- Strona główna

- Społeczność

- Doświadczeni handlowcy

- Technical & Fundamental Analysis by Sold ECN Securities

Advertisement

Edit Your Comment

Technical & Fundamental Analysis by Sold ECN Securities

Uczestnik z Dec 08, 2021

325 postów

Feb 07, 2022 at 14:53

Uczestnik z Dec 08, 2021

325 postów

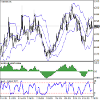

NZDUSD Market Update by Solid ECN Securities

Upward correction is likely to continue

Current trend

After the January decline to the levels of 0.654, the NZDUSD is being corrected with the target at 0.67 due to the emergence of investor interest in risky assets.

Reserve Bank of New Zealand governor Adrian Orr is likely to revert to a plan to tighten monetary policy by scaling back quantitative stimulus and raising interest rates to keep inflation from rising. The next meeting of the board of governors of the regulator will be held on February 23. Until then, the instrument will probably trade in a correction.

If there is information about a possible increase in the interest rate closer to the meeting, then the level of 0.67 may be broken upwards, which allows quotes to continue moving towards the key resistance level of 0.6864. Otherwise, the NZDUSD pair will remain under pressure.

Support and resistance

The long-term trend is downwards. At the end of January, the rate of the NZDUSD pair reached the support level of 0.654, which was held by the "bulls," which led to the development of a correctional model with the target at the level of 0.67. An additional factor indicating the continuation of the upward correction is the readings of the RSI indicator, which formed the Convergence signal.

The medium-term trend remains downward. Last week, the key resistance 0.6683–0.6669 was tested. If it is held, the decline will continue with the target at the low of January.

Resistance levels: 0.67, 0.6864, 0.7055.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 08, 2022 at 09:21

Uczestnik z Dec 08, 2021

325 postów

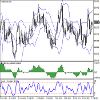

USDCAD market update by Solid ECN Securities

The pair is testing 1.2700 for a breakout

Current trend

The US dollar demonstrates active growth in pair with the Canadian currency during the trading in Asia, once again testing the level of 1.27 for a breakout.

The US currency received short-term support on Friday after the publication of a strong report on the labor market for January, which turned out to be much better than investors' forecasts. Strong data reinforced the belief of market participants that the US Fed may act more aggressively in choosing the vector of monetary policy. In particular, it is possible that at the March meeting of the regulator, the rate will be raised immediately by 50 basis points.

In turn, the Canadian report on the labor market, also released last Friday, was extremely disappointing.

Resistance levels: 1.27, 1.275, 1.2786, 1.2812.

Support levels: 1.265, 1.26, 1.2558, 1.25.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 08, 2022 at 09:35

Uczestnik z Dec 08, 2021

325 postów

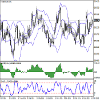

USDCHF Market Analysis by Solid ECN Securities

Consolidation in anticipation of new drivers

Yesterday, the quotes were supported by the publication of data on unemployment. At the end of January, the indicator fell from 2.4% to 2.3%, better than the market's neutral forecasts. The report on the labor market for January also surpassed the preliminary estimates of experts. In particular, Nonfarm Payrolls amounted to 467K, which was more than three times better than market expectations. Wage data also added optimism: hourly wages rose by 0.7% MoM and 5.7% YoY for January, which was better than analysts' forecasts of 0.5% and 5.2%.

On the daily chart, Bollinger bands are steadily growing.

The price range narrows slightly, remaining quite spacious for the current level of activity in the market. The MACD indicator reverses upwards, keeping a relatively strong buy signal. Stochastic shows a more confident upward trend but is rapidly approaching its highs, indicating that the US dollar may become overbought in the ultra-short term.

Resistance levels: 0.926, 0.9276, 0.93, 0.9341.

Support levels: 0.922, 0.92, 0.9177, 0.9157.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 09, 2022 at 16:01

Uczestnik z Dec 08, 2021

325 postów

USDJPY

The pair is aiming for the January high

Due to the difference in approaches to regulating monetary processes by the Bank of Japan and the US Federal Reserve, the USDJPY pair is strengthening its position and has now reached the level of 115.4, preparing to continue its upward trend towards 116.10.

The long-term trend is upwards. Yesterday, the price broke through the resistance level of 115.40, and the next growth target was 116.1, which breakout allows the quotes to rise to the 117 area.

The medium-term trend is upwards. Last week, the price reversed at the support level of 114.45. It renewed the local high at 115.60, which breakout will allow the rate to rise to the 116.25 area.

Resistance levels: 116.1, 117.

Support levels: 114.3, 113.5, 112.7.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 10, 2022 at 10:02

Uczestnik z Dec 08, 2021

325 postów

NZDUSD market insights by Solid ECN Securities

The pair is consolidation at local highs

The New Zealand dollar traded flat against the US dollar during the Asian session, holding near 0.668. The day before, NZDUSD showed active growth, updating local highs from January 26, in response to a general improvement in market sentiment.

In addition, the US currency remains under pressure ahead of today's publication of statistics on consumer inflation, as well as the monthly report on the state of the US budget for January. The market expects confirmation of a moderate increase in price pressure in the country, which will become an additional argument for the US Federal Reserve to tighten monetary policy. The start of the interest rate hike cycle is expected in March, but now the main question is how much the rate will be adjusted.

Tomorrow, investors will be focused on a block of statistics from New Zealand. In particular, traders expect January statistics on Electronic Card Retail Sales, as well as Business NZ PMI. The index is projected to moderately increase from 53.7 to 55.3 points.

Resistance levels: 0.67, 0.6732, 0.6761, 0.68.

Support levels: 0.665, 0.66, 0.6528, 0.65.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 10, 2022 at 11:22

Uczestnik z Dec 08, 2021

325 postów

AUDUSD market insights by Solid ECN Securities

Australia's economy is recovering steadily

The Australian currency demonstrates relative stability against the background of the neutrality of the US dollar, currently forming a local uptrend and trading around 0.7172.

Macroeconomic statistics coming from Australia indicate that the country's economy continues to recover from the effects of the coronavirus pandemic confidently.The index of building permits issued for January added 8.2%, which coincided with preliminary market estimates and exceeded the December increase of 2.6%. Thus, the probability that the Australian dollar will end the trading week with positive dynamics is quite high.

The situation in the currency pair may seriously change today after the publication of inflation data in the US. Investors are closely watching the dynamics of consumer prices in light of the possible start of a cycle of interest rate hikes by the US Federal Reserve in March this year. According to analysts, the figure will rise to 7.3%, surpassing the December value of 7.0%. If the forecast is implemented, the probability of a rate increase will increase significantly, locally supporting the US dollar, which has been trading almost neutral since Monday.

On the global chart, the price moves within a long downtrend. Technical indicators are in the state of a sell signal, which is already ready to change to an upward one: the EMA fluctuation range on the Alligator indicator is actively narrowing, and the AO histogram forms upward bars in the sell zone.

Resistance levels: 0.7227, 0.7415.

Support levels: 0.71, 0.698.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 10, 2022 at 14:54

Uczestnik z Dec 08, 2021

325 postów

GBPUSD Market insight by Solid ECN Securities

Consolidation ahead of the release of statistics from the USA

Now the price of the GBPUSD pair is trying to gain a foothold above 1.355, but a serious increase will be possible if the asset leaves the descending channel, breaking through the level of 1.361. At the same time, the targets of the upward dynamics will be 1.3732 and 1.3793. If the level of 1.3488 breaks down, the decline may continue to 1.3366 and 1.3300.

The indicators still do not give a single signal: the Bollinger Bands are horizontal, the MACD histogram is near the zero zone, its volumes are insignificant, and the Stochastic is directed downwards.

Resistance levels: 1.3610, 1.3732, 1.3793.

Support levels: 1.3488, 1.3366, 1.33.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 11, 2022 at 07:11

Uczestnik z Dec 08, 2021

325 postów

AUDUSD market insight by Solid ECN Securities

Australian currency updates local lows

The Australian dollar is developing a strong "bearish" momentum in tandem with the US currency, testing the level of 0.7120 for a breakdown and updating local lows from February 8.

In addition to technical correction factors at the end of the week, the downtrend was facilitated by strong macroeconomic statistics on inflation in the US, published the day before. The data showed a further acceleration in domestic consumer inflation to 7.5%, which is likely to require the US Federal Reserve to tighten monetary policy sooner during 2022. The start of the interest rate hike cycle is expected in March, when the quantitative easing (QE) program comes to an end.

The focus of investors today will also be on the Fed Monetary Policy Report and data on Michigan Consumer Sentiment Index for February.

Support and resistance

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is almost unchanged, but it remains rather spacious for the current level of activity in the market. MACD is reversing downwards preserving the previous weak buy signal. Stochastic, having rebounded from the level of "80" is declining, signaling in favor of the development of correctional dynamics in the ultra-short term.

Current showings of the indicators do not contradict the further development of the "bearish" trend in the short term.

Resistance levels: 0.716, 0.72, 0.7250, 0.73.

Support levels: 0.71, 0.705, 0.7, 0.695.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 11, 2022 at 08:37

Uczestnik z Dec 08, 2021

325 postów

GBPUSD market insights by Solid ECN Securities

Correction after the publication of US inflation data

Current trend

During the Asian session, the GBPUSD pair is falling, testing the level of 1.352 for a breakdown.

The development of corrective dynamics at the end of the week is due to the appearance of strong US statistics on inflation, which forces investors to act ahead of the curve. There is practically no doubt that the US Federal Reserve will start a cycle of raising interest rates during the March meeting. Now the whole question is how fast the US regulator will tighten its monetary policy and whether the risks of rising consumer prices were correctly assessed from the very beginning.

Meanwhile, British investors expect on Friday a block of macroeconomic statistics from the UK on GDP dynamics for the fourth quarter. Forecasts suggest some slowdown in the indicator from 6.8% to 6.4%. Also, December data on the dynamics of industrial production and an estimate of GDP growth rates from NIESR for January 2022 will be published during the day.

Support and resistance

On the daily chart, Bollinger Bands move flat. The price range narrows slightly, remaining quite spacious for the observed trading dynamics for the instrument. MACD falls, keeping a poor sell signal (the histogram is below the signal line). Stochastic shows a more confident decline, quickly approaching its lows, indicating that the pound may become oversold in the ultra-short term.

Resistance levels: 1.3550, 1.3600, 1.3650, 1.3700.

Support levels: 1.3500, 1.3460, 1.3435, 1.3400.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 11, 2022 at 10:47

Uczestnik z Dec 08, 2021

325 postów

USDCHF market insights by Solid ECN

The US currency received an impetus to grow

The US dollar shows active growth against the Swiss franc during the Asian session, testing 0.927 for a breakout. The day before, the instrument had already attempted a steady growth and even updated local highs from January 31 near the level of 0.93, but the dollar failed to consolidate on new highs.

Considerable support for the US currency is provided by macroeconomic statistics from the US on consumer inflation published the day before. In January, the Consumer Price Index rose by 0.6% in monthly terms and by 7.5% in annual terms, which turned out to be stronger than market forecasts at 0.5% and 7.3%, respectively. Consumer inflation excluding Food and Energy over the same period increased by 0.6% MoM and by 6% YoY, which also turned out to be higher than the growth by 0.1% projected in both cases.

Today, investors are awaiting the publication of Consumer Price Index in Switzerland for January. Market forecasts suggest that the rate of price growth will remain at the level of 1.5%.

Support and resistance

Bollinger Bands on the daily chart show a steady increase. The price range is narrowing, pointing at the ambiguous nature of trading in the short/medium term. MACD indicator is growing, while preserving a rather stable buy signal (located above the signal line). Stochastic, approaching the level of "80" reversed into a downward plane and so far practically does not react to the appearance of upward dynamics.

Resistance levels: 0.9276, 0.93, 0.9341, 0.9372.

Support levels: 0.926, 0.922, 0.92, 0.9177.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 11, 2022 at 11:05

Uczestnik z Dec 08, 2021

325 postów

EURUSD

The European currency shows an active decline against the US dollar during the Asian session, developing an extremely uncertain corrective trend that can be traced this week. EUR/USD is testing the level of 1.1380 for a breakdown and is located not far from the local lows of the previous day. The pressure on the instrument's positions intensified yesterday with the publication of statistics on consumer inflation in the US, which strengthened the belief that the US Federal Reserve can act faster in terms of tightening monetary policy. In January, the Consumer Price Index rose by 0.6% in monthly terms and by 7.5% in annual terms, which turned out to be stronger than market forecasts at 0.5% and 7.3%, respectively. Consumer Inflation excluding Food and Energy over the same period increased by 0.6% MoM and by 6% YoY, which also turned out to be higher than the growth by 0.1% projected in both cases. Investors today are focused on the January statistics on consumer inflation in Germany.

GBPUSD

The British pound is trading downward against the US currency during the morning session, testing 1.3520 for a breakdown. The development of corrective dynamics is due to the appearance of strong US statistics on inflation, which forces investors to act ahead of the curve. There is practically no doubt that the US Federal Reserve will start a cycle of raising interest rates during the March meeting. Now the question is how fast the US regulator will tighten its monetary policy and whether the risks of rising consumer prices were correctly assessed from the very beginning. Today, investors expect the release of a block of macroeconomic statistics from the UK on GDP dynamics for Q4 2021. Forecasts suggest some slowdown in the national economy from 6.8% to 6.4%. In addition, December data on the dynamics of Industrial Production and NIESR GDP Estimate for January 2022 will be published during the day.

AUDUSD

The Australian dollar is developing a strong "bearish" momentum in tandem with the US currency, testing the level of 0.7120 for a breakdown and updating local lows from February 8. In addition to technical correction factors at the end of the week, the downtrend was facilitated by strong macroeconomic statistics on inflation in the US, published the day before. The data showed a further acceleration in domestic consumer inflation to 7.5%, which is likely to require the US Federal Reserve to tighten monetary policy sooner during 2022. The start of the interest rate hike cycle is expected in March, when the quantitative easing (QE) program comes to an end. The focus of investors today will also be on the Fed Monetary Policy Report and data on Michigan Consumer Sentiment Index for February.

USDJPY

The US dollar shows weak growth against the Japanese yen in Asian trading, trying to consolidate above 116.00 and updating local highs since the beginning of the year. The day before, the US currency received a strong impetus to growth, reacting to data on the dynamics of consumer prices in the US, continuing to update record highs. It is likely that rising inflation will require the US Federal Reserve to take additional steps to tighten monetary policy, but so far the US regulator calls for a gradual and balanced approach. The dollar received additional support yesterday from the US Monthly Budget Statement for January, which showed a notable increase in the budget surplus by 119B dollars after a deficit of 21B dollars in December. Analysts were expecting a 25B dollar surplus.

XAUUSD

Gold prices are declining, correcting after the upward rally of January 31. Significant pressure on the instrument is exerted by macroeconomic statistics from the US on inflation for January, released the day before. Annual consumer price growth accelerated to 7.5%, the highest since 1982 and above average market forecasts of 7.3%. Rising inflationary pressures have led to a revision of a possible schedule for an interest rate hike in 2022. In particular, now most of the analysts expect a rate correction during the March meeting of the US Federal Reserve at once by 50 basis points.

The European currency shows an active decline against the US dollar during the Asian session, developing an extremely uncertain corrective trend that can be traced this week. EUR/USD is testing the level of 1.1380 for a breakdown and is located not far from the local lows of the previous day. The pressure on the instrument's positions intensified yesterday with the publication of statistics on consumer inflation in the US, which strengthened the belief that the US Federal Reserve can act faster in terms of tightening monetary policy. In January, the Consumer Price Index rose by 0.6% in monthly terms and by 7.5% in annual terms, which turned out to be stronger than market forecasts at 0.5% and 7.3%, respectively. Consumer Inflation excluding Food and Energy over the same period increased by 0.6% MoM and by 6% YoY, which also turned out to be higher than the growth by 0.1% projected in both cases. Investors today are focused on the January statistics on consumer inflation in Germany.

GBPUSD

The British pound is trading downward against the US currency during the morning session, testing 1.3520 for a breakdown. The development of corrective dynamics is due to the appearance of strong US statistics on inflation, which forces investors to act ahead of the curve. There is practically no doubt that the US Federal Reserve will start a cycle of raising interest rates during the March meeting. Now the question is how fast the US regulator will tighten its monetary policy and whether the risks of rising consumer prices were correctly assessed from the very beginning. Today, investors expect the release of a block of macroeconomic statistics from the UK on GDP dynamics for Q4 2021. Forecasts suggest some slowdown in the national economy from 6.8% to 6.4%. In addition, December data on the dynamics of Industrial Production and NIESR GDP Estimate for January 2022 will be published during the day.

AUDUSD

The Australian dollar is developing a strong "bearish" momentum in tandem with the US currency, testing the level of 0.7120 for a breakdown and updating local lows from February 8. In addition to technical correction factors at the end of the week, the downtrend was facilitated by strong macroeconomic statistics on inflation in the US, published the day before. The data showed a further acceleration in domestic consumer inflation to 7.5%, which is likely to require the US Federal Reserve to tighten monetary policy sooner during 2022. The start of the interest rate hike cycle is expected in March, when the quantitative easing (QE) program comes to an end. The focus of investors today will also be on the Fed Monetary Policy Report and data on Michigan Consumer Sentiment Index for February.

USDJPY

The US dollar shows weak growth against the Japanese yen in Asian trading, trying to consolidate above 116.00 and updating local highs since the beginning of the year. The day before, the US currency received a strong impetus to growth, reacting to data on the dynamics of consumer prices in the US, continuing to update record highs. It is likely that rising inflation will require the US Federal Reserve to take additional steps to tighten monetary policy, but so far the US regulator calls for a gradual and balanced approach. The dollar received additional support yesterday from the US Monthly Budget Statement for January, which showed a notable increase in the budget surplus by 119B dollars after a deficit of 21B dollars in December. Analysts were expecting a 25B dollar surplus.

XAUUSD

Gold prices are declining, correcting after the upward rally of January 31. Significant pressure on the instrument is exerted by macroeconomic statistics from the US on inflation for January, released the day before. Annual consumer price growth accelerated to 7.5%, the highest since 1982 and above average market forecasts of 7.3%. Rising inflationary pressures have led to a revision of a possible schedule for an interest rate hike in 2022. In particular, now most of the analysts expect a rate correction during the March meeting of the US Federal Reserve at once by 50 basis points.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 11, 2022 at 14:19

Uczestnik z Dec 08, 2021

325 postów

NZDUSD

The US dollar takes the lead in the pair

The New Zealand currency continues to trade without pronounced dynamics amid growing tensions caused by coronavirus restrictions. At the moment, the NZDUSD pair is close to 0.6635.

At the end of January, New Zealand moved to the maximum "red" alert level due to the discovery of 12 cases of infection with the Omicron strain, as a result of which the government tightened quarantine restrictions. Hundreds of protesters took to the streets in Wellington to blockade the streets leading to the New Zealand Parliament against mandatory vaccinations and new sanitary measures. However, Prime Minister Jacinda Ardern said the protesters did not represent the views of the majority of the population. Currently, the focus of the spread of infection is recorded in Auckland. Despite the difficult epidemiological situation, the country's economy slowly recovers.

Only the manufacturing sector is lagging. Consumer activity for the same period, on the contrary, increased, and the volume of retail sales using electronic cards increased.

The USD Index was able to break the narrow sideways range and began to rise again, reaching the level of 96. The main factor supporting the US dollar was the January report on consumer prices, which reached 7.5%, significantly exceeding 7.0% in December. Also, to rising inflation, the labor market showed positive results. Thus, these data indicate that the US Federal Reserve has almost no other choice but to raise interest rates already during the March meeting.

Support and resistance

The asset moves within the global downtrend. Technical indicators keep a sell signal: fast EMAs on the Alligator indicator are below the signal line, and the AO oscillator histogram forms local rising bars in the sell zone.

Support levels: 0.6602, 0.647.

Resistance levels: 0.6705, 0.686.

The US dollar takes the lead in the pair

The New Zealand currency continues to trade without pronounced dynamics amid growing tensions caused by coronavirus restrictions. At the moment, the NZDUSD pair is close to 0.6635.

At the end of January, New Zealand moved to the maximum "red" alert level due to the discovery of 12 cases of infection with the Omicron strain, as a result of which the government tightened quarantine restrictions. Hundreds of protesters took to the streets in Wellington to blockade the streets leading to the New Zealand Parliament against mandatory vaccinations and new sanitary measures. However, Prime Minister Jacinda Ardern said the protesters did not represent the views of the majority of the population. Currently, the focus of the spread of infection is recorded in Auckland. Despite the difficult epidemiological situation, the country's economy slowly recovers.

Only the manufacturing sector is lagging. Consumer activity for the same period, on the contrary, increased, and the volume of retail sales using electronic cards increased.

The USD Index was able to break the narrow sideways range and began to rise again, reaching the level of 96. The main factor supporting the US dollar was the January report on consumer prices, which reached 7.5%, significantly exceeding 7.0% in December. Also, to rising inflation, the labor market showed positive results. Thus, these data indicate that the US Federal Reserve has almost no other choice but to raise interest rates already during the March meeting.

Support and resistance

The asset moves within the global downtrend. Technical indicators keep a sell signal: fast EMAs on the Alligator indicator are below the signal line, and the AO oscillator histogram forms local rising bars in the sell zone.

Support levels: 0.6602, 0.647.

Resistance levels: 0.6705, 0.686.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 14, 2022 at 08:20

Uczestnik z Dec 08, 2021

325 postów

EURUSD market update

The euro weakens after the statements of the President of the ECB

The European currency shows an uncertain growth against the US dollar during the Asian session, trying to correct after a sharp decline last Friday, when the instrument updated the local lows of February 3.

The sharp weakening of the single currency was facilitated by the words of the President of the European Central Bank (ECB), Christine Lagarde, that raising the rate at the moment will not help reduce price pressure, but will only lead to a further slowdown in the economy and, ultimately, simply harm it. Investors took this statement as another signal that the difference in the monetary policies of the US Federal Reserve and the ECB will increase significantly this year. The conservative forecast for the American regulator assumes a rate hike of 1–1.75% during 2022, while the ECB is expected to raise interest rates by only 50 basis points this year at best.

Last Friday's macroeconomic statistics from Germany did not have a noticeable effect on the instrument's dynamics. As expected, consumer inflation in January remained unchanged at 0.4% MoM and 4.9% YoY.

Support and resistance

Bollinger Bands in D1 chart show weak growth. The price range is narrowed, being spacious enough for the current activity level in the market. MACD is going down preserving a stable sell signal (located below the signal line). Stochastic keeps a downward direction but is already approaching its lows, which indicates the risks of oversold EUR in the ultra-short term.

Resistance levels: 1.1363, 1.14, 1.145, 1.15.

Support levels: 1.1300, 1.1255, 1.122, 1.1185.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 14, 2022 at 09:20

Uczestnik z Dec 08, 2021

325 postów

NZDUSD market insights by Solid ECN Securities

The instrument develops a downward trend

The pressure on the positions of the New Zealand dollar, also to the growth of the US currency, is exerted by poor macroeconomic statistics from New Zealand. At the beginning of the new week, the macroeconomic background remains mostly negative. Thus, the index of activity in the services sector from Business NZ for January fell from 49.8 to 45.9 points, which was worse than the average expectations of analysts.

Support and resistance

On the daily chart, Bollinger bands smoothly reverse into a horizontal plane. The price range narrows, reflecting the ambiguous nature of trading in the short term. The MACD indicator reverses downwards, forming a new sell signal (the histogram tries to consolidate below the signal line). Stochastic shows similar dynamics but the indicator line rapidly approaches its lows, indicating that the instrument may become oversold in the ultra-short term.

Resistance levels: 0.665, 0.67, 0.6732, 0.6761.

Support levels: 0.66, 0.6528, 0.65, 0.645.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 14, 2022 at 09:46

Uczestnik z Dec 08, 2021

325 postów

USDCAD Market Update by Solid ECN Securities

Interest rate hike risks support the US dollar

The US dollar shows ambiguous dynamics of trading against the Canadian currency during today's Asian session, holding near 1.273.

The instrument managed to demonstrate a moderate positive trend at the end of last week, which was supported by expectations of a further increase in the interest rate by the US Fed against the backdrop of a sharp rise in inflation in the country by 7.5%, which is the highest level since February 1982.

The Canadian dollar, in turn, is still under pressure from a weak report on the labor market, released at the beginning of the month, and expects new drivers for possible growth. On Wednesday, Canada will release a block of macroeconomic statistics on the dynamics of consumer prices in January. On the same day, Timothy Lane, the member of the Board of Governors of the Bank of Canada, will make a speech.

Support and resistance

Bollinger Bands in D1 chart show weak growth. The price range is actively narrowing, pointing at the ambiguous nature of trading in the short term. MACD is growing preserving a weak buy signal (located above the signal line). Stochastic grows more steadily but is rapidly approaching its highs, which reflects risks of the overbought USD in the ultra-short term.

Resistance levels: 1.275, 1.2786, 1.2812, 1.285.

Support levels: 1.27, 1.265, 1.26, 1.2558.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 14, 2022 at 10:00

Uczestnik z Dec 08, 2021

325 postów

GBPUSD market update by Solid ECn Securities

UK GDP statistics disappointed the market

The UK currency continues unsuccessful attempts to consolidate in the uptrend. The ambiguous macroeconomic statistics do not allow the pound to strengthen its positions, and at the moment, the GBPUSD pair is trading within a sideways trend around 1.3543.

The asset's dynamics may maintain until the end of the day since the US Federal Reserve announced an extraordinary meeting of the regulator's managers tonight, the results of which will determine the direction of the pair movement. As stated, the meeting will be held following the accelerated procedures, and it is expected to consider the issue of changing rates. Most analysts agree that holding the meeting right now is an attempt by the regulator to justify its impotence and lost time, which led to a historical rise in inflation to 7.5%. Experts suggest that the department will not dare to adjust the indicators today but publish a schedule of increases soon.

Support and resistance

The instrument is traded within the global downward channel, forming a local sideways channel. Technical indicators keep a poor buy signal: fast EMAs on the Alligator indicator are above the signal one, and the AO oscillator histogram is trading close to the transition level.

Resistance levels: 1.3600, 1.372.

Support levels: 1.3504, 1.3366.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 14, 2022 at 10:12

Uczestnik z Dec 08, 2021

325 postów

USDJPY market insights by Solid ECN Securities

US Fed may raise rates today

Due to the stabilization of the US currency, the USDJPY pair is correcting around the level of 115.5.

Yesterday, the Japanese currency made a significant leap after the Bank of Japan announced the first purchase of government debt bonds (JGB) in the last three years. Previously, such an operation was carried out at the end of July 2018. According to the regulator, the buyback will be carried out in an unlimited amount on Monday to keep long-term interest rates under control. The main reason for this move is that the underlying yield of the 10-year JGB bonds approached the upper limit of 0.25%, amounting to 0.23%. The policy of the Bank of Japan suggests that the rate on these bonds should be close to zero, but this does not happen, as a result of which the regulator decided to intervene.

Today may become one of the most volatile for the financial markets since it is on February 14 that the US Federal Reserve has scheduled its emergency meeting. The American regulator decided to discuss the issue of interest rates ahead of the usual schedule, according to which the next meeting should be held in March.

According to the US regulator, the reason for holding the meeting accelerated was the increase in inflation to 7.5% from 7.0% a month earlier. If the rate is raised today, the dollar could significantly leap upwards.

Support and resistance

The asset is correcting within the rising global channel, approaching the resistance line. Technical indicators keep a stable buy signal: fast EMAs on the Alligator indicator are above the signal line, and the AO oscillator histogram forms upward bars.

Resistance levels: 116.1, 117.8.

Support levels: 114.6, 113.5.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 14, 2022 at 11:07

Uczestnik z Dec 08, 2021

325 postów

S&P 500 Market insights by Solid ECN Securities

Investors are waiting for signals from the US Fed

The S&P 500 is correcting lower, trading at 4425 amid a disappointing inflation report. Consumer prices in the US rose by 7.5% in annual terms, which is a significant obstacle to the development of national business. Such a high figure cancels out almost all the profits that companies show, and in this regard, today's emergency meeting of the US Federal Reserve is seen as the only support measure.

The growth leaders in the index are Newell Brands Inc. (+11.07%), Baker Hughes Co. (+6.20%), Occidental Petroleum Corp. (+5.65%). Among the leaders of the decline are Under Armour A (-12.49%), Under Armour C (-11.37%), AMD Inc. (-10.01%).

Support and resistance

The index quotes are trading in a local downtrend, forming another wave of decline. Technical indicators are still in the state of a weak sell signal: the fluctuation range of the Alligator indicator EMAs is actively narrowing and the histogram of the AO oscillator is trading in the sales area, approaching the transition level.

Support levels: 4400, 4265.

Resistance levels: 4462, 4580.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 14, 2022 at 16:21

Uczestnik z Dec 08, 2021

325 postów

Microsoft Corp. market insights by Solid ECN Securities

The price has set new local lows

At the end of January, Microsoft Corp. reported for Q2 2022. Revenue grew by 20%, exceeding the expectations of The Wall Street analysts. The company sees steady demand for its cloud computing and productivity software. Thus, the Azure cloud infrastructure platform increased revenue by 46%, and commercial revenue from Office 365 increased by 19%. In general, the corporation is becoming more and more profitable, expanding its activities around the world. Operating and net profit increased by 24% and 21%. Earnings per share rose 22% to 2.48 dollars, also exceeding market expectations of 2.31 dollars.

Support and resistance

There is a corrective movement in the company's shares, the instrument has set new local lows, and at the moment the quotes are consolidating. The key range is 292-317. The instrument has the potential to further correction. Indicators point out the strength of sellers: the price has fixed below MA (50) and MA (200), the MACD histogram has started to decline again. Positions are to be opened from key levels.

Comparing company's multiplier with its competitors in the industry, we can say that #MSFT shares are neutral.

Resistance levels: 306, 317, 323.5.

Support levels: 292, 281, 272.

Solid ECN, a True ECN Broker

Uczestnik z Dec 08, 2021

325 postów

Feb 15, 2022 at 06:58

Uczestnik z Dec 08, 2021

325 postów

Crude Oil market insight by Solid ECN Securities

Prices renew record highs

At the beginning of the week, the quotes of "black gold" approached the level of 96.00 for the first time since October 2014, reacting to a further escalation of tension in Eastern Europe. In particular, due to the situation around Ukraine, there were concerns among traders about the export of Russian oil and the introduction of new Western sanctions.

During the day, the US will release statistics on manufacturing inflation and publish the traditional report from the American Petroleum Institute (API) on stocks for February 11. The previous report showed a decrease of 2.025M barrels.

Support and resistance

Bollinger bands show steady growth on the daily chart: the price range expands from above but not as fast as the "bullish" sentiment develops. MACD grows, keeping a poor buy signal and above the signal line. Stochastic demonstrates similar dynamics, but the indicator line is close to its highs, reflecting that the instrument may become overbought in the ultra-short term.

Resistance levels: 94.5, 95.5, 96.5, 97.5.

Support levels: 93.34, 92, 91, 90.

Solid ECN, a True ECN Broker

*Komercyjne wykorzystanie i spam są nieprawidłowe i mogą spowodować zamknięcie konta.

Wskazówka: opublikowanie adresu URL obrazu / YouTube automatycznie wstawi go do twojego postu!

Wskazówka: wpisz znak@, aby automatycznie wypełnić nazwę użytkownika uczestniczącego w tej dyskusji.