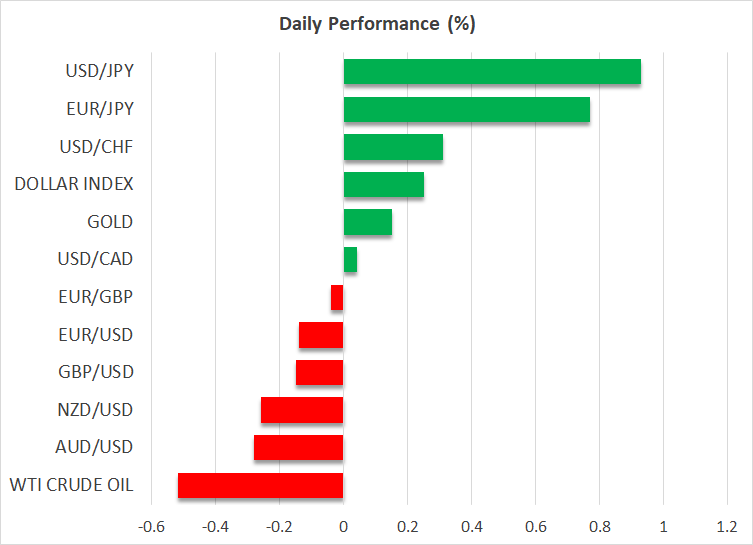

Dollar, gold and US yields continue to rise

Euro remains on the back foot

The euro is desperately trying to show some signs of life and recover against both the US dollar and the pound. But the continued dovish commentary from ECB officials and the weak euro area data prints are acting as strong headwinds. The doves are openly talking about the possibility of an even more aggressive rate cut in December, with President Lagarde and ECB members Lane, Stournaras and Cipollone expected to sing the same tune in their scheduled appearances today.

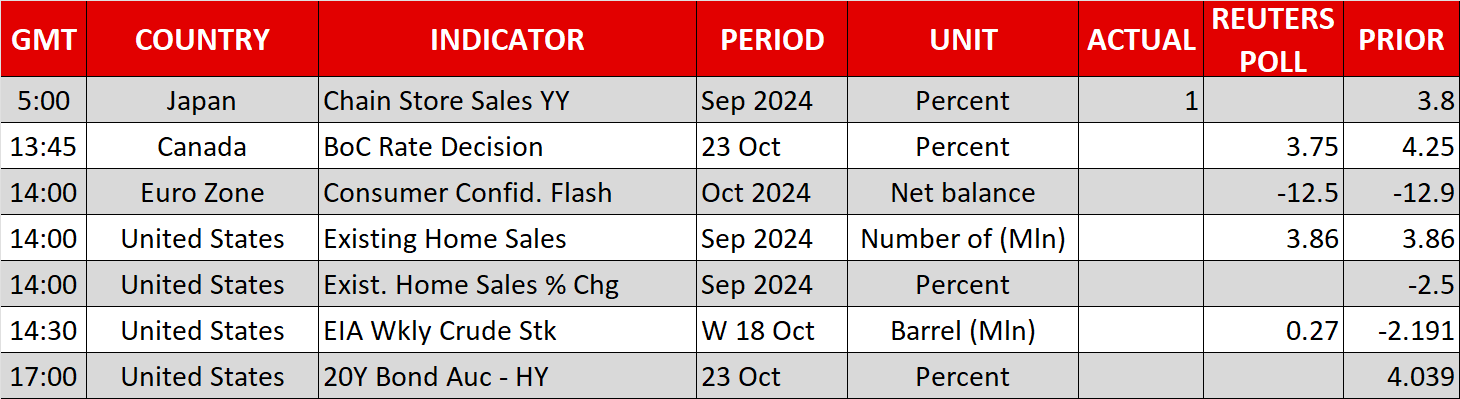

However, a 50bps move is contingent on the incoming data prints, the outcome of the next big risk events and developments in the Middle East. This means that Thursday’s preliminary PMI surveys for October remain the key release of the month and will most likely attract stronger interest than the next inflation report, which is expected to show a small acceleration in inflationary pressures.

Gold continues to rally

In the meantime, the overall market sentiment is equally important for the euro. Gold recorded a new all-time high with its 2024 gains climbing to around 34%. This is the strongest yearly performance since the 31% rally in 2007 when the 2007-2008 global financial crisis was unfolding. Interestingly, 2008 was one of the worst years for global stock markets but gold gained only 5% on an annual basis.

US yields keep rising

Gold seems to be undaunted by the continued rise in US Treasury yields. The 10-year yield is hovering north of 4.2%, a level that could be justified when examining both the current inflation and growth rates. However, the Fed is actually easing its monetary policy stance – with at least two Fed speakers on the wires again today - and hence it is the first time that the 10-year US yield is climbing aggressively higher 35 days after the first rate cut in the Fed cycle.

Amidst these developments, equities are trying to digest the incoming earnings reports - Tesla will announce its third quarter figures today - and gradually prepare for the week starting on November 4, which includes the US election and the Fed meeting, that should see a sizeable increase in volatility.

BoC to cut again

Just two weeks before the crucial Fed meeting, the Bank of Canada is expected to announce another rate cut. The market is very confident that a 50bps rate cut will be decided at today’s gathering, as it is pricing in a 90% probability for such a move, mostly due to inflation dropping to 1.6% yoy in September.

However, some investment houses believe that the BoC could opt for a smaller move on the back of better jobs numbers and decent GDP figures. In addition, it is argued that it makes sense for the BoC to wait for the early November risk events before opting for an aggressive rate cut.

Confirmation of the 50bps rate cut expectations could extend the current loonie weakness. However, its performance depends mostly on the quarterly forecasts. Should these point to further aggressive monetary policy easing steps, then dollar/loonie has the potential to retest the early August highs, even if Macklem et al surprise today with a 25bps rate cut.

.jpg)