EBC Markets Briefing | Fast money fails to pull lira out of a death spiral

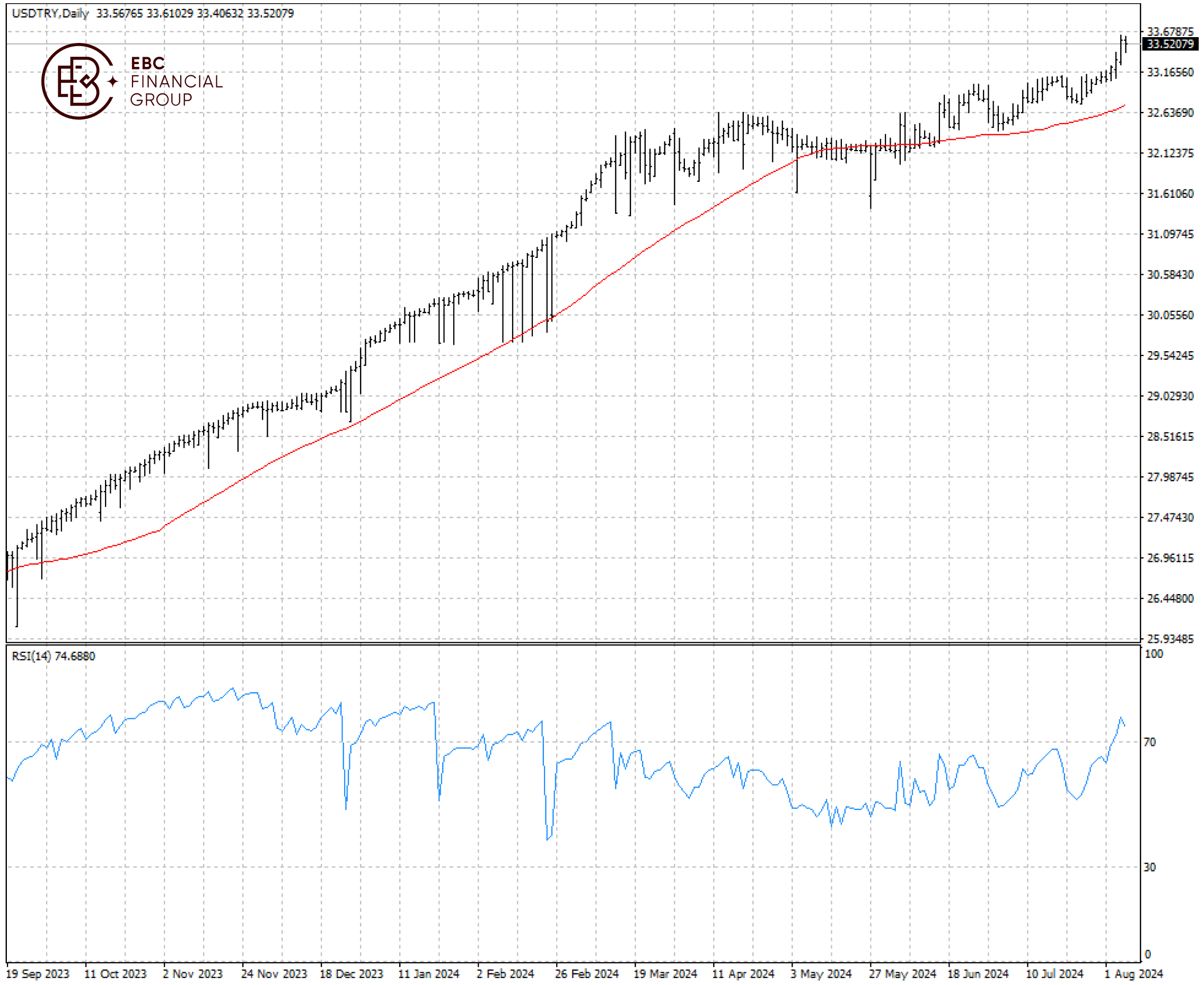

The Turkish Lira hit a fresh record low this week although the dollar was on the back foot following a weak jobs report. The downward spiral seems endless with a loss of 13.8% this year.

Hedge funds and other traders have pumped billions of dollars into the Turkish lira in recent months for good returns, which left the country more vulnerable to sudden swings in sentiment.

That is the latest sign of how Turkey’s pivot towards conventional economic policies helped attract inflows. Moody’s Investors Service in July awarded Turkey a rare two-notch upgrade to its junk-level credit rating to B1.

More importantly, the central bank could rebuild its foreign currency war chest which was depleted. Turkey’s headline inflation saw the sharpest drop in nearly two years in July, slightly below the consensus forecast.

It remains a challenge to persuade households and businesses of the credibility of the projected inflation path, with their 12-month expectations significantly higher than those reflected in the financial markets.

More conservative investors, such as pension funds, remain too nervous to make large allocations to Turkey, on concerns Erdoğan will change course on policy. Large-scale FDI also remained elusive.

The lira was clearly oversold amid volatility storm but there are no signs of reversing long-term downtrend. The level to watch is 50 SMA below which will likely unlock further rally potential.

EBC Fintech Development Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Brand Influence or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.