Strong data didn't derail markets from expectations of a 50bp Fed cut

On Tuesday afternoon, markets received the final piece of the economic puzzle before the Fed's rate decision on Wednesday evening. The data confirmed the strength of the economy and beat expectations, but by the end of the day, the markets had regained confidence in a 50bp cut.

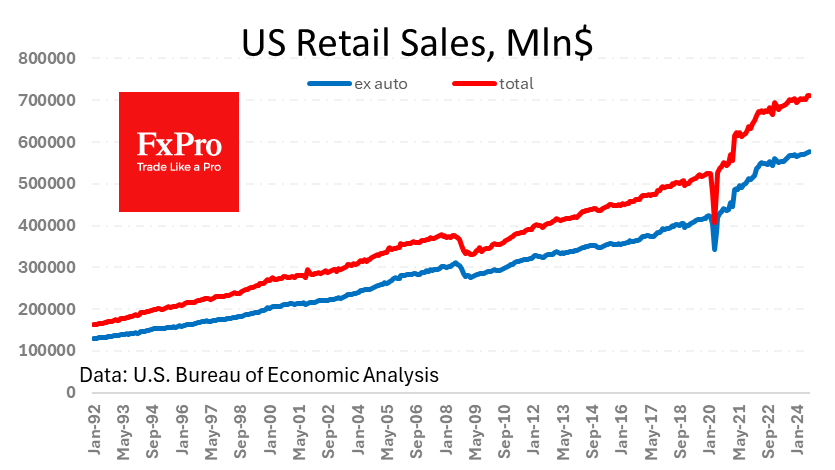

Retail sales rose 0.1% m/m in August after rising 1.1% in the previous month, defying forecasts for a 0.2% decline. Monetary sales growth slowed to 2.2% y/y. This is below inflation, but clearly, there is no reason to talk about the need for an accelerated cut in the policy rate to a neutral level. Healthy final demand is indicated by rising spending on building materials and equipment against the backdrop of falling fuel costs. That said, Americans drove all-time highs in miles over the summer, so it's falling prices and more fuel-efficient cars, not savings; that's the story here.

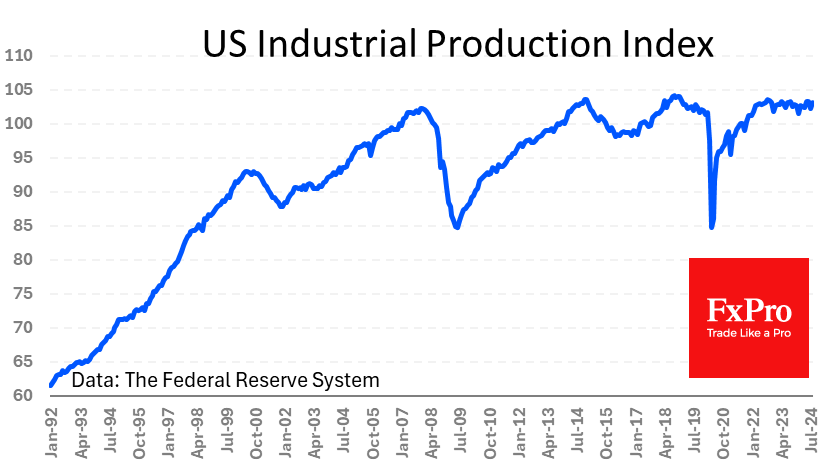

Equally noteworthy is the industrial production index, which is tracked and published directly by the Fed. Data released on Tuesday showed a 0.9% increase in manufacturing, nearly reversing two months of declines. The broader industrial production index rose 0.8% after a 0.9% decline the month before. At 103.14, the index is near all-time highs and less than 1% below the peak reached in late 2018. Last week's monetary easing, scheduled for July 2019, came at a time when manufacturing was 2% below its peak.

The strong data swung market expectations for a while towards a standard easing move of 25 points, as opposed to an emergency-looking 50 points. But very quickly, the pendulum swung back the other way. As we can now see, neither the labour market and inflation figures nor retail and manufacturing activity are able to move markets away from expectations of a 50-point move. At the same time, analysts, on average, expect a 25-point decline. This divergence creates tension and promises a nervous market reaction to the release of the decision and during the subsequent press conference.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)