Edit Your Comment

GBP/USD daily outlook

Uczestnik z Apr 09, 2014

832 postów

Apr 25, 2017 at 22:56

Uczestnik z Apr 09, 2014

832 postów

Gbp/Usd is slowly building up some gains but still within the range, upside seems limited, 1.0900 act as psychological resistance level.

Apr 26, 2017 at 13:27

Uczestnik z Feb 04, 2017

40 postów

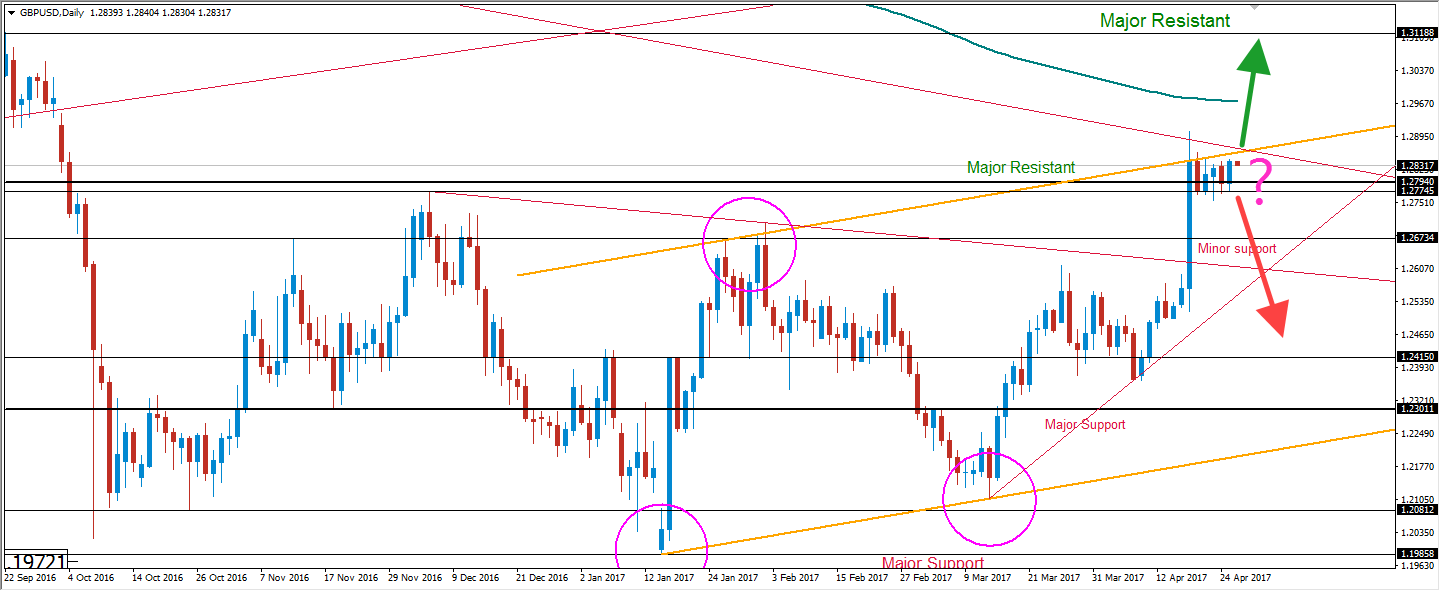

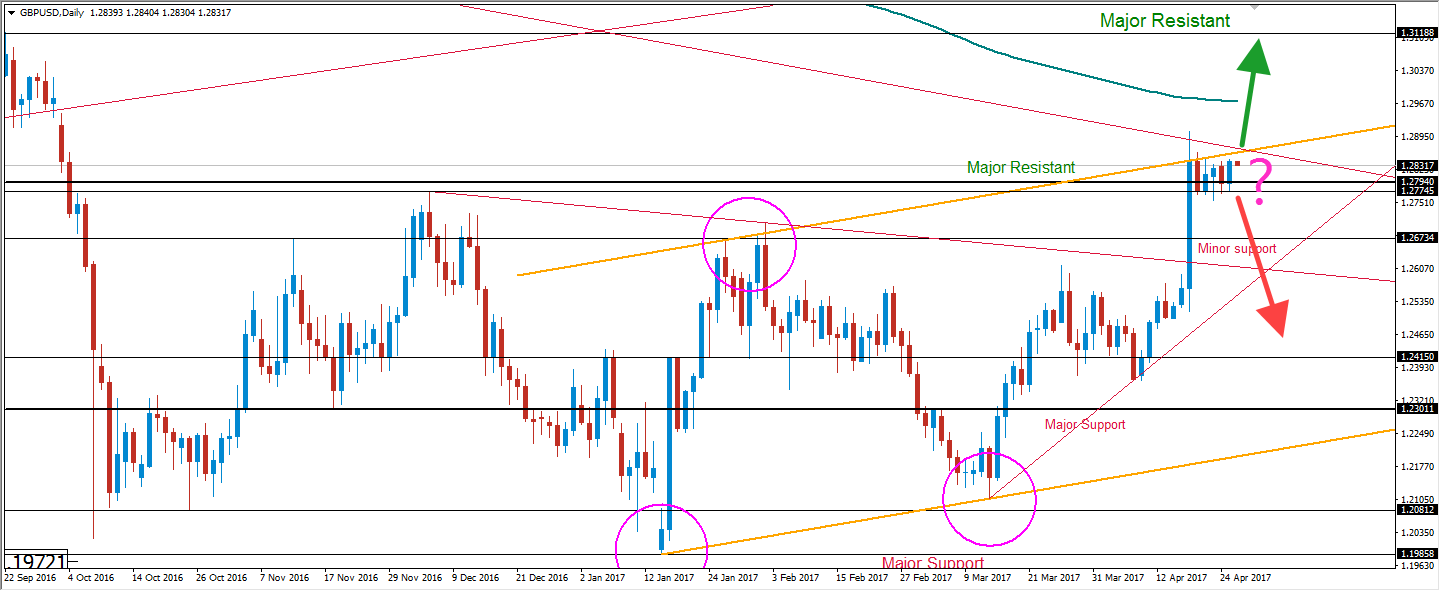

We had a wonderful bullish candle yesterday, however technically still not a bullish breakout yet. Price action need to break the previous lower low trendline too, which we are expecting to happen today.

A closing above 1.2870-1.2880 area would open door to next major resistant 1.31188. Check the chart.

Check my Tickmil chart, and you need to update the price action according to your broker)

A closing above 1.2870-1.2880 area would open door to next major resistant 1.31188. Check the chart.

Check my Tickmil chart, and you need to update the price action according to your broker)

Helping new traders

Uczestnik z Apr 09, 2014

832 postów

Apr 26, 2017 at 22:27

Uczestnik z Apr 09, 2014

832 postów

Cable continues to be trading within a narrow range in positive territroy , there is no clear directional strength, the consolidation would probably continue until Friday preliminary Q1 GDP release.

Uczestnik z Apr 09, 2014

832 postów

Apr 27, 2017 at 10:09

Uczestnik z Apr 09, 2014

832 postów

Finally, the pair confirmed a bullish break out of 1.2910/1.2900 zone after multi-week consolidation. On the upside, 1.2950 and follow by 1.30 psychological level might be in sight.

Uczestnik z Apr 09, 2016

419 postów

Apr 27, 2017 at 16:38

Uczestnik z Apr 09, 2016

419 postów

Pound/dollar made a moderate upward momentum yesterday, forming a peak at 1.2845. Expectations are bullish for testing 1.2900. A clear breakthrough and daily closure over this area can clear the road ahead of the bulls up to 1.3000 - 1.3050 and give further confirmation of the bullish scenario on the double bottom. Support for the day is 1.2800. A clear break below it could take the price to a neutral trading area, but only a clear break below 1.2750 would have to stop the upside-down scenario on the double bottom.

Uczestnik z Nov 16, 2015

708 postów

Apr 27, 2017 at 17:21

Uczestnik z Nov 16, 2015

708 postów

The pound recorded another neutral session against the dollar on Wednesday. The pair continues to fluctuate around the levels it reached in the middle of last week. It is expected soon that the British currency will prevail and the resistance at 1.2901 will be pierced. Trading on Wednesday was open at a 1.2840, and the trend was neutral almost all the time. A weak bullish momentum was noticed in the afternoon when the pair reached a peak at 1.2862, but the pound quickly lost the lead.

Uczestnik z Nov 16, 2015

708 postów

Apr 27, 2017 at 17:24

Uczestnik z Nov 16, 2015

708 postów

GBP/USD

Key levels to watch for:

Support: 1.2511; 1.2413;

Resistance: 1.2901; 1.3057;

Key levels to watch for:

Support: 1.2511; 1.2413;

Resistance: 1.2901; 1.3057;

Uczestnik z Apr 09, 2016

419 postów

Apr 27, 2017 at 18:16

Uczestnik z Apr 09, 2016

419 postów

GBP/USD - Buy at 1.2872

• Entry: 1.2905 (market)

• Stop: 1.2796

• Limit: 1.2961

• Time horizon: 1 day

• Entry: 1.2905 (market)

• Stop: 1.2796

• Limit: 1.2961

• Time horizon: 1 day

Apr 28, 2017 at 11:06

Uczestnik z Dec 30, 2013

1 postów

!!!

Apr 28, 2017 at 11:10

Uczestnik z Mar 23, 2017

38 postów

It’s been a irritating 1-1/2 month for GBP/USD bears because the pair keeps strengthening regardless of weak economic facts, Brexit uncertainty and May’s call for UK snap elections.

The preliminary UK GDP release could turn out to be a non-event for the markets, unless the number prints way under the estimates. The UK Q1 growth rate is visible slowing to 0.4% q/q from the preceding zone’s 0.7% reading.

A weaker-than-expected determines could yield a technical pull again, given the overbought conditions at the intraday charts. Strong support at 1.26 might be positioned to test over the following couple of days.

Alternatively, a positive surprise could shake out a few greater GBP bears, hence commencing doors for 1.30 handle. There is consensus in the marketplace that Pound’s sharp rally this month is the end result of the unwinding of the shorts.

Technical Levels to watch:

The pair jumped above 1.29 handle in Asia and was last seen trading around 1.2910 levels. The unwinding of shorts could gather pace if the spot breaks above 1.30, thus opening doors for 1.3119 (June 2016 low). On the downside, failure to hold above the weekly 50-MA level of 1.2845 could yield a sell-off to 1.2631 (weekly 5-MA).

To know our latest recommendation or forex tips along with stop loss and target price visit www.mmfsolutions.sg

The preliminary UK GDP release could turn out to be a non-event for the markets, unless the number prints way under the estimates. The UK Q1 growth rate is visible slowing to 0.4% q/q from the preceding zone’s 0.7% reading.

A weaker-than-expected determines could yield a technical pull again, given the overbought conditions at the intraday charts. Strong support at 1.26 might be positioned to test over the following couple of days.

Alternatively, a positive surprise could shake out a few greater GBP bears, hence commencing doors for 1.30 handle. There is consensus in the marketplace that Pound’s sharp rally this month is the end result of the unwinding of the shorts.

Technical Levels to watch:

The pair jumped above 1.29 handle in Asia and was last seen trading around 1.2910 levels. The unwinding of shorts could gather pace if the spot breaks above 1.30, thus opening doors for 1.3119 (June 2016 low). On the downside, failure to hold above the weekly 50-MA level of 1.2845 could yield a sell-off to 1.2631 (weekly 5-MA).

To know our latest recommendation or forex tips along with stop loss and target price visit www.mmfsolutions.sg

Uczestnik z Oct 02, 2014

905 postów

Apr 30, 2017 at 09:24

Uczestnik z Oct 02, 2014

905 postów

GBP/USD is having a very strong bullish rally as price advanced to a high of 1.2962. Bears might try to take it down this week.

Positivity

Uczestnik z Apr 09, 2014

832 postów

May 01, 2017 at 00:21

Uczestnik z Apr 09, 2014

832 postów

The pair is showing small pull back, but risk remains on the upside. I'm expecting Gbp/Usd would consolidating further until break above 1.2965 and lead to next resistance zone at 1.3.

Uczestnik z Jul 10, 2014

1114 postów

May 01, 2017 at 13:29

(edytowane May 01, 2017 at 13:30)

Uczestnik z Jul 10, 2014

1114 postów

csc2009 posted:

The pair is showing small pull back, but risk remains on the upside. I'm expecting Gbp/Usd would consolidating further until break above 1.2965 and lead to next resistance zone at 1.3.

I agree. The retracement could continue back to 1.2890 - 1.2880, or even lower than that, but the trend remains bullish for now.

May 01, 2017 at 19:48

Uczestnik z Feb 04, 2017

40 postów

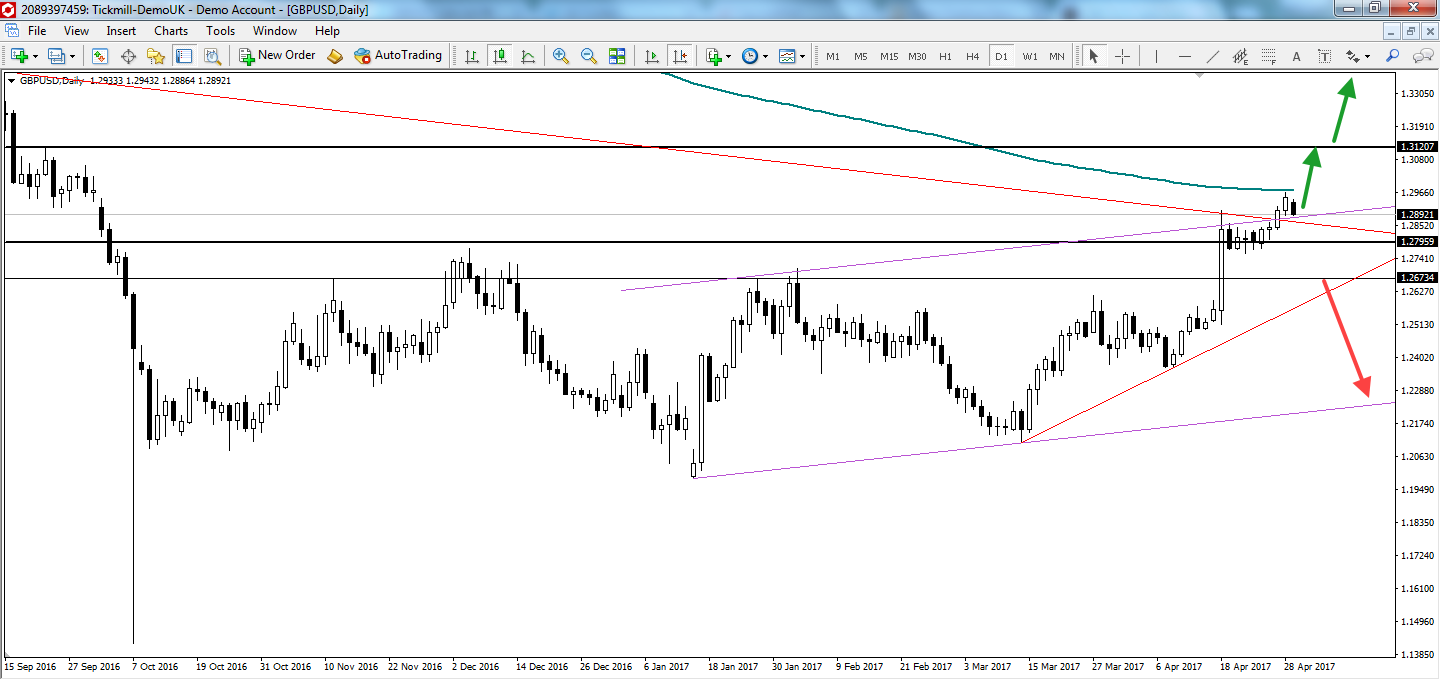

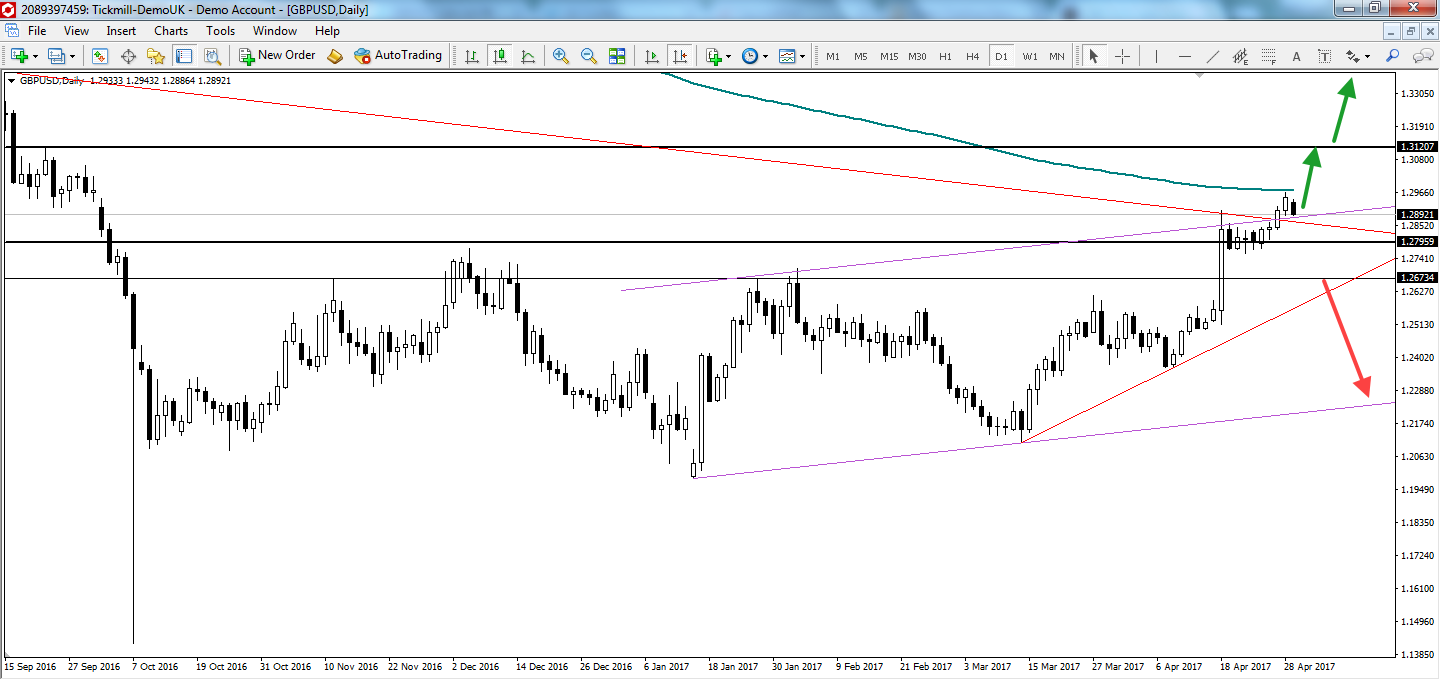

GBPUSD having a bearish candle today however, It is still above the Major Resistant 1.27959 (Low of July 6, 2016, 1 week later of Brexit) as well as above the lower low trendline (multiyear 2015-2016) .

So, bullish momentam of GBPUSD is still intact, But GBPUSD can revisit the 1.2773 area before reach the final trarget 1.31207 (low of June 27, a day after the brexit)

Check the screenshot for chart analysis.

So, bullish momentam of GBPUSD is still intact, But GBPUSD can revisit the 1.2773 area before reach the final trarget 1.31207 (low of June 27, a day after the brexit)

Check the screenshot for chart analysis.

Helping new traders

Uczestnik z Dec 31, 2014

102 postów

May 02, 2017 at 04:00

Uczestnik z Dec 31, 2014

102 postów

The GBPUSD was corrected lower yesterday bottomed at 1.2882. The bias is neutral in nearest term but as long as stay above 1.2780/50 I still prefer a bullish scenario at this phase with nearest target seen around 1.3050 area. Immediate support is seen around 1.2860. A clear break below that area could trigger further bearish pressure testing 1.2800 but only a clear break below 1.2780/50 would interrupt the double bottom bullish scenario.

Top Forex Robot

Uczestnik z Jul 10, 2014

1114 postów

May 02, 2017 at 14:22

Uczestnik z Jul 10, 2014

1114 postów

GBP/USD retraced back to 1.2860 and bounced off from that level after forming an inverted hammer candlestick on the one-hour time-frame. It is moving to the upside again and it will likely test the previous high at 1.2965.

Uczestnik z Dec 31, 2014

102 postów

May 03, 2017 at 08:40

Uczestnik z Dec 31, 2014

102 postów

The GBPUSD regained its bullish momentum yesterday topped at 1.2939 and hit 1.2946 earlier today in Asian session. The bias is bullish in nearest term testing 1.2965. A clear break above that area could trigger further bullish pressure testing 1.3000 – 1.3050 area as a part of the double bottom bullish scenario on daily chart. From an H1 chart perspective as you can see on my H1 chart below, price is consistently moving above the EMA 200 suggests a valid bullish trend. Immediate support is seen around 1.2910. A clear break below that area could lead price to neutral zone in nearest term testing 1.2865 but only a clear break back below 1.2780/50 would interrupt the double bottom bullish scenario.

Top Forex Robot

*Komercyjne wykorzystanie i spam są nieprawidłowe i mogą spowodować zamknięcie konta.

Wskazówka: opublikowanie adresu URL obrazu / YouTube automatycznie wstawi go do twojego postu!

Wskazówka: wpisz znak@, aby automatycznie wypełnić nazwę użytkownika uczestniczącego w tej dyskusji.