Quiet crypto awaits a signal from senior markets

Market Picture

During the week, the crypto market gained 0.7% and showed very low volatility over the last four days, with movements around the $1.17 trillion level. The Cryptocurrency Fear and Greed Index moved into neutral territory and is now in the middle - at 50.

It all feels like a summer lull as major market participants wait for signals of change or confirmation of critical trends in the "senior" markets.

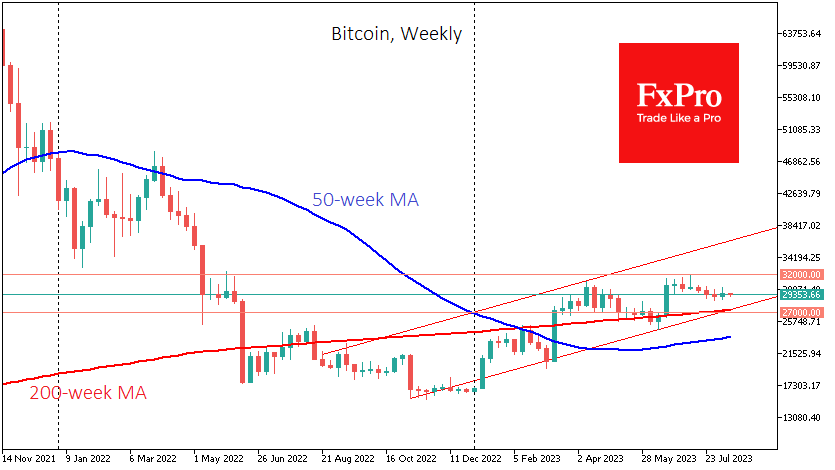

Bitcoin managed to close last week with growth, and the bulls' managed to support the price on its dips below 29K. Whether this is a temporary pause on the way down or a solid foundation to build further growth remains to be seen.

Recently, bitcoin has decoupled from the Nasdaq index, with which it previously had a very high correlation. Once, bitcoin's similar resilience ended in an accelerated sell-off when the crypto market realised that the pressure on stocks was a trend and not a brief technical correction.

Perhaps the only exception would be a repeat of the string of banking problems, triggering a wave of demand for capital protection that cryptocurrencies could meet.

News Background

The US SEC has asked ARK Invest and 21Shares for new "comments, views and arguments" on their application for Bitcoin ETFs, which can be submitted within 21 days.

The SEC will likely approve several ETFs based on the first cryptocurrency at once, Matrixport believes. If the regulator delays a decision on the applications, a mid-September correction in BTC is possible.

Crypto exchange Bittrex agreed to pay a $24 million fine to settle SEC claims. The regulator accused the platform of failing to register and selling unregistered securities.

US institutional crypto platform Bakkt's reported 25-fold year-over-year revenue growth in Q2 25-fold to $348 million, while trading volume plunged 51%.

According to Bloomberg Intelligence, the launch of the PayPal (PYUSD) stablecoin based on the Ethereum network could significantly impact the entire ecosystem of the second-most-capitalised cryptocurrency. ETH will have huge growth potential even if only a tiny percentage of PayPal's customer base starts using the PYUSD stablecoin.

The launch of PYUSD will improve payment efficiency and customer service, but adoption of the asset is unlikely to be widespread, Bank of America said.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)