Harmon (에 의해 HarmonTrade)

| : 게인 | +23831.89% |

| 드로다운 | 23.10% |

| 핍스: | 256692.7 |

| 거래 | 308 |

| 원 : |

|

| 손실: |

|

| : 종류 | 리얼 |

| 레버리지: | 1:500 |

| 거래 : | 알려지지 않음 |

Harmon 토론

GBPUSD, unlike eurusd feels more confident. On D1 tf, we also see a local decline in the strengthening phase of the US dollar, but in the medium term I also see an upward movement.

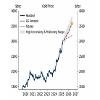

Tomorrow I will make a markup on the USD index DXY. So far everything indicates that we will fall as well as in the first term of Trump's presidency, so there is no point in betting on the strengthening of the dollar. Against this background, gold is rising and there are still questions about the US stock market for now

US Dollar Index DXY.On tf D1 there is a potential for local growth, it can be until the end of the month on the background of geopolitical triggers, but further we are waiting for another fall. All this correlates well with the fact that we are waiting for local strengthening of EURUSD and GBPUSD, and in general, all majors.

Today will be the publication of cpi for the UK, so we also closely follow the British pound

On Gold today the probability of 60% to close the day below the opening price of 3021.55.

The buying zone is 3010.34-2987.57 with the target at 3021.55. Buying is in priority while the US dollar background is weak.

The selling zone is 3029.59-3042.65. But we expect new sales from the level of 3049.25 and above with the target of 3042.65. In sales we reduce the trading volume 4 times

Gold broke out upwards after a three-day consolidation. While I will be out of the market, the only thought now is to wait for a false breakdown of $3060 and try to go short.

There is a higher than expected demand from the world Central Banks and a solid inflow of funds into gold ETFs

Gold hits another all-time record. Despite any attempts to develop a corrective movement, the buyers completely offset the sellers. Rating agencies set targets up to $3500 per troy ounce by the end of the year. If we update the high every day, at this rate we will see this target already in summer. It is closer than it seems.

Cryptocurrency is falling across the market today. ETH has already lost over 5%, bitcoin minus 2%.

There is a possibility that the peak in crypto has already passed and a deep long correction awaits us. Meanwhile, gold is growing and updating historical highs.SP500 is also at the lows for very long months.Indeed, gold has infinite upside potential against this backdrop

It's another minor day in the cryptocurrency market. Bitcoin is down 3.5% (84k) and Ether ($1,881) and Ripple ($2.18) are down 5.5%

I remember now how in early December, when Bitcoin exceeded 100k, the Financial Times editorial board apologised to readers for the negative coverage of crypto in their articles.

Wrote at the time that the sentiment around crypto strongly resembled bearish capitulation at the peak of the market.

The information backdrop back then was literally pushing crypto investments. That was the peak of the market. It's business as usual. This story is as old as the world and repeats itself with enviable regularity in any market.

.png)

_TV.png)

_AO.png)