FXCharger (Por forexstore)

The user has made his system private.

Edit Your Comment

FXCharger Discussão

Membro Desde Feb 22, 2011

4573 posts

Feb 21, 2020 at 08:26

Membro Desde Feb 22, 2011

4573 posts

togr posted:3165 posted:togr posted:

I am not in any way affliated with FxCharger

But I would say closing trades at 15% loss is the right thing

And even though it is martingale at some point it should recover.

You need to look at system from long term perspective, does it make money for last 12 months?

Are the results stable?

I did backtest my own aggressive martingale system and it works for years with max dd of 13%.

I believe the owner can make some adjustements to get approximatelly the same results.

My BT of my own system are still running.

It is pretty slow as it is tick data BT with 99.9% precision

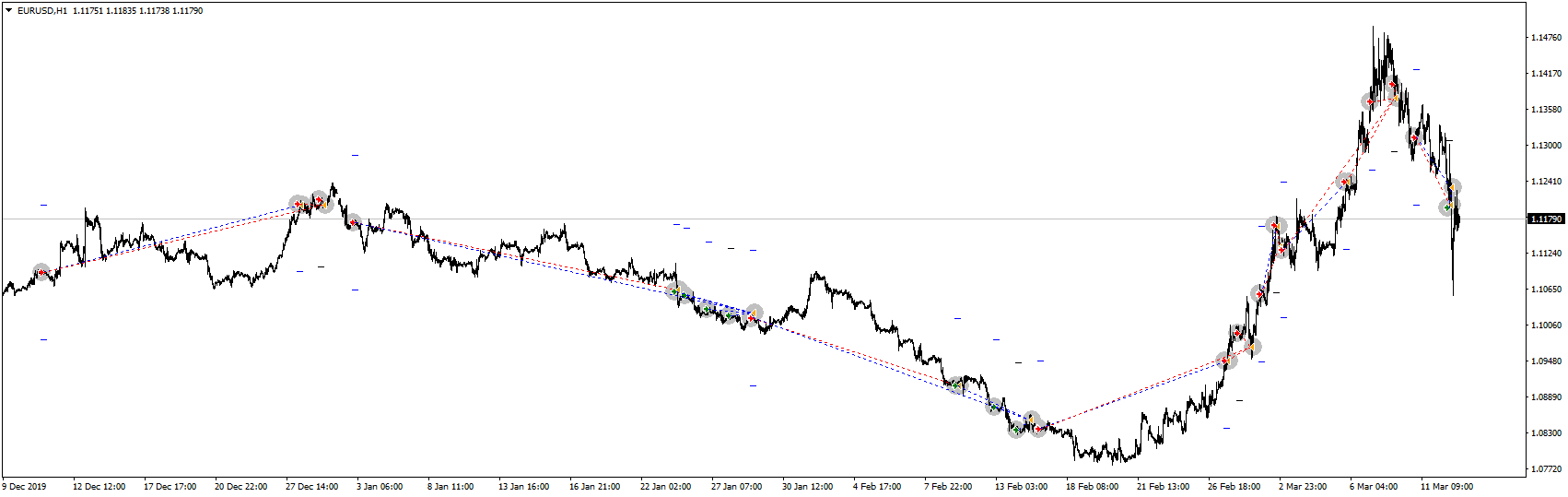

As you can see even with occasional spikes it had never hid stop loss at 15% DD. Max DD was about 13%.

The trading logic is the same aggressive one - not doubling but quadrupling trade size.

On the other hand I have limited number of such trades to decrease risk/burden

Your screenshot has nothing to show.

No numbers, No size of lots, No 99.9% modeling quality printed on the gif you upload.

We need more revealed details. As I showed earlier.

That is what mt4 is showing, I can't change that :)

More details are possible only once it finishes and generates the report. It is at 2017/12/20 now

2018/10/02 now

Membro Desde Feb 22, 2011

4573 posts

Feb 21, 2020 at 14:26

Membro Desde Feb 22, 2011

4573 posts

MicF posted:

I did a BT with 99,9% tickdata, too some years ago, but I always got at least one drawdown.

I used Dukascopy's data.

And the EA doesn't allow backtesting before 2012 (if I recall it correctly).

how much was the DD?

Membro Desde Feb 22, 2011

4573 posts

Feb 24, 2020 at 12:12

Membro Desde Feb 22, 2011

4573 posts

MicF posted:

As much, as I set the risk.

The risk value is definitely obeyed.

Really, that is so much revealing answer :)

Membro Desde Jul 26, 2010

80 posts

Membro Desde Feb 22, 2011

4573 posts

Mar 02, 2020 at 07:30

Membro Desde Feb 22, 2011

4573 posts

It is hard to trade nowadays.

Markets are crazy due to Coronavirus

Markets are crazy due to Coronavirus

Membro Desde Mar 02, 2020

10 posts

Mar 06, 2020 at 01:29

Membro Desde Oct 28, 2018

21 posts

togr posted:

It is hard to trade nowadays.

Markets are crazy due to Coronavirus

I disagree.

Coronovirus has nothing to do with it.

It is all about adding features that this moderator ignores.

My set of param provides profit for both Short and Long trades at these days as well.

forex_trader_1153031

Membro Desde Feb 28, 2020

78 posts

Mar 07, 2020 at 06:37

Membro Desde Feb 28, 2020

78 posts

Fxswdn posted:

Coronvirus came with a lot of opportunities for the trend following systems and all the systems based on direction

And has came with alot of pain to the systems which based on corrections and retresments.

Corona virus really made us huge profits I must admit.

Mar 08, 2020 at 11:36

Membro Desde Nov 26, 2016

93 posts

Now it happened, that the stop loss hit a second time shortly after a first one.

I can recall the discussion, that it "statistically" can't happen and hence you could increase the risk to 100% after a hit to catch up the loss.

Unlikely doesn't equal impossible.

BTW the statement is mathematically wrong anyway.

I can recall the discussion, that it "statistically" can't happen and hence you could increase the risk to 100% after a hit to catch up the loss.

Unlikely doesn't equal impossible.

BTW the statement is mathematically wrong anyway.

Mar 12, 2020 at 14:35

Membro Desde Feb 18, 2020

19 posts

MicF posted:

Now it happened, that the stop loss hit a second time shortly after a first one.

I can recall the discussion, that it "statistically" can't happen and hence you could increase the risk to 100% after a hit to catch up the loss.

Unlikely doesn't equal impossible.

BTW the statement is mathematically wrong anyway.

math is not really my strong side - can you explain it to me?

Mar 12, 2020 at 15:14

Membro Desde Nov 26, 2016

93 posts

It is called stochastically independent i. e. if you roll a dice your chances to get a 6 is 1/6 at the first try and will be 1/6 at any further tries.

So even if you rolled the dice 100 times and didn't get any 6, the chances you would get a 6 in the 101st try are still 1/6.

So even if you rolled the dice 100 times and didn't get any 6, the chances you would get a 6 in the 101st try are still 1/6.

forex_trader_305974

Membro Desde Feb 16, 2016

71 posts

Mar 12, 2020 at 15:25

Membro Desde Feb 16, 2016

71 posts

MicF posted:

Now it happened, that the stop loss hit a second time shortly after a first one.

I can recall the discussion, that it "statistically" can't happen and hence you could increase the risk to 100% after a hit to catch up the loss.

Unlikely doesn't equal impossible.

BTW the statement is mathematically wrong anyway.

Hello MicF,

Yes, double loss is very sad for us and for our clients. But anyway, we never told that it's impossible, do not change the meaning of our words, please. And about your words "BTW the statement is mathematically wrong anyway. " - I would like to draw your attention to the fact that this is not about mathematics at all, but about probability theory. This is a big difference 😄

Here is my old post about it:"If you do not take into account all the factors, then you are right. But in our situation, you need to take into account history. A simple example: What is the chance of eagle side of the coin, when you toss it? It's easy, the chance of each side is 50/50%. If we toss coin 100 times, approximately we will get 50 eagles and 50 tails. But if will be the situation, that we toss the coin 50 times, and get the eagle side only 10 times and 40 times of another side of the coin. For the next 50 times of tosses, the chance will be the same 50/50? Or we understand that now probability theory will 'try' to balance the scales of probability and next 50 times of tosses, will have approximately 40 eagles and 10 another side of the coin.

This is a primitive (rough) example, but it shows approximately what I mean. There are many factors that make an effect on the probability. We can't get guaranty from probability, but we can have it on our side and use it."

As I told previously (old post) in the last sentence, we can't get guaranty from probability theory (unlike math). We just try to get the probability on our side and made some profit from it. Unfortunately, the situation at the market very and very dangerous, there are many not typical movements at the market - it caused the second stoploss. That is why we stopped trading at the moment and will restart it a little bit later when the situation will stabilize.

Mar 12, 2020 at 23:11

Membro Desde Oct 28, 2018

21 posts

Membro Desde Sep 28, 2015

6 posts

Mar 19, 2020 at 18:37

Membro Desde Sep 28, 2015

6 posts

This is a basic strategy of semi martingale. Basically open 2 initial positions 0.01 lots each, long and short with a take profit of 100 pips. Wait for one to trigger and martingale the losing position by adding incremental lots once a day at the end of the day. Do until 1% of equity is hit and close all the losing positions. The key questions are how many to positions to add and at what lot increments per position to add? One can examine by looking at the trade history.

Trade to trade well, not to make money, when you trade well, money will come!

*Uso comercial e spam não serão tolerados, podendo resultar no encerramento da conta.

Dica: Postar uma imagem/URL do YouTube irá incorporá-la automaticamente no seu post!

Dica: Insira o sinal @ para preencher automaticamente um nome de utilizador que participe nesta discussão.