Advertisement

Edit Your Comment

Profit / loss analysis and trading talks

Member Since May 19, 2020

321 posts

Feb 26, 2024 at 12:12

Member Since May 19, 2020

321 posts

Two similar EUR/JPY sell trades will be analyzed as one.

The opening was conditioned by the continuation of the correction within the uptrend. The top at 163.460 was identified and then followed by a sharp return to the zone below 163.000, suggesting that continued growth and even a retest of 163.460 would be unlikely. However, there was still the possibility of a narrowing horizontal correction forming, and in this case, in order to prevent losses, I set a stop loss at 163.329 and 163.343.

Further decline was also confirmed by the MACD crossing the signal line on the 15-minute chart, as well as the RSI leaving the oversold zone.

Thus, after a short-term growth, I decided to enter the market and set take profit at the level of 162.759 and 162.726, in the zone of EMA 100 influence, since I considered its penetration as unlikely.

The trades were closed at the take profit level, their duration was a little more than 4 hours and the total balance increase was 1.82%.

The opening was conditioned by the continuation of the correction within the uptrend. The top at 163.460 was identified and then followed by a sharp return to the zone below 163.000, suggesting that continued growth and even a retest of 163.460 would be unlikely. However, there was still the possibility of a narrowing horizontal correction forming, and in this case, in order to prevent losses, I set a stop loss at 163.329 and 163.343.

Further decline was also confirmed by the MACD crossing the signal line on the 15-minute chart, as well as the RSI leaving the oversold zone.

Thus, after a short-term growth, I decided to enter the market and set take profit at the level of 162.759 and 162.726, in the zone of EMA 100 influence, since I considered its penetration as unlikely.

The trades were closed at the take profit level, their duration was a little more than 4 hours and the total balance increase was 1.82%.

@Marcellus8610

Member Since Feb 22, 2024

17 posts

Feb 26, 2024 at 17:23

Member Since Feb 22, 2024

17 posts

Raven1209 posted:

In my recent GBP/USD trade, initiated on February 21st, I entered a short position at 1.26044. A stop loss was set at 1.26329, just above a minor resistance point to limit risk, while the take profit was placed at 1.25752, targeting a previous support level.

The trade closed on the same day at the stop loss level, resulting in a $5,700 loss. This outcome suggests that my bearish outlook was perhaps premature, or I may have overlooked short-term bullish signals. It's a reminder of the volatile and unpredictable nature of forex markets and the necessity of rigorous risk management.

Hi all. Had an interesting experience with Tesla recently. Thought I nailed the entry point, but the market had other plans. Ended up with a loss that left me scratching my head. Lesson learned: even with big players like Tesla, thorough analysis is key. Now, I'm revisiting my strategy, looking at where I misread the signals. Excited to hear your thoughts on dissecting trades—maybe someone else had a Tesla tale too?

Feb 26, 2024 at 17:24

Member Since Sep 02, 2022

57 posts

Oscar555 posted:lexusxxx posted:MarcellusLux posted:

@WhiteWitcher continuing the discussion, for example, market analysis can be significantly enhanced by tools using artificial intelligence.

As for more abstract approaches, there are always open questions in studying the psychology of traders and market behavior. I believe this is very important in crypto trading, where the reaction of the holders decides a lot.

You talk about the importance of trades analysis. But what should those who trade with the help of an EA do?

If this is your EA, then it will also be useful for you to work on improving it.

Its not my EA. I bought it.

Member Since May 19, 2020

321 posts

Feb 28, 2024 at 00:13

Member Since May 19, 2020

321 posts

lexusxxx posted:MarcellusLux posted:

@WhiteWitcher continuing the discussion, for example, market analysis can be significantly enhanced by tools using artificial intelligence.

As for more abstract approaches, there are always open questions in studying the psychology of traders and market behavior. I believe this is very important in crypto trading, where the reaction of the holders decides a lot.

You talk about the importance of trades analysis. But what should those who trade with the help of an EA do?

When you buy an EA, I suppose you completely trust the developer. If you invest or subscribe to signals, then you trust the trader. Therefore, in this case it is not your concern.

@Marcellus8610

Member Since May 19, 2020

321 posts

Feb 28, 2024 at 12:04

Member Since Sep 29, 2022

68 posts

AyanaBuchanan posted:Raven1209 posted:

In my recent GBP/USD trade, initiated on February 21st, I entered a short position at 1.26044. A stop loss was set at 1.26329, just above a minor resistance point to limit risk, while the take profit was placed at 1.25752, targeting a previous support level.

The trade closed on the same day at the stop loss level, resulting in a $5,700 loss. This outcome suggests that my bearish outlook was perhaps premature, or I may have overlooked short-term bullish signals. It's a reminder of the volatile and unpredictable nature of forex markets and the necessity of rigorous risk management.

Hi all. Had an interesting experience with Tesla recently. Thought I nailed the entry point, but the market had other plans. Ended up with a loss that left me scratching my head. Lesson learned: even with big players like Tesla, thorough analysis is key. Now, I'm revisiting my strategy, looking at where I misread the signals. Excited to hear your thoughts on dissecting trades—maybe someone else had a Tesla tale too?

I'm sorry for your trade, but it’s more important that you've made the right conclusion. The market does have an unpredictable nature, and relying on long-term stability even for companies like Tesla would just not be possible for me personally. Not to mention the nerve-wracking volatility.

Why did you choose Tesla?

Member Since Aug 19, 2021

203 posts

Mar 01, 2024 at 14:24

Member Since Aug 19, 2021

203 posts

lexusxxx posted:Oscar555 posted:lexusxxx posted:MarcellusLux posted:

@WhiteWitcher continuing the discussion, for example, market analysis can be significantly enhanced by tools using artificial intelligence.

As for more abstract approaches, there are always open questions in studying the psychology of traders and market behavior. I believe this is very important in crypto trading, where the reaction of the holders decides a lot.

You talk about the importance of trades analysis. But what should those who trade with the help of an EA do?

If this is your EA, then it will also be useful for you to work on improving it.

Its not my EA. I bought it.

Oh really? And what about the advisor? Does it help you get a lot of profit? Lol.

Member Since Mar 31, 2021

222 posts

Mar 01, 2024 at 15:21

Member Since Mar 31, 2021

222 posts

WhiteWitcher posted:Oscar555 posted:

I see your point, @MarcellusLux , about the advancements in AI and psychological studies in trading. While these are undoubtedly promising, we must also be cautious about overestimating technology's ability to predict market behaviors accurately, especially in unpredictable markets like crypto.

Oh there are no unpredictable markets. lol.

Well I suppose the market is difficult to predict, but it is possible. This imposes a high risk, but isn't the whole point of trading to reduce the risk of losses and increase the likelihood of winning?

Think thrice before opening an order

Member Since Aug 19, 2021

203 posts

Mar 04, 2024 at 13:26

Member Since Aug 19, 2021

203 posts

Rococo_XVII posted:WhiteWitcher posted:Oscar555 posted:

I see your point, @MarcellusLux , about the advancements in AI and psychological studies in trading. While these are undoubtedly promising, we must also be cautious about overestimating technology's ability to predict market behaviors accurately, especially in unpredictable markets like crypto.

Oh there are no unpredictable markets. lol.

Well I suppose the market is difficult to predict, but it is possible. This imposes a high risk, but isn't the whole point of trading to reduce the risk of losses and increase the likelihood of winning?

Oh that's right, my friend. If markets were unpredictable, then there would be no point in making profit from it.

Mar 04, 2024 at 14:03

Member Since Jan 15, 2024

37 posts

WhiteWitcher posted:Oscar555 posted:

I see your point, @MarcellusLux , about the advancements in AI and psychological studies in trading. While these are undoubtedly promising, we must also be cautious about overestimating technology's ability to predict market behaviors accurately, especially in unpredictable markets like crypto.

Oh there are no unpredictable markets. lol.

Then you probably predict any market and earn millions?😁

Mar 05, 2024 at 12:40

Member Since Sep 02, 2022

57 posts

MarcellusLux posted:lexusxxx posted:MarcellusLux posted:

@WhiteWitcher continuing the discussion, for example, market analysis can be significantly enhanced by tools using artificial intelligence.

As for more abstract approaches, there are always open questions in studying the psychology of traders and market behavior. I believe this is very important in crypto trading, where the reaction of the holders decides a lot.

You talk about the importance of trades analysis. But what should those who trade with the help of an EA do?

When you buy an EA, I suppose you completely trust the developer. If you invest or subscribe to signals, then you trust the trader. Therefore, in this case it is not your concern.

Yes, you are right. Without trust there will be no proper work and constant doubt. I couldn't stand living in such constant tension. Therefore, I chose my advisor very carefully.

Member Since Feb 14, 2024

6 posts

Mar 05, 2024 at 15:35

Member Since Feb 14, 2024

6 posts

How can you trust anyone 100%. Perhaps if there are some qualifications , accreditation, or regulation, but there is nothing like that in Forex. Someone could be eloquent, smart, and convincing, but they could still be a scammer just pretending.

Member Since Mar 31, 2021

222 posts

Mar 06, 2024 at 12:37

Member Since Mar 31, 2021

222 posts

Gert12 posted:

What are your thoughts about Bitcoin? Are any of you analyzing it? It's 62k now.

Bitcoin has been pleasantly surprising lately and has grown again

But I do not trade on it the volatility is too high.

Think thrice before opening an order

Member Since Feb 22, 2024

4 posts

Mar 08, 2024 at 07:17

Member Since Sep 02, 2022

57 posts

MicroCake134 posted:

How can you trust anyone 100%. Perhaps if there are some qualifications , accreditation, or regulation, but there is nothing like that in Forex. Someone could be eloquent, smart, and convincing, but they could still be a scammer just pretending.

I talked about sufficient trust, about careful selection before buying an advisor but not about 100% trust. Without trust how can I use for example a purchased advisor with my real money? Is it turns out that you shouldn’t trust anyone in principle and you shouldn’t trade Forex either in your opinion??

Unfortunately, I don’t know how to write advisors

What about you?

Mar 08, 2024 at 07:18

Member Since Sep 02, 2022

57 posts

MicroCake134 posted:

How can you trust anyone 100%. Perhaps if there are some qualifications , accreditation, or regulation, but there is nothing like that in Forex. Someone could be eloquent, smart, and convincing, but they could still be a scammer just pretending.

And you know what? This is my advisor, my trading, my money. Show me your result, I`ll think about your qualifications.

Member Since Aug 19, 2021

203 posts

Mar 08, 2024 at 12:06

Member Since Aug 19, 2021

203 posts

Oscar555 posted:WhiteWitcher posted:Oscar555 posted:

I see your point, @MarcellusLux , about the advancements in AI and psychological studies in trading. While these are undoubtedly promising, we must also be cautious about overestimating technology's ability to predict market behaviors accurately, especially in unpredictable markets like crypto.

Oh there are no unpredictable markets. lol.

Then you probably predict any market and earn millions?😁

Oh I'm going in this direction. Otherwise, why are we in Forex trading? Lol.

Member Since May 19, 2020

321 posts

Mar 08, 2024 at 13:36

Member Since May 19, 2020

321 posts

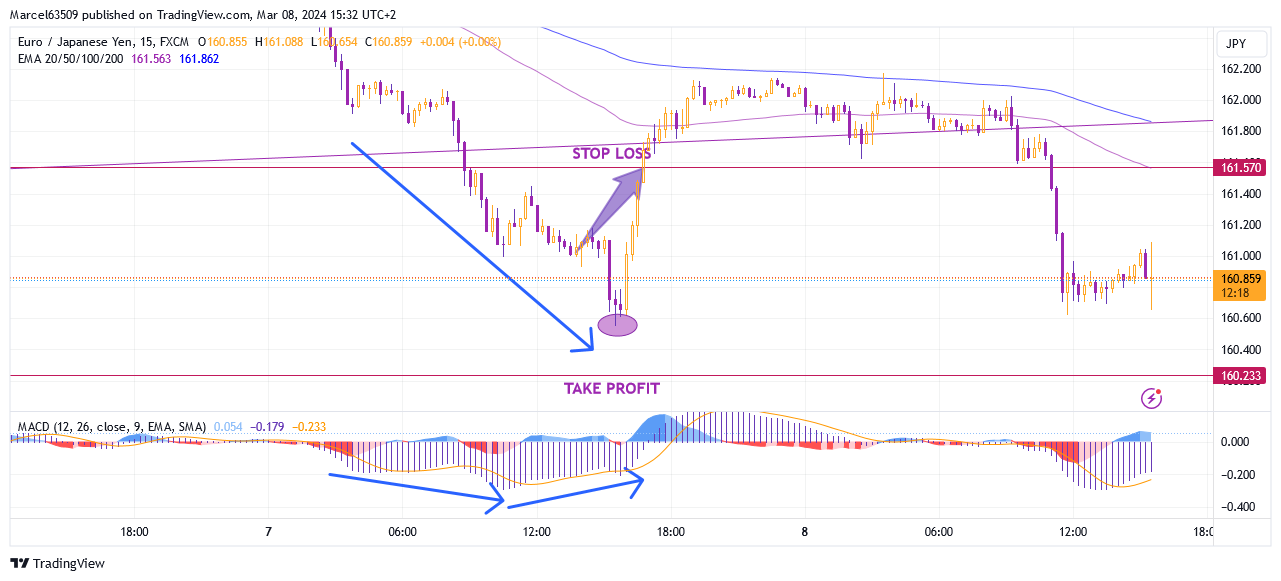

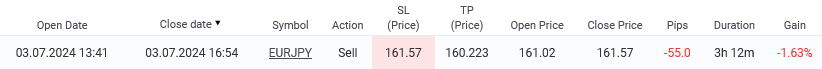

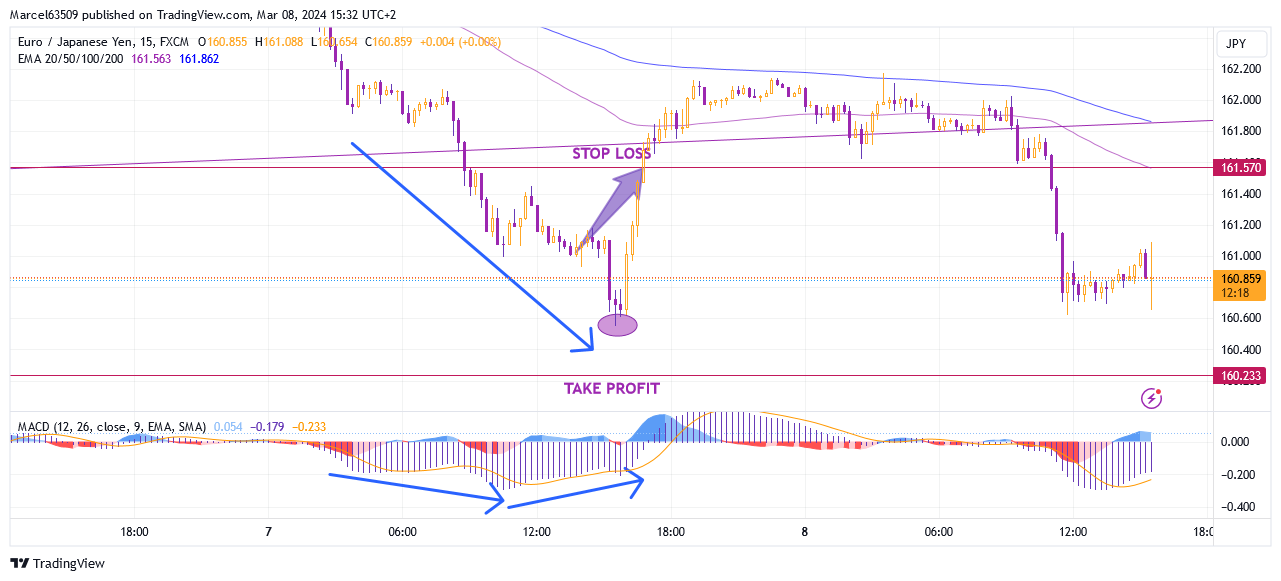

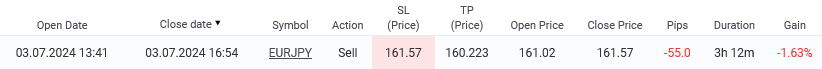

Analysis of the EUR/JPY trade which was closed yesterday with a loss of -1.63%.

The trade lasted 3 hours 12 minutes and covered -55.0 pips.

On the daily, four-hour and hourly charts there was a strong MACD signal to continue the fall, while the uptrend channel on the daily chart was previously broken after falling below 161.500 and breaking the EMA 200 level on the four-hour chart. Also, the EMA on the hourly and four-hour charts were above the price level, which suggested a further fall possibility.

I set my take profit above the EMA 100 level on the daily chart. The stop loss was set above the four-hour EMA 200 level in case it was broken and to avoid further losses.

Divergence on short-term time frames was not taken into account and in vain. You can see that shortly before the opening, a divergence began to form on the MACD, which eventually ended in growth.

The conclusion that I could draw is that a further fall is not excluded and I may return to selling EUR/JPY later. Also, I would note the importance of considering both long-term and short-term time frames, as this can help you make money and not lose.

The trade lasted 3 hours 12 minutes and covered -55.0 pips.

On the daily, four-hour and hourly charts there was a strong MACD signal to continue the fall, while the uptrend channel on the daily chart was previously broken after falling below 161.500 and breaking the EMA 200 level on the four-hour chart. Also, the EMA on the hourly and four-hour charts were above the price level, which suggested a further fall possibility.

I set my take profit above the EMA 100 level on the daily chart. The stop loss was set above the four-hour EMA 200 level in case it was broken and to avoid further losses.

Divergence on short-term time frames was not taken into account and in vain. You can see that shortly before the opening, a divergence began to form on the MACD, which eventually ended in growth.

The conclusion that I could draw is that a further fall is not excluded and I may return to selling EUR/JPY later. Also, I would note the importance of considering both long-term and short-term time frames, as this can help you make money and not lose.

@Marcellus8610

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.

.png)

_for.png)

.png)