Inertia Trader (By babyjake1961)

The user has deleted this system.

Edit Your Comment

Inertia Trader Discussion

Member Since May 04, 2012

1534 posts

Dec 21, 2016 at 04:24

Member Since May 04, 2012

1534 posts

aeronthomas posted:

fxMasterGuru, thanks for these backtests. very interesting that the M5 seems to be performing better than M15. Would it be possible for Vendor to tick the box that allows comments to show in history (or magic numbers), I believe the timeframes are contained here. Then we can do a customer analysis and decide based on at least the live data for this year, what the return would be for just M5, M15 and both together, and also the DD for each scenario. Cheers

@aeronthomas

If running simultaneously, you can assign different Magic Numbers to each EA versions and do Custom Analysis based on that.

Please click "Vouch" if you liked my post. If not, just put me on your Blocked list. :o)

Member Since Dec 04, 2010

1447 posts

Dec 21, 2016 at 04:29

Member Since Dec 04, 2010

1447 posts

FxMasterGuru posted:yes by default the EA uses different magic numbers for each, but I can't see them on vendors account under customer analysis as by default myfxbook I believe hides magic numbers, it's a simple step to tick the box under an accounts settings in myfxbook to enable viewing of these, I notice ryan's account posted earlier has them displayed along with comments which makes the said custom analysis easy. cheersaeronthomas posted:

fxMasterGuru, thanks for these backtests. very interesting that the M5 seems to be performing better than M15. Would it be possible for Vendor to tick the box that allows comments to show in history (or magic numbers), I believe the timeframes are contained here. Then we can do a customer analysis and decide based on at least the live data for this year, what the return would be for just M5, M15 and both together, and also the DD for each scenario. Cheers

@aeronthomas

If running simultaneously, you can assign different Magic Numbers to each EA versions and do Custom Analysis based on that.

Dec 21, 2016 at 05:34

Member Since Sep 23, 2016

77 posts

I can tell you what it's going to make it more interesting is I added the G/U add-on. Box is checked so we can do some analysis on the different time frame EA's. It's going to probably double my risk but that's OK for now. It's not going on my main account until a good test had been done.

I would love to know what that "inertia" indicator is comprised of.... Possibly atr and a momentum indicator?

I would love to know what that "inertia" indicator is comprised of.... Possibly atr and a momentum indicator?

Choose a good reputation over great riches (PROVERBS 22:1)

Member Since Mar 31, 2016

69 posts

Dec 21, 2016 at 06:44

Member Since Mar 31, 2016

69 posts

It's better to run the EA on both the M5 and M15 time frames to diversify: often one time frame has losing trades when the other one has winning ones, so the account's equity curve looks smoother.

The EA is not using any indicators whatsoever.

The EA is not using any indicators whatsoever.

Member Since May 04, 2012

1534 posts

Dec 21, 2016 at 07:28

(edited Dec 21, 2016 at 07:29)

Member Since May 04, 2012

1534 posts

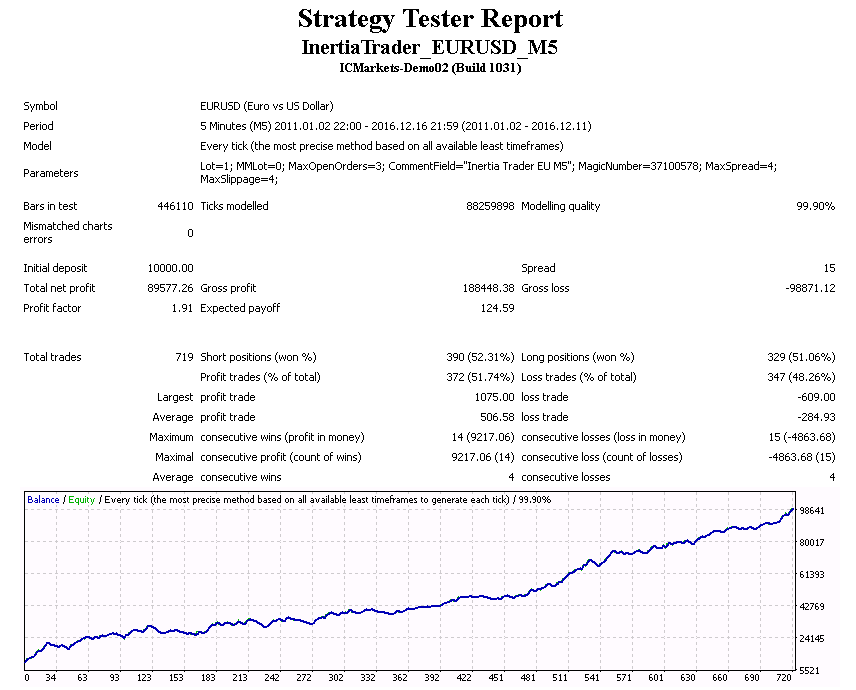

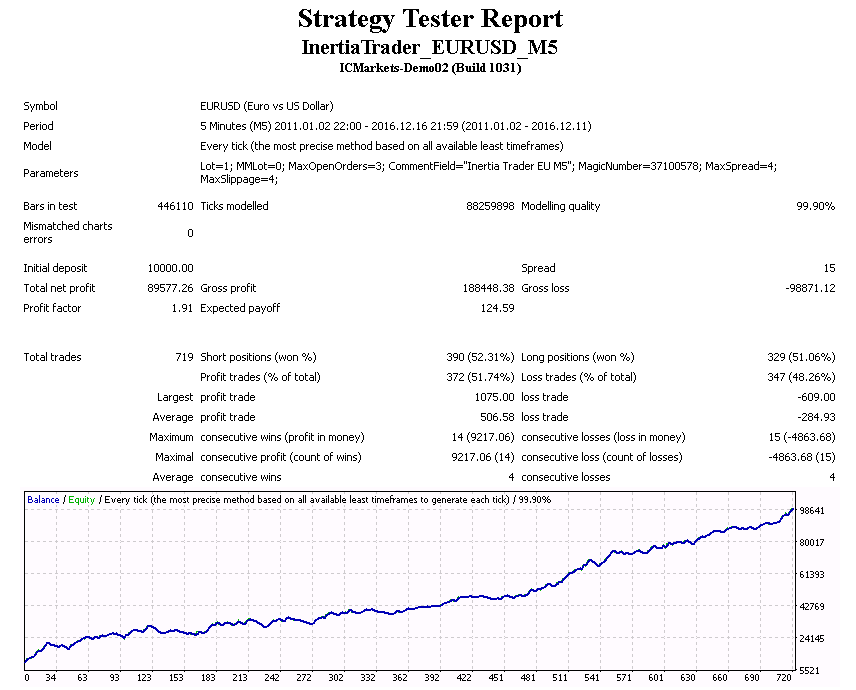

It is also interesting to look at the EA's non-reinvested, "fixed-lot" based, linear performance on M5. Fixed lot backtests' DD results are falsely low (because the lot size remains the same while the balance grows in such tests, i.e. the risk and the drawdowns are getting smaller and smaller as the account grows), and so should not be considered (which is why they are not shown on the below screenshot).

1. The linear test shows an average 150% non-reinvested profit per year (i.e. 12.5% per month) using 1 lot per $10k, so if someone decided to actually SPEND the profits instead of reinvesting them for 6 years, he/she would be able to make a decent $1250 average monthly income on $10,000 investment with the risk of 45%, i.e. -$4,500 max. DD, which (realistic) DD figure comes from the previous backtest report using balance-based (1 lot/$10k) lot sizing, i.e. MM with reinvested profits. This -$4,500 max. DD might be OK on the long run if it comes after the first $4,500 profit (i.e. after the first 4 months), otherwise it can be REALLY discouraging, i.e. if happening during the first month.

2. The linear test also shows that the EA had a significantly better backtest performance since October of 2014 (steeper profit curve), however, it could be only a result of some smart ""curve-fitting"" (please Google "Texas Sharpshooter Fallacy").

1. The linear test shows an average 150% non-reinvested profit per year (i.e. 12.5% per month) using 1 lot per $10k, so if someone decided to actually SPEND the profits instead of reinvesting them for 6 years, he/she would be able to make a decent $1250 average monthly income on $10,000 investment with the risk of 45%, i.e. -$4,500 max. DD, which (realistic) DD figure comes from the previous backtest report using balance-based (1 lot/$10k) lot sizing, i.e. MM with reinvested profits. This -$4,500 max. DD might be OK on the long run if it comes after the first $4,500 profit (i.e. after the first 4 months), otherwise it can be REALLY discouraging, i.e. if happening during the first month.

2. The linear test also shows that the EA had a significantly better backtest performance since October of 2014 (steeper profit curve), however, it could be only a result of some smart ""curve-fitting"" (please Google "Texas Sharpshooter Fallacy").

Please click "Vouch" if you liked my post. If not, just put me on your Blocked list. :o)

Dec 21, 2016 at 11:42

Member Since Jan 03, 2014

218 posts

Member Since Mar 31, 2016

69 posts

Dec 21, 2016 at 13:38

Member Since Mar 31, 2016

69 posts

goode posted:

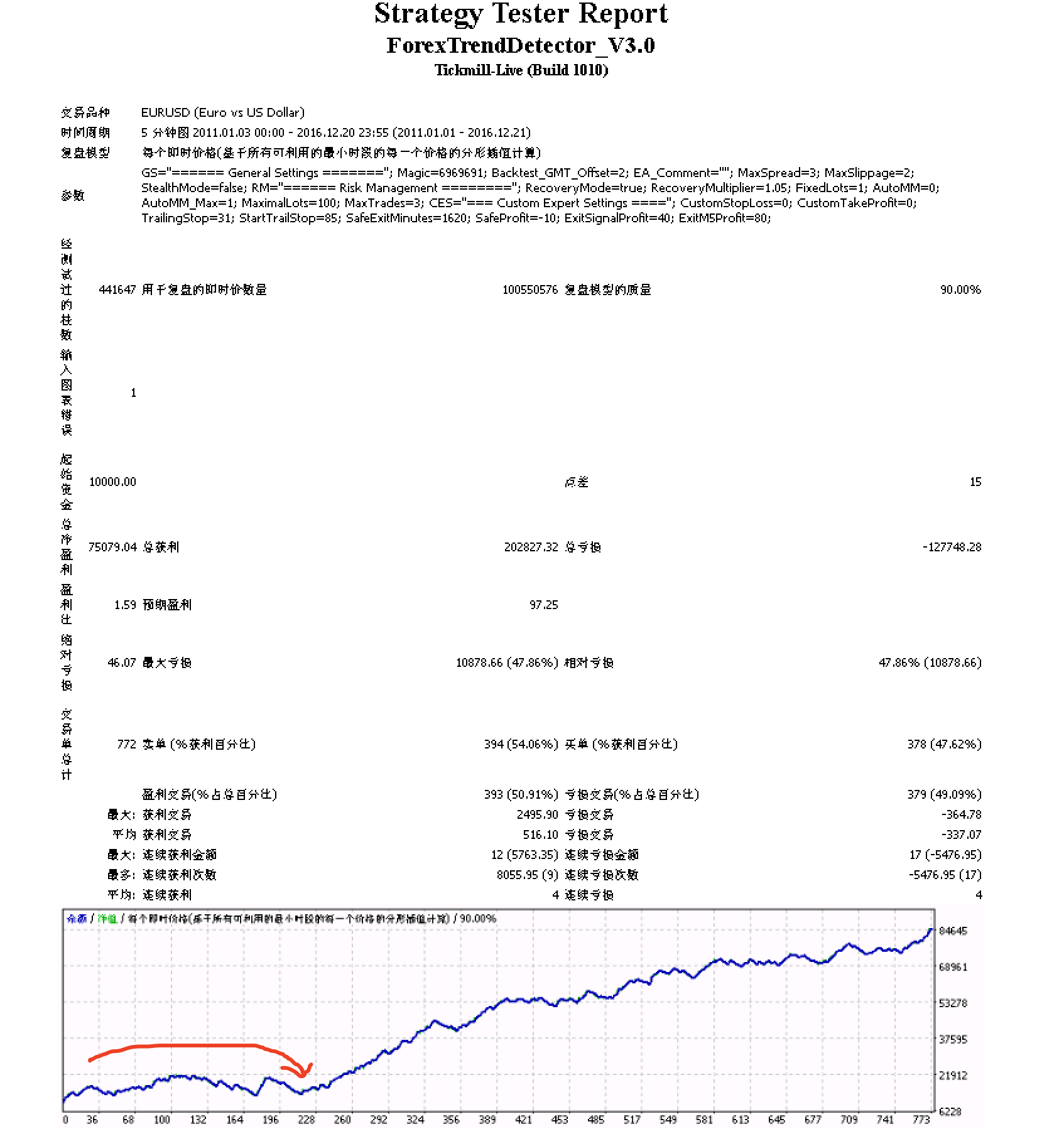

Compared with forextrenddetector backtest 2011 till now,start at 10000$ with fixlot=1 maxopenorders=3 spread=15 as your backtest on Inertia Trader,

looks inertia traders has better curve.

i have question,its have trailing SL? and every order has different sl,sometime less than 20 sometimes about 60?

It has dynamically calculated SL and TP which depend on the price momentum strength.

Member Since Mar 31, 2016

69 posts

Member Since Mar 31, 2016

69 posts

Dec 22, 2016 at 07:44

Member Since Mar 31, 2016

69 posts

jibull posted:babyjake1961 posted:jibull posted:

Pls, how many license is available on purchasing the EA?

One per account. You can purchase additional licenses to run the EA on additional accounts.

The additional license cost $347 as well?

Yes.

Member Since Oct 20, 2009

4 posts

Member Since Mar 31, 2016

69 posts

Member Since Dec 04, 2010

1447 posts

Dec 29, 2016 at 06:51

Member Since Dec 04, 2010

1447 posts

I would suggest redubbing the audio on that sales page video on the website to $347, from $147. otherwise future buyers will be confused... cheers

Dec 29, 2016 at 07:46

Member Since Feb 06, 2010

74 posts

May I ask why are you selling this ea as appose to account management, pamm or just trading it for yourself.....If too many people are trading your ea doesn't it make it obsolete.....I'm just curious to why would someone with a good ea such as yours would set a business plan to sell it unless they felt there is no longevity to it and figures to capitalize on it in the early stage. I'm really not a fan of ea's because it has been proven that over time they always fail because the markets is always changing. For those that I know that has created an ea that can recognize market changes and react according, do not sell them or if they do its on a subscription base. Usually not affordable for the average trader. At $347 one time fee, your ea is a bargain but anyone buying has to recognize the possibility of the system not being able to sustain the market. Just want to know your thoughts

Member Since Mar 31, 2016

69 posts

Dec 29, 2016 at 19:13

Member Since Feb 06, 2010

74 posts

babyjake1961 posted:

Selling the EA is a faster way to raise trading capital for ourselves.

Not for nothing but you deposited $100,000 in May of this year and since than have made almost $500k in profit alone in 6 months. That is amazing. That is 1,415 of your ea systems sales in 6 months. That's 235 ea systems per month. Are you telling me that you are raising more capital selling the ea than your actual profits that you've shown us?...

Member Since Mar 31, 2016

69 posts

Dec 30, 2016 at 01:32

Member Since Feb 06, 2010

74 posts

babyjake1961 posted:

One doesn't hurt the other.

Not what I was asking base on your previous answer. I viewed your presentation and it states that you are selling it to give the little guys the opportunity to come up, not so much in those words, it says nothing about the fast fund raising that you mentioned. But you are making money both ways I guess so kudos to you. I will wait a little to see how this unfolds. I seriously hope that this works out because a lot of people believe in your EA. Not that there will be any consequences for you if it does not, after all the seller always makes a profit. I'm hoping it has longevity because of the buyers and it will be the first low budget ea that will make a believer out of me.

Member Since Mar 31, 2016

69 posts

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.