Nvidia supercharges tech rally, euro loses momentum

Tech propels stocks to new highs

Equity markets rode to new record highs on Thursday, after a stellar earnings report from Nvidia lit a fire under tech shares. The world’s most important chip designer knocked it out of the park as it delivered earnings and revenue that easily beat analyst estimates, which were already set extremely high.

Nvidia shares rose more than 16% in the aftermath, sending the entire tech sector into overdrive and lifting the S&P 500 into new uncharted highs. Investors are increasingly throwing caution to the wind and chasing this astonishing tech rally, confident that the artificial intelligence boom will shield corporate profits even if the economy turns.

Hence, shares of big tech and chipmakers in particular are seen as ‘all weather’ investments in this environment. However, not every tech stock has been so fortunate. Shares of Apple and Tesla are down so far this year, with Tesla losing over 20%.

Apple and Tesla are more consumer-oriented and seem to be lagging behind in the AI arms race, which has led investors to conclude that they are not as bulletproof as the likes of Nvidia or Microsoft. This paints a picture of a two-speed stock market, even within the tech space.

Euro surrenders gains on German gloom

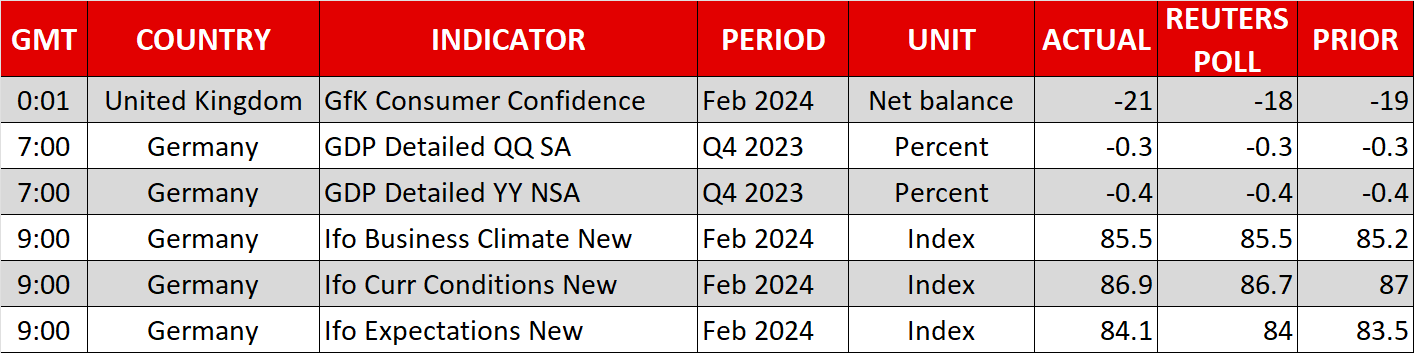

It was a volatile session in the FX arena, albeit with little to show for it in the end. The euro ripped higher early in the session following some encouraging business surveys from France, before proceeding to surrender those gains after the prints from Germany dispelled the optimism.

German manufacturing remains in dire straits, fueling concerns that Europe’s largest economy might be headed for a deeper recession. A slowdown in global trade and higher energy costs have left deep wounds in the export-heavy economy, and the situation could get worse as a court ruling has forced the German government to slash spending to comply with constitutional debt rules.

In other words, the German economy desperately needs an injection of stimulus, but is about to be given a dose of austerity instead. That does not inspire confidence in the outlook. In fact, it sets up a situation where the ECB slashes interest rates faster and deeper than what markets currently anticipate, which could keep the euro heavy.

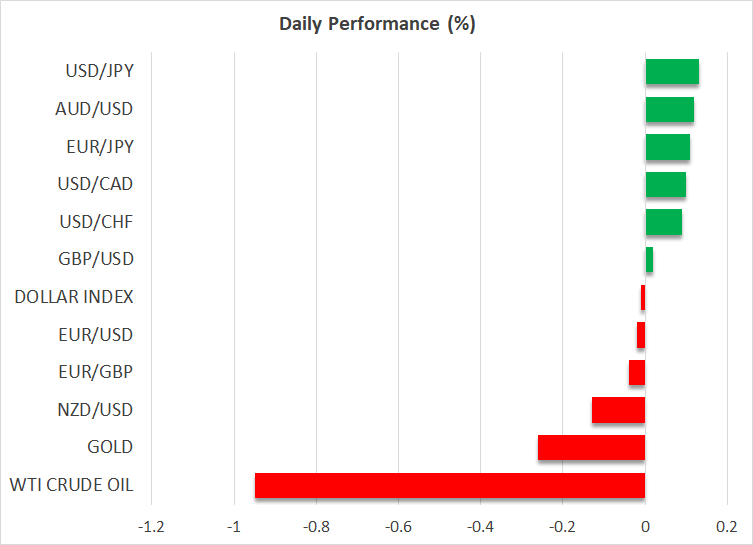

Dollar bounces back, risk-linked FX shines

In a mirror reflection of the euro, the US dollar lost some ground early in the session but managed to recoup nearly all its losses. The recovery was aided by another round of economic data that corroborated the resilience of the US economy, with a drop in weekly applications for unemployment benefits reaffirming that the labor market remains robust.

Reflecting the strength in the US economic data pulse, several Fed officials were on the wires arguing that there is no rush to cut interest rates. The overarching message is that rate cuts are on the horizon, but that’s probably a story for the summer or even beyond, depending on how the data evolves.

That said, the dollar still closed in the red against most of the risk-linked currencies. The British pound, alongside the Australian and New Zealand dollars, all outperformed the dollar with a little help from the euphoria in stock markets.