- Strona główna

- Społeczność

- Nowi Handlowcy

- Martingale vs Non Martingale simplified mathematic compariso...

Advertisement

Edit Your Comment

Martingale vs Non Martingale simplified mathematic comparison.

Feb 11, 2015 at 06:54

Uczestnik z Apr 05, 2014

33 postów

Martingale: The gambler doubles his bet after every loss...

Martingale vs. Non Martingale (Simplified RoR vs Profit in 3 trade runs with all possibilities worked out)

Lets take a very small run and calculate all possibilities. We will start with 4 units to risk over 3 trades with 8 possible total outcomes all worked out to provide an over all EV of 3 trades. The system has a 50% chance of winning and wins 1.1x risk when it wins. Lets define Risk of Ruin as losing 75% of the 4 unit start account. Of course we don't normally only make 3 trades and risk such a high proportion of our risk capitol but I will show later how the conclusions hold true to some degree when we add trades or increase our edge or reduce risk or reduce the martingale multiplier.

Standard risk 0.43 unit on each trade NON martingale:

sum “L” “L” “L”

-1.29 -0.43 -0.43 -0.43

“W” “L” “L”

-0.39 0.47 -0.43 -0.43

“L” “W” “L”

-0.39 -0.43 0.47 -0.43

“W” “W” “L”

0.52 0.47 0.47 -0.43

“L” “L” “W”

-0.39 -0.43 -0.43 0.47

“W” “L” “W”

0.52 0.47 -0.43 0.47

“L” “W” “W”

0.52 -0.43 0.47 0.47

“W” “W” “W”

1.42 0.47 0.47 0.47

EV of 8 runs 0.52

Martingale (2x) start risk 0.43 unit:

sum “L” “L” “L”

-3.01 -0.43 -0.86 -1.72

“W” “L” “L”

-0.82 0.47 -0.43 -0.86

“L” “W” “L”

0.09 -0.43 0.95 -0.43

“W” “W” “L”

0.52 0.47 0.47 -0.43

“L” “L” “W”

0.60 -0.43 -0.86 1.89

“W” “L” “W”

0.99 0.47 -0.43 0.95

“L” “W” “W”

0.99 -0.43 0.95 0.47

“W” “W” “W”

1.42 0.47 0.47 0.47

EV of 8 runs 0.77

Hey the Martingale really is more profitable! Well, of course it is, we have taken on more risk so it's not a fair comparison. Notice in the martingale we have 1 run that is -3 units. -3 units from our start balance of 4 is a ruin. 1 ruin in 8 is a 12.5% RoR. Lets boost our risk on the NON Martingale run so it too has a 12.5% RoR.

Standard Risk 1 NON Martingale

sum “L” “L” “L”

-3.00 -1.00 -1.00 -1.00

“W” “L” “L”

-0.90 1.10 -1.00 -1.00

“L” “W” “L”

-0.90 -1.00 1.10 -1.00

“W” “W” “L”

1.20 1.10 1.10 -1.00

“L” “L” “W”

-0.90 -1.00 -1.00 1.10

“W” “L” “W”

1.20 1.10 -1.00 1.10

“L” “W” “W”

1.20 -1.00 1.10 1.10

“W” “W” “W”

3.30 1.10 1.10 1.10

EV of 8 runs 1.20

OK, there we have it, NON Martingale is miles ahead of Martingale in EV when we compare strategies with the same RoR. What if we reduce the Martingale Multiplier? Apparently, 1.5 multiplier and a 0.63 start size gives us a 12.5% RoR so we can compare....

Martingale (1.5x) start risk 0.63

sum “L” “L” “L”

-2.99 -0.63 -0.95 -1.42

“W” “L” “L”

-0.88 0.69 -0.63 -0.95

“L” “W” “L”

-0.22 -0.63 1.04 -0.63

“W” “W” “L”

0.76 0.69 0.69 -0.63

“L” “L” “W”

-0.02 -0.63 -0.95 1.56

“W” “L” “W”

1.10 0.69 -0.63 1.04

“L” “W” “W”

1.10 -0.63 1.04 0.69

“W” “W” “W”

2.08 0.69 0.69 0.69

EV of 8 runs 0.93

Still no dice for Marty. The best EV to RoR ratio is non martingale. What if we increase the edge of the actual system? Lets bring it from 1.1 to 1.5...

Martingale (1.5x) start risk 0.63

sum “L” “L” “L”

-2.99 -0.63 -0.95 -1.42

“W” “L” “L”

-0.63 0.95 -0.63 -0.95

“L” “W” “L”

0.16 -0.63 1.42 -0.63

“W” “W” “L”

1.26 0.95 0.95 -0.63

“L” “L” “W”

0.55 -0.63 -0.95 2.13

“W” “L” “W”

1.73 0.95 -0.63 1.42

“L” “W” “W”

1.73 -0.63 1.42 0.95

“W” “W” “W”

2.84 0.95 0.95 0.95

EV of 8 runs 4.65

Standard Risk 1 NON Martingale

sum “L” “L” “L”

-3.00 -1.00 -1.00 -1.00

“W” “L” “L”

-0.50 1.50 -1.00 -1.00

“L” “W” “L”

-0.50 -1.00 1.50 -1.00

“W” “W” “L”

2.00 1.50 1.50 -1.00

“L” “L” “W”

-0.50 -1.00 -1.00 1.50

“W” “L” “W”

2.00 1.50 -1.00 1.50

“L” “W” “W”

2.00 -1.00 1.50 1.50

“W” “W” “W”

4.50 1.50 1.50 1.50

EV of 8 runs 6.00

Again the best EV comes from NON Martingale. Can we do even better if we reduce risk after a loss instead of increasing it? Lets try a simple percentage risk of current equity strategy. Apparently we can achieve a RoR of 12.5% by risking 37% of current equity on each trade...

Percentage Risk 37% (NON Martingale)

sum “L” first trade bal “L” 2nd bal “L” fin bal

-3.00 -1.48 2.52 -0.93 1.59 -0.59 1.00

“W”

“L”

“L”

-1.53 2.22 6.22 -2.30 3.92 -1.45 2.47

“L”

“W”

“L”

-1.53 -1.48 2.52 1.40 3.92 -1.45 2.47

“W”

“W”

“L”

2.09 2.22 6.22 3.45 9.67 -3.58 6.09

sum “L” first trade bal “L” 2nd bal “W” fin bal

-1.53 -1.48 2.52 -0.93 1.59 0.88 2.47

“W”

“L”

“W”

2.09 2.22 6.22 -2.30 3.92 2.17 6.09

“L”

“W”

“W”

2.09 -1.48 2.52 1.40 3.92 2.17 6.09

“W”

“W”

“W”

11.04 2.22 6.22 3.45 9.67 5.37 15.04

EV of 8 runs 9.73

OK so the percent risk strategy has double the EV as a 1.5x Martingale strategy of the same RoR. OK well, what if we redefine RoR to be only -0.25(6.25% dd)? That should give us more realistic risk compared to start capitol.

Percentage Risk 2.1% (NON Martingale)

sum “L” first trade bal “L” 2nd bal “L” fin bal

-0.25 -0.08 3.92 -0.08 3.83 -0.08 3.75

“W”

“L”

“L”

-0.05 0.13 4.13 -0.09 4.04 -0.08 3.95

“L”

“W”

“L”

-0.05 -0.08 3.92 0.12 4.04 -0.08 3.95

“W”

“W”

“L”

0.17 0.13 4.13 0.13 4.26 -0.09 4.17

sum “L” first trade bal “L” 2nd bal “W” fin bal

-0.05 -0.08 3.92 -0.08 3.83 0.12 3.95

“W”

“L”

“W”

0.17 0.13 4.13 -0.09 4.04 0.13 4.17

“L”

“W”

“W”

0.17 -0.08 3.92 0.12 4.04 0.13 4.17

“W”

“W”

“W”

0.39 0.13 4.13 0.13 4.26 0.13 4.39

EV of 8 runs 0.51

Martingale (1.5x) start risk 0.052

sum “L” “L” “L”

-0.25 -0.05 -0.08 -0.12

“W” “L” “L”

-0.05 0.08 -0.05 -0.08

“L” “W” “L”

0.01 -0.05 0.12 -0.05

“W” “W” “L”

0.10 0.08 0.08 -0.05

“L” “L” “W”

0.05 -0.05 -0.08 0.18

“W” “L” “W”

0.14 0.08 -0.05 0.12

“L” “W” “W”

0.14 -0.05 0.12 0.08

“W” “W” “W”

0.23 0.08 0.08 0.08

EV of 8 runs 0.38

Martingale loses again but here we can see the EV differences starting to get more subtle. We now know that if we want to increase profits by accepting more risk, we are always better off taking additional risk by increasing our percent risk of equity than we are switching to a Martingale.

Martingale vs. Non Martingale (Simplified RoR vs Profit in 3 trade runs with all possibilities worked out)

Lets take a very small run and calculate all possibilities. We will start with 4 units to risk over 3 trades with 8 possible total outcomes all worked out to provide an over all EV of 3 trades. The system has a 50% chance of winning and wins 1.1x risk when it wins. Lets define Risk of Ruin as losing 75% of the 4 unit start account. Of course we don't normally only make 3 trades and risk such a high proportion of our risk capitol but I will show later how the conclusions hold true to some degree when we add trades or increase our edge or reduce risk or reduce the martingale multiplier.

Standard risk 0.43 unit on each trade NON martingale:

sum “L” “L” “L”

-1.29 -0.43 -0.43 -0.43

“W” “L” “L”

-0.39 0.47 -0.43 -0.43

“L” “W” “L”

-0.39 -0.43 0.47 -0.43

“W” “W” “L”

0.52 0.47 0.47 -0.43

“L” “L” “W”

-0.39 -0.43 -0.43 0.47

“W” “L” “W”

0.52 0.47 -0.43 0.47

“L” “W” “W”

0.52 -0.43 0.47 0.47

“W” “W” “W”

1.42 0.47 0.47 0.47

EV of 8 runs 0.52

Martingale (2x) start risk 0.43 unit:

sum “L” “L” “L”

-3.01 -0.43 -0.86 -1.72

“W” “L” “L”

-0.82 0.47 -0.43 -0.86

“L” “W” “L”

0.09 -0.43 0.95 -0.43

“W” “W” “L”

0.52 0.47 0.47 -0.43

“L” “L” “W”

0.60 -0.43 -0.86 1.89

“W” “L” “W”

0.99 0.47 -0.43 0.95

“L” “W” “W”

0.99 -0.43 0.95 0.47

“W” “W” “W”

1.42 0.47 0.47 0.47

EV of 8 runs 0.77

Hey the Martingale really is more profitable! Well, of course it is, we have taken on more risk so it's not a fair comparison. Notice in the martingale we have 1 run that is -3 units. -3 units from our start balance of 4 is a ruin. 1 ruin in 8 is a 12.5% RoR. Lets boost our risk on the NON Martingale run so it too has a 12.5% RoR.

Standard Risk 1 NON Martingale

sum “L” “L” “L”

-3.00 -1.00 -1.00 -1.00

“W” “L” “L”

-0.90 1.10 -1.00 -1.00

“L” “W” “L”

-0.90 -1.00 1.10 -1.00

“W” “W” “L”

1.20 1.10 1.10 -1.00

“L” “L” “W”

-0.90 -1.00 -1.00 1.10

“W” “L” “W”

1.20 1.10 -1.00 1.10

“L” “W” “W”

1.20 -1.00 1.10 1.10

“W” “W” “W”

3.30 1.10 1.10 1.10

EV of 8 runs 1.20

OK, there we have it, NON Martingale is miles ahead of Martingale in EV when we compare strategies with the same RoR. What if we reduce the Martingale Multiplier? Apparently, 1.5 multiplier and a 0.63 start size gives us a 12.5% RoR so we can compare....

Martingale (1.5x) start risk 0.63

sum “L” “L” “L”

-2.99 -0.63 -0.95 -1.42

“W” “L” “L”

-0.88 0.69 -0.63 -0.95

“L” “W” “L”

-0.22 -0.63 1.04 -0.63

“W” “W” “L”

0.76 0.69 0.69 -0.63

“L” “L” “W”

-0.02 -0.63 -0.95 1.56

“W” “L” “W”

1.10 0.69 -0.63 1.04

“L” “W” “W”

1.10 -0.63 1.04 0.69

“W” “W” “W”

2.08 0.69 0.69 0.69

EV of 8 runs 0.93

Still no dice for Marty. The best EV to RoR ratio is non martingale. What if we increase the edge of the actual system? Lets bring it from 1.1 to 1.5...

Martingale (1.5x) start risk 0.63

sum “L” “L” “L”

-2.99 -0.63 -0.95 -1.42

“W” “L” “L”

-0.63 0.95 -0.63 -0.95

“L” “W” “L”

0.16 -0.63 1.42 -0.63

“W” “W” “L”

1.26 0.95 0.95 -0.63

“L” “L” “W”

0.55 -0.63 -0.95 2.13

“W” “L” “W”

1.73 0.95 -0.63 1.42

“L” “W” “W”

1.73 -0.63 1.42 0.95

“W” “W” “W”

2.84 0.95 0.95 0.95

EV of 8 runs 4.65

Standard Risk 1 NON Martingale

sum “L” “L” “L”

-3.00 -1.00 -1.00 -1.00

“W” “L” “L”

-0.50 1.50 -1.00 -1.00

“L” “W” “L”

-0.50 -1.00 1.50 -1.00

“W” “W” “L”

2.00 1.50 1.50 -1.00

“L” “L” “W”

-0.50 -1.00 -1.00 1.50

“W” “L” “W”

2.00 1.50 -1.00 1.50

“L” “W” “W”

2.00 -1.00 1.50 1.50

“W” “W” “W”

4.50 1.50 1.50 1.50

EV of 8 runs 6.00

Again the best EV comes from NON Martingale. Can we do even better if we reduce risk after a loss instead of increasing it? Lets try a simple percentage risk of current equity strategy. Apparently we can achieve a RoR of 12.5% by risking 37% of current equity on each trade...

Percentage Risk 37% (NON Martingale)

sum “L” first trade bal “L” 2nd bal “L” fin bal

-3.00 -1.48 2.52 -0.93 1.59 -0.59 1.00

“W”

“L”

“L”

-1.53 2.22 6.22 -2.30 3.92 -1.45 2.47

“L”

“W”

“L”

-1.53 -1.48 2.52 1.40 3.92 -1.45 2.47

“W”

“W”

“L”

2.09 2.22 6.22 3.45 9.67 -3.58 6.09

sum “L” first trade bal “L” 2nd bal “W” fin bal

-1.53 -1.48 2.52 -0.93 1.59 0.88 2.47

“W”

“L”

“W”

2.09 2.22 6.22 -2.30 3.92 2.17 6.09

“L”

“W”

“W”

2.09 -1.48 2.52 1.40 3.92 2.17 6.09

“W”

“W”

“W”

11.04 2.22 6.22 3.45 9.67 5.37 15.04

EV of 8 runs 9.73

OK so the percent risk strategy has double the EV as a 1.5x Martingale strategy of the same RoR. OK well, what if we redefine RoR to be only -0.25(6.25% dd)? That should give us more realistic risk compared to start capitol.

Percentage Risk 2.1% (NON Martingale)

sum “L” first trade bal “L” 2nd bal “L” fin bal

-0.25 -0.08 3.92 -0.08 3.83 -0.08 3.75

“W”

“L”

“L”

-0.05 0.13 4.13 -0.09 4.04 -0.08 3.95

“L”

“W”

“L”

-0.05 -0.08 3.92 0.12 4.04 -0.08 3.95

“W”

“W”

“L”

0.17 0.13 4.13 0.13 4.26 -0.09 4.17

sum “L” first trade bal “L” 2nd bal “W” fin bal

-0.05 -0.08 3.92 -0.08 3.83 0.12 3.95

“W”

“L”

“W”

0.17 0.13 4.13 -0.09 4.04 0.13 4.17

“L”

“W”

“W”

0.17 -0.08 3.92 0.12 4.04 0.13 4.17

“W”

“W”

“W”

0.39 0.13 4.13 0.13 4.26 0.13 4.39

EV of 8 runs 0.51

Martingale (1.5x) start risk 0.052

sum “L” “L” “L”

-0.25 -0.05 -0.08 -0.12

“W” “L” “L”

-0.05 0.08 -0.05 -0.08

“L” “W” “L”

0.01 -0.05 0.12 -0.05

“W” “W” “L”

0.10 0.08 0.08 -0.05

“L” “L” “W”

0.05 -0.05 -0.08 0.18

“W” “L” “W”

0.14 0.08 -0.05 0.12

“L” “W” “W”

0.14 -0.05 0.12 0.08

“W” “W” “W”

0.23 0.08 0.08 0.08

EV of 8 runs 0.38

Martingale loses again but here we can see the EV differences starting to get more subtle. We now know that if we want to increase profits by accepting more risk, we are always better off taking additional risk by increasing our percent risk of equity than we are switching to a Martingale.

Feb 12, 2015 at 12:04

Uczestnik z Apr 05, 2014

33 postów

The Illusion of Profit

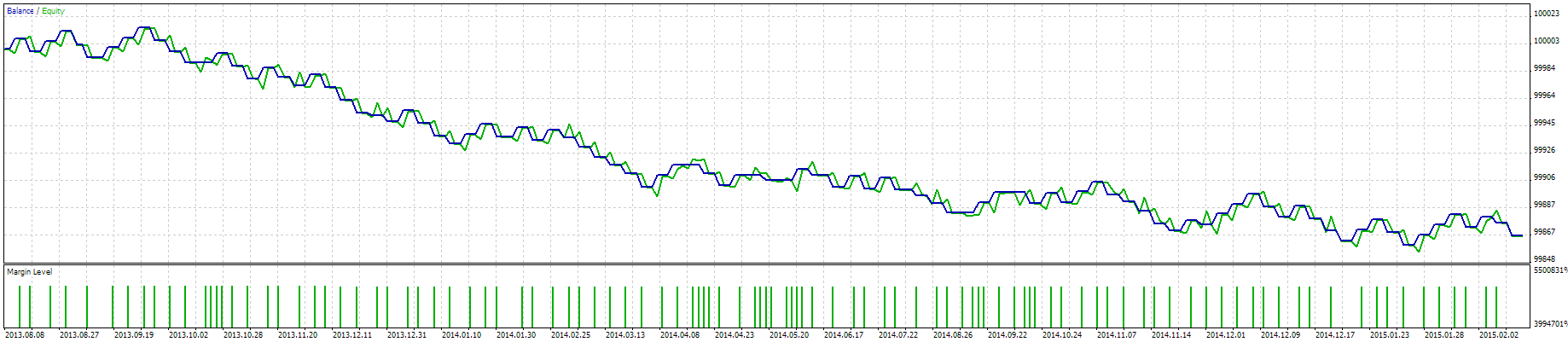

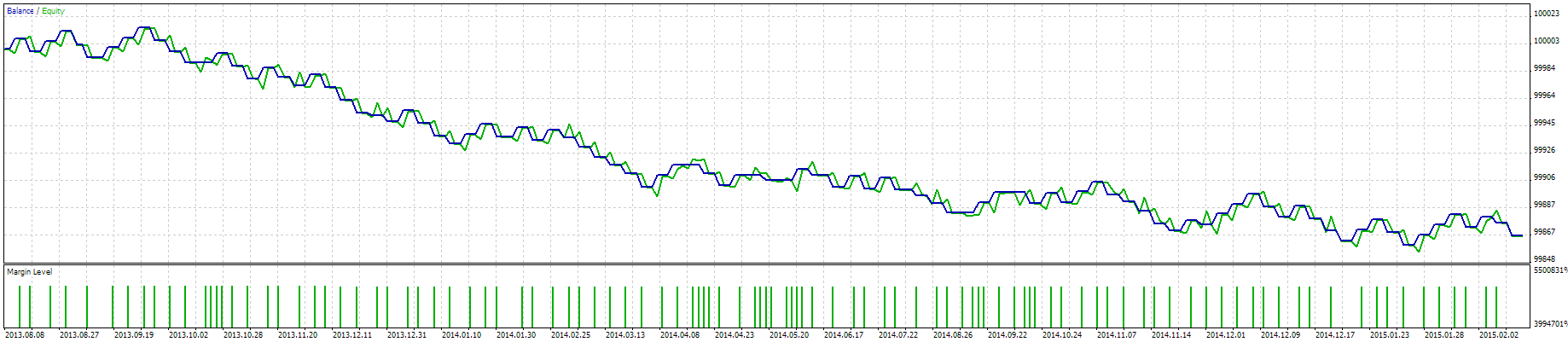

So, it's not a death sentence though, what's all this hype about how dangerous Martingale is? Well, something else we see is that Martingale has a disproportionate amount of winning runs vs losing runs. Adding to equity on each loser significantly increases the chance that any end trade will end in a profitable account, but that doesn't mean it's more profitable, it's not, the EV of Martingale is always lower. It does mean that effectively draw-downs are made less likely usually delaying them but also increasing them. A much larger sample size will be required to converge on true system performance of a given system where edge is unknown. So much so that we can literally take a losing strategy and apply a large enough start account to a small enough starting lot and make it look profitable for some time. Lets try it! Here's a losing run...

It's very clear to the eye the performance of this strategy is poor and we have a negative EV here. But we can hide this with a simple Martingale MM....

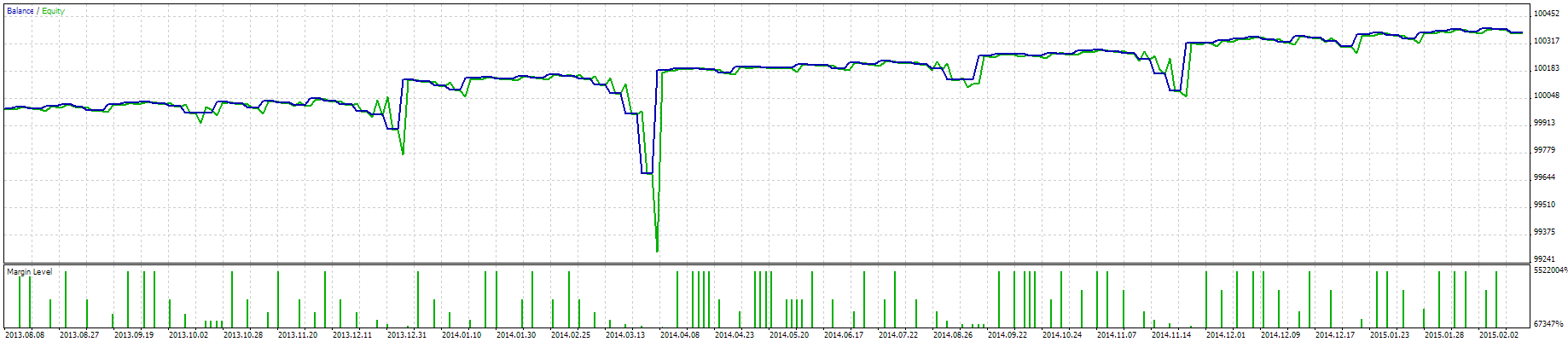

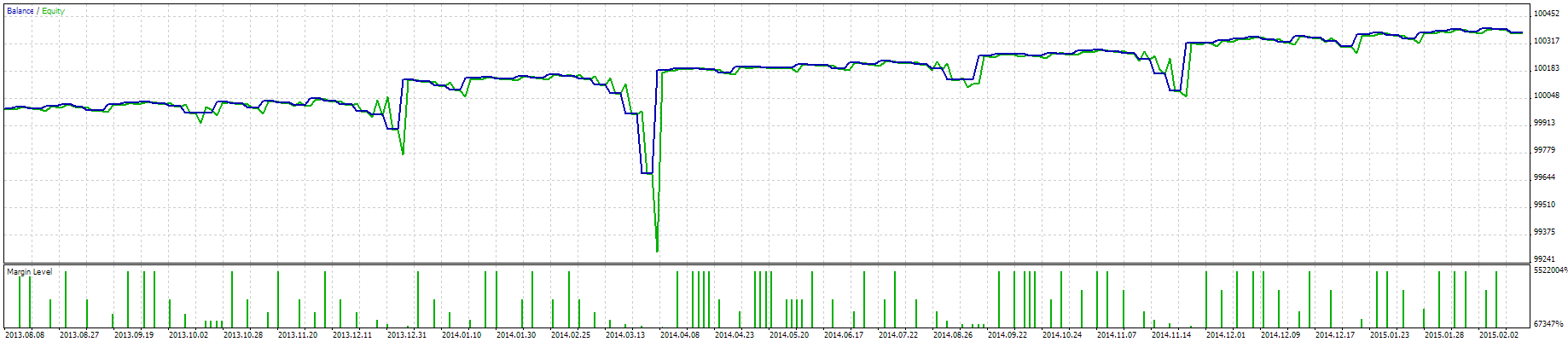

Like magic, we have delayed our losses beyond the sample! But when they do hit us they will be big. We now have an illusion of profitability and (semi)hidden enormous risk. Continuing to run the martingale with this losing strategy will result eventually in a larger loss than the non martingale would lose in the same period. So, one danger is that poor performance can be masked by unscrupulous EA or signal providers.... Why does the market even allow this?

So, it's not a death sentence though, what's all this hype about how dangerous Martingale is? Well, something else we see is that Martingale has a disproportionate amount of winning runs vs losing runs. Adding to equity on each loser significantly increases the chance that any end trade will end in a profitable account, but that doesn't mean it's more profitable, it's not, the EV of Martingale is always lower. It does mean that effectively draw-downs are made less likely usually delaying them but also increasing them. A much larger sample size will be required to converge on true system performance of a given system where edge is unknown. So much so that we can literally take a losing strategy and apply a large enough start account to a small enough starting lot and make it look profitable for some time. Lets try it! Here's a losing run...

It's very clear to the eye the performance of this strategy is poor and we have a negative EV here. But we can hide this with a simple Martingale MM....

Like magic, we have delayed our losses beyond the sample! But when they do hit us they will be big. We now have an illusion of profitability and (semi)hidden enormous risk. Continuing to run the martingale with this losing strategy will result eventually in a larger loss than the non martingale would lose in the same period. So, one danger is that poor performance can be masked by unscrupulous EA or signal providers.... Why does the market even allow this?

Uczestnik z Oct 07, 2014

134 postów

Feb 12, 2015 at 21:41

Uczestnik z Oct 07, 2014

134 postów

Hey Ben,

Congrats! your post is awesome

Congrats! your post is awesome

THIS IS A MARATHON, NOT A SPRINT.

Feb 17, 2015 at 02:51

Uczestnik z Apr 05, 2014

33 postów

ty MOMAFOREX

.......

But is it really dangerous if we know we have an edge? Let's compare two strategies with equal EV. We will use the last Martingale table and compare it to a NON martingale strategy of equal EV to compare risk.

Non Martingale 1.57% risk

sum “L” first trade bal “L” 2nd bal “L” fin bal

-0.19 -0.06 3.94 -0.06 3.88 -0.06 3.81

“W”

“L”

“L”

-0.03 0.09 4.09 -0.06 4.03 -0.06 3.97

“L”

“W”

“L”

-0.03 -0.06 3.94 0.09 4.03 -0.06 3.97

“W”

“W”

“L”

0.12 0.09 4.09 0.10 4.19 -0.07 4.12

sum “L” first trade bal “L” 2nd bal “W” fin bal

-0.03 -0.06 3.94 -0.06 3.88 0.09 3.97

“W”

“L”

“W”

0.12 0.09 4.09 -0.06 4.03 0.09 4.12

“L”

“W”

“W”

0.12 -0.06 3.94 0.09 4.03 0.09 4.12

“W”

“W”

“W”

0.29 0.09 4.09 0.10 4.19 0.10 4.29

EV of 8 runs 0.38

So with percent of equity strategy we are 12.5% chance of a 0.19 DD and a system of equal EV with the Martingale landed us at 12.5% chance of a 0.25 DD. What if we increase risk a little and drop the edge of our system from 1.5 back to 1.1 and contrast even more by going back to 2x martingale instead of 1.5x? Here we go...

Non Martingale 5% risk

sum “L” first trade bal “L” 2nd bal “L” fin bal

-0.57 -0.20 3.80 -0.19 3.61 -0.18 3.43

“W”

“L”

“L”

-0.19 0.22 4.22 -0.21 4.01 -0.20 3.81

“L”

“W”

“L”

-0.19 -0.20 3.80 0.21 4.01 -0.20 3.81

“W”

“W”

“L”

0.23 0.22 4.22 0.23 4.45 -0.22 4.23

sum “L” first trade bal “L” 2nd bal “W” fin bal

-0.19 -0.20 3.80 -0.19 3.61 0.20 3.81

“W”

“L”

“W”

0.23 0.22 4.22 -0.21 4.01 0.22 4.23

“L”

“W”

“W”

0.23 -0.20 3.80 0.21 4.01 0.22 4.23

“W”

“W”

“W”

0.70 0.22 4.22 0.23 4.45 0.24 4.70

EV of 8 runs 0.24

Martingale (2x) 0.16 units risked

sum “L” “L” “L”

-0.76 -0.16 -0.24 -0.36

“W” “L” “L”

-0.22 0.18 -0.16 -0.24

“L” “W” “L”

-0.06 -0.16 0.26 -0.16

“W” “W” “L”

0.19 0.18 0.18 -0.16

“L” “L” “W”

0.00 -0.16 -0.24 0.40

“W” “L” “W”

0.28 0.18 -0.16 0.26

“L” “W” “W”

0.28 -0.16 0.26 0.18

“W” “W” “W”

0.53 0.18 0.18 0.18

EV of 8 runs 0.24

12.5% Chance of 0.57 DD vs Marty's 12.5% chance of 0.76 DD. Significant but not deadly... yet.... let's add one more trade with exact same systems here as we already know Martingale always has the lower EV to RoR ratio, lets focus on the risk of trading Martingale over and over. Here are the two losing runs which now occur at a 6.25% frequency:

Non Martingale 5% risk

sum “L” first trade bal “L” 2nd bal “L” fin bal “L” fin bal

-0.74 -0.20 3.80 -0.19 3.61 -0.18 3.43 -0.17 3.26

Martingale (2x) 0.16 start lot

sum “L” “L” “L” “L”

-1.30 -0.16 -0.24 -0.36 -0.54

The risk of the Martingale is now nearly double that of the risk of the percent of equity strategy. The more trades we plan, the higher the risk jumps for Martingale in contrast to a percent of equity strategy. So, if for some reason the lower profitability to RoR ratio of any Martingale system isn't a good enough reason to shy away from it (you don't like money?) consider the additional risk of each additional planned trade in a Martingale strategy.....

.......

But is it really dangerous if we know we have an edge? Let's compare two strategies with equal EV. We will use the last Martingale table and compare it to a NON martingale strategy of equal EV to compare risk.

Non Martingale 1.57% risk

sum “L” first trade bal “L” 2nd bal “L” fin bal

-0.19 -0.06 3.94 -0.06 3.88 -0.06 3.81

“W”

“L”

“L”

-0.03 0.09 4.09 -0.06 4.03 -0.06 3.97

“L”

“W”

“L”

-0.03 -0.06 3.94 0.09 4.03 -0.06 3.97

“W”

“W”

“L”

0.12 0.09 4.09 0.10 4.19 -0.07 4.12

sum “L” first trade bal “L” 2nd bal “W” fin bal

-0.03 -0.06 3.94 -0.06 3.88 0.09 3.97

“W”

“L”

“W”

0.12 0.09 4.09 -0.06 4.03 0.09 4.12

“L”

“W”

“W”

0.12 -0.06 3.94 0.09 4.03 0.09 4.12

“W”

“W”

“W”

0.29 0.09 4.09 0.10 4.19 0.10 4.29

EV of 8 runs 0.38

So with percent of equity strategy we are 12.5% chance of a 0.19 DD and a system of equal EV with the Martingale landed us at 12.5% chance of a 0.25 DD. What if we increase risk a little and drop the edge of our system from 1.5 back to 1.1 and contrast even more by going back to 2x martingale instead of 1.5x? Here we go...

Non Martingale 5% risk

sum “L” first trade bal “L” 2nd bal “L” fin bal

-0.57 -0.20 3.80 -0.19 3.61 -0.18 3.43

“W”

“L”

“L”

-0.19 0.22 4.22 -0.21 4.01 -0.20 3.81

“L”

“W”

“L”

-0.19 -0.20 3.80 0.21 4.01 -0.20 3.81

“W”

“W”

“L”

0.23 0.22 4.22 0.23 4.45 -0.22 4.23

sum “L” first trade bal “L” 2nd bal “W” fin bal

-0.19 -0.20 3.80 -0.19 3.61 0.20 3.81

“W”

“L”

“W”

0.23 0.22 4.22 -0.21 4.01 0.22 4.23

“L”

“W”

“W”

0.23 -0.20 3.80 0.21 4.01 0.22 4.23

“W”

“W”

“W”

0.70 0.22 4.22 0.23 4.45 0.24 4.70

EV of 8 runs 0.24

Martingale (2x) 0.16 units risked

sum “L” “L” “L”

-0.76 -0.16 -0.24 -0.36

“W” “L” “L”

-0.22 0.18 -0.16 -0.24

“L” “W” “L”

-0.06 -0.16 0.26 -0.16

“W” “W” “L”

0.19 0.18 0.18 -0.16

“L” “L” “W”

0.00 -0.16 -0.24 0.40

“W” “L” “W”

0.28 0.18 -0.16 0.26

“L” “W” “W”

0.28 -0.16 0.26 0.18

“W” “W” “W”

0.53 0.18 0.18 0.18

EV of 8 runs 0.24

12.5% Chance of 0.57 DD vs Marty's 12.5% chance of 0.76 DD. Significant but not deadly... yet.... let's add one more trade with exact same systems here as we already know Martingale always has the lower EV to RoR ratio, lets focus on the risk of trading Martingale over and over. Here are the two losing runs which now occur at a 6.25% frequency:

Non Martingale 5% risk

sum “L” first trade bal “L” 2nd bal “L” fin bal “L” fin bal

-0.74 -0.20 3.80 -0.19 3.61 -0.18 3.43 -0.17 3.26

Martingale (2x) 0.16 start lot

sum “L” “L” “L” “L”

-1.30 -0.16 -0.24 -0.36 -0.54

The risk of the Martingale is now nearly double that of the risk of the percent of equity strategy. The more trades we plan, the higher the risk jumps for Martingale in contrast to a percent of equity strategy. So, if for some reason the lower profitability to RoR ratio of any Martingale system isn't a good enough reason to shy away from it (you don't like money?) consider the additional risk of each additional planned trade in a Martingale strategy.....

*Komercyjne wykorzystanie i spam są nieprawidłowe i mogą spowodować zamknięcie konta.

Wskazówka: opublikowanie adresu URL obrazu / YouTube automatycznie wstawi go do twojego postu!

Wskazówka: wpisz znak@, aby automatycznie wypełnić nazwę użytkownika uczestniczącego w tej dyskusji.