Weak PMIs Failed to Dampen GBPUSD

The dollar appears to be tired of rising. This explains why the GBPUSD has risen 0.5% since the start of the day to 1.2980, even though UK PMIs for October failed to meet expectations of maintaining previous levels.

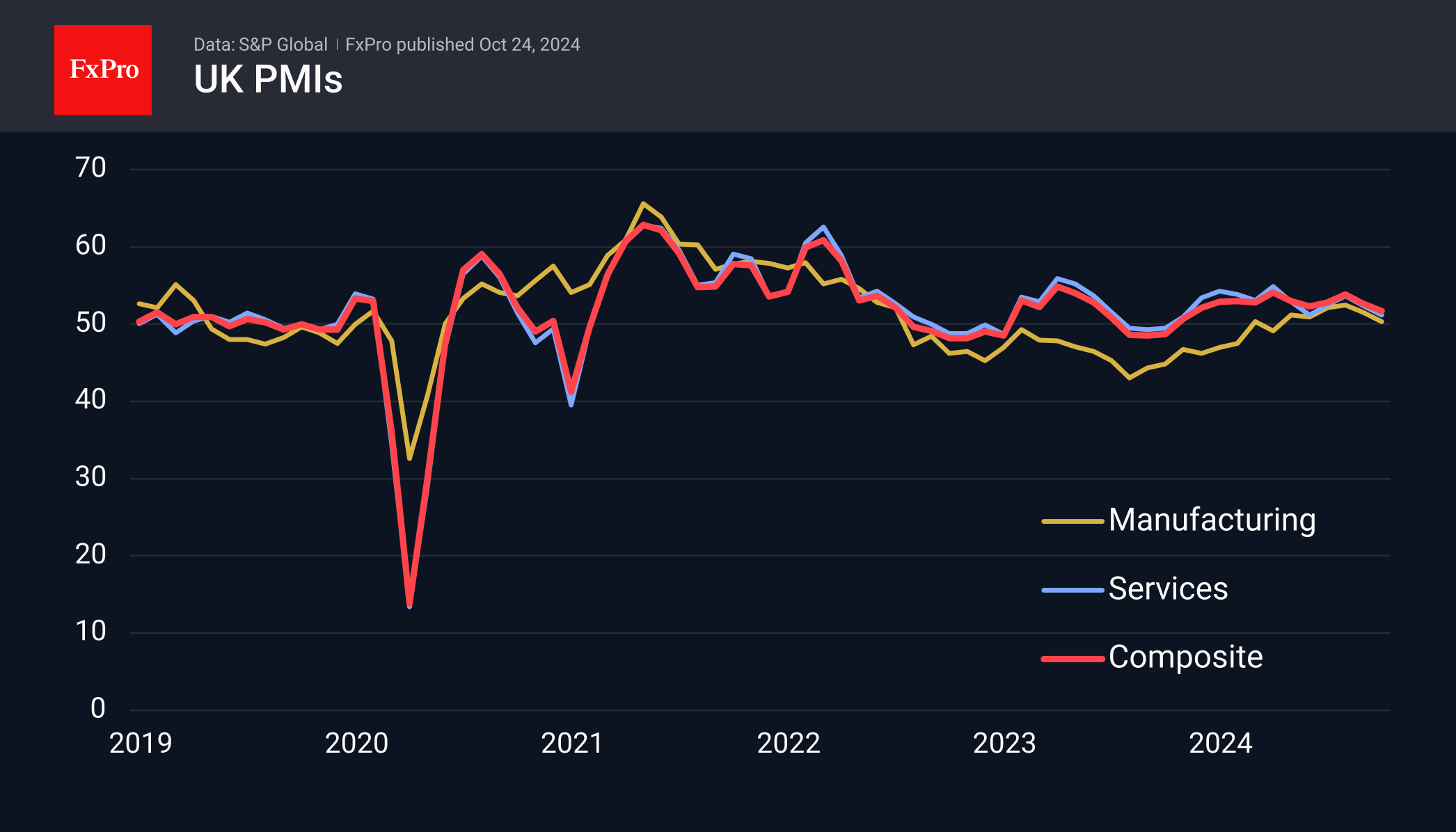

The Manufacturing PMI index fell from 51.5 to 50.3—the lowest since April—against expectations for a continuation. The Service PMI fell to 51.8, the lowest level in eleven months, down from 52.4 in September. The services sector actively pulled the composite index to 51.7 from 52.6 in the previous month.

However, it is worth noting that all the indices remain in growth territory, whereas Europe's manufacturing sector has been signalling contraction for many months.

A separate report from the CBI noted a slight slowdown in the decline of industrial orders, as the corresponding index rose from -35 to -27.

Meanwhile, the British Pound rose for most of the day, coming under pressure immediately after the release of the PMI figures. The GBPUSD has recovered most of Wednesday's losses and is now back at 1.2980. If this rebound develops into a full-blown correction of the previous decline, the pound could bounce to 1.3030 (76.4% of the decline and pivot area in September) or even rise to 1.31 (61.8% of the decline).

However, the fundamental news is still on the side of the GBPUSD sellers, suggesting selling on the growth rather than buying on the dip.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)