Sterling proves unprepared for new highs

The British Pound has been under increased pressure over the past few weeks, facing serious resistance as it tries to break important long-term levels against the Dollar and Euro.

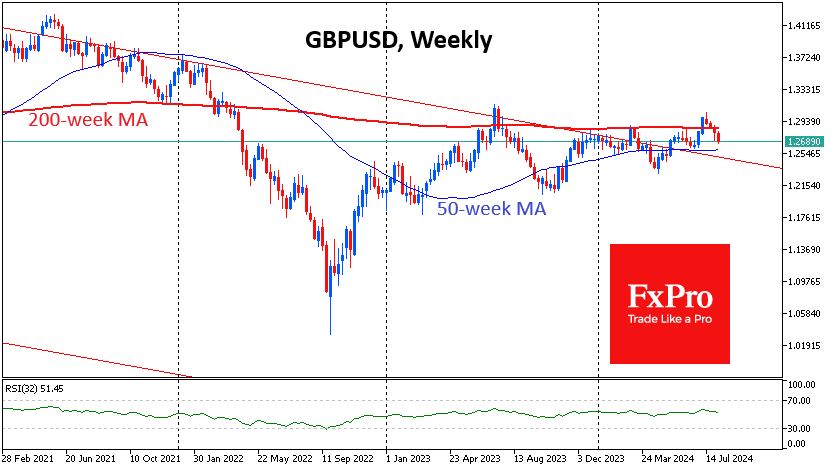

GBPUSD exceeded its 200-week moving average at 1.2850 in July, repeating an attempt a year ago to break a multi-year downtrend. Like a year ago, the pound failed to do so, and the market balance has shifted back in favour of sellers.

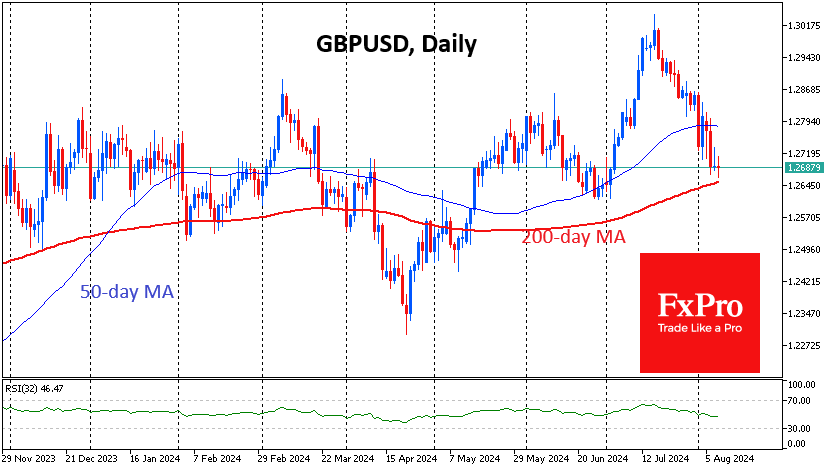

The pound is trading at roughly the same levels from which it started the year, having rebounded from 1.23 in April and failing to stay above 1.30 in July.

Nevertheless, even the horizontal movement of GBPUSD is working in favour of the bulls, as over the past three months, the pound has managed to consolidate above the resistance line of the descending channel that has dominated since 2008.

On the daily timeframes, the bullish view on the pound is being tested as GBPUSD has pulled back towards the 200-day moving average at 1.2660 and is trading near the area of the late June lows. A failure below this line in the coming days would be a more serious event than the April decline, as it would show that the July reversal downwards was not just a technical correction.

The most important reason for the pressure on the pound is monetary policy, as the Bank of England swiftly eased policy in response to falling inflation.

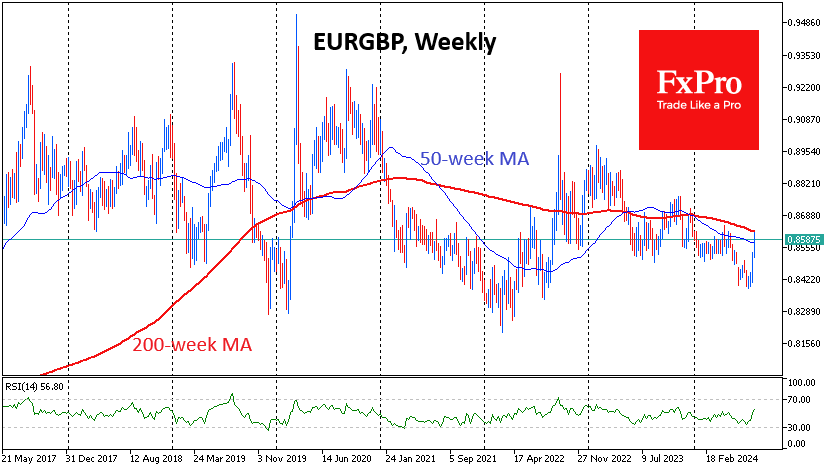

However, the impressive buying of the Euro against the Pound over the past fortnight cannot be overlooked. The fall in EURGBP to near two-year lows has made buying euros against the pound attractive, especially when it appeared that the ECB and the Bank of England were moving at roughly the same pace in easing policy. For EURGBP, this is a pullback deeper inside the trading range of the past eight years.

A decisive reversal to the upside for the EURGBP increases the chances of a bullish scenario towards the upper end of the range near 0.9000. This will become the main scenario after consolidation above the 200-week average at 0.8620.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)