Edit Your Comment

Trading Journal

Oct 25, 2018 at 22:12

會員從Jan 24, 2018開始

207帖子

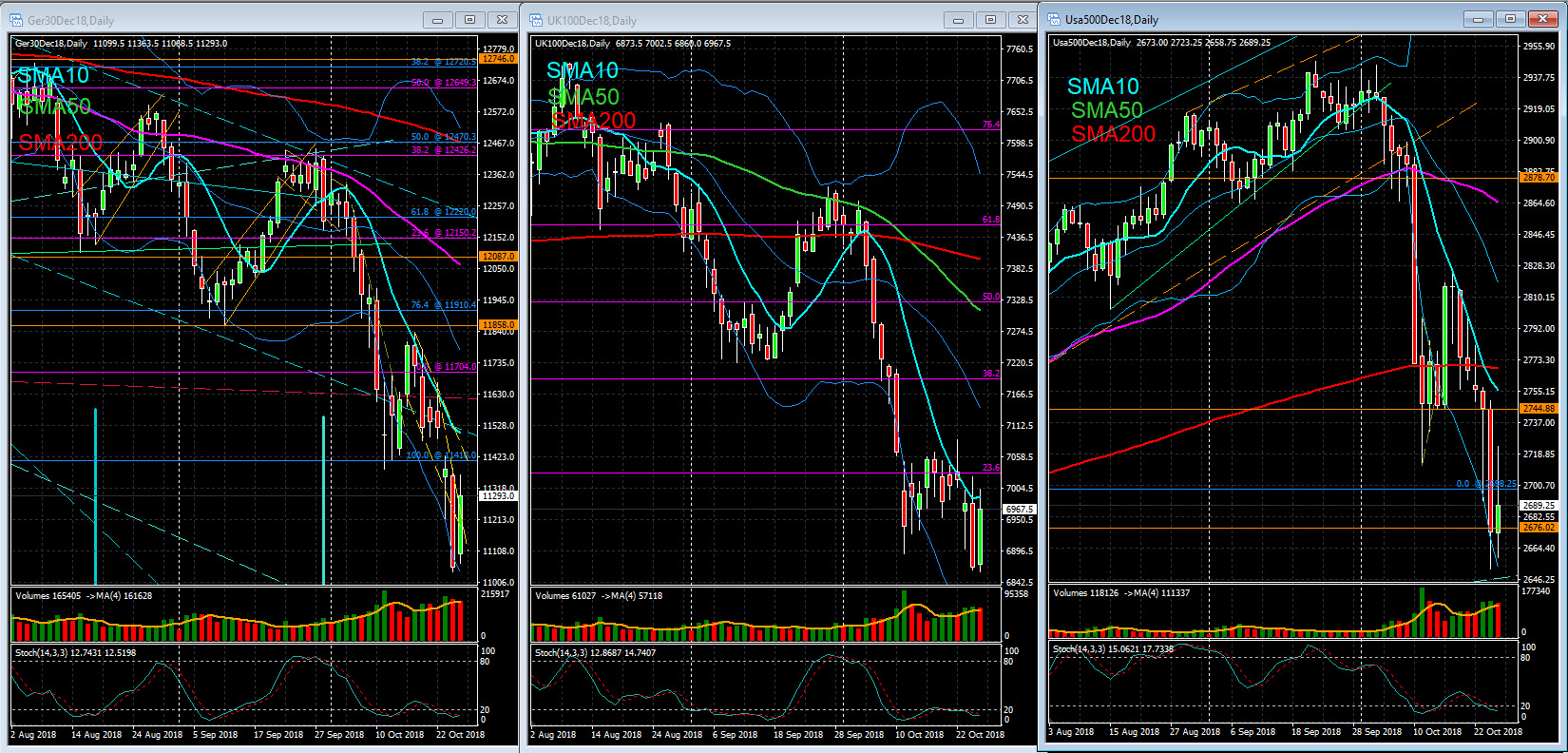

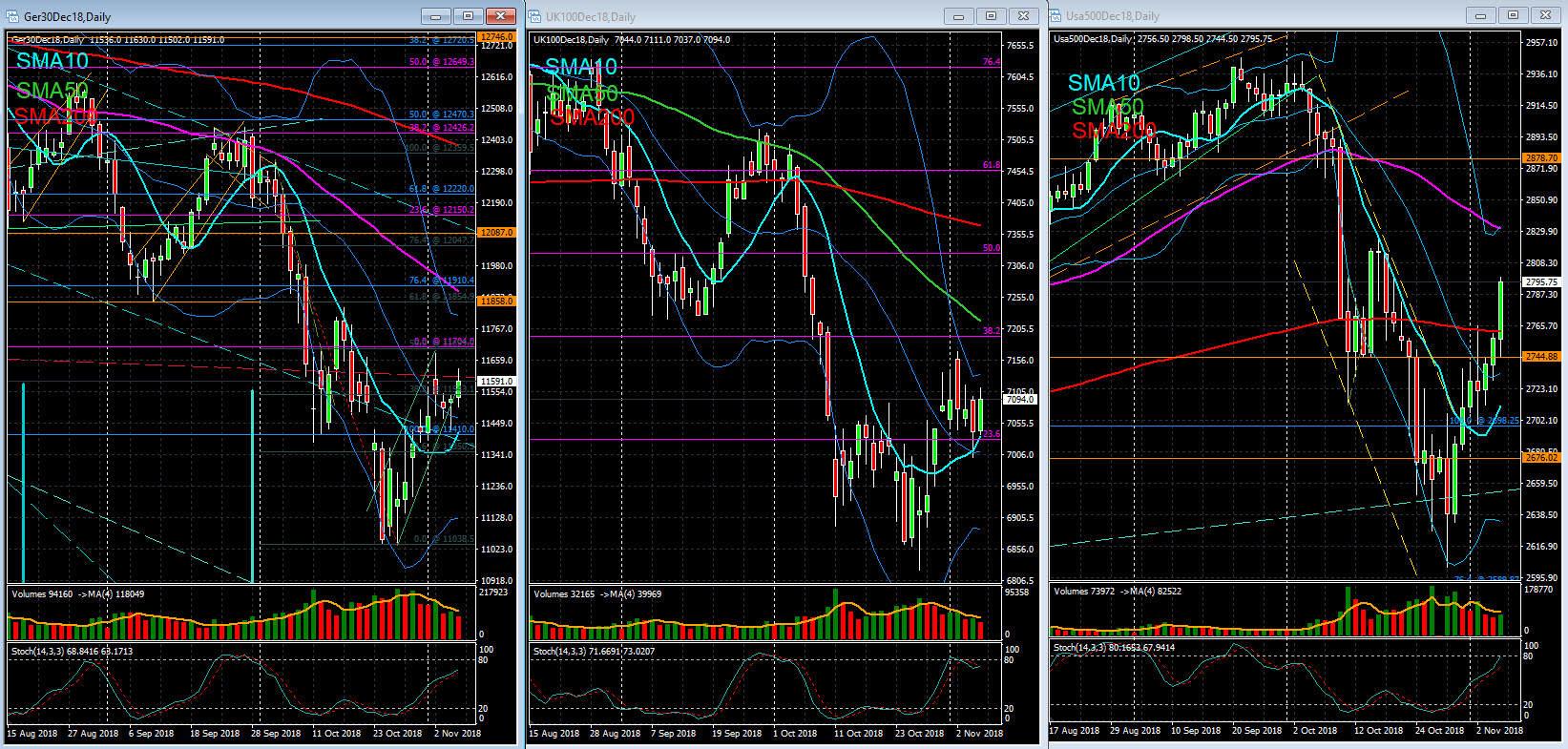

Stock Markets – Closing Note - 25 Oct

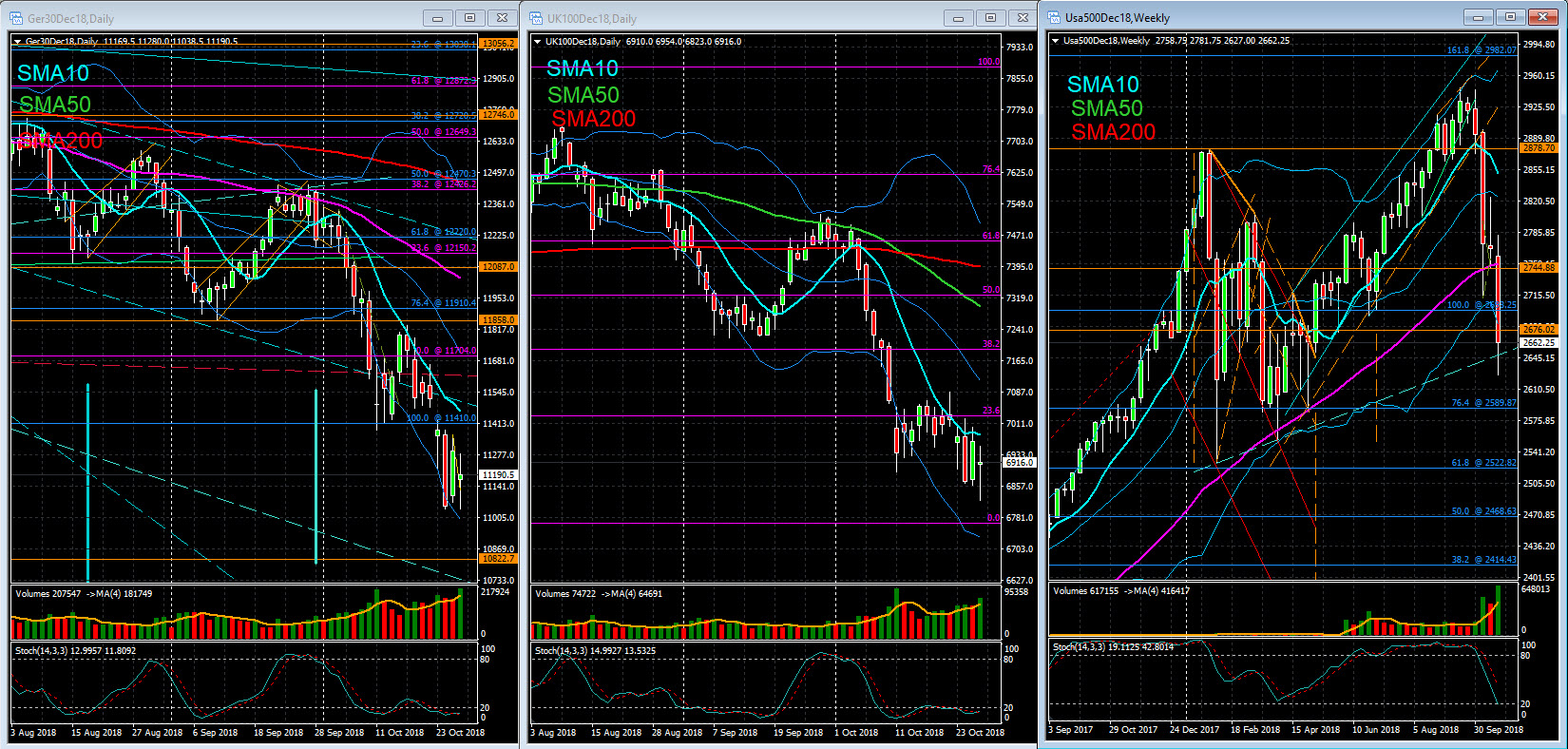

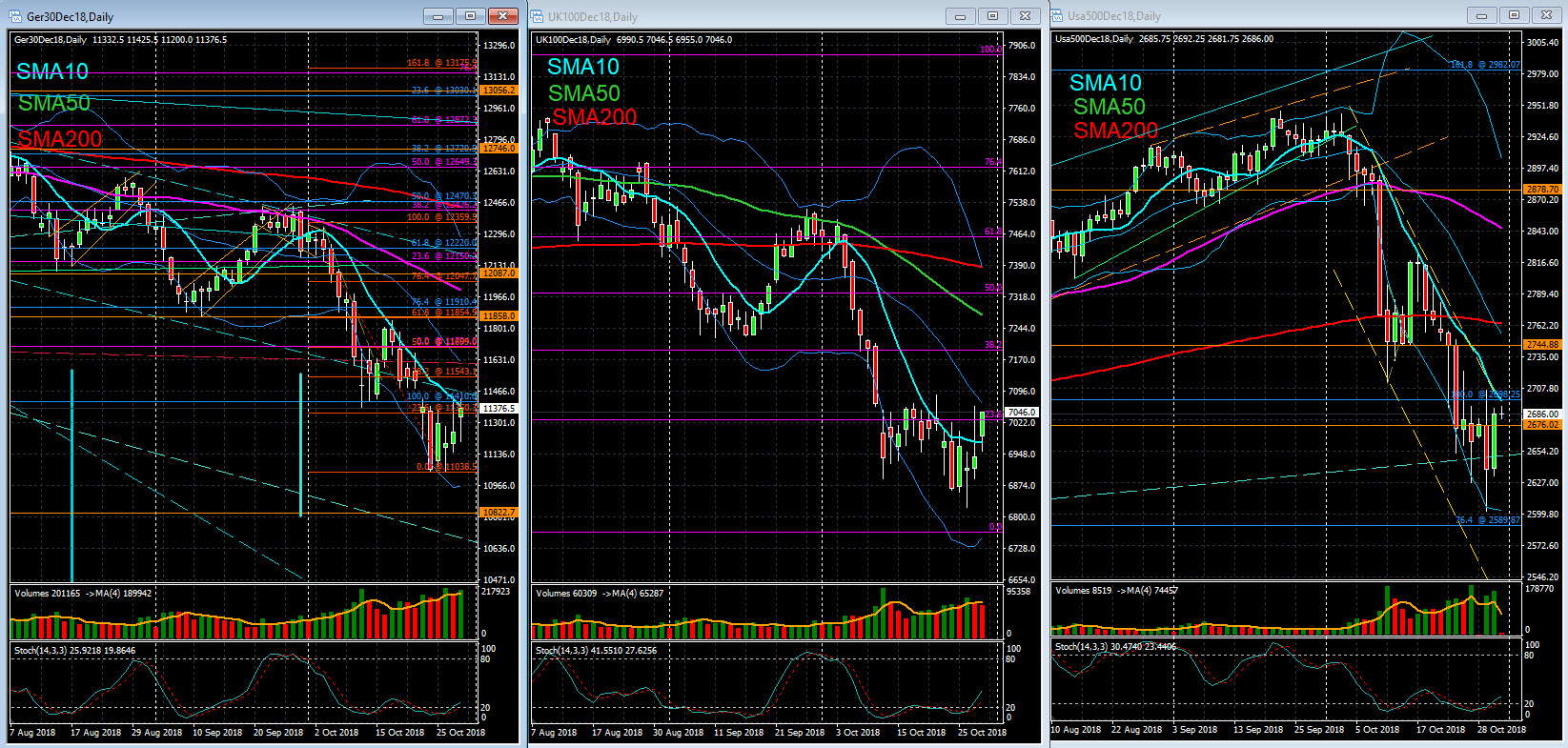

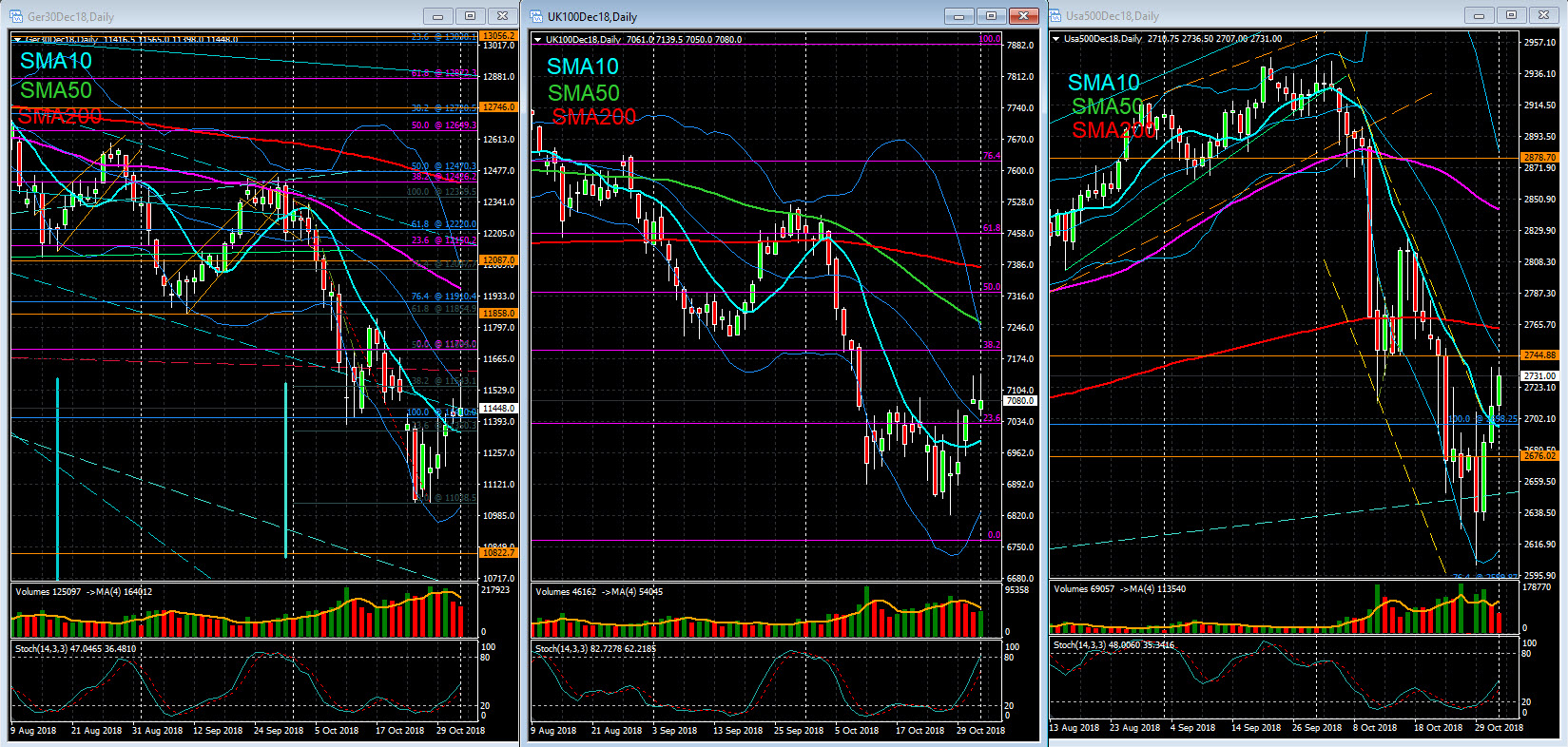

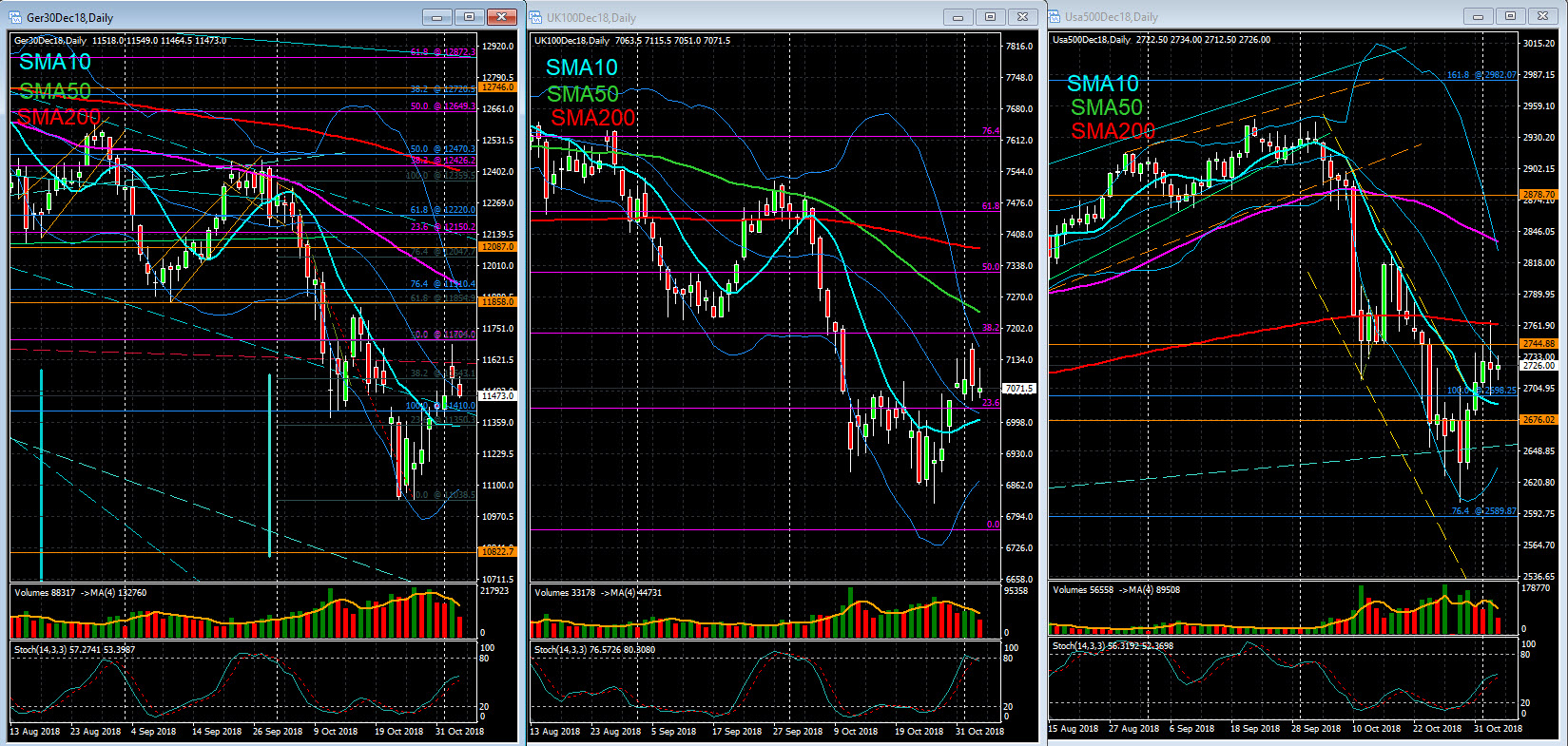

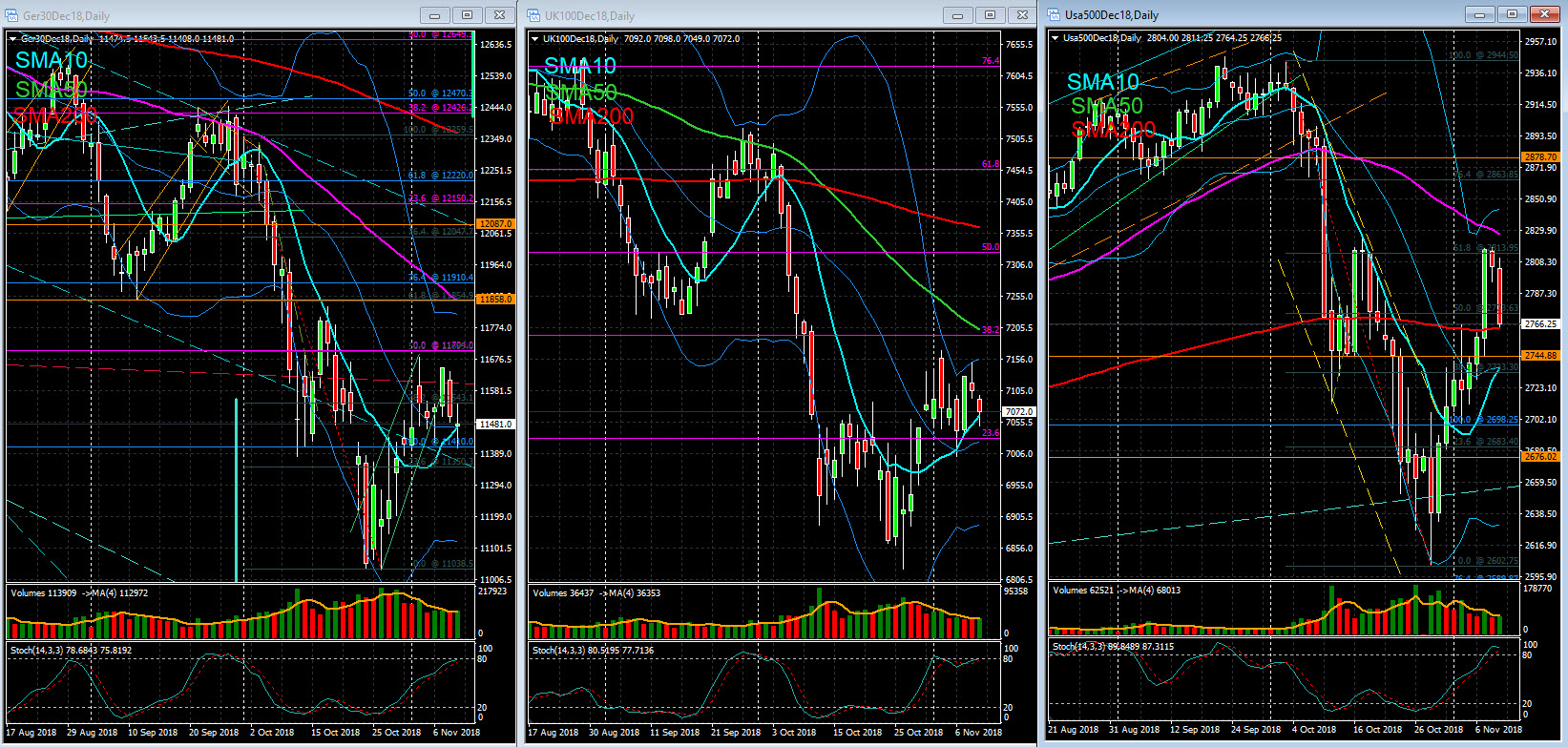

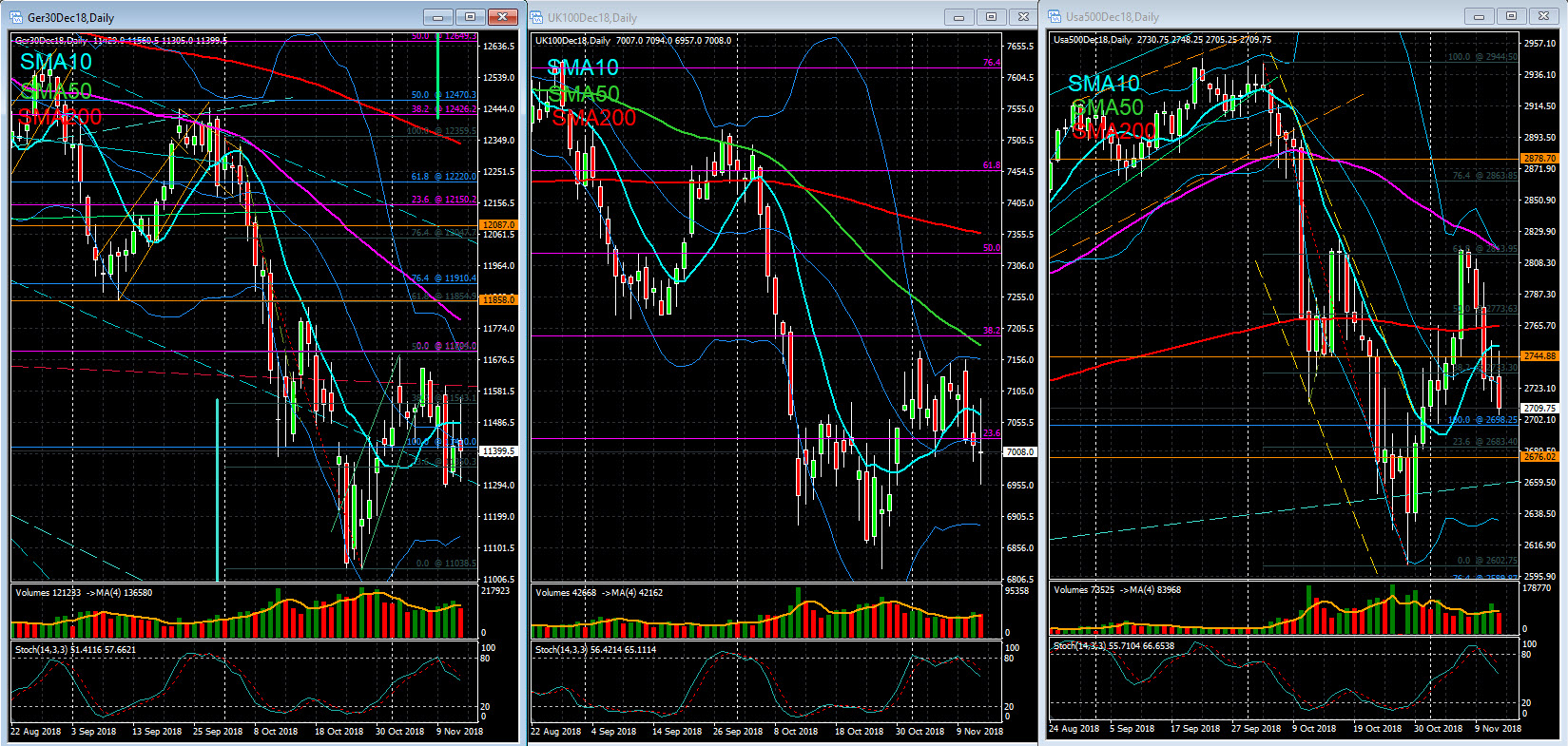

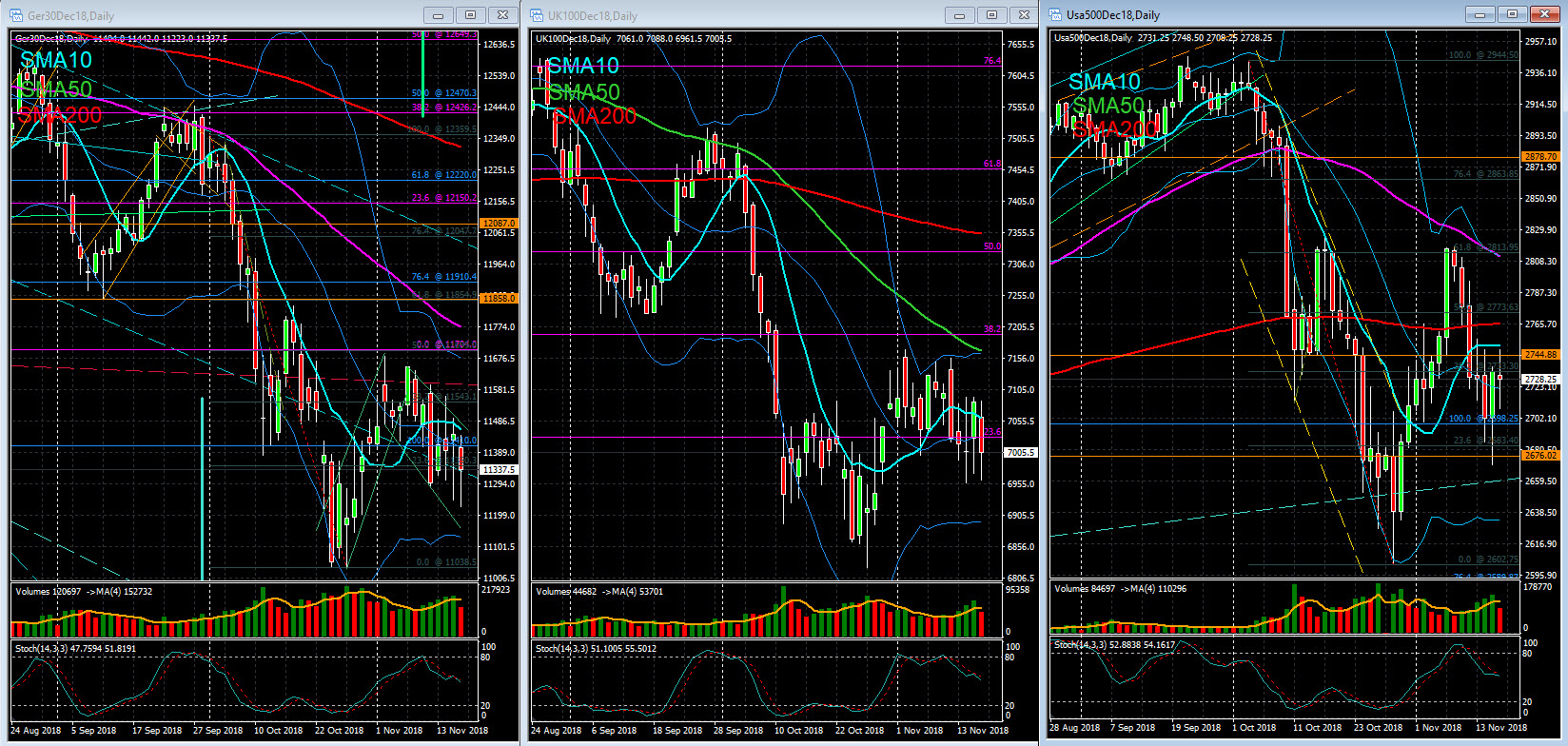

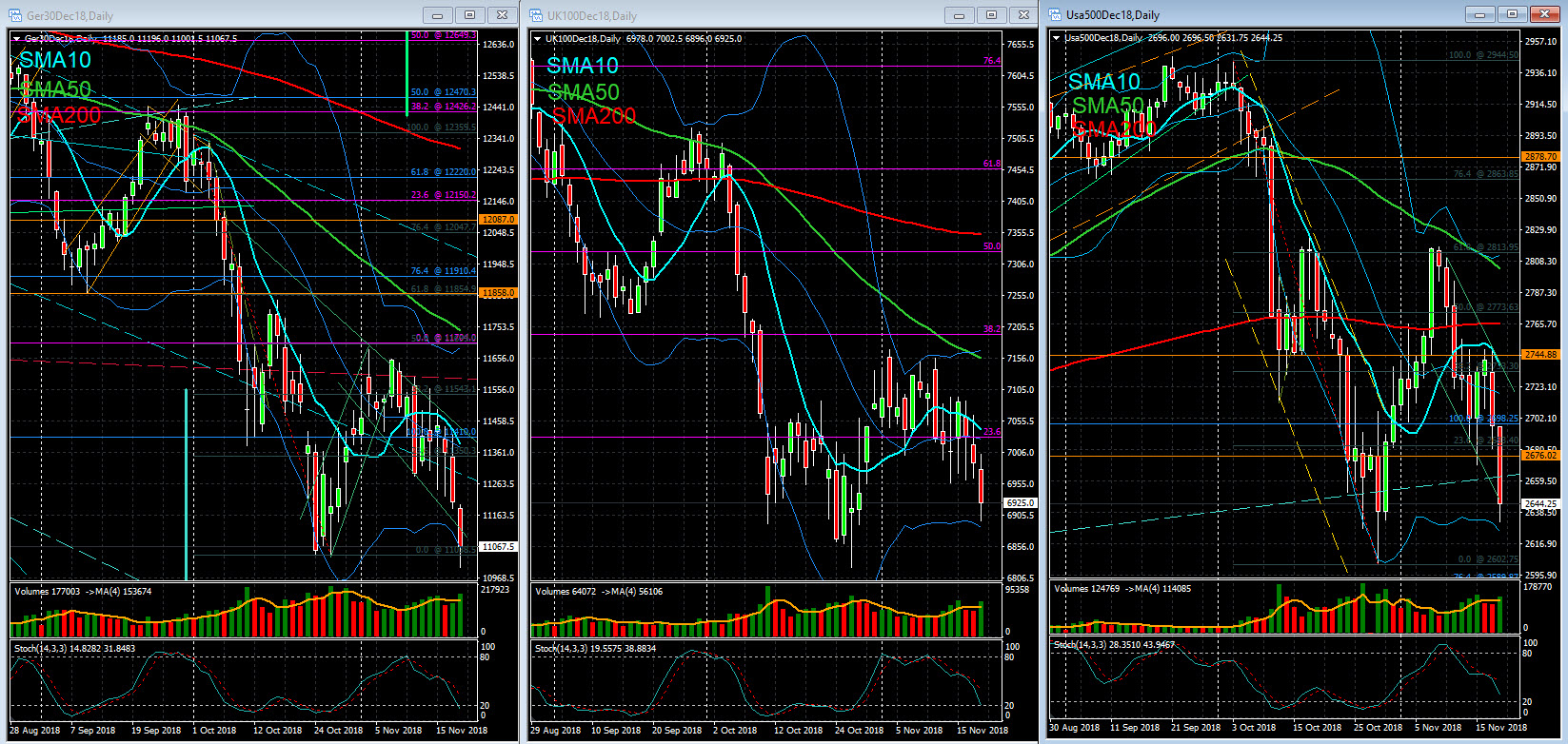

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

The opening of the European session was pressured by the heavy losses suffered by the American indexes yesterday. Subsequently, European markets were able to build a gradual recovery. Somewhat hesitantly, investors began to buy the stocks that had posted the biggest losses in the last week. This was also due to the absence of developments in the tense relations between Italy and the European Commission, which induced Italian 10-year yields to fall from 0.10% from 3.60% to 3.50%. This downward movement of these interest rates favored Italian banking stocks, which served as a catalyst for the rest of the European sector. The Earnings Season was relegated to the background. UBS announced that in the 3rd quarter it achieved a profit of 1200 M. CHF and an operating result of 7300 M.CHF. These two items exceeded analysts' forecasts. Daimler reported an EPS of 1.58€ less than the estimated 1.89€. Revenues amounted to 40210 M€ compared to 39330M€. The CEO of the company defended that in the fourth quarter is expected to see a recovery of activity. The ECB meeting was in line with the expectations of investors, and this institution reiterated the statement from the previous meeting. With regard to the political-budgetary situation in Italy, Mario Draghi was confident that an agreement between Brussels and Rome would be reached.

After the 4% drop yesterday, the US indices traded with a valuation that oscillated between the 1% of the Dow Jones and the 2.50% of Nasdaq. In addition to this recovery represents a technical reaction to yesterday's decline, the US indexes were reflecting the good results of Microsoft. The company reported EPS of USD 1.14 and revenues of USD 29080. These numbers compare with the 0.96 USD and 27880 M.USD forecast respectively. Microsoft was up 5.80%.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

The opening of the European session was pressured by the heavy losses suffered by the American indexes yesterday. Subsequently, European markets were able to build a gradual recovery. Somewhat hesitantly, investors began to buy the stocks that had posted the biggest losses in the last week. This was also due to the absence of developments in the tense relations between Italy and the European Commission, which induced Italian 10-year yields to fall from 0.10% from 3.60% to 3.50%. This downward movement of these interest rates favored Italian banking stocks, which served as a catalyst for the rest of the European sector. The Earnings Season was relegated to the background. UBS announced that in the 3rd quarter it achieved a profit of 1200 M. CHF and an operating result of 7300 M.CHF. These two items exceeded analysts' forecasts. Daimler reported an EPS of 1.58€ less than the estimated 1.89€. Revenues amounted to 40210 M€ compared to 39330M€. The CEO of the company defended that in the fourth quarter is expected to see a recovery of activity. The ECB meeting was in line with the expectations of investors, and this institution reiterated the statement from the previous meeting. With regard to the political-budgetary situation in Italy, Mario Draghi was confident that an agreement between Brussels and Rome would be reached.

After the 4% drop yesterday, the US indices traded with a valuation that oscillated between the 1% of the Dow Jones and the 2.50% of Nasdaq. In addition to this recovery represents a technical reaction to yesterday's decline, the US indexes were reflecting the good results of Microsoft. The company reported EPS of USD 1.14 and revenues of USD 29080. These numbers compare with the 0.96 USD and 27880 M.USD forecast respectively. Microsoft was up 5.80%.

Oct 27, 2018 at 01:58

會員從Jan 24, 2018開始

207帖子

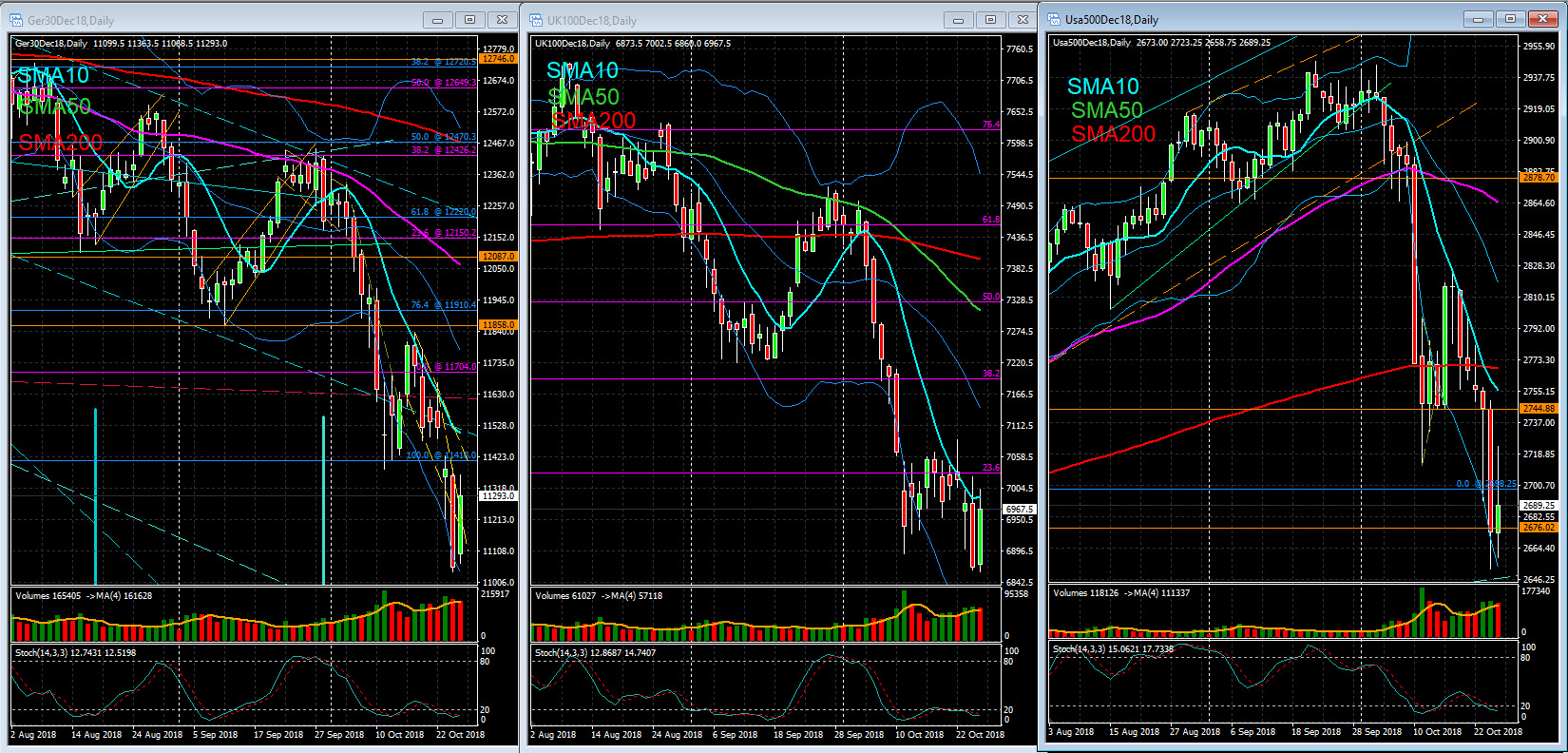

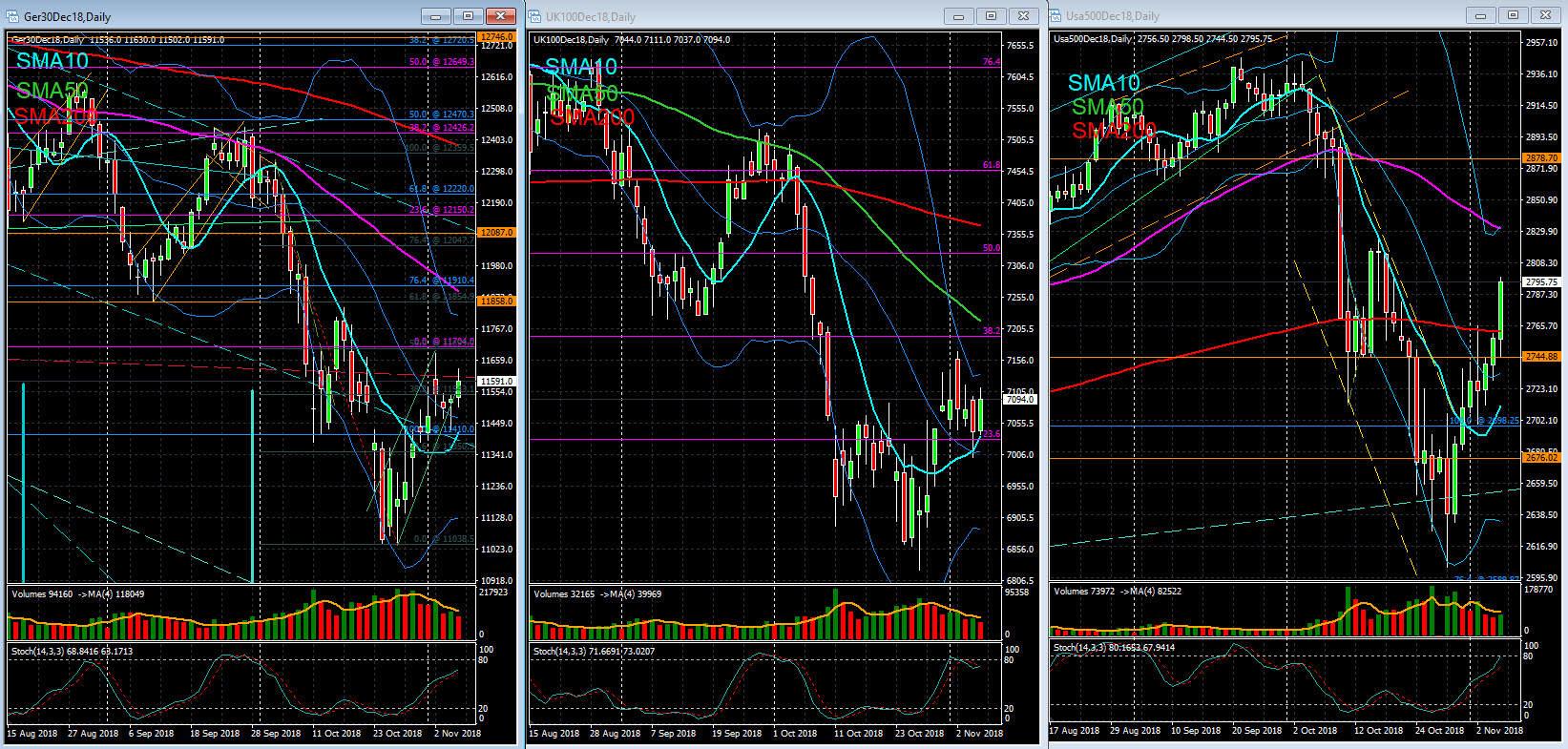

Stock Markets – Closing Note - 26 Oct

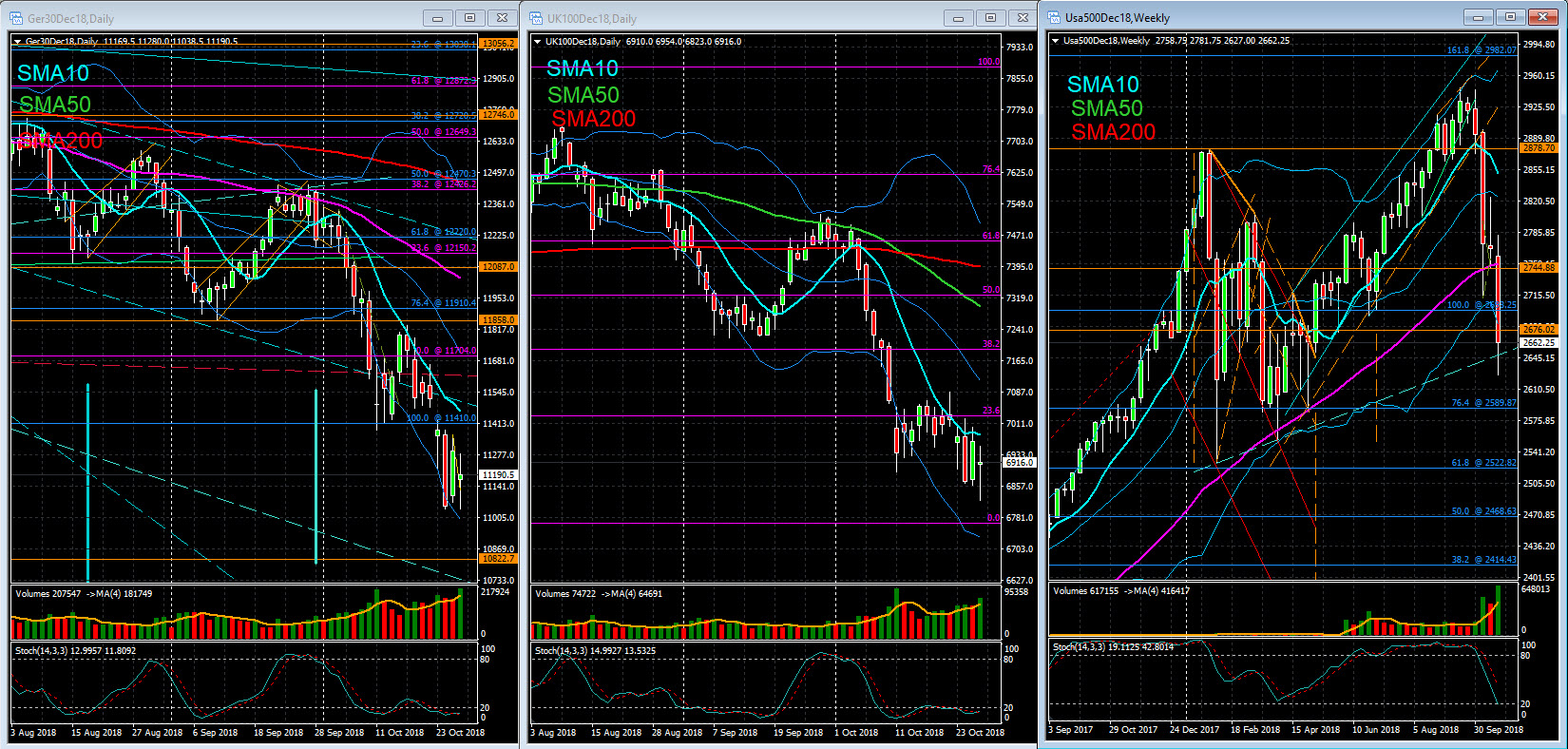

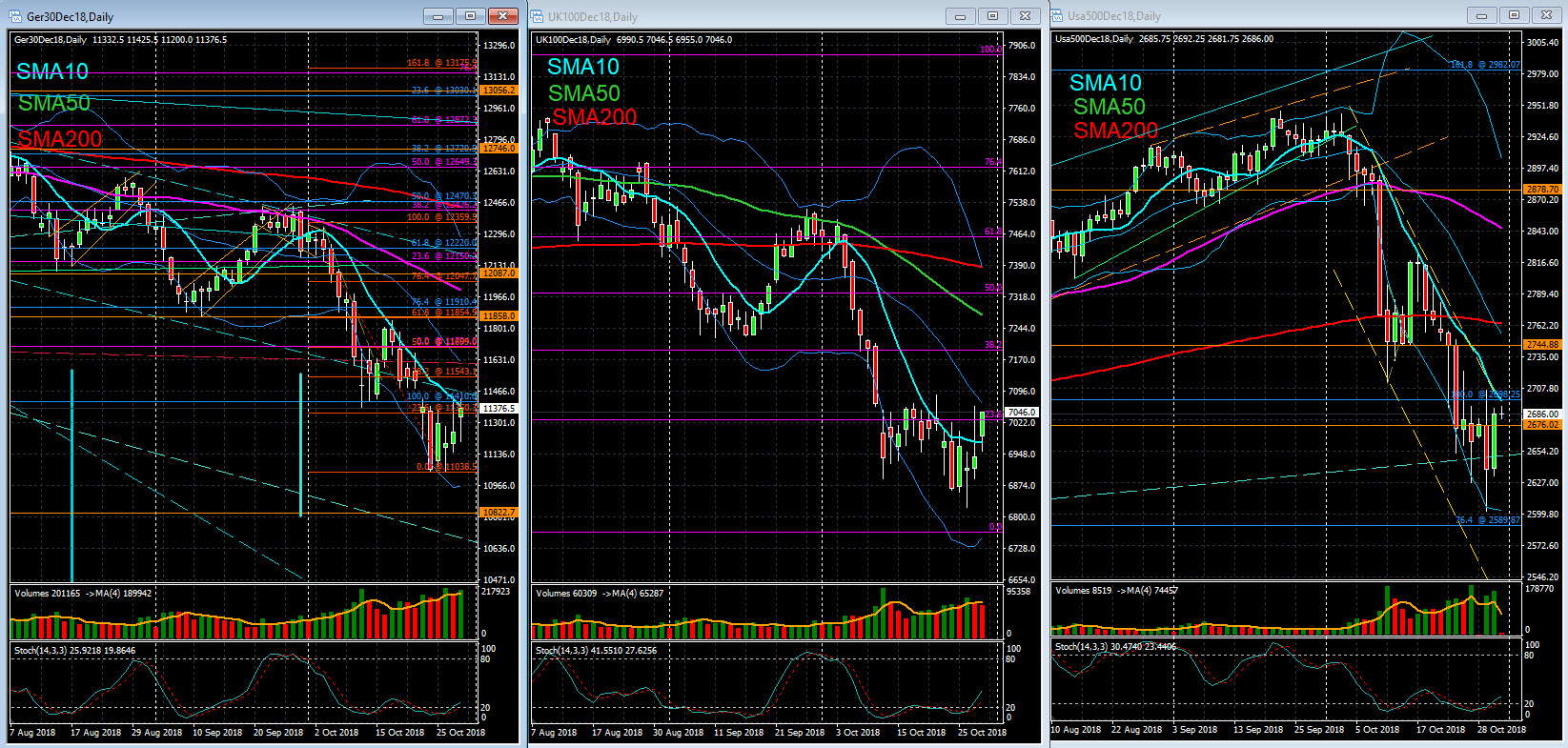

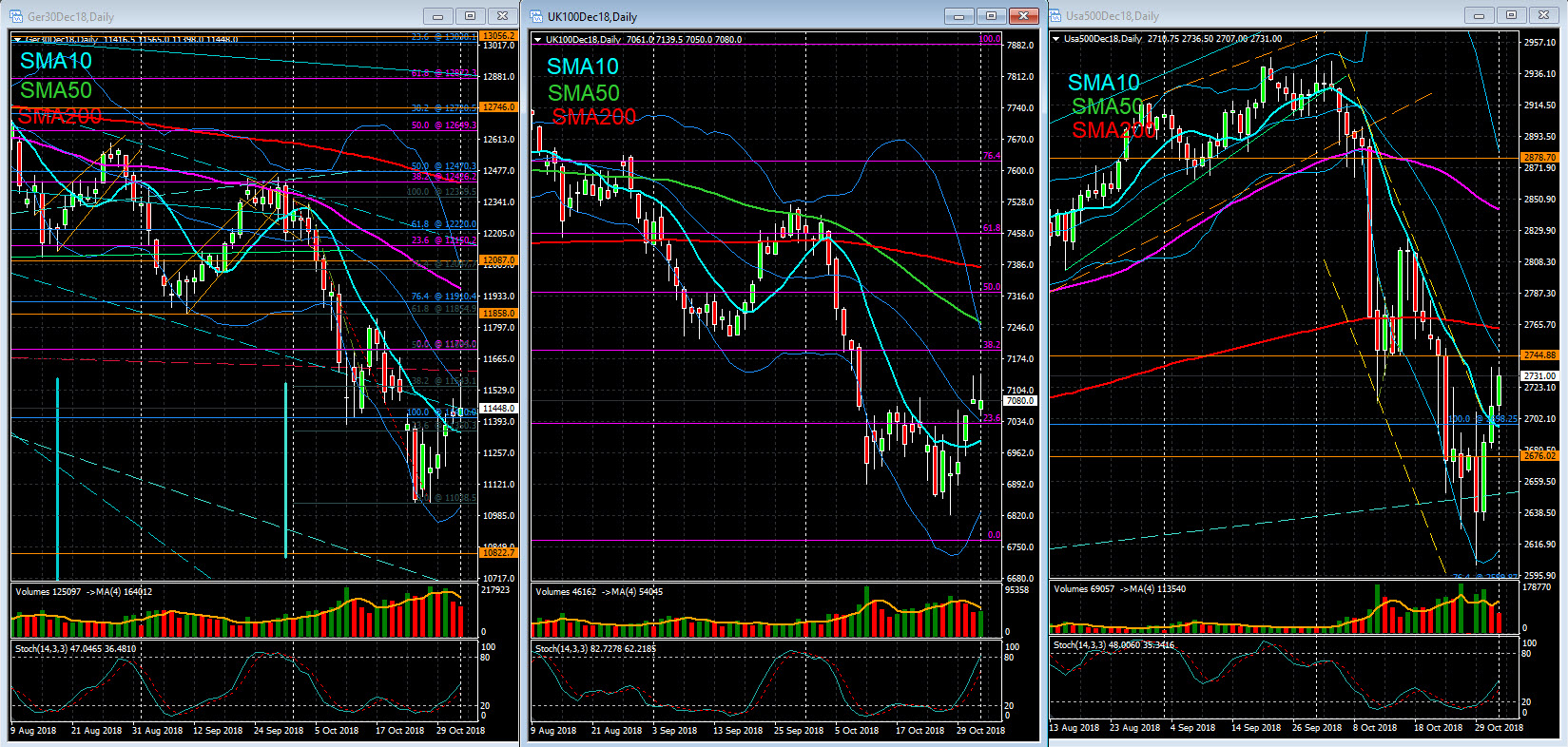

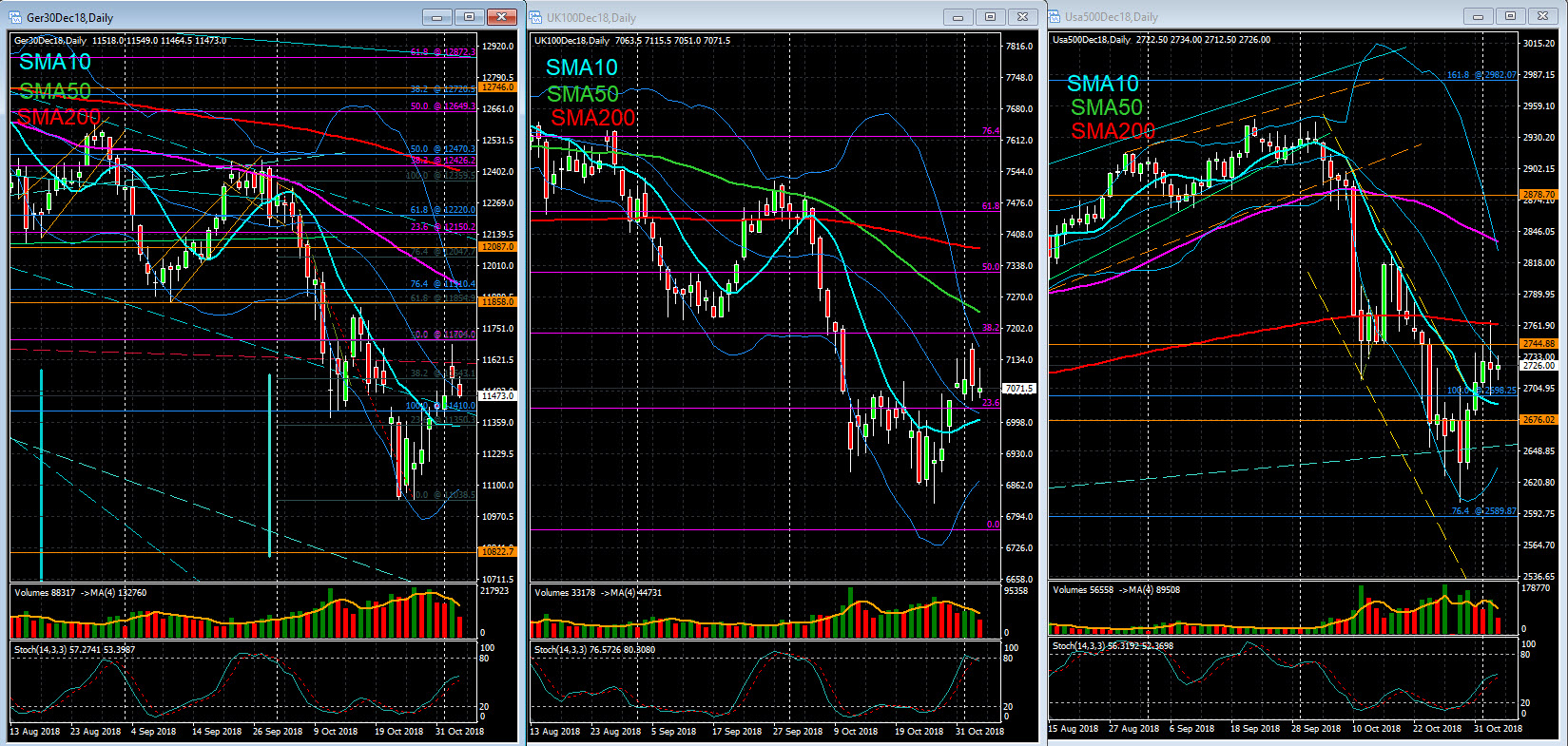

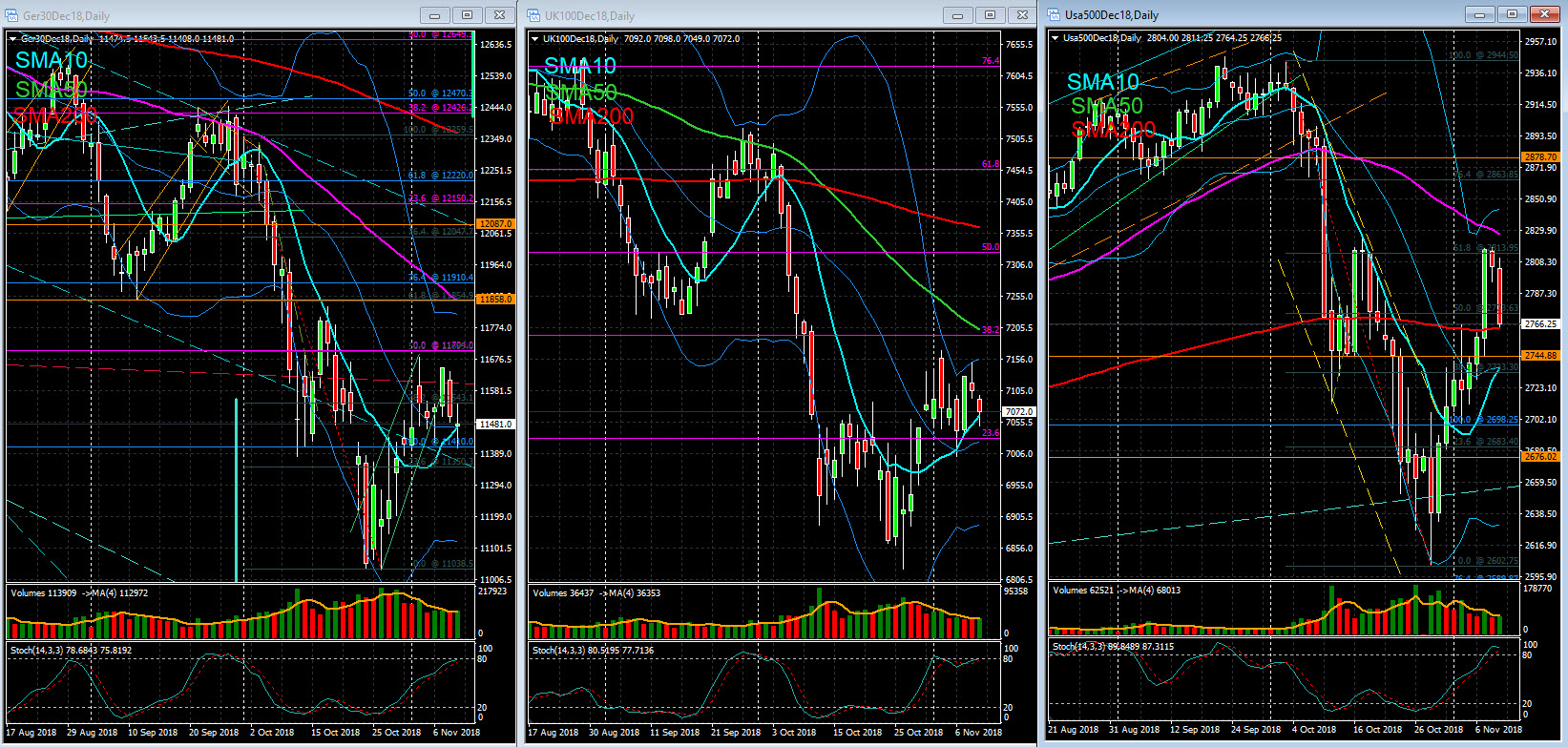

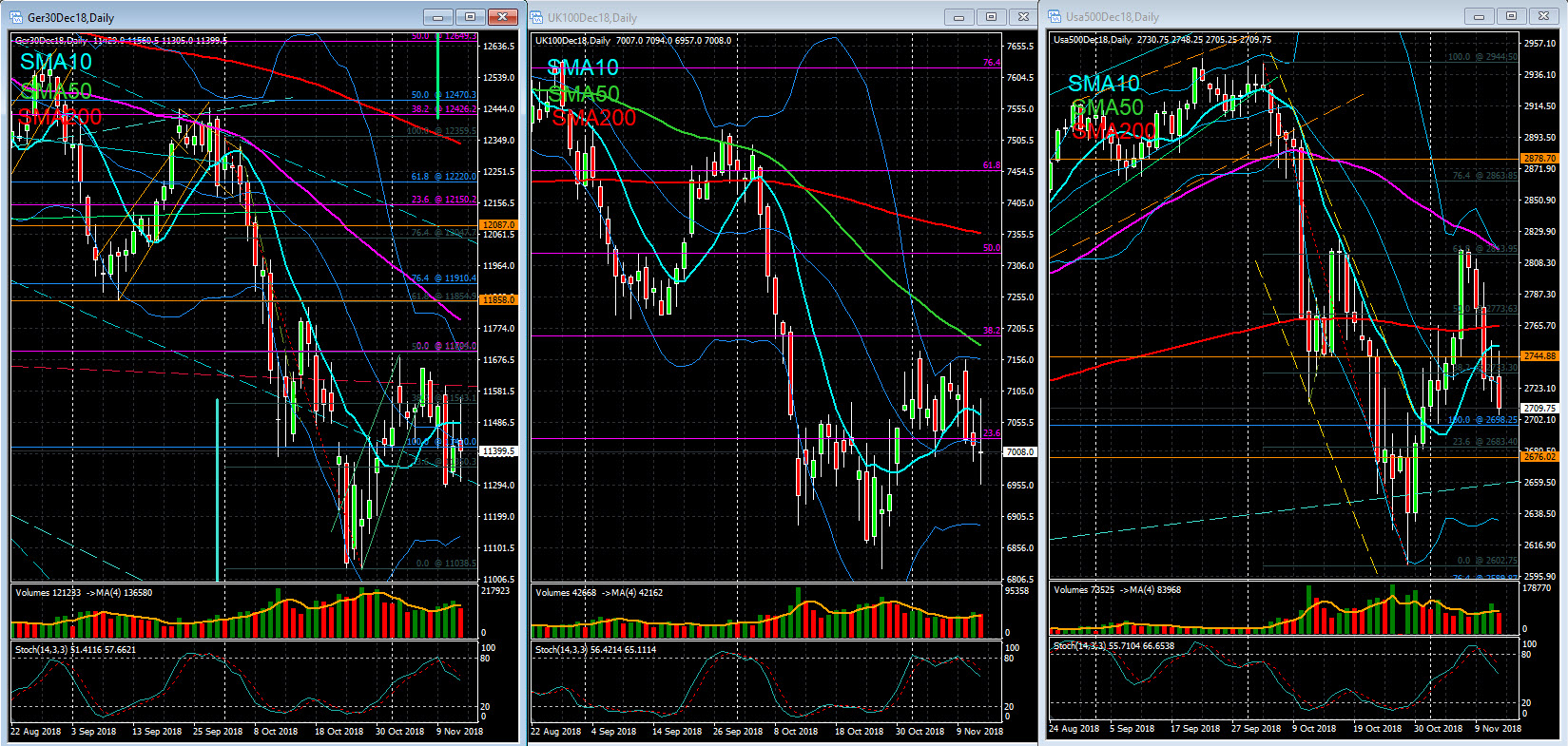

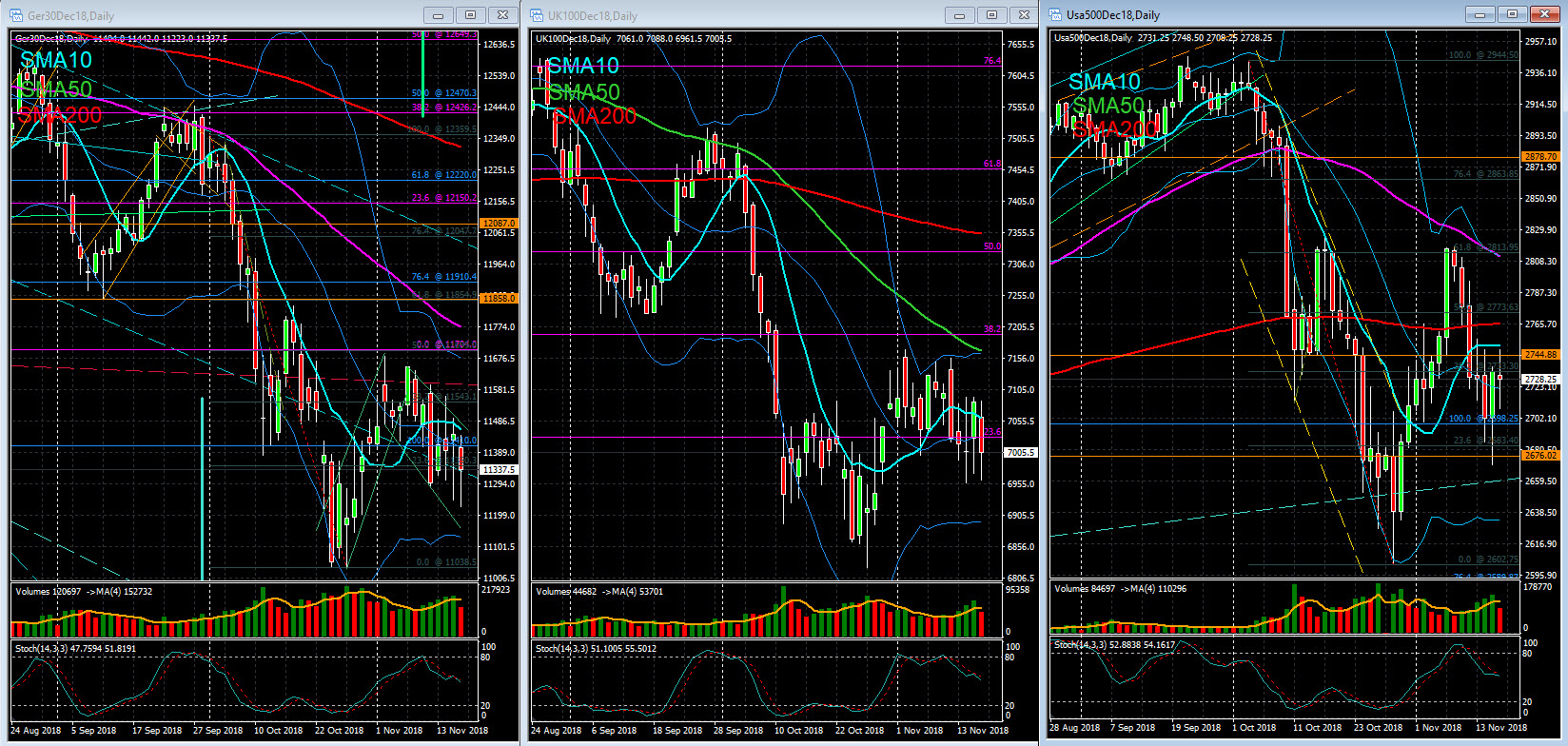

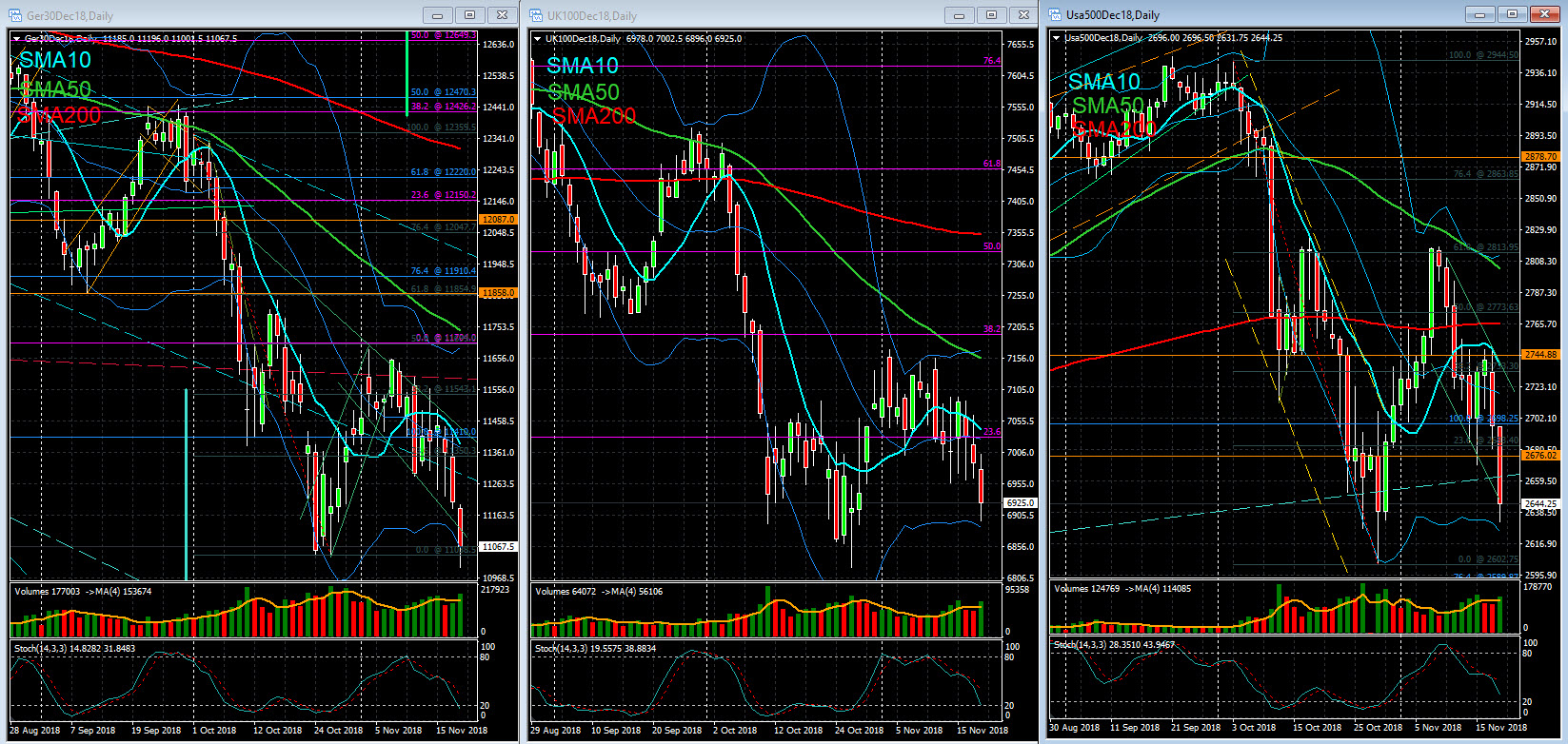

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

The results released by the North American Amazon and Alphabet penalized the sentiment of investors and, consequently, the European indexes that finished this last session of the week with strong losses. Several sectors reported losses of more than 2%. In fact, the day was marked by the reaction of investors to various business results known on both sides of the Atlantic. In the automotive sector, Valeo recorded a strong devaluation (-21.02%), after the automobile manufacturer downgraded its estimates, based on the slowdown of the Chinese economy. Total fell 1.52%. The French oil company reported a 48% increase in quarterly net profit, due to the increase in oil prices, to 3960 M.USD (slightly above forecasts). Revenues increased 27% to 54720 M.USD. Caixabank rose 0.43%. The bank announced that in the 3rd quarter it reached a net profit of 470 M. €. Net interest income stood at 1240 M. € and the CET1 (fully loaded) capital ratio was 11.40%. In Milan, ENI also appreciated (0.99%) after reporting that quarterly profit increased, due to higher oil prices and lower tax burden. Adjusted net income stood at € 1,390m, compared to € 1020m forecast. Meanwhile, investors are waiting for Standard & Poor's to announce the Italian debt rating. Currently, this agency attributes to Italy a rating of BBB, which corresponds to an adequate capacity to repay the debt contracted but in the future may deteriorate. This rating is two levels above the speculative or junk level.

The US market has returned to negative territory today, with the disappointing results of major technology companies masking published economic indicators. Alphabet and Amazon fell about 3% and 8%, respectively, after yesterday after the closing the two companies made known their quarterly results. The other companies in the FAANG group were also penalized. In terms of economic indicators, the Commerce Department reported that the US economy grew 3.50% over the previous year, up from the 3.30% expected by economists. In addition, private consumption (which contributes more than two-thirds to economic activity) increased by 4%, the May increase since the fourth quarter of 2014), above the expected 3.30%. GDP-related inflation stood at 1.70%, compared with 2.10% expected by economists. On the other hand, the consumer confidence index measured by the University of Michigan reached 98.6 in October, against the expected 99.0.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

The results released by the North American Amazon and Alphabet penalized the sentiment of investors and, consequently, the European indexes that finished this last session of the week with strong losses. Several sectors reported losses of more than 2%. In fact, the day was marked by the reaction of investors to various business results known on both sides of the Atlantic. In the automotive sector, Valeo recorded a strong devaluation (-21.02%), after the automobile manufacturer downgraded its estimates, based on the slowdown of the Chinese economy. Total fell 1.52%. The French oil company reported a 48% increase in quarterly net profit, due to the increase in oil prices, to 3960 M.USD (slightly above forecasts). Revenues increased 27% to 54720 M.USD. Caixabank rose 0.43%. The bank announced that in the 3rd quarter it reached a net profit of 470 M. €. Net interest income stood at 1240 M. € and the CET1 (fully loaded) capital ratio was 11.40%. In Milan, ENI also appreciated (0.99%) after reporting that quarterly profit increased, due to higher oil prices and lower tax burden. Adjusted net income stood at € 1,390m, compared to € 1020m forecast. Meanwhile, investors are waiting for Standard & Poor's to announce the Italian debt rating. Currently, this agency attributes to Italy a rating of BBB, which corresponds to an adequate capacity to repay the debt contracted but in the future may deteriorate. This rating is two levels above the speculative or junk level.

The US market has returned to negative territory today, with the disappointing results of major technology companies masking published economic indicators. Alphabet and Amazon fell about 3% and 8%, respectively, after yesterday after the closing the two companies made known their quarterly results. The other companies in the FAANG group were also penalized. In terms of economic indicators, the Commerce Department reported that the US economy grew 3.50% over the previous year, up from the 3.30% expected by economists. In addition, private consumption (which contributes more than two-thirds to economic activity) increased by 4%, the May increase since the fourth quarter of 2014), above the expected 3.30%. GDP-related inflation stood at 1.70%, compared with 2.10% expected by economists. On the other hand, the consumer confidence index measured by the University of Michigan reached 98.6 in October, against the expected 99.0.

Oct 30, 2018 at 01:15

會員從Jan 24, 2018開始

207帖子

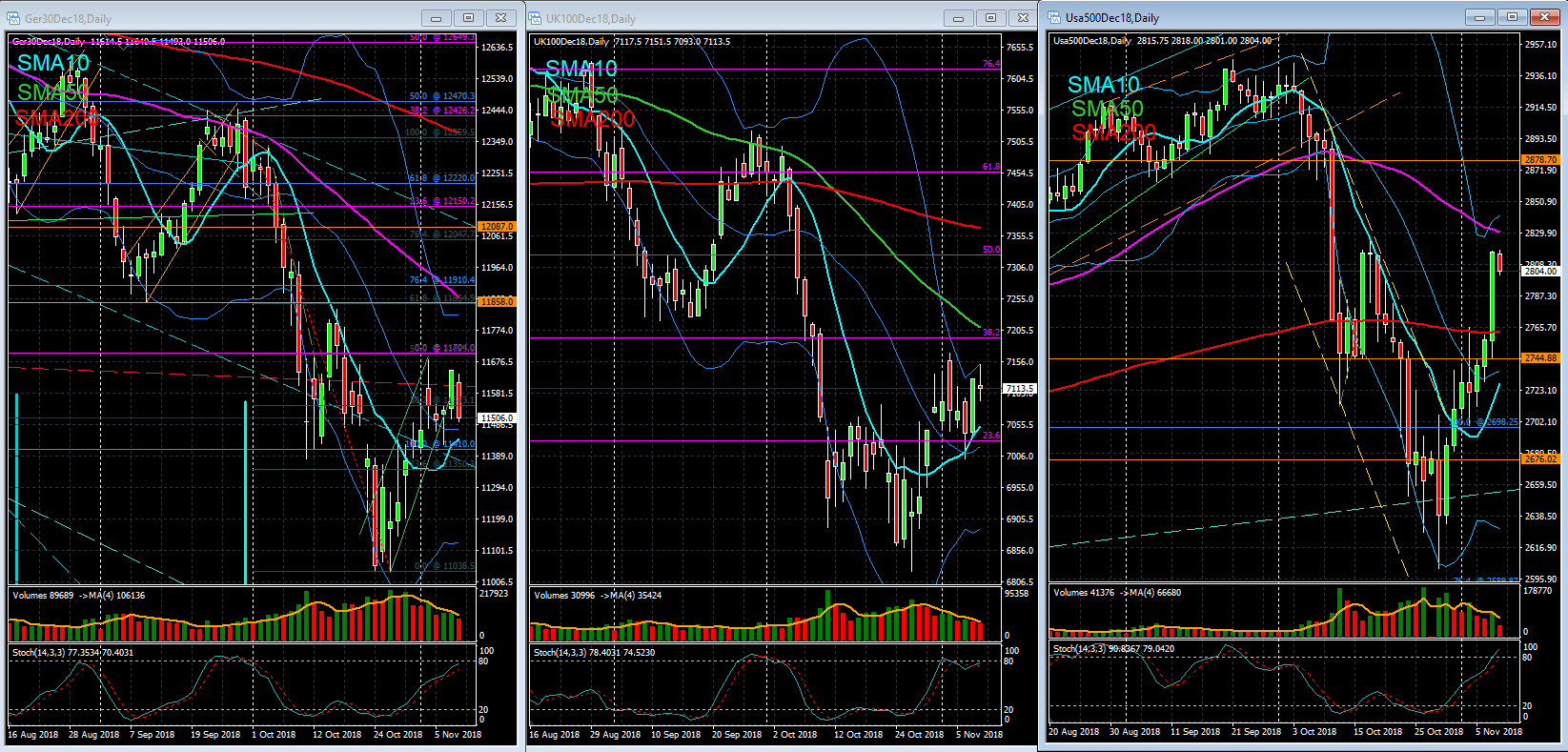

Stock Markets – Closing Note - 29 Oct

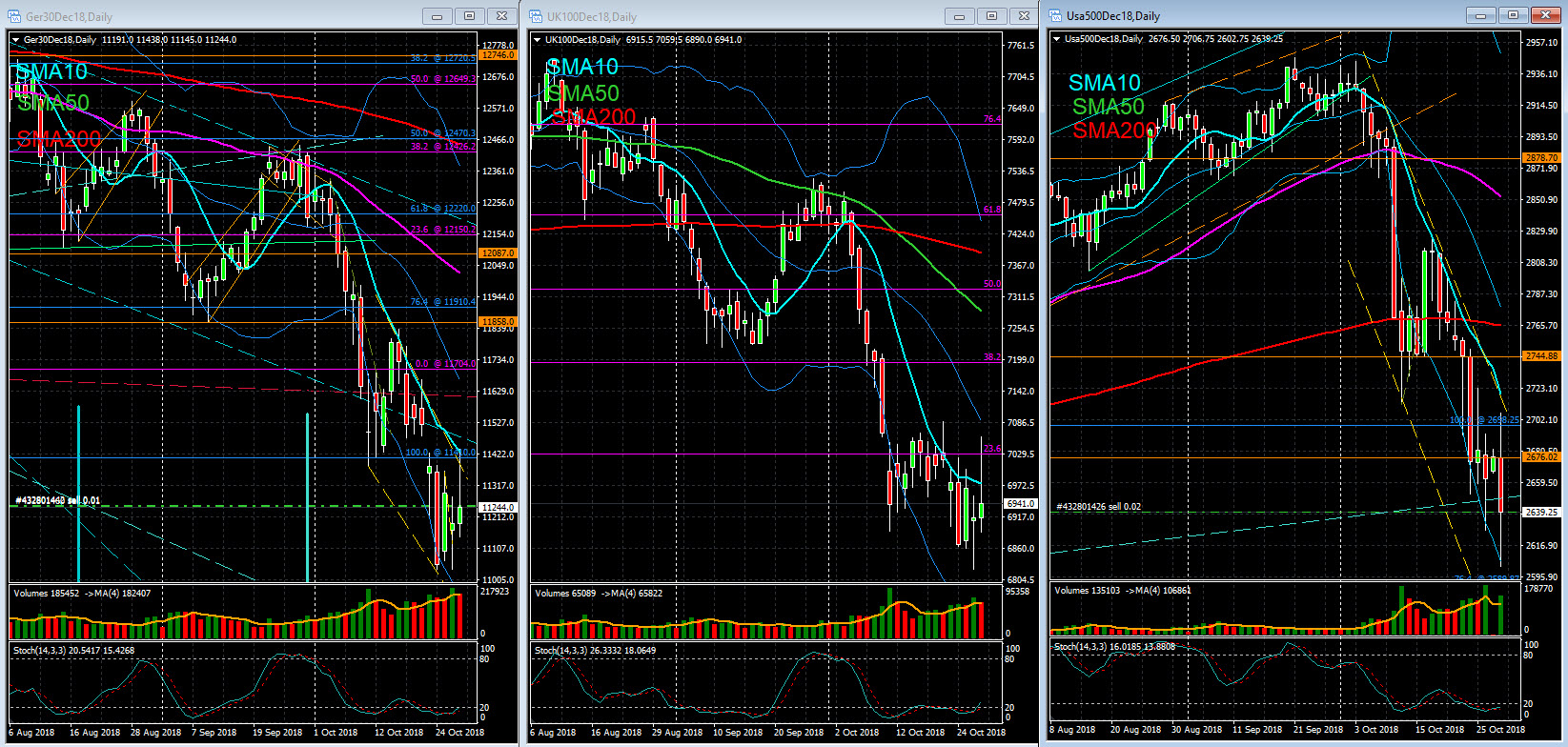

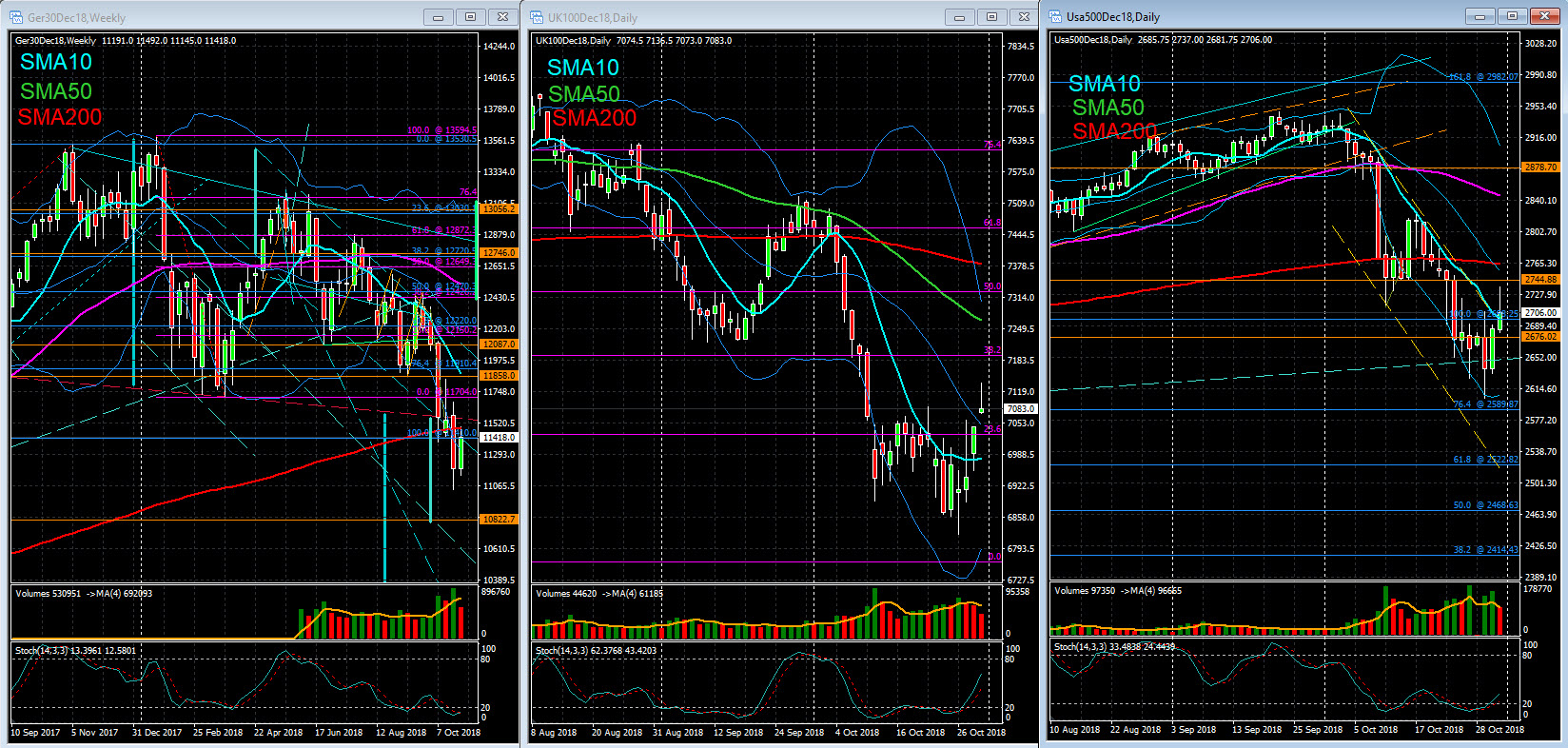

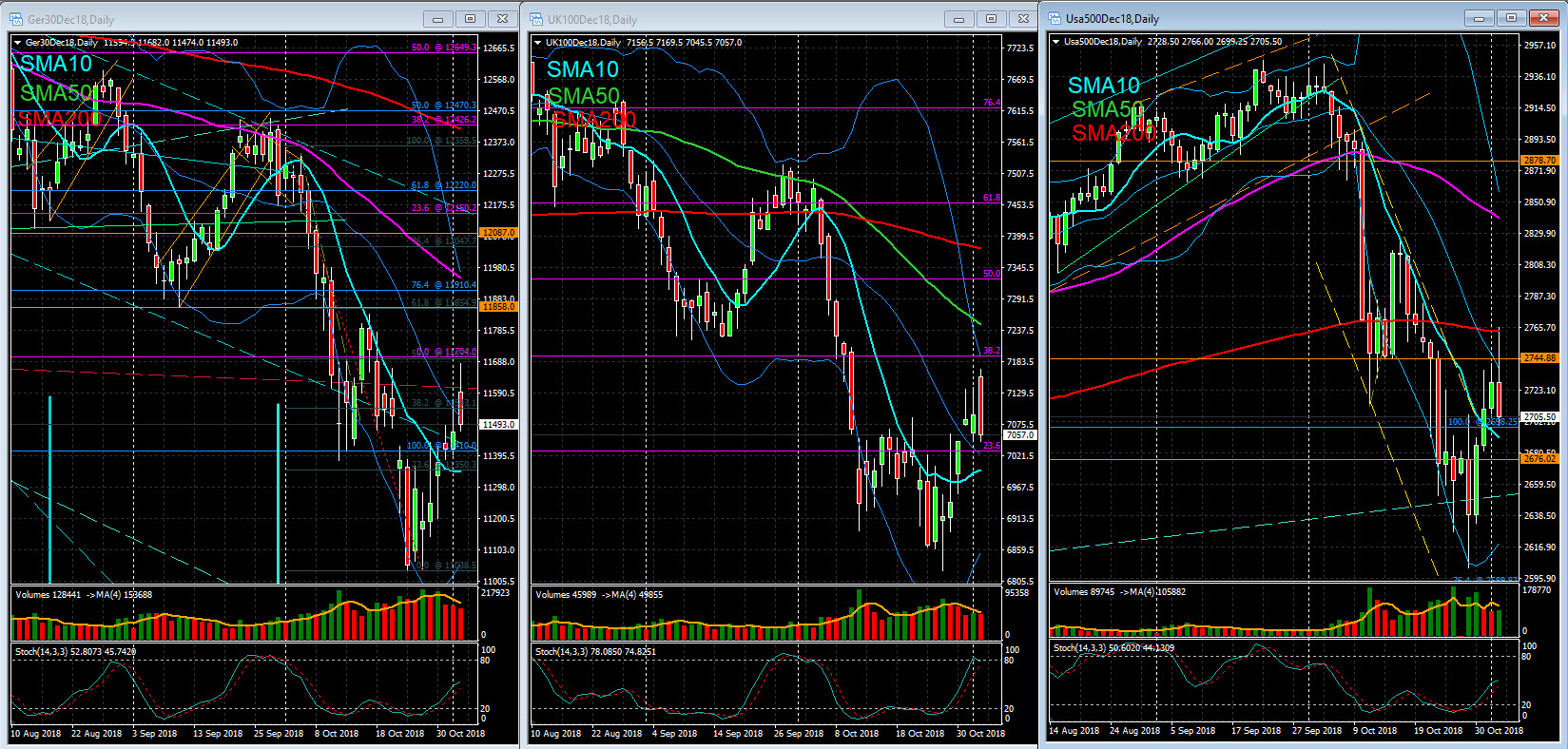

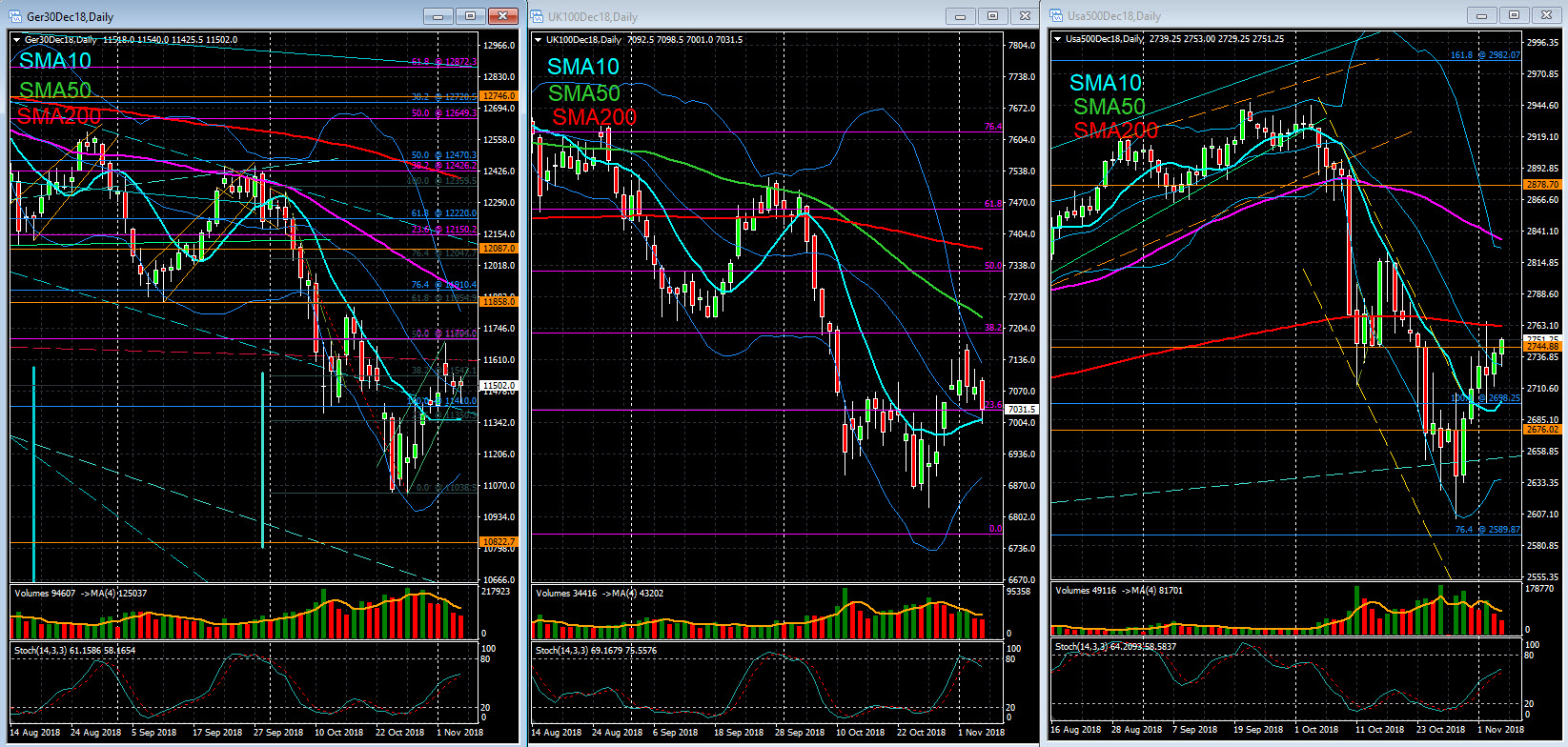

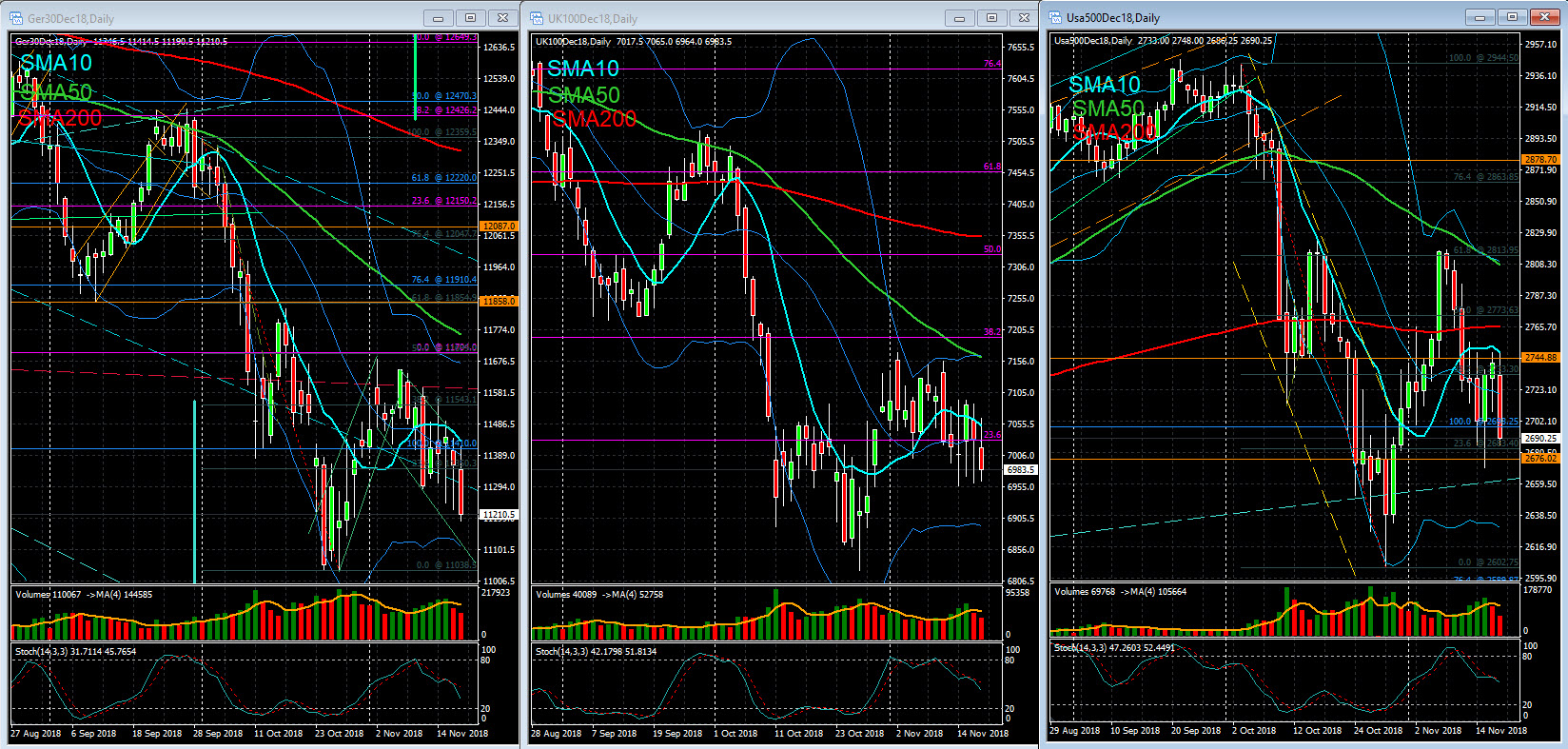

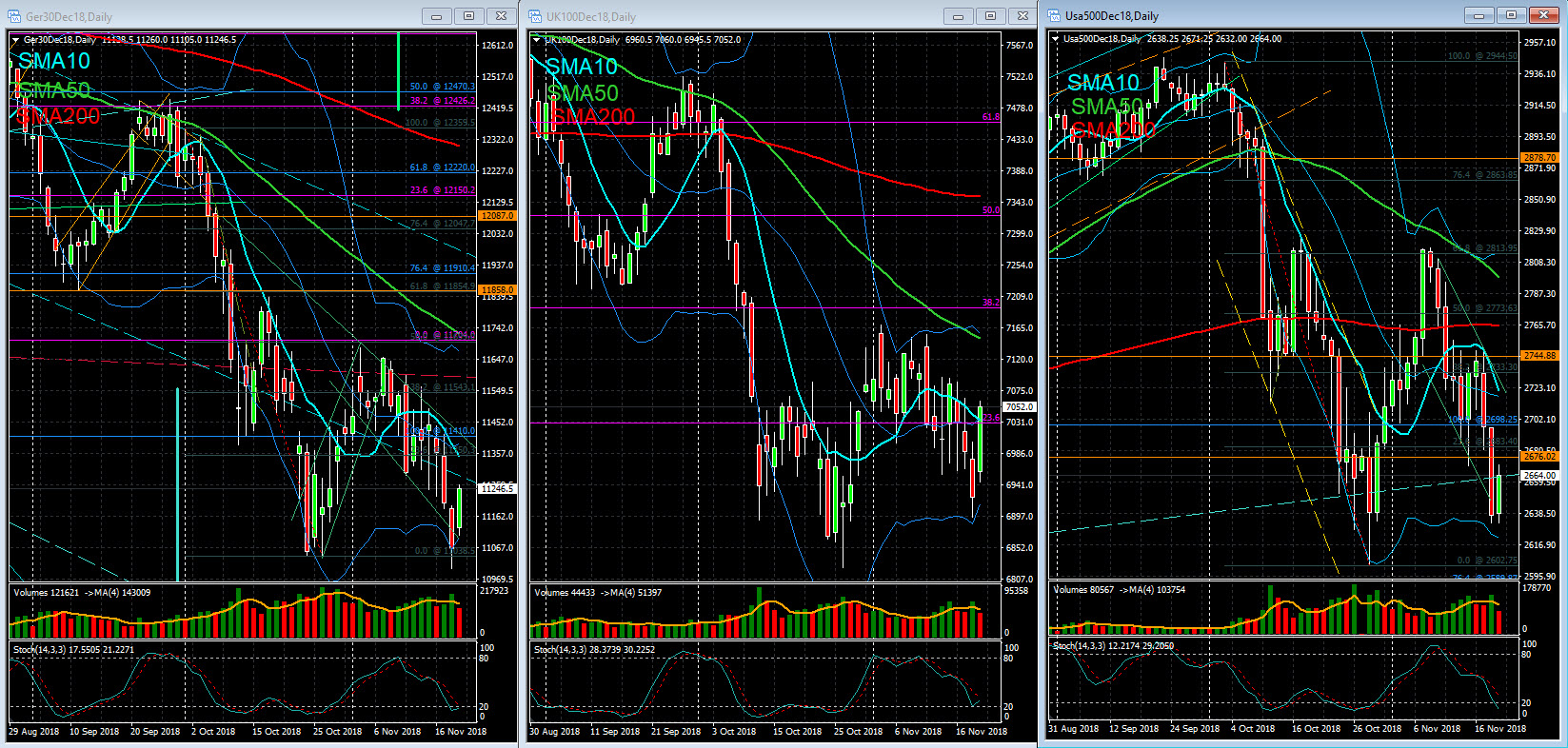

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

After a week of heavy losses, the first day of the week was positive for European stock markets. The decision by the Standard & Poor's agency to reduce only the outlook (perspective) of Italy's debt rather than its rating attenuates the risks associated with Italian fiscal policy in the short term. Italian banks today recorded considerable appreciations (over 3.60%). The automobile sector was responsible for part of the gains, having registered a valuation around the 2.90%. Companies like Volkswagen and Daimler rose more than 5 percent, boosted by Bloomberg news that China will reduce the tax burden associated with buying cars by 50 percent. Banks also lived a positive day, benefiting from some results. HSBC appreciated 5.80%, after having reported a profit before tax of 5922 M.USD (28% compared to the same quarter of 2017) and a banking product of 13798 M.USD (6.32%). These results, which surpassed the forecasts, were due in part to an aggressive but efficient cost cut.

The US market started its session on the rise, fueled by the news about IBM and the performance of the banking industry. IBM declined 3.16% after the company announced that it launched a takeover bid for Red Hat for 34,000 M.USD ($ 190 per share compared to Friday's price of $ 116.68). Red Hat is one of the world's leading experts in enterprise software, particularly in the hybrid cloud concept (based on a person's or company's own cloud interaction with a publicly accessible cloud). However, gains were however hampered by the negative behavior of some technology companies such as Amazon and Netflix. On the macroeconomic front, in September, household income increased by 0.20%, compared to the estimated 0.40%, while spending rose 0.40% in line with expectations. Inflation associated with consumption stood at 2%, also according to economists' projections.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

After a week of heavy losses, the first day of the week was positive for European stock markets. The decision by the Standard & Poor's agency to reduce only the outlook (perspective) of Italy's debt rather than its rating attenuates the risks associated with Italian fiscal policy in the short term. Italian banks today recorded considerable appreciations (over 3.60%). The automobile sector was responsible for part of the gains, having registered a valuation around the 2.90%. Companies like Volkswagen and Daimler rose more than 5 percent, boosted by Bloomberg news that China will reduce the tax burden associated with buying cars by 50 percent. Banks also lived a positive day, benefiting from some results. HSBC appreciated 5.80%, after having reported a profit before tax of 5922 M.USD (28% compared to the same quarter of 2017) and a banking product of 13798 M.USD (6.32%). These results, which surpassed the forecasts, were due in part to an aggressive but efficient cost cut.

The US market started its session on the rise, fueled by the news about IBM and the performance of the banking industry. IBM declined 3.16% after the company announced that it launched a takeover bid for Red Hat for 34,000 M.USD ($ 190 per share compared to Friday's price of $ 116.68). Red Hat is one of the world's leading experts in enterprise software, particularly in the hybrid cloud concept (based on a person's or company's own cloud interaction with a publicly accessible cloud). However, gains were however hampered by the negative behavior of some technology companies such as Amazon and Netflix. On the macroeconomic front, in September, household income increased by 0.20%, compared to the estimated 0.40%, while spending rose 0.40% in line with expectations. Inflation associated with consumption stood at 2%, also according to economists' projections.

Oct 31, 2018 at 02:38

會員從Jan 24, 2018開始

207帖子

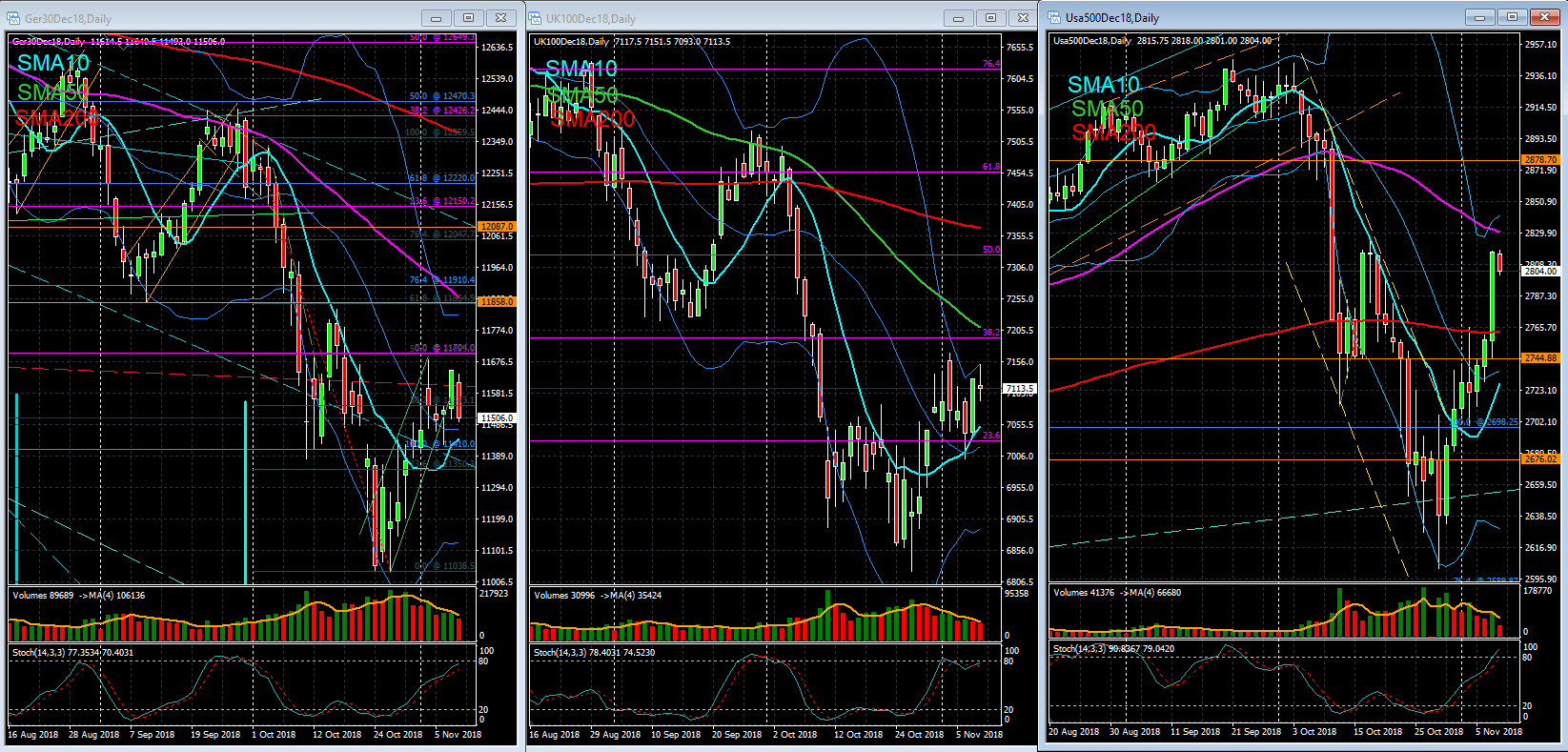

Stock Markets – Closing Note - 30 Oct

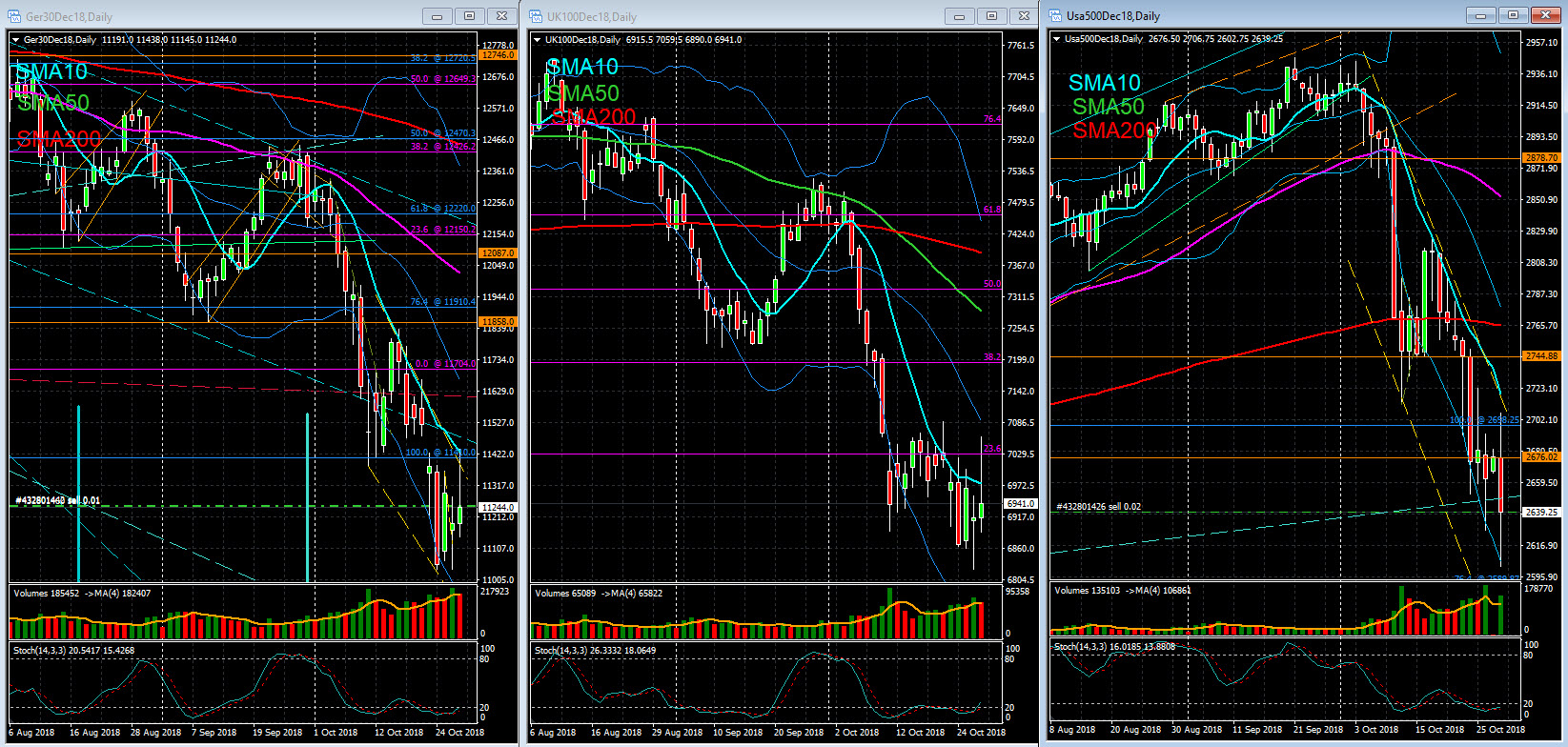

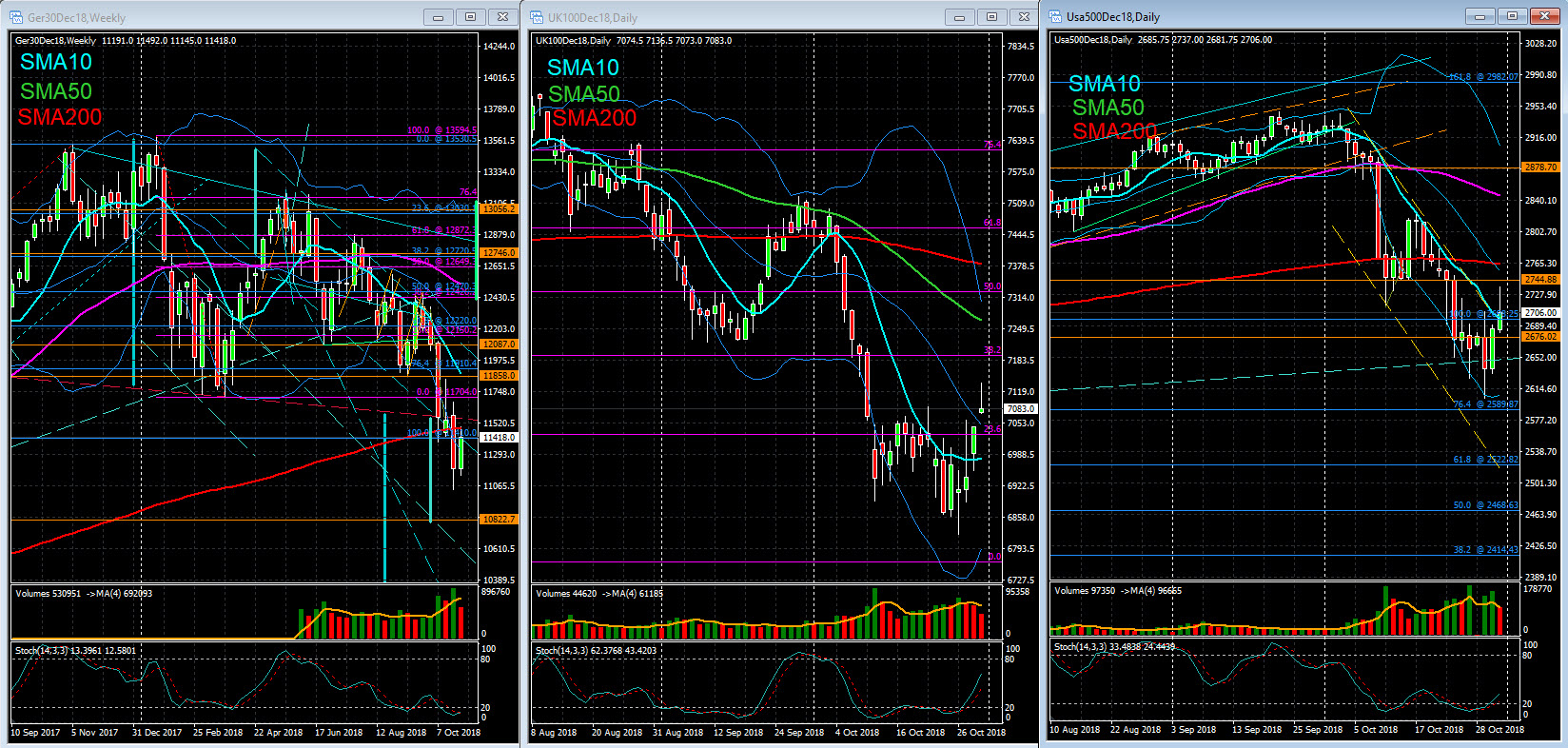

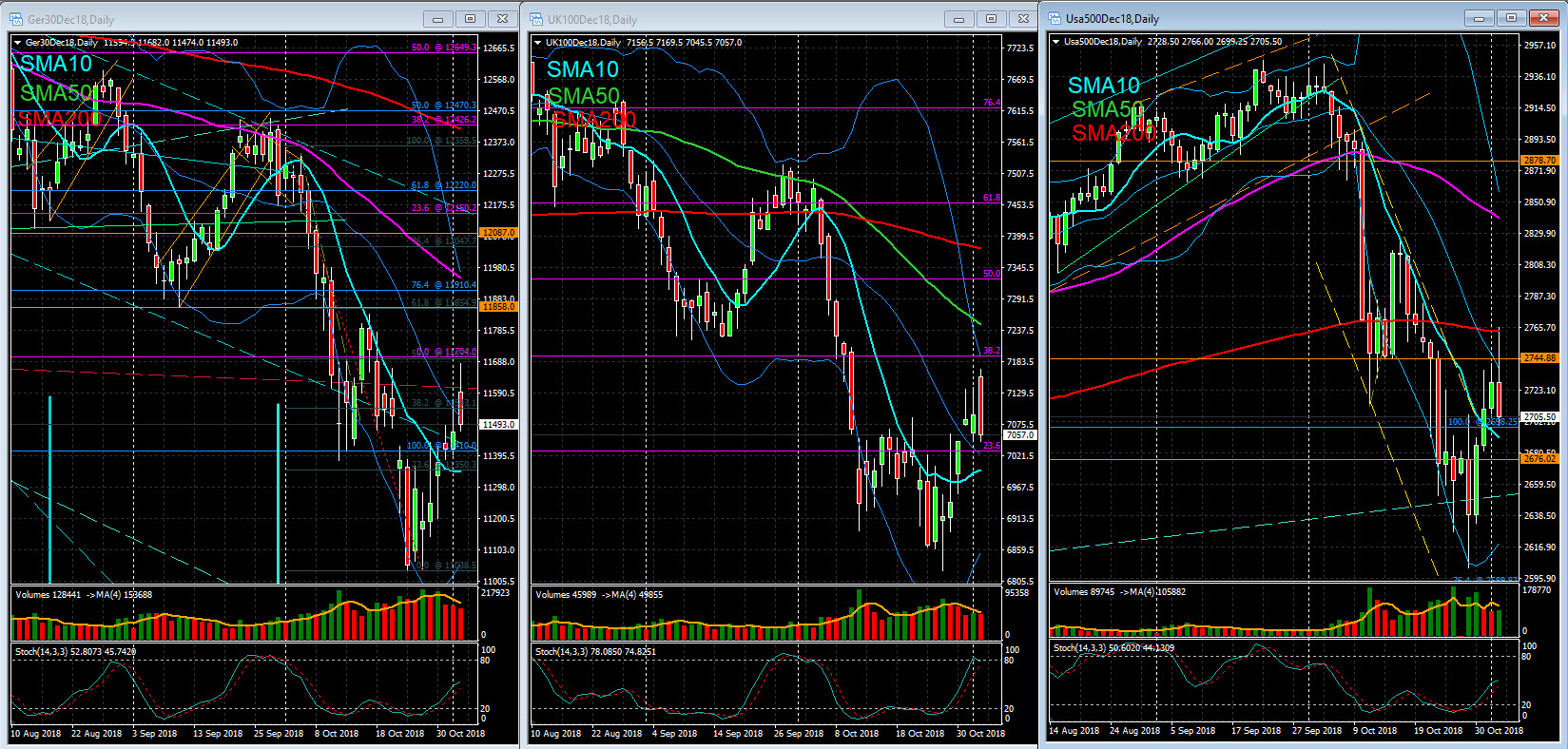

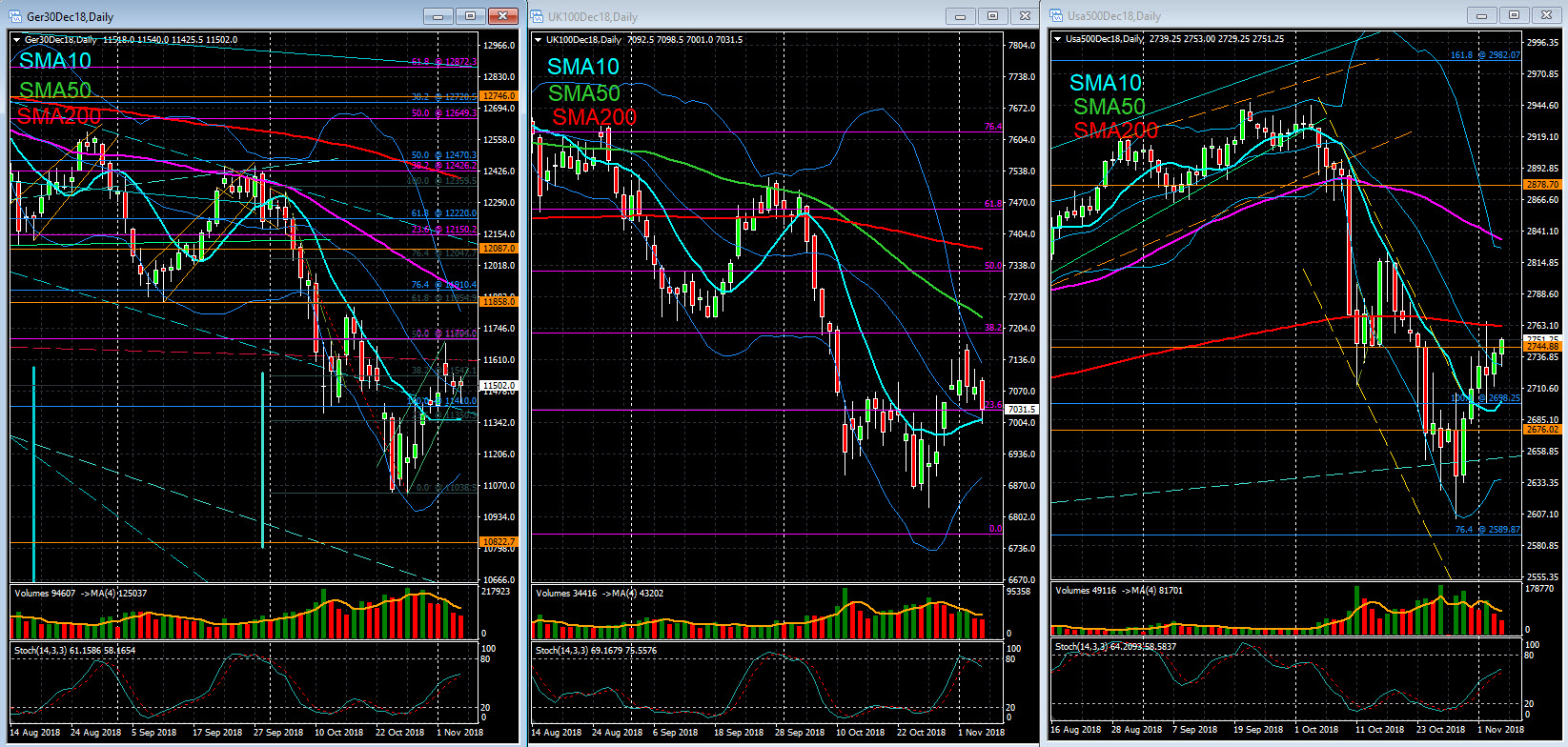

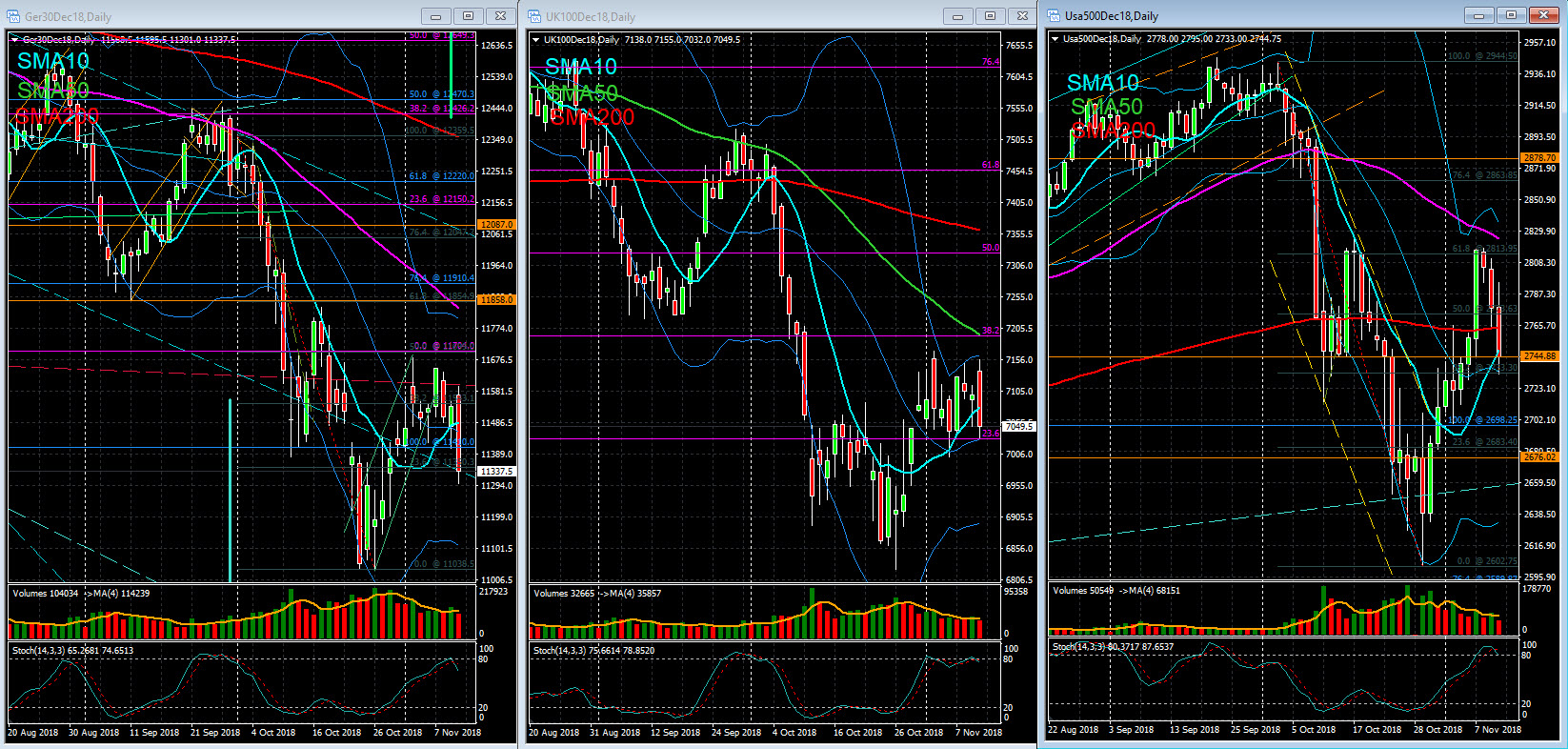

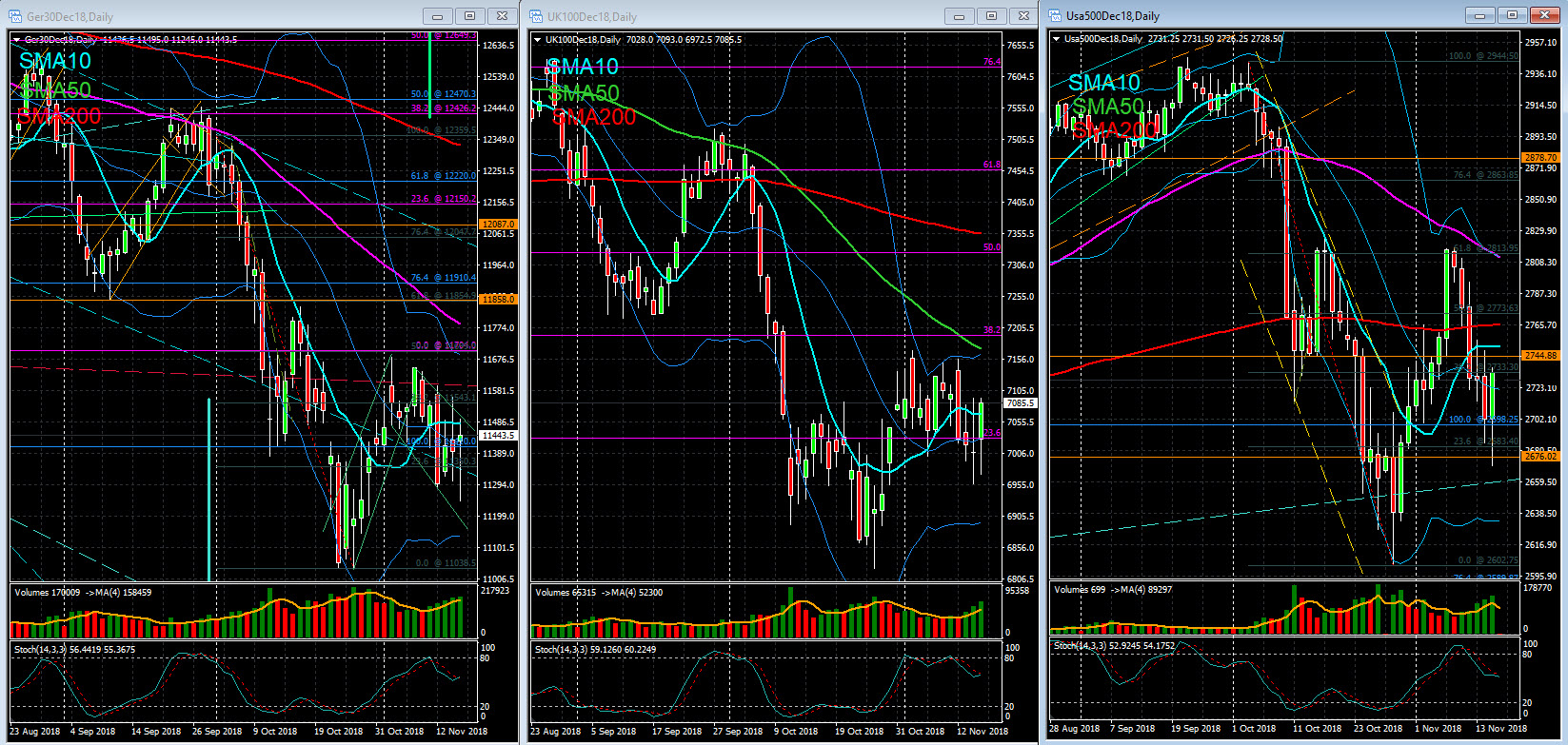

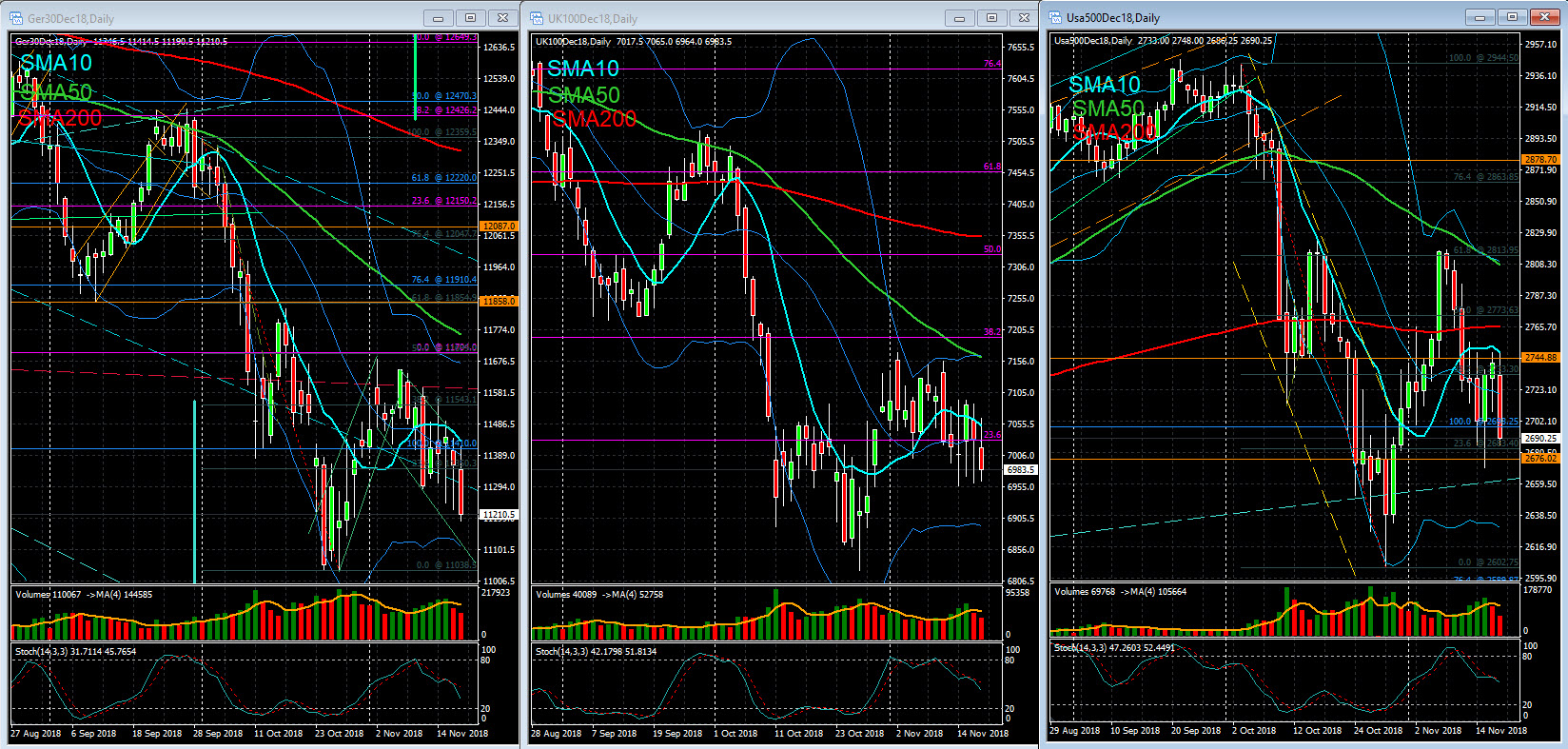

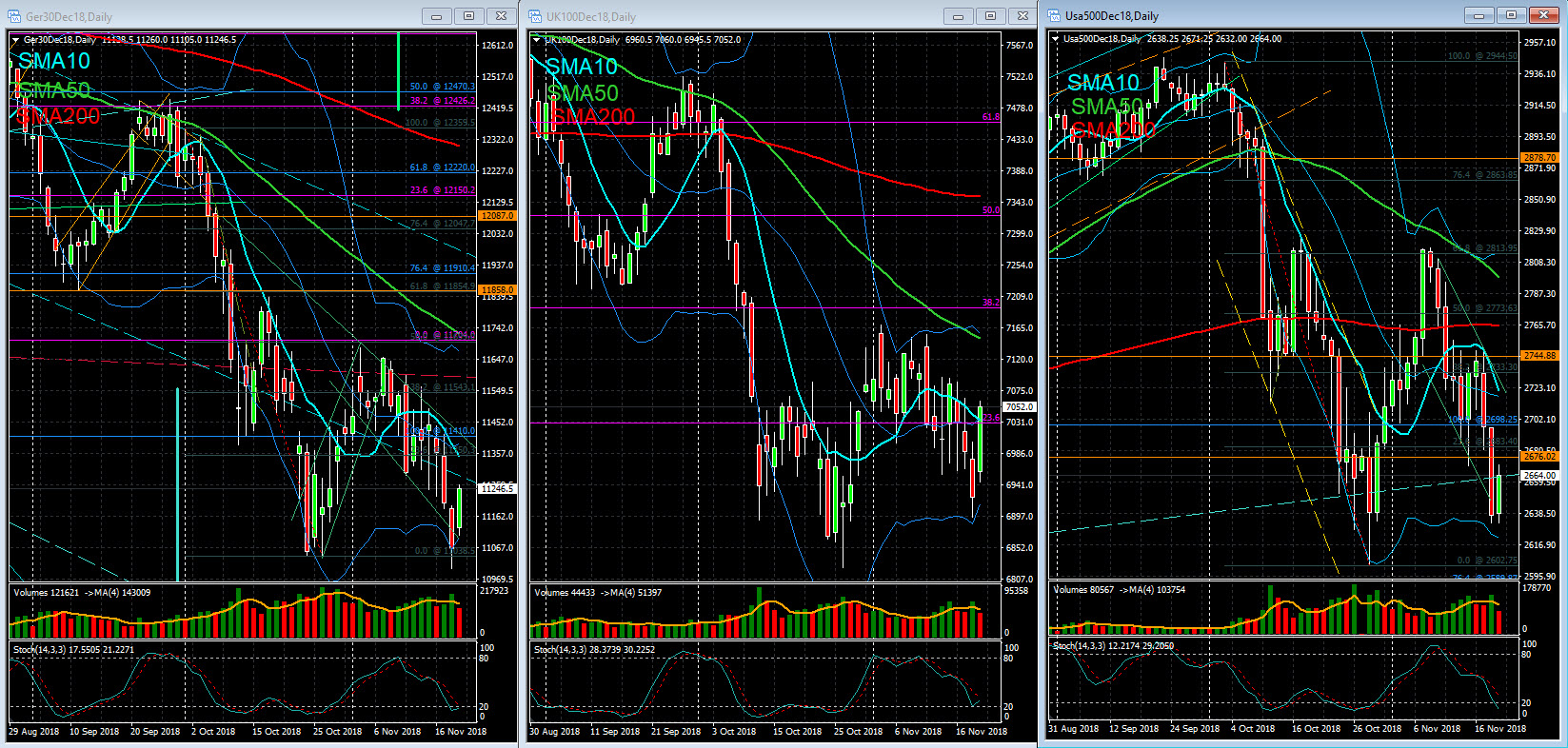

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets reversed to negative terrain in the afternoon, with virtually all sectors in negative territory. Leading losses were the producers of raw materials as well as businesses related to travel and leisure. Lufthansa reported quarterly results lower than forecasts, leading to significant losses (-7.76%). BNP Paribas shares fell 2.80% after the bank's quarterly accounts showed that trading income remains under pressure. On the contrary, the BP oil company appreciated around 2% after reporting quarterly profit more than doubled in the three months ending September. Volkswagen also gained ground, after reporting a quarterly profit of 2700 M.€ (145% on the homologous quarter of 2017) compared to the estimated 2290 M.€. In addition to the business results, attention was also focused on US-China trade relations, after it was reported that the Trump Administration was considering increasing the tariffs of 257,000 M.USD of Chinese products that had not yet undergone a worsening of the customs fee if the next meeting between the American President and the Chinese President (scheduled for November G20) is inconclusive. Regarding the macroeconomic scenario, inflation in Germany was published in October, which has risen more than expected, putting inflation at the highest level of the last decade, at 2.50%. At the same time, it was announced that in the third quarter the Eurozone grew 1.70%, the slowest pace since the end of 2014.

General Electric's results have disappointed the market, with the stock retracted to the lowest since July 2009. The company has announced a dividend reduction of $ 0.01 per share and said it will split the power unit into two new units. IBM also lost ground after UBS lowered its target price from $ 180 to $ 150. Meanwhile, Apple shares rose 0.28 percent on the day the Cupertino company introduced a new version of the Mac Mini, which it calls "the longest ever upgrade" of the device. In terms of economic indicators, and on the real estate market, house prices increased by 5.49% year-on-year, the lowest annual growth in the last 20 months. Estimates pointed to 5.80%. Consumer confidence in October, as measured by the Conference Board, reached 137.9, the high of the last 18 years, compared to the expected 135.9.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets reversed to negative terrain in the afternoon, with virtually all sectors in negative territory. Leading losses were the producers of raw materials as well as businesses related to travel and leisure. Lufthansa reported quarterly results lower than forecasts, leading to significant losses (-7.76%). BNP Paribas shares fell 2.80% after the bank's quarterly accounts showed that trading income remains under pressure. On the contrary, the BP oil company appreciated around 2% after reporting quarterly profit more than doubled in the three months ending September. Volkswagen also gained ground, after reporting a quarterly profit of 2700 M.€ (145% on the homologous quarter of 2017) compared to the estimated 2290 M.€. In addition to the business results, attention was also focused on US-China trade relations, after it was reported that the Trump Administration was considering increasing the tariffs of 257,000 M.USD of Chinese products that had not yet undergone a worsening of the customs fee if the next meeting between the American President and the Chinese President (scheduled for November G20) is inconclusive. Regarding the macroeconomic scenario, inflation in Germany was published in October, which has risen more than expected, putting inflation at the highest level of the last decade, at 2.50%. At the same time, it was announced that in the third quarter the Eurozone grew 1.70%, the slowest pace since the end of 2014.

General Electric's results have disappointed the market, with the stock retracted to the lowest since July 2009. The company has announced a dividend reduction of $ 0.01 per share and said it will split the power unit into two new units. IBM also lost ground after UBS lowered its target price from $ 180 to $ 150. Meanwhile, Apple shares rose 0.28 percent on the day the Cupertino company introduced a new version of the Mac Mini, which it calls "the longest ever upgrade" of the device. In terms of economic indicators, and on the real estate market, house prices increased by 5.49% year-on-year, the lowest annual growth in the last 20 months. Estimates pointed to 5.80%. Consumer confidence in October, as measured by the Conference Board, reached 137.9, the high of the last 18 years, compared to the expected 135.9.

Oct 31, 2018 at 22:04

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 31 Oct

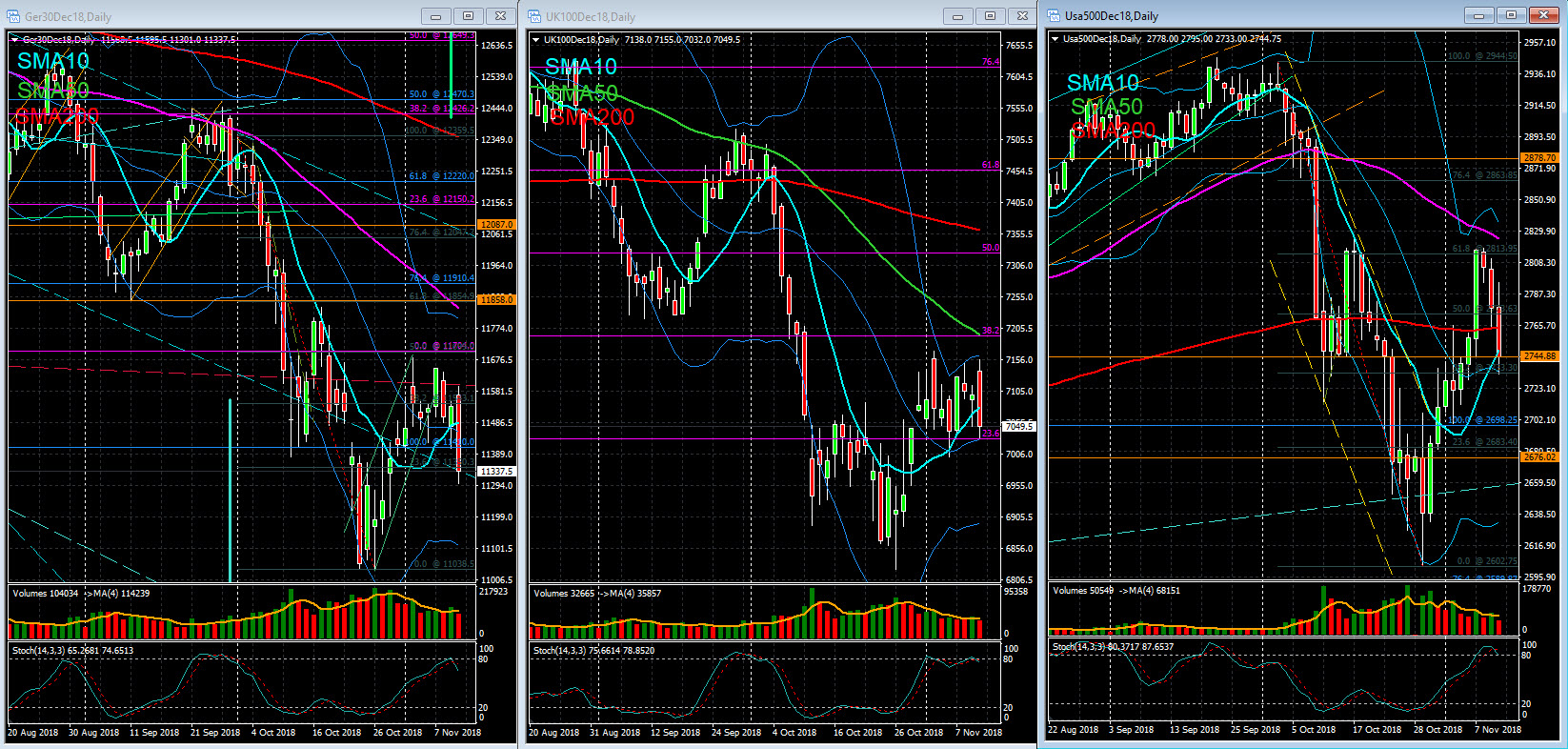

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European stock markets ended higher in a session in which several sectors of activity closed with valuations above 2%. Of note are the gains of raw material producers, oil companies and the technology sector. As for the reaction of investors to the published results, Sanofi rose 4.67%, after the French pharmaceutical announced higher than expected profits and improved guidance. Also in Paris, L'Oreal appreciated 6.87%, after having released quarterly sales higher than those presented last year. In Madrid, Repsol reported results in line with the estimate and Fitch improved the company's outlook from Stable to Positive, while Telefonica posted higher-than-expected earnings improved its outlook for results for 2018. Both companies recorded considerable appreciations. On the macroeconomic front, inflation in the Eurozone accelerated to 2.20% in October from 2.10% in the previous month and expected by economists.

Wall Street traded higher, recovering part of the losses recorded during the month of October. General Motors and Yum! Brands were favored by their superior results. Coca-Cola also reported quarterly results above expectations, but its shares were now slightly losing. In the technology sector, Facebook was up more than 3.50%, after yesterday after closing reported its results and have informed that its margins should stop decreasing after 2019. Today's session was also boosted by employment data. The ADP Employment Report revealed that 227,000 jobs were created in the private sector, up from 187,000 expected. Also revealed was the Chicago PMI economic activity index which stood at 58.4, below the estimated 60.0.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European stock markets ended higher in a session in which several sectors of activity closed with valuations above 2%. Of note are the gains of raw material producers, oil companies and the technology sector. As for the reaction of investors to the published results, Sanofi rose 4.67%, after the French pharmaceutical announced higher than expected profits and improved guidance. Also in Paris, L'Oreal appreciated 6.87%, after having released quarterly sales higher than those presented last year. In Madrid, Repsol reported results in line with the estimate and Fitch improved the company's outlook from Stable to Positive, while Telefonica posted higher-than-expected earnings improved its outlook for results for 2018. Both companies recorded considerable appreciations. On the macroeconomic front, inflation in the Eurozone accelerated to 2.20% in October from 2.10% in the previous month and expected by economists.

Wall Street traded higher, recovering part of the losses recorded during the month of October. General Motors and Yum! Brands were favored by their superior results. Coca-Cola also reported quarterly results above expectations, but its shares were now slightly losing. In the technology sector, Facebook was up more than 3.50%, after yesterday after closing reported its results and have informed that its margins should stop decreasing after 2019. Today's session was also boosted by employment data. The ADP Employment Report revealed that 227,000 jobs were created in the private sector, up from 187,000 expected. Also revealed was the Chicago PMI economic activity index which stood at 58.4, below the estimated 60.0.

Nov 02, 2018 at 03:44

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 1 Nov

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

The main European indexes were divided between gains and losses, pressured by the sharp fall in oil prices in the international markets. Despite this, they managed to close mostly and slightly higher, continuing a certain recovery after having experienced the worst month since January 2016 in October.

Interest rates in euro countries are rising, with the exception of Italy, in a scenario marked by uncertainty surrounding Brexit. The 10-year Italian debt rate is easing 5.2 basis points to 3.376%, moving away from the 3.6% peak reached when the European Commission cut Italy's budget.

On Wall Street, one could assist to an upward inflection. This after the US president assured this Thursday on Twitter that negotiations with China are "on track".

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

The main European indexes were divided between gains and losses, pressured by the sharp fall in oil prices in the international markets. Despite this, they managed to close mostly and slightly higher, continuing a certain recovery after having experienced the worst month since January 2016 in October.

Interest rates in euro countries are rising, with the exception of Italy, in a scenario marked by uncertainty surrounding Brexit. The 10-year Italian debt rate is easing 5.2 basis points to 3.376%, moving away from the 3.6% peak reached when the European Commission cut Italy's budget.

On Wall Street, one could assist to an upward inflection. This after the US president assured this Thursday on Twitter that negotiations with China are "on track".

Nov 02, 2018 at 17:19

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 2 Nov

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

The positive sentiment triggered by the expectation of an agreement between the US and China encouraged investors in this last session of the week. The day was also marked by investors' reaction to Apple's results. Companies such as STMicroelectronics and Infineon, suppliers to the Cupertino multinational, were ultimately more influenced by positive sentiment in the markets than by Apple's behavior. In addition, the banking sector has also been in the spotlight, the day the European regulator will release the results of stress tests. More particularly, the results of Italian banks should be more scrutinized (since the beginning of the year, Italian banks' shares have lost 22% and 34% since their April high). At the end of today's session, Unicredit, Intensa Sanpaolo, BPM Banking and Unione Banche Italiane ended up with considerable gains.

The North American market opened up, favored by the expectation around the G20 meeting that will take place in Buenos Aires between November 30 and December 1. Donald Trump announced yesterday by tweet that he had talked on the phone with his Chinese counterpart and that the negotiations between the respective countries "are going very well". This telephone conversation precedes the aforementioned bilateral meeting. However, moods were fading after news today that members of the government have said that there is still no indication of an agreement between the two countries and that it may take longer to be achieved. Thus, at the close of European markets, the Wall Street trend was already negative. On the other hand, initial optimism was also fueled by employment data. The US Department of Labor revealed that during the month of October 250,000 were created, above the estimated 200,000. The unemployment rate stood at 3.70%, the lowest level of the last 49 years. In addition, wage growth accelerated from the previous 2.80% to 3.10%, the largest increase since April 2009. In the business plan, today's highlight goes to Apple that was devalued, after yesterday after closing the company has reported the results. Revenue and EPS outperformed analysts' forecasts, but Outlook (outlook) for the fourth quarter (usually the highest-grossing quarter of sales since it includes the Holiday Season) fell short of expectations. Apple expects next-quarter revenues to be between 89,000 M.USD and 93,000 M.USD, compared to 92700 estimated by analyst consensus. In addition, the company reported that it will stop reporting on the number of iPhones sales, a fact that was closely monitored by analysts, so the reaction to this announcement was not the best.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

The positive sentiment triggered by the expectation of an agreement between the US and China encouraged investors in this last session of the week. The day was also marked by investors' reaction to Apple's results. Companies such as STMicroelectronics and Infineon, suppliers to the Cupertino multinational, were ultimately more influenced by positive sentiment in the markets than by Apple's behavior. In addition, the banking sector has also been in the spotlight, the day the European regulator will release the results of stress tests. More particularly, the results of Italian banks should be more scrutinized (since the beginning of the year, Italian banks' shares have lost 22% and 34% since their April high). At the end of today's session, Unicredit, Intensa Sanpaolo, BPM Banking and Unione Banche Italiane ended up with considerable gains.

The North American market opened up, favored by the expectation around the G20 meeting that will take place in Buenos Aires between November 30 and December 1. Donald Trump announced yesterday by tweet that he had talked on the phone with his Chinese counterpart and that the negotiations between the respective countries "are going very well". This telephone conversation precedes the aforementioned bilateral meeting. However, moods were fading after news today that members of the government have said that there is still no indication of an agreement between the two countries and that it may take longer to be achieved. Thus, at the close of European markets, the Wall Street trend was already negative. On the other hand, initial optimism was also fueled by employment data. The US Department of Labor revealed that during the month of October 250,000 were created, above the estimated 200,000. The unemployment rate stood at 3.70%, the lowest level of the last 49 years. In addition, wage growth accelerated from the previous 2.80% to 3.10%, the largest increase since April 2009. In the business plan, today's highlight goes to Apple that was devalued, after yesterday after closing the company has reported the results. Revenue and EPS outperformed analysts' forecasts, but Outlook (outlook) for the fourth quarter (usually the highest-grossing quarter of sales since it includes the Holiday Season) fell short of expectations. Apple expects next-quarter revenues to be between 89,000 M.USD and 93,000 M.USD, compared to 92700 estimated by analyst consensus. In addition, the company reported that it will stop reporting on the number of iPhones sales, a fact that was closely monitored by analysts, so the reaction to this announcement was not the best.

Nov 05, 2018 at 19:04

(已編輯Nov 05, 2018 at 19:05)

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 5 Nov

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

Most European markets ended the week higher. The gains from the oil, utilities and commodities sectors contrasted with the losses of the technology sector. The banking sector closed with a slight loss. In Milan, the major banks ended up low, despite the good news revealed by the stress tests carried out on 4 banking institutions in the country. All of them reported capital ratios higher than those required in the extreme scenario: Intesa Sanpaolo reached a ratio of 10.64%, Unicredit 9.34%, UBI Banca 7.42% and Banco BPM 6.67%. The results of these tests further attenuate the risk that the economic and budgetary situation in Italy generates in the context of European stock markets. In terms of economic indicators, the ISM index for the non-manufacturing sector stood at 60.3, above the expected 59.0.

On the eve of midterm elections in the United States, Wall Street traded in different directions. In the financial sector, Berkshire Hathaway led the gains, in response to the good results reported. Other institutions also contributed to the gains of the session, such as Citigroup and Bank of America. Oil prices rose in international markets on the day the United States activated a new package of sanctions on Iran - which meant ending oil purchases in this Arab country as a way of punishing Tehran for breaches of the nuclear deal.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

Most European markets ended the week higher. The gains from the oil, utilities and commodities sectors contrasted with the losses of the technology sector. The banking sector closed with a slight loss. In Milan, the major banks ended up low, despite the good news revealed by the stress tests carried out on 4 banking institutions in the country. All of them reported capital ratios higher than those required in the extreme scenario: Intesa Sanpaolo reached a ratio of 10.64%, Unicredit 9.34%, UBI Banca 7.42% and Banco BPM 6.67%. The results of these tests further attenuate the risk that the economic and budgetary situation in Italy generates in the context of European stock markets. In terms of economic indicators, the ISM index for the non-manufacturing sector stood at 60.3, above the expected 59.0.

On the eve of midterm elections in the United States, Wall Street traded in different directions. In the financial sector, Berkshire Hathaway led the gains, in response to the good results reported. Other institutions also contributed to the gains of the session, such as Citigroup and Bank of America. Oil prices rose in international markets on the day the United States activated a new package of sanctions on Iran - which meant ending oil purchases in this Arab country as a way of punishing Tehran for breaches of the nuclear deal.

Nov 06, 2018 at 18:24

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 6 Nov

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

Most European Indexes slightly declined today. The investor focus was on the US (due to the mid-term elections) as well as on the published business results. The telecommunications industry led the losses, in contrast to the banking, retail and automotive sectors that were among the best performers. In Madrid, Siemens Gamesa showed a considerable appreciation (14%), after reaching its annual objectives. However, the company cautioned that commodity prices and emerging market volatility could penalize margins by 2019. Adecco and Deutsche Post also reacted positively to the presentation of the respective accounts. However, the uncertainty associated with Brexit and the relations between Brussels and Italy continued to weigh on investors' decisions. In terms of economic indicators, the PMI economic activity index in the Euro Zone stood at 53.1 in October, compared to 52.7 expected by economists, while the same indicator for the services sector reached 53.7, up from the estimated 53.3.

In mid-term elections, the US market was trading higher. The sentiment was expected with respect to the outcome of the mentionted elections, but the question of trade relations between the US and China was still present. Chinese Vice President Wang Qishan said Monday that China is ready to start negotiations and work with the US to resolve trade disputes. Reuters informed that senior representatives of the two countries are due to meet in Washington earlier this Friday. In sectoral terms, the industrial and technological sectors led the gains.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

Most European Indexes slightly declined today. The investor focus was on the US (due to the mid-term elections) as well as on the published business results. The telecommunications industry led the losses, in contrast to the banking, retail and automotive sectors that were among the best performers. In Madrid, Siemens Gamesa showed a considerable appreciation (14%), after reaching its annual objectives. However, the company cautioned that commodity prices and emerging market volatility could penalize margins by 2019. Adecco and Deutsche Post also reacted positively to the presentation of the respective accounts. However, the uncertainty associated with Brexit and the relations between Brussels and Italy continued to weigh on investors' decisions. In terms of economic indicators, the PMI economic activity index in the Euro Zone stood at 53.1 in October, compared to 52.7 expected by economists, while the same indicator for the services sector reached 53.7, up from the estimated 53.3.

In mid-term elections, the US market was trading higher. The sentiment was expected with respect to the outcome of the mentionted elections, but the question of trade relations between the US and China was still present. Chinese Vice President Wang Qishan said Monday that China is ready to start negotiations and work with the US to resolve trade disputes. Reuters informed that senior representatives of the two countries are due to meet in Washington earlier this Friday. In sectoral terms, the industrial and technological sectors led the gains.

Nov 07, 2018 at 17:53

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 7 Nov

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

Today was mainly about reactions to the results of the US elections. Several sectors closed with valuations above 1%, especially the banks and the oil sector (curiously despite the drop in the price of oil). In Madrid, the banking sector performed very well in response to the Supreme Court's decision to pay the stamp duty burden associated with mortgages: contrary to the decision taken in October, the Supreme Court now determines that it will be the customers, not the banks, to bear these charges. In Frankfurt, Adidas lost ground despite raising its profit outlook for the year.

The result of the midterm elections was being welcomed by the US stock market: the Democrats managed to have a majority in the House of Representatives, while Republicans strengthened their position in the Senate. Stocks from well-known companies such as Caterpillar, Goldman Sachs, Amazon and Alphabet traded on a rising trend. In the meantime, the FED meeting will begin today, the outcome of which will only be known tomorrow. After raising the benchmark interest rate at last September's meeting, the Federal Reserve is expected to keep the range of 2.00% -2.25% and will reiterate its intention to continue tightening monetary policy in the coming quarters, an attitude supported by the most recent economic indicators.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

Today was mainly about reactions to the results of the US elections. Several sectors closed with valuations above 1%, especially the banks and the oil sector (curiously despite the drop in the price of oil). In Madrid, the banking sector performed very well in response to the Supreme Court's decision to pay the stamp duty burden associated with mortgages: contrary to the decision taken in October, the Supreme Court now determines that it will be the customers, not the banks, to bear these charges. In Frankfurt, Adidas lost ground despite raising its profit outlook for the year.

The result of the midterm elections was being welcomed by the US stock market: the Democrats managed to have a majority in the House of Representatives, while Republicans strengthened their position in the Senate. Stocks from well-known companies such as Caterpillar, Goldman Sachs, Amazon and Alphabet traded on a rising trend. In the meantime, the FED meeting will begin today, the outcome of which will only be known tomorrow. After raising the benchmark interest rate at last September's meeting, the Federal Reserve is expected to keep the range of 2.00% -2.25% and will reiterate its intention to continue tightening monetary policy in the coming quarters, an attitude supported by the most recent economic indicators.

Nov 08, 2018 at 23:04

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 8 Nov

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets closed higher, in a session where the focus was on business results. However, the mood was restrained after the European Commission and IMF perspectives for the Eurozone were known. The European Commission expects the GDP of this region to grow 2.10% this year, but by 2019 and 2020 it should fall back to 1.90% and 1.70%, respectively. In turn, the IMF also lowered its forecasts for the European economy, reducing its growth estimates from 2.80% in 2017 to 2.30% in 2018 and 1.90% in 2019. The banking sector was one of the best performers in response to the good results published by Commerzbank and Société Générale, which exceeded the estimates. Commerzbank reported that its third-quarter results declined, partly due to extraordinary gains that were recorded in the same period of the previous year. Thus, profit fell from € 476m to € 218m (vs. € 202m expected) and revenues fell from € 2510m to € 2190m (vs. € 2180m). The bank reiterated its annual profit outlook. Société Générale reported a 32% increase in quarterly profit to € 1230 M., which surpassed the estimates. In Italy, BPM rose 2.86%, after announcing that it is analyzing the market conditions in order to be able to sell 8600 M. € bad credit. On the contrary, Unicredit fell by about 4%. The Italian bank revealed that losses from its investments hurt its quarterly profits. Net income decreased to 29 M. €, from 2820 M. € in 2017, when the result was driven by a capital gain from the sale of the Pioneer Investments unit. In Frankfurt, Siemens gained ground. The company has announced that it will raise its dividend even though profit has fallen to 681 M. € from the expected 737 M. € due to the high costs associated with the restructuring of one of its units.

Following the reactions to the election results, Wall Street traded with contained variations as investors awaited the outcome of the Fed meeting. Today's meeting should be of an interim nature. In fact, this month's meeting will represent a bridge between the September meeting (when the central bank raised the central rate by 0.25%) and the December meeting (when it will presumably make a further increase). As no press conference is scheduled, investors' attention will be drawn to the statement of the meeting. In this field, the FED message should not change significantly from the previous meeting. The Central Bank continues to have a positive view of the economy, based on internal consumption and the dynamism of the labor market, which will eventually bring inflation within the limits recommended by this institution. Faced with this reality, the FED should continue to increase, gradually, interest rates. In the business plan, Qualcomm lost more than 7%, after providing sales forecasts for the last quarter of the year below the analysts' estimates.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets closed higher, in a session where the focus was on business results. However, the mood was restrained after the European Commission and IMF perspectives for the Eurozone were known. The European Commission expects the GDP of this region to grow 2.10% this year, but by 2019 and 2020 it should fall back to 1.90% and 1.70%, respectively. In turn, the IMF also lowered its forecasts for the European economy, reducing its growth estimates from 2.80% in 2017 to 2.30% in 2018 and 1.90% in 2019. The banking sector was one of the best performers in response to the good results published by Commerzbank and Société Générale, which exceeded the estimates. Commerzbank reported that its third-quarter results declined, partly due to extraordinary gains that were recorded in the same period of the previous year. Thus, profit fell from € 476m to € 218m (vs. € 202m expected) and revenues fell from € 2510m to € 2190m (vs. € 2180m). The bank reiterated its annual profit outlook. Société Générale reported a 32% increase in quarterly profit to € 1230 M., which surpassed the estimates. In Italy, BPM rose 2.86%, after announcing that it is analyzing the market conditions in order to be able to sell 8600 M. € bad credit. On the contrary, Unicredit fell by about 4%. The Italian bank revealed that losses from its investments hurt its quarterly profits. Net income decreased to 29 M. €, from 2820 M. € in 2017, when the result was driven by a capital gain from the sale of the Pioneer Investments unit. In Frankfurt, Siemens gained ground. The company has announced that it will raise its dividend even though profit has fallen to 681 M. € from the expected 737 M. € due to the high costs associated with the restructuring of one of its units.

Following the reactions to the election results, Wall Street traded with contained variations as investors awaited the outcome of the Fed meeting. Today's meeting should be of an interim nature. In fact, this month's meeting will represent a bridge between the September meeting (when the central bank raised the central rate by 0.25%) and the December meeting (when it will presumably make a further increase). As no press conference is scheduled, investors' attention will be drawn to the statement of the meeting. In this field, the FED message should not change significantly from the previous meeting. The Central Bank continues to have a positive view of the economy, based on internal consumption and the dynamism of the labor market, which will eventually bring inflation within the limits recommended by this institution. Faced with this reality, the FED should continue to increase, gradually, interest rates. In the business plan, Qualcomm lost more than 7%, after providing sales forecasts for the last quarter of the year below the analysts' estimates.

Nov 09, 2018 at 19:38

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 9 Nov

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European stock markets closed lower on Friday as investors reacted to comments made yesterday by the US Federal Reserve and political developments in Italy and Brexit. In addition, reactions to published results were also observed. Raw material producers, a sector very exposed to the Chinese economy, led the losses, penalized by the sentiment that was mirrored in the behavior of the Asian stock markets today. Banks have also lost ground, with UBS being hampered by news that the US government is accusing Switzerland's biggest bank of defrauding investors of selling mortgage-backed assets that led to the global financial crisis in 2008. By its time, BBVA was also under a lot of pressure because the Mexican government intends to eliminate some of the commissions charged to clients. The Italian banks presented different behavior on a day marked by a high expectation of the meeting between Eurogroup President Mario Centeno and Italian Finance Minister Giovanni Tria after the European Commission published economic forecasts that differ from those of Rome. Allianz has advanced more than 2%. The insurer reported quarterly profits of 1940 M. € (24% on the same quarter of 2017) more than the estimated 1880 M. €. The insurer was comfortable with this year's goals. Still in Frankfurt, Thyssenkrupp fell about 9% after lowering its profit estimates for the second time this year.

In this last session of a week very rich in events (from the mid-term elections to the FED meeting), the US market was trading lower. Today, leading the losses were the energy and technology sectors. The price of oil fell in international markets, having broken the US $ 60 per barrel barrier for the first time since March. This downward trend that has been taking place in recent times comes at a time when an increase in the global supply of this raw material is expected to be faster than expected. It should be recalled that in October the price of this raw material reached its highest levels because of fears that US sanctions against Iran (which came into force this week) limited the market leading to a shortage in certain regions. However, other major producers such as Saudi Arabia, Russia and shale oil companies in the US have steadily increased production, more than offsetting the decline in Iranian barrels.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European stock markets closed lower on Friday as investors reacted to comments made yesterday by the US Federal Reserve and political developments in Italy and Brexit. In addition, reactions to published results were also observed. Raw material producers, a sector very exposed to the Chinese economy, led the losses, penalized by the sentiment that was mirrored in the behavior of the Asian stock markets today. Banks have also lost ground, with UBS being hampered by news that the US government is accusing Switzerland's biggest bank of defrauding investors of selling mortgage-backed assets that led to the global financial crisis in 2008. By its time, BBVA was also under a lot of pressure because the Mexican government intends to eliminate some of the commissions charged to clients. The Italian banks presented different behavior on a day marked by a high expectation of the meeting between Eurogroup President Mario Centeno and Italian Finance Minister Giovanni Tria after the European Commission published economic forecasts that differ from those of Rome. Allianz has advanced more than 2%. The insurer reported quarterly profits of 1940 M. € (24% on the same quarter of 2017) more than the estimated 1880 M. €. The insurer was comfortable with this year's goals. Still in Frankfurt, Thyssenkrupp fell about 9% after lowering its profit estimates for the second time this year.

In this last session of a week very rich in events (from the mid-term elections to the FED meeting), the US market was trading lower. Today, leading the losses were the energy and technology sectors. The price of oil fell in international markets, having broken the US $ 60 per barrel barrier for the first time since March. This downward trend that has been taking place in recent times comes at a time when an increase in the global supply of this raw material is expected to be faster than expected. It should be recalled that in October the price of this raw material reached its highest levels because of fears that US sanctions against Iran (which came into force this week) limited the market leading to a shortage in certain regions. However, other major producers such as Saudi Arabia, Russia and shale oil companies in the US have steadily increased production, more than offsetting the decline in Iranian barrels.

Nov 12, 2018 at 20:35

會員從Jan 24, 2018開始

207帖子

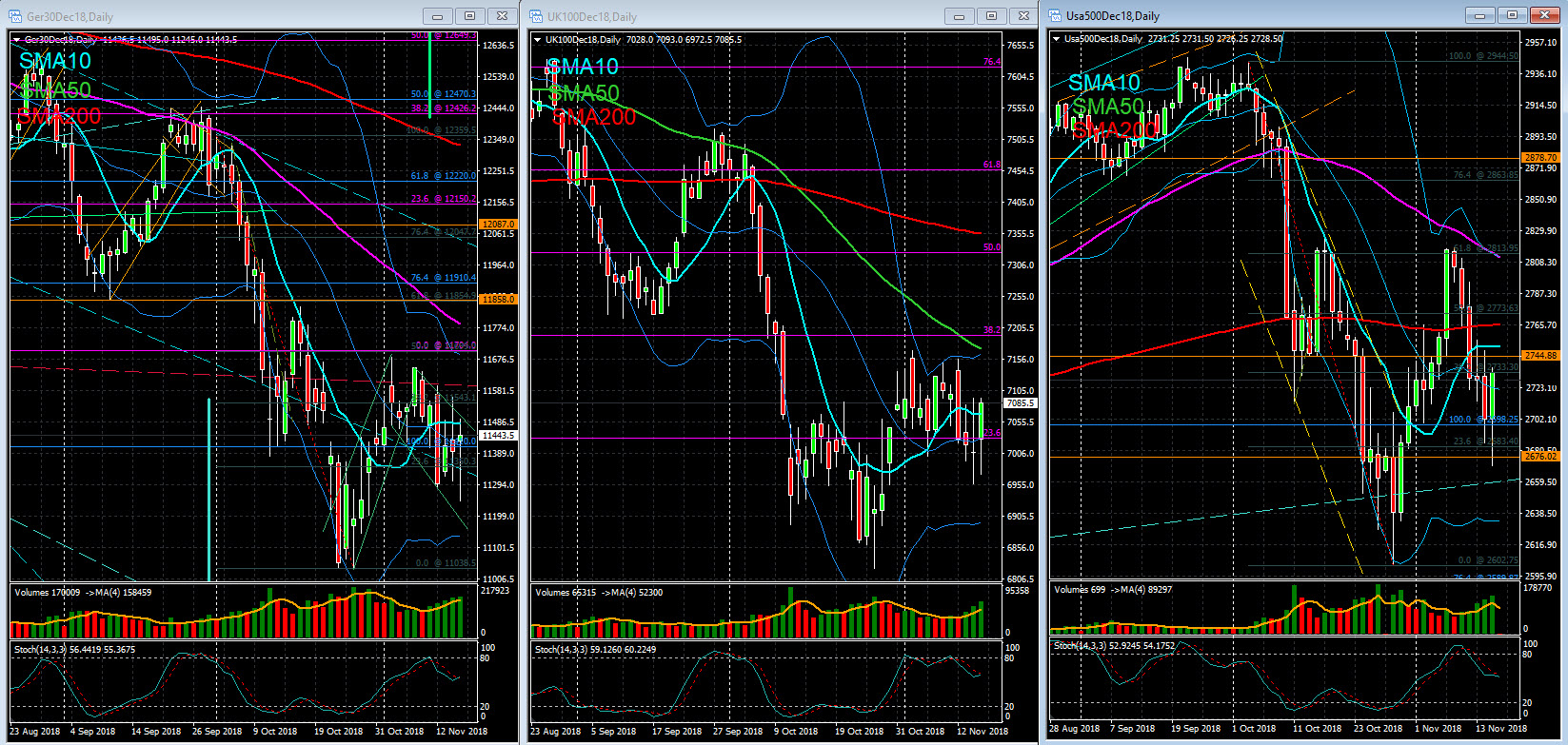

Stock Markets – Closing Note - 12 Nov

European stock markets reversed to negative ground, driven by the behavior of the technological, automotive and industrial sectors. The technology companies were influenced in part by the performance of the US counterparts, more specifically by the news from Apple. Its sector fell 3.50%. In Frankfurt, SAP lost 5.65%, having agreed to acquire Qualtrics for 8 M.USD. Infineon depreciated by concerns about reduced demand. Conversely, it was the oil sector. Over the weekend Saudi Arabia announced a cut in production for December in response to the recent drop in prices. BP and Royal Dutch rose 1.18% and 0.34%, respectively. In Milan, the highlight goes to Telecom Italia that benefited from the news of an eventual merger with rival Open Fiber.

The behavior of Apple's stocks dictated part of the course of the North American market. In fact, Cupertino's stock fell more than 4.50%, after Lumentum Holdings, which manufactures technology for facial recognition for iPhones, has narrowed its outlook for the second fiscal quarter of 2019. This negative performance was detrimental the performance of the entire industry, including Alphabet and Amazon. On the other hand, in addition to the fears associated with global economic growth, the appreciation of the Dollar also pressured the stock market.

European stock markets reversed to negative ground, driven by the behavior of the technological, automotive and industrial sectors. The technology companies were influenced in part by the performance of the US counterparts, more specifically by the news from Apple. Its sector fell 3.50%. In Frankfurt, SAP lost 5.65%, having agreed to acquire Qualtrics for 8 M.USD. Infineon depreciated by concerns about reduced demand. Conversely, it was the oil sector. Over the weekend Saudi Arabia announced a cut in production for December in response to the recent drop in prices. BP and Royal Dutch rose 1.18% and 0.34%, respectively. In Milan, the highlight goes to Telecom Italia that benefited from the news of an eventual merger with rival Open Fiber.

The behavior of Apple's stocks dictated part of the course of the North American market. In fact, Cupertino's stock fell more than 4.50%, after Lumentum Holdings, which manufactures technology for facial recognition for iPhones, has narrowed its outlook for the second fiscal quarter of 2019. This negative performance was detrimental the performance of the entire industry, including Alphabet and Amazon. On the other hand, in addition to the fears associated with global economic growth, the appreciation of the Dollar also pressured the stock market.

Nov 14, 2018 at 00:23

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 13 Nov

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

Today's session was marked by slight gains. The telecommunications companies were among the best performers, with Vodafone leading the gains, after having presented its results. The British company has announced that it will keep the dividend unchanged, thus stopping a cycle of continuous increases. The reason for this decision is the need to contain the debt after the acquisition of Liberty Global for 22 000 M.USD. The banking sector was also one of the good performers, with some Italian banks standing out. On the contrary, the oil sector recorded significant losses, reflecting the fall in the price of oil that reacted to the statements of the President of the United States. At the macroeconomic level, the annual rate of inflation in Germany reached 2.50% in October, the highest level in more than 10 years, mainly due to the rise in the prices of oil products.

Wall Street traded higher, with the tech sector recovering some of the lost ground yesterday. In addition, the news of renewed talks between the US and China on the trade issues involving the two countries also helped to support the positive sentiment. Meanwhile, oil prices fell below $ 70 a barrel, a day after Donald Trump said he hoped OPEC would not cut production of this commodity in order to raise prices.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

Today's session was marked by slight gains. The telecommunications companies were among the best performers, with Vodafone leading the gains, after having presented its results. The British company has announced that it will keep the dividend unchanged, thus stopping a cycle of continuous increases. The reason for this decision is the need to contain the debt after the acquisition of Liberty Global for 22 000 M.USD. The banking sector was also one of the good performers, with some Italian banks standing out. On the contrary, the oil sector recorded significant losses, reflecting the fall in the price of oil that reacted to the statements of the President of the United States. At the macroeconomic level, the annual rate of inflation in Germany reached 2.50% in October, the highest level in more than 10 years, mainly due to the rise in the prices of oil products.

Wall Street traded higher, with the tech sector recovering some of the lost ground yesterday. In addition, the news of renewed talks between the US and China on the trade issues involving the two countries also helped to support the positive sentiment. Meanwhile, oil prices fell below $ 70 a barrel, a day after Donald Trump said he hoped OPEC would not cut production of this commodity in order to raise prices.

Nov 14, 2018 at 17:54

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 14 Nov

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets ended lower, prompted by the trend reversal on Wall Street. The Italian market closed down after the Italian government announced that it would maintain its economic growth and deficit forecasts for 2019, despite the demands of the European Commission to review its budget. On the macroeconomic front, Eurozone GDP grew 1.70% in the third quarter, according to the second Eurostat estimate released today. This number was in line with economists' estimates.

Wall Street traded lower, retreating from early gains. At stake was the further decline in Apple shares (due to a cut in its recommendation by an investment house) and the devaluation of the banking sector. Oil prices rebounded after Reuters reported that OPEC plans to cut oil production by as much as 1.4 million barrels a day. In terms of economic indicators, the consumer price index rose 0.30% in October, in line with forecasts, driven by rising gas prices, second-hand cars and housing. If we exclude the most volatile components, this indicator was 0.20% in monthly terms and 2.10% in annual terms (compared to estimates of 2.20%).

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets ended lower, prompted by the trend reversal on Wall Street. The Italian market closed down after the Italian government announced that it would maintain its economic growth and deficit forecasts for 2019, despite the demands of the European Commission to review its budget. On the macroeconomic front, Eurozone GDP grew 1.70% in the third quarter, according to the second Eurostat estimate released today. This number was in line with economists' estimates.

Wall Street traded lower, retreating from early gains. At stake was the further decline in Apple shares (due to a cut in its recommendation by an investment house) and the devaluation of the banking sector. Oil prices rebounded after Reuters reported that OPEC plans to cut oil production by as much as 1.4 million barrels a day. In terms of economic indicators, the consumer price index rose 0.30% in October, in line with forecasts, driven by rising gas prices, second-hand cars and housing. If we exclude the most volatile components, this indicator was 0.20% in monthly terms and 2.10% in annual terms (compared to estimates of 2.20%).

Nov 15, 2018 at 23:56

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 15 Nov

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets have declined, pressed by the current political situation in the UK. After a pre-agreement was reached yesterday between the United Kingdom and the European Union on Brexit, several British ministers today presented their resignation. The British Pound depreciated about 1.50% against the Dollar. The car sector ended up with a loss of more than 1%, after it was reported that European car sales fell by 7.40% in October. Instead, commodity producers showed overperformance after Reuters reported that China had sent a written response to the US regarding possible progress in the trade relations of the two countries.

The US market traded on a downward trajectory. In the Dow Jones index, shares of Amazon and Walmart led the losses. The retailer reported positive quarterly results that however were not able to offset the negative impact caused by Warren Buffett's reduced stake in the company. Walmart reported a profit that surpassed the estimates (driven by online sales), but revenue fell short of forecasts. EPS reached USD 1.08 and revenues USD 124890. In the technology sector, Cisco posted a significant gain after having posted profit and revenue above expectations. Revenues increased 7.70%. In terms of economic indicators, retail sales increased 0.80% in October, above the expected 0.50%. If we exclude auto sales, this indicator rose 0.70%, compared to the 0.50% forecast. On the labor market, the number of weekly applications for unemployment benefits increased in 2000 to 216 000 compared to the expected 213 000.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets have declined, pressed by the current political situation in the UK. After a pre-agreement was reached yesterday between the United Kingdom and the European Union on Brexit, several British ministers today presented their resignation. The British Pound depreciated about 1.50% against the Dollar. The car sector ended up with a loss of more than 1%, after it was reported that European car sales fell by 7.40% in October. Instead, commodity producers showed overperformance after Reuters reported that China had sent a written response to the US regarding possible progress in the trade relations of the two countries.

The US market traded on a downward trajectory. In the Dow Jones index, shares of Amazon and Walmart led the losses. The retailer reported positive quarterly results that however were not able to offset the negative impact caused by Warren Buffett's reduced stake in the company. Walmart reported a profit that surpassed the estimates (driven by online sales), but revenue fell short of forecasts. EPS reached USD 1.08 and revenues USD 124890. In the technology sector, Cisco posted a significant gain after having posted profit and revenue above expectations. Revenues increased 7.70%. In terms of economic indicators, retail sales increased 0.80% in October, above the expected 0.50%. If we exclude auto sales, this indicator rose 0.70%, compared to the 0.50% forecast. On the labor market, the number of weekly applications for unemployment benefits increased in 2000 to 216 000 compared to the expected 213 000.

Nov 17, 2018 at 02:07

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 16 Nov

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

The issue of Brexit and the ensuing political instability that has arisen in recent days have once again influenced investor sentiment. Investors will continue to structure their expectations according to the evolution of events. Yesterday is a convincing proof of the speed of events. The session started under good auspices after Theresa May managed to bring together within her cabinet and her party a consensus that would increase the likelihood of the agreement reached with the European Union being approved in Parliament. Subsequently, the massive dismissal of six executive ministers forced investors to recalculate these probabilities. In this context, the London Stock Exchange finished in low, although with a contained devaluation. This behavior was justified by the positive performance of the mining companies, which also favored the sector of raw material producers and made it the best performer in sectorial terms. Oil prices rose on international markets, fueled by expectations of OPEC production cuts, although production of this raw material at record US levels has limited the upward trajectory. In macroeconomic terms, Eurostat today reported that consumer prices in the Eurozone increased 2.20% in October this year. This is the highest growth in consumer prices since December 2012.

The US market traded lower, with the technology sector ranking the 2nd worst performer in the S&P 500 index. Nvidia shares fell more than 17 percent after showing disappointing revenue and prospects. In the macroeconomic level, industrial production in October registered an increase of 0.10%, below the expected 0.20%.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

The issue of Brexit and the ensuing political instability that has arisen in recent days have once again influenced investor sentiment. Investors will continue to structure their expectations according to the evolution of events. Yesterday is a convincing proof of the speed of events. The session started under good auspices after Theresa May managed to bring together within her cabinet and her party a consensus that would increase the likelihood of the agreement reached with the European Union being approved in Parliament. Subsequently, the massive dismissal of six executive ministers forced investors to recalculate these probabilities. In this context, the London Stock Exchange finished in low, although with a contained devaluation. This behavior was justified by the positive performance of the mining companies, which also favored the sector of raw material producers and made it the best performer in sectorial terms. Oil prices rose on international markets, fueled by expectations of OPEC production cuts, although production of this raw material at record US levels has limited the upward trajectory. In macroeconomic terms, Eurostat today reported that consumer prices in the Eurozone increased 2.20% in October this year. This is the highest growth in consumer prices since December 2012.

The US market traded lower, with the technology sector ranking the 2nd worst performer in the S&P 500 index. Nvidia shares fell more than 17 percent after showing disappointing revenue and prospects. In the macroeconomic level, industrial production in October registered an increase of 0.10%, below the expected 0.20%.

Nov 20, 2018 at 01:22

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 19 Nov

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

In the begining of the week, uncertainty surrounding Brexit was once again influencing European markets. In addition, the news about Renault more specifically conditioned their stocks and the sector as a whole. President of Renault, CEO Carlos Ghosn, was arrested on suspicion of having reported a lower salary than he actually received in Japan for his duties at Nissan. Carlos Ghosn will be fired from the Japanese manufacturer. Renault shares fell 8.43%. Once again, the producers of raw materials presented a relative overperformance, thus helping the performance of the British market, where some mining companies negotiate.

Wall Street traded lower, under pressure from Apple and semiconductor companies. Apple's shares were down 3.40 percent after the Wall Street Journal reported that the company cut production of its latest iPhones earlier this year. The technology sector was also penalized by the news that Chinese authorities have alleged "significant evidence" of Samsung's antitrust, SK Hynix and Micron Technology's violation of antitrust rules. Shares of Micron and Advanced Micro Devices were down more than 3 percent. In terms of indicators, the sentiment index of builders stood at 60 in November, compared to 67 expected by economists.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

In the begining of the week, uncertainty surrounding Brexit was once again influencing European markets. In addition, the news about Renault more specifically conditioned their stocks and the sector as a whole. President of Renault, CEO Carlos Ghosn, was arrested on suspicion of having reported a lower salary than he actually received in Japan for his duties at Nissan. Carlos Ghosn will be fired from the Japanese manufacturer. Renault shares fell 8.43%. Once again, the producers of raw materials presented a relative overperformance, thus helping the performance of the British market, where some mining companies negotiate.

Wall Street traded lower, under pressure from Apple and semiconductor companies. Apple's shares were down 3.40 percent after the Wall Street Journal reported that the company cut production of its latest iPhones earlier this year. The technology sector was also penalized by the news that Chinese authorities have alleged "significant evidence" of Samsung's antitrust, SK Hynix and Micron Technology's violation of antitrust rules. Shares of Micron and Advanced Micro Devices were down more than 3 percent. In terms of indicators, the sentiment index of builders stood at 60 in November, compared to 67 expected by economists.

Nov 20, 2018 at 20:36

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 20 Nov

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

The Nasdaq's strong losses during yesterday's session spread to Asian markets and European stock markets. Although the technology sector accounts for only 6% of the DJStoxx600 (compared to the 25% it represents in the S&P500), today it has depreciated more than 2%. Two other sectors that were heavily pressured were banking and commodity producers. In Frankfurt, Deutsche Bank was penalized for the ongoing investigation into allegations of involvement in the money laundering scandal of Danske Bank. Still in the banking sector Société Générale declined 2.13%, after the news that the bank paid a fine of 1340 M.USD to the American authorities for not respecting the sanctions imposed by this country to Iran, Sudan and Cuba. In London, the mining companies reported significant losses, thus harming the producers of raw materials. Brexit's latest development concerns the inability of the internal opposition to Theresa May to issue a motion of censure to the Prime Minister. In the oil markets, crude has once again accumulated losses, falling by more than 4% today. Investors recently expected OPEC (Saudi Arabia-led) to cut output in order to stabilize the drop in oil prices, which has lost 25 percent since early October.

The selling pressure that hit Wall Street yesterday, and more specifically the technology sector, remained in today's session: the major companies in the industry, namely the well-known FAANG. In recent days, market sentiment over major tech stocks has been shaken by a Wall Street Journal report that Apple has cut back production of its latest iPhones earlier this year. Apple declined today by about 2.50%, while Amazon, Facebook and Netflix were down more than 2.50%. Chipmakers also traded with sharp losses. In retail, Target disappointed the market by reporting declining margins and increased sales, joining the long list of retailers that gave the market little cheering news before the so-called holiday season. In terms of economic indicators, homes at the start of construction increased 1.50% in October, compared to an estimated growth of 1.80% by economists. On the other hand, the number of building permits decreased less than expected (-0.60% vs. -0.80%).

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

The Nasdaq's strong losses during yesterday's session spread to Asian markets and European stock markets. Although the technology sector accounts for only 6% of the DJStoxx600 (compared to the 25% it represents in the S&P500), today it has depreciated more than 2%. Two other sectors that were heavily pressured were banking and commodity producers. In Frankfurt, Deutsche Bank was penalized for the ongoing investigation into allegations of involvement in the money laundering scandal of Danske Bank. Still in the banking sector Société Générale declined 2.13%, after the news that the bank paid a fine of 1340 M.USD to the American authorities for not respecting the sanctions imposed by this country to Iran, Sudan and Cuba. In London, the mining companies reported significant losses, thus harming the producers of raw materials. Brexit's latest development concerns the inability of the internal opposition to Theresa May to issue a motion of censure to the Prime Minister. In the oil markets, crude has once again accumulated losses, falling by more than 4% today. Investors recently expected OPEC (Saudi Arabia-led) to cut output in order to stabilize the drop in oil prices, which has lost 25 percent since early October.

The selling pressure that hit Wall Street yesterday, and more specifically the technology sector, remained in today's session: the major companies in the industry, namely the well-known FAANG. In recent days, market sentiment over major tech stocks has been shaken by a Wall Street Journal report that Apple has cut back production of its latest iPhones earlier this year. Apple declined today by about 2.50%, while Amazon, Facebook and Netflix were down more than 2.50%. Chipmakers also traded with sharp losses. In retail, Target disappointed the market by reporting declining margins and increased sales, joining the long list of retailers that gave the market little cheering news before the so-called holiday season. In terms of economic indicators, homes at the start of construction increased 1.50% in October, compared to an estimated growth of 1.80% by economists. On the other hand, the number of building permits decreased less than expected (-0.60% vs. -0.80%).

Nov 21, 2018 at 20:08

會員從Jan 24, 2018開始

207帖子

Stock Markets – Closing Note - 21 Nov

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

After significant losses at yesterday's session, today's session was positive for European stock exchanges. Several sectors closed with valuations above 1%. One of these was the banking sector, with Italian institutions making gains, with news that Italian Prime Minister Matteo Salvini may be preparing to revise the State Budget. As expected, the European Commission rejected the revised budget proposal submitted by the Italian Government and could formally initiate the sanctions process. Still in the political field, the UK's Prime Minister, Theresa May, is meeting in Brussels with the President of the European Commission, Jean-Claude Juncker. May will continue negotiations on the departure of the United Kingdom from the European Union. In the US, oil prices rose, a performance favored by data from the US Petroleum Institute, which shows that US crude reserves unexpectedly fell last week. However, today it was the turn of the Energy Information Administration of this country to have reported that oil reserves increased for the ninth consecutive week. Boosting the car sector, notably Renault, was recovering after the scandal over the arrest of CEO Carlos Ghosn.

Wall Street traded bullish, with much of the tech companies recovering from recent losses. Still, after the strong selling pressure that shook the technology sector yesterday, news was still worrying. Foxconn, Apple's largest supplier, today announced a cost-cutting plan, including a reduction in the number of employees, anticipating a 2019 "very difficult and competitive" year. On the macroeconomic level, there were several data known today, since tomorrow is a holiday (Thanksgiving). Orders for durable goods during the month of October fell 4.40%, compared with an expected decrease of only 2.60%. If we exclude transport orders, this indicator increased by 0.10%, below the expected 0.40%. Meanwhile, the advanced indicators of the economy during the same month were in line with expectations (0.10%). On the other hand, the number of weekly applications for unemployment benefits stood at 224 000, compared to the expected 215 000. On the real estate market, sales of used homes rose more than expected (1.40% vs. 1%) and the consumer confidence index, measured by the University of Michigan, reached 97.50, below the estimated 98.30. However, in terms of monetary policy, Reuters advanced that the MNI news agency said the Federal Reserve is planning to pause interest rates by the spring of next year.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

After significant losses at yesterday's session, today's session was positive for European stock exchanges. Several sectors closed with valuations above 1%. One of these was the banking sector, with Italian institutions making gains, with news that Italian Prime Minister Matteo Salvini may be preparing to revise the State Budget. As expected, the European Commission rejected the revised budget proposal submitted by the Italian Government and could formally initiate the sanctions process. Still in the political field, the UK's Prime Minister, Theresa May, is meeting in Brussels with the President of the European Commission, Jean-Claude Juncker. May will continue negotiations on the departure of the United Kingdom from the European Union. In the US, oil prices rose, a performance favored by data from the US Petroleum Institute, which shows that US crude reserves unexpectedly fell last week. However, today it was the turn of the Energy Information Administration of this country to have reported that oil reserves increased for the ninth consecutive week. Boosting the car sector, notably Renault, was recovering after the scandal over the arrest of CEO Carlos Ghosn.

Wall Street traded bullish, with much of the tech companies recovering from recent losses. Still, after the strong selling pressure that shook the technology sector yesterday, news was still worrying. Foxconn, Apple's largest supplier, today announced a cost-cutting plan, including a reduction in the number of employees, anticipating a 2019 "very difficult and competitive" year. On the macroeconomic level, there were several data known today, since tomorrow is a holiday (Thanksgiving). Orders for durable goods during the month of October fell 4.40%, compared with an expected decrease of only 2.60%. If we exclude transport orders, this indicator increased by 0.10%, below the expected 0.40%. Meanwhile, the advanced indicators of the economy during the same month were in line with expectations (0.10%). On the other hand, the number of weekly applications for unemployment benefits stood at 224 000, compared to the expected 215 000. On the real estate market, sales of used homes rose more than expected (1.40% vs. 1%) and the consumer confidence index, measured by the University of Michigan, reached 97.50, below the estimated 98.30. However, in terms of monetary policy, Reuters advanced that the MNI news agency said the Federal Reserve is planning to pause interest rates by the spring of next year.

*商業用途和垃圾郵件將不被容忍,並可能導致帳戶終止。

提示:發佈圖片/YouTube網址會自動嵌入到您的帖子中!

提示:鍵入@符號,自動完成參與此討論的用戶名。