- Início

- Comunidade

- Negociantes Experientes

- Technical & Fundamental Analysis by Sold ECN Securities

Advertisement

Edit Your Comment

Technical & Fundamental Analysis by Sold ECN Securities

Feb 22, 2022 at 08:48

Membro Desde Dec 08, 2021

325 posts

USDCAD market update by Solidecn

The US dollar is holding at local highs

During the Asian session, the USDCAD pair shows flat trading dynamics, consolidating near local highs of February 15. Investor activity remains subdued as US markets were closed on Monday for President's Day. At the same time, the news background was quite rich in various publications, and the focus of the market was the aggravation of the geopolitical situation in Eastern Europe. The optimistic sentiments of the traders were leveled after the official Kremlin stated that a meeting of the Russian and US presidents on the Ukrainian crisis was not yet planned. Earlier, the Russian leader announced the recognition of the self-proclaimed Donetsk and Lugansk People's Republics.

In turn, the pressure on the Canadian dollar remains after the publication of rather poor statistics last Friday. Thus, the volume of retail sales for December fell sharply by 1.8%. The focus of investors on Tuesday is a block of data from the US on business activity in February, while Canada will publish a report on ADP jobs for January.

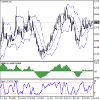

Support and resistance

Bollinger bands on the daily chart are growing slightly: the price range expands from above, letting the "bulls" renew local highs. MACD shows an uncertain growth and keeps a very poor buy signal. Stochastic moves more confidently but reflects that USD may become overbought in the ultra-short term.

Resistance levels: 1.2786, 1.2812, 1.285, 1.29.

Support levels: 1.275, 1.27, 1.265, 1.26.

Solid ECN, a True ECN Broker

Feb 22, 2022 at 15:49

Membro Desde Dec 08, 2021

325 posts

Market update by Solidecn

AUDUSD, Australian economy received a new impetus to growth

Amid the stabilization of the US currency, the AUDUSD pair is correcting within an uptrend, trading around 0.72.

Yesterday, the Australian authorities announced opening borders for citizens and tourists staying in the country. Now people with a vaccination certificate have the opportunity to visit the country. It was a major step in the revival of the tourism sector, which is losing almost 3B US dollars annually and has declined for more than two years since the start of the coronavirus pandemic.

Also, the "bulls" received an impulse to increase after the publication on Monday of optimistic macroeconomic statistics from Australia:

The index of activity in the manufacturing sector for February increased to 57.6 points. In general, the country's economy continues to recover, and with the opening of borders, the demand for the national currency of Australia will only increase. Additional support for quotes is provided by the growth of commodity markets and a decrease in demand for risky assets against the backdrop of a worsening geopolitical situation in Eastern Europe.

The index of the American currency reacts weakly to any incoming information, trading near the level of 96, which it reached amid geopolitical tensions. As for macroeconomic data, tomorrow's data on business activity in the services and manufacturing sectors could provide local support for the US dollar, but the expected publication of the February consumer confidence index from the Conference Board, which, according to analysts, may fall to 110 points from 113.8 points for January, most likely, will not allow the dollar to strengthen significantly.

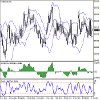

Support and resistance

On the global chart, the price moves within a wide channel. Technical indicators are in the state of a poor signal to buy: indicator Alligator's EMA fluctuations range expands upwards, and the AO histogram moved into the zone of purchases.

Resistance levels: 0.7283, 0.7457.

Support levels: 0.7100, 0.6990.

Solid ECN, a True ECN Broker

Feb 23, 2022 at 06:58

Membro Desde Dec 08, 2021

325 posts

Market update by SolidECN

Crude Oil, the uptrend is possible

Prices for "black gold" continue to grow rapidly against the backdrop of the geopolitical situation in Eastern Europe. The day before, Brent Crude Oil quotes rose above 96.50, but by the end of the session corrected to 93.75.

In general, the situation on the market remains tense.

Investors fear interruptions in the supply of Russian oil and gas to the market in the event of active hostilities on the borders with Ukraine, which is intensified due to the actions of the German authorities, who suspended the certification of the Nord Stream 2 gas pipeline the day before.

Experts believe that Russia will continue to fulfill its obligations under gas contracts, but will not increase the volume of supplies if necessary, not wanting to increase transportation through Ukrainian territory.

The prerequisites for further growth in energy prices on the market remain, although the increase in quotations is somewhat restrained by the possibility of concluding an American-Iranian "nuclear deal". In this case, Iran will be able to bring additional volumes of cheaper oil to the market, but in the current situation, even they are unlikely to be able to fully meet the growing demand.

Support and resistance

The price continues to be in an uptrend, the target of which may be at 100. The key level for the "bears" seems to be at 91 (the center line of Bollinger Bands), the breakdown of which will give the prospect of a corrective decline to 87.5.

However, this variant of the movement seems less likely, since the technical indicators indicate continued uptrend:

Bollinger Bands and Stochastic reverse upwards, and MACD is stable in the positive zone.

Resistance levels: 95, 100, 106.25.

Support levels: 91, 87.5, 81.25.

Solid ECN, a True ECN Broker

Feb 23, 2022 at 08:12

Membro Desde Dec 08, 2021

325 posts

Market update by SolidECN

GBPUSD is in a state of uncertainty

Yesterday, the GBPUSD pair corrected downwards and tested the level of 1.3550.

GBP is under pressure as investors fear the imposition of mutual economic sanctions and interruptions in the supply of energy to European countries after the leadership of the Russian Federation recognized the independence of the Donetsk and Lugansk People's Republics.

At the moment, the market has stabilized, as the sanctions against the Russian economy were moderate. The US implied a ban on trade and investment in business on the territory of the new republics introduced measures against the State Development Corporation VEB.RF and Promsvyazbank, as well as several Russian officials.

Five more Russian banks and some officials fell under the UK restrictions. For now, restrictive measures look symbolic, which does not allow the price to drop significantly. However, after a deterioration in the geopolitical situation, their list can be significantly expanded. In this case, Russia may limit the supply of oil, gas, wheat, palladium, nickel, and other metals to the market, adversely affecting European and American production.

Experts fear that global regulators may postpone the tightening of monetary policy in the face of uncertainty. The situation will continue to be quite tense, and cautious investors will diversify their portfolios.

Support and resistance

The key "bearish" level is 1.355. Its and the middle line of Bollinger bands breakdown allows a decline to 1.3427 and 1.3366. The breakout of 1.361 will provide growth towards 1.374.

The indicators do not give a single signal:

Bollinger bands reverse upwards, Stochastic reverses downwards, and MACD is stable in the positive zone.

Resistance levels: 1.361, 1.3772, 1.374.

Support levels: 1.355, 1.3427, 1.3366.

Solid ECN, a True ECN Broker

Feb 23, 2022 at 09:08

Membro Desde Dec 08, 2021

325 posts

By SolidECN

Investors increase positions in gold

Gold quotes continue to be traded at increased volumes and are kept in the area of annual highs, at the second most important psychological level of $1900.

The positive dynamics is facilitated by the acceleration of inflation rates in the world and increased geopolitical risks, since the news background regarding the crisis on the borders of Ukraine again occupies a significant place on the current agenda. In the context of global price pressure and the imminent increase in rates by central banks, investors are buying the precious metal as a defensive asset, withdrawing their capital from risky instruments such as stocks and currencies.

The current dynamics also have a local reason.

The Federal Office for Customs and Border Security of Switzerland published a report on the import and export of gold in January 2022, according to which the total export volume of the precious metal from the country amounted to 115.74 tons, which is 20% higher than in December last year, and 43% higher than in January 2021.

Asian buyers account for more than 100 tons:

China ranked first in terms of exports, importing 70 tons of gold; another 11.6 tons were bought by India, and 8 tons were bought by Singapore. The total amount of exports of the precious metal for the month exceeded 6.22B Swiss francs. In turn, the volume of imports to Switzerland also increased to 6.51B Swiss francs, which is significantly higher than in December.

Support and resistance

On the daily chart, the price reached the level of the global high of June 2021 and is now trying to consolidate at this level.

Technical indicators maintain a steady buy signal:

the fast EMAs of the Alligator indicator are above the signal line, and the histogram of the AO oscillator is trading in the buy zone, forming new ascending bars.

Support levels: 1878, 1810.

Resistance levels: 1914, 1950.

Solid ECN, a True ECN Broker

Feb 23, 2022 at 10:25

Membro Desde Dec 08, 2021

325 posts

Market update by SolidECN

USDCAD

American currency took the lead in the pair

Due to ongoing mass protests by Canadian truckers opposing anti-coronavirus measures, the USDCAD pair shows local sideways dynamics and is around 1.2747.

Canadian Prime Minister Justin Trudeau announced that a state of emergency had been introduced in the Canadian capital of Ottawa to contain protests against sanitary measures that have been going on for almost three weeks and stabilize the situation in the country as a whole until at least mid-March. It means that supply disruptions could seriously slow down a strong economic recovery in Canada. As for macroeconomic statistics, no important publications are expected this week, and the national currency is likely to continue to weaken slightly.

Since the beginning of the week, the USD Index has not left the narrow sideways range around 96. Yesterday the US dollar was slightly supported by data on business activity indices. Services PMI for February rose, and Manufacturing PMI amounted to 57.5 points, significantly higher than the January. The data from the Conference Board also was positive. The consumer confidence index fixed at 110.5 points, slightly better than the forecasted.

Support and resistance

On the global chart, the price tries to break the resistance line of the local Triangle pattern.

Technical indicators are in a buy signal:

indicator Alligator’s EMA fluctuations range expands towards growth, and the histogram of the AO oscillator forms rising bars in the buying zone.

Resistance levels: 1.2788, 1.2938.

Support levels: 1.2697, 1.252.

Solid ECN, a True ECN Broker

Feb 23, 2022 at 11:11

Membro Desde Dec 08, 2021

325 posts

**ASX 200, Australian bond market continues to rise**

Due to the ending season of corporate reporting and growth in the bond market, the quotes of the leading index of the Australian economy, ASX 200, are correcting in a sideways trend near the level of 7195.

Data provided by the diversified financial company HUB24 Ltd. reflected positive performance, with Q4 2021 revenue of A$80.07B, well above forecasts of A$60.63B. Among the corporations that reported worse than analysts expected was retail retailer Woolworths Group Ltd., whose quarterly revenue was below market estimates of 18.66B Australian dollars and recorded around 15.82B Australian dollars.

As for the bond market, the strong growth that began in the first days of the new year continues now, and the popular 10-year bonds are trading at a yield of 2.266%, which is much higher than last week's 2.100%. Only conservative bonds are in no hurry to actively rise: the yield on 20-year bonds has been holding around 2.700% for the second week already, which is still significantly higher than 2.300% at the beginning of the month.

**Support and resistance**

The price continues to trade within the global sideways channel, forming another local corrective wave. Technical indicators are ready to reverse and give a buy signal: indicator Alligator's EMA fluctuations range crossed each other, and the AO oscillator histogram moved into the buy zone, forming new upward bars.

Resistance levels: 7285, 7476.

Support levels: 7125, 6910.

Solid ECN, a True ECN Broker

Feb 24, 2022 at 07:25

Membro Desde Dec 08, 2021

325 posts

Market update by SolidECN

EURUSD

Euro updates local lows since the end of January

The European currency shows an active decline against the US dollar during the Asian session, updating local lows from January 31 and approaching strong support at around 1.12.

Noticeable pressure on the positions of the single currency on Thursday morning is put by another aggravation of the situation in the east of Ukraine. Russian President Vladimir Putin announced a special military operation on the territory of Donbass, which provoked a sharp increase in demand for safe assets and led to the fall of the ruble to its lowest level since 2016.

In response, President Joe Biden said the US and its allies and partners would "respond in a united and decisive manner". It is planned that the American leader will discuss the current situation with other members of the G7.

Meanwhile, investors also evaluated the data on inflation in the euro area in January published the day before. As expected, the CPI at the beginning of the year is kept near the level of 5.1%, but in monthly terms, the rate of price growth slowed down somewhat from 0.4% to 0.3%. It is likely that high inflation will put pressure on the positions of the European Central Bank (ECB), which is due to meet for its next meeting in March. The European regulator still maintains a soft monetary policy, and also continues the program of quantitative easing.

Support and resistance

On the D1 chart Bollinger Bands are reversing into the descending plane. The price range is expanding from below; however, it fails to catch the surge of the "bearish" sentiment at the moment.

MACD is going down preserving a stable sell signal. Stochastic keeps a downward direction but is located near its lows, which indicates the risks of oversold EUR in the ultra-short term.

Resistance levels: 1.1255, 1.13, 1.1367, 1.14.

Support levels: 1.122, 1.1185, 1.113, 1.11.

Solid ECN, a True ECN Broker

Feb 24, 2022 at 11:24

Membro Desde Dec 08, 2021

325 posts

Market update by Solid ECN

WTI Crude Oil, "black gold" rushed to new highs

Against the backdrop of the start of a military operation announced by the Russian authorities in Donbas, the price of Crude Oil shows an uptrend in trading. Interest in risky assets is rapidly falling, as investors expect the situation on the Ukrainian borders to worsen.

Against this background, the quotes of "black gold" reach new highs around $99 and approach the level of $100. If the military conflict develops, the price may rush to the levels of $110 – $115.

The US President Joe Biden announced the imposition of sanctions against the operating company Nord Stream 2 and its corporate executives, and also announced the US readiness to take further steps in the event of an escalation of the situation around Ukraine. The rhetoric of the head of the White House raises concerns among investors about a possible shortage of energy resources due to growing global demand, and, as a result, leads to an increase in the price of oil and its products.

Meanwhile, the EU authorities are also expanding the package of sanctions measures against Russian companies and individuals, which pushes energy prices up and could lead to an increase in quotations to $150 per barrel.

De-escalation of tension around Ukraine is not yet expected, so a breakdown of the level of $100 is most likely. The next growth target will be at #105. Investors will continue to follow geopolitical situation, which is now coming to the fore.

Support and resistance

The long-term trend is upward. Today, the price of the asset tested 99.00, approaching as close as possible the level of $100, the breakdown of which, as well as fixing the price above it, will most likely reach the next target in the area of $105.

As part of the medium-term uptrend, the oil price reached the target zone 6 (98.51–97.93). A breakout of this area and consolidation of the price above it will lead to an increase in prices towards the area of the target zone 7 (104.36–103.78). Key support is shifting to 92.12–91.36.

Resistance levels: 100, 105, 110.

Support levels: 95, 92.4, 89.

Solid ECN, a True ECN Broker

Feb 25, 2022 at 09:55

Membro Desde Dec 08, 2021

325 posts

Market update by Solid ECN

USDTRY

Turkey's tourism sector is under pressure

The USDTRY pair is growing, trading around the level of 13.9.

The Turkish lira is declining amid the aggravation of the geopolitical situation in Eastern Europe. According to experts, the negative consequences of the military conflict on the borders of Ukraine are inevitable for the country's economy. The longer air traffic is closed, the more the tourism sector will suffer.

Yesterday, the head of the South Aegean Tourism Association told reporters that over the past ten days, hotel reservations by Ukrainian citizens had stopped, and no new vacation requests had been recorded from Russians for two days. He also stressed that Russia and Ukraine are key areas that bring up to 70% of the total cash flow per year. In a worst-case scenario, Turkey could lose 4–5M tourists from both countries at once, resulting in a loss of $5B in revenue. According to 2022 data, tourism revenue was $22B, and the average profit per tourist increased from $630 to $800–900.

Support and resistance

Currency quotes continue to rise as part of the next wave of global growth. Technical indicators are holding a buy signal, which is getting stronger: the range of EMA fluctuations on the alligator indicator has begun to expand again, and the histogram of the AO oscillator is forming rising bars, being in the buying zone.

Resistance levels: 14.35, 15.66.

Support levels: 13.47, 12.75.

USDTRY

Turkey's tourism sector is under pressure

The USDTRY pair is growing, trading around the level of 13.9.

The Turkish lira is declining amid the aggravation of the geopolitical situation in Eastern Europe. According to experts, the negative consequences of the military conflict on the borders of Ukraine are inevitable for the country's economy. The longer air traffic is closed, the more the tourism sector will suffer.

Yesterday, the head of the South Aegean Tourism Association told reporters that over the past ten days, hotel reservations by Ukrainian citizens had stopped, and no new vacation requests had been recorded from Russians for two days. He also stressed that Russia and Ukraine are key areas that bring up to 70% of the total cash flow per year. In a worst-case scenario, Turkey could lose 4–5M tourists from both countries at once, resulting in a loss of $5B in revenue. According to 2022 data, tourism revenue was $22B, and the average profit per tourist increased from $630 to $800–900.

Support and resistance

Currency quotes continue to rise as part of the next wave of global growth. Technical indicators are holding a buy signal, which is getting stronger: the range of EMA fluctuations on the alligator indicator has begun to expand again, and the histogram of the AO oscillator is forming rising bars, being in the buying zone.

Resistance levels: 14.35, 15.66.

Support levels: 13.47, 12.75.

Solid ECN, a True ECN Broker

Mar 02, 2022 at 07:50

Membro Desde Dec 08, 2021

325 posts

EURUSD holds at record lows

The pressure on the position of the trading instrument is still exerted by the growing geopolitical tension in Eastern Europe Negotiations aimed at an immediate ceasefire, which the parties tried to hold at the end of February, did not lead to any results, and Russian troops continue to conduct a special military operation on the territory of Ukraine. In the meantime, the Russian economy is facing unprecedented pressure from sanctions, which has some counter-effect.

Macroeconomic statistics from Europe published yesterday turned out to be mixed.

The statistics on business activity showed a slight decline, but the February data does not yet include such a sharp deterioration in the situation in Eastern Europe. Anyway, the Markit Manufacturing PMI in the euro area in February fell, while analysts did not expect any changes at all. But statistics on inflation in Germany supported the position of the euro. The Harmonized Price Index increased by 5.5%, beating forecasts of a 5.4% increase.

Support and resistance

Bollinger Bands in D1 chart demonstrate active decrease. The price range is expanding, but at the moment it is not keeping up with the surge of "bearish" sentiment. MACD is going down preserving a stable sell signal. Stochastic is showing similar dynamics; however, the indicator is rapidly approaching its lows, indicating the risks of oversold EUR in the ultra-short term.

Resistance levels: 1.115, 1.1185, 1.1220, 1.1255.

Support levels: 1.11, 1.1054, 1.1, 1.0952.

Solid ECN, a True ECN Broker

Mar 03, 2022 at 07:12

Membro Desde Dec 08, 2021

325 posts

Market Update by Solid ECN

GBPUSD

The pound is consolidating near 1.34

The macroeconomic background from the UK remained rather restrained, as well as the general sentiment on the market against the backdrop of escalating tensions in Eastern Europe. Anyway, yesterday's data showed the BRC Retail Price Index rising 1.8% in January after rising 1.5% in December. The Nationwide House Price Index (not seasonally adjusted) accelerated from 11.2% to 12.6% in February, well ahead of forecasts of a slowdown to 10.7%.

Meanwhile, the EU countries, as well as the UK, continue to exert significant sanctions pressure on Russia. The day before, the British Ministry of Finance banned the largest financial institution in Russia, Sberbank PJSC, from conducting clearing operations in pounds. In addition, a complete freeze on the assets of three Russian banks was introduced, and all Russian companies were denied access to the capital market of the United Kingdom. Sanctions also harm the European economy, but the West's position in this sense is clear and unambiguous.

Support and resistance

Bollinger Bands in D1 chart demonstrate a moderate decrease. The price range expands from below, making way for new local lows for the "bears". MACD has reversed upwards preserving a sell signal. Stochastic demonstrates similar dynamics, gradually changing its direction. Current readings of the indicators signal in favor of a corrective growth in the ultra-short term.

Resistance levels: 1.3435, 1.346, 1.35, 1.355.

Support levels: 1.335, 1.33, 1.3250, 1.32.

GBPUSD

The pound is consolidating near 1.34

The macroeconomic background from the UK remained rather restrained, as well as the general sentiment on the market against the backdrop of escalating tensions in Eastern Europe. Anyway, yesterday's data showed the BRC Retail Price Index rising 1.8% in January after rising 1.5% in December. The Nationwide House Price Index (not seasonally adjusted) accelerated from 11.2% to 12.6% in February, well ahead of forecasts of a slowdown to 10.7%.

Meanwhile, the EU countries, as well as the UK, continue to exert significant sanctions pressure on Russia. The day before, the British Ministry of Finance banned the largest financial institution in Russia, Sberbank PJSC, from conducting clearing operations in pounds. In addition, a complete freeze on the assets of three Russian banks was introduced, and all Russian companies were denied access to the capital market of the United Kingdom. Sanctions also harm the European economy, but the West's position in this sense is clear and unambiguous.

Support and resistance

Bollinger Bands in D1 chart demonstrate a moderate decrease. The price range expands from below, making way for new local lows for the "bears". MACD has reversed upwards preserving a sell signal. Stochastic demonstrates similar dynamics, gradually changing its direction. Current readings of the indicators signal in favor of a corrective growth in the ultra-short term.

Resistance levels: 1.3435, 1.346, 1.35, 1.355.

Support levels: 1.335, 1.33, 1.3250, 1.32.

Solid ECN, a True ECN Broker

Mar 03, 2022 at 09:14

Membro Desde Dec 08, 2021

325 posts

Market Update by Solid ECN

USDCHF

Growth ahead of the release of the report on the US labor market

Current trend

During the Asian session, the USDCHF pair is growing slightly, trying to consolidate above the psychological level of 0.92. The market's focus is the situation in the east of Europe, where, despite tough economic sanctions and the consolidated position of Western countries, Russia continues to conduct a special military operation. However, investors are also trying to assess how much the escalation of tensions will affect the global economy.

At the end of the week, the market will receive the February report on the US labor market, but for now, investors are reacting to the publication of the ADP report and the speech of the head of the US Federal Reserve, Jerome Powell. The statistics showed an increase of 475K in Nonfarm Payrolls after 509K last month. Market forecasts assumed growth of only 388K. Commenting on the published data, the department chairman confirmed the intention officials to raise the key interest rate at a meeting at the end of March. He also noted systemic improvements in the labor market and again pointed to rising inflation, well above the target threshold of 2% per annum.

Support and resistance

Bollinger bands are moderately declining on the daily chart: the price range is actively narrowing from above, indicating an ambiguous nature of trading in the short term. The MACD indicator reverses upwards, forming a new buy signal (the histogram is trying to consolidate above the signal line). Also, the indicator is preparing to test the zero line for a breakout. Stochastic, reversed from the level of "20" into an upward plane, signals in favor of developing "bullish" dynamics in the short and/or ultra-short term.

Resistance levels: 0.9220, 0.9250, 0.9276, 0.9300.

Support levels: 0.9200, 0.9175, 0.9148, 0.9100.

USDCHF

Growth ahead of the release of the report on the US labor market

Current trend

During the Asian session, the USDCHF pair is growing slightly, trying to consolidate above the psychological level of 0.92. The market's focus is the situation in the east of Europe, where, despite tough economic sanctions and the consolidated position of Western countries, Russia continues to conduct a special military operation. However, investors are also trying to assess how much the escalation of tensions will affect the global economy.

At the end of the week, the market will receive the February report on the US labor market, but for now, investors are reacting to the publication of the ADP report and the speech of the head of the US Federal Reserve, Jerome Powell. The statistics showed an increase of 475K in Nonfarm Payrolls after 509K last month. Market forecasts assumed growth of only 388K. Commenting on the published data, the department chairman confirmed the intention officials to raise the key interest rate at a meeting at the end of March. He also noted systemic improvements in the labor market and again pointed to rising inflation, well above the target threshold of 2% per annum.

Support and resistance

Bollinger bands are moderately declining on the daily chart: the price range is actively narrowing from above, indicating an ambiguous nature of trading in the short term. The MACD indicator reverses upwards, forming a new buy signal (the histogram is trying to consolidate above the signal line). Also, the indicator is preparing to test the zero line for a breakout. Stochastic, reversed from the level of "20" into an upward plane, signals in favor of developing "bullish" dynamics in the short and/or ultra-short term.

Resistance levels: 0.9220, 0.9250, 0.9276, 0.9300.

Support levels: 0.9200, 0.9175, 0.9148, 0.9100.

Solid ECN, a True ECN Broker

Mar 04, 2022 at 07:17

Membro Desde Dec 08, 2021

325 posts

USDCAD, wins back losses

During the Asian session, the USDCAD pair is growing uncertainly, developing the “bullish” momentum formed yesterday, when the instrument was trading near local lows since January 26.

Investors are in no hurry to open long positions on the US currency, preferring to wait for today's publication of the final report on the labor market for February, hoping to receive additional confirmation of the possibility of raising interest rates during the March meeting of the US Federal Reserve. Given the aggravation of the situation around Ukraine, it is likely that the regulator may change its original plans. Some concern is caused by the US statistics on business activity published in recent days, which reflects the rapid decline in sentiment, especially in the service sector.

The Canadian currency is supported by the actions of the Bank of Canada. On Wednesday, the regulator expectedly raised interest rates by 25 basis points to 0.5%. Yesterday, the head of department, Tiff Macklem, stressed that the Board of Governors of the bank expects further tightening of monetary policy as the national economy grows, while the previous target levels remain unchanged.

Support and resistance

On the daily chart, Bollinger bands reverse a horizontal plane: the price range slightly expands from below, trying to keep with the surge in trading activity in the middle of the week. MACD indicator tries to reverse upwards, keeping its previous sell signal (the histogram is below the signal line). Stochastic shows similar dynamics, retreating slightly from its lows, signaling that the US dollar is oversold in the ultra-short term.

Resistance levels: 1.2700, 1.2750, 1.2786, 1.2812.

Support levels: 1.2650, 1.2600, 1.2558, 1.2500.

Solid ECN, a True ECN Broker

Mar 04, 2022 at 09:20

Membro Desde Dec 08, 2021

325 posts

Gold, Murray analysis

Quotes of XAU/USD continue to grow actively for the second month in a row. During this time, the price reversed upwards from 1781.25 ([1/8]), broke into the positive part of the Murray trading range and is now actively testing the reverse level of 1937.50 ([6/8]), consolidation above which will give the prospect of the uptrend up to the upper limit trading range 2000.00 ([8/8]). If the level of 1906.25 ([5/8]) is broken down, the corrective decline within the central Murray corridor may continue to the levels of 1875.00 ([4/8]), 1843.75 ([3/8]), but this option of price movement seems less likely.

Technical indicators confirm the preservation of the uptrend: Bollinger Bands and Stochastic are directed upwards, and MACD histogram is increasing in the positive zone.

Support and resistance

Resistance levels: 1937, 1968, 2000.

Support levels: 1906, 1875, 1843.

Quotes of XAU/USD continue to grow actively for the second month in a row. During this time, the price reversed upwards from 1781.25 ([1/8]), broke into the positive part of the Murray trading range and is now actively testing the reverse level of 1937.50 ([6/8]), consolidation above which will give the prospect of the uptrend up to the upper limit trading range 2000.00 ([8/8]). If the level of 1906.25 ([5/8]) is broken down, the corrective decline within the central Murray corridor may continue to the levels of 1875.00 ([4/8]), 1843.75 ([3/8]), but this option of price movement seems less likely.

Technical indicators confirm the preservation of the uptrend: Bollinger Bands and Stochastic are directed upwards, and MACD histogram is increasing in the positive zone.

Support and resistance

Resistance levels: 1937, 1968, 2000.

Support levels: 1906, 1875, 1843.

Solid ECN, a True ECN Broker

Mar 08, 2022 at 07:57

Membro Desde Dec 08, 2021

325 posts

GBPUSD, the pound is consolidating near 1.31

The British pound regains lost ground during the morning session on March 8, trying to retreat from record lows since November 2021, updated the day before. The downtrend in GBP/USD is due to the rapid strengthening of the US dollar quotes, as market participants are in a hurry to hedge risks against the backdrop of rising inflation and the continuation of a special military operation of Russian troops in Ukraine. On Monday, the trading instrument came close to strong support at 1.3100, below which the British currency was last traded in November 2020.

The pound, like many other high-yielding assets, is being sold amid escalating tensions in Eastern Europe and sanctions pressure exerted by Western countries on Russia, which intensified earlier in the week after the US authorities announced that they were considering a complete ban on energy imports from Russia. The position of European countries on this issue is not unanimous, as some of them, such as Germany, say that it is currently not possible to resolve the energy issue without Russian supplies. Against this backdrop, prices for gasoline, gas and electricity continue to rise in Europe.

The macroeconomic statistics from Great Britain, released at the beginning of the week, did not have a significant impact on the dynamics of the instrument. Halifax House Prices rose by 0.5% in February, which turned out to be noticeably worse than market forecasts at the level of 1.1%. BRC Like-For-Like Retail Sales in February slowed down sharply from 8.1% to 2.7%, while the market expected a strong growth of 15.2%.

Support and resistance

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is expanding, but at the moment it is not keeping up with the surge of "bearish" sentiment. MACD is going down preserving a stable sell signal. Stochastic keeps a steady downward direction but is already approaching its lows, which indicates the risks of oversold pound in the ultra-short term.

Resistance levels: 1.315, 1.3200, 1.3250, 1.33.

Support levels: 1.31, 1.305, 1.3, 1.296.

The British pound regains lost ground during the morning session on March 8, trying to retreat from record lows since November 2021, updated the day before. The downtrend in GBP/USD is due to the rapid strengthening of the US dollar quotes, as market participants are in a hurry to hedge risks against the backdrop of rising inflation and the continuation of a special military operation of Russian troops in Ukraine. On Monday, the trading instrument came close to strong support at 1.3100, below which the British currency was last traded in November 2020.

The pound, like many other high-yielding assets, is being sold amid escalating tensions in Eastern Europe and sanctions pressure exerted by Western countries on Russia, which intensified earlier in the week after the US authorities announced that they were considering a complete ban on energy imports from Russia. The position of European countries on this issue is not unanimous, as some of them, such as Germany, say that it is currently not possible to resolve the energy issue without Russian supplies. Against this backdrop, prices for gasoline, gas and electricity continue to rise in Europe.

The macroeconomic statistics from Great Britain, released at the beginning of the week, did not have a significant impact on the dynamics of the instrument. Halifax House Prices rose by 0.5% in February, which turned out to be noticeably worse than market forecasts at the level of 1.1%. BRC Like-For-Like Retail Sales in February slowed down sharply from 8.1% to 2.7%, while the market expected a strong growth of 15.2%.

Support and resistance

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is expanding, but at the moment it is not keeping up with the surge of "bearish" sentiment. MACD is going down preserving a stable sell signal. Stochastic keeps a steady downward direction but is already approaching its lows, which indicates the risks of oversold pound in the ultra-short term.

Resistance levels: 1.315, 1.3200, 1.3250, 1.33.

Support levels: 1.31, 1.305, 1.3, 1.296.

Solid ECN, a True ECN Broker

Mar 09, 2022 at 10:22

Membro Desde Dec 08, 2021

325 posts

EURUSD, the euro develops technical correction

The European currency shows weak growth against the US dollar during the Asian session, developing a corrective momentum and testing 1.09 for a breakout; however, further development of the "bullish" dynamics for the instrument is limited by negative market sentiment regarding the growth prospects of the eurozone economy.

Analysts pay attention to the sharp increase in quotations on commodity markets after Russian President Vladimir Putin initiated a special military operation in Ukraine. Subsequently, the authorities of the Western countries imposed unprecedented sanctions on the Russian economy, and many global companies decided to refuse cooperation with business partners from Russia. In addition, the United States announced the day before that the country was completely refusing to import Russian oil, gas and other energy carriers, which is likely to further aggravate the situation on the commodity markets. Europe, in turn, will not yet be able to completely ban Russian imports, since it is much more dependent on them. However, further restrictions are possible, and, for example, the UK said earlier in the week that it intends to cut off Russian energy supplies by the end of 2022. In addition, sanctions could backfire, causing the euro system to fall, as a freeze on Russian assets could negatively impact European banks.

This week, investors will focus on the decision of the European Central Bank (ECB) on interest rates. The meeting will take place on Thursday, March 10, and current market forecasts suggest that the regulator will not change the parameters of monetary policy. Moreover, it is quite possible that the ECB will not raise rates at all this year, given the possible slowdown in economic growth in the region.

Support and resistance

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is changing slightly, but remains rather spacious for the current level of activity in the market. MACD is trying to reverse upwards keeping a previous sell signal (located below the signal line). Stochastic is showing similar dynamics, retreating from its lows, indicating strongly oversold EUR in the ultra-short term.

Resistance levels: 1.095, 1.1, 1.1054, 1.11.

Support levels: 1.09, 1.086, 1.08, 1.075.

The European currency shows weak growth against the US dollar during the Asian session, developing a corrective momentum and testing 1.09 for a breakout; however, further development of the "bullish" dynamics for the instrument is limited by negative market sentiment regarding the growth prospects of the eurozone economy.

Analysts pay attention to the sharp increase in quotations on commodity markets after Russian President Vladimir Putin initiated a special military operation in Ukraine. Subsequently, the authorities of the Western countries imposed unprecedented sanctions on the Russian economy, and many global companies decided to refuse cooperation with business partners from Russia. In addition, the United States announced the day before that the country was completely refusing to import Russian oil, gas and other energy carriers, which is likely to further aggravate the situation on the commodity markets. Europe, in turn, will not yet be able to completely ban Russian imports, since it is much more dependent on them. However, further restrictions are possible, and, for example, the UK said earlier in the week that it intends to cut off Russian energy supplies by the end of 2022. In addition, sanctions could backfire, causing the euro system to fall, as a freeze on Russian assets could negatively impact European banks.

This week, investors will focus on the decision of the European Central Bank (ECB) on interest rates. The meeting will take place on Thursday, March 10, and current market forecasts suggest that the regulator will not change the parameters of monetary policy. Moreover, it is quite possible that the ECB will not raise rates at all this year, given the possible slowdown in economic growth in the region.

Support and resistance

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is changing slightly, but remains rather spacious for the current level of activity in the market. MACD is trying to reverse upwards keeping a previous sell signal (located below the signal line). Stochastic is showing similar dynamics, retreating from its lows, indicating strongly oversold EUR in the ultra-short term.

Resistance levels: 1.095, 1.1, 1.1054, 1.11.

Support levels: 1.09, 1.086, 1.08, 1.075.

Solid ECN, a True ECN Broker

Mar 10, 2022 at 08:08

Membro Desde Dec 08, 2021

325 posts

NZDUSD, consolidation at local highs

New Zealand dollar has been showing near zero trend against US dollar in the Asian session, consolidating around 0.6830. The day before, NZDUSD tried to show corrective growth amid some improvement in investor sentiment regarding the prospects for a diplomatic scenario for resolving the conflict in Ukraine, but so far significant risks remain.

Quotes of the asset are also supported by positive macroeconomic statistics from New Zealand and China. New Zealand Manufacturing Sales volumes corrected to 8.2% in Q4 2021 after declining by 6.6% in the previous quarter. Chinese statistics recorded a steady increase in Consumer Prices, indicating a resumption of economic recovery: in February, the figure increased by 0.6% in monthly terms and by 0.9% in annual terms, which was better than market forecasts (0.3% MoM and 0.8% YoY). In turn, the data released today turned out to be more pessimistic. Electronic Card Retail Sales in New Zealand showed a sharp decline of 7.8% in February after rising by 3% in January, although analysts had expected zero dynamics. In annual terms, sales volumes slowed down from 5.7% to 1.1%, which also turned out to be worse than preliminary market forecasts at 9.6%.

Support and resistance

Bollinger Bands on the daily chart show a steady increase. The price range is slightly narrowing, reflecting the ambiguous dynamics of trading in the short term. MACD is trying to reverse downwards, forming a weak sell signal (the histogram is trying to consolidate below the signal line). Stochastic shows a more confident decline, signaling in favor of the development of corrective dynamics in the nearest future.

Resistance levels: 0.684, 0.6866, 0.69, 0.6924.

Support levels: 0.6795, 0.6766, 0.6732, 0.67.

New Zealand dollar has been showing near zero trend against US dollar in the Asian session, consolidating around 0.6830. The day before, NZDUSD tried to show corrective growth amid some improvement in investor sentiment regarding the prospects for a diplomatic scenario for resolving the conflict in Ukraine, but so far significant risks remain.

Quotes of the asset are also supported by positive macroeconomic statistics from New Zealand and China. New Zealand Manufacturing Sales volumes corrected to 8.2% in Q4 2021 after declining by 6.6% in the previous quarter. Chinese statistics recorded a steady increase in Consumer Prices, indicating a resumption of economic recovery: in February, the figure increased by 0.6% in monthly terms and by 0.9% in annual terms, which was better than market forecasts (0.3% MoM and 0.8% YoY). In turn, the data released today turned out to be more pessimistic. Electronic Card Retail Sales in New Zealand showed a sharp decline of 7.8% in February after rising by 3% in January, although analysts had expected zero dynamics. In annual terms, sales volumes slowed down from 5.7% to 1.1%, which also turned out to be worse than preliminary market forecasts at 9.6%.

Support and resistance

Bollinger Bands on the daily chart show a steady increase. The price range is slightly narrowing, reflecting the ambiguous dynamics of trading in the short term. MACD is trying to reverse downwards, forming a weak sell signal (the histogram is trying to consolidate below the signal line). Stochastic shows a more confident decline, signaling in favor of the development of corrective dynamics in the nearest future.

Resistance levels: 0.684, 0.6866, 0.69, 0.6924.

Support levels: 0.6795, 0.6766, 0.6732, 0.67.

Solid ECN, a True ECN Broker

*Uso comercial e spam não serão tolerados, podendo resultar no encerramento da conta.

Dica: Postar uma imagem/URL do YouTube irá incorporá-la automaticamente no seu post!

Dica: Insira o sinal @ para preencher automaticamente um nome de utilizador que participe nesta discussão.