Edit Your Comment

Newbie ans strategy

Sep 22, 2017 at 07:02

Aug 09, 2017 부터 멤버

게시물94

Practically, every trade should develop his own trading strategy for ensuring successful trading life. This is because no two people are identical and they may have different trading styles and attitude towards the Forex market. A trading plan should emphasize the safety of our capital and should not take more risk than we can afford to lose without getting mentally disturbed.

Oct 27, 2017 at 10:14

Aug 11, 2017 부터 멤버

게시물870

This market is too much volatile and there is nobody who can predict the real faction of this market with certainly , that’s why for keeping survive in here we the traders have to depend on our trading strategies that we select according to our trading experience. First of all we traders have to ensure real money managing plan if we get maximal result by our trading strategies.

Oct 27, 2017 at 12:07

Apr 18, 2017 부터 멤버

게시물700

Mohammadi posted:

This market is too much volatile and there is nobody who can predict the real faction of this market with certainly , that’s why for keeping survive in here we the traders have to depend on our trading strategies that we select according to our trading experience. First of all we traders have to ensure real money managing plan if we get maximal result by our trading strategies.

Yes, it’s an unpredictable market! But, for being a good performer you need to have a specific trading system and trading plan! By the way, I agree with your opinion on money management.

Oct 30, 2017 at 15:33

Aug 09, 2017 부터 멤버

게시물94

The success is depend on your trading knowledge , on the other hand despite of good trading knowledge that’s not possible at all to make profit with great consistency if you don’t have a reliable support from a credible trading broker , because the broker can affects the result of our trading with certainly.

Nov 03, 2017 at 14:00

Aug 09, 2017 부터 멤버

게시물94

as a newcomer , MT4 is a trading platform which is most popular by the traders who are particularly newcomers. In my trading career, as a newcomer from my first day of trading I have been using MT4 broker that is really comfortable to me when trading practically.

Feb 23, 2016 부터 멤버

게시물5

Nov 05, 2017 at 07:27

Feb 23, 2016 부터 멤버

게시물5

Forex like other trading system are buying and selling process.

When you buy something on the market, some people are selling to you at the same time.

If everybody was doing exactly the same thing, the market would not be able to work properly !

When you buy something on the market, some people are selling to you at the same time.

If everybody was doing exactly the same thing, the market would not be able to work properly !

Trading is like sailing. If there is no wind, you will not sail

Nov 08, 2017 at 15:51

Aug 11, 2017 부터 멤버

게시물870

In Fx trading as a newbie I am looking for a great source for gathering proper market principle which is very supportive to lead a comfortable trading life with certainly , many of us suggest me to trade demo account , but honestly speaking , I always feel boring when trading in demo account . but I have acquired some basic information from here about trading .

Aug 27, 2017 부터 멤버

게시물875

Dec 29, 2017 at 13:29

Aug 27, 2017 부터 멤버

게시물875

YuTsai posted:

If everyone use same strategy, there will no trading business. Inovation is the key for success in any industries.

I see, many traders are using Price Action trading strategy but they have the different trading history based on their recent trading performances! So, the same strategy doesn’t mean same result.

keeping patience.......

Dec 29, 2017 at 16:24

Dec 11, 2015 부터 멤버

게시물1462

I don't think there's any danger of everyone suddenly starting to use the same strategy. There are millions of traders out there and many, many strategies. People often can't agree what to have for lunch let alone about the strategy that should be used to make money.

Dec 30, 2017 at 07:28

(편집됨 Dec 30, 2017 at 07:34)

Jun 14, 2013 부터 멤버

게시물127

Adribaasmet posted:YuTsai posted:

If everyone use same strategy, there will no trading business. Inovation is the key for success in any industries.

I see, many traders are using Price Action trading strategy but they have the different trading history based on their recent trading performances! So, the same strategy doesn’t mean same result.

"Price Action Trading" is a very broad concept. It can mean anything from trading Japanese Candle Patterns, Historical Support & Resistance, Fibonacci Retracement/Extentions, Elliot Wave and countless chart patterns like Double Tops, Head & Shoulders, etc. A Trader can use any one of them or a combination of a few of them, and it is still technically called Price Action Trading.

Price Action literally means analyzing the movement or behavior of the price of an instruments over a particular time frame. I personally think all new traders should learn the basics of Price Action trading and then combine it it with fundamental analysis and perhaps 1 or 2 good indicators like the RSI or 2 Moving averages to formulate his/her on strategy. And I'm only talking manual trading here.

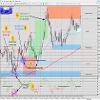

Here's an example of one of the ways I use RSI indicator to look for Buy/Sell setups. Refer the attached image of a GBPUSD Daily chart (showing price movement from May 2017 to Dec 2017). I added a number of arrows and text to illustrate. The following can be applied on any time-frame, but it works better of higher time-frames like the 1-Hour and up.

1) Look for divergence on the RSI. At number one there was Bullish Divergence below the 30 level (must occur when RSI was below 30 or above 70) This indicates that the downward momentum is weak and a shift to upward momentum is expected. Basically the possibility of a trend reversal from the downtrend to an uptrend is very strong. Important! - don't yet act on this. Wait for confirmation of the reversal.

2) Look for a break of the previous High/Low. At number two the market reversed and broke the previous Swing-High. This in itself is an indicator that a possible reversal has begun. Again DO NOT act on this yet.

3) Now this is where the Price Action magic happens. At number 3 the market pulled back and re-tested the break of the previous High. As price action traders this is the point we sit up and take notice. We look to see how the market reacts around this level. If the Resistance/Support level of number 2 holds then we want to Buy, else if it breaks, and then breaks the RSI Divergence level, the trade setup is invalid.

4) At number 4, at the close of first or second candle after the retest, we place a buy order.

5) Number 5 illustrates the placement of the stop loss level, below the RSI Divergence level

6) Number 6 illustrates how we place our take-profit target level. I typically look for previous support/resistance levels, but they have to give me at least a 1:2 or better risk reward ratio.

The point of all this is to illustrate that Price Action Trading cannot be defined in a single strategy. Sometimes I use RSI Divergence, sometimes I see a Head & Shoulders or Double Top/Bottom pattern. Sometimes I simply look at how markets react to economic data around key sup/res levels. That's what makes it exciting and interesting for me - figuring out what the emotional response of the crowd is to key levels, and then detecting where the smart money is going. I'm not always right of course, and losses is something you HAVE to accept as part of your trading career, but man it feels good when you execute a good trade setup perfectly!

The key is to use your God-given intelligence and actually LOOK what the market (price) is doing around key levels. Always remember that Price Action is a direct reflection of the collective Greed/Fear of all the people that participate in a market. So what you actually want to do is figure out what the smart money (market movers) is doing and then follow them.

Anyway guys, good luck trading out there, and may 2018 be a very profitable year!

Cheers

Keep it simple, be disciplined, get rich slowly and above all protect your equity!

Aug 27, 2017 부터 멤버

게시물875

Dec 31, 2017 at 11:21

Aug 27, 2017 부터 멤버

게시물875

JacoAF posted:Thanks a lot for your description! It’s a great community to learn Forex! I see, many of you dedicated members here and obviously I wanna learn more from all of your posts and threads!Adribaasmet posted:YuTsai posted:

If everyone use same strategy, there will no trading business. Inovation is the key for success in any industries.

I see, many traders are using Price Action trading strategy but they have the different trading history based on their recent trading performances! So, the same strategy doesn’t mean same result.

"Price Action Trading" is a very broad concept. It can mean anything from trading Japanese Candle Patterns, Historical Support & Resistance, Fibonacci Retracement/Extentions, Elliot Wave and countless chart patterns like Double Tops, Head & Shoulders, etc. A Trader can use any one of them or a combination of a few of them, and it is still technically called Price Action Trading.

Price Action literally means analyzing the movement or behavior of the price of an instruments over a particular time frame. I personally think all new traders should learn the basics of Price Action trading and then combine it it with fundamental analysis and perhaps 1 or 2 good indicators like the RSI or 2 Moving averages to formulate his/her on strategy. And I'm only talking manual trading here.

Here's an example of one of the ways I use RSI indicator to look for Buy/Sell setups. Refer the attached image of a GBPUSD Daily chart (showing price movement from May 2017 to Dec 2017). I added a number of arrows and text to illustrate. The following can be applied on any time-frame, but it works better of higher time-frames like the 1-Hour and up.

1) Look for divergence on the RSI. At number one there was Bullish Divergence below the 30 level (must occur when RSI was below 30 or above 70) This indicates that the downward momentum is weak and a shift to upward momentum is expected. Basically the possibility of a trend reversal from the downtrend to an uptrend is very strong. Important! - don't yet act on this. Wait for confirmation of the reversal.

2) Look for a break of the previous High/Low. At number two the market reversed and broke the previous Swing-High. This in itself is an indicator that a possible reversal has begun. Again DO NOT act on this yet.

3) Now this is where the Price Action magic happens. At number 3 the market pulled back and re-tested the break of the previous High. As price action traders this is the point we sit up and take notice. We look to see how the market reacts around this level. If the Resistance/Support level of number 2 holds then we want to Buy, else if it breaks, and then breaks the RSI Divergence level, the trade setup is invalid.

4) At number 4, at the close of first or second candle after the retest, we place a buy order.

5) Number 5 illustrates the placement of the stop loss level, below the RSI Divergence level

6) Number 6 illustrates how we place our take-profit target level. I typically look for previous support/resistance levels, but they have to give me at least a 1:2 or better risk reward ratio.

The point of all this is to illustrate that Price Action Trading cannot be defined in a single strategy. Sometimes I use RSI Divergence, sometimes I see a Head & Shoulders or Double Top/Bottom pattern. Sometimes I simply look at how markets react to economic data around key sup/res levels. That's what makes it exciting and interesting for me - figuring out what the emotional response of the crowd is to key levels, and then detecting where the smart money is going. I'm not always right of course, and losses is something you HAVE to accept as part of your trading career, but man it feels good when you execute a good trade setup perfectly!

The key is to use your God-given intelligence and actually LOOK what the market (price) is doing around key levels. Always remember that Price Action is a direct reflection of the collective Greed/Fear of all the people that participate in a market. So what you actually want to do is figure out what the smart money (market movers) is doing and then follow them.

Anyway guys, good luck trading out there, and may 2018 be a very profitable year!

Cheers

keeping patience.......

Apr 26, 2018 at 10:12

Apr 18, 2017 부터 멤버

게시물659

Adribaasmet posted:JacoAF posted:Thanks a lot for your description! It’s a great community to learn Forex! I see, many of you dedicated members here and obviously I wanna learn more from all of your posts and threads!Adribaasmet posted:YuTsai posted:

If everyone use same strategy, there will no trading business. Inovation is the key for success in any industries.

I see, many traders are using Price Action trading strategy but they have the different trading history based on their recent trading performances! So, the same strategy doesn’t mean same result.

"Price Action Trading" is a very broad concept. It can mean anything from trading Japanese Candle Patterns, Historical Support & Resistance, Fibonacci Retracement/Extentions, Elliot Wave and countless chart patterns like Double Tops, Head & Shoulders, etc. A Trader can use any one of them or a combination of a few of them, and it is still technically called Price Action Trading.

Price Action literally means analyzing the movement or behavior of the price of an instruments over a particular time frame. I personally think all new traders should learn the basics of Price Action trading and then combine it it with fundamental analysis and perhaps 1 or 2 good indicators like the RSI or 2 Moving averages to formulate his/her on strategy. And I'm only talking manual trading here.

Here's an example of one of the ways I use RSI indicator to look for Buy/Sell setups. Refer the attached image of a GBPUSD Daily chart (showing price movement from May 2017 to Dec 2017). I added a number of arrows and text to illustrate. The following can be applied on any time-frame, but it works better of higher time-frames like the 1-Hour and up.

1) Look for divergence on the RSI. At number one there was Bullish Divergence below the 30 level (must occur when RSI was below 30 or above 70) This indicates that the downward momentum is weak and a shift to upward momentum is expected. Basically the possibility of a trend reversal from the downtrend to an uptrend is very strong. Important! - don't yet act on this. Wait for confirmation of the reversal.

2) Look for a break of the previous High/Low. At number two the market reversed and broke the previous Swing-High. This in itself is an indicator that a possible reversal has begun. Again DO NOT act on this yet.

3) Now this is where the Price Action magic happens. At number 3 the market pulled back and re-tested the break of the previous High. As price action traders this is the point we sit up and take notice. We look to see how the market reacts around this level. If the Resistance/Support level of number 2 holds then we want to Buy, else if it breaks, and then breaks the RSI Divergence level, the trade setup is invalid.

4) At number 4, at the close of first or second candle after the retest, we place a buy order.

5) Number 5 illustrates the placement of the stop loss level, below the RSI Divergence level

6) Number 6 illustrates how we place our take-profit target level. I typically look for previous support/resistance levels, but they have to give me at least a 1:2 or better risk reward ratio.

The point of all this is to illustrate that Price Action Trading cannot be defined in a single strategy. Sometimes I use RSI Divergence, sometimes I see a Head & Shoulders or Double Top/Bottom pattern. Sometimes I simply look at how markets react to economic data around key sup/res levels. That's what makes it exciting and interesting for me - figuring out what the emotional response of the crowd is to key levels, and then detecting where the smart money is going. I'm not always right of course, and losses is something you HAVE to accept as part of your trading career, but man it feels good when you execute a good trade setup perfectly!

The key is to use your God-given intelligence and actually LOOK what the market (price) is doing around key levels. Always remember that Price Action is a direct reflection of the collective Greed/Fear of all the people that participate in a market. So what you actually want to do is figure out what the smart money (market movers) is doing and then follow them.

Anyway guys, good luck trading out there, and may 2018 be a very profitable year!

Cheers

Exactly, myfxbook is one of the biggest community; I have also learned a lot here! keep learning & updating yourself.

Apr 30, 2018 at 10:45

Aug 11, 2017 부터 멤버

게시물870

A number of novice traders start their live trading too earlier before completing their task in demo! That’s the main reason of 90% faultier statistic in Forex! I see, which traders are making right now handsome money in their live account, they all of used their demo account more than one year! So, if you want to enjoy their live trading, spend enough time in your demo!

*상업적 사용 및 스팸은 허용되지 않으며 계정이 해지될 수 있습니다.

팁: 이미지/유튜브 URL을 게시하면 게시물에 자동으로 삽입됩니다!

팁: @기호를 입력하여 이 토론에 참여하는 사용자 이름을 자동으로 완성합니다.