- Início

- Comunidade

- Negociantes Experientes

- What's the best way to trade Martingale Forex Trading

Advertisement

Edit Your Comment

What's the best way to trade Martingale Forex Trading

Membro Desde Feb 22, 2011

4573 posts

Nov 27, 2014 at 07:38

Membro Desde Feb 22, 2011

4573 posts

ForexAssistant posted:

Vontogr, why do you say that? You use stop-losses in technical trading why would you not use some limit on a recovery system. I use a Fibonacci sequence as apposed to a martingale series because I get 2 more iterations for less draw.

Martingale = 1, 2, 4, 8, 16, 32, 64, 128, gives a total draw for 8 iterations = 255 times the size of the first trade.

Fibonacci = 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, total draw for 10 iterations = 232 times first trade.

I use 10 iterations as my limit, after that I use a slow recovery to compensate for the infrequent times that the primary recovery system fails. A slow recovery is starting back at the base size but every trade is doubled. One half of the doubled trade is for current profits while the other half of the trade pays off the loss. After the loss has been recovered, we drop back to single trade size.

So you see, it does not get bigger and bigger, it has a limit. Only amateurs would try to use a recovery system without some limits in place. I don't think anyone believes that I am one of those.

Bob

If you use limit of recovery it wont help.

Lets say you set maximum number of martingale trades to 8

Then in case you loose $100 on first not martinagle trade

Your next martinagle trades would be

-200

-400

-800

-1600

-3200

-6400

-12800

-25600

You end up loosing more than $50,000

Nov 27, 2014 at 08:00

Membro Desde Dec 29, 2013

10 posts

Although i dont dismiss a martingale system outright (manual or automated), the question you need to ask yourself, is it worth it. The initial steady gains come at a big price. You need to be able to live with the constant stress whether a DD will ramp up to unsustainable drawdowns. common pitfalls; overleveraging, backtest curvefitting.

The characteristics of a currency pair are also important. The high volatility pairs (ea JPY) look profitable but they can trend strong and from what ive seen martingale always fails on jpy pairs. I consider audnzd the best pair for a martingale to succeed.

PS. a gridsystem doesnt have to be technically martingale to be just as dangerous. The lotsize AND the space between taken trades in the same direction determine the agressiveness.

More aggressive system= less likely to fail short term, because it needs the currency to retrace less to get out of a basket of trades. But when it does fail (too minor retrace) its going down fast. You will want to seek a balance in agressiveness.

The characteristics of a currency pair are also important. The high volatility pairs (ea JPY) look profitable but they can trend strong and from what ive seen martingale always fails on jpy pairs. I consider audnzd the best pair for a martingale to succeed.

PS. a gridsystem doesnt have to be technically martingale to be just as dangerous. The lotsize AND the space between taken trades in the same direction determine the agressiveness.

More aggressive system= less likely to fail short term, because it needs the currency to retrace less to get out of a basket of trades. But when it does fail (too minor retrace) its going down fast. You will want to seek a balance in agressiveness.

Membro Desde Jun 28, 2011

444 posts

Nov 27, 2014 at 15:28

Membro Desde Jun 28, 2011

444 posts

Vontogr, losing $50,000 is no big thing if you are trading 5 million. Your stated trade sizes are huge to start with. Using the Fibonacci series from above lets work out what 10 iterations would be.

If we lost ten times in a row, first, that isn't a problem with the recovery system, it is a problem with your trading system, however, if our ranges were 20 pips, trading .01 lots would generate a change of 10 cents per pip or 2 dollars per range. Since 10 iterations would cost 232 times the $2.00 per range we would end up with a loss of $464.00

The slow recovery would kick in and we would need to take 232 profitable trades to make up the loss.

For our account size we would need 3 times the maximum loss (3 X $464 = $1392) plus the margin. I use a leverage of 200:1 which means that I have to put aside $5 for every .01 lots traded. In recovery mode we trade twice the size for each level so we would double the max Reserve. (2 X $5 X 89) which equals $890. Remember that every time the trade is closed, the margin is released so we only need to account for the highest trade size.

Adding the two is ($1392 + $890) $2282. So if we have $2500 in the account, even a double system failure would not deplete the account. The odds of getting a double system failure is dependent on the trading system but even a standard martingale with a 50/50 chance of winning would have a probability of un-reclaimed loss of 1 over (2 to the 10th power times 2). This gives a rough probability of .00049. In short, Not likely to happen once in 2000 trades.

The profitability for 2000 trades is $4000, at risk is $1392, so the odds are with you.

That's why my systems tend to work, there is no guess work, they are all mathematical.

Bob

If we lost ten times in a row, first, that isn't a problem with the recovery system, it is a problem with your trading system, however, if our ranges were 20 pips, trading .01 lots would generate a change of 10 cents per pip or 2 dollars per range. Since 10 iterations would cost 232 times the $2.00 per range we would end up with a loss of $464.00

The slow recovery would kick in and we would need to take 232 profitable trades to make up the loss.

For our account size we would need 3 times the maximum loss (3 X $464 = $1392) plus the margin. I use a leverage of 200:1 which means that I have to put aside $5 for every .01 lots traded. In recovery mode we trade twice the size for each level so we would double the max Reserve. (2 X $5 X 89) which equals $890. Remember that every time the trade is closed, the margin is released so we only need to account for the highest trade size.

Adding the two is ($1392 + $890) $2282. So if we have $2500 in the account, even a double system failure would not deplete the account. The odds of getting a double system failure is dependent on the trading system but even a standard martingale with a 50/50 chance of winning would have a probability of un-reclaimed loss of 1 over (2 to the 10th power times 2). This gives a rough probability of .00049. In short, Not likely to happen once in 2000 trades.

The profitability for 2000 trades is $4000, at risk is $1392, so the odds are with you.

That's why my systems tend to work, there is no guess work, they are all mathematical.

Bob

where research touches lives.

Membro Desde Feb 22, 2011

4573 posts

Nov 28, 2014 at 10:58

Membro Desde Feb 22, 2011

4573 posts

ForexAssistant posted:

Vontogr, losing $50,000 is no big thing if you are trading 5 million. Your stated trade sizes are huge to start with. Using the Fibonacci series from above lets work out what 10 iterations would be.

If we lost ten times in a row, first, that isn't a problem with the recovery system, it is a problem with your trading system, however, if our ranges were 20 pips, trading .01 lots would generate a change of 10 cents per pip or 2 dollars per range. Since 10 iterations would cost 232 times the $2.00 per range we would end up with a loss of $464.00

The slow recovery would kick in and we would need to take 232 profitable trades to make up the loss.

For our account size we would need 3 times the maximum loss (3 X $464 = $1392) plus the margin. I use a leverage of 200:1 which means that I have to put aside $5 for every .01 lots traded. In recovery mode we trade twice the size for each level so we would double the max Reserve. (2 X $5 X 89) which equals $890. Remember that every time the trade is closed, the margin is released so we only need to account for the highest trade size.

Adding the two is ($1392 + $890) $2282. So if we have $2500 in the account, even a double system failure would not deplete the account. The odds of getting a double system failure is dependent on the trading system but even a standard martingale with a 50/50 chance of winning would have a probability of un-reclaimed loss of 1 over (2 to the 10th power times 2). This gives a rough probability of .00049. In short, Not likely to happen once in 2000 trades.

The profitability for 2000 trades is $4000, at risk is $1392, so the odds are with you.

That's why my systems tend to work, there is no guess work, they are all mathematical.

Bob

That's my point

Why on earth would you use martingale on 5 mil account. It is much better and safer to use strategy that does not need martingale

Membro Desde Oct 22, 2014

10 posts

Nov 28, 2014 at 12:18

Membro Desde Oct 22, 2014

10 posts

Martingale systems is suicidal systems, Basic principle of martingale retracement, but never forgot forex market is unpredictable, volatile, sometimes never give up retracement that time trader suicide, 90 success trade = 1 single worst martingale trade finished, example last mont US retails data times EURO/USD suddenly jumbs more than 230 pips that time martingale activate traders must died so careful for martingale my opinion

Membro Desde Jun 28, 2011

444 posts

Nov 28, 2014 at 18:57

Membro Desde Jun 28, 2011

444 posts

""example last mont US retails data times EURO/USD suddenly jumbs more than 230 pips"

Yes, I know, I made good money off of that move. I will say this again as it seems to be important. "A recovery system will make good traders better but not make a bad trading system somehow miraculously good. If you can't figure out how to get in the right direction over a 230 pip change, don't blame the recovery system, that's the trading systems fault. Even automated systems have pause buttons. (Actually a set of criteria that pauses the trading until released.)

But don't let me change your mind, if you don't like recovery systems, don't use them. I don't always use them either. The RISE program took over 3000 trades with no losses, now why would I want to put a recovery system on something like that? All a recovery system does is eliminate the wrong trades, not make good ones. If your trading system isn't right better than 50% of the time, no recovery system will make it profitable.

A martingale or other recovery system is only for good traders, a tool to help them become more profitable. A chainsaw is a valuable tool, just don't let your kids play with it. Same idea.

Bob

Yes, I know, I made good money off of that move. I will say this again as it seems to be important. "A recovery system will make good traders better but not make a bad trading system somehow miraculously good. If you can't figure out how to get in the right direction over a 230 pip change, don't blame the recovery system, that's the trading systems fault. Even automated systems have pause buttons. (Actually a set of criteria that pauses the trading until released.)

But don't let me change your mind, if you don't like recovery systems, don't use them. I don't always use them either. The RISE program took over 3000 trades with no losses, now why would I want to put a recovery system on something like that? All a recovery system does is eliminate the wrong trades, not make good ones. If your trading system isn't right better than 50% of the time, no recovery system will make it profitable.

A martingale or other recovery system is only for good traders, a tool to help them become more profitable. A chainsaw is a valuable tool, just don't let your kids play with it. Same idea.

Bob

where research touches lives.

forex_trader_20011

Membro Desde Oct 08, 2010

407 posts

Nov 29, 2014 at 11:49

Membro Desde Oct 08, 2010

407 posts

Of course there are brokers out there that trade in micro lots that you can test a martingale system without risking big money. I have only found one that has an account type that offers 1 Lot = 1000 units (instead of the standard 100,000 units).

http://forexbrokerinc.com

It is because of this broker is the ONLY reason I am able to attempt a full martingale MM system without stressing over losing a ton of money. If it blows the account, I just re-fund it.

http://forexbrokerinc.com

It is because of this broker is the ONLY reason I am able to attempt a full martingale MM system without stressing over losing a ton of money. If it blows the account, I just re-fund it.

forex_trader_20011

Membro Desde Oct 08, 2010

407 posts

Nov 29, 2014 at 11:49

Membro Desde Oct 08, 2010

407 posts

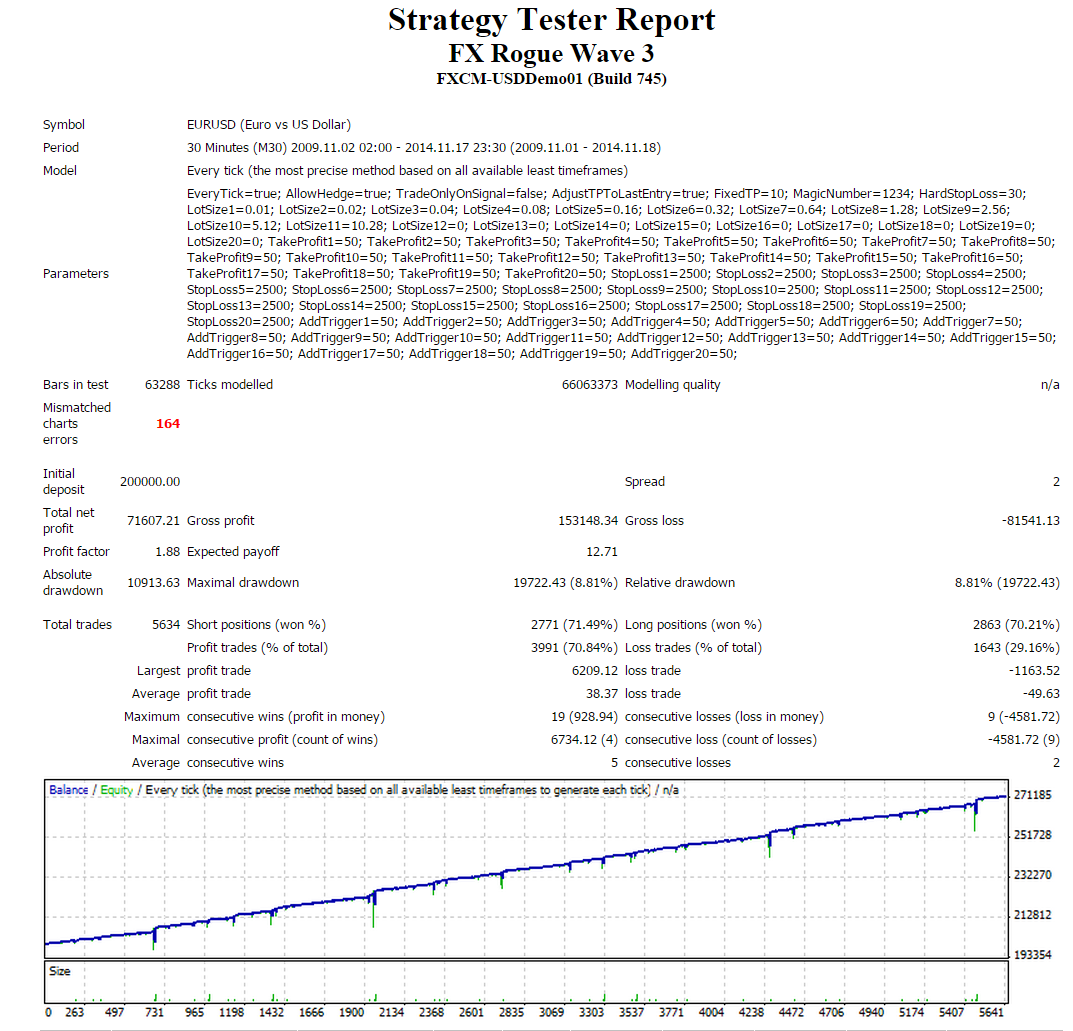

In the attachment is an example of a system that uses the Martingale on a 5 year back test. I use this myself. I have it limited to 11 iterations starting at .01 and doubling up to 10.24 micro lots using the broker above.

During the 5 years, it only used the 10.24 lot size on 4 occasions and recovered each time.

During the 5 years, it only used the 10.24 lot size on 4 occasions and recovered each time.

forex_trader_139412

Membro Desde Jul 16, 2013

352 posts

Nov 29, 2014 at 17:12

Membro Desde Jul 16, 2013

352 posts

@ibthescottyb

It will be an outstanding performance of the EA if you can get the same results with 99% quality backtests. Believe me.. there is a huge difference. I did backtests on my EA that were of 90% modeling qualilty and I was very impressed. Then I went trough the whole process (yes it is not as easy) and did a 99% modeling quality backtest. I am still impressed, but I had to do a whole lot of changes to get what I wanted. There was a huge difference between 90% and 99%. Yours is showing n/a and 164 mismatched charts.

It will be an outstanding performance of the EA if you can get the same results with 99% quality backtests. Believe me.. there is a huge difference. I did backtests on my EA that were of 90% modeling qualilty and I was very impressed. Then I went trough the whole process (yes it is not as easy) and did a 99% modeling quality backtest. I am still impressed, but I had to do a whole lot of changes to get what I wanted. There was a huge difference between 90% and 99%. Yours is showing n/a and 164 mismatched charts.

Nov 29, 2014 at 17:23

(editado Nov 29, 2014 at 17:24)

Membro Desde Oct 28, 2010

89 posts

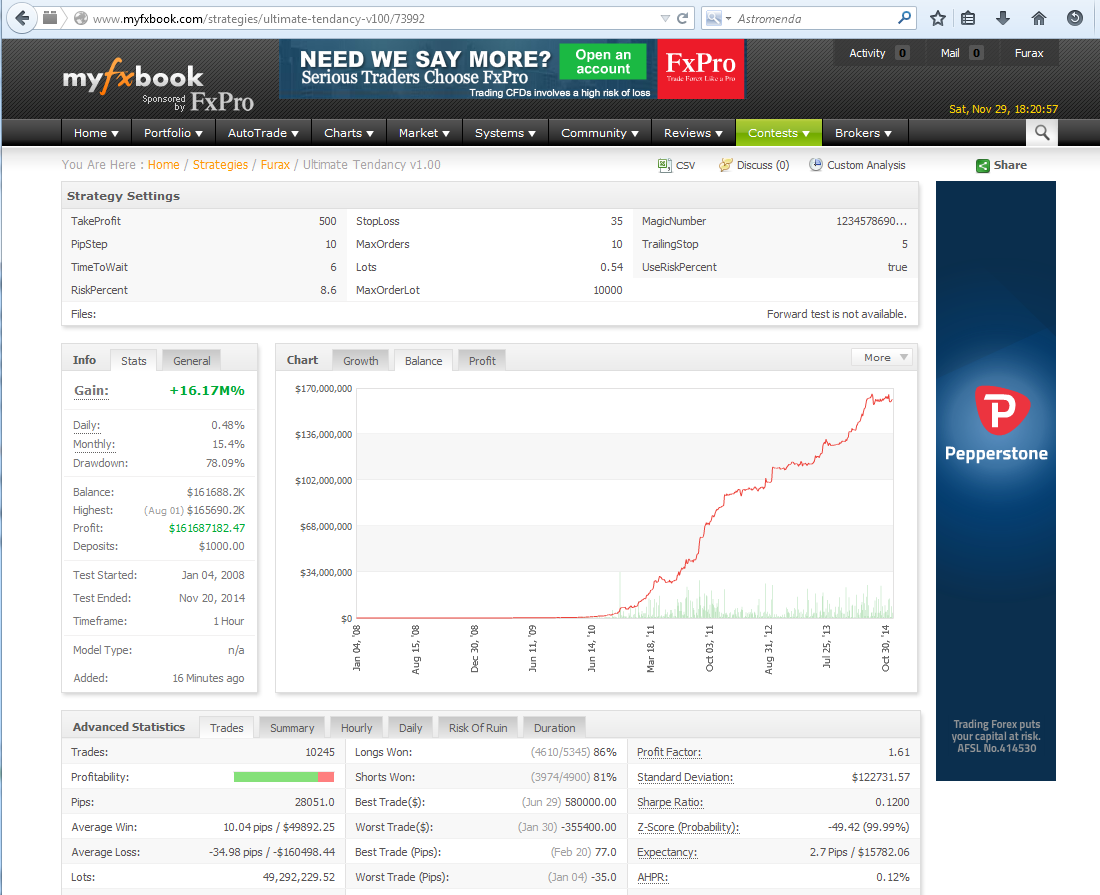

I created sevral martingale systems but the best are an EA based on indicators.

http://www.myfxbook.com/strategies/ultimate-tendancy-v100/73992

http://www.myfxbook.com/strategies/ultimate-tendancy-v100/73992

On entend l'arbre qui tombe mais pas la forêt qui pousse...

forex_trader_20011

Membro Desde Oct 08, 2010

407 posts

Nov 30, 2014 at 07:30

Membro Desde Oct 08, 2010

407 posts

RSTrading posted:

@ibthescottyb

It will be an outstanding performance of the EA if you can get the same results with 99% quality backtests. Believe me.. there is a huge difference. I did backtests on my EA that were of 90% modeling qualilty and I was very impressed. Then I went trough the whole process (yes it is not as easy) and did a 99% modeling quality backtest. I am still impressed, but I had to do a whole lot of changes to get what I wanted. There was a huge difference between 90% and 99%. Yours is showing n/a and 164 mismatched charts.

Agreed. I just threw up a back test I did without taking the time to set up a 90% quality test. But, understand that I do not wish to hijack this thread with my strategy, only to show what a martingale is capable of.

Membro Desde Oct 22, 2014

10 posts

Nov 30, 2014 at 13:09

Membro Desde Oct 14, 2012

2 posts

Martingal is an interesting topic.

In fact, it depend on your goal : managing your money or selling a system (software, signal, pamm... whatever).

About your money, the mathematic expectancy is negative. Thousands of mathematicians demonstrate it again and again during sciecles. So arguing if recovery system is a good idea or not is wasting time.

On the other hand, martingale strategy could be strongh or lite. It may clean balance curve a leatle and provide a better win ratio percent. Of course mathematic expectancy is lower but nobody can see it. As the competition between systems is strong, and the customers are not... well informed ? it's a necessity to plug these improvment to a valuable strategy. What a pity. But world is like that.

Roughly, there are 3 ways to add martingale methods in a strategy :

- Dont take the losses and prey. Keep on trading and claiming how hedging is valuable. It works most of time because of retracements events.

- Increase the size of the bets after a loss. And continue it until the first win (or several wins) compensate the losses.

- Average down prices (or up), with a grid system. This methode average the open price, plus realise more or less the two previous methods.

All theses methods can be more or less hidden with partial application (smouthed size increase, lower lots with grids, taking partial losses after partial retracement during recovering process...).

All theses method lose money on a long term point of view. But it may work (if well parameted) during months, years...

In fact, the martingale approch is everywhere in the world and in the life.

- Martingale is like a mortgage you obtain from destiny. You just dont know when it's time to pay.

- You can go too fast in a moto race. If you dont crash, you win the race. If you do it every moto, again and again, a day you will crash.

- You may not pay your car insurance. So you earn prime money every year. Until the crash come.

- Most of hedge fund apply this kind of approch during early 2k : taking incredibly high risk in front of rare events. As events are rare, nothing appends. Managers take their big fees years after years, then the founds crashed with investor money.

In fact, martingales and partial martingales are everywhere. It's a good way to share benefits with investors and let them tacking all the losses when the crash come. Most of hedge fund managers are millionaires. When they losed billions from institutionals investors nobody go to jail.

Personaly I dont use martingale because of this ethic issue.

On the other hand, many had notice the anti martingale affect of the proportional money managment. Proportional mean that the more equity you have, the more lots you invest. If the system is valuable, you can see the exponential equity curve. When doing simulations (bootstrap or montecarlo), you can see that more of 50% of stories (or excursions) are under the mean. It's because few lucky excursions go to the sky and few unlucky DD go to zero. So if you are in the mean luck/unluck you notice that increasing lots size within balance increase take you off a few money. It's because of the anti martingale affect of proportional money managment. If the system is very powerfull (20% and more per year) the effect is noticeable. It is why Kelly formula exist in finance lots size calculation. There is a limit (if yield is very high) where anti martingale become stronger that mathematic expectancy of a bet.

It's the only reason why I could add an epsilon touch of martingale during lots size calculation.

A apologise for my poor english.

Jeff.

In fact, it depend on your goal : managing your money or selling a system (software, signal, pamm... whatever).

About your money, the mathematic expectancy is negative. Thousands of mathematicians demonstrate it again and again during sciecles. So arguing if recovery system is a good idea or not is wasting time.

On the other hand, martingale strategy could be strongh or lite. It may clean balance curve a leatle and provide a better win ratio percent. Of course mathematic expectancy is lower but nobody can see it. As the competition between systems is strong, and the customers are not... well informed ? it's a necessity to plug these improvment to a valuable strategy. What a pity. But world is like that.

Roughly, there are 3 ways to add martingale methods in a strategy :

- Dont take the losses and prey. Keep on trading and claiming how hedging is valuable. It works most of time because of retracements events.

- Increase the size of the bets after a loss. And continue it until the first win (or several wins) compensate the losses.

- Average down prices (or up), with a grid system. This methode average the open price, plus realise more or less the two previous methods.

All theses methods can be more or less hidden with partial application (smouthed size increase, lower lots with grids, taking partial losses after partial retracement during recovering process...).

All theses method lose money on a long term point of view. But it may work (if well parameted) during months, years...

In fact, the martingale approch is everywhere in the world and in the life.

- Martingale is like a mortgage you obtain from destiny. You just dont know when it's time to pay.

- You can go too fast in a moto race. If you dont crash, you win the race. If you do it every moto, again and again, a day you will crash.

- You may not pay your car insurance. So you earn prime money every year. Until the crash come.

- Most of hedge fund apply this kind of approch during early 2k : taking incredibly high risk in front of rare events. As events are rare, nothing appends. Managers take their big fees years after years, then the founds crashed with investor money.

In fact, martingales and partial martingales are everywhere. It's a good way to share benefits with investors and let them tacking all the losses when the crash come. Most of hedge fund managers are millionaires. When they losed billions from institutionals investors nobody go to jail.

Personaly I dont use martingale because of this ethic issue.

On the other hand, many had notice the anti martingale affect of the proportional money managment. Proportional mean that the more equity you have, the more lots you invest. If the system is valuable, you can see the exponential equity curve. When doing simulations (bootstrap or montecarlo), you can see that more of 50% of stories (or excursions) are under the mean. It's because few lucky excursions go to the sky and few unlucky DD go to zero. So if you are in the mean luck/unluck you notice that increasing lots size within balance increase take you off a few money. It's because of the anti martingale affect of proportional money managment. If the system is very powerfull (20% and more per year) the effect is noticeable. It is why Kelly formula exist in finance lots size calculation. There is a limit (if yield is very high) where anti martingale become stronger that mathematic expectancy of a bet.

It's the only reason why I could add an epsilon touch of martingale during lots size calculation.

A apologise for my poor english.

Jeff.

Membro Desde Jun 28, 2011

444 posts

Nov 30, 2014 at 15:01

Membro Desde Jun 28, 2011

444 posts

"About your money, the mathematic expectancy is negative. Thousands of mathematicians demonstrate it again and again during sciecles.".

Jeff; I am a mathematician, well, that is what I got my degree in - Operations Research.

Before we can discuss profitability, we first need to establish the working paramiters. If we are talking about a fifty/fifty probability such as in the fair coin toss, then a martingale sequence is the same probability of outcome as the coin toss because the probability of failure diminishes with the greater number of iterations by the same factor as the growth of the bet size.

However, if the win ratio is 90%, then doubling your bet size is less than the diminishing probability of failure. Without establishing the paramiters first, expressions like "mathematic expectancy is negative" I'm afraid hasn't any discernible meaning.

Bob

Jeff; I am a mathematician, well, that is what I got my degree in - Operations Research.

Before we can discuss profitability, we first need to establish the working paramiters. If we are talking about a fifty/fifty probability such as in the fair coin toss, then a martingale sequence is the same probability of outcome as the coin toss because the probability of failure diminishes with the greater number of iterations by the same factor as the growth of the bet size.

However, if the win ratio is 90%, then doubling your bet size is less than the diminishing probability of failure. Without establishing the paramiters first, expressions like "mathematic expectancy is negative" I'm afraid hasn't any discernible meaning.

Bob

where research touches lives.

forex_trader_202879

Membro Desde Aug 07, 2014

378 posts

Dec 01, 2014 at 03:23

Membro Desde Aug 07, 2014

378 posts

Martingale is only money management. If you have a system which doesn't experience more then 4 losses in a row, then Martingale would work excellent with such system. Most people consider martingale a "coin toss" form of trading, when the reality is trading support and resistance is the biggest coin toss of them all.

Membro Desde Feb 22, 2011

4573 posts

Dec 01, 2014 at 10:12

Membro Desde Feb 22, 2011

4573 posts

ibthescottyb posted:

In the attachment is an example of a system that uses the Martingale on a 5 year back test. I use this myself. I have it limited to 11 iterations starting at .01 and doubling up to 10.24 micro lots using the broker above.

During the 5 years, it only used the 10.24 lot size on 4 occasions and recovered each time.

Yes in BT you got 4 times maximum allowed numbers of position.

What would you do it this last resort fail and position close with loss?

Dec 01, 2014 at 10:38

Membro Desde Oct 28, 2010

89 posts

forex_trader_20011

Membro Desde Oct 08, 2010

407 posts

*Uso comercial e spam não serão tolerados, podendo resultar no encerramento da conta.

Dica: Postar uma imagem/URL do YouTube irá incorporá-la automaticamente no seu post!

Dica: Insira o sinal @ para preencher automaticamente um nome de utilizador que participe nesta discussão.