also closed lower. Dieter Zetsche, president of Daimler-Mercedes for 12 years, will give up the German brand's executive command, becoming chairman of the board of directors. In Paris, Bouygues rose 2.66%, after J.P Morgan raised its recommendation from 'neutral' to 'overweight'.

Wall Street was trading at a slight high, with the focus mostly on monetary policy. At today's FED meeting, the Central Bank raised benchmark rates by 0.25% to the range of 2% to 2.25%. Officials’ projections for the future path of rates steepened, even as the Fed acknowledged inflation shows no signs of accelerating. This Fed decision comes at a time of renewed fears about trade tensions after Mr Trump's intervention at UN headquarters yesterday. In the Assembly of this institution, Donald Trump reiterated the position of his Administration on world trade, warning that his country "will no longer tolerate the abuse of other nations that harms American workers." In addition, the American President has stated that OPEC is displeasing other nations with a policy that artificially raises oil prices. In the macroeconomic field, IBM shares rose more than 2 percent after UBS raised its "neutral" recommendation to "buy", as it expects the company to report better than expected next year.

Sep 27, 2018 at 20:43

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note – 27 Sep

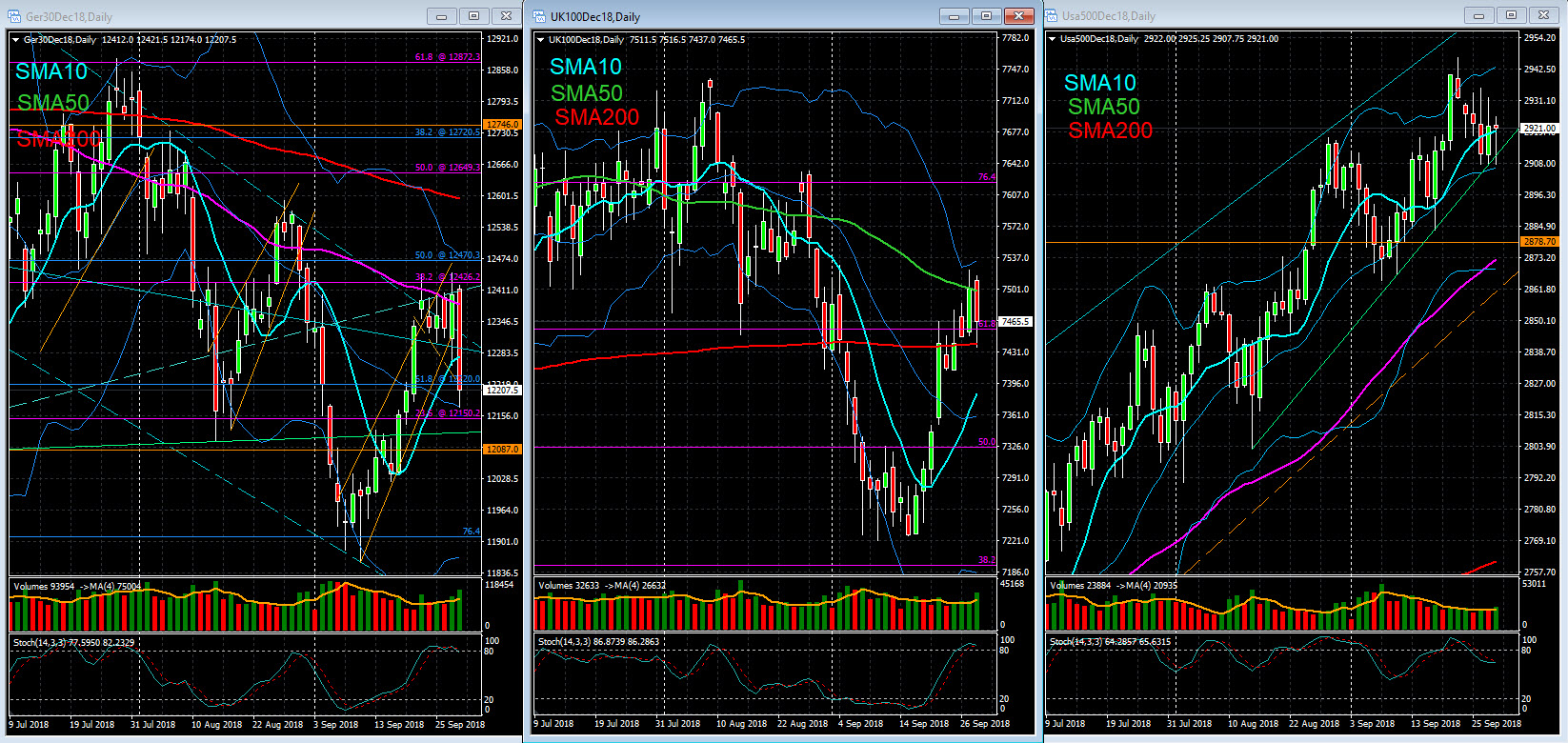

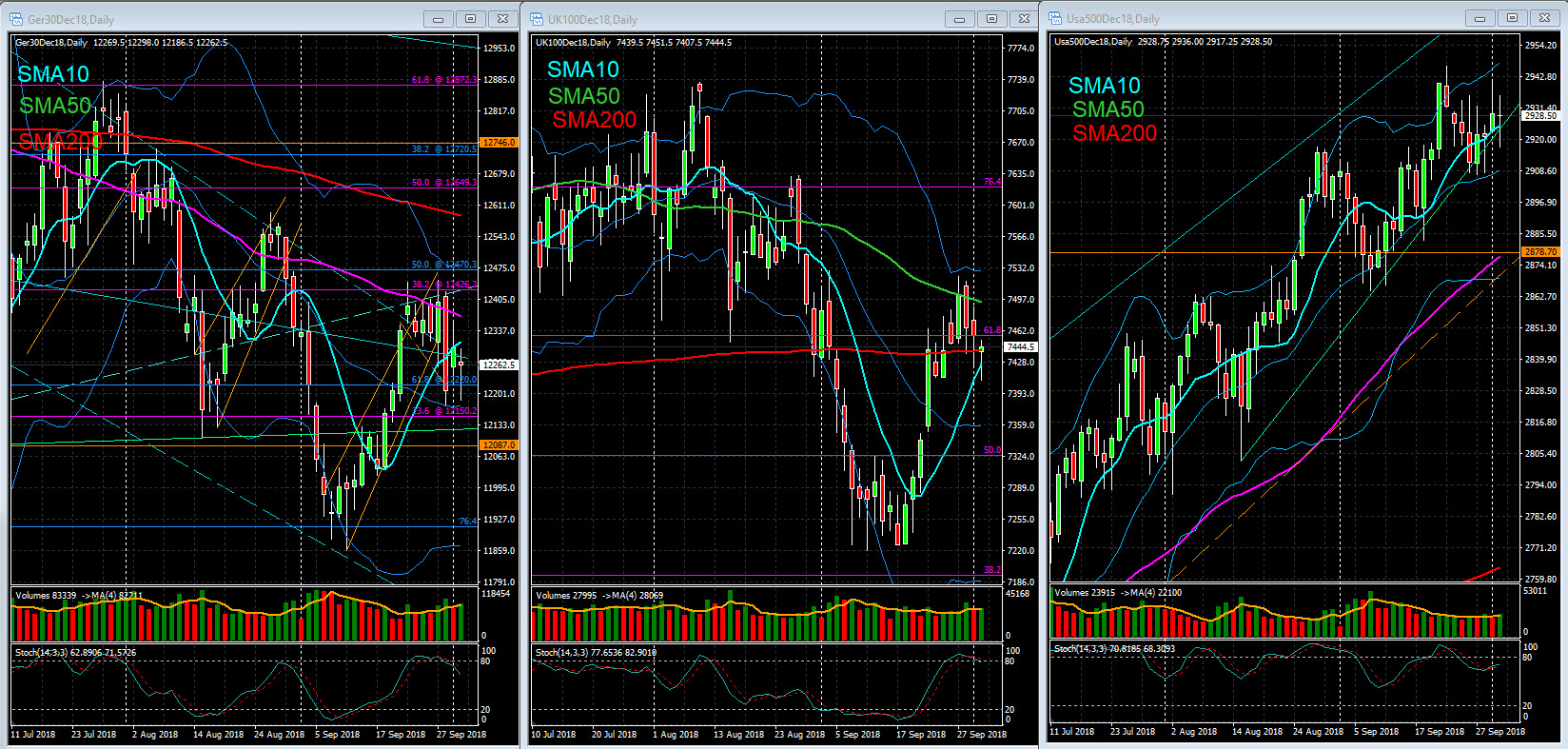

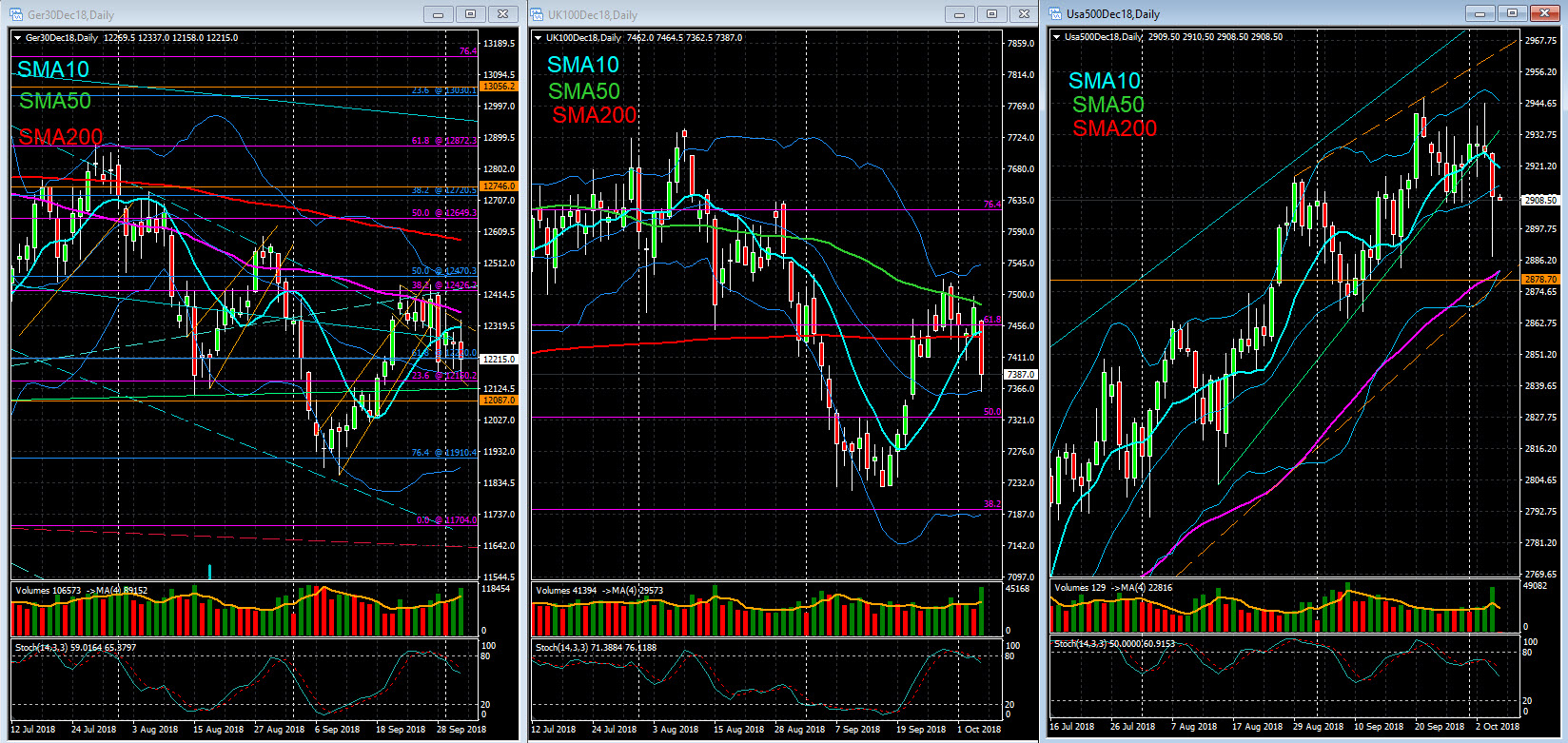

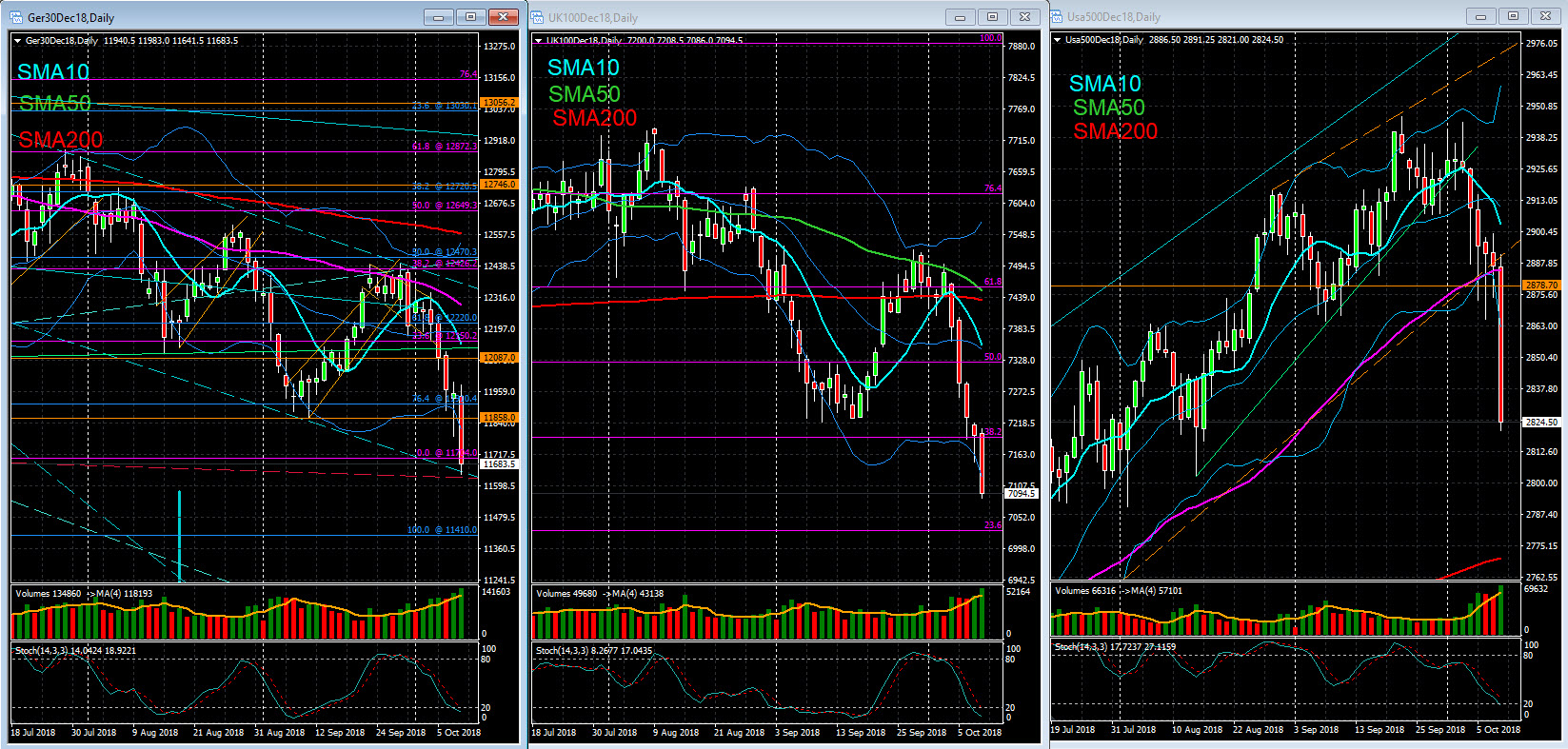

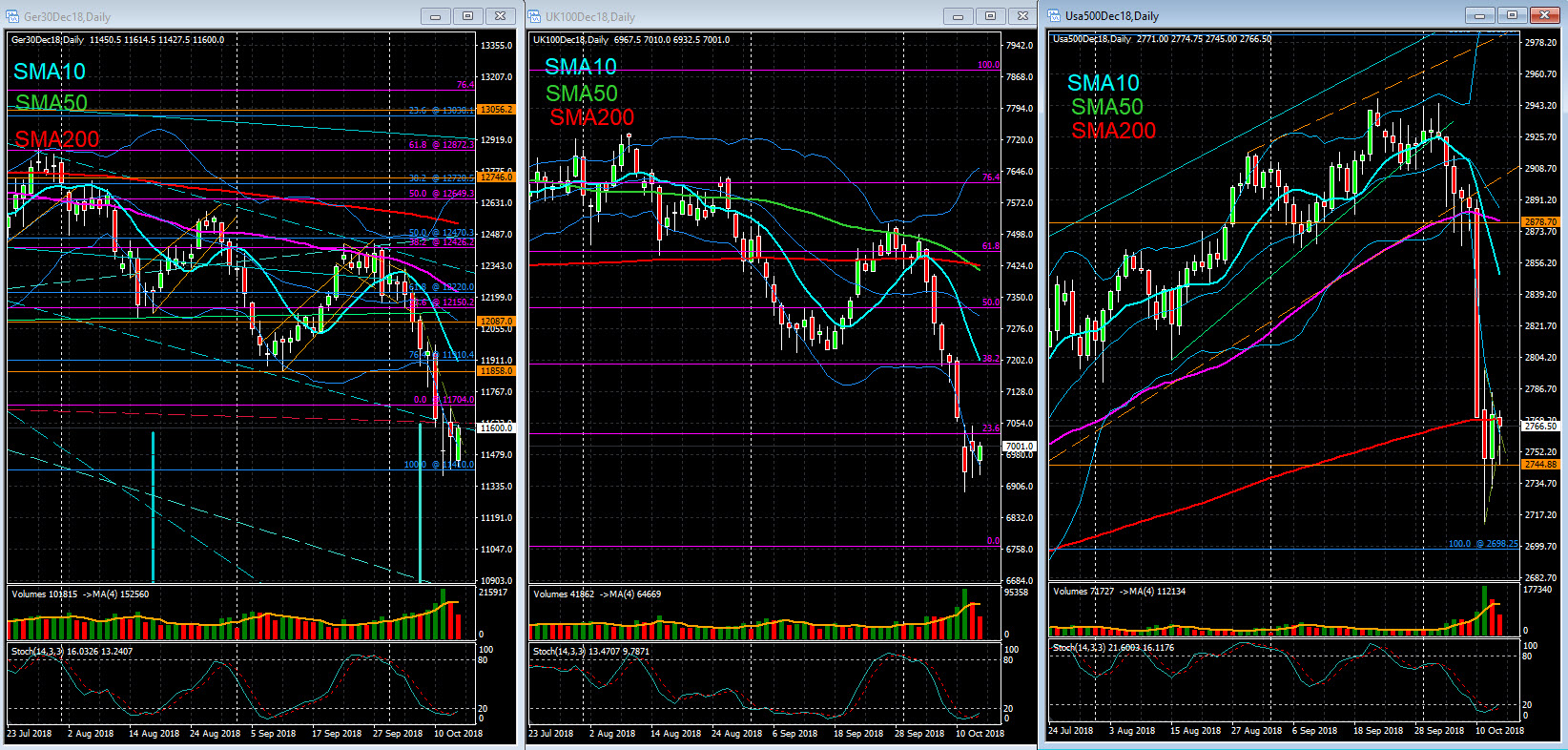

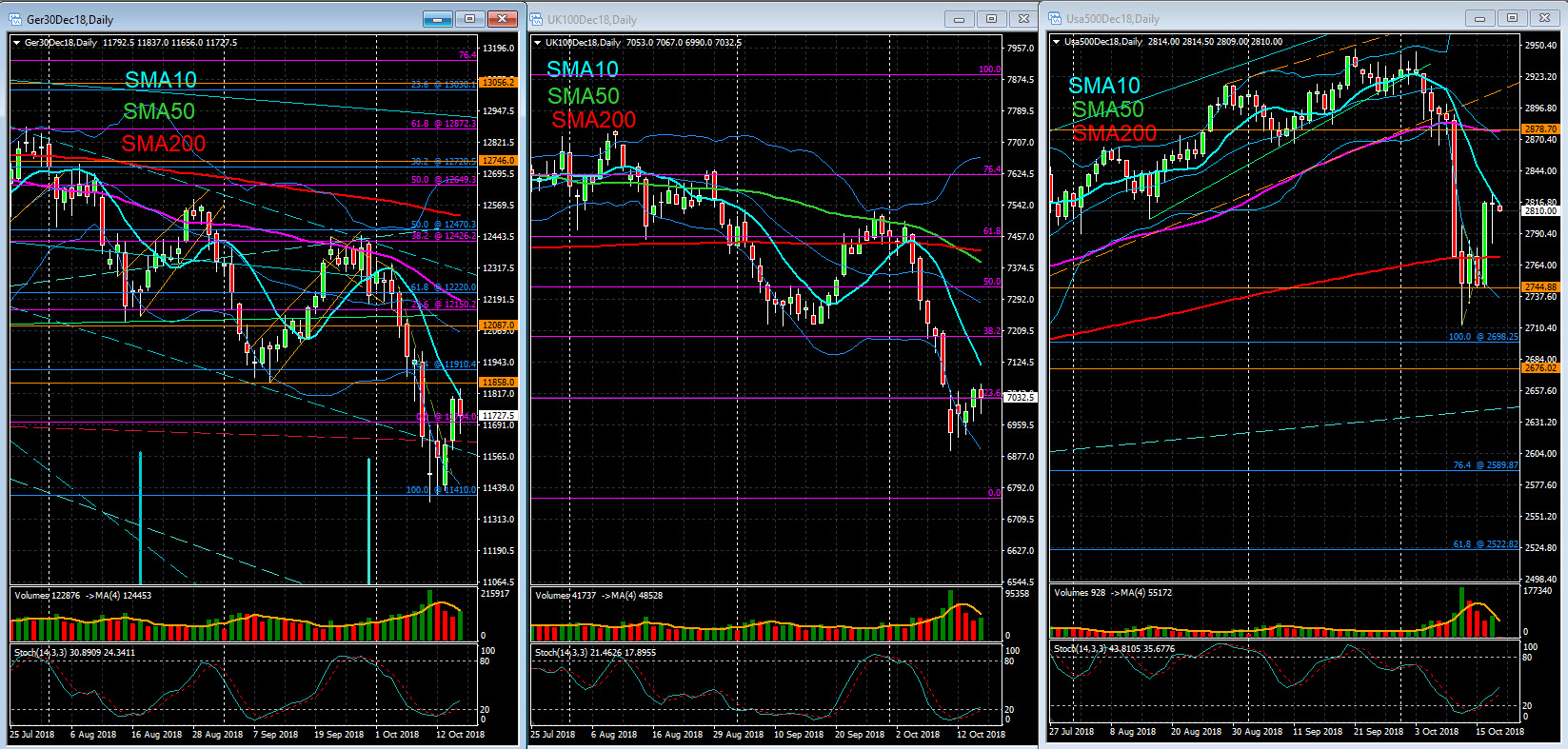

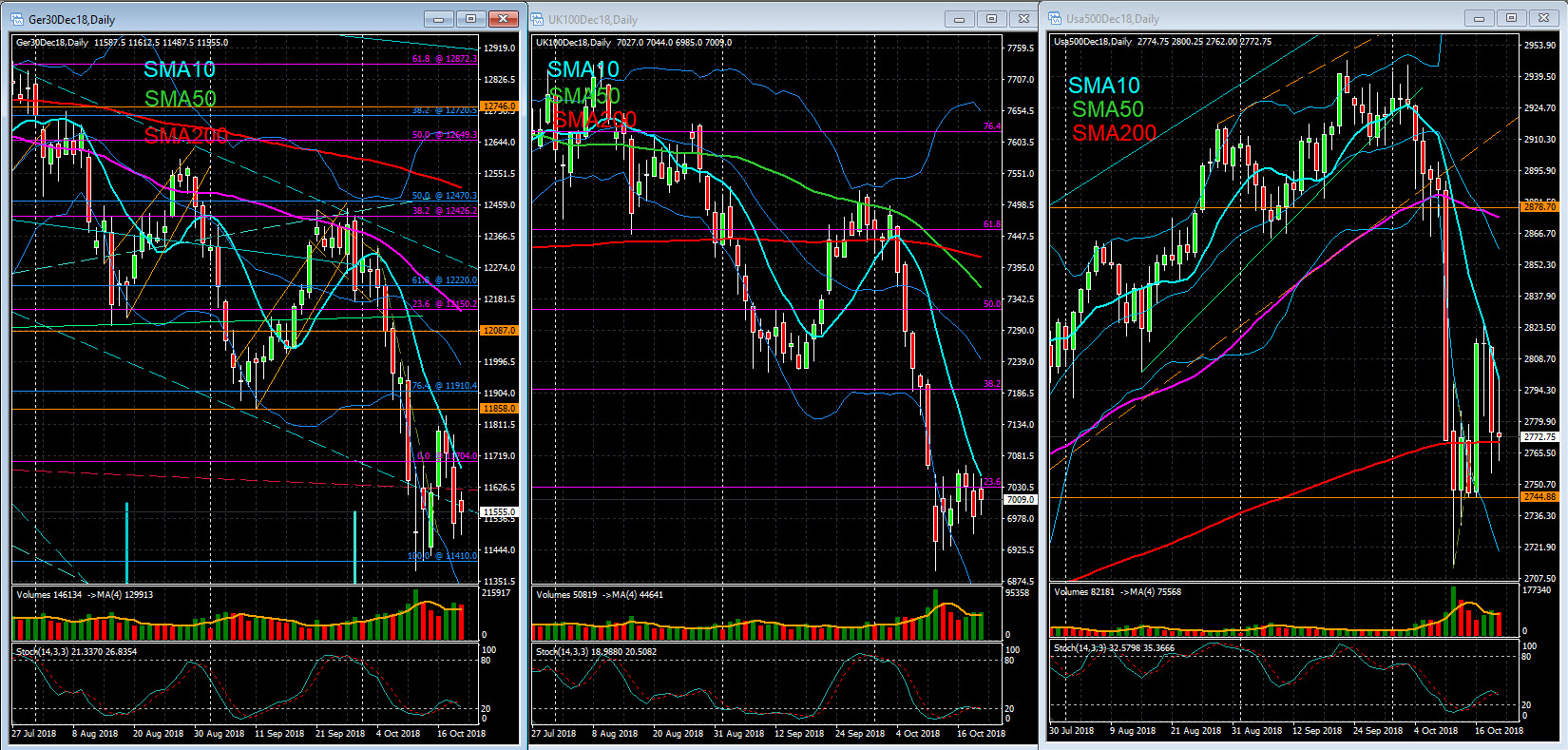

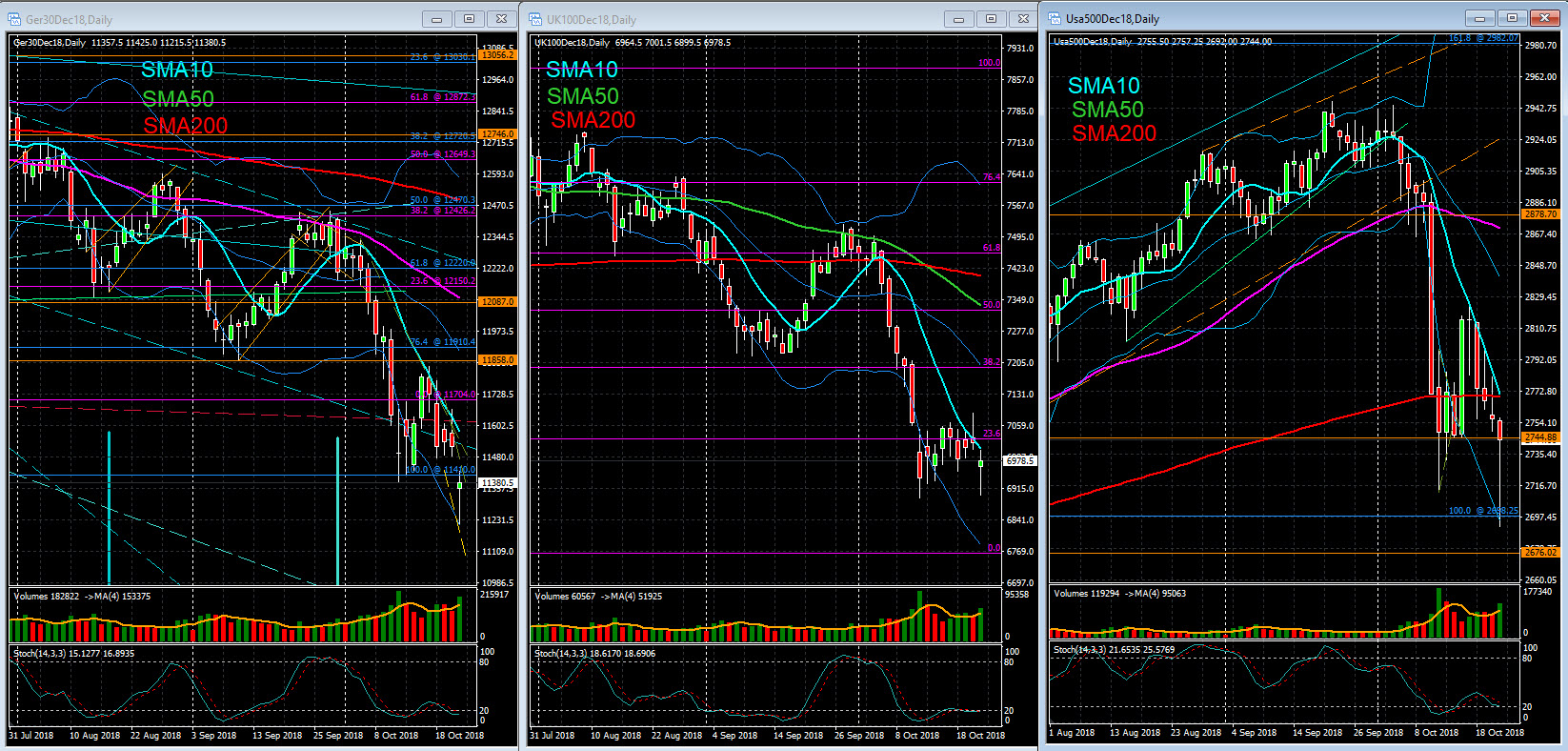

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

Europe's markets closed slightly higher, with investors reacting to yesterday's Fed meeting and monitoring developments in the budget debate in Italy. Today is the deadline for the Italian Government to present the first draft of the Budget for 2019, but according to the Italian press, this presentation should be delayed due to the divergence within the government, which should await the return of the Prime Minister from the UN's Assembly. The initial losses of the Italian market were later softened by the news that the Italian Executive would meet still today at 8 pm local time and by holding an Italian debt auction that attracted a very reasonable buyer interest. At the corporate level, we highlight the stocks of Sweden's H & M. The Scandinavian retailer reported below-market results and sales, although its market share in several countries has increased. The market reaction turned out to be quite positive, with the stock appreciating 11%.

Major US indices traded higher, still in the aftermath of yesterday's Fed meeting. The Central Bank raised the benchmark interest rate by 0.25% to 2% -2.25%. This was the 8th increase since 2015. In the statement, the Fed increased its forecasts for economic growth to 2018 (from 2.80% to 3.10%) and 2019 (2.40% to 2.50%). After yesterday's rise in central rates, the Fed no longer calls the monetary policy "accommodative", but abandoning such an expression does not mean that the cycle of rate increases is over. According to the individual projections of the Governors of this Central Bank, 12 out of 16 believe that in December rates will increase further. By 2019, a majority of FED members (12 out of 16) estimate benchmark rates to be between 2.75% and 3.25%.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

Europe's markets closed slightly higher, with investors reacting to yesterday's Fed meeting and monitoring developments in the budget debate in Italy. Today is the deadline for the Italian Government to present the first draft of the Budget for 2019, but according to the Italian press, this presentation should be delayed due to the divergence within the government, which should await the return of the Prime Minister from the UN's Assembly. The initial losses of the Italian market were later softened by the news that the Italian Executive would meet still today at 8 pm local time and by holding an Italian debt auction that attracted a very reasonable buyer interest. At the corporate level, we highlight the stocks of Sweden's H & M. The Scandinavian retailer reported below-market results and sales, although its market share in several countries has increased. The market reaction turned out to be quite positive, with the stock appreciating 11%.

Major US indices traded higher, still in the aftermath of yesterday's Fed meeting. The Central Bank raised the benchmark interest rate by 0.25% to 2% -2.25%. This was the 8th increase since 2015. In the statement, the Fed increased its forecasts for economic growth to 2018 (from 2.80% to 3.10%) and 2019 (2.40% to 2.50%). After yesterday's rise in central rates, the Fed no longer calls the monetary policy "accommodative", but abandoning such an expression does not mean that the cycle of rate increases is over. According to the individual projections of the Governors of this Central Bank, 12 out of 16 believe that in December rates will increase further. By 2019, a majority of FED members (12 out of 16) estimate benchmark rates to be between 2.75% and 3.25%.

Sep 30, 2018 at 07:18

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note – 28 Sep

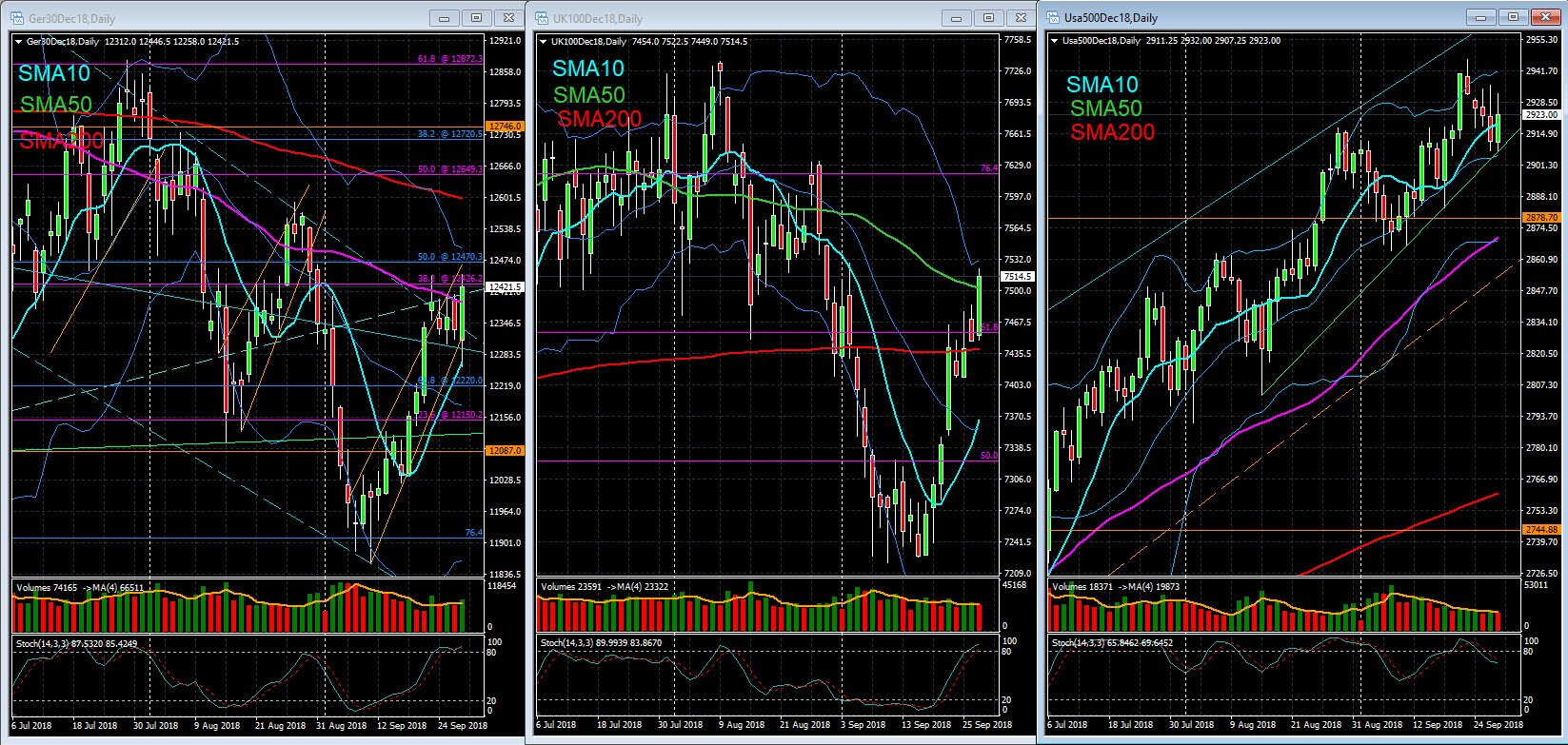

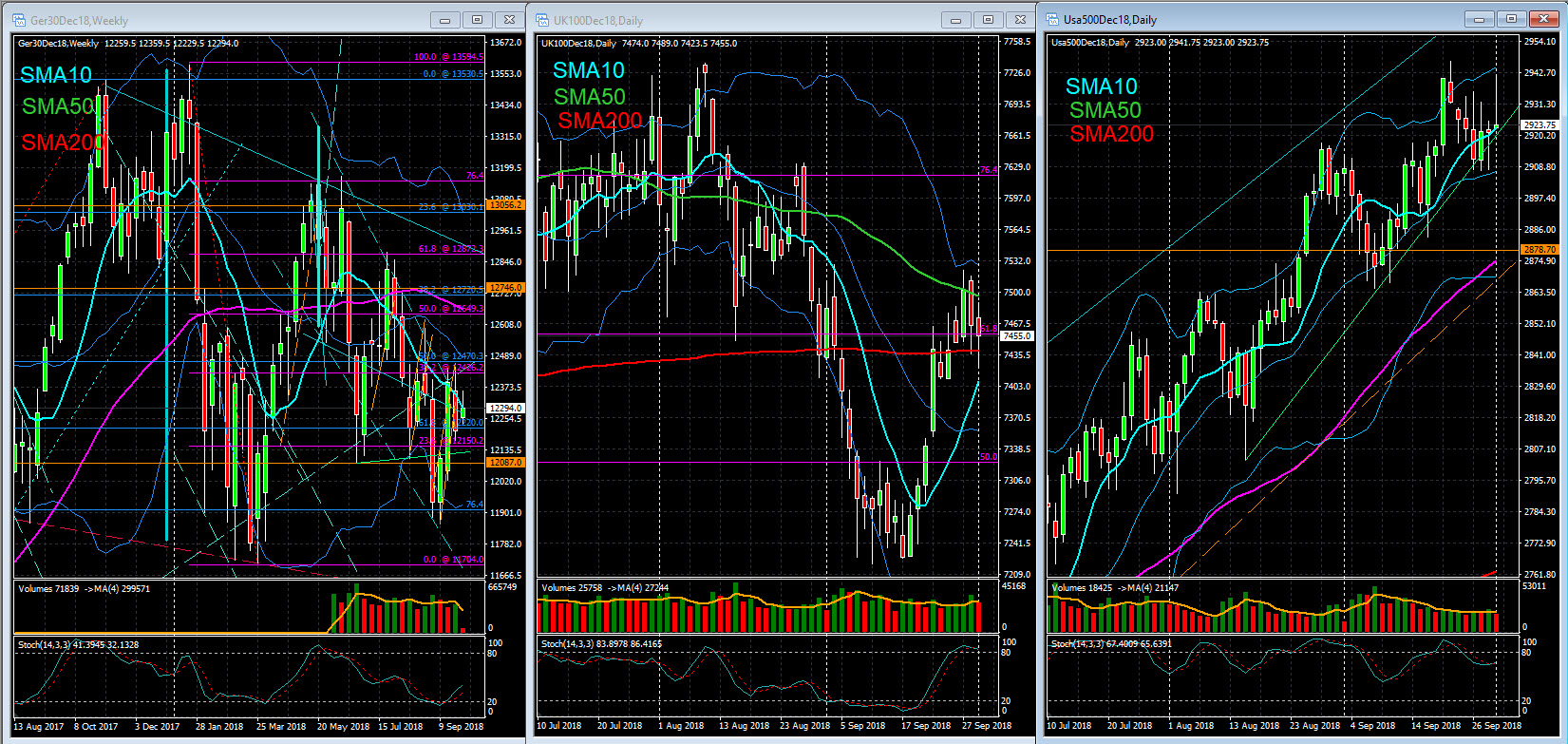

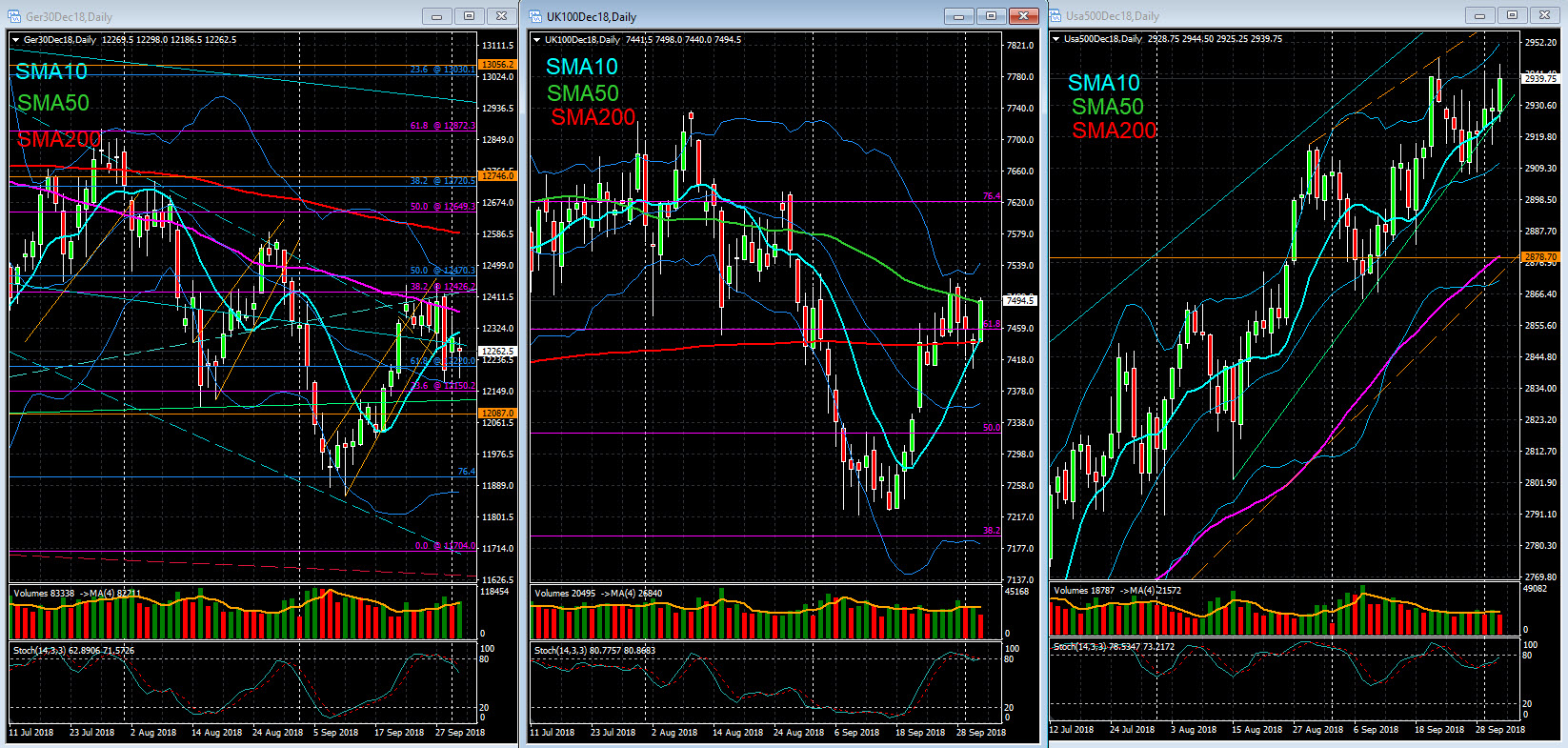

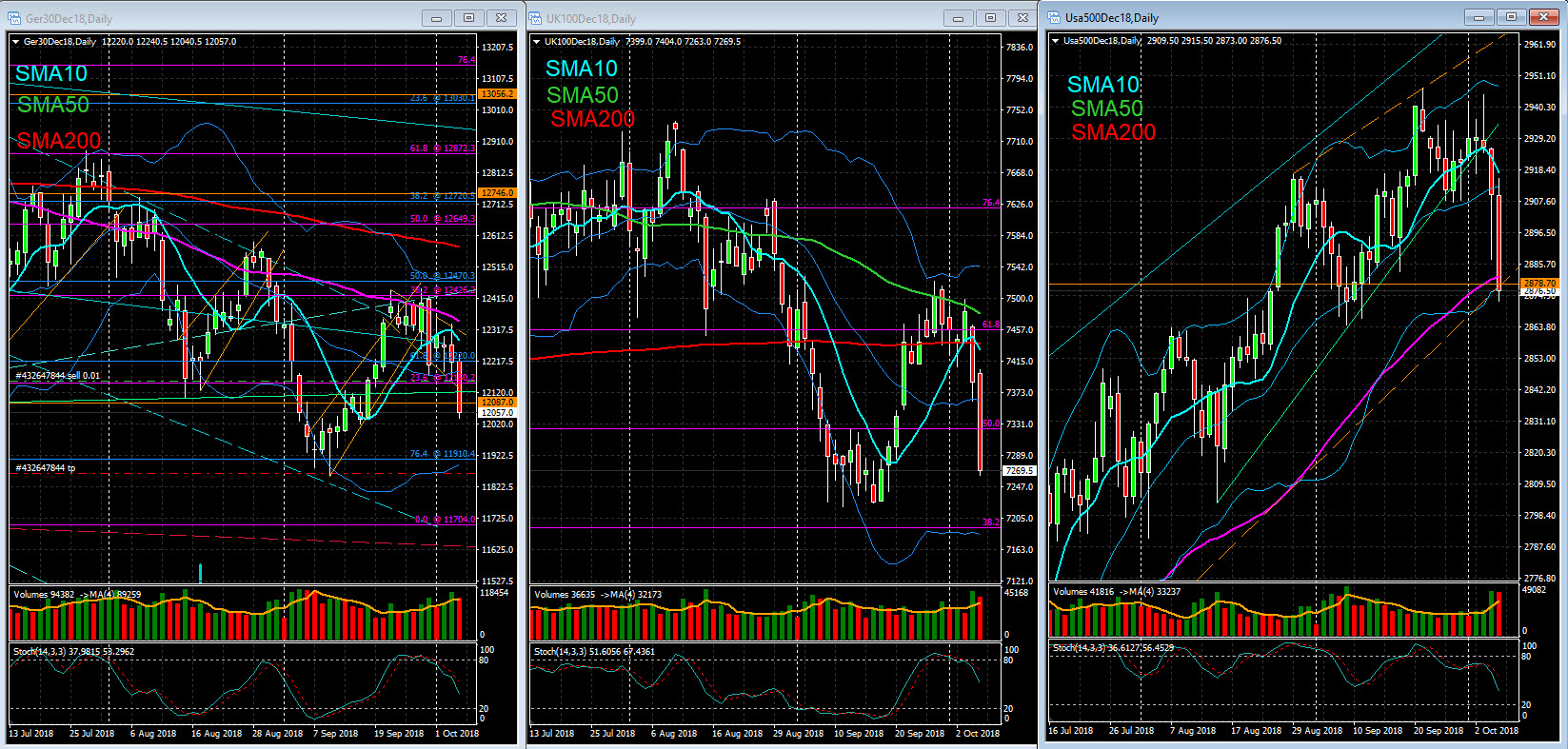

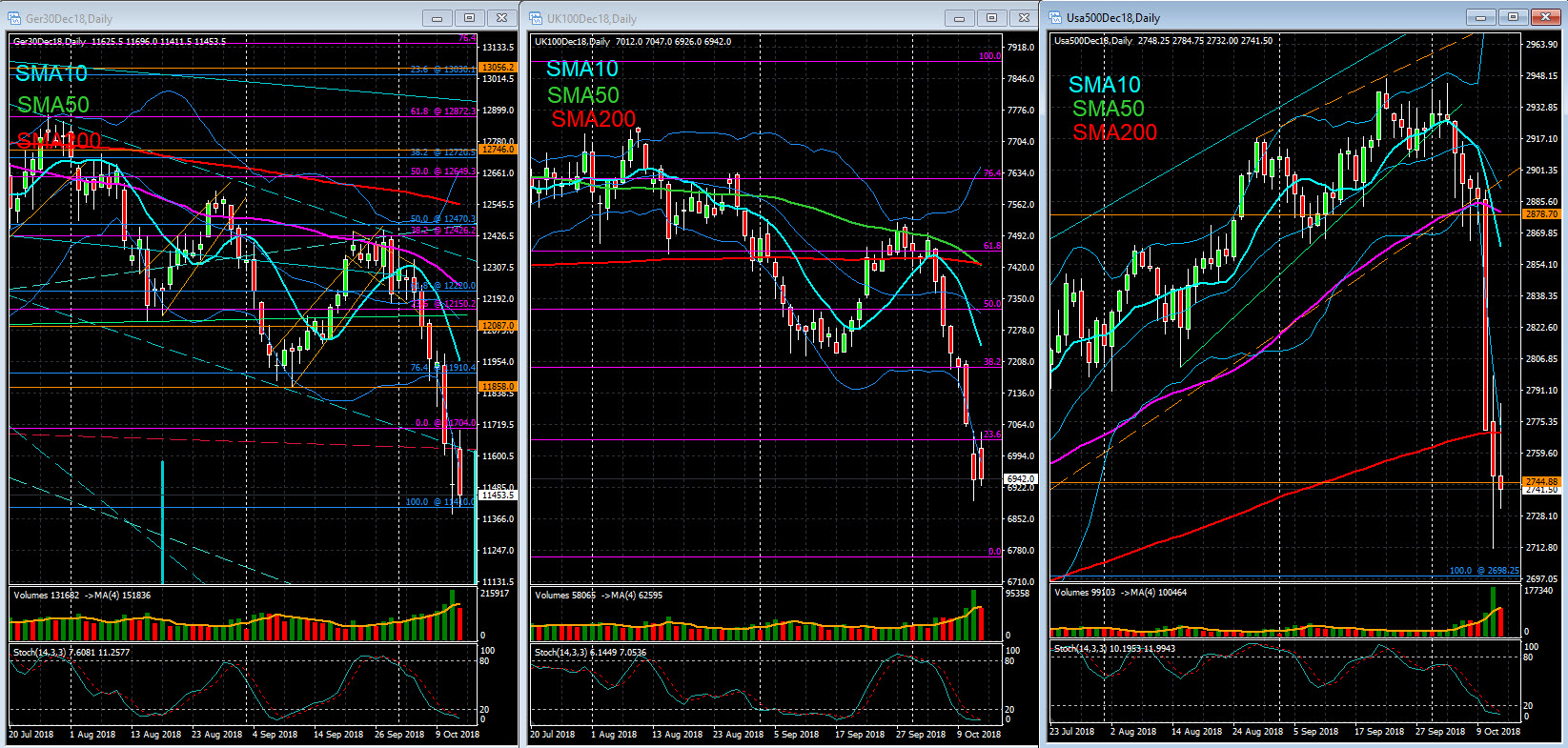

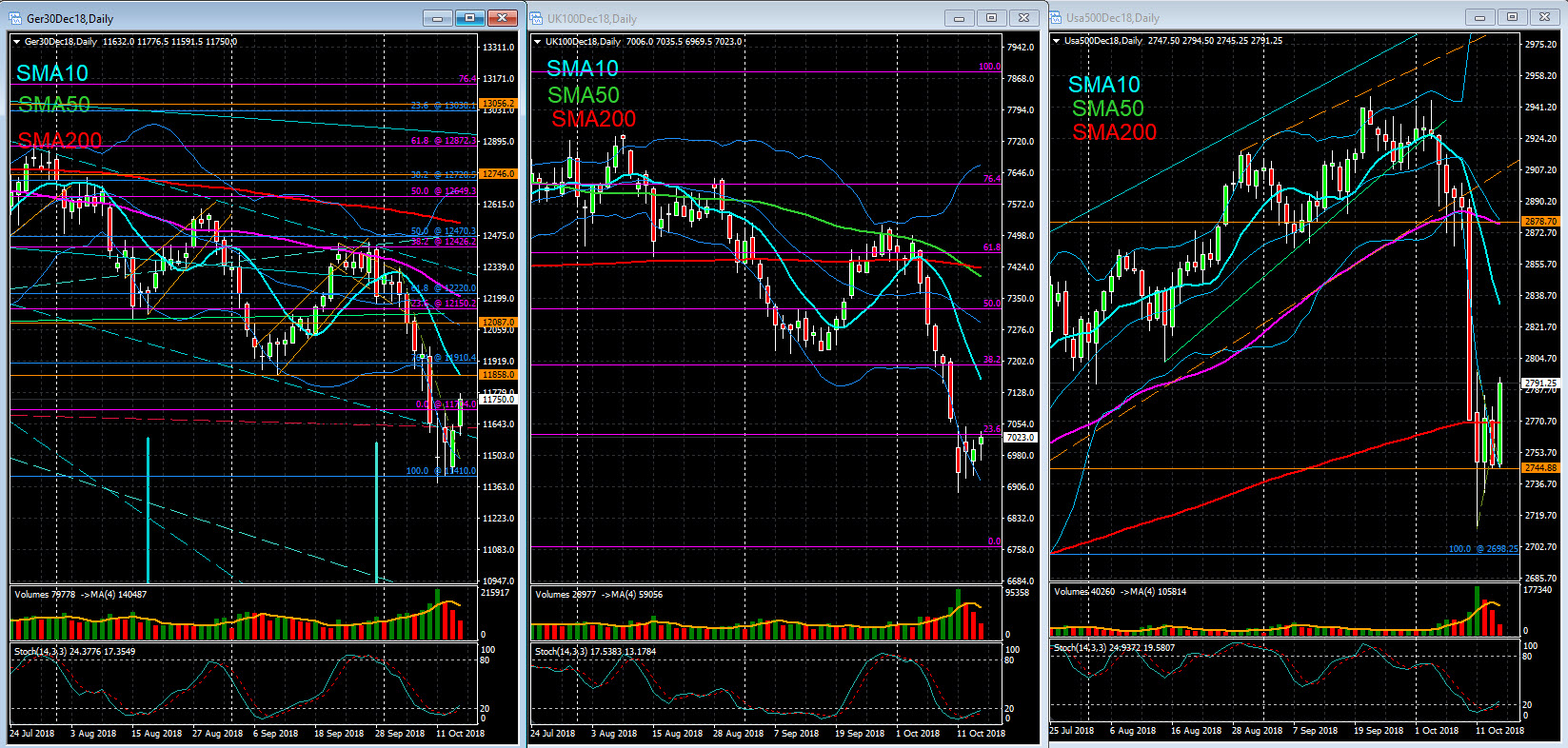

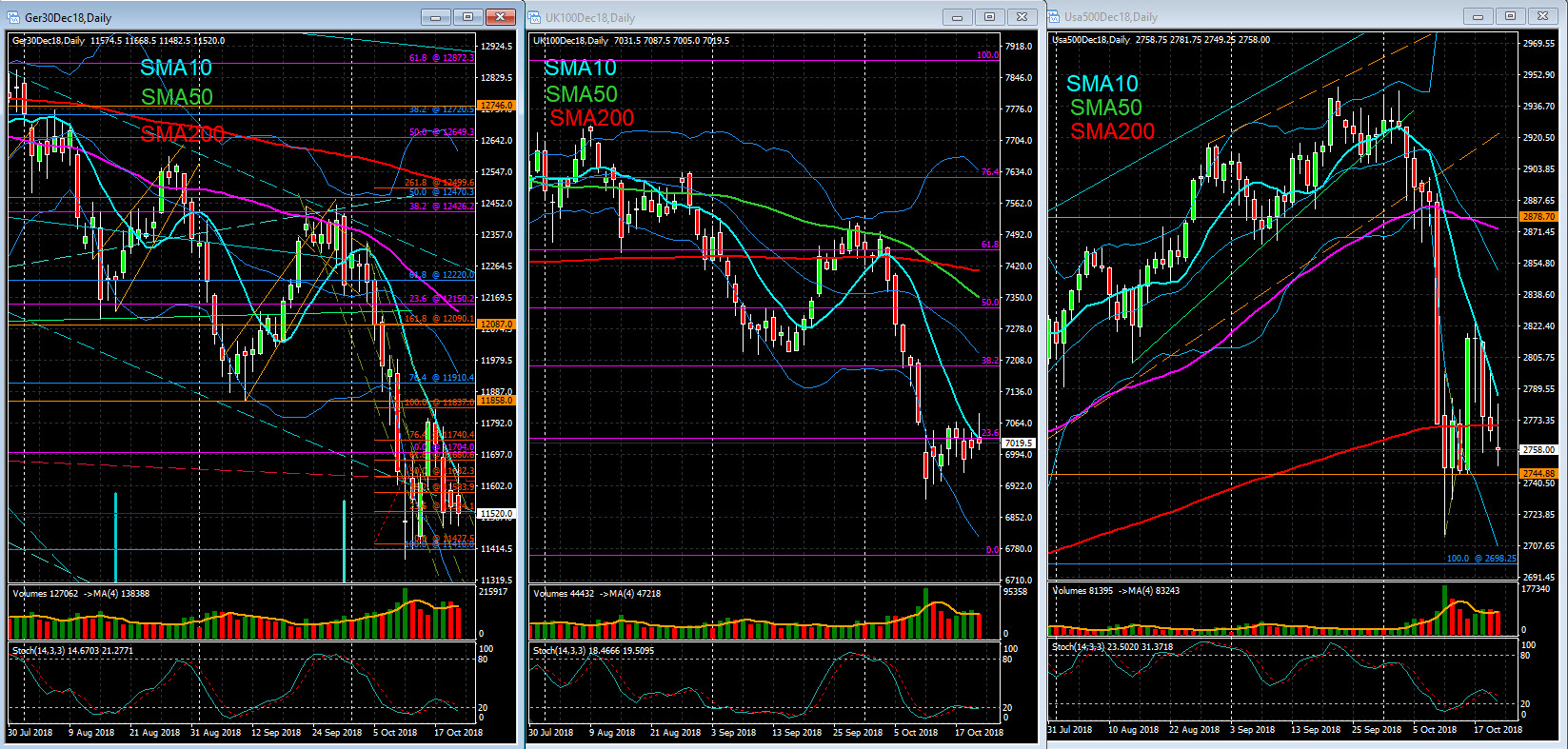

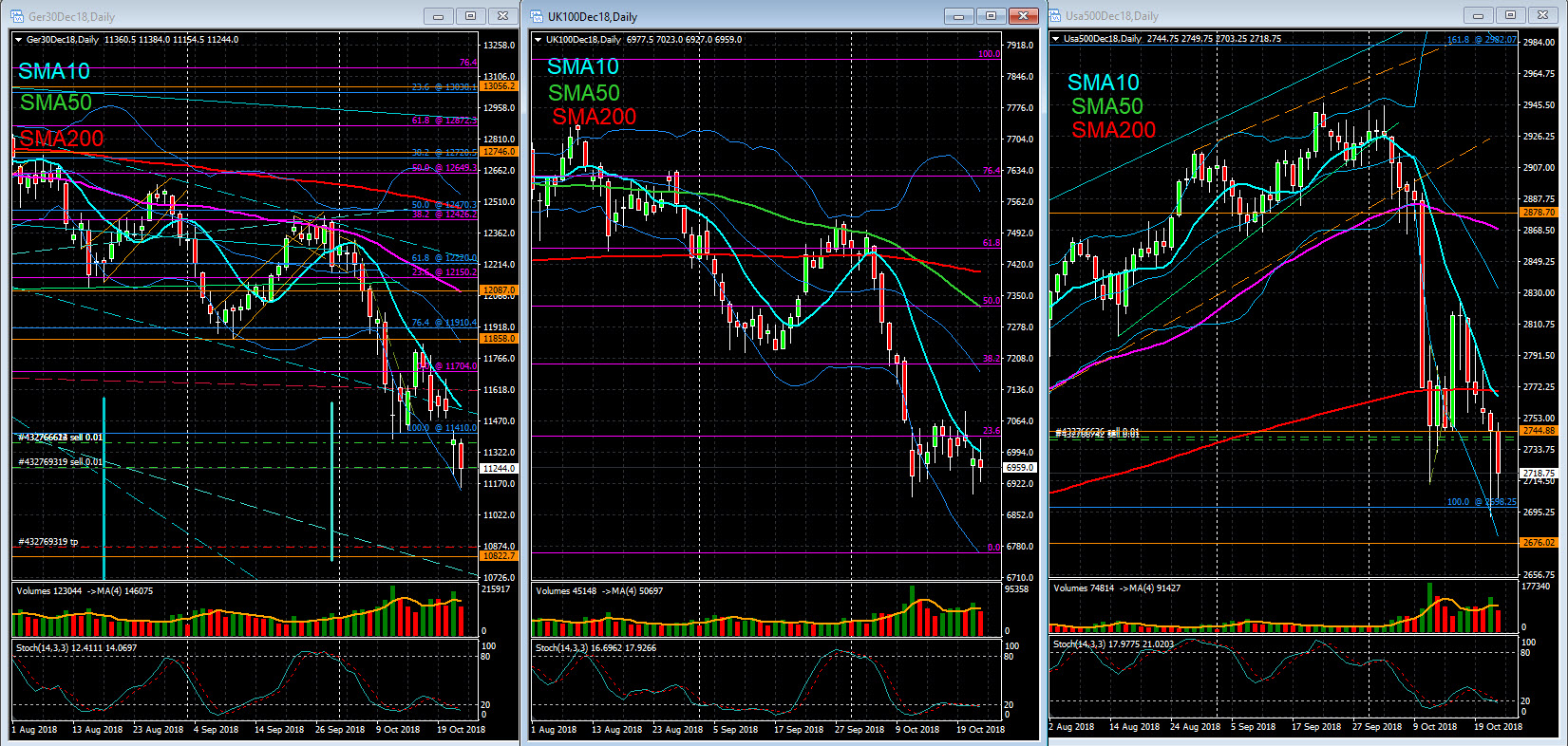

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets closed with sharp losses, with investors reacting negatively to the course of the political and budgetary situation in Italy. After 12 hours of intense discussion, the directives of Luigi di Mai - (leader of the 5 Stelle Movement) with the support of his coalition partner Matteo Salvini eventually prevailed over the more conservative position of the Finance Minister. Among the measures that have been approved are the attribution of a citizenship income and a partial reform of the Law of Reforms and Pensions. Implementation of these measures will imply that the public deficit will remain at 2.40% over the next 3 years. This budget could shock the European Commission and perhaps force the rating agencies to reassess their analysis of the Italian debt. As a consequence of these risks, Italian yields rose, while stocks in this country, and especially banks, fell sharply. FTSEMIB fell 3.40% and 10-year yields rose 0.25% to 3.15%.

The main American indices traded with slight variations, not showing a high permeability to the tensions caused by the politico-budgetary situation in Italy. Data on household incomes and expenditures were in line with economists' estimates. More importantly, household inflation, the preferred measure of the FED, stood at 2.20%, also in line with forecasts.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets closed with sharp losses, with investors reacting negatively to the course of the political and budgetary situation in Italy. After 12 hours of intense discussion, the directives of Luigi di Mai - (leader of the 5 Stelle Movement) with the support of his coalition partner Matteo Salvini eventually prevailed over the more conservative position of the Finance Minister. Among the measures that have been approved are the attribution of a citizenship income and a partial reform of the Law of Reforms and Pensions. Implementation of these measures will imply that the public deficit will remain at 2.40% over the next 3 years. This budget could shock the European Commission and perhaps force the rating agencies to reassess their analysis of the Italian debt. As a consequence of these risks, Italian yields rose, while stocks in this country, and especially banks, fell sharply. FTSEMIB fell 3.40% and 10-year yields rose 0.25% to 3.15%.

The main American indices traded with slight variations, not showing a high permeability to the tensions caused by the politico-budgetary situation in Italy. Data on household incomes and expenditures were in line with economists' estimates. More importantly, household inflation, the preferred measure of the FED, stood at 2.20%, also in line with forecasts.

Oct 01, 2018 at 19:56

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note – 1 Oct

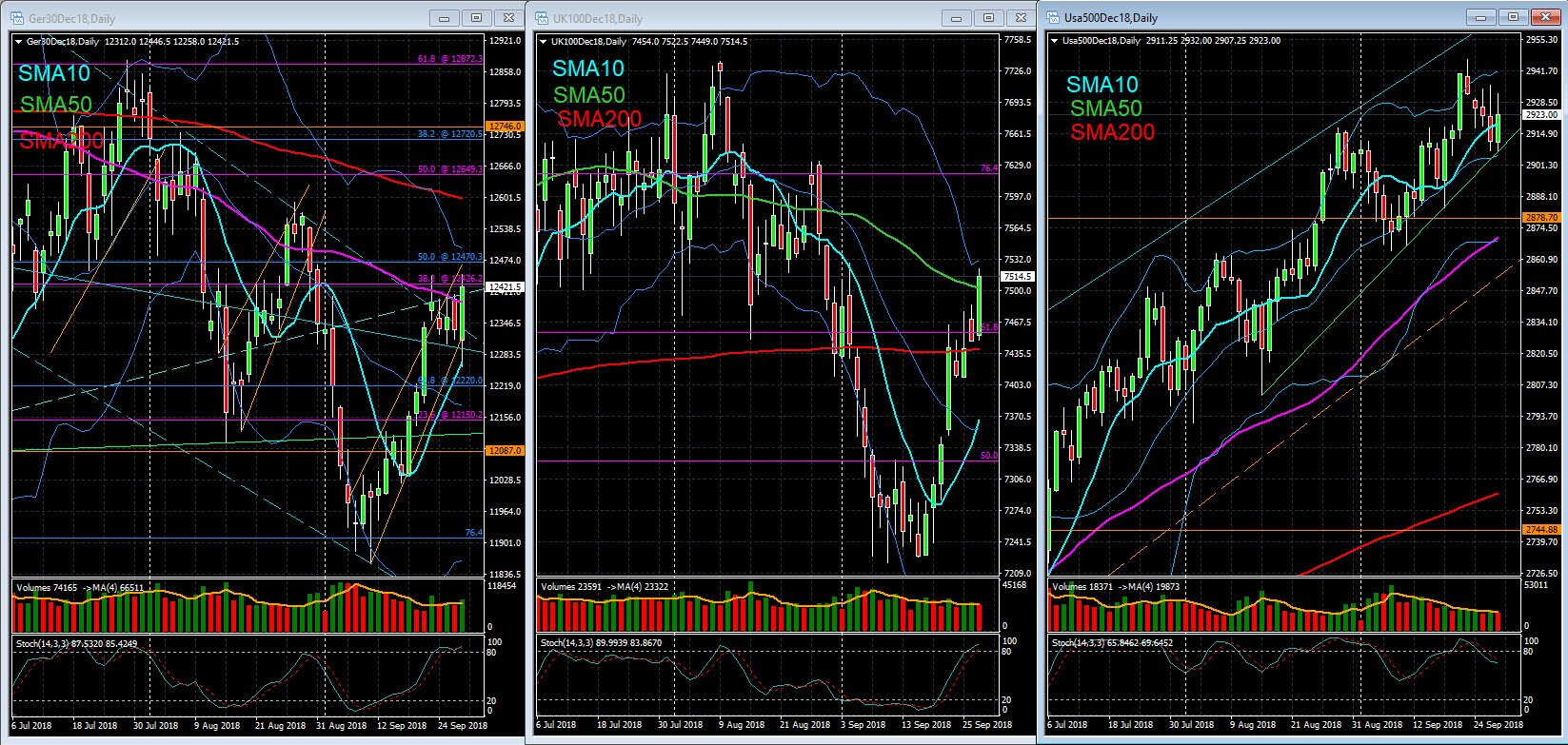

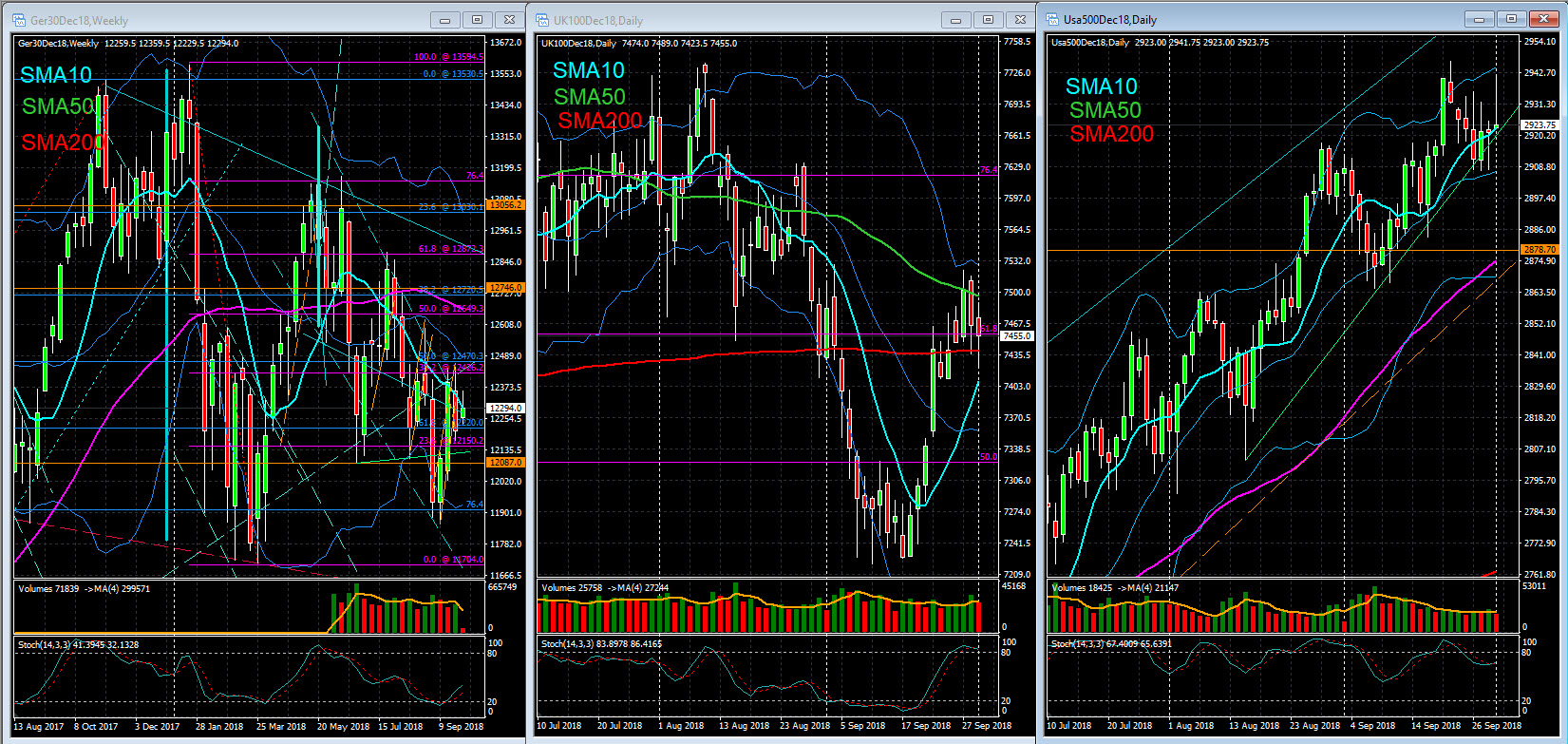

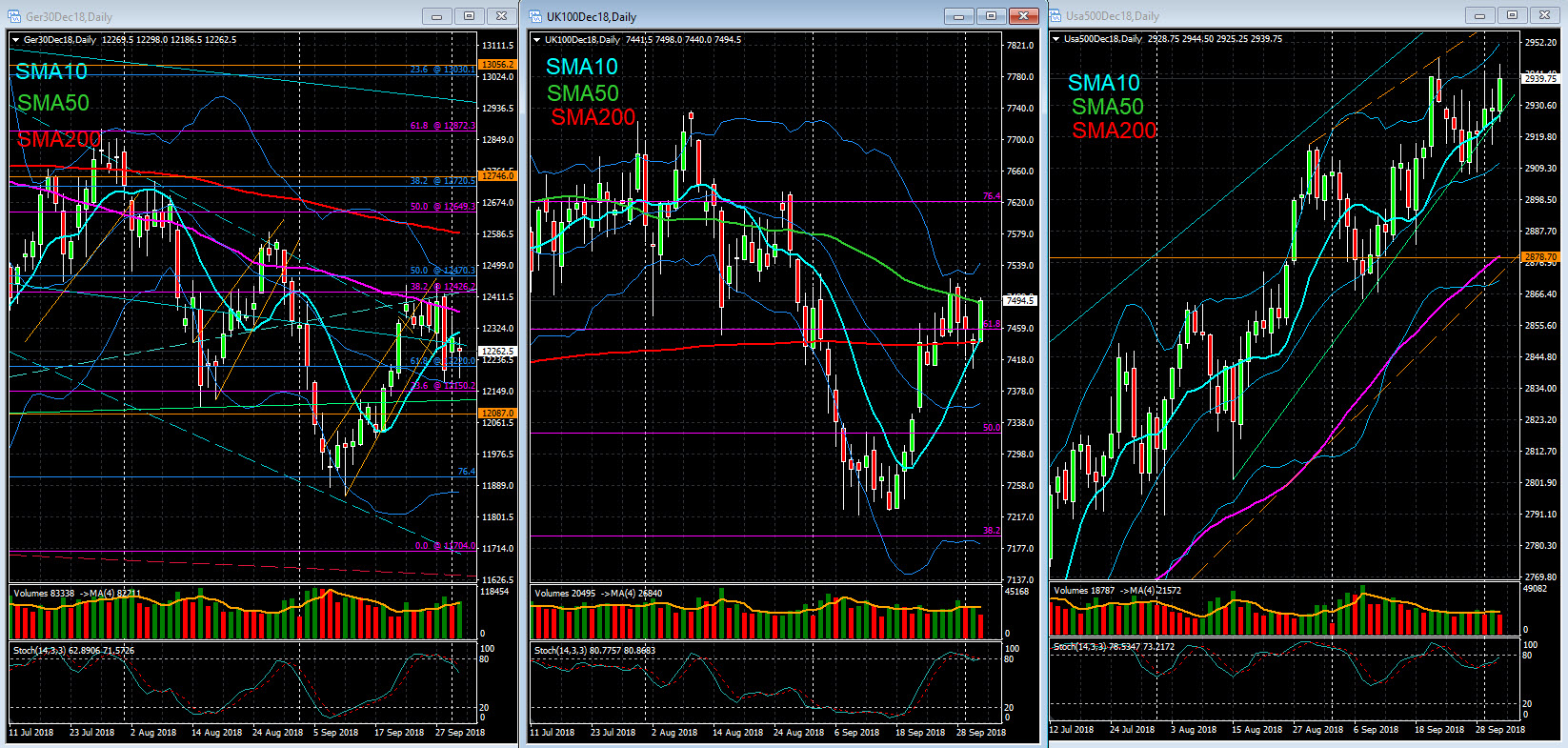

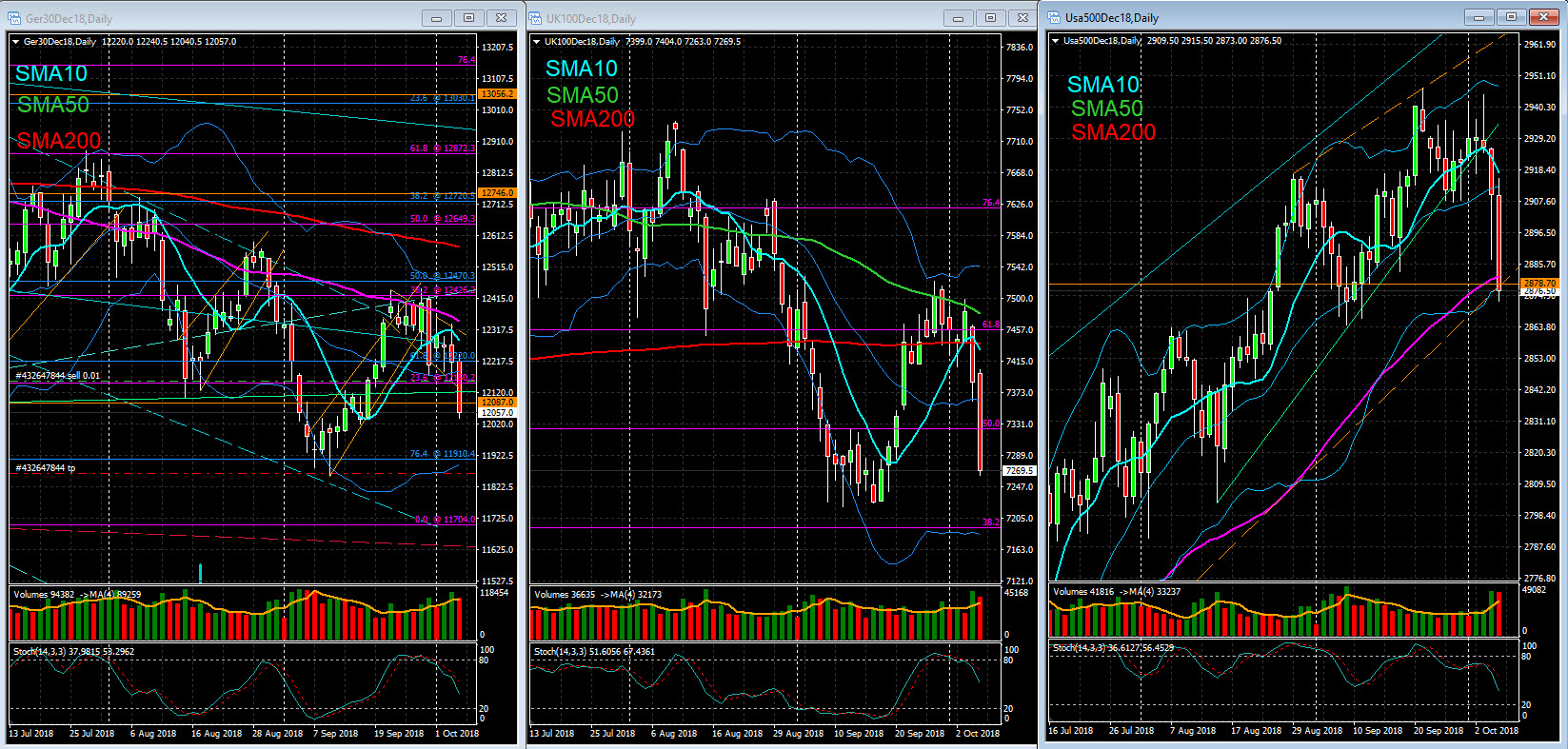

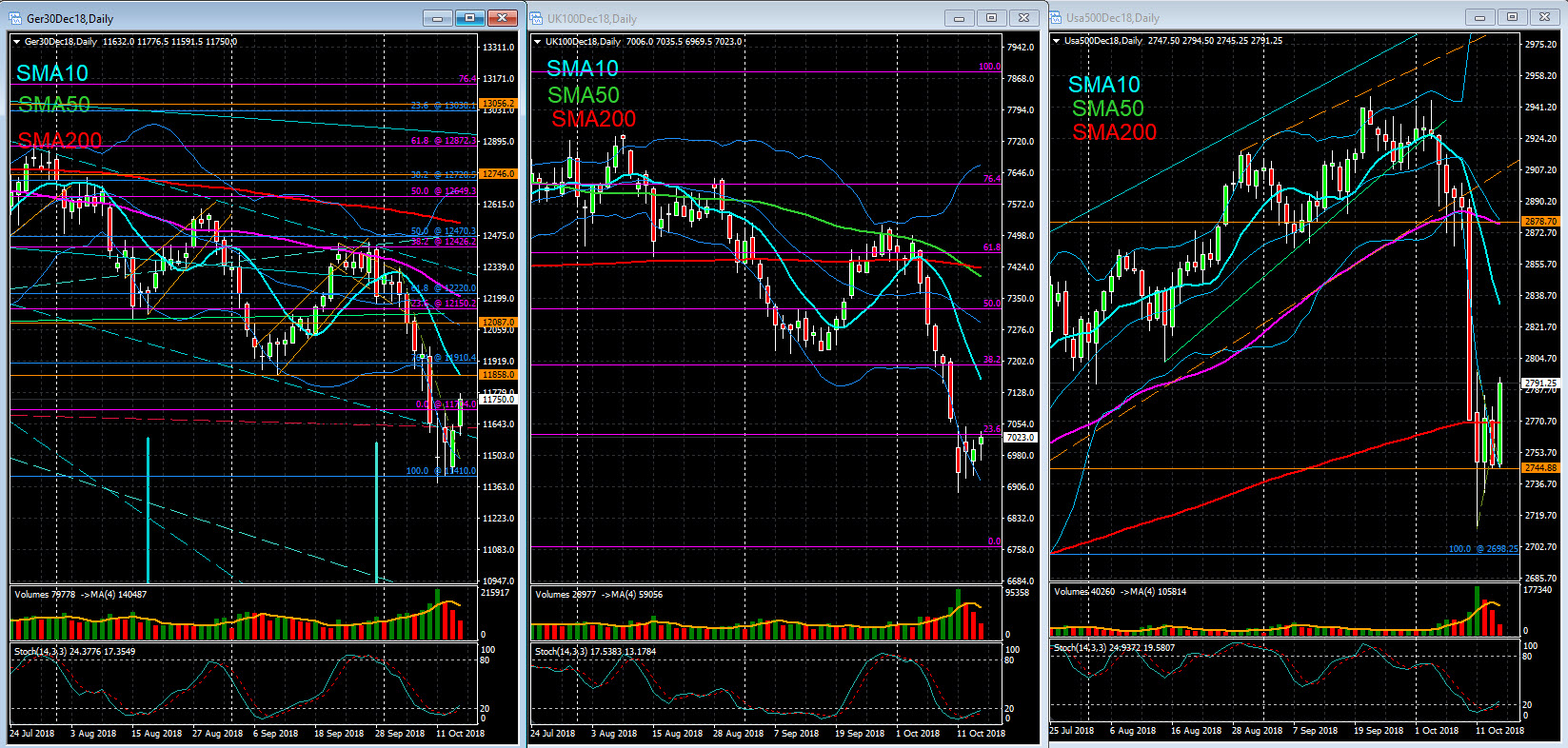

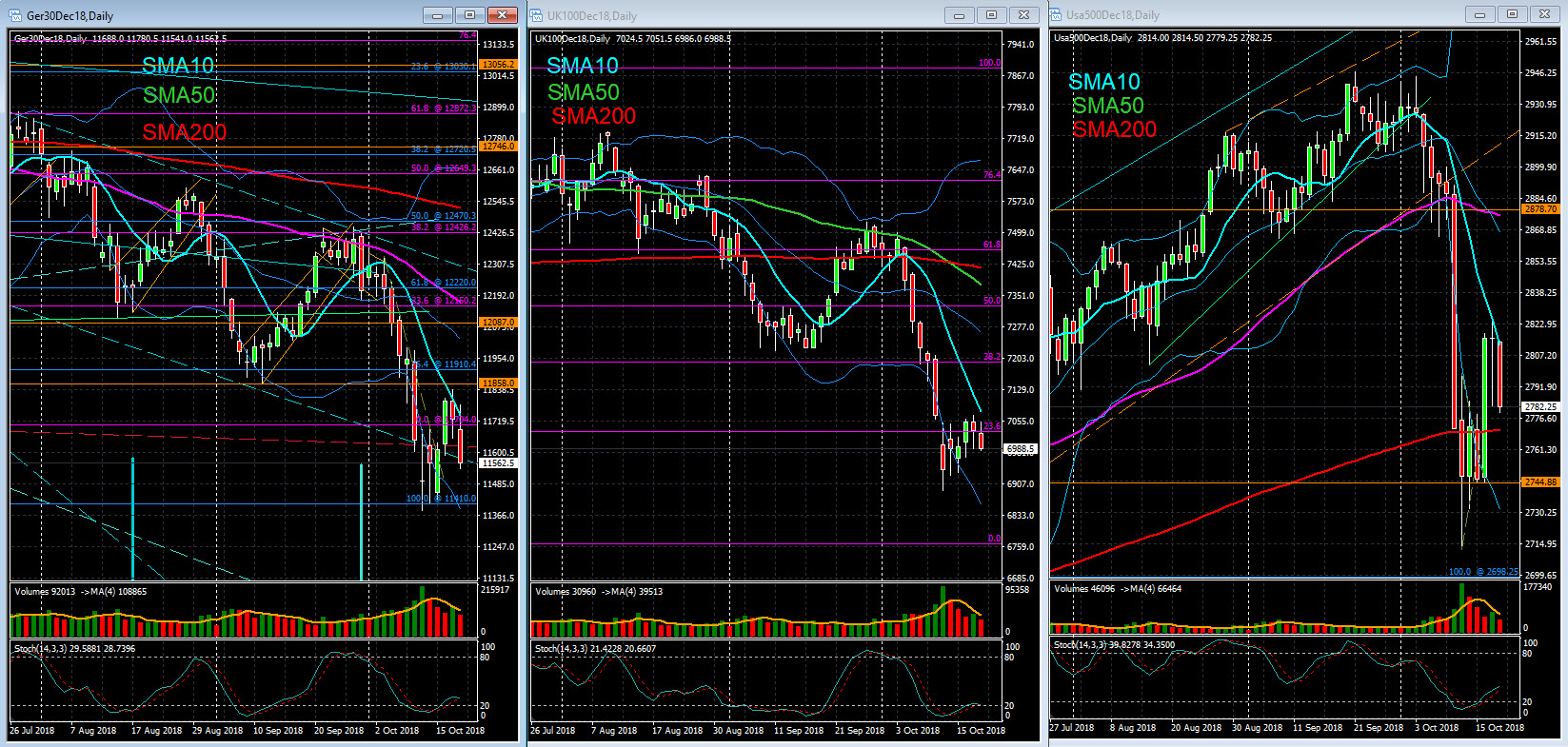

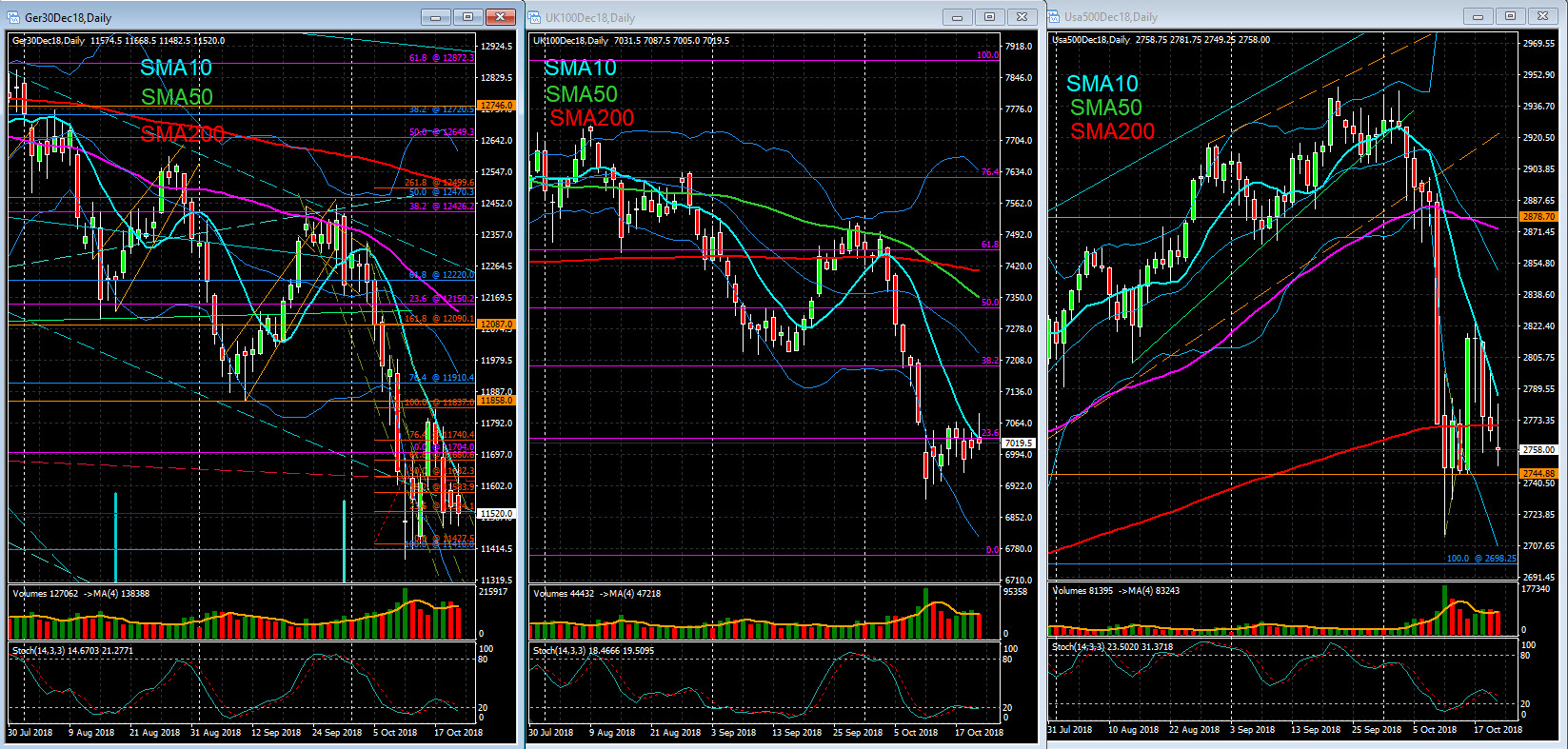

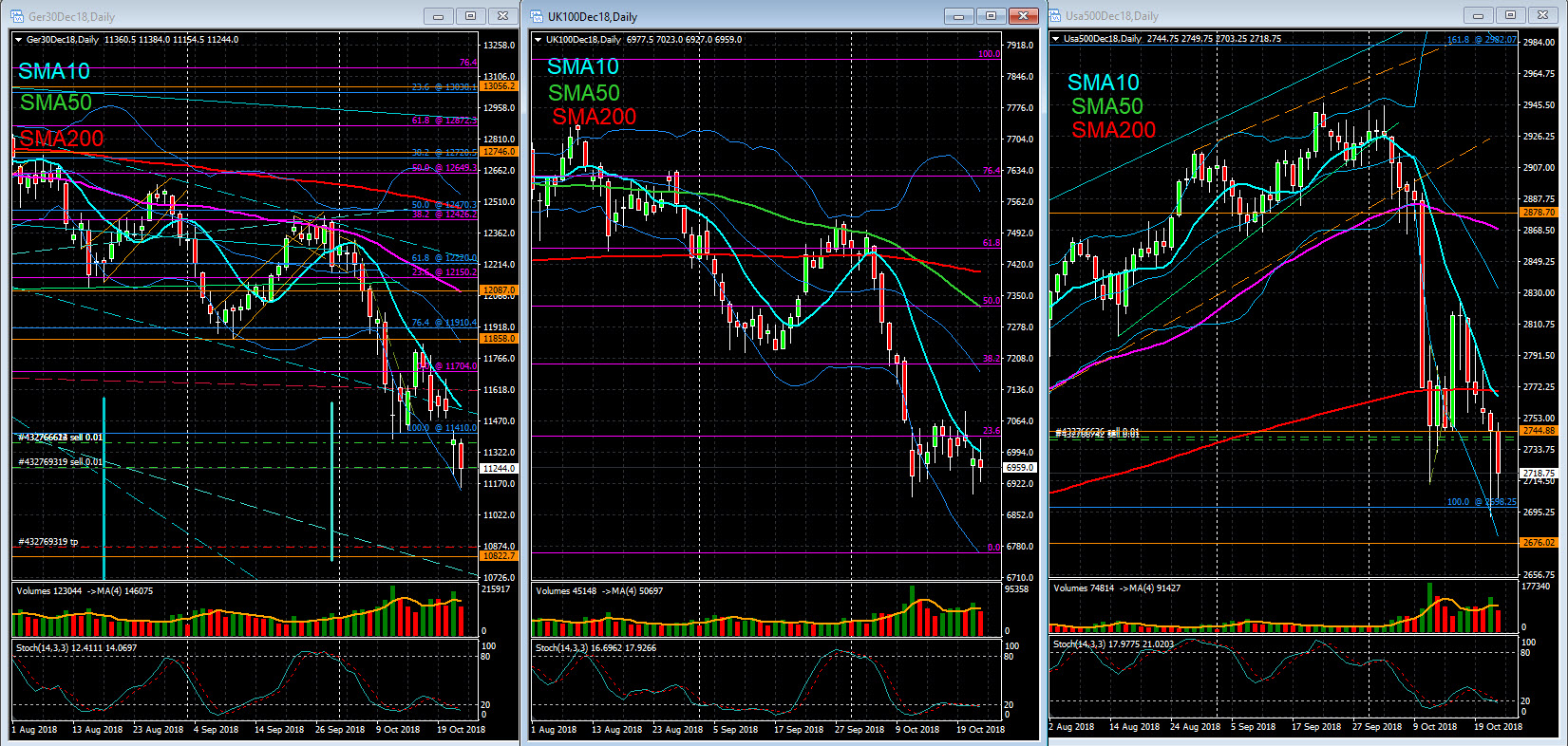

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

The reaction of investors to the US-Canada trade agreement was positive, with October having a favorable start for European indices. In sectoral terms, gains from the technology sector contrasted with losses made by travel and leisure companies, after Ryanair reduced its annual profit outlook. Air France-KLM depreciated 4.15%. In Milan, the stock market closed at a low, mainly due to the fall in bank stocks. Intesa Sanpaolo fell 4.52% and Unicredit fell 2.18%. In Frankfurt, shares of healthcare company Fresenius rose more than 8 percent after Bloomberg reportedly won a court case against generic maker Akorn. In terms of economic indicators, the PMI index for the manufacturing sector in the Euro Zone stood at 53.2 in September. Economists pointed to the 53.3.

Wall Street has started the session to negotiate higher. Tesla's shares posted considerable gains after news that Elon Musk stepped down as president of the company after reaching an agreement with the SEC that filed a lawsuit against him for fraud. On the contrary, General Electric showed a significant drop following the replacement of CEO John Flannery by Lawrence Culp. In the macroeconomic field, the ISM index for the manufacturing sector reached 59.8 in September, against the expected 60.0. The respective inflation component stood at 66.9, compared to 72.78 expected. Regarding real estate, construction investment increased by 0.10% in August, compared to the expected 0.40%.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

The reaction of investors to the US-Canada trade agreement was positive, with October having a favorable start for European indices. In sectoral terms, gains from the technology sector contrasted with losses made by travel and leisure companies, after Ryanair reduced its annual profit outlook. Air France-KLM depreciated 4.15%. In Milan, the stock market closed at a low, mainly due to the fall in bank stocks. Intesa Sanpaolo fell 4.52% and Unicredit fell 2.18%. In Frankfurt, shares of healthcare company Fresenius rose more than 8 percent after Bloomberg reportedly won a court case against generic maker Akorn. In terms of economic indicators, the PMI index for the manufacturing sector in the Euro Zone stood at 53.2 in September. Economists pointed to the 53.3.

Wall Street has started the session to negotiate higher. Tesla's shares posted considerable gains after news that Elon Musk stepped down as president of the company after reaching an agreement with the SEC that filed a lawsuit against him for fraud. On the contrary, General Electric showed a significant drop following the replacement of CEO John Flannery by Lawrence Culp. In the macroeconomic field, the ISM index for the manufacturing sector reached 59.8 in September, against the expected 60.0. The respective inflation component stood at 66.9, compared to 72.78 expected. Regarding real estate, construction investment increased by 0.10% in August, compared to the expected 0.40%.

Oct 03, 2018 at 00:11

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 2 Oct

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European stock markets closed lower, with the financial sector among the worst performers. Leading this negative sentiment was once again the uncertainty associated with the political situation in Italy and, more specifically, the "anti-euro" comments of a senior official of the Northern League, a party that supports the Italian government. According to Claudio Borghi, who chairs the budget committee of the lower house of the Italian Parliament, Italy would have more favorable economic conditions if it were outside the Euro Zone. As a result, 10-year Italian OT yields rose to 3.40%, the highest level since March 2014. A positive note for commodity producers who traded on a counter-cycle on a day marked by rising coal prices to USD 100 per ton in Europe for the first time in more than five years. In terms of business, Azko Nobel advanced 0.48%. The Dutch chemical company has announced that it will distribute the proceeds from the sale of some non-core assets to shareholders by an indicative amount of 5500 M. €. In Frankfurt, ThyssenKrupp rose 0.72%. The CEO of the company said in an interview with a German newspaper that the stock will likely cease to be a constituent of the DAX index.

The US market traded without significant variation, a day after the market reacted positively to the US-Canada trade agreement. Amazon shares were slightly retreating after the company announced it would raise its minimum wage to $ 15 an hour for all US workers. Facebook titles also reacted negatively. On the other hand, the banking sector was trading lower, in response to the downward trend in 10-year TO yields to around 3,050%. Investors followed President Jerome Powell's address on "Prospects for Jobs and Inflation" that took place today in Boston.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European stock markets closed lower, with the financial sector among the worst performers. Leading this negative sentiment was once again the uncertainty associated with the political situation in Italy and, more specifically, the "anti-euro" comments of a senior official of the Northern League, a party that supports the Italian government. According to Claudio Borghi, who chairs the budget committee of the lower house of the Italian Parliament, Italy would have more favorable economic conditions if it were outside the Euro Zone. As a result, 10-year Italian OT yields rose to 3.40%, the highest level since March 2014. A positive note for commodity producers who traded on a counter-cycle on a day marked by rising coal prices to USD 100 per ton in Europe for the first time in more than five years. In terms of business, Azko Nobel advanced 0.48%. The Dutch chemical company has announced that it will distribute the proceeds from the sale of some non-core assets to shareholders by an indicative amount of 5500 M. €. In Frankfurt, ThyssenKrupp rose 0.72%. The CEO of the company said in an interview with a German newspaper that the stock will likely cease to be a constituent of the DAX index.

The US market traded without significant variation, a day after the market reacted positively to the US-Canada trade agreement. Amazon shares were slightly retreating after the company announced it would raise its minimum wage to $ 15 an hour for all US workers. Facebook titles also reacted negatively. On the other hand, the banking sector was trading lower, in response to the downward trend in 10-year TO yields to around 3,050%. Investors followed President Jerome Powell's address on "Prospects for Jobs and Inflation" that took place today in Boston.

Oct 04, 2018 at 00:54

(已編輯Oct 04, 2018 at 00:55)

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 3 Oct

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European stock exchanges traded in different directions, with investors keeping an eye on developments in the political situation in Italy and global trade. The Italian stock market closed positive, with the main stock index rising 0.89%. Italian 2-year yields fell to 1,200% after Corriere della Sera reported that the Rome government would be willing to make some concessions in budgetary terms. Thus, as anticipated by this newspaper, the deficit for 2019 would remain at 2.40%, but in 2020 it would be 2.20% and 2.20% in 2021. However, there was an increase in the spread between the Italian yields at 10 and 2 years, a new barometer that investors and Italian economists use to assess the degree of risk associated with the country's financial and budgetary situation. The greater the differential between 10-year and 2-year interest rates, the more comfortable the budgetary and financial position of an economy.

Wall Street has begun trading on an upward trajectory, with investors reacting positively to the economic data on the labor market. In terms of economic indicators, the ADP employment report showed that 230,000 jobs were created in September (the highest since February), up from 184,000 estimated by economists. It should be noted that next Friday will be known the employment report. On the other hand, the ISM index for the services sector reached 61.6 in September, above the forecast 58.0. With respect to the debt market, 10-year TO yields rose to around 3,086%, favoring the banking sector. In sectoral terms, the financial and technological sectors led the gains.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European stock exchanges traded in different directions, with investors keeping an eye on developments in the political situation in Italy and global trade. The Italian stock market closed positive, with the main stock index rising 0.89%. Italian 2-year yields fell to 1,200% after Corriere della Sera reported that the Rome government would be willing to make some concessions in budgetary terms. Thus, as anticipated by this newspaper, the deficit for 2019 would remain at 2.40%, but in 2020 it would be 2.20% and 2.20% in 2021. However, there was an increase in the spread between the Italian yields at 10 and 2 years, a new barometer that investors and Italian economists use to assess the degree of risk associated with the country's financial and budgetary situation. The greater the differential between 10-year and 2-year interest rates, the more comfortable the budgetary and financial position of an economy.

Wall Street has begun trading on an upward trajectory, with investors reacting positively to the economic data on the labor market. In terms of economic indicators, the ADP employment report showed that 230,000 jobs were created in September (the highest since February), up from 184,000 estimated by economists. It should be noted that next Friday will be known the employment report. On the other hand, the ISM index for the services sector reached 61.6 in September, above the forecast 58.0. With respect to the debt market, 10-year TO yields rose to around 3,086%, favoring the banking sector. In sectoral terms, the financial and technological sectors led the gains.

Oct 04, 2018 at 22:12

(已編輯Oct 04, 2018 at 22:20)

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 4 Oct

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets closed lower, penalized by the behavior of the US debt market, namely the 10-year Treasury yields climb. In sectoral terms, and just as on Wall Street, the banking and insurance sectors outperformed. Of note is the gains of the banking sector in Italy, on the day that the 10-Year Threasury yields in the country rose again to 3.33%.

On Wall Street, debt market behavior was the main driver of the market in today's session, after 10-year Threasury yields reached their highest level since 2011, with the breakout of the level of 3.20%. Influencing this behavior were the words of the Federal Reserve Chairman who said that the Central Bank "is far from having a neutral position on interest rates. Recall that economists have pointed to two interest rate hikes this year and another in 2019. Companies like Procter & Gamble, influenced by interest rate swings, lost ground, while banks were favored by this upward move of yields. Of note were J.P. Morgan, Citigroup and Bank of America, which rose more than 1%. In terms of indicators, the number of weekly applications for unemployment benefits reached 207 000, compared to the estimated 215 000. On the other hand, factory orders increased by 2.30% last August, compared with an expected growth of 2.10%.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets closed lower, penalized by the behavior of the US debt market, namely the 10-year Treasury yields climb. In sectoral terms, and just as on Wall Street, the banking and insurance sectors outperformed. Of note is the gains of the banking sector in Italy, on the day that the 10-Year Threasury yields in the country rose again to 3.33%.

On Wall Street, debt market behavior was the main driver of the market in today's session, after 10-year Threasury yields reached their highest level since 2011, with the breakout of the level of 3.20%. Influencing this behavior were the words of the Federal Reserve Chairman who said that the Central Bank "is far from having a neutral position on interest rates. Recall that economists have pointed to two interest rate hikes this year and another in 2019. Companies like Procter & Gamble, influenced by interest rate swings, lost ground, while banks were favored by this upward move of yields. Of note were J.P. Morgan, Citigroup and Bank of America, which rose more than 1%. In terms of indicators, the number of weekly applications for unemployment benefits reached 207 000, compared to the estimated 215 000. On the other hand, factory orders increased by 2.30% last August, compared with an expected growth of 2.10%.

Oct 05, 2018 at 18:49

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 5 Oct

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

Stock markets have been penalized by rising interest rates on US bonds, which has left investors worried that stocks are overvalued as rising financing costs could hurt corporate earnings. Virtually all sectors made a negative contribution, except for the media. The sectors of raw materials, technology, automobiles and energy were the ones that most pressured European markets. Economic data on the US economy continue to show signs of robustness, reinforcing the prospect of further US Federal Reserve interest increases, which will exacerbate the cost of financing quoted shares. This Friday, October 5, the US Department of Labor revealed that the unemployment rate dropped to 3.7% in September, a low of 1969. It is necessary to go back 48 years to find a level of unemployment so low in the US economy.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

Stock markets have been penalized by rising interest rates on US bonds, which has left investors worried that stocks are overvalued as rising financing costs could hurt corporate earnings. Virtually all sectors made a negative contribution, except for the media. The sectors of raw materials, technology, automobiles and energy were the ones that most pressured European markets. Economic data on the US economy continue to show signs of robustness, reinforcing the prospect of further US Federal Reserve interest increases, which will exacerbate the cost of financing quoted shares. This Friday, October 5, the US Department of Labor revealed that the unemployment rate dropped to 3.7% in September, a low of 1969. It is necessary to go back 48 years to find a level of unemployment so low in the US economy.

Oct 08, 2018 at 23:33

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 8 Oct

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets ended down, with several sectors reporting losses of more than 1%. Banks were again particularly affected by the current situation in Italy. The Italian stock market depreciated more than 2% and OT yields reached new highs. In fact, despite last week's more conciliatory stance, the weekend was marked by harsh criticism of the European project of the two party leaders who form the government. On the other hand, the weakness of the Asian markets, justified by the fall of the Chinese stock exchanges, also influenced the performance of the European markets. The Central Bank of China today reduced the reserve ratio of banks (percentage of deposits that banks are required to keep) by 1%. This announcement heightened fears about the economic impact of trade tensions between the US and China. However, today the Caixin PMI index was published, which describes the activity of service companies (mostly private and small and medium-sized), which in September reached 53.1, above 51.4.

The US market was on a downward trajectory, driven by fears about the recent rise in Treasury Bond yields. However, it should be noted that today the bond market was closed to commemorate Columbus Day.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets ended down, with several sectors reporting losses of more than 1%. Banks were again particularly affected by the current situation in Italy. The Italian stock market depreciated more than 2% and OT yields reached new highs. In fact, despite last week's more conciliatory stance, the weekend was marked by harsh criticism of the European project of the two party leaders who form the government. On the other hand, the weakness of the Asian markets, justified by the fall of the Chinese stock exchanges, also influenced the performance of the European markets. The Central Bank of China today reduced the reserve ratio of banks (percentage of deposits that banks are required to keep) by 1%. This announcement heightened fears about the economic impact of trade tensions between the US and China. However, today the Caixin PMI index was published, which describes the activity of service companies (mostly private and small and medium-sized), which in September reached 53.1, above 51.4.

The US market was on a downward trajectory, driven by fears about the recent rise in Treasury Bond yields. However, it should be noted that today the bond market was closed to commemorate Columbus Day.

Oct 11, 2018 at 05:40

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 10 Oct

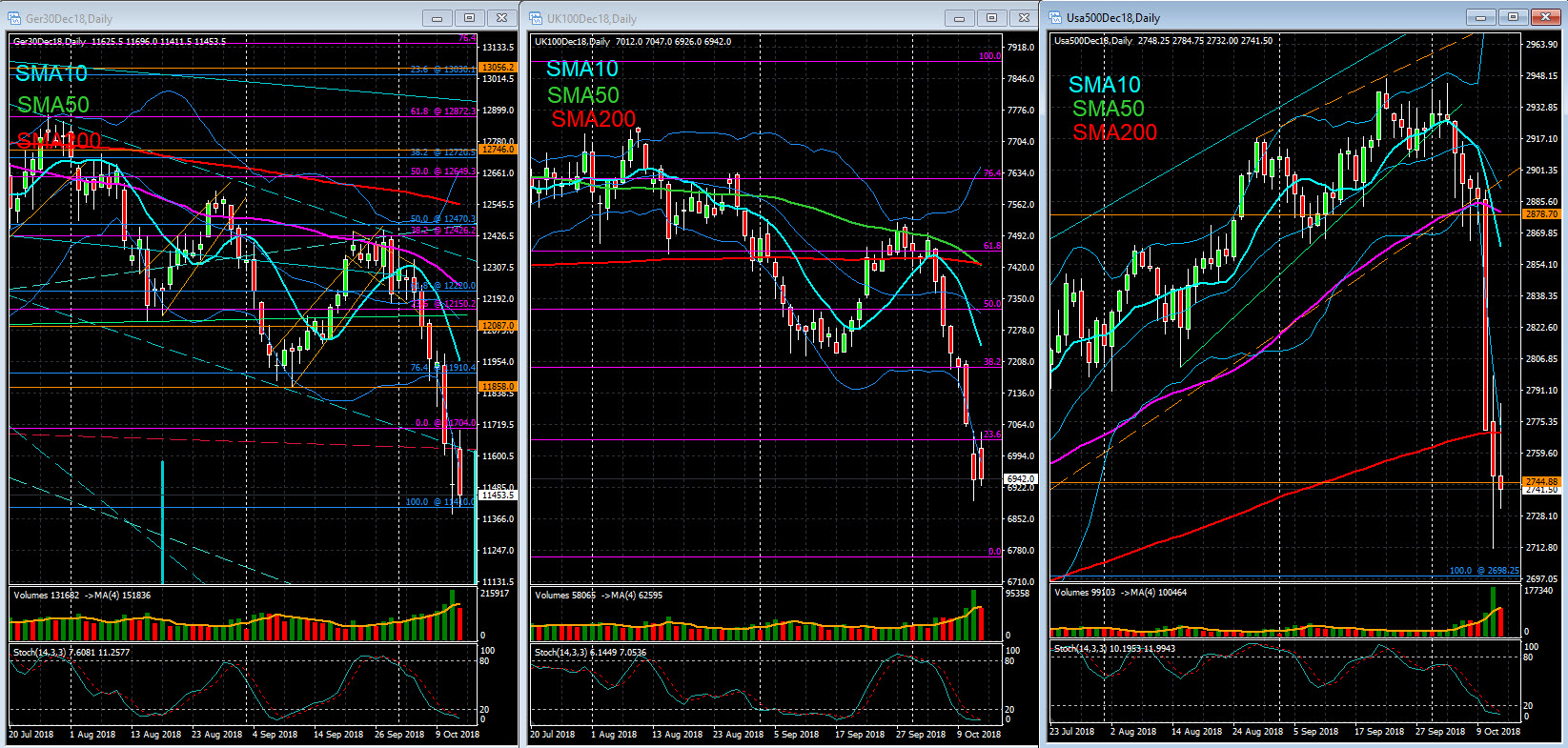

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets ended the session on Wednesday with sharp losses. The attentions remained focused on the unfolding of the political situation in Italy, which again conditioned the sentiment of global investors. In this context, the International Monetary Fund, in the report on Global Financial Stability released today, warned of the risk of contagion of the Italian situation for the whole financial system of the Euro Zone and global. However, it was the rise in yields in the USA and the subsequent negative reaction of the stock exchange in that country to dictate the direction of the European markets. The automotive sector and commodity producers were among the worst performers in face of exacerbating fears about global economic growth and rising US interest rates. In business terms, LVMH fell 7.14%, after having reported a slowdown in its sales. Other luxury goods companies also posted losses, after Morgan Stanley reduced its underweight recommendation.

The US market traded lower, again penalized by rising yields. Yields on 10-year Treasury Bonds traded around 2.30%, one day after peaking at their highest level since 2011 and yields on 2-year Treasury Bonds have peaked since 2008. Still, the banking sector benefited of this upward trend, with the securities of some financial institutions registering an overperformance. To remember that this situation of the debt market comes two days after starting a new Earnings Season. On Friday, the quarterly results of Citigroup, Wells Fargo and J.P. Morgan will be published.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets ended the session on Wednesday with sharp losses. The attentions remained focused on the unfolding of the political situation in Italy, which again conditioned the sentiment of global investors. In this context, the International Monetary Fund, in the report on Global Financial Stability released today, warned of the risk of contagion of the Italian situation for the whole financial system of the Euro Zone and global. However, it was the rise in yields in the USA and the subsequent negative reaction of the stock exchange in that country to dictate the direction of the European markets. The automotive sector and commodity producers were among the worst performers in face of exacerbating fears about global economic growth and rising US interest rates. In business terms, LVMH fell 7.14%, after having reported a slowdown in its sales. Other luxury goods companies also posted losses, after Morgan Stanley reduced its underweight recommendation.

The US market traded lower, again penalized by rising yields. Yields on 10-year Treasury Bonds traded around 2.30%, one day after peaking at their highest level since 2011 and yields on 2-year Treasury Bonds have peaked since 2008. Still, the banking sector benefited of this upward trend, with the securities of some financial institutions registering an overperformance. To remember that this situation of the debt market comes two days after starting a new Earnings Season. On Friday, the quarterly results of Citigroup, Wells Fargo and J.P. Morgan will be published.

Oct 11, 2018 at 20:40

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 11 Oct

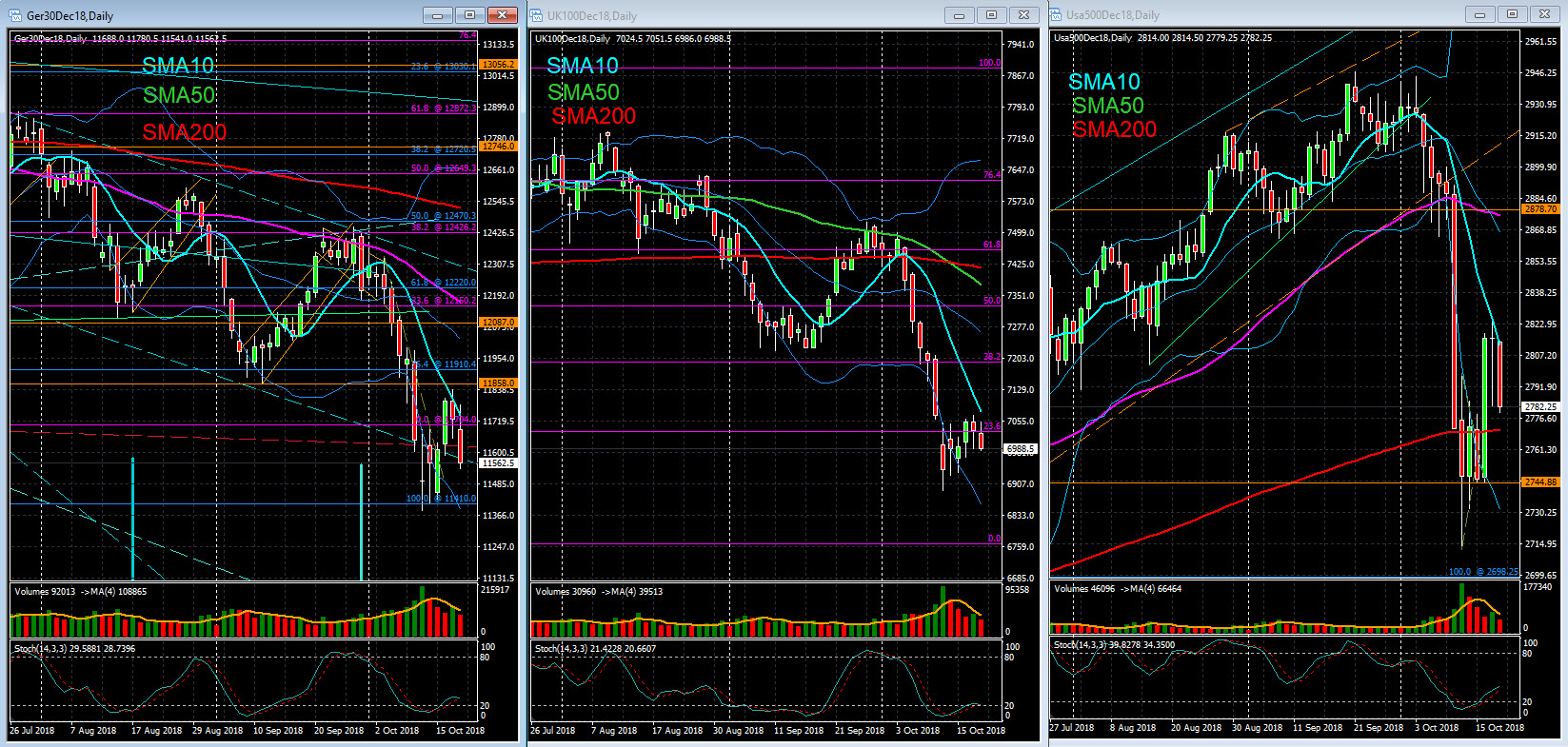

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

As anticipated, the fall in US markets and its rapid spread to Asian stock markets intensified risk aversion on European markets. The strong rise in yields and worries about global economic growth were at the root of this negative sentiment among investors. Thus, the financial and technological sectors led the falls. The oil sector also conditioned the performance of European indices on a day when the price of oil fell by more than 1%. In the corporate field, shares of BMW fell 1.49% after news of the investment of 4200 M.USD in the joint venture with China's Brilliance Auto.

The US market was trading lower, although losses were being mitigated by the posting of lower-than-expected inflation. Inflation relative to September, measured by the consumer price index, was known today. This index reached 2.30% in annual terms, compared to the expected 2.40% and the previous 2.70%. If we exclude the most volatile goods (core version), it grew 2.20% below the expected 2.30%. As a result, Treasury Bond yields retreat from recent highs: 10-year Treasury Bond yields traded at around 3,167%, after having reached the highs of the last 7 years in recent days. It should be remembered that it was this upward trajectory of interest rates that aroused investor fears about the future of the monetary policy of the Fed, which yesterday was exacerbated by the comments of President Trump criticizing the Central Bank's actions. Already today, Donald Trump gave an interview during which criticizes the policy of the institution for being "too aggressive." On the labor market, the number of weekly applications for unemployment benefits showed a slight increase during the month of October, although it remained at minimum levels from the 60s. This indicator increased from 7,000 to 214,000, compared to 207,000 estimated.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

As anticipated, the fall in US markets and its rapid spread to Asian stock markets intensified risk aversion on European markets. The strong rise in yields and worries about global economic growth were at the root of this negative sentiment among investors. Thus, the financial and technological sectors led the falls. The oil sector also conditioned the performance of European indices on a day when the price of oil fell by more than 1%. In the corporate field, shares of BMW fell 1.49% after news of the investment of 4200 M.USD in the joint venture with China's Brilliance Auto.

The US market was trading lower, although losses were being mitigated by the posting of lower-than-expected inflation. Inflation relative to September, measured by the consumer price index, was known today. This index reached 2.30% in annual terms, compared to the expected 2.40% and the previous 2.70%. If we exclude the most volatile goods (core version), it grew 2.20% below the expected 2.30%. As a result, Treasury Bond yields retreat from recent highs: 10-year Treasury Bond yields traded at around 3,167%, after having reached the highs of the last 7 years in recent days. It should be remembered that it was this upward trajectory of interest rates that aroused investor fears about the future of the monetary policy of the Fed, which yesterday was exacerbated by the comments of President Trump criticizing the Central Bank's actions. Already today, Donald Trump gave an interview during which criticizes the policy of the institution for being "too aggressive." On the labor market, the number of weekly applications for unemployment benefits showed a slight increase during the month of October, although it remained at minimum levels from the 60s. This indicator increased from 7,000 to 214,000, compared to 207,000 estimated.

Oct 12, 2018 at 18:23

(已編輯Oct 12, 2018 at 18:24)

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 12 Oct

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

The recovery that US futures and Asian stock exchanges got through last night inspired European investors. However and despite the positive sentiment coming from the Asian session, European investors still showed some nervousness during today's session. In fact, most Old Continent indexes were able to achieve gains of more than 1% in the first hour of trading. Subsequently, these advances were being lost, as the initial impetus was losing conviction.

In the US, investor sentiment was divided between the yields and the results of some of the major banks in the country. In the debt market there was a slight increase in yields but they were not intimidating investors. The earnings season began today with the quarterly accounts of JP Morgan, Citigroup and Welsl Fargo. JP Morgan reported an EPS of $ 2.34 and a banking product of $ 27,800 M.USD, compared with $ 2.26 and $ 27540 in advance. The increase in profits was mainly due to the good performance of the activity of providing credit to consumption. Citigroup announced a EPS that beat the estimates (1.73 USD vs. 1.69 USD) although the banking product fell short of anticipated (18389 M.USD vs 18501 M.USD). In part, Citigroup's results were favored by tax effects and lower costs. Wells Fargo, the largest US lender, posted EPS of 1.13 USD (est. 1.17 USD) and a banking product of 21900 M.USD, practically in line with the estimates. While shares of Wells Fargo and Citigroup traded bullish, JP Morgan bonds showed no significant changes.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

The recovery that US futures and Asian stock exchanges got through last night inspired European investors. However and despite the positive sentiment coming from the Asian session, European investors still showed some nervousness during today's session. In fact, most Old Continent indexes were able to achieve gains of more than 1% in the first hour of trading. Subsequently, these advances were being lost, as the initial impetus was losing conviction.

In the US, investor sentiment was divided between the yields and the results of some of the major banks in the country. In the debt market there was a slight increase in yields but they were not intimidating investors. The earnings season began today with the quarterly accounts of JP Morgan, Citigroup and Welsl Fargo. JP Morgan reported an EPS of $ 2.34 and a banking product of $ 27,800 M.USD, compared with $ 2.26 and $ 27540 in advance. The increase in profits was mainly due to the good performance of the activity of providing credit to consumption. Citigroup announced a EPS that beat the estimates (1.73 USD vs. 1.69 USD) although the banking product fell short of anticipated (18389 M.USD vs 18501 M.USD). In part, Citigroup's results were favored by tax effects and lower costs. Wells Fargo, the largest US lender, posted EPS of 1.13 USD (est. 1.17 USD) and a banking product of 21900 M.USD, practically in line with the estimates. While shares of Wells Fargo and Citigroup traded bullish, JP Morgan bonds showed no significant changes.

Oct 15, 2018 at 23:47

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 15 Oct

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European stock markets ended slightly higher, with most sectors on positive ground. After a very negative week, investors remain wary of geopolitical tensions, but are looking forward to the US earnings season that is expected to bring some confidence back. The telecommunications companies headed the gains, while the industrial sector was the protagonist of the biggest losses. In Germany, the stock market closed with a gain of 0.80%, although the results of the Bavarian elections yesterday confirmed the fears of investors. The CSU suffered a historic defeat reaching only 37% (compared to 48% of the last election), failing to reach a majority, thus forming a coalition. Meanwhile, the price of oil was watched more closely in the face of the current US-Saudi feud over the disappearance of a Saudi journalist. The European oil sector ended up bullish.

Wall Street traded lower, further accentuating losses from last week. In the technology sector, the falls of Apple and Netflix conditioned the performance of the Nasdaq index. Shares of Netflix were influenced by the price cut by an analyst, Raymond James, while Apple was hurt by the fact that Goldman Sachs had said that the Cupertino company's results could fall this year as a result of the slowdown in demand in China. In terms of results, Bank of America reported better-than-expected quarterly results and revenues. However, the action lost ground. On the macroeconomic front, retail sales for September increased by 0.10%, below the estimated 0.60%. If we exclude auto sales, this indicator decreased by 0.10%, compared to forecasts of a 0.40% increase.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European stock markets ended slightly higher, with most sectors on positive ground. After a very negative week, investors remain wary of geopolitical tensions, but are looking forward to the US earnings season that is expected to bring some confidence back. The telecommunications companies headed the gains, while the industrial sector was the protagonist of the biggest losses. In Germany, the stock market closed with a gain of 0.80%, although the results of the Bavarian elections yesterday confirmed the fears of investors. The CSU suffered a historic defeat reaching only 37% (compared to 48% of the last election), failing to reach a majority, thus forming a coalition. Meanwhile, the price of oil was watched more closely in the face of the current US-Saudi feud over the disappearance of a Saudi journalist. The European oil sector ended up bullish.

Wall Street traded lower, further accentuating losses from last week. In the technology sector, the falls of Apple and Netflix conditioned the performance of the Nasdaq index. Shares of Netflix were influenced by the price cut by an analyst, Raymond James, while Apple was hurt by the fact that Goldman Sachs had said that the Cupertino company's results could fall this year as a result of the slowdown in demand in China. In terms of results, Bank of America reported better-than-expected quarterly results and revenues. However, the action lost ground. On the macroeconomic front, retail sales for September increased by 0.10%, below the estimated 0.60%. If we exclude auto sales, this indicator decreased by 0.10%, compared to forecasts of a 0.40% increase.

Oct 17, 2018 at 01:05

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 16 Oct

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European stock markets experienced a very positive day, with some sectors showing gains of more than 2%. The focus was mainly on the dispute between the United States and Saudi Arabia (following the assassination of the Saudi journalist in Turkey). The producers of raw materials presented a relative underperformance. One day after his government presented a controversial State Budget to the European Commission, the Milan Stock Exchange was the best performer of the day. However, it is important to underline that transalpine banking securities have been underperformance vis-à-vis other sectors.

Wall Street traded bullish, with investors cheered by the release of some quarterly results. The results of Morgan Stanley and Goldman Sachs outperformed forecasts, while BlackRock surprised by the positive outlook but fell short in terms of revenue. Outside the financial sector, we highlight Johnson & Johnson whose results were above expectations. In terms of economic indicators, industrial production during the month of September increased by 0.30%, compared to forecasts of 0.20%.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European stock markets experienced a very positive day, with some sectors showing gains of more than 2%. The focus was mainly on the dispute between the United States and Saudi Arabia (following the assassination of the Saudi journalist in Turkey). The producers of raw materials presented a relative underperformance. One day after his government presented a controversial State Budget to the European Commission, the Milan Stock Exchange was the best performer of the day. However, it is important to underline that transalpine banking securities have been underperformance vis-à-vis other sectors.

Wall Street traded bullish, with investors cheered by the release of some quarterly results. The results of Morgan Stanley and Goldman Sachs outperformed forecasts, while BlackRock surprised by the positive outlook but fell short in terms of revenue. Outside the financial sector, we highlight Johnson & Johnson whose results were above expectations. In terms of economic indicators, industrial production during the month of September increased by 0.30%, compared to forecasts of 0.20%.

Oct 18, 2018 at 01:10

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 17 Oct

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European stock markets closed lower, especially in southern Europe - Spain and Italy. The car industry was one of the worst performers, after it was reported that car sales in the European Union fell (23.40%) for the first time in 6 months. Volkswagen, Fiat and Renault titles led the losses. Also in sharp decline were the food and oil sectors. In Madrid, the stocks of DIA again showed a significant drop (-13%). In contrast, the technology sector, with ASML rising 3.47%, after its quarterly results surpassed expectations. In Amsterdam, Akzo Nobel also saw a considerable gain after the coating company announced that the profit from its main operations increased by 8%. Fresenius Medical Care shares fell more than 16% after the company cut its sales forecasts and prospects to 2018 in the face of a weaker performance at its US unit. In terms of economic indicators, the final reading of inflation for the Euro Zone during the month of September was in line with forecasts (2.10%). In its core version, which excludes the most volatile items, this indicator reached 0.90%.

On the day of publication of the minutes of the FED meeting and reaction to published business results, the US market opened in negative territory. The minutes of the FED meeting are a tool widely used by debt market players to gauge the sentiment prevailing within the Central Bank and what are the most sensitive issues for its members. The future of US monetary policy will depend essentially on two issues. The first is to know the level of interest rates from which monetary policy ceases to be accommodative and becomes neutral. The second concerns the Central Bank's dilemma whether monetary policy should remain in a neutral state or if it is to be tightened in the face of strong economic acceleration. Another document that can move the financial markets is what the US Treasury will publish regarding the foreign exchange market. In the business field, IBM shares fell 6.46% after yesterday after closing its quarterly results, which showed a drop in revenue higher than expected, due to the slowdown in software sales. Revenues reached 18760 M.USD, compared to estimates of 19,100 M.USD. The recurring EPS hit them 3.42 USD, against the expected 3.40 USD. On the contrary, Netflix presented its quarterly accounts, having registered a record number in the increase of the number of subscribers. The EPS was 0.89 USD, against the expected 0.68 USD. Revenues were in line with estimates. Thus, the shares of this company had a valuation of 4.53%. After closing, it will be Alcoa's turn to present its quarterly results.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European stock markets closed lower, especially in southern Europe - Spain and Italy. The car industry was one of the worst performers, after it was reported that car sales in the European Union fell (23.40%) for the first time in 6 months. Volkswagen, Fiat and Renault titles led the losses. Also in sharp decline were the food and oil sectors. In Madrid, the stocks of DIA again showed a significant drop (-13%). In contrast, the technology sector, with ASML rising 3.47%, after its quarterly results surpassed expectations. In Amsterdam, Akzo Nobel also saw a considerable gain after the coating company announced that the profit from its main operations increased by 8%. Fresenius Medical Care shares fell more than 16% after the company cut its sales forecasts and prospects to 2018 in the face of a weaker performance at its US unit. In terms of economic indicators, the final reading of inflation for the Euro Zone during the month of September was in line with forecasts (2.10%). In its core version, which excludes the most volatile items, this indicator reached 0.90%.

On the day of publication of the minutes of the FED meeting and reaction to published business results, the US market opened in negative territory. The minutes of the FED meeting are a tool widely used by debt market players to gauge the sentiment prevailing within the Central Bank and what are the most sensitive issues for its members. The future of US monetary policy will depend essentially on two issues. The first is to know the level of interest rates from which monetary policy ceases to be accommodative and becomes neutral. The second concerns the Central Bank's dilemma whether monetary policy should remain in a neutral state or if it is to be tightened in the face of strong economic acceleration. Another document that can move the financial markets is what the US Treasury will publish regarding the foreign exchange market. In the business field, IBM shares fell 6.46% after yesterday after closing its quarterly results, which showed a drop in revenue higher than expected, due to the slowdown in software sales. Revenues reached 18760 M.USD, compared to estimates of 19,100 M.USD. The recurring EPS hit them 3.42 USD, against the expected 3.40 USD. On the contrary, Netflix presented its quarterly accounts, having registered a record number in the increase of the number of subscribers. The EPS was 0.89 USD, against the expected 0.68 USD. Revenues were in line with estimates. Thus, the shares of this company had a valuation of 4.53%. After closing, it will be Alcoa's turn to present its quarterly results.

Oct 18, 2018 at 21:22

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 18 Oct

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European stock markets closed mostly lower, in a session marked by the presentation and consequent reaction to the published business results. At the same time, attention was focused on the current impasse in the Brexit issue. The DJSToxx Banks was penalized by strong selling pressure that hit Italian and Spanish banks. Transalpine bank bonds reflected the widening of the spread between Italian and German yields, which has hit the highs since 2013. The main Spanish banks were heavily penalized, with losses ranging from 2% to 6.50% on the day the Supreme Spanish Court ruled that it should be the banking institutions, not the client, to pay the stamp duty associated with registering a mortgage by changing the standard that has been followed so far. The media sector remained prominent, with France's Publicis rising about 3.75%, after the world's 3rd largest advertising company reported that net revenue increased 1.30% in the third quarter. In the retail sector, Carrefour led the gains, after having posted higher sales in the third quarter, referring to the strong performance of its main markets, French and Brazilian. Unilever said today that its sales growth was 3.80% in the quarter, with the increase since the beginning of the year at 2.90%. Total revenues amounted to 12500 M.USD, representing an annual decline of 4.80% due to a negative exchange rate effect and the sale of some of its businesses, which included brands such as Becel and ProActiv. Its shares fell 0.80%. Among technology, SAP% decreased 6.04%. The German company raised its outlook to 2018, after having seen solid growth in its cloud business. Ericsson posted a quarterly net profit that exceeded the estimates by a significant margin, standing at 2750 M.SEK, compared to the estimates of 630 M.SEK. Sales increased 8.90% to 53810 MSEK, also above expected 50280 M.SEK.

US indices were trading lower, reflecting a decline in major tech stocks and rising yields. Alcoa rose 8%, after yesterday after closing its quarterly results, which were above expectations, due to the rise in aluminum oxide prices. Excluding non-recurring items, Alcoa recorded a EPS of 0.63 USD, compared to the estimates of 0.50 USD. Revenues rose 14.40% to 3390 M.USD, above the expected 3310 M.USD. After the closing of the session will be known the results of American Express.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European stock markets closed mostly lower, in a session marked by the presentation and consequent reaction to the published business results. At the same time, attention was focused on the current impasse in the Brexit issue. The DJSToxx Banks was penalized by strong selling pressure that hit Italian and Spanish banks. Transalpine bank bonds reflected the widening of the spread between Italian and German yields, which has hit the highs since 2013. The main Spanish banks were heavily penalized, with losses ranging from 2% to 6.50% on the day the Supreme Spanish Court ruled that it should be the banking institutions, not the client, to pay the stamp duty associated with registering a mortgage by changing the standard that has been followed so far. The media sector remained prominent, with France's Publicis rising about 3.75%, after the world's 3rd largest advertising company reported that net revenue increased 1.30% in the third quarter. In the retail sector, Carrefour led the gains, after having posted higher sales in the third quarter, referring to the strong performance of its main markets, French and Brazilian. Unilever said today that its sales growth was 3.80% in the quarter, with the increase since the beginning of the year at 2.90%. Total revenues amounted to 12500 M.USD, representing an annual decline of 4.80% due to a negative exchange rate effect and the sale of some of its businesses, which included brands such as Becel and ProActiv. Its shares fell 0.80%. Among technology, SAP% decreased 6.04%. The German company raised its outlook to 2018, after having seen solid growth in its cloud business. Ericsson posted a quarterly net profit that exceeded the estimates by a significant margin, standing at 2750 M.SEK, compared to the estimates of 630 M.SEK. Sales increased 8.90% to 53810 MSEK, also above expected 50280 M.SEK.

US indices were trading lower, reflecting a decline in major tech stocks and rising yields. Alcoa rose 8%, after yesterday after closing its quarterly results, which were above expectations, due to the rise in aluminum oxide prices. Excluding non-recurring items, Alcoa recorded a EPS of 0.63 USD, compared to the estimates of 0.50 USD. Revenues rose 14.40% to 3390 M.USD, above the expected 3310 M.USD. After the closing of the session will be known the results of American Express.

Oct 20, 2018 at 00:31

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 19 Oct

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European indices traded lower. Investors had to divide their attention across multiple fronts. At the external level, China's economic data penalized the European export sector. In the third quarter, the Chinese economy grew 6.50%, below the 6.60%, which is the lowest quarterly growth since 2009. At the domestic level, the weakness of the banking sector, more precisely that of southern Europe, stood out. In Italy, friction between the two parties in the governing coalition was driving the spread between Italian and German interest rates to a new high in the last five years. This spread is a risk barometer of the economic and financial situation of the country and an increase penalizes the stocks of this country and with greater incidence the bank bonds. However, at the end of the day the most conciliatory words of European Commissioner Moscovici regarding the Italian situation triggered a rally in Italian banking stocks and a stabilization of the spread.

US stocks were recovering some of the losses suffered yesterday. Encouraging this rise were the good results presented by some companies such as Procter & Gamble, Honeywell, American Express and Schlumberger. At the macroeconomic level, home sales reached 5.15 million units (annualized) compared to the estimated 5.29 million.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European indices traded lower. Investors had to divide their attention across multiple fronts. At the external level, China's economic data penalized the European export sector. In the third quarter, the Chinese economy grew 6.50%, below the 6.60%, which is the lowest quarterly growth since 2009. At the domestic level, the weakness of the banking sector, more precisely that of southern Europe, stood out. In Italy, friction between the two parties in the governing coalition was driving the spread between Italian and German interest rates to a new high in the last five years. This spread is a risk barometer of the economic and financial situation of the country and an increase penalizes the stocks of this country and with greater incidence the bank bonds. However, at the end of the day the most conciliatory words of European Commissioner Moscovici regarding the Italian situation triggered a rally in Italian banking stocks and a stabilization of the spread.

US stocks were recovering some of the losses suffered yesterday. Encouraging this rise were the good results presented by some companies such as Procter & Gamble, Honeywell, American Express and Schlumberger. At the macroeconomic level, home sales reached 5.15 million units (annualized) compared to the estimated 5.29 million.

Oct 23, 2018 at 00:51

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 22 Oct

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets ended the day in low. The rise of the Chinese stock exchanges and the first reaction of the bond market to the reduction of the rating of Italy gave an initial boost to the stock indices. The 4.50% rise in the Shanghai stock market enabled commodity producers and the auto industry to rank among the best performers. Fiat advanced 3% as a result of the news that it sold its hi-tech unit Magneti Marelli to a company owned by the private equity fund KKR for 6200 M. €. On Friday after closing, Moody's downgraded Italian debt from Baa2 to Baa3 with a stable outlook. This is the last degree of the investment category and indicates a moderate credit risk. In an early stage, the market reacted positively, with Italian yields and its spread declining against the Germans. However, in the second part of the session, Italian bonds lost all ground gained in the morning, spreading their weakness to other European assets. Despite the conciliatory tone of the letter sent by Finance Minister Giovanni Tria to the European Commission, the Italian Government reiterated that it will not change the State Budget already presented. The Earnings Season remains one of the main themes of the week. Ryanair posted a considerable gain, despite having reported a profit for the second fiscal quarter below expectations. The company also announced that it has made significant progress in preventing further strikes. On the contrary, Philips fell more than 6% after its quarterly results fell short of forecasts. Shares of the Day suffered heavy losses (-25%) on the day the company revealed that it reviewed the accounts for 2017 and accounted for minus 20 M. € in revenues.

American indices traded without a common trend. The Dow Jones and S & P were being penalized by the correction of the banking and oil sectors. Nasdaq was trading higher, benefiting from the appreciation of the shares of major technology companies. This week, Microsoft, Google, Amazon, among other companies will report their quarterly accounts.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets ended the day in low. The rise of the Chinese stock exchanges and the first reaction of the bond market to the reduction of the rating of Italy gave an initial boost to the stock indices. The 4.50% rise in the Shanghai stock market enabled commodity producers and the auto industry to rank among the best performers. Fiat advanced 3% as a result of the news that it sold its hi-tech unit Magneti Marelli to a company owned by the private equity fund KKR for 6200 M. €. On Friday after closing, Moody's downgraded Italian debt from Baa2 to Baa3 with a stable outlook. This is the last degree of the investment category and indicates a moderate credit risk. In an early stage, the market reacted positively, with Italian yields and its spread declining against the Germans. However, in the second part of the session, Italian bonds lost all ground gained in the morning, spreading their weakness to other European assets. Despite the conciliatory tone of the letter sent by Finance Minister Giovanni Tria to the European Commission, the Italian Government reiterated that it will not change the State Budget already presented. The Earnings Season remains one of the main themes of the week. Ryanair posted a considerable gain, despite having reported a profit for the second fiscal quarter below expectations. The company also announced that it has made significant progress in preventing further strikes. On the contrary, Philips fell more than 6% after its quarterly results fell short of forecasts. Shares of the Day suffered heavy losses (-25%) on the day the company revealed that it reviewed the accounts for 2017 and accounted for minus 20 M. € in revenues.

American indices traded without a common trend. The Dow Jones and S & P were being penalized by the correction of the banking and oil sectors. Nasdaq was trading higher, benefiting from the appreciation of the shares of major technology companies. This week, Microsoft, Google, Amazon, among other companies will report their quarterly accounts.

Oct 23, 2018 at 23:03

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 23 Oct

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

Today there were strong losses for European stock exchanges, with investors sentiment influenced by the weakness of the Chinese stock markets and the situation in Italy. Influencing investor sentiment has been the disappointing business results that have marked the last few days. The letter sent to Brussels by the Italian Ministry of Finance was released. In a conciliatory way in which it recognizes some correctness of the objections of the European Commission, the Italian Government has reiterated that it will not alter its Budget. As a result, the market was still waiting for further developments, with the Italian stock market ending up with a 0.70% drop and Italian 10-year yields up 8 basis points (0.08%) compared to yesterday. On the other hand, the poor performance shown by the Asian stock markets also penalized the markets, mainly the producers of raw materials, a sector very sensitive to the economic cycle of this country. Another sector that closed today with heavy losses was the technological one, due to a sharp fall of an Austrian chip maker, AMS. This company disappointed investors by presenting their outlook for the fourth quarter. In Frankfurt, Bayer fell 9.69% following confirmation in the US of the conviction of its subsidiary Monsanto for hiding the danger of Roundup, its herbicide with glyphosate. In the automotive sector, BMW has said it will call for overhauling 1.6 million diesel-powered vehicles worldwide due to problems in the exhaust gas cooling circuit. Renault reported its quarterly sales. Revenues amounted to 11500 M. € compared to the 12,200 M. € that analysts, on average, estimated. Renault cut its projections for the growth of the Chinese car market (2% compared to the previous 5%).

Geopolitical tensions around Saudi Arabia and some disappointing results were hampering the Wall Street session. Before the opening of the session, the results of McDonald's, 3M's and Caterpillar's were known. 3M reported lower-than-expected earnings and revenues while Caterpillar disappointed investors by reiterating its projections for the rest of the year.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

Today there were strong losses for European stock exchanges, with investors sentiment influenced by the weakness of the Chinese stock markets and the situation in Italy. Influencing investor sentiment has been the disappointing business results that have marked the last few days. The letter sent to Brussels by the Italian Ministry of Finance was released. In a conciliatory way in which it recognizes some correctness of the objections of the European Commission, the Italian Government has reiterated that it will not alter its Budget. As a result, the market was still waiting for further developments, with the Italian stock market ending up with a 0.70% drop and Italian 10-year yields up 8 basis points (0.08%) compared to yesterday. On the other hand, the poor performance shown by the Asian stock markets also penalized the markets, mainly the producers of raw materials, a sector very sensitive to the economic cycle of this country. Another sector that closed today with heavy losses was the technological one, due to a sharp fall of an Austrian chip maker, AMS. This company disappointed investors by presenting their outlook for the fourth quarter. In Frankfurt, Bayer fell 9.69% following confirmation in the US of the conviction of its subsidiary Monsanto for hiding the danger of Roundup, its herbicide with glyphosate. In the automotive sector, BMW has said it will call for overhauling 1.6 million diesel-powered vehicles worldwide due to problems in the exhaust gas cooling circuit. Renault reported its quarterly sales. Revenues amounted to 11500 M. € compared to the 12,200 M. € that analysts, on average, estimated. Renault cut its projections for the growth of the Chinese car market (2% compared to the previous 5%).

Geopolitical tensions around Saudi Arabia and some disappointing results were hampering the Wall Street session. Before the opening of the session, the results of McDonald's, 3M's and Caterpillar's were known. 3M reported lower-than-expected earnings and revenues while Caterpillar disappointed investors by reiterating its projections for the rest of the year.

Oct 24, 2018 at 21:38

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 24 Oct

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets closed with losses in a session that initially had been influenced by the recoveries of the US stock exchanges the day before and the Chinese stock exchanges during the Asian session. Even so, volatility once again dominated the day, as some of the risks that characterize the current economic situation continued to be present. Thus, in the last hour of trading, the European indices lost all the gains made in the morning. The economic and financial situation in Italy has been marked, following the European Commission's disapproval of the Italian Budget for 2019, by an exchange of words between Rome and Brussels. This tension created a selling pressure on Italian assets and the Euro. Investors are now awaiting Standard & Poor's rating of the Italian debt rating, scheduled for Friday. The trend of the session was still influenced by the results reported by European companies before the opening. Barclays posted a better-than-expected result: quarterly profit before taxes increased from 1110 M.GBP in the same period in 2017 to 1460 M.GBP, compared to the expected 1330 M.GBP. Deutsche Bank said third-quarter profit fell 65% to 229 M. €, due to a decline in trading income, although it surpassed the estimates (229 M.€ vs. 149 M.€). Total revenues fell 9% to 6,200 M.€, practically in line with estimates. The bank reiterated its objectives for the coming quarter. STMicroelectronics reported an increase in sales and profit in the third quarter. Net revenues increased 11.20% over the previous quarter to 2520 M.USD, slightly above the company's target and operating profit increased 38% to 398 M.USD. The company said it expects fourth-quarter revenue to grow about 5.70% over the previous quarter.

The three main indices traded bearish. The Nasdaq and smaller S&P were being penalized for weakness in technology stocks. Today and tomorrow, companies like Microsoft, Google and Amazon will report their quarterly accounts. Dow Jones' losses were being mitigated in relative terms by the good performance of Boeing, a company considered a barometer of trade tensions between the US and China.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets closed with losses in a session that initially had been influenced by the recoveries of the US stock exchanges the day before and the Chinese stock exchanges during the Asian session. Even so, volatility once again dominated the day, as some of the risks that characterize the current economic situation continued to be present. Thus, in the last hour of trading, the European indices lost all the gains made in the morning. The economic and financial situation in Italy has been marked, following the European Commission's disapproval of the Italian Budget for 2019, by an exchange of words between Rome and Brussels. This tension created a selling pressure on Italian assets and the Euro. Investors are now awaiting Standard & Poor's rating of the Italian debt rating, scheduled for Friday. The trend of the session was still influenced by the results reported by European companies before the opening. Barclays posted a better-than-expected result: quarterly profit before taxes increased from 1110 M.GBP in the same period in 2017 to 1460 M.GBP, compared to the expected 1330 M.GBP. Deutsche Bank said third-quarter profit fell 65% to 229 M. €, due to a decline in trading income, although it surpassed the estimates (229 M.€ vs. 149 M.€). Total revenues fell 9% to 6,200 M.€, practically in line with estimates. The bank reiterated its objectives for the coming quarter. STMicroelectronics reported an increase in sales and profit in the third quarter. Net revenues increased 11.20% over the previous quarter to 2520 M.USD, slightly above the company's target and operating profit increased 38% to 398 M.USD. The company said it expects fourth-quarter revenue to grow about 5.70% over the previous quarter.

The three main indices traded bearish. The Nasdaq and smaller S&P were being penalized for weakness in technology stocks. Today and tomorrow, companies like Microsoft, Google and Amazon will report their quarterly accounts. Dow Jones' losses were being mitigated in relative terms by the good performance of Boeing, a company considered a barometer of trade tensions between the US and China.

*商業用途和垃圾郵件將不被容忍,並可能導致帳戶終止。

提示:發佈圖片/YouTube網址會自動嵌入到您的帖子中!

提示:鍵入@符號,自動完成參與此討論的用戶名。