USDJPY: Samurai weighing the next move

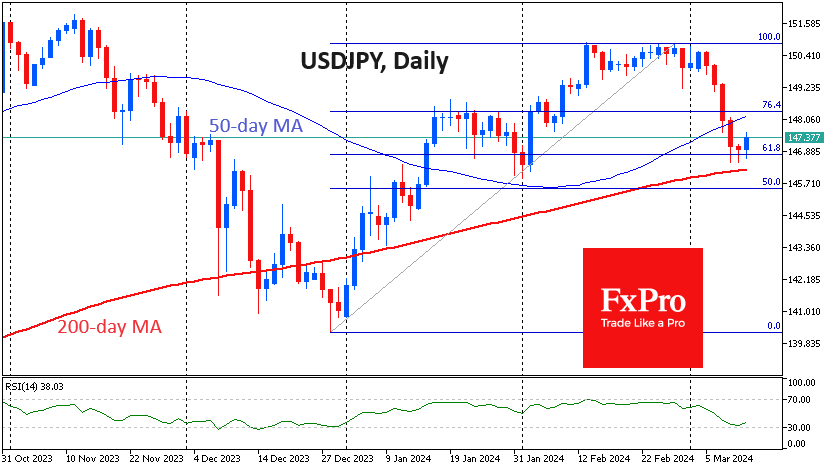

USDJPY is bouncing back after five trading sessions where it fell by a cumulative 2.5%. On daily timeframes, the pair’s subsequent move after the pause allows us to determine further medium-term trends.

The weakening of the dollar accompanied the pair's decline since the end of last month, but it can also be seen as a correction from the late December lows at 140.3 to last month's peaks at 150.8. Buying in the pair came at the 61.8% level, emphasising the classic Fibonacci pattern.

USDJPY also approached the 200-day moving average, which has acted as a support level since mid-2023.

The yen is likely to go into consolidation for a week, freezing up until the Bank of Japan's decision next Tuesday. This is also a sufficient interval for market forces to build up enough liquidity to make a decisive move in one direction or another.

Potentially, a failure of USDJPY below 146 would signal a victory for the Bears, making us expect the next consolidation no earlier than 140-141.

On the contrary, the ability to get back above 148, where the 50-day moving average is located, would be an early signal of the pair's resumption of growth with the first potential target at 150.8.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)