Edit Your Comment

gold advise

Členom od Jul 10, 2014

1114 príspevkov

Mar 19, 2018 at 18:18

Členom od Jul 10, 2014

1114 príspevkov

The tight sideways consolidation continues, the precious metal bounced off from $1,307 but so far there is no signal there will be a break out to the upside either.

Členom od Jul 10, 2014

1114 príspevkov

Mar 20, 2018 at 18:35

Členom od Jul 10, 2014

1114 príspevkov

Gold is stubbornly testing the support at $1,307 but whether that means it will finally break out below it is anyone's guess.

Členom od Sep 12, 2015

1933 príspevkov

Mar 20, 2018 at 18:41

Členom od Sep 12, 2015

1933 príspevkov

Dollar looks like it has further to go,I expect Gold to drop just below maybe 1280.

"They mistook leverage with genius".

Členom od Oct 11, 2013

769 príspevkov

Mar 21, 2018 at 00:11

Členom od Oct 11, 2013

769 príspevkov

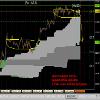

Gold has been dropping slowly to the 1309 level where it has lost some of its bearish momentum. The 1300 level could still work as a support in case of a drop to that level. To the upside, the 1320 level where we can find the 55 day EMA could act as resistance.

Členom od Mar 04, 2018

39 príspevkov

Mar 21, 2018 at 08:02

Členom od Mar 04, 2018

39 príspevkov

victoriajensen

Hi dear, I'm following you!! 😄

natalie986754@

Členom od Jul 10, 2014

1114 príspevkov

Mar 21, 2018 at 19:28

Členom od Jul 10, 2014

1114 príspevkov

Gold finally moved to the upside today and it is testing the resistance at $1,335. A breakout above that level could lead to a further move to the upside towards $1,350.

Členom od Jul 10, 2014

1114 príspevkov

Mar 22, 2018 at 20:02

Členom od Jul 10, 2014

1114 príspevkov

The sideways consolidation continues, Gold bounced off from $1,335.

Členom od Oct 11, 2013

769 príspevkov

Mar 23, 2018 at 13:00

Členom od Oct 11, 2013

769 príspevkov

Good rally on gold, the commodity keeps rallying and it may reach the 1350 level. To the downside, the 1320 level where we can find the 55 day EMA may act as support.

Členom od Jul 22, 2013

123 príspevkov

Mar 23, 2018 at 13:07

Členom od Jul 22, 2013

123 príspevkov

SNF-Complex system - build in 2007 \ Tested from 1970.

Členom od Jul 10, 2014

1114 príspevkov

Mar 23, 2018 at 18:51

Členom od Jul 10, 2014

1114 príspevkov

It may even reach $1,365 if it finally breaks out above $1,350.

Členom od Mar 04, 2018

39 príspevkov

Mar 25, 2018 at 05:27

Členom od Mar 04, 2018

39 príspevkov

What’s next? – GOLD 23.03.18

Gold prices were higher in Asian hours on Friday, with market players preparing for a fresh batch of economic releases later in the day, while the US dollar remains on the spotlight.

On the Comex division of the New York Mercantile Exchange, gold futures were up 0.87 percent at $1.338.90 a troy ounce as of 06:30 GMT.

The yellow metal moved away from two-week highs as the American currency recovered some positions after bouncing in the way of a widely expected interest rate hike on Wednesday.

Earlier this week, the US Federal Reserve increased its benchmark rate by 25 basis points to a range between 1.50 percent and 1.75 percent.

The US dollar index, which measures the greenback against six major currencies, was trading 0.24 percent lower at 89.16 by the time of this writing.

On Thursday, President Donald Trump announced tariffs on nearly $50 billion worth of Chinese exports invoking Section 301 of the 1974 Trade Act. The Trump administration considers China is violating multiple terms on US intellectual property.

Investors are concerned that the decision would increase tension between the world’s two biggest economies and potentially derivate in a massive trade war.

Meanwhile, BNP Paribas said it continues to expect a fourth interest rate hike this year.

“With the median dot holding at three hikes for this year by the tiniest of margin, for us the balance of risk is clearly weighted towards the FOMC bringing forward its rate path expectations,” wrote BNP Paribas.

On the data front, initial jobless claims rose to 229,000 from an estimated 225,000. Preliminary readings on manufacturing and services PMIs came below expectations at 55.7 and 54.1.

Ahead in the session, durable goods orders for February will be out at 12:30 GMT. New home sales for February are expected to be published at 14:00 GMT.

Gold prices were higher in Asian hours on Friday, with market players preparing for a fresh batch of economic releases later in the day, while the US dollar remains on the spotlight.

On the Comex division of the New York Mercantile Exchange, gold futures were up 0.87 percent at $1.338.90 a troy ounce as of 06:30 GMT.

The yellow metal moved away from two-week highs as the American currency recovered some positions after bouncing in the way of a widely expected interest rate hike on Wednesday.

Earlier this week, the US Federal Reserve increased its benchmark rate by 25 basis points to a range between 1.50 percent and 1.75 percent.

The US dollar index, which measures the greenback against six major currencies, was trading 0.24 percent lower at 89.16 by the time of this writing.

On Thursday, President Donald Trump announced tariffs on nearly $50 billion worth of Chinese exports invoking Section 301 of the 1974 Trade Act. The Trump administration considers China is violating multiple terms on US intellectual property.

Investors are concerned that the decision would increase tension between the world’s two biggest economies and potentially derivate in a massive trade war.

Meanwhile, BNP Paribas said it continues to expect a fourth interest rate hike this year.

“With the median dot holding at three hikes for this year by the tiniest of margin, for us the balance of risk is clearly weighted towards the FOMC bringing forward its rate path expectations,” wrote BNP Paribas.

On the data front, initial jobless claims rose to 229,000 from an estimated 225,000. Preliminary readings on manufacturing and services PMIs came below expectations at 55.7 and 54.1.

Ahead in the session, durable goods orders for February will be out at 12:30 GMT. New home sales for February are expected to be published at 14:00 GMT.

natalie986754@

Členom od Jul 22, 2013

123 príspevkov

Mar 26, 2018 at 11:02

Členom od Jul 22, 2013

123 príspevkov

SNF-Complex system - build in 2007 \ Tested from 1970.

Členom od Jul 10, 2014

1114 príspevkov

Mar 26, 2018 at 18:05

Členom od Jul 10, 2014

1114 príspevkov

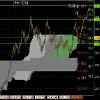

Gold finally broke out above $1,350 today and the move to the upside will likely continue for now.

Členom od Sep 12, 2015

1933 príspevkov

Mar 26, 2018 at 18:07

Členom od Sep 12, 2015

1933 príspevkov

That might change when Eur/USD hits 25 ,not far away.

"They mistook leverage with genius".

Členom od Jul 10, 2014

1114 príspevkov

Mar 27, 2018 at 16:59

Členom od Jul 10, 2014

1114 príspevkov

Gold bounced off from $1,356 but the move to the upside may still continue.

Členom od Oct 11, 2013

769 príspevkov

Mar 28, 2018 at 06:12

Členom od Oct 11, 2013

769 príspevkov

As of gold, the precious metal broke above the 1350 level, but the bullish momentum is lost due to the fact that risk aversion has come back into the markets. For now the 55 day EMA may act as support at the 1323 level. To the upside, the peak at the 1366 level could act as resistance.

Členom od Jul 10, 2014

1114 príspevkov

Mar 28, 2018 at 17:08

Členom od Jul 10, 2014

1114 príspevkov

Gold is very bearish for now. It is testing $1,325 and if it breaks out below that level it may fall to $1,306 again.

Členom od Mar 04, 2018

39 príspevkov

Mar 29, 2018 at 06:15

Členom od Mar 04, 2018

39 príspevkov

HI @victoriajensen are you gold trader?

natalie986754@

Členom od Jul 22, 2013

123 príspevkov

Mar 29, 2018 at 06:34

Členom od Jul 22, 2013

123 príspevkov

SNF_Complex posted:

gold possible scenario

we hit main target 1323,

now I wait correct to 1355, than possible 1370-80

SNF-Complex system - build in 2007 \ Tested from 1970.

Členom od Jul 10, 2014

1114 príspevkov

Mar 29, 2018 at 17:57

Členom od Jul 10, 2014

1114 príspevkov

I do trade Gold, yes.

For now the precious metal is relatively bearish although it still hasn't broken out below $1,320. The question is whether it will do that before the end of the week.

For now the precious metal is relatively bearish although it still hasn't broken out below $1,320. The question is whether it will do that before the end of the week.

*Komerčné použitie a spam nebudú tolerované a môžu viesť k zrušeniu účtu.

Tip: Uverejnením adresy URL obrázku /služby YouTube sa automaticky vloží do vášho príspevku!

Tip: Zadajte znak @, aby ste automaticky vyplnili meno používateľa, ktorý sa zúčastňuje tejto diskusie.