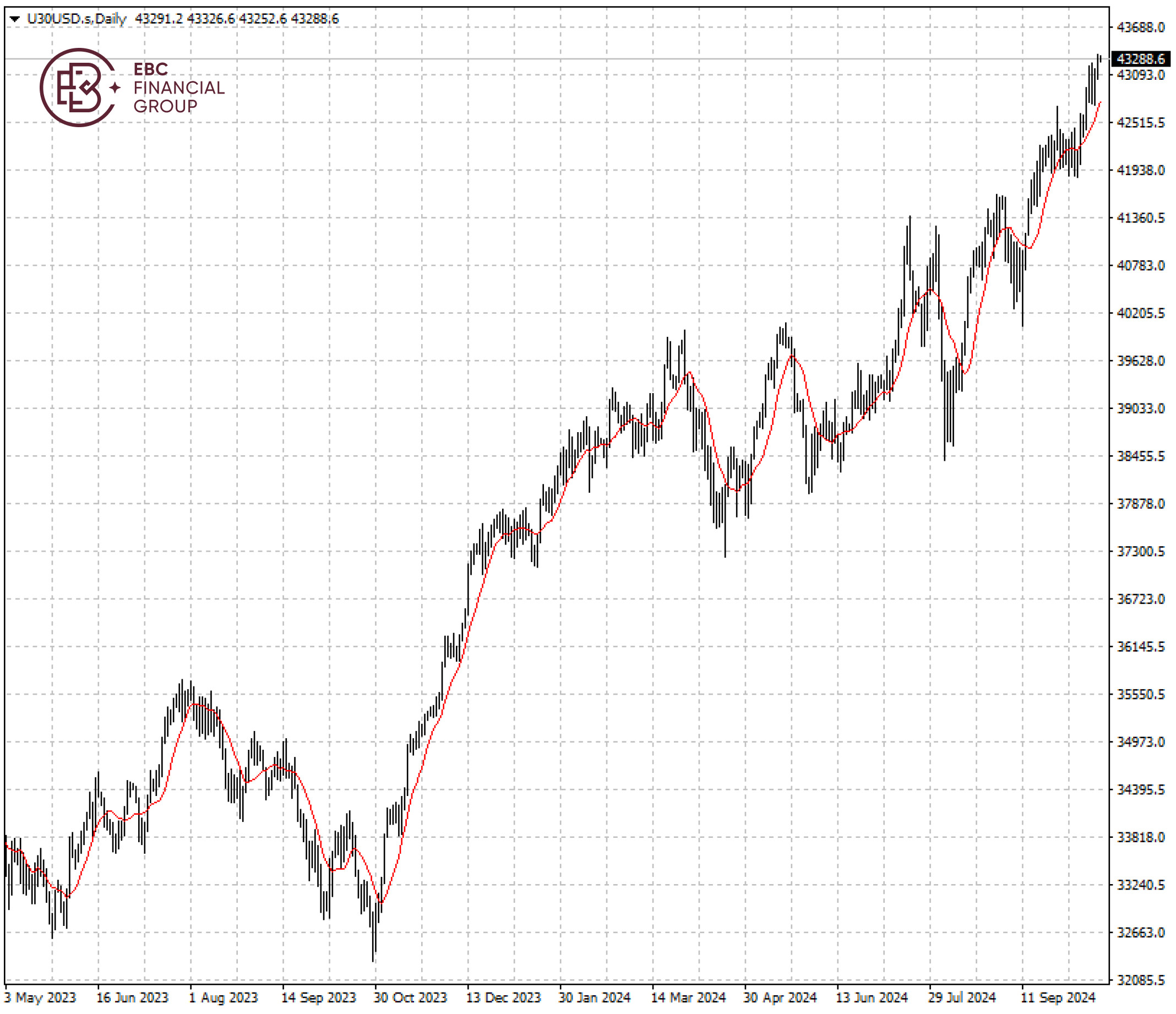

EBC Markets Briefing | Dow nabs closing record on TSMC’s buoyant report

The Dow advanced on Thursday to its fourth record close in the last five sessions on stronger-than-expected monthly retail sales and TSMC's upbeat forecast.

Last week US bank stocks hit their highest level since before the collapse of SVB as better than expected profits from JPMorgan Chase and Wells Fargo boosted hopes of an economic “soft landing” in the country.

Other Wall St’s giants that revealed earnings later also surprised to the upside, including Morgan Stanley, Goldman Sachs and BofA. The strong performance has paved the way for the Dow and the S&P 500 to outperform.

Chip socks kept their pace up with Nvidia remaining the Wall Street's second most valuable company though Some market participants have questioned the long-term resilience of the boom.

Alphabet, Microsoft, Amazon and Meta have all indicated that they will continue to spend large sums on AI infrastructure through next year, to the benefit of AI hardware companies.

Whereas AI software is typically offered on a subscription basis, hardware is a one-time sale. Analysts warned that AI chip stocks are in a bubble that will eventually burst once Big Tech’s spending eases.

Technical indicators indicate that Dow has further to go with no hurdle in sight. The short-term bias will still be bullish if the index stays above 10 SMA.

EBC Institute Perspectives Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC International Business Expansion or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.