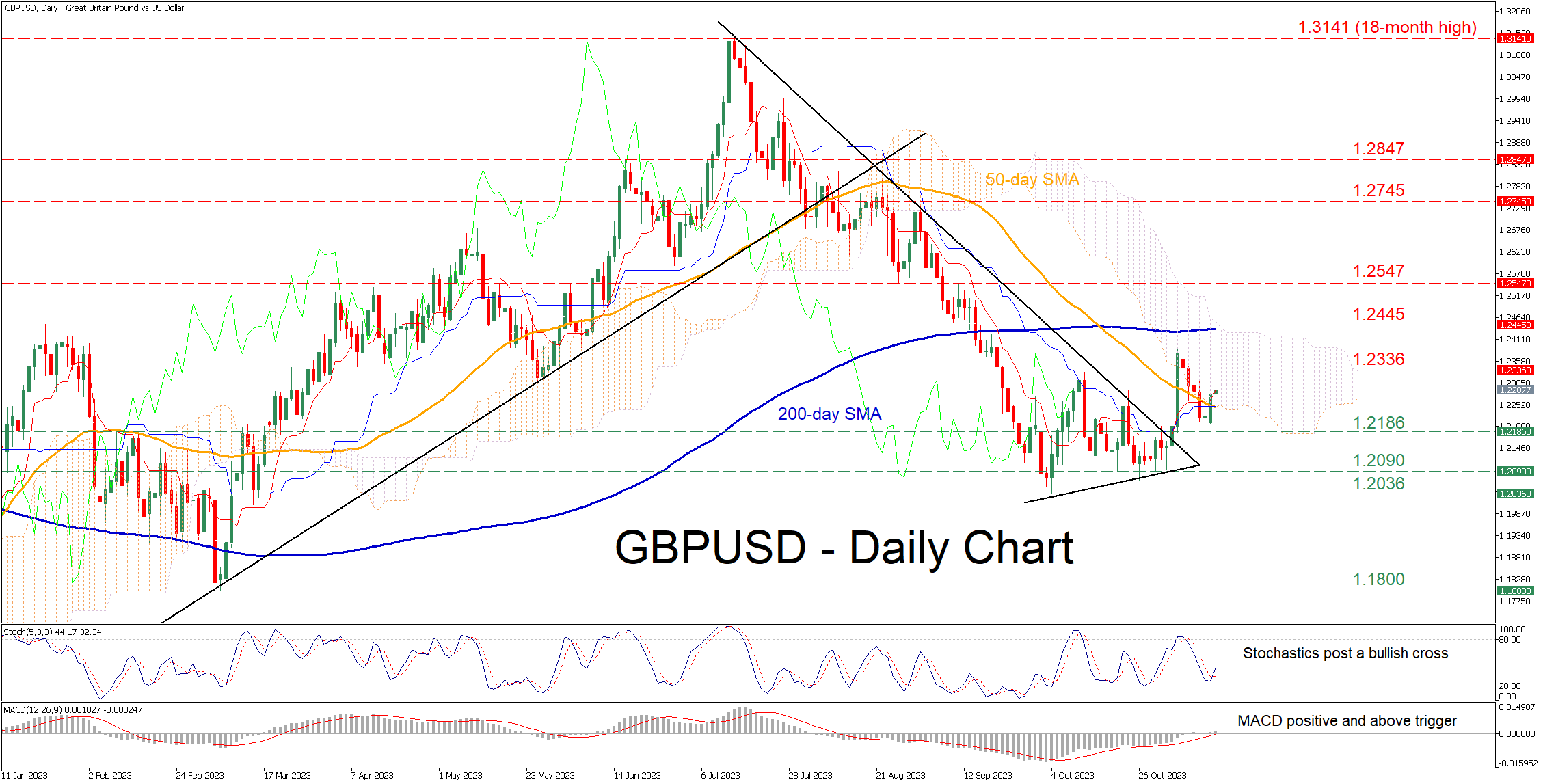

GBP/USD enters Ichimoku cloud after claiming 50-SMA

GBPUSD had been forming a profound structure of lower highs and lower lows since its 18-month peak of 1.3141. Although the pair’s latest attempt to recoup some losses got rejected by the 200-day simple moving average (SMA), buyers managed to halt the retreat and reclaim the 50-day SMA.

Should buying interest intensify further, the October peak of 1.2336 could act as the first barrier for the price to clear. Surpassing that zone, the pair could advance towards the December-January resistance zone of 1.2445, which lies close to the 200-day SMA and rejected the latest advance. A break above that level could open the door for the 1.2547 hurdle.

Alternatively, if the price moves lower, initial declines could cease around the recent support of 1.2186. Failing to halt there, the pair may challenge the 1.2090 support territory ahead of the eight-month low of 1.2036. Even lower, the March bottom of 1.1800 could provide downside protection.

In brief, GBPUSD seems to be regaining some traction as the momentum indicators have turned positive in the last couple of sessions. However, the bearish long-term pattern remains intact.

.jpg)