All Eye on NFP Today

- The dollar index remains firm ahead of the Nonfarm Payroll that is due today.

- The market is cautious of a potential Japanese intervention to save Yen’s strength.

- Oil prices recovered from previous losses as the U.S. crude data came better-than-expected.

Market Summary

The dollar index remains elevated in recent highs as markets await the highly anticipated U.S. Nonfarm Payrolls (NFP) data today. This key job report will provide insight into the Fed's hawkish stance and its impact on dollar strength. With the NFP expected at 164k, a higher-than-anticipated reading could drive the dollar higher. Meanwhile, traders are also focusing on the Japanese yen, wary of potential market intervention by Japanese authorities, which could strengthen the currency. The Bank of Japan’s acknowledgment of satisfying wage growth has also increased speculation of a January rate hike.

In commodities, oil prices have recovered losses from the previous session, supported by a sharp decline in U.S. Cushing crude inventories, the largest since October. Conversely, gold prices remain steady but show signs of weakening bullish momentum. A stronger-than-expected NFP reading could weigh heavily on gold, reversing its recent gains as the dollar strengthens.

Current rate hike bets on 29th January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (93.1%) VS -25 bps (6.9%)

Market Movements

DOLLAR_INDX, H4

The Dollar Index continued its rally, supported by robust US economic performance and hawkish Fed expectations. Economists forecast Nonfarm Payrolls to decline to 227K while unemployment remains at 4.2%. Meanwhile, the Federal Reserve's FOMC meeting minutes revealed concerns about inflation, with officials citing potential risks stemming from Trump’s policy proposals, including deregulation and tax cuts. These inflationary concerns could prompt the Fed to maintain a higher interest rate environment, further supporting the dollar's rally.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 62, suggesting the index might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 109.50, 110.60

Support level: 107.65, 105.75

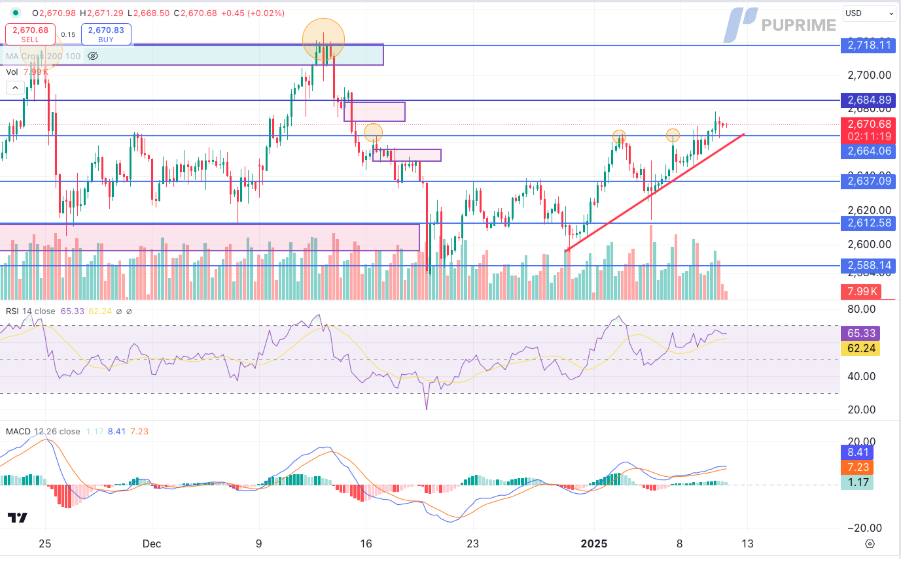

XAU/USD, H4

Gold prices surged, breaking through a key resistance level, as investors flocked to safe-haven assets amid heightened market uncertainties. Concerns over trade policies, combined with potential volatility from upcoming Nonfarm Payrolls and unemployment rate data, have bolstered demand for gold. Although a hawkish Fed tone and strong US economic data typically weigh on gold prices, persistent uncertainties surrounding Trump’s policies have kept global investors in a risk-off mode

Gold prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 65, suggesting the commodity might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 2685.00, 2720.00

Support level: 2665.00, 2635.00

GBP/USD,H4

The GBP/USD pair traded quietly in the last session, hovering near recent lows as the strengthened U.S. dollar continued to exert pressure. Traders are closely monitoring today's U.S. Nonfarm Payrolls (NFP) data, which is expected to significantly influence the dollar's strength and the pair's movement. A stronger-than-expected NFP reading could reinforce the Fed's hawkish stance, potentially driving the pair to fresh lows.

The pair consolidated in the last session at its recent low level, giving a neutral signal. The RSI is flowing flat near the oversold zone while the MACD continues to edge lower, suggesting that the pair is trading with strong bearish momentum.

Resistance level: 1.2410, 1.2505

Support level: 1.2220, 1.2140

EUR/USD,H4

The EUR/USD pair has been trading flat in recent sessions, awaiting a catalyst to determine its direction. The euro faced additional downside pressure as Eurozone Retail Sales fell to 1.2%, below the previous reading. The pair's movement remains heavily influenced by the U.S. dollar, making today's Nonfarm Payrolls (NFP) report a critical event for traders to gauge the pair's future direction.

The pair is currently testing its uptrend support level at near 1.0300, which is also its psychological support level; a break below such a level would be a bearish signal for the pair. The RSI has been sliding, while the MACD continues to edge lower after breaking below the zero line, suggesting that the pair is trading with bearish momentum.

Resistance level: 1.0330, 1.0458

Support level: 1.0230, 1.0112

USD/JPY, H4:

The USD/JPY pair is approaching a critical level near the 160.00 mark, a threshold the Japanese authorities are keen to avoid, raising the possibility of market intervention to support the Yen. With the U.S. Nonfarm Payrolls (NFP) report due today, concerns from Japan have intensified, as a strong dollar could push the pair to this level. However, expectations of a hawkish Bank of Japan (BoJ) interest rate decision in the near term have provided some support for the Yen, potentially limiting the pair's upside.

The USD/JPY has been trading flat for the past three weeks but has been gradually edging higher, suggesting a bullish bias for the pair. The RSI has been supported at above the 50 level, while the MACD has been hovering above the zero line, suggesting that the pair remains trading with bullish momentum.

Resistance level: 159.15, 160.50

Support level: 157.15, 156.00

GBPAUD, H4:

The continuous rise in UK long-term bond yields has bolstered the Pound Sterling, creating downward pressure on the GBP/AUD pair. This has resulted in a lower-high price pattern, signaling a bearish bias for the pair. On the other hand, the Australian dollar has faced headwinds from recent lackluster Chinese economic indicators, further dampening its strength. Additionally, speculation surrounding a potential February rate cut by the Reserve Bank of Australia (RBA) has weighed on the Aussie dollar, contributing to the pair's bearish outlook.

The GBPAUD pair is trading bearishly as a lower-high price pattern is formed. The RSI is hovering close to the oversold zone, while the MACD is edging lower at below the zero line, suggesting that the pair is trading with bearish momentum.

Resistance level: 1.9930, 2.0060

Support level: 1.9790, 1.9690

CL OIL, H4Oil prices rebounded more than 1%, supported by surging winter fuel demand as cold weather gripped parts of the US and Europe. The Energy Information Administration (EIA) reported that US Gulf Coast refiners raised crude oil net inputs to their highest levels since December 2018. JPMorgan analysts project that January oil demand will expand by 1.4 million barrels per day (bpd) year-on-year, reaching 101.4 million bpd, largely due to increased use of heating fuels in the Northern Hemisphere.

Oil prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 62, suggesting the commodity might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 74.85, 75.95

Support level: 73.60, 72.75