Edit Your Comment

The fallacy of Martingale/Grid systems

May 03, 2024 at 10:52

Mar 17, 2021 부터 멤버

게시물14

The vast majority of martingale/grid grid systems, or variations of are destined to blow up accounts (or result in unrecoverable drawdown). New traders may not be aware of these gambling methods, which require a near infinite source of funds to pull off.

How to spot a martingale/grid system

1) Short account life.

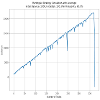

2) Unrealistic equity curves that only ever go up (unless they blow up!).

3) Equity will have significant areas of drawdown if the account hasn't blown up.

4) Increasing position sizes as the account gets further into drawdown.

Be wary of these systems, they look great until they aren't. This is a form of time-based gambling. (an very small minority of scenarios may be an exception).

Example equity curve attached.

How to spot a martingale/grid system

1) Short account life.

2) Unrealistic equity curves that only ever go up (unless they blow up!).

3) Equity will have significant areas of drawdown if the account hasn't blown up.

4) Increasing position sizes as the account gets further into drawdown.

Be wary of these systems, they look great until they aren't. This is a form of time-based gambling. (an very small minority of scenarios may be an exception).

Example equity curve attached.

Mottos are corny. Just find an edge, test it rigorously and trade it.

May 08, 2024 부터 멤버

게시물3

May 11, 2024 at 04:38

(편집됨 May 11, 2024 at 04:38)

May 08, 2024 부터 멤버

게시물3

I have yet to see one prune outlier trades effectively. I'm not saying it can't be done, it just I've never seen it. Anyone I have heard of that uses them, plans on running them until failure, while doing withdrawals until they blow up. Then they start over and see how far they can get.

Argue for your limitations, and sure enough, they are yours.

Jun 05, 2024 부터 멤버

게시물10

Jun 15, 2024 at 07:04

Apr 17, 2024 부터 멤버

게시물15

Gwydaer posted:

The vast majority of martingale/grid grid systems, or variations of are destined to blow up accounts (or result in unrecoverable drawdown). New traders may not be aware of these gambling methods, which require a near infinite source of funds to pull off.

How to spot a martingale/grid system

1) Short account life.

2) Unrealistic equity curves that only ever go up (unless they blow up!).

3) Equity will have significant areas of drawdown if the account hasn't blown up.

4) Increasing position sizes as the account gets further into drawdown.

Be wary of these systems, they look great until they aren't. This is a form of time-based gambling. (an very small minority of scenarios may be an exception).

Example equity curve attached.

Dude, one thing you have to understand is that with any EA strategy, you have to have manual wind control or you may end up failing. This is because there are so many uncertainties in the market, such as the Fed meeting, or the monthly non-agricultural employment data.

So, it is very necessary to trade with artificial dare and good risk control. Moreover, many trading strategies, can only be applied to a certain market situation, for example, some strategies are only applicable to the up and down vibration of the market, but in the unilateral market, it is easy to lose money.

Therefore, the strategy I use, with 24-hour manual risk control, 2 years of time, very stable.

Newton once said: If I can see farther than others, it is because I am standing on the shoulders of giants.

Jun 12, 2024 부터 멤버

게시물6

Jun 23, 2024 at 07:12

Apr 17, 2024 부터 멤버

게시물15

ScoutQueen posted:

What do you mean by " manual wind control "?

Because the machine can not recognize the reality of the situation, for example, today's meeting of the Federal Reserve announced a major decision, but the bot can not be recognized, this time the market appeared in the bot prediction of the opposite trend, then your bot trading strategy will be a serious loss.

Because the bot trading I used before had no human manual risk control, I ended up losing a lot of money.

Now I use bot trading strategy are manual risk control strategy.

Newton once said: If I can see farther than others, it is because I am standing on the shoulders of giants.

May 17, 2024 부터 멤버

게시물2

Feb 21, 2024 부터 멤버

게시물2

Oct 29, 2009 부터 멤버

게시물74

Jul 12, 2024 부터 멤버

게시물7

Jul 12, 2024 at 12:32

Dec 30, 2023 부터 멤버

게시물5

OptiflowCapital posted:

I use two martingal systems on gold...

I have drawdown protection on both, I turn it off at major events.

Runs great.

Same here, it's not the system that matters, but the approach and methodology used to trade it. And, by the way, martingale is not the same as grid-based system, besides multiplying position sizes they have nothing it common.

*상업적 사용 및 스팸은 허용되지 않으며 계정이 해지될 수 있습니다.

팁: 이미지/유튜브 URL을 게시하면 게시물에 자동으로 삽입됩니다!

팁: @기호를 입력하여 이 토론에 참여하는 사용자 이름을 자동으로 완성합니다.