- Home

- Community

- New Traders

- Do you think you can turn $200 into $400 in six weeks?

Edit Your Comment

Do you think you can turn $200 into $400 in six weeks?

Member Since Nov 21, 2011

1601 posts

Jun 17, 2014 at 21:02

Member Since Nov 21, 2011

1601 posts

* a lot from other traders

Now prepare 1K USD... you are going to loose it!

Now prepare 1K USD... you are going to loose it!

Jun 17, 2014 at 21:05

Member Since Jun 07, 2011

372 posts

CrazyTrader posted:

Lol now he is challenging me for 1KUSD prize!

Demo Account 20 winning trades in a row. I'm not a scalper I will show you!

You want to add difficulties?... force to trade

Trade the trend... you talk about newbies that bought eurusd while it was going down!

I even suggested a short trade in the middle of the entire retracement.

Now last Long signal was well anticipated by the "M" Pattern 2 weeks before it hit support @ 1.3500.

Guess What? Again a swing trade 100% into the green territory!!!

Lol. You want to win the contest... just follow my signals... get a ride for 150 pips and forget about opening 50 trades

Very Good analysis.

Member Since Nov 21, 2011

1601 posts

Jun 17, 2014 at 21:19

Member Since Nov 21, 2011

1601 posts

Learn from each other... level up!

Sharing experience!

Not being stubborn about a ridiculous pip drawndown theory.

Sharing experience!

Not being stubborn about a ridiculous pip drawndown theory.

Member Since Nov 21, 2011

1601 posts

Jun 17, 2014 at 21:21

Member Since Nov 21, 2011

1601 posts

Hang on for a while...

He will tell about in a moment!

He will tell about in a moment!

Member Since Apr 14, 2013

398 posts

Jun 17, 2014 at 23:04

Member Since Apr 14, 2013

398 posts

I know you would love to know more about why MOST OF MY TRADES have a high Reward ratio compared to risk. To fiqure that out you would simply have to LOOK AT MY TRADES. Once you do you'll find patterns in my trading history. Identify the pattern and you will fiqure out about how to keep your a Pip-drawdown low.

Focus on pip-drawdown

Member Since Apr 14, 2013

398 posts

Jun 17, 2014 at 23:10

Member Since Apr 14, 2013

398 posts

bewayopa posted:CrazyTrader posted:

Lol now he is challenging me for 1KUSD prize!

Demo Account 20 winning trades in a row. I'm not a scalper I will show you!

You want to add difficulties?... force to trade

Trade the trend... you talk about newbies that bought eurusd while it was going down!

I even suggested a short trade in the middle of the entire retracement.

Now last Long signal was well anticipated by the "M" Pattern 2 weeks before it hit support @ 1.3500.

Guess What? Again a swing trade 100% into the green territory!!!

Lol. You want to win the contest... just follow my signals... get a ride for 150 pips and forget about opening 50 trades

Very Good analysis.

Yes good analysis AFTER the fact. Now the question is did he make money from this? Of course not as he doesnt trade in a live account. Si SuperNoobie are you going to come take this 1k or what?

Focus on pip-drawdown

Member Since Apr 14, 2013

398 posts

Jun 17, 2014 at 23:42

Member Since Apr 14, 2013

398 posts

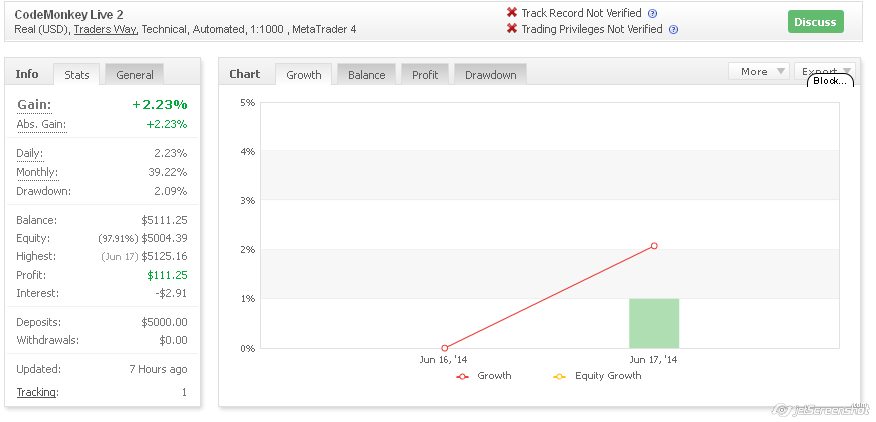

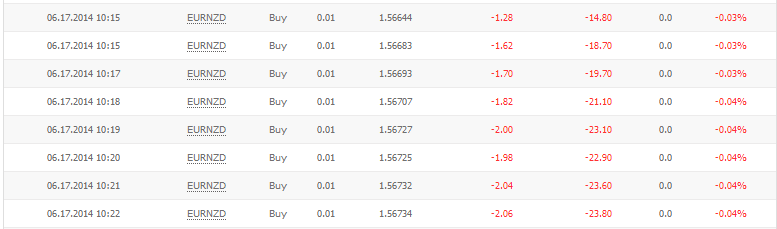

Ok lets look at the trades of Codemonkey.... It is clear to see that CodeMonkey isn't scalping. What he is actually doing is wagering very small lots, to counter trade the price action which lead to the price. Have a look at some of his floating losses. What do you notice?

Notice that he is placing .01 orders against his pair of choose, but notice the amount of orders. Also look at the time, and the price of the currency as he continues to add orders.For example he sees that price is moving up, and because he has a perceived idea that the price above is "resistance" he will place counter trades of the short term trend (in this case the move up) every .1 or every 1 pip apart. Ladies and gentlemen his system isn't special at all. If all of a sudden the market decides to trend hard, he will end up losing 100-200 pips in about 2 days, and although his dd % will be LOW (because he is placing .01 wagers in a 5k account) it will take him a very long time just to break even.

Notice that he is placing .01 orders against his pair of choose, but notice the amount of orders. Also look at the time, and the price of the currency as he continues to add orders.For example he sees that price is moving up, and because he has a perceived idea that the price above is "resistance" he will place counter trades of the short term trend (in this case the move up) every .1 or every 1 pip apart. Ladies and gentlemen his system isn't special at all. If all of a sudden the market decides to trend hard, he will end up losing 100-200 pips in about 2 days, and although his dd % will be LOW (because he is placing .01 wagers in a 5k account) it will take him a very long time just to break even.

Focus on pip-drawdown

Member Since Aug 19, 2013

180 posts

Member Since Aug 19, 2013

180 posts

Member Since Aug 19, 2013

180 posts

Member Since Aug 19, 2013

180 posts

Member Since Apr 14, 2013

398 posts

Jun 17, 2014 at 23:54

Member Since Apr 14, 2013

398 posts

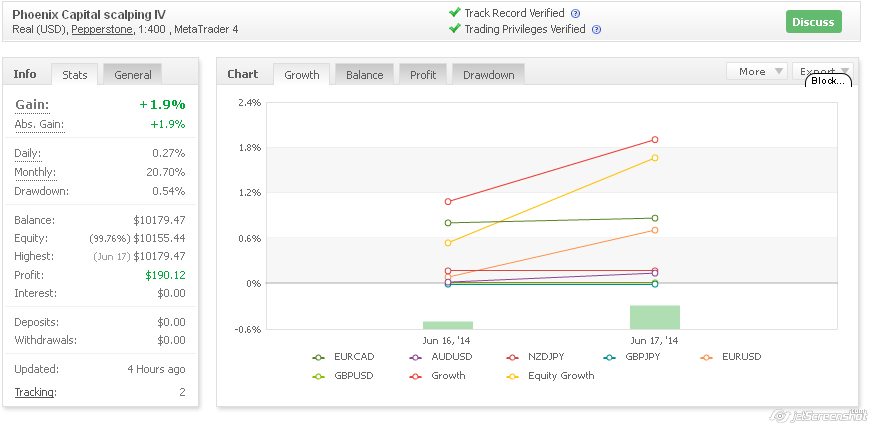

Have a look at the following chart.

The blue box is where codemonkey took his position. Now I won't "monday morning quaterback" his call, but you can see the amount of orders (the red lines) which were triggered by himself or his EA. Now the position which he took today was pretty silly because the price had already spiked almost 100 pips once he took the trade.

The chart below shows you WHY he took the trade.

If you see the box highlighted in blue, that was the last time EUR/NZD accumulated before dropping downwards, and recovering today. You can see his pending BUYS were made at the same level in which EUR/NZD accumulated several trading days ago. That is one of the dangers of trading support and resistance, is that at any given time a "support" can be a "resistance" or vica versa. So as of right now it is costing him 20 pips. He may end up closing those trades for profit, etc but the reality is he is simply wagering extension/reversal at the last accumulation level of a currency.

The blue box is where codemonkey took his position. Now I won't "monday morning quaterback" his call, but you can see the amount of orders (the red lines) which were triggered by himself or his EA. Now the position which he took today was pretty silly because the price had already spiked almost 100 pips once he took the trade.

The chart below shows you WHY he took the trade.

If you see the box highlighted in blue, that was the last time EUR/NZD accumulated before dropping downwards, and recovering today. You can see his pending BUYS were made at the same level in which EUR/NZD accumulated several trading days ago. That is one of the dangers of trading support and resistance, is that at any given time a "support" can be a "resistance" or vica versa. So as of right now it is costing him 20 pips. He may end up closing those trades for profit, etc but the reality is he is simply wagering extension/reversal at the last accumulation level of a currency.

Focus on pip-drawdown

Member Since Aug 19, 2013

180 posts

Jun 17, 2014 at 23:55

Member Since Aug 19, 2013

180 posts

Member Since Apr 14, 2013

398 posts

Jun 17, 2014 at 23:56

Member Since Apr 14, 2013

398 posts

CodeMonkey posted:

You are showing previous trades on your account counting towards your account growth. Adjust the time from monday session and you will see you are behind me.

Who cares. Remember this is 2 weeks long, and I am simply one trade away from putting you to bed. It is evident to see that you aren't scalping, and your simply wagering on support and resistance, and doing very poorly at it.

Focus on pip-drawdown

Member Since Aug 19, 2013

180 posts

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.