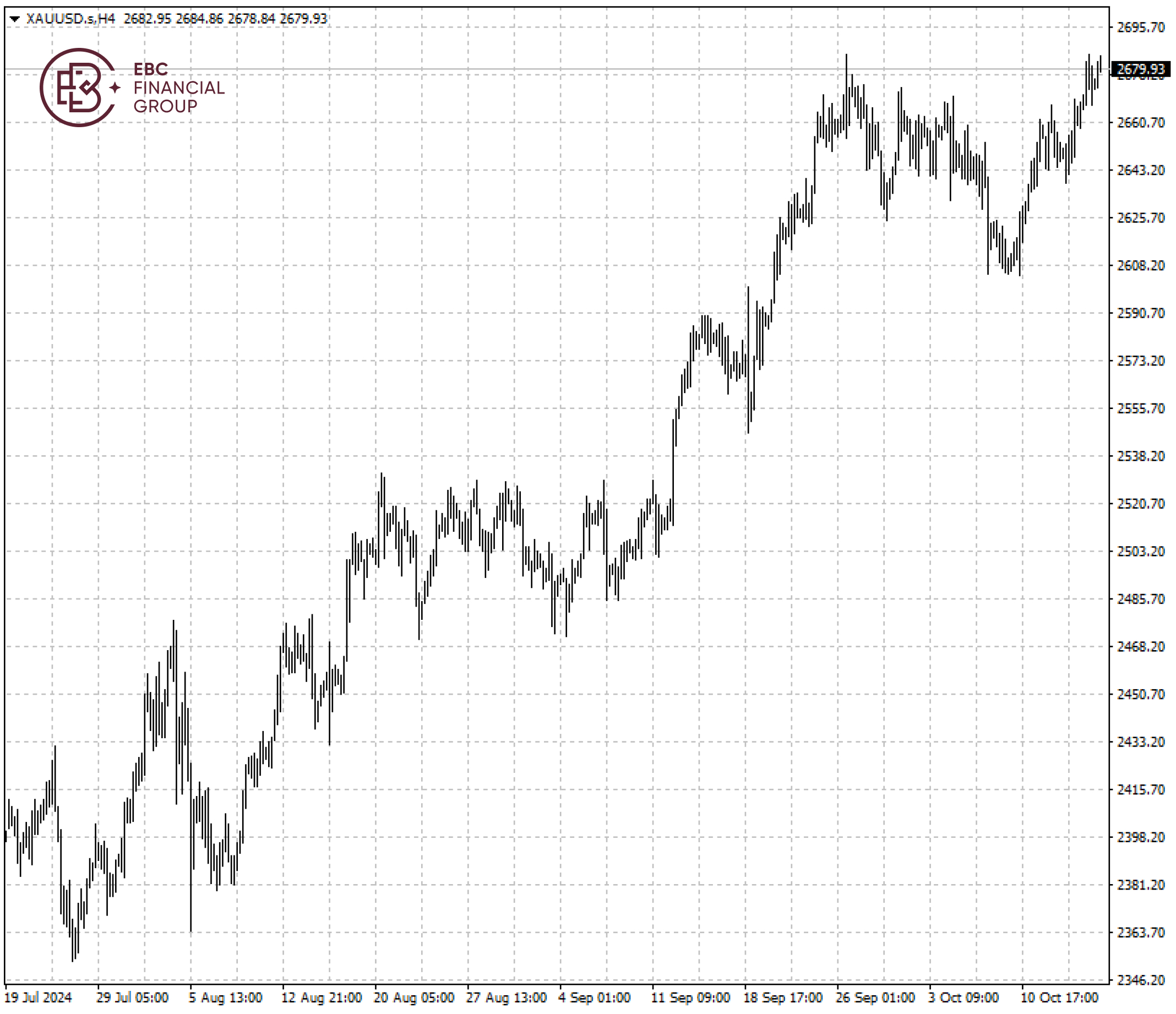

EBC Markets Briefing | Bullion eyes record high despite dollar comeback

Gold flirted with its all-time peak on Thursday as Treasury yields fell. Delegates to the LBMA's annual gathering predicted gold prices would rise to $2,941 over the next 12 months and silver prices would jump to $45.

Global central banks increased purchases for their reserves by 6% to 183 tons in Q2, according to the WGC, though China's central bank held back on buying gold for a fifth straight month in September.

Those market players remain keen buyers of gold to diversify their reserves for financial or strategic reasons, representatives of three central banks told the LBMA annual conference.

Global physically backed gold ETFs registered a fifth consecutive month of inflows in September as North America-listed funds added to their holding. Year-to-date net flows in dollar terms rose to a positive $389 million.

With the prospect of future US rate cuts and rising geopolitical tensions, speculators increased their total net long position on COMEX to the highest level since February 2020 by the end of September.

Dollar calls are rising in popularity in currency options markets, in line with moves by some of the world’s biggest companies to hedge their currency risk against Trump as the election date draws near.

Clearly bullion needs to clear the resistance around 2,685 to gain more momentum, otherwise the double-top pattern will be formed – a sign of a pullback towards 2,608.

EBC Institute Perspectives Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC International Business Expansion or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.