- Início

- Comunidade

- Negociantes Experientes

- Swing Trading Analysis & Results

Advertisement

Edit Your Comment

Swing Trading Analysis & Results

Membro Desde Nov 19, 2014

157 posts

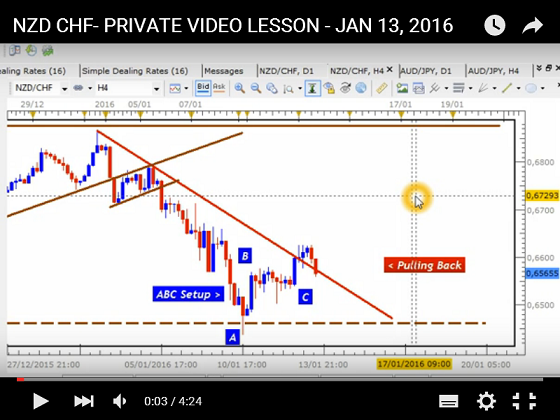

Jan 15, 2016 at 08:05

Membro Desde Nov 19, 2014

157 posts

Membro Desde Nov 19, 2014

157 posts

Membro Desde Oct 02, 2014

905 posts

Membro Desde Jan 14, 2010

2279 posts

Jan 21, 2016 at 17:24

Membro Desde Jan 14, 2010

2279 posts

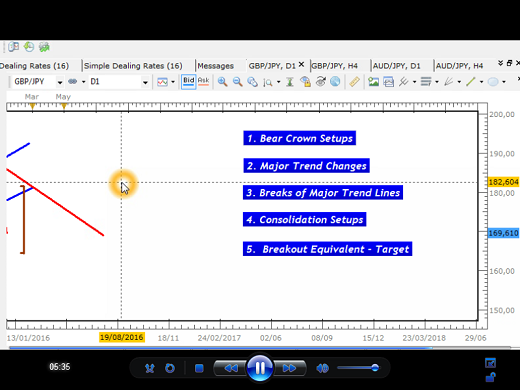

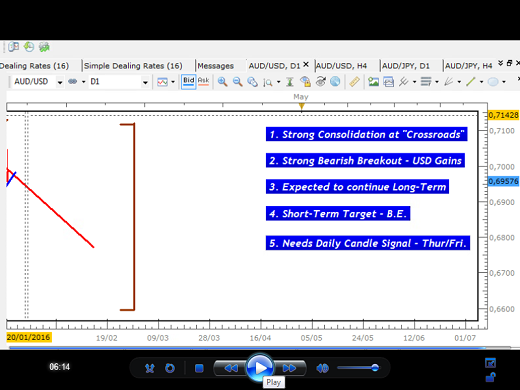

DRFXTRADING posted:

All three have trading possibilities. However, AUD USD, GBP JPY are the front runners.

Duane

I think jpy and usd are up for correction. they are both overextended mightily.

Membro Desde Nov 19, 2014

157 posts

Mar 10, 2016 at 05:08

(editado Mar 10, 2016 at 05:11)

Membro Desde Nov 19, 2014

157 posts

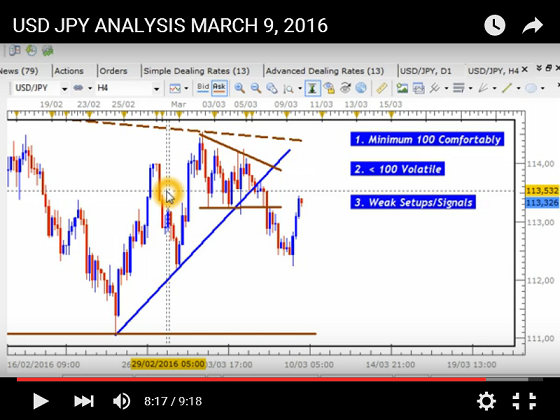

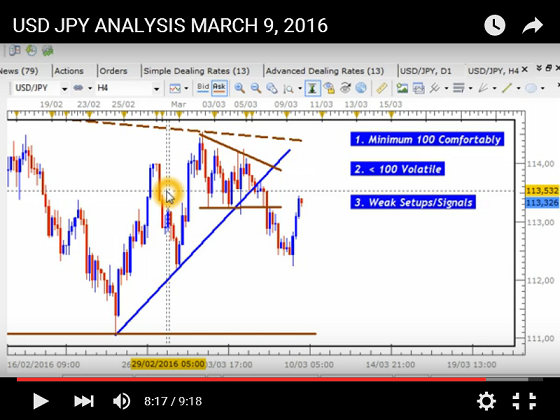

Hey all,

Sharp Reversal USD JPY, would have taken out Stop Loss had I traded it..

It was tempting, but there were some important reasons that led me to avoid this one.

/MARCH_2_2016_USD_JPY_YOUTUBE_DAILY.png" target="_blank" rel="noopener noreferrer nofollow"> /MARCH_2_2016_USD_JPY_YOUTUBE_DAILY.png"/>

/MARCH_2_2016_USD_JPY_YOUTUBE_DAILY.png"/>

As you can see, the last Bearish Candle was fairly weak compared to those that normally lead to strong moves such as those that led to the strong downtrend on the left hand side of the chart.

Key is to always keep an eye on the Daily Chart despite how strong the signals on the 4 H Chart maybe.

Sharp Reversal USD JPY, would have taken out Stop Loss had I traded it..

It was tempting, but there were some important reasons that led me to avoid this one.

/MARCH_2_2016_USD_JPY_YOUTUBE_DAILY.png" target="_blank" rel="noopener noreferrer nofollow">

As you can see, the last Bearish Candle was fairly weak compared to those that normally lead to strong moves such as those that led to the strong downtrend on the left hand side of the chart.

Key is to always keep an eye on the Daily Chart despite how strong the signals on the 4 H Chart maybe.

Trade Less, Earn More

Membro Desde Nov 19, 2014

157 posts

Mar 10, 2016 at 05:47

(editado Mar 10, 2016 at 05:49)

Membro Desde Nov 19, 2014

157 posts

Hey all

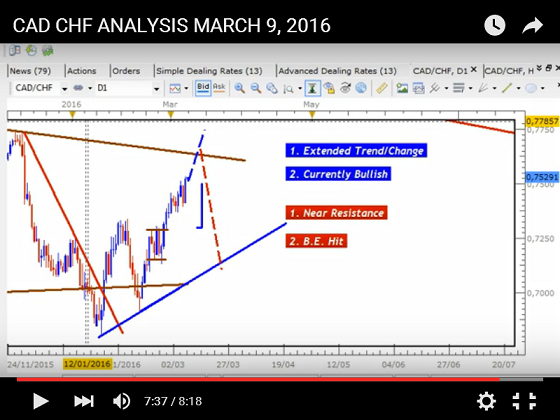

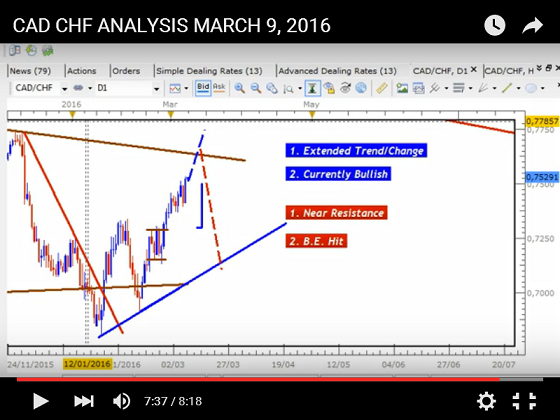

CAD CHF rallying towards the Resistance of its Large Pennant Setup similar to the AUD CHF just traded.

Difference is that CAD CHF is doing so with weaker candles and the Breakout Target for the small Range Setup has been hit.

This could see the pair starting to pullback before actually hitting the Resistance.

&feature=youtu.be

On the other hand, the current Uptrend is fairly strong and we have a Bullish Candle that closed yesterday on the Daily Chart. This could take it to the Resistance oon the way to a breakout.

Whatever it does, just have to wait until we see a strong setup and signal to trade, AS LONG AS they meet my/your trading rules.

Duane

DRFXTRADING

CAD CHF rallying towards the Resistance of its Large Pennant Setup similar to the AUD CHF just traded.

Difference is that CAD CHF is doing so with weaker candles and the Breakout Target for the small Range Setup has been hit.

This could see the pair starting to pullback before actually hitting the Resistance.

&feature=youtu.be

On the other hand, the current Uptrend is fairly strong and we have a Bullish Candle that closed yesterday on the Daily Chart. This could take it to the Resistance oon the way to a breakout.

Whatever it does, just have to wait until we see a strong setup and signal to trade, AS LONG AS they meet my/your trading rules.

Duane

DRFXTRADING

Trade Less, Earn More

Membro Desde Nov 19, 2014

157 posts

Mar 14, 2016 at 01:57

Membro Desde Nov 19, 2014

157 posts

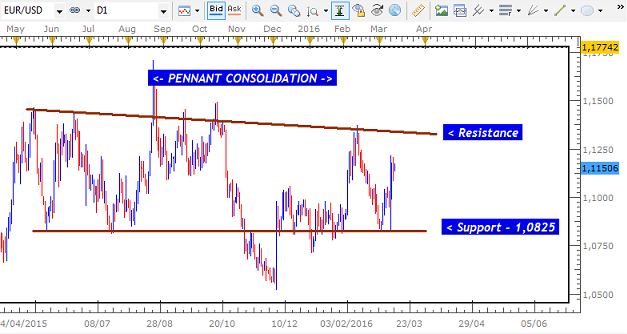

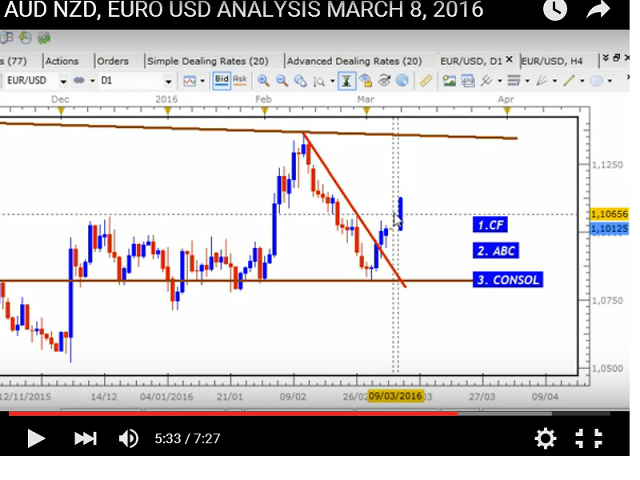

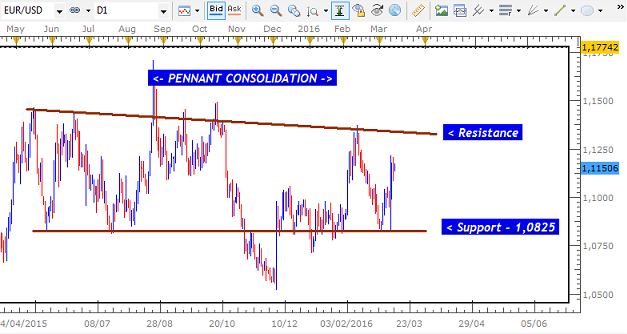

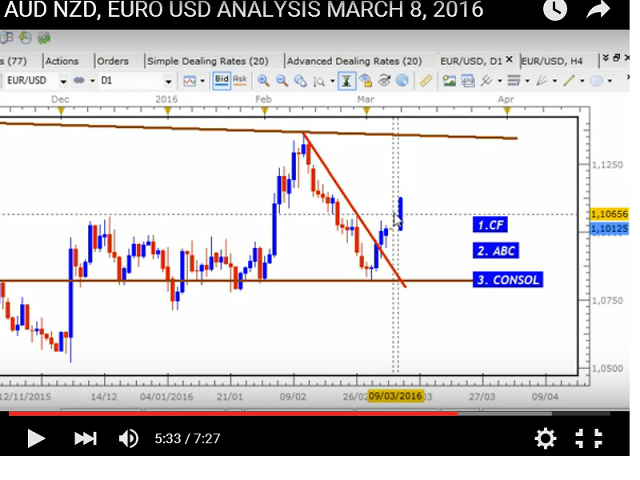

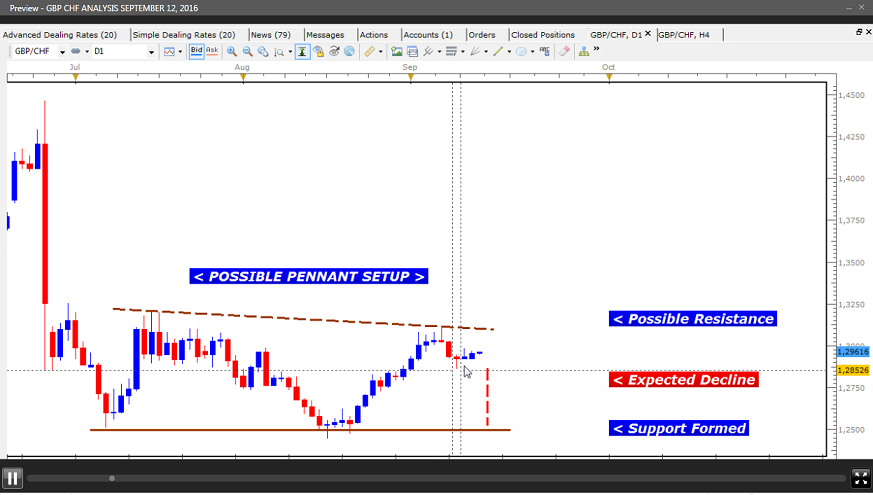

This EURO bad boy been in a Pennant for quite awhile..Daily Chart..

This explains most of the crazy **** moves that been happeniing over the last several months, like that on Thursday.

Even though it was set off by the ECB action, these setups often have these erratic moves as they move from Support to Resistance.

I was actually getting ready to trade this bullish, expecting one of 3 possible Signals...

/FEB_4_2016__EURO_USD_DAILY_149_PIPS_Z0.png" target="_blank" rel="noopener noreferrer nofollow"> /FEB_4_2016__EURO_USD_DAILY_149_PIPS_Z0.png"/>

/FEB_4_2016__EURO_USD_DAILY_149_PIPS_Z0.png"/>

Sometimes these setups can lead to losses with these types of news etc., but sometimes when you catch them at the right time with the right setup..can take our pound of flesh from them

Duane

DRFXTRADING

This explains most of the crazy **** moves that been happeniing over the last several months, like that on Thursday.

Even though it was set off by the ECB action, these setups often have these erratic moves as they move from Support to Resistance.

I was actually getting ready to trade this bullish, expecting one of 3 possible Signals...

/FEB_4_2016__EURO_USD_DAILY_149_PIPS_Z0.png" target="_blank" rel="noopener noreferrer nofollow">

Sometimes these setups can lead to losses with these types of news etc., but sometimes when you catch them at the right time with the right setup..can take our pound of flesh from them

Duane

DRFXTRADING

Trade Less, Earn More

Membro Desde Nov 19, 2014

157 posts

Membro Desde Mar 13, 2016

2 posts

Membro Desde Nov 19, 2014

157 posts

Oct 09, 2016 at 07:06

Membro Desde Nov 19, 2014

157 posts

Hey Traders, how goes it?

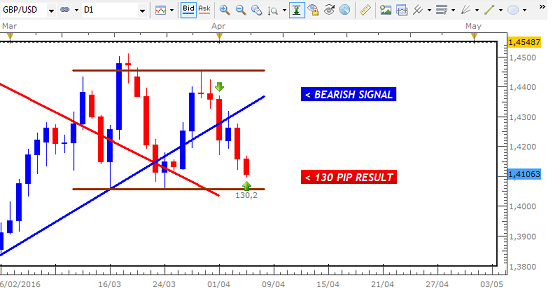

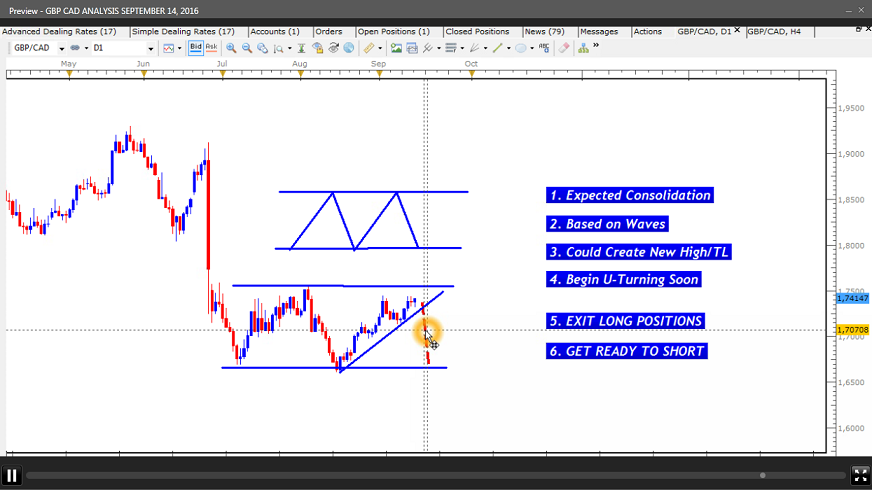

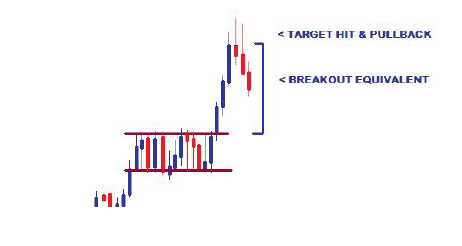

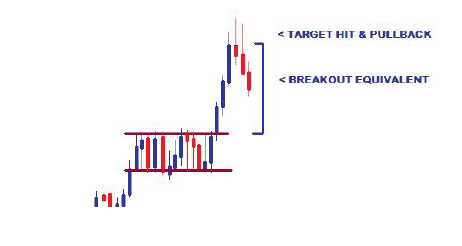

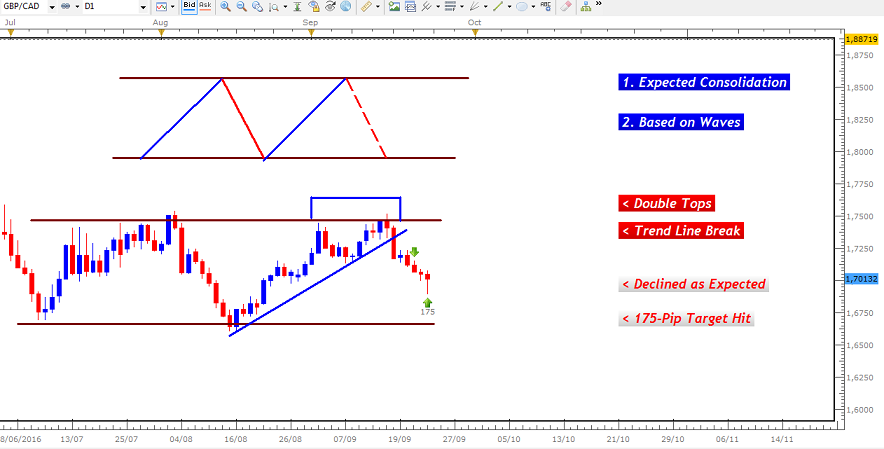

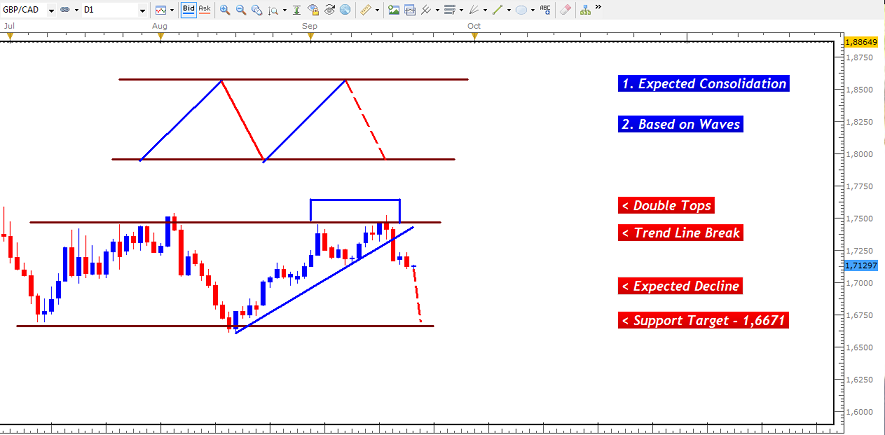

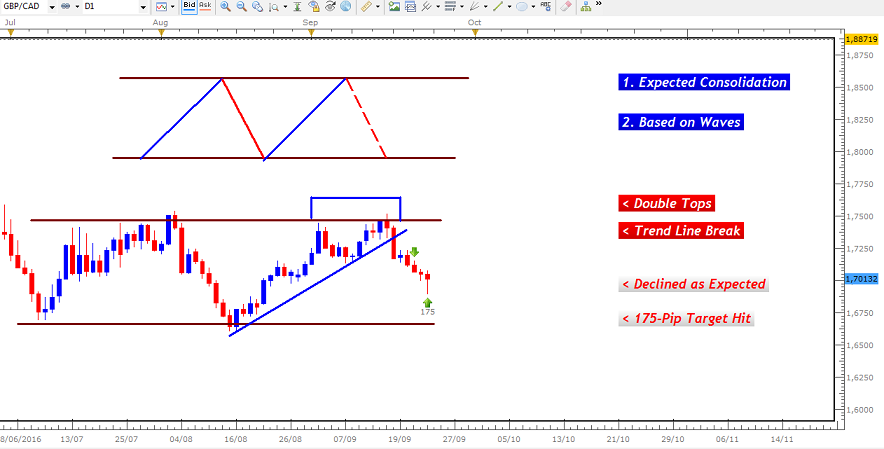

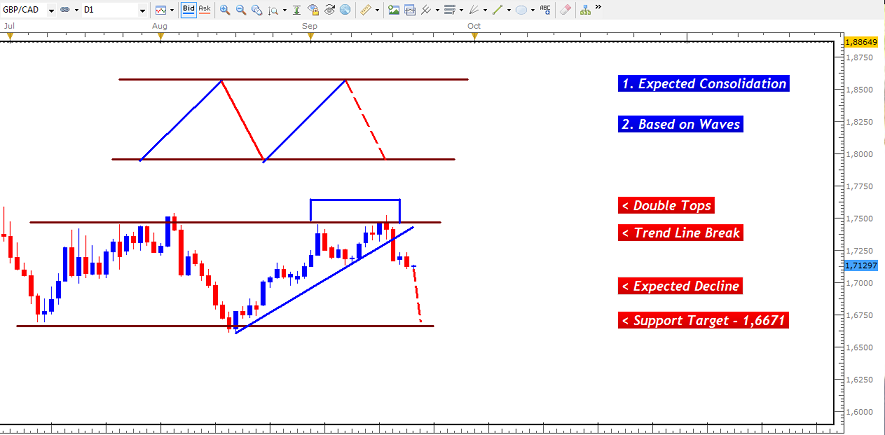

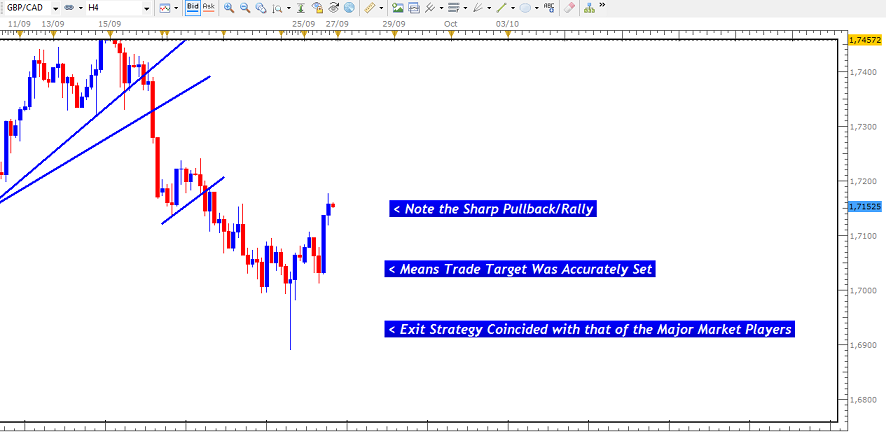

I firmly believe the Currrency Market WANTS US TO BE PROFITABLE. It WANTS US TO BE ABLE TO PREDICT IT and profit from it unlike the false belief given to us that its impossible to be successful. Take the recent trade on the GBP CAD.

This recent trade on the GBP CAD provided 175 Pips in about 3 days, as the pair continued to form a Range Setup on its Daily Chart.

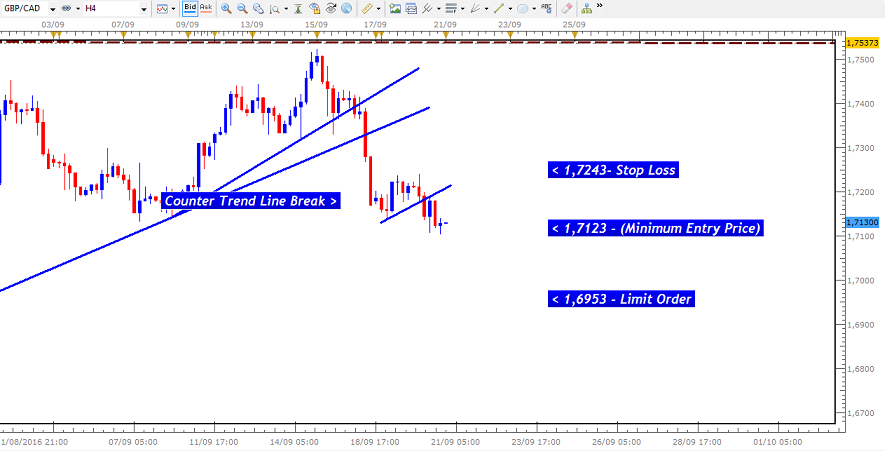

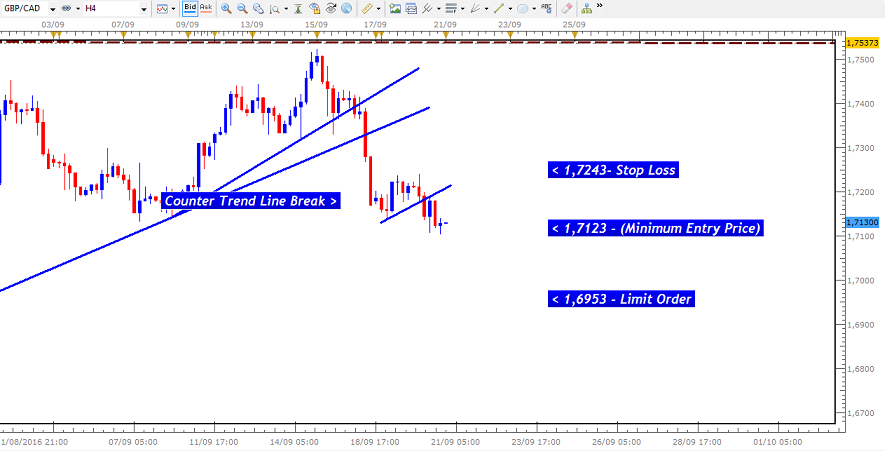

The Signals given that gave the green light that it was good time to enter was the Double Tops and the break of the Uptrend Line on the Daily Chart...

After these were seen, I then used the 4 Hour Chart to enter short...

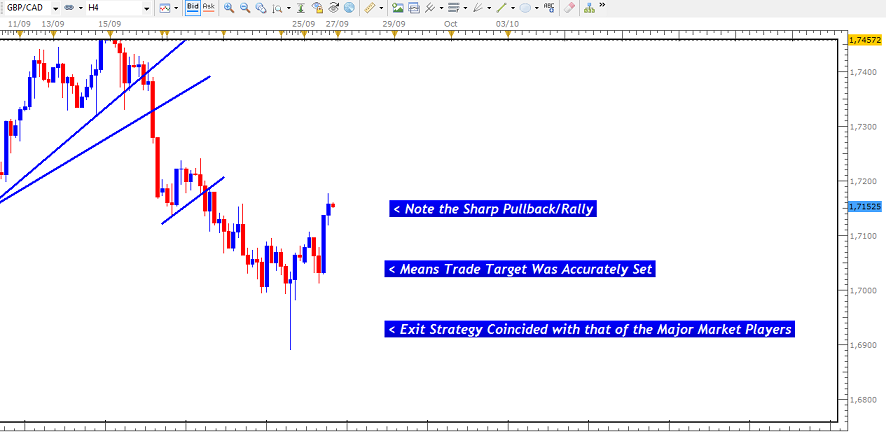

After a few days, target was hit. This was folllowed by a sharp pullback that took place shortly after my exit, indicating that the target was accurately set and that my Exit Strategy was in sync with those of other traders.

As I continue to trade, what I realize is that the Currency Market almost WANTS US TO PREDICT IT and PROFIT FROM IT. (Unlike some of the brokers out there lol) Why do I say this?

One of the main things about this trade was that it took advantage of being able to predict the formation of the Range and the downtrend that was gonna take place.

As you will hear in the video analysis below, there are certain pattens of candles that the market gives that tells us when these patterns are taking place. Once you can spot them and anticipate when U-Turns will take place, you´ll have the ability to exit trends that are about to end and get ready to trade in the opposite direction - for strong gains.

This is how the market works. It has a certain set of Candlestick Patterns that indicate what will take place. These patterns are repeated on a regular basis and happen across all curencies. Its almost as if the market wants to make sure we can see what it will do by repeating these patterns over and over every week until we finally see it, understand it and are able to make a trading plan to profit from them.

So the market is very difficult even to the experienced traders, but it gets easier when we are able to spot these patterns and profit from them with less fear and anxiety but with more Confidence and Certainty.

Duane

I firmly believe the Currrency Market WANTS US TO BE PROFITABLE. It WANTS US TO BE ABLE TO PREDICT IT and profit from it unlike the false belief given to us that its impossible to be successful. Take the recent trade on the GBP CAD.

This recent trade on the GBP CAD provided 175 Pips in about 3 days, as the pair continued to form a Range Setup on its Daily Chart.

The Signals given that gave the green light that it was good time to enter was the Double Tops and the break of the Uptrend Line on the Daily Chart...

After these were seen, I then used the 4 Hour Chart to enter short...

After a few days, target was hit. This was folllowed by a sharp pullback that took place shortly after my exit, indicating that the target was accurately set and that my Exit Strategy was in sync with those of other traders.

As I continue to trade, what I realize is that the Currency Market almost WANTS US TO PREDICT IT and PROFIT FROM IT. (Unlike some of the brokers out there lol) Why do I say this?

One of the main things about this trade was that it took advantage of being able to predict the formation of the Range and the downtrend that was gonna take place.

As you will hear in the video analysis below, there are certain pattens of candles that the market gives that tells us when these patterns are taking place. Once you can spot them and anticipate when U-Turns will take place, you´ll have the ability to exit trends that are about to end and get ready to trade in the opposite direction - for strong gains.

This is how the market works. It has a certain set of Candlestick Patterns that indicate what will take place. These patterns are repeated on a regular basis and happen across all curencies. Its almost as if the market wants to make sure we can see what it will do by repeating these patterns over and over every week until we finally see it, understand it and are able to make a trading plan to profit from them.

So the market is very difficult even to the experienced traders, but it gets easier when we are able to spot these patterns and profit from them with less fear and anxiety but with more Confidence and Certainty.

Duane

Trade Less, Earn More

Membro Desde Nov 19, 2014

157 posts

Dec 04, 2016 at 09:56

Membro Desde Nov 19, 2014

157 posts

Hey Traders,

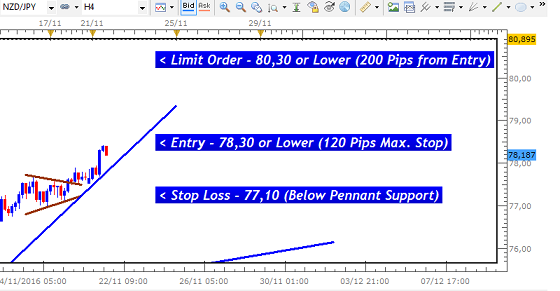

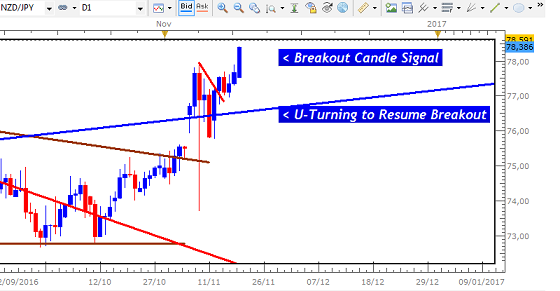

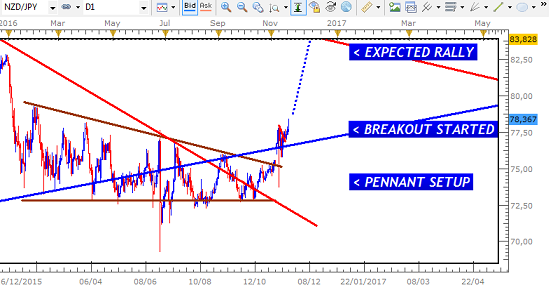

Latest trade gave me a great 198 Pip Gain on the NZD JPY over the last few days as you can see on my Live Account below.

Live Trades- previously done with Dukascopy which cant be linked to Myfxbook - now being done with FXPRO and being tracked. This is to better show (prove?) that this strategy will work under Live Trading Conditions.

THE TRADE

The pair was breaking out of a large Consolidation on the Daily Chart. The Daily Chart gave a Signal indicating a buying opportunity to take advantage of the move and the 4H Chart provided a strong area for the Stop Loss. Recall that my Signals for entry come from the FXCM platform because this uses the New York Close Candle of the Daily Chart which is crucial to Price Action strategies like mine.

DAILY CHART PENNANT SETUP

DAILY CHART SIGNAL

4 H CHART SETUP

You can view the Video Analysis of the trade below as well as the Video on the 2 main factors required to be a good Swing Trader trading setups like this.

/NOVEMBER_29_2016_VIDEO_ANALYSIS_ADV_198_PIPS.png" target="_blank" rel="noopener noreferrer nofollow">

/NOVEMBER_29_2016_VIDEO_ANALYSIS_ADV_NEVER_WATCH.png" target="_blank" rel="noopener noreferrer nofollow">

The Main Technical Factors Supporting the trade were:

- Being Able to Accurately Identify Consolidation Breakouts

- Determining the Right Signals to Trade on the Daily Chart

- Using Only the Strongest Areas for your Stop Losses in order to Protect Your Trade

- Patience to Hold Trades for up to 6 Days

. Discipline to NEVER look at your trades while they are open in order to avoid Sabotaging your Profitability

Comments welcomed

Duane

DRFXSWINGTRADING

Trade Less, Earn More

Membro Desde Nov 19, 2014

157 posts

Membro Desde Dec 08, 2016

19 posts

Membro Desde Nov 19, 2014

157 posts

Membro Desde Nov 19, 2014

157 posts

Dec 27, 2016 at 07:30

Membro Desde Nov 19, 2014

157 posts

Hey Traders how goes it!!,

Just to give you an update...

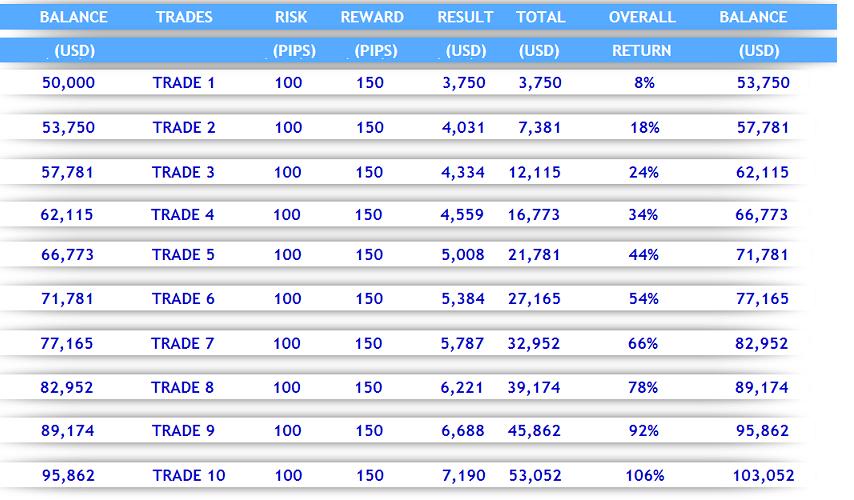

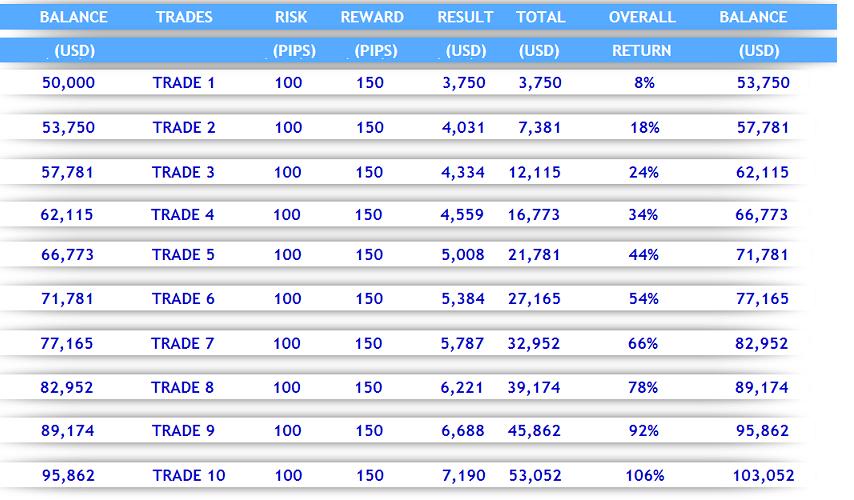

Every year, I aim to achieve a targeet of at least 100% Rate of Return. I think that if you can achieve these results within a Year as a Swing Trader who doesnt want/have the time to stay glued to the market, youll put yourself in a good position Long-Term.

I target 100-200 Pips per trade, using Stop Losses of 100 Pips on average, trading the Daily and 4 Hour Charts. I use a 5% Risk Per Trade.

The table above assumes an average gain of 150 Pips. So the idea is that you only trade a few times a month to target the best setups, that have the Highest Probability of success.

For the 2015/2016 period, I was able to earn 46.43% after just 6 trades, which based on that table, would have meant that I only needed 5 more trades to achieve that minimum target. However, due to unusually low market liquidity, return was affected over the next few months, pushing down to the mid 20%. When conditions did improve, I was able to resume hitting large Pip targets which allowed the return to end the period at 42.43%. Not bad but much lower than what I expect from my system.

Heading into the 2016/2017 period,I am now up 9.0% after that one trade of 198 Pips on the NZD JPY that I highlighted in the previous post. So assuming normal conditions, would now need 9 Trades to hit that target. Of course, trading losses are expected along the way, but it is expected that once the market remains liquid, will not take long to reach that goal...and more.

If you dont want to watch the market every day and battle the volatile intra-day volatility, Swing Trading is your best bet.

Duane

DRFXSWINGTRADING

Just to give you an update...

Every year, I aim to achieve a targeet of at least 100% Rate of Return. I think that if you can achieve these results within a Year as a Swing Trader who doesnt want/have the time to stay glued to the market, youll put yourself in a good position Long-Term.

I target 100-200 Pips per trade, using Stop Losses of 100 Pips on average, trading the Daily and 4 Hour Charts. I use a 5% Risk Per Trade.

The table above assumes an average gain of 150 Pips. So the idea is that you only trade a few times a month to target the best setups, that have the Highest Probability of success.

For the 2015/2016 period, I was able to earn 46.43% after just 6 trades, which based on that table, would have meant that I only needed 5 more trades to achieve that minimum target. However, due to unusually low market liquidity, return was affected over the next few months, pushing down to the mid 20%. When conditions did improve, I was able to resume hitting large Pip targets which allowed the return to end the period at 42.43%. Not bad but much lower than what I expect from my system.

Heading into the 2016/2017 period,I am now up 9.0% after that one trade of 198 Pips on the NZD JPY that I highlighted in the previous post. So assuming normal conditions, would now need 9 Trades to hit that target. Of course, trading losses are expected along the way, but it is expected that once the market remains liquid, will not take long to reach that goal...and more.

If you dont want to watch the market every day and battle the volatile intra-day volatility, Swing Trading is your best bet.

Duane

DRFXSWINGTRADING

Trade Less, Earn More

Membro Desde Jun 01, 2011

4 posts

Membro Desde Nov 19, 2014

157 posts

Dec 29, 2016 at 11:33

Membro Desde Nov 19, 2014

157 posts

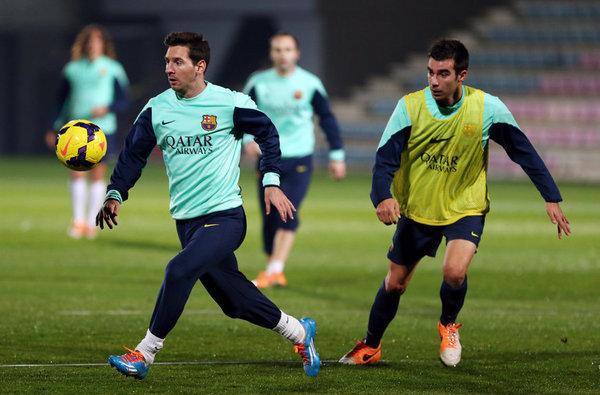

IS IT DEMO "VS" LIVE.OR DEMO "THEN" LIVE?

There is a popular belief that Demo Trading doesnt prepare you for Live Trading. This couldnt be further from the truth.

Like other areas of life and other professions, if you dont prepare adequately in the simulated environment...

...you will not be successful. Even the greats need to practice.

This is why Demo Accounts were created. Because of how difficult this market is, achieving Profitability with fake money is the only guarantee you will do so with Real Money. Otherwise, Disaster awaits.

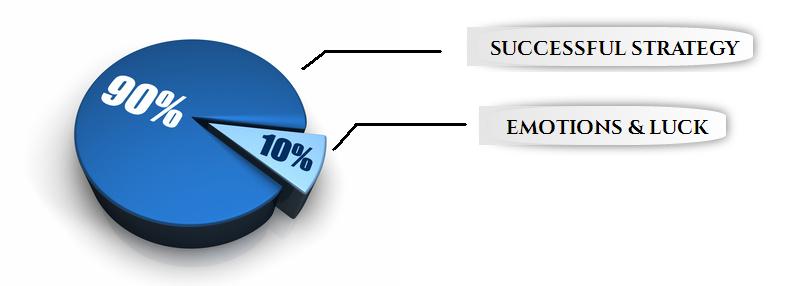

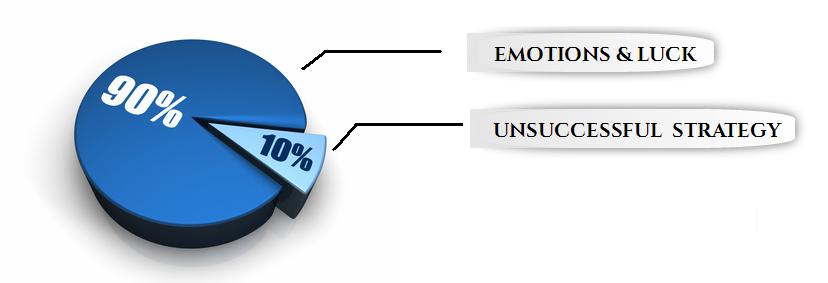

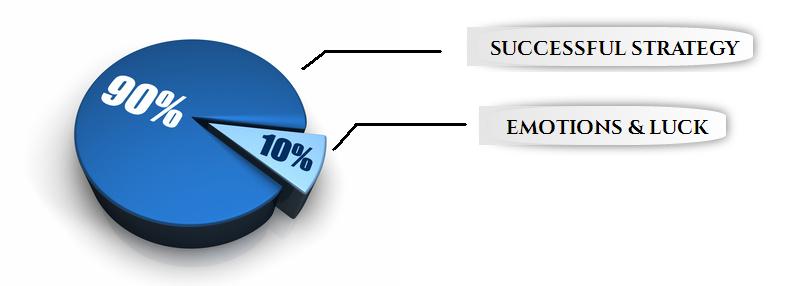

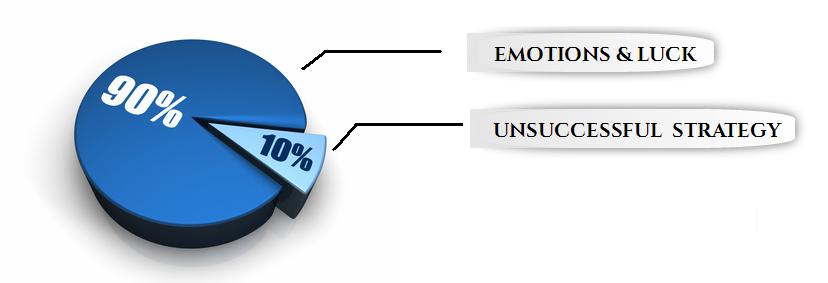

The consequence will be that instead of your Live Account giving you profitable results by being dependent on a Successful Strategy rather than Emotions or Luck,

it will produce losses after losses by being dependent on a Emotions & Luck..

Since a 200 Pip Move on the EURO USD is the same on a Demo as it is on a Live, if you have a successful strategy that captures this on a Demo, you will be able to do that on a Live.

What would stop you?

Duane

DRFXSWINGTRADING

There is a popular belief that Demo Trading doesnt prepare you for Live Trading. This couldnt be further from the truth.

Like other areas of life and other professions, if you dont prepare adequately in the simulated environment...

...you will not be successful. Even the greats need to practice.

This is why Demo Accounts were created. Because of how difficult this market is, achieving Profitability with fake money is the only guarantee you will do so with Real Money. Otherwise, Disaster awaits.

The consequence will be that instead of your Live Account giving you profitable results by being dependent on a Successful Strategy rather than Emotions or Luck,

it will produce losses after losses by being dependent on a Emotions & Luck..

Since a 200 Pip Move on the EURO USD is the same on a Demo as it is on a Live, if you have a successful strategy that captures this on a Demo, you will be able to do that on a Live.

What would stop you?

Duane

DRFXSWINGTRADING

Trade Less, Earn More

Membro Desde Nov 19, 2014

157 posts

*Uso comercial e spam não serão tolerados, podendo resultar no encerramento da conta.

Dica: Postar uma imagem/URL do YouTube irá incorporá-la automaticamente no seu post!

Dica: Insira o sinal @ para preencher automaticamente um nome de utilizador que participe nesta discussão.