Edit Your Comment

Analysis for Improvement

Medlem sedan Sep 23, 2013

45 inlägg

Jan 06, 2014 at 20:02

Medlem sedan Sep 23, 2013

45 inlägg

I have been a trader since August and let’s face it, I haven’t made money yet.

In my day job the pivot table is my best friend, and between MT4 and myfxbook a lot of data is available.

I have posted this in a few places but I appreciate the difference in input from slightly different audiences, so I’m throwing it out there to get any other ideas I can.

My problem with systems is that they usually tell me “DON’T TRADE!”, and I usually ignore that and lose some more money...

For the month of January then, I will stick entirely to 1 system and log my results. I will take into account the stats of my successes to date, develop a plan, and stick to it.

Successful trade features:

Wednesday and Thursday have been my best days

Highest % of wins was between 5-7 AM and 9-10 AM closing after an average of 7.5 hours

Longs on Tuesday & Wednesday were the only trades I averaged a profit

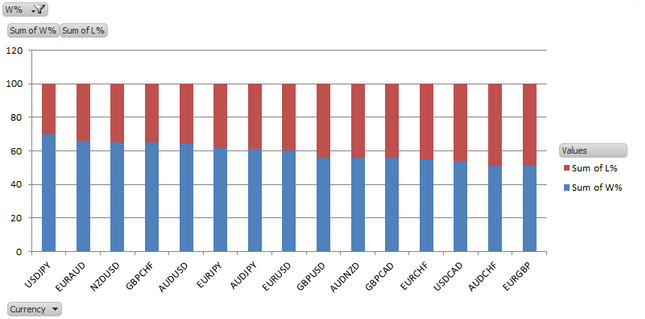

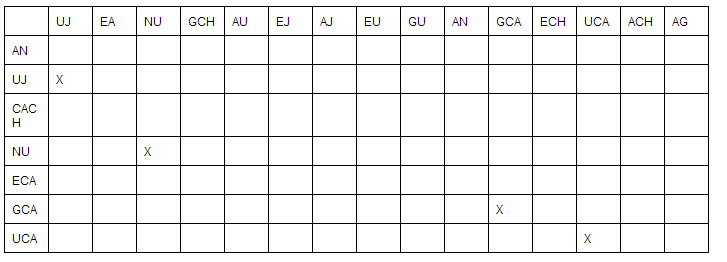

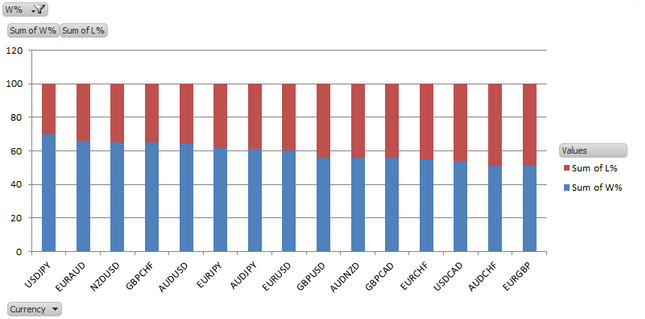

I won over 50% of trades in UJ, EA, NU, GCH, AU, EJ, AJ, EU, GU, AN, GCA, ECH, UCA, ACH, EG

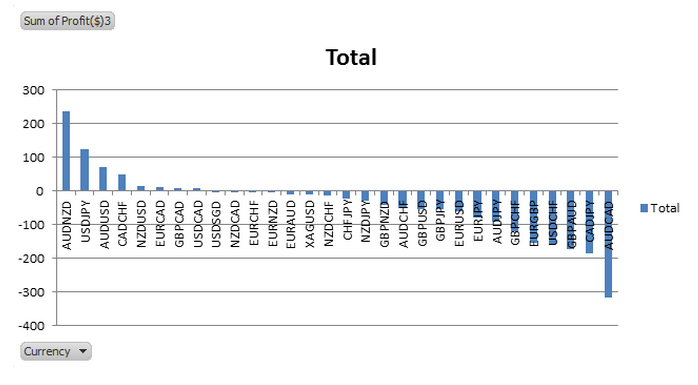

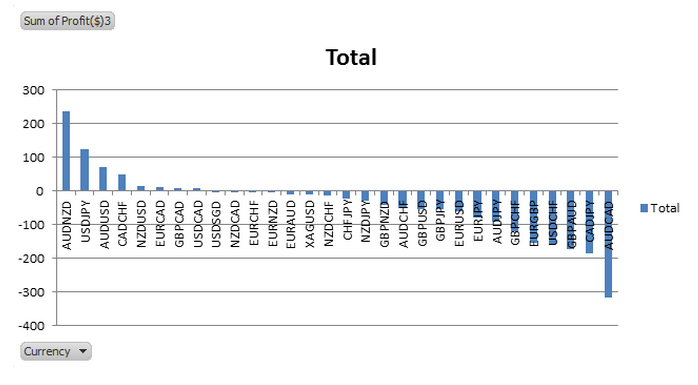

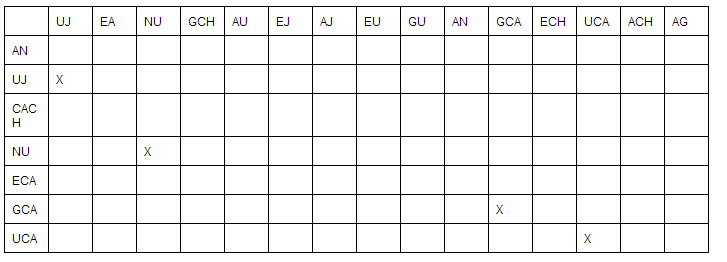

I made a profit on AN, UJ, CACH, NU, ECA, GCA, and UCA only.

Only USDJPY, NZDUSD, GBPCAD and USDCAD fall into both categories.

The other thing to think about is the signals. I don’t really have accurate records.

Plan

I will record the basis / signal name & location for every trade on FPA and expose myself to others’ opinions

I will look for signals discussed by “The Forex Guy”’s excellent site

I will trade in line with the 200 SMA on whichever chart I enter, unless it is neutral

I will trade in line with the 10 & 20 EMAs on whichever chart I enter

I will set my risk to 5% of my balance or $10, whichever is more, using $/SLD

I will set SL at the last swing + the spread

I will set a trailing stop equal to the distance between entry and stop loss

I will flag weekly swing levels and only enter if entry-to-swing > SLD x 4

I will only trade Tuesday late night, Wednesday early morning, noon, after work and late night, Thursday early morning, noon, after work and late night (all times NY time).

I will trade D1, H4, H1 and M15, and record which chart I used for every trade

I will only trade USDJPY, NZDUSD, GBPCAD and USDCAD

I will log the characteristics of my pairs every Wednesday and Thursday before I take any trades

Any feedback / suggestions are welcome.

In my day job the pivot table is my best friend, and between MT4 and myfxbook a lot of data is available.

I have posted this in a few places but I appreciate the difference in input from slightly different audiences, so I’m throwing it out there to get any other ideas I can.

My problem with systems is that they usually tell me “DON’T TRADE!”, and I usually ignore that and lose some more money...

For the month of January then, I will stick entirely to 1 system and log my results. I will take into account the stats of my successes to date, develop a plan, and stick to it.

Successful trade features:

Wednesday and Thursday have been my best days

Highest % of wins was between 5-7 AM and 9-10 AM closing after an average of 7.5 hours

Longs on Tuesday & Wednesday were the only trades I averaged a profit

I won over 50% of trades in UJ, EA, NU, GCH, AU, EJ, AJ, EU, GU, AN, GCA, ECH, UCA, ACH, EG

I made a profit on AN, UJ, CACH, NU, ECA, GCA, and UCA only.

Only USDJPY, NZDUSD, GBPCAD and USDCAD fall into both categories.

The other thing to think about is the signals. I don’t really have accurate records.

Plan

I will record the basis / signal name & location for every trade on FPA and expose myself to others’ opinions

I will look for signals discussed by “The Forex Guy”’s excellent site

I will trade in line with the 200 SMA on whichever chart I enter, unless it is neutral

I will trade in line with the 10 & 20 EMAs on whichever chart I enter

I will set my risk to 5% of my balance or $10, whichever is more, using $/SLD

I will set SL at the last swing + the spread

I will set a trailing stop equal to the distance between entry and stop loss

I will flag weekly swing levels and only enter if entry-to-swing > SLD x 4

I will only trade Tuesday late night, Wednesday early morning, noon, after work and late night, Thursday early morning, noon, after work and late night (all times NY time).

I will trade D1, H4, H1 and M15, and record which chart I used for every trade

I will only trade USDJPY, NZDUSD, GBPCAD and USDCAD

I will log the characteristics of my pairs every Wednesday and Thursday before I take any trades

Any feedback / suggestions are welcome.

"Press On" has solved and will always solve, the problems of the Human Race

Medlem sedan Jun 03, 2010

675 inlägg

Jan 06, 2014 at 20:24

Medlem sedan Jun 03, 2010

675 inlägg

Hello!

In my opinion , 5% risk and average hold time > 7h is quite risky. But, as still as it brigs profits - it's good. :)

In my opinion , 5% risk and average hold time > 7h is quite risky. But, as still as it brigs profits - it's good. :)

PAMM MANAGER // Professional Fund Manager

Medlem sedan Sep 23, 2013

45 inlägg

Jan 06, 2014 at 22:26

Medlem sedan Sep 23, 2013

45 inlägg

Thanks for posting!

I have noticed some very small amounts being risked in forums; dumb newbie question, but is that for real?

I guess what I mean is, do we really have so little confidence in the market's predictability that we have to place such small orders?

I'd be interested to know what people think, I have wondered about it for a while but didn't really know who / how / where to ask.

adrian8891 posted:In my opinion , 5% risk and average hold time > 7h is quite risky.

I have noticed some very small amounts being risked in forums; dumb newbie question, but is that for real?

I guess what I mean is, do we really have so little confidence in the market's predictability that we have to place such small orders?

I'd be interested to know what people think, I have wondered about it for a while but didn't really know who / how / where to ask.

"Press On" has solved and will always solve, the problems of the Human Race

Medlem sedan Jun 03, 2010

675 inlägg

Jan 06, 2014 at 22:40

Medlem sedan Jun 03, 2010

675 inlägg

I think it is not about market predictiability. It's about market inpredictability and a lot of changes in short amount of time - technical and mental. New platforms, bigger leverage, 5 digit quotes , more knowledge about market, bigger and bigger volume. We should say something also about brokers cheats like VirtualDealer Plug-in what might also make us "Stopped-out".

PAMM MANAGER // Professional Fund Manager

Medlem sedan Oct 28, 2009

1409 inlägg

Jan 09, 2014 at 15:20

(redigerad Jan 09, 2014 at 15:21)

Medlem sedan Oct 28, 2009

1409 inlägg

It all comes down to your system at the end of the day and a few things need to be looked at. Check out your Z-score which tells you how likely losses will follow losses, you can of course also check your trading history. You also need to consider your risk:reward ratio.

If you have a system that could lose 20 times in a row 5% stake will blow you out. If it could lose 10 times in a row then you are down half your capital and recovering from that in effect means you have to double your capital, which is not easy.

Here's an example. I used to have a pattern that historically only won 12% of the time, but when it worked it gained 10 times more than when it lost. So overall it was a winning strategy, however 5% would blow your account. 1% was a reasonable risk. I also had a strategy that won 56% of the time with a 1:1 risk reward and so 5% was not an unreasonable stake.

You also need to bear in mind how many trades you are entering at once if you are trading multiple pairs and probably set yourself a total percentage risk for the whole basket of trades.

So the short answer, analyse your system's performance historically and then expect things could be worse than that.

Hope this helps.

Best regards Steve

If you have a system that could lose 20 times in a row 5% stake will blow you out. If it could lose 10 times in a row then you are down half your capital and recovering from that in effect means you have to double your capital, which is not easy.

Here's an example. I used to have a pattern that historically only won 12% of the time, but when it worked it gained 10 times more than when it lost. So overall it was a winning strategy, however 5% would blow your account. 1% was a reasonable risk. I also had a strategy that won 56% of the time with a 1:1 risk reward and so 5% was not an unreasonable stake.

You also need to bear in mind how many trades you are entering at once if you are trading multiple pairs and probably set yourself a total percentage risk for the whole basket of trades.

So the short answer, analyse your system's performance historically and then expect things could be worse than that.

Hope this helps.

Best regards Steve

11:15, restate my assumptions: 1. Mathematics is the language of nature. 2. Everything around us can be represented and understood through numbers. 3. If you graph these numbers, patterns emerge. Therefore: There are patterns everywhere in nature.

Jan 09, 2014 at 21:01

Medlem sedan Jul 02, 2013

56 inlägg

@UncleSteve its all about risk & money management.

start balance of $100

and only use (1) trade @ 0.01 micro lot = 10 cents/ a pip

if the market moves 10 pips = $1.00 = 1% of $100

if the market moves 100 pips = $10.00 = 10% of $100

depending on your broker/margin/leverage. the market can move 1000 pips against you before you are wiped out.

better to understand the system before you trade so you know what will make you lose money.

and it is safer to use more money and lower risk/gain.

good luck!

start balance of $100

and only use (1) trade @ 0.01 micro lot = 10 cents/ a pip

if the market moves 10 pips = $1.00 = 1% of $100

if the market moves 100 pips = $10.00 = 10% of $100

depending on your broker/margin/leverage. the market can move 1000 pips against you before you are wiped out.

better to understand the system before you trade so you know what will make you lose money.

and it is safer to use more money and lower risk/gain.

good luck!

Sleep is for the weak

Medlem sedan Sep 23, 2013

45 inlägg

Jan 24, 2014 at 17:22

Medlem sedan Sep 23, 2013

45 inlägg

dgaf posted:

@UncleSteve its all about risk & money management.

...

and it is safer to use more money and lower risk/gain.

Very true, I didn't reply before but thanks for the input.

I have had a heck of a month so far following this system, and the only real change for February is going to be adding other instruments as long as they are trending. I might do them in demo only for a month.

the R:R ration is interesting, and I have done well so far by setting my SL at a visually indicated place (like the last D1 swing) and then dividing what I'm willing to risk by the distance in points (pipettes) to get an approximate lot size. I then set a TS equal to the SL distance and this month has been very good for that. I'll post some pics later when I get a chance.

"Press On" has solved and will always solve, the problems of the Human Race

Medlem sedan Sep 23, 2013

45 inlägg

Jan 24, 2014 at 17:27

Medlem sedan Sep 23, 2013

45 inlägg

adrian8891 posted:

I think it is not about market predictiability. It's about market inpredictability and a lot of changes in short amount of time - technical and mental. New platforms, bigger leverage, 5 digit quotes , more knowledge about market, bigger and bigger volume. We should say something also about brokers cheats like VirtualDealer Plug-in what might also make us "Stopped-out".

Very true, and my response to this is to rerun my stats regularly and document the things I learn. I have a simple log I use, just a 4-column spreadsheet where I record things that happened that I didn't like, things I did to try to figure out a solution and what happened as a result, lessons learned, and date solved (or dropped).

Re the dealer plug-ins I'd love to say they're a myth, but I know my broker close enough to have discussed them with him. They do exist and the liquidity providers / software providers encourage brokers to use them. My broker is audited monthly to make they are doing what they say, and they say they have turned all such plug-ins off.

"Press On" has solved and will always solve, the problems of the Human Race

*Kommersiell användning och skräppost tolereras inte och kan leda till att kontot avslutas.

Tips: Om du lägger upp en bild/youtube-adress bäddas den automatiskt in i ditt inlägg!

Tips: Skriv @-tecknet för att automatiskt komplettera ett användarnamn som deltar i den här diskussionen.