Edit Your Comment

USDCAD

Membro Desde Dec 09, 2012

1 posts

Aug 25, 2016 at 01:39

Membro Desde Dec 09, 2012

1 posts

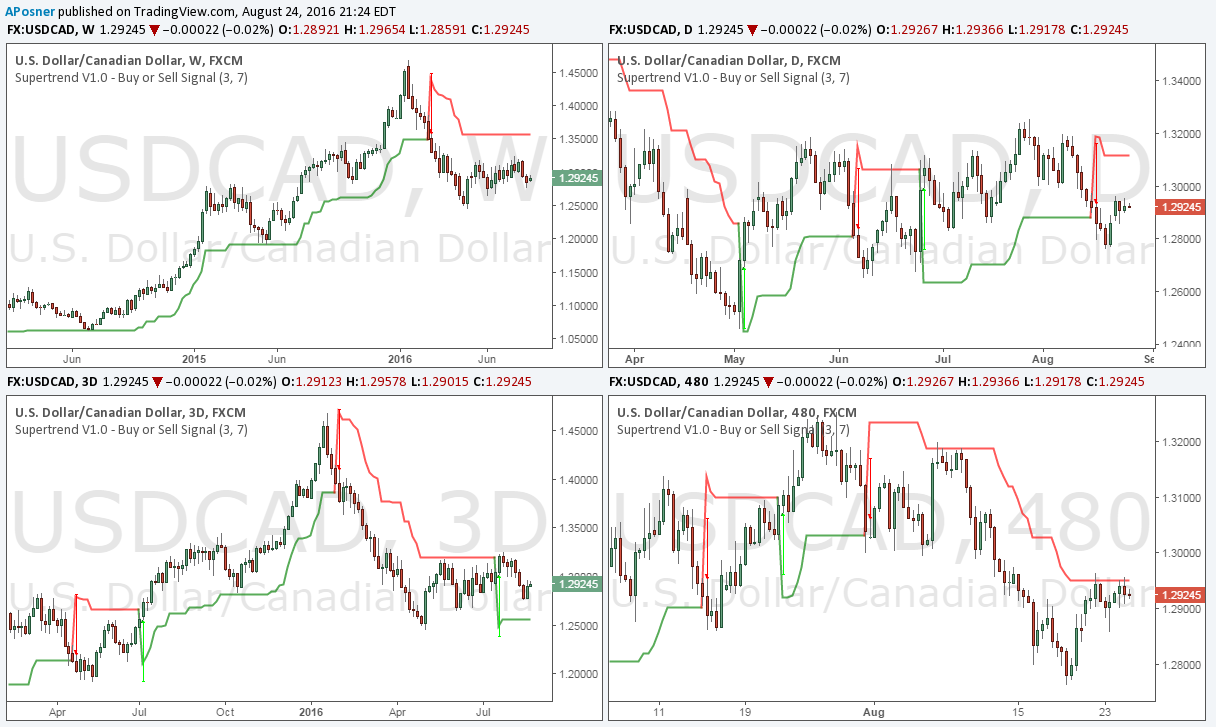

USD/CAD rally was short lived

With the fall in oil comes a decline in the USD/CAD pair. The pair was already in a medium-term downtrend but recently had been rallying with oil. Crude oil prices made their way to nearly $50 this month which provided a catalyst for USD/CAD to rally. With the build in oil, today the momentum behind the crude rally is over, and this will weigh on the Loonie.

From a technical perspective, the pair has been consolidating sideways all week near the 1.2950 area which is a support/resistance line tracing back to October 2105 with multiple touch point since then. On an 8 hour chart, the price has run to the median line and has been moving sideways. With each bullish push into the declining pitchfork, the median line has rejected price setting up the reversal.

Current situation:

- The pair has found resistance at the median line of the pitchfork on the 8-hour chart.

- US economic data dominates the calendar Thursday and Friday this week. Next week more US data and Canadian m/m GDP.

Looking ahead:

- Lower oil prices will result in a weaker Loonie. The market currently lacks a catalyst to push oil up over $50. There is another inventory report next Wednesday.

Notes:

- The overnight lending rates of the two currencies are now the same negating any carry benefit for the Loonie.

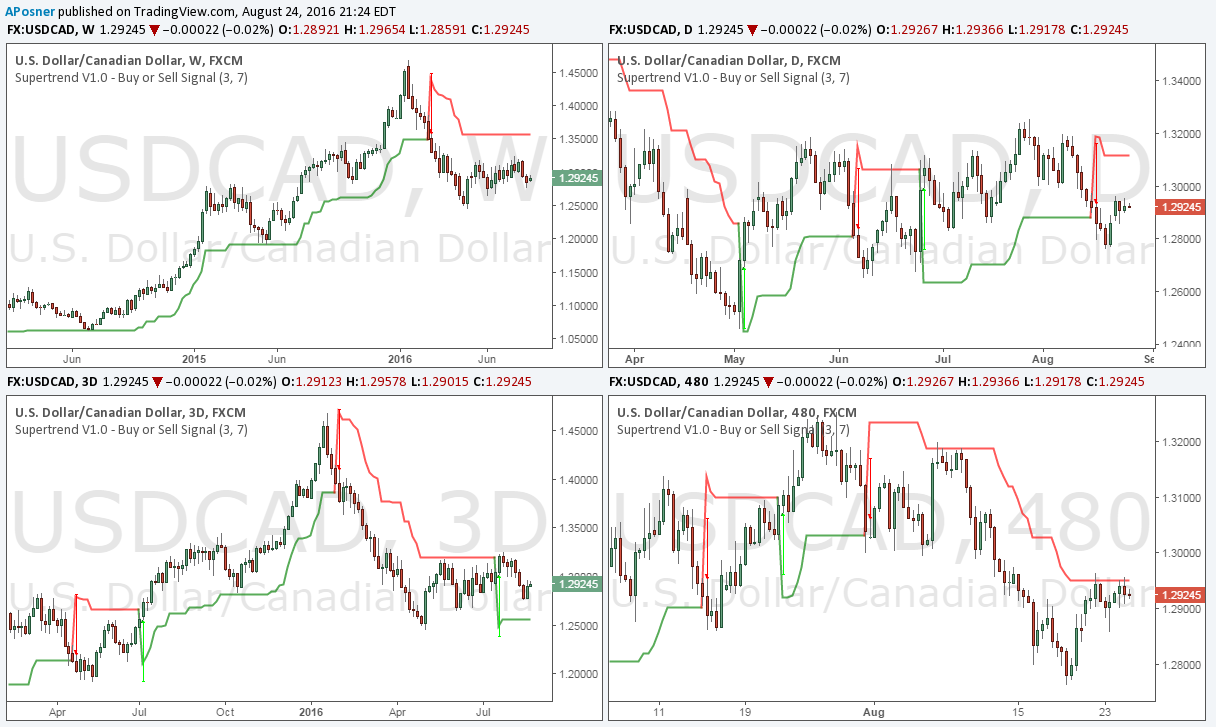

With the fall in oil comes a decline in the USD/CAD pair. The pair was already in a medium-term downtrend but recently had been rallying with oil. Crude oil prices made their way to nearly $50 this month which provided a catalyst for USD/CAD to rally. With the build in oil, today the momentum behind the crude rally is over, and this will weigh on the Loonie.

From a technical perspective, the pair has been consolidating sideways all week near the 1.2950 area which is a support/resistance line tracing back to October 2105 with multiple touch point since then. On an 8 hour chart, the price has run to the median line and has been moving sideways. With each bullish push into the declining pitchfork, the median line has rejected price setting up the reversal.

Current situation:

- The pair has found resistance at the median line of the pitchfork on the 8-hour chart.

- US economic data dominates the calendar Thursday and Friday this week. Next week more US data and Canadian m/m GDP.

Looking ahead:

- Lower oil prices will result in a weaker Loonie. The market currently lacks a catalyst to push oil up over $50. There is another inventory report next Wednesday.

Notes:

- The overnight lending rates of the two currencies are now the same negating any carry benefit for the Loonie.

Uncommon Wisdom for All

Membro Desde Oct 02, 2014

905 posts

Sep 07, 2016 at 12:33

Membro Desde Nov 14, 2015

315 posts

jayrness posted:

@dianajs , do you think that the interest rate decision, if it will remain at 0.50%, will give the cad a bullish trend, or will remain its bearish bias?

There is virtually no chance that they'll change the rate. Its all about the statement.

Membro Desde Nov 09, 2015

20 posts

*Uso comercial e spam não serão tolerados, podendo resultar no encerramento da conta.

Dica: Postar uma imagem/URL do YouTube irá incorporá-la automaticamente no seu post!

Dica: Insira o sinal @ para preencher automaticamente um nome de utilizador que participe nesta discussão.