- Início

- Comunidade

- Sistemas de Negociação

- FX Rogue Wave 3.0 Reversal Strategy - Acct #3

Advertisement

FX Rogue Wave 3.0 Reversal Strategy - Acct #3 (Por forex_trader_20011)

O utilizador eliminou este sistema.

Edit Your Comment

FX Rogue Wave 3.0 Reversal Strategy - Acct #3 Discussão

forex_trader_20011

Membro Desde Oct 08, 2010

407 posts

Nov 26, 2014 at 14:51

Membro Desde Oct 08, 2010

407 posts

With the use of three indicators

Moving Average

MACD

Force Index

When they agree the trend is LONG, a BUY is placed at .01 Lots with a TP of 40 pips. If the order hit TP a new order is opened at .01 continuing in the direction of the first.

IF the price action reverses, and the order goes negative 40 pips, an additional order is opened at .02 lots, with a TP of 50 pips and the TP of the 1st order is moved to this level also.

If the price continues to go negative 40 pips, an additional order is opened at .04 lots, with a TP of 50 pips and the TP of the 1st order and 2nd is moved to this level also. The process continues until the price reverses positive. I have a limit of 11 iterations of the Martingale so the maximum lot size is 10.24 lots.

My broker allows hedging, so while the price is going negative on the LONG trades, it is profiting on the SHORT trades that were opened when the MA, MACD and FI lined up on the downtrend.

With this strategy, the price would have to go against me almost 500 pips without a 50 pip retrace during that entire time to lose. Yes, it is possible. But, all in fun. Never trade with funds you can't afford to lose.

Also, to help negate a loss, I have three different accounts running the same EA that were started at different price points, so if one of the accounts were to blow. I just move money between the accounts to perpetuate my income stream.

Moving Average

MACD

Force Index

When they agree the trend is LONG, a BUY is placed at .01 Lots with a TP of 40 pips. If the order hit TP a new order is opened at .01 continuing in the direction of the first.

IF the price action reverses, and the order goes negative 40 pips, an additional order is opened at .02 lots, with a TP of 50 pips and the TP of the 1st order is moved to this level also.

If the price continues to go negative 40 pips, an additional order is opened at .04 lots, with a TP of 50 pips and the TP of the 1st order and 2nd is moved to this level also. The process continues until the price reverses positive. I have a limit of 11 iterations of the Martingale so the maximum lot size is 10.24 lots.

My broker allows hedging, so while the price is going negative on the LONG trades, it is profiting on the SHORT trades that were opened when the MA, MACD and FI lined up on the downtrend.

With this strategy, the price would have to go against me almost 500 pips without a 50 pip retrace during that entire time to lose. Yes, it is possible. But, all in fun. Never trade with funds you can't afford to lose.

Also, to help negate a loss, I have three different accounts running the same EA that were started at different price points, so if one of the accounts were to blow. I just move money between the accounts to perpetuate my income stream.

Membro Desde Feb 22, 2011

4573 posts

Nov 26, 2014 at 15:12

Membro Desde Feb 22, 2011

4573 posts

Well the results look nice,

but the system is martingale,

so the risk that account will be blown away is high

but the system is martingale,

so the risk that account will be blown away is high

Membro Desde Dec 15, 2010

784 posts

Membro Desde Dec 15, 2010

784 posts

forex_trader_20011

Membro Desde Oct 08, 2010

407 posts

Dec 28, 2014 at 07:20

Membro Desde Oct 08, 2010

407 posts

Once the indicators detect a trend movement, the EA begins trading. The sooner this detection takes place, the sooner trading begins. I use the 1m chart on EURUSD – GBPUSD – USDCAD – USDJPY – AUDUSD – NZDUSD – EURJPY – USDCHF.

As requested, I have attached the user guide. This is the same user guide that my customers receive that request an evaluation copy.

As requested, I have attached the user guide. This is the same user guide that my customers receive that request an evaluation copy.

forex_trader_20011

Membro Desde Oct 08, 2010

407 posts

Dec 28, 2014 at 22:07

Membro Desde Oct 08, 2010

407 posts

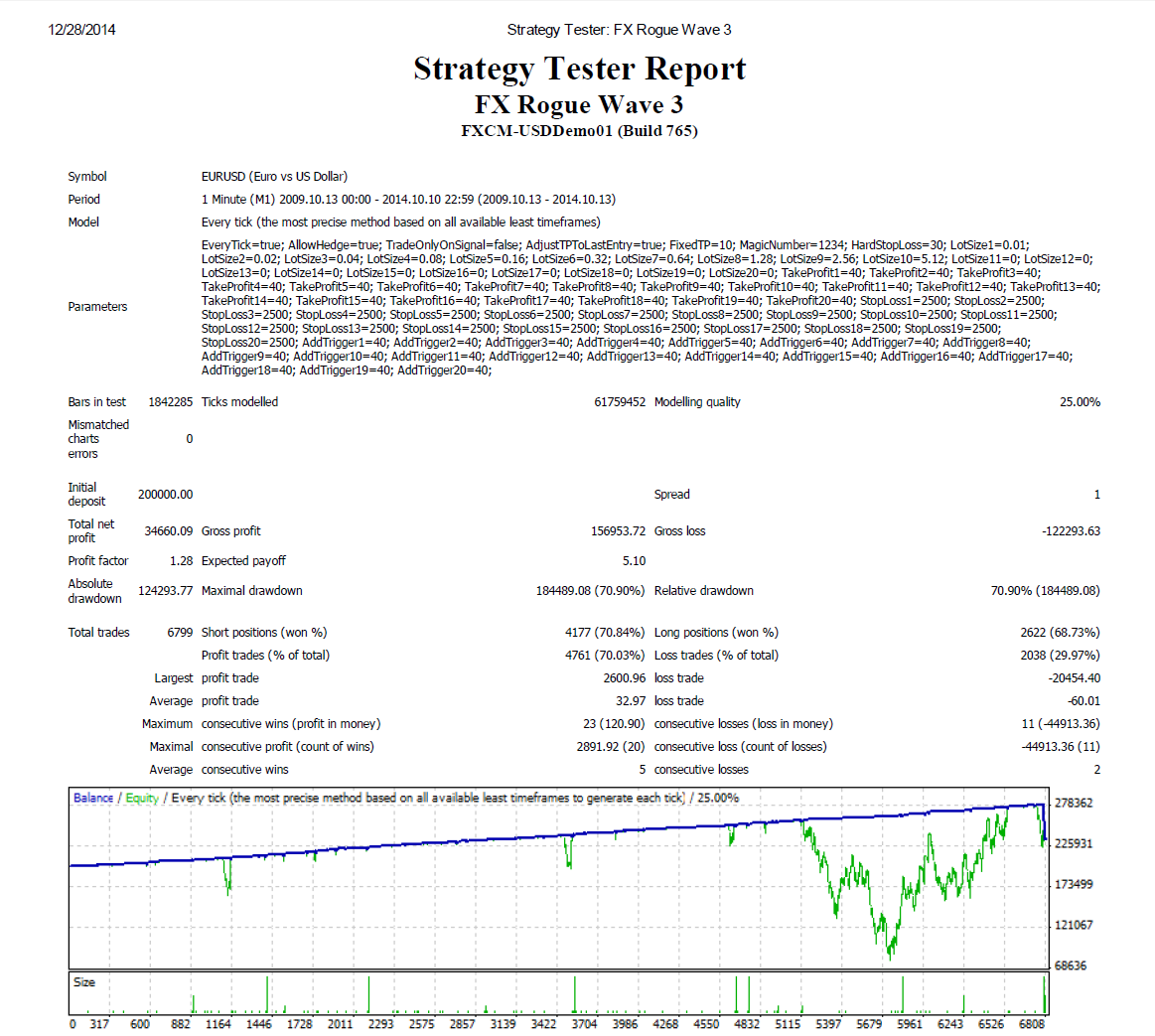

I have attached a 5 year back test report for EURUSD using 1m metatrader data.

As you can see, the price broke out of the encoded channel on 3 occasions during this time. Each time the price returned to our trade sequences closing in profit. The final set of losses were caused by the open orders closing at the end of the test period and not by standard loss.

My intention is to reset the EA with a new magic number any time the highest iteration is used. By keeping the previous sequence open and allowing new sequences to begin, my income stream remains somewhat constant which is my personal goal for this EA.

As you can see, the price broke out of the encoded channel on 3 occasions during this time. Each time the price returned to our trade sequences closing in profit. The final set of losses were caused by the open orders closing at the end of the test period and not by standard loss.

My intention is to reset the EA with a new magic number any time the highest iteration is used. By keeping the previous sequence open and allowing new sequences to begin, my income stream remains somewhat constant which is my personal goal for this EA.

*Uso comercial e spam não serão tolerados, podendo resultar no encerramento da conta.

Dica: Postar uma imagem/URL do YouTube irá incorporá-la automaticamente no seu post!

Dica: Insira o sinal @ para preencher automaticamente um nome de utilizador que participe nesta discussão.