US Inflation: Without Notable Decline

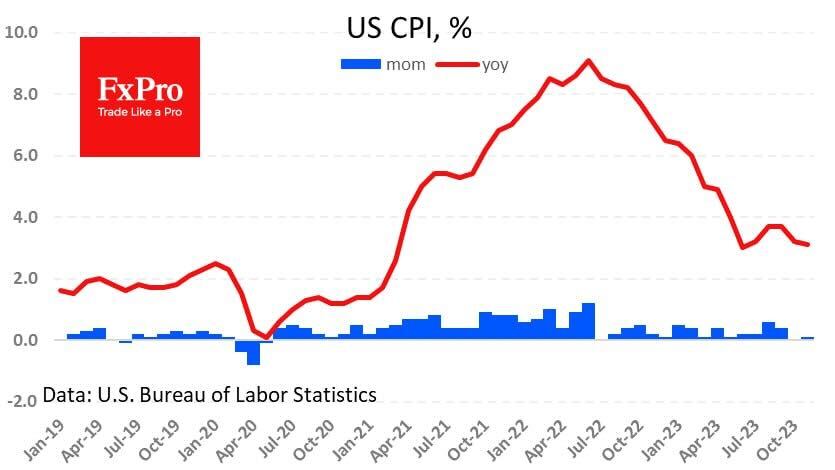

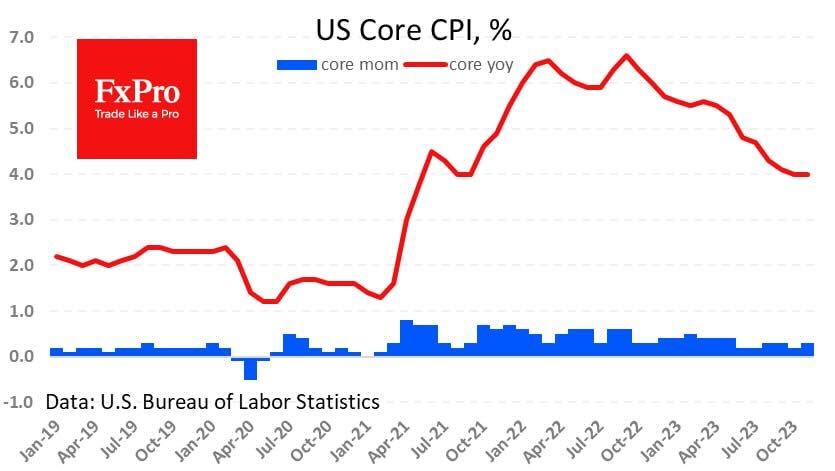

US consumer prices rose by 0.1% m/m (weaker than expected 0.0%). Annual inflation slowed from 3.2% to 3.1%. Core (excluding food and energy) rose 0.3% m/m, maintaining its annual growth rate of 4.0%.

Overall inflation has stabilised at levels above 3% y/y since June, with no meaningful downward progress. The nominal CPI has added over 1.4% in the meantime.

The core index stabilised at twice the target. Monthly growth rates for the last six months also show no signs of slowing down.

Strictly speaking, with this data, the Fed has no reason to sing a victory song over inflation on Wednesday night. This is moderately positive data for the US dollar, justifying the Fed’s ‘rates higher for longer’ motto. Nevertheless, the markets seem to have saved the main reaction for the FOMC outcome on Wednesday evening, as in the end, it is not so much the data that matters but the central bank’s interpretation of it.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)