- Início

- Comunidade

- Geral

- what is biggest pip trade you have seen?

Advertisement

Edit Your Comment

what is biggest pip trade you have seen?

Nov 06, 2019 at 14:02

Membro Desde Mar 10, 2019

55 posts

JDavda posted:

My biggest trade was 1700 pips shorting EURNZD. It was back in 2014 when the Euro was falling apart. The best part was that it was collecting a nice swap while I held for just over three months.

But it actually messed me up pretty bad. While it was one great trade, this was early on in my trading and set the wrong mindset for me. After that, I gave back all the profits and a significant chunk on top of that chasing 1000 pips trades. Since then times have changed and there is a lot more of this grinding type action in the markets. I find it much more tougher to get the big trades these days and now look for much smaller pips.

The only place I think you might be still able to get a good return with fair risk is in equities. Perhaps Gold if it does another leg higher, but timing is so important in these type of trades if you want to make sure your risk is controlled.

an interesting story of yours and a good post overall... The markets nowadays are tougher for everyone, scalpers and trend traders - everywhere including stocks, little value left in most of them. Mr Soros had a much easier life in the 60s... At the moment imho fx is still the best even if they cut rates like mad 😡... what about trends in GBP this year? - very juicy for a leveraged trend follower 😎...😉

every beautiful garden has a strong hedge around

Nov 06, 2019 at 15:34

Membro Desde Jun 18, 2013

8 posts

tacet posted:what about trends in GBP this year? - very juicy for a leveraged trend follower 😎...😉

GBP is one of those few currencies that has been trending nicely. Not sure if it makes sense chasing it higher with GBP/USD up like 5% in Oct.. but certainly would look to get involved on a dip.

I'm not entirely convinced the political backdrop warrants further gains, but the technicals sure do look good.

If you don't stay humble, the market will make you humble

Nov 07, 2019 at 14:13

Membro Desde Mar 10, 2019

55 posts

There were lots of good trends since you've started, like GBPUSD mid 2014 to 2017: from ~ 1.70 to ~1.20. Fetch your calculator and see how much you'd gain in cash selling every weekly bar (or at least a green bar). Even with your 0.01 lots per bar it would be ...? ... There is nothing wrong with scalping thou...

every beautiful garden has a strong hedge around

Nov 07, 2019 at 18:22

Membro Desde Jun 18, 2013

8 posts

Your post has made me take a trip down memory lane. I did have some good trades in GBPUSD.

Didn't trade it much in 2014 because I was mostly shorting the euro. I got a great short in the middle of 2015 that I rode down to 1.50. In 2016 I wanted to short 1.50 but then Brexit happened. It hit 1.50 during the vote but the pair was fluctuating over 150 pips per minute. So I didn't take that trade. I had losses in 2016 trying to short the run up to Brexit.

I don't know what happened in 2017. To this day that rally makes little sense to me. Luckily I didn't trade that pair much at that time, I would have been on the wrong side of that for sure. The last good trade I had in the pair was a short in April 2018 that I held till July I think... These are probably my best trades, but again, have had many losing trades in between trying to catch that trend and chasing big pip moves.

Probably should trade GBPUSD more.. it certainly trends better than EURUSD. I find a low risk position can often be put on at the European open or on a bounce at the NY open which could turn out to be a runner.

Didn't trade it much in 2014 because I was mostly shorting the euro. I got a great short in the middle of 2015 that I rode down to 1.50. In 2016 I wanted to short 1.50 but then Brexit happened. It hit 1.50 during the vote but the pair was fluctuating over 150 pips per minute. So I didn't take that trade. I had losses in 2016 trying to short the run up to Brexit.

I don't know what happened in 2017. To this day that rally makes little sense to me. Luckily I didn't trade that pair much at that time, I would have been on the wrong side of that for sure. The last good trade I had in the pair was a short in April 2018 that I held till July I think... These are probably my best trades, but again, have had many losing trades in between trying to catch that trend and chasing big pip moves.

Probably should trade GBPUSD more.. it certainly trends better than EURUSD. I find a low risk position can often be put on at the European open or on a bounce at the NY open which could turn out to be a runner.

If you don't stay humble, the market will make you humble

Nov 08, 2019 at 14:01

Membro Desde Mar 10, 2019

55 posts

Nov 10, 2019 at 11:13

Membro Desde Jun 18, 2013

8 posts

That chart looks good in hindsight but momentum is slowing in a major way. Which makes it hard to stick with a directional bias with conviction. There was more money to be had there on carry than direction.

I'm speculating that swing traders didn't do well in that pair. Anybody that sold breaks since the second half of 2018 would probably have gotten stopped out or faked out.

I'm speculating that swing traders didn't do well in that pair. Anybody that sold breaks since the second half of 2018 would probably have gotten stopped out or faked out.

If you don't stay humble, the market will make you humble

Membro Desde Jan 05, 2016

1097 posts

Nov 10, 2019 at 21:59

Membro Desde Jan 05, 2016

1097 posts

tacet posted:

the carry here is in the right direction 😄 I've just started a new thread in the General (FA: the holy grail of trend trading) - contribute pls. We have to remember that FA > TA...😎

FA = Fundamental Analysis

TA = Technical Analysis

FA and TA should Both be given equal consideration for analysis, with a primary focus on Risk Management for the account.

To focus only on FA and ignore the information from TA is a massive mistake and is one of many contributing factors to people losing money in the markets.

To be profitable an investor needs to consider ALL available information and manage their risks appropriately.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

Nov 11, 2019 at 02:49

Membro Desde Oct 23, 2014

78 posts

there is always some major pair combination that is in trend. my best was 800 pips with a 40 pip stop loss.in 3 weeks. gbp/cad. always like to be like a surfer;fall of with many small stop losses and catch a big one.;that pays for losses.one trick i do is once getting a trend is get to breakeven after 100 pips.i think the trick is using previous daily;weekly; and monthly lows or highs as stop losses.

Membro Desde Jan 25, 2010

1288 posts

Nov 11, 2019 at 08:37

Membro Desde Jan 25, 2010

1288 posts

tacet posted:

Outside major pairs my tops:

Still holds the title of this thread!

To be profitable an investor needs to consider ALL available information and manage their risks appropriately.

a) As Michael Steinhart stated in a 2004 speech, among his top trading rules:

4/Make good decisions even with incomplete information.

It is a good idea to gather as much information as possible before entering any single trade, but the available information will never be complete or perfect. Investors need to be trained to work on the facts, figure out what does matter, and take the right trading decisions before all others gain awareness of the situation. They then need to have the courage to put sufficient money behind the trade to achieve a meaningful outcome.

b) 3. Have a Flexible Analysis Approach:

https://optimusfutures.com/tradeblog/archives/3-tips-to-trading-unpredictable-markets

c) Stack the odds in your favor:

https://dailypriceaction.com/blog/is-forex-trading-gambling/

Nov 11, 2019 at 08:52

Membro Desde Mar 10, 2019

55 posts

Professional4X posted:tacet posted:

FA and TA should Both be given equal consideration for analysis, with a primary focus on Risk Management for the account.

To focus only on FA and ignore the information from TA is a massive mistake and is one of many contributing factors to people losing money in the markets.

To be profitable an investor needs to consider ALL available information and manage their risks appropriately.

very well said. I am not dismissing TA, far from that, just saying that FA is primary to TA. Consider here TA as a supportive instrument to FA, better entries/exits etc...

every beautiful garden has a strong hedge around

Nov 14, 2019 at 22:42

Membro Desde Mar 10, 2019

55 posts

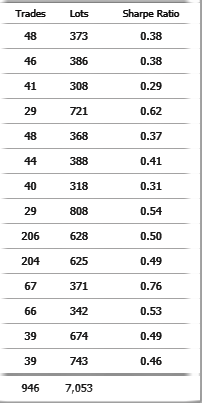

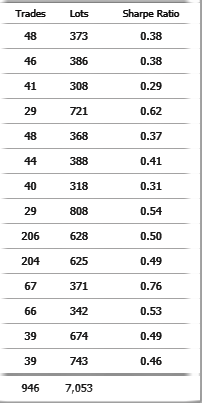

Apart of "number of pips in a closed trade" there is another statistical measure which separates a scalper and a trend trader: the "Sharpe". It relates to risk as you know. Usually, in forex, a scalper has Sharpe below 0.1, whereas a successful trend trader's Sharpe is above 0.25. In my little fx projects I try to get Sharpe of at least 0.5, but it's not easy - I need to improve 😳.

I know some fx trend traders who consistently return Sharpe above 1. I have never met a fx trader whos Sharpe is 2 or close to this number let say over 500 trades - this would be absolutely outstanding in any investment/trading field... Anyone here?

I know some fx trend traders who consistently return Sharpe above 1. I have never met a fx trader whos Sharpe is 2 or close to this number let say over 500 trades - this would be absolutely outstanding in any investment/trading field... Anyone here?

every beautiful garden has a strong hedge around

Membro Desde Feb 22, 2011

4573 posts

Nov 15, 2019 at 12:35

Membro Desde Feb 22, 2011

4573 posts

I made 20705.3 pips on my Caesar account.

That is what count, single trade even though it might be impressive does mean nothing as in context with other trades it might even be loss when you sum it up.

Imagine opening 2 trades with opposite direction at the same time, you got very big winner with lot of pips which you can post here,

but as a sum of both trades you will face the loss - if you close them both at the same time,

it might be possible to close both with profit but that would reuqire closing them at different times and not much market move,

That is what count, single trade even though it might be impressive does mean nothing as in context with other trades it might even be loss when you sum it up.

Imagine opening 2 trades with opposite direction at the same time, you got very big winner with lot of pips which you can post here,

but as a sum of both trades you will face the loss - if you close them both at the same time,

it might be possible to close both with profit but that would reuqire closing them at different times and not much market move,

Nov 17, 2019 at 14:43

Membro Desde Mar 10, 2019

55 posts

togr posted:

I made 20705.3 pips on my Caesar account.

That is what count, single trade even though it might be impressive does mean nothing as in context with other trades it might even be loss when you sum it up.

Imagine opening 2 trades with opposite direction at the same time, you got very big winner with lot of pips which you can post here,

but as a sum of both trades you will face the loss - if you close them both at the same time,

it might be possible to close both with profit but that would reuqire closing them at different times and not much market move,

what you said is absolutely right, but the trader who started this thread had a specific question. It's like in sports, f.e. tennis - you may play on the ATP tour, getting to semi-finals many times and winning a lot of money, but never reaching or winning in major finals like in the Opens... Trend traders do discuss/show their longest trades in pips - because for them one of the most important qualities is to run a trade from start to end! Thus the question asked in the beginning of the thread is a rightful one... Scalpers may not appreciate this topic but they should not dismiss it.

I like your Caesar trading, a good number of pips - it would correspond to a bloody long trend (2-3 years) 😄...

every beautiful garden has a strong hedge around

*Uso comercial e spam não serão tolerados, podendo resultar no encerramento da conta.

Dica: Postar uma imagem/URL do YouTube irá incorporá-la automaticamente no seu post!

Dica: Insira o sinal @ para preencher automaticamente um nome de utilizador que participe nesta discussão.

_OS.png)