Cash Cow Signal (โดย Cash_Cow)

| กำไร : | +1570.29% |

| ขาดทุนสะสม | 20.98% |

| pips: | -9020.1 |

| การเทรด | 9857 |

| ได้กำไร : |

|

| ขาดทุน : |

|

| ประเภท : | จริง |

| เลเวอเรจ: | 1:200 |

| การเทรด : | ไม่ทราบ |

Edit Your Comment

Cash Cow Signal การสนทนา

เป็นสมาชิกตั้งแต่ Dec 04, 2010

1447 โพสต์

Mar 25, 2016 at 10:56

เป็นสมาชิกตั้งแต่ Dec 04, 2010

1447 โพสต์

Thanks Frank I too was interested but now I know it's a martingale will stay away. Cheers

Mar 27, 2016 at 13:44

(แก้ไขแล้ว Mar 27, 2016 at 13:57)

เป็นสมาชิกตั้งแต่ Nov 26, 2015

39 โพสต์

That is absolutely untrue. We are NOT a martingale. This is evident by looking at our positive trading expectancy and very limited risk.

We do scale risk to enter trades. This is when a trader places many smaller trades in a zone they feel the probability of a retracement is high. We find this to be superior vs one large trade.

If you have questions, just ask us. RedRhinoFX (AKA Frank) is selling a competing signal, so his motives for deception are clear. He enjoys going to other threads and trying to trash other signal providers to make his own system look better.

How about we let the trading do the talking Frank? Who has better risk management? Who has better performance?

I say we let the public decide. There is no reason to stock other vendors and try and deceive people by saying things that are not true. Shame on you.

CC

We do scale risk to enter trades. This is when a trader places many smaller trades in a zone they feel the probability of a retracement is high. We find this to be superior vs one large trade.

If you have questions, just ask us. RedRhinoFX (AKA Frank) is selling a competing signal, so his motives for deception are clear. He enjoys going to other threads and trying to trash other signal providers to make his own system look better.

How about we let the trading do the talking Frank? Who has better risk management? Who has better performance?

I say we let the public decide. There is no reason to stock other vendors and try and deceive people by saying things that are not true. Shame on you.

CC

The market can stay irrational longer than you can stay solvent.

Mar 27, 2016 at 13:46

(แก้ไขแล้ว Mar 27, 2016 at 14:05)

เป็นสมาชิกตั้งแต่ Nov 26, 2015

39 โพสต์

didarsd posted:

hi ..

Anybody use this signal....if update will be helpful...

Hello,

We have a lot of subs through www.signalstart.com and www.mql5.com

I think there is one review from a sub on www.mql5.com.

regards,

CC

The market can stay irrational longer than you can stay solvent.

เป็นสมาชิกตั้งแต่ May 20, 2011

694 โพสต์

Mar 28, 2016 at 01:58

เป็นสมาชิกตั้งแต่ May 20, 2011

694 โพสต์

I am subscribed to this signal and the management is excellent! The losses are cut to avoid from going into massive DD and I have made really easy money on this only two weeks in. The author has since increased the subscription price and I think I will be continuing as the signal does use a stoploss and is managed tightly so it doesn't get out of hand.

Mar 28, 2016 at 13:25

(แก้ไขแล้ว Mar 28, 2016 at 13:34)

เป็นสมาชิกตั้งแต่ Nov 26, 2015

39 โพสต์

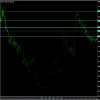

Mr. Rhino. I have no idea why the concept of scaling is so difficult for you to accept as a fund manager. I have attached an image of the EURUSD 1 hour time chart. As you can see there is some lines drawn in blue for some possible entry points. Lets say a trader wants to SHORT the EURUSD. He has an account with $20,000 and is willing to risk a maximum of 5% of his account. He can place a 1.0 lot sell trade at one of those blue lines OR he could place a 0.25 lot trade at each one of those blue lines (four trades total). If all trades trigger, he will have a total of 1.0 lot of exposure. This is the same as if he were to place one large trade for 1.0 lots.

Keep in mind both entry strategies will be using a fixed risk of 5% in this example. So they are risking THE EXACT SAME WITH FOUR TRADES OR ONE TRADE. THEY JUST USE A DIFFERENT STRATEGY FOR ENTRY.

Does the strategy of using four trades at 0.25 lots (total of 1.0 lots) any different from a RISK MANAGEMENT PERSPECTIVE than one large trade of 1.0 lots if both are risking 5%???

The answer is no.

They are risking the same. The only difference is the second entry strategy is using SCALING to enter the EURUSD short.

Does this mean that Scaling is the same as Grid trading???

The answer once again is no.

The trader is simply using an alternative entry strategy that spreads risk over several entry points vs one large position. The concept is not so complicated and has benefits. I invite you to try this Rhino. Just stop going from forum to forum and trolling us by calling us a grid. Its unprofessional as a vendor.

CC

Keep in mind both entry strategies will be using a fixed risk of 5% in this example. So they are risking THE EXACT SAME WITH FOUR TRADES OR ONE TRADE. THEY JUST USE A DIFFERENT STRATEGY FOR ENTRY.

Does the strategy of using four trades at 0.25 lots (total of 1.0 lots) any different from a RISK MANAGEMENT PERSPECTIVE than one large trade of 1.0 lots if both are risking 5%???

The answer is no.

They are risking the same. The only difference is the second entry strategy is using SCALING to enter the EURUSD short.

Does this mean that Scaling is the same as Grid trading???

The answer once again is no.

The trader is simply using an alternative entry strategy that spreads risk over several entry points vs one large position. The concept is not so complicated and has benefits. I invite you to try this Rhino. Just stop going from forum to forum and trolling us by calling us a grid. Its unprofessional as a vendor.

CC

The market can stay irrational longer than you can stay solvent.

Mar 28, 2016 at 13:31

เป็นสมาชิกตั้งแต่ Nov 26, 2015

39 โพสต์

didarsd posted:

lot size should open

Just so you know, we do very lot size depending on the objective of the trade. The one constant is our risk management. We tolerate a maximum of 4.5% floating drawdown before closing all open positions and a maximum of 7% monthly risk.

regards,

CC

The market can stay irrational longer than you can stay solvent.

เป็นสมาชิกตั้งแต่ May 20, 2011

694 โพสต์

Mar 28, 2016 at 18:39

(แก้ไขแล้ว Mar 28, 2016 at 18:44)

เป็นสมาชิกตั้งแต่ May 20, 2011

694 โพสต์

Cash_Cow posted:

Keep in mind both entry strategies will be using a fixed risk of 5% in this example. So they are risking THE EXACT SAME WITH FOUR TRADES OR ONE TRADE. THEY JUST USE A DIFFERENT STRATEGY FOR ENTRY.

Does the strategy of using four trades at 0.25 lots (total of 1.0 lots) any different from a RISK MANAGEMENT PERSPECTIVE than one large trade of 1.0 lots if both are risking 5%???

The answer is no.

They are risking the same. The only difference is the second entry strategy is using SCALING to enter the EURUSD short.

Does this mean that Scaling is the same as Grid trading???

The answer once again is no.

YES, as long as one defines what their RISK is aka where they will get out if it doesn't work out.. That is all that matters.

Judging by the SHARPE ratio and the avg loss size to avg win, Id say its pretty good!

I think everyone has their own style and what works for some people doesn't work for others.

เป็นสมาชิกตั้งแต่ Dec 04, 2010

1447 โพสต์

Mar 29, 2016 at 06:18

เป็นสมาชิกตั้งแต่ Dec 04, 2010

1447 โพสต์

FXtrader2010 posted:

I am subscribed to this signal and the management is excellent! The losses are cut to avoid from going into massive DD and I have made really easy money on this only two weeks in. The author has since increased the subscription price and I think I will be continuing as the signal does use a stoploss and is managed tightly so it doesn't get out of hand.

thanks for the review

เป็นสมาชิกตั้งแต่ May 20, 2011

694 โพสต์

Mar 29, 2016 at 07:06

เป็นสมาชิกตั้งแต่ May 20, 2011

694 โพสต์

aeronthomas posted:It is still early to say, but I have seen and sub'ed a lot of signals , most of them are shit but this guy, as long as he can keep discipline really has something here I think.FXtrader2010 posted:

I am subscribed to this signal and the management is excellent! The losses are cut to avoid from going into massive DD and I have made really easy money on this only two weeks in. The author has since increased the subscription price and I think I will be continuing as the signal does use a stoploss and is managed tightly so it doesn't get out of hand.

thanks for the review

Mar 30, 2016 at 15:29

เป็นสมาชิกตั้งแต่ Nov 26, 2015

39 โพสต์

The last 24 hours have been difficult for us because of the strong movements in the USD. We set a new drawdown high last night of 1.7%. We have been able to reduce the drawdown to under 0.5% as of now and reduced some exposure. We were not expecting Yellen to be so dovish and it caught us a little off guard.

Sorry to the subs who just joined us! We usually trade better than this.

take care everyone!

CC

Sorry to the subs who just joined us! We usually trade better than this.

take care everyone!

CC

The market can stay irrational longer than you can stay solvent.

Apr 03, 2016 at 12:51

เป็นสมาชิกตั้งแต่ Jan 13, 2016

11 โพสต์

Cash_Cow posted:

Our Cash Cow Signal uses two different strategies. A manual strategy and a Mean Reversion algo.

We had an existing account with IC Markets that we funded with $50,000. We mostly used it for the final stages of testing. At the beginning of 2016 we started copying the algo trades to this account.

Here is a link: https://www.myfxbook.com/members/Cash_Cow/keystone-pamm/1544815

This account is now used as a PAMM account we call our Keystone PAMM. It will receive all the trades that the Cash Cow Signal receives, plus one additional strategy. It is currently offered through IC Markets with a $500 minimum to join and no subscription fee.

regards,

CC

You are saying with the normal risk ratio, you will make a consistent 5% profit a month... i can see in your PAMM account the profit rate has reached to 5% only once in the past 4 months.

Can you express something on this !? Can we conclude that even the mentioned 5% is not confirmed?

Apr 03, 2016 at 13:20

เป็นสมาชิกตั้งแต่ Nov 26, 2015

39 โพสต์

johndoe2016 posted:

What's the price for subscription and how can I use this at IC Markets?

I already have an account there?

Hello,

We have a PAMM with IC Markets. They are a great broker.

If you would like to receive our trading signal, it is a flat rate of $75 per month. The PAMM is a 25% equity based performance fee.

regards,

CC

The market can stay irrational longer than you can stay solvent.

Apr 03, 2016 at 13:25

เป็นสมาชิกตั้งแต่ Nov 26, 2015

39 โพสต์

jamshidz posted:Cash_Cow posted:

Our Cash Cow Signal uses two different strategies. A manual strategy and a Mean Reversion algo.

We had an existing account with IC Markets that we funded with $50,000. We mostly used it for the final stages of testing. At the beginning of 2016 we started copying the algo trades to this account.

Here is a link: https://www.myfxbook.com/members/Cash_Cow/keystone-pamm/1544815

This account is now used as a PAMM account we call our Keystone PAMM. It will receive all the trades that the Cash Cow Signal receives, plus one additional strategy. It is currently offered through IC Markets with a $500 minimum to join and no subscription fee.

regards,

CC

You are saying with the normal risk ratio, you will make a consistent 5% profit a month... i can see in your PAMM account the profit rate has reached to 5% only once in the past 4 months.

Can you express something on this !? Can we conclude that even the mentioned 5% is not confirmed?

Hello,

We are adding a few new strategies that should boost our average return from just over 4% to around 5% monthly using standard risk.

Last month trading was a bit slow due to all the major news announcements. We had to be cautious with our Mean Reversion strategy with the FED and ECB.

regards,

CC

The market can stay irrational longer than you can stay solvent.

Apr 04, 2016 at 06:26

เป็นสมาชิกตั้งแต่ Jan 13, 2016

11 โพสต์

Cash_Cow posted:jamshidz posted:Cash_Cow posted:

Our Cash Cow Signal uses two different strategies. A manual strategy and a Mean Reversion algo.

We had an existing account with IC Markets that we funded with $50,000. We mostly used it for the final stages of testing. At the beginning of 2016 we started copying the algo trades to this account.

Here is a link: https://www.myfxbook.com/members/Cash_Cow/keystone-pamm/1544815

This account is now used as a PAMM account we call our Keystone PAMM. It will receive all the trades that the Cash Cow Signal receives, plus one additional strategy. It is currently offered through IC Markets with a $500 minimum to join and no subscription fee.

regards,

CC

You are saying with the normal risk ratio, you will make a consistent 5% profit a month... i can see in your PAMM account the profit rate has reached to 5% only once in the past 4 months.

Can you express something on this !? Can we conclude that even the mentioned 5% is not confirmed?

Hello,

We are adding a few new strategies that should boost our average return from just over 4% to around 5% monthly using standard risk.

Last month trading was a bit slow due to all the major news announcements. We had to be cautious with our Mean Reversion strategy with the FED and ECB.

regards,

CC

Hi,

Thanks for the prompt response.

What is the risk ratio that you would recommend for 10k equity ?

What would you suggest, signals or PAMM?

It's the best to hear the pros & cons of each from you youself.

Apr 04, 2016 at 11:46

เป็นสมาชิกตั้งแต่ Nov 26, 2015

39 โพสต์

Hello,

I would say the signal because you will be able to control your own risk and subscribe to more than one signal if you want, but you may have additional costs with the signal like vps. If you only want to run Cash Cow on your account, then the PAMM would be better. Just so you know, the PAMM is using a risk of 1.5X our Signal account.

With $10,000 I would recommend using a multiplier of 2, because we base our trades from a $20,000 account. This would allow you to receive all the trades we place, however your risk and reward would be double our Signal account. Let me know your thoughts.

regards,

CC

I would say the signal because you will be able to control your own risk and subscribe to more than one signal if you want, but you may have additional costs with the signal like vps. If you only want to run Cash Cow on your account, then the PAMM would be better. Just so you know, the PAMM is using a risk of 1.5X our Signal account.

With $10,000 I would recommend using a multiplier of 2, because we base our trades from a $20,000 account. This would allow you to receive all the trades we place, however your risk and reward would be double our Signal account. Let me know your thoughts.

regards,

CC

The market can stay irrational longer than you can stay solvent.

*การใช้งานเชิงพาณิชย์และสแปมจะไม่ได้รับการยอมรับ และอาจส่งผลให้บัญชีถูกยกเลิก

เคล็ดลับ: การโพสต์รูปภาพ/youtube url จะฝังลงในโพสต์ของคุณโดยอัตโนมัติ!

เคล็ดลับ: พิมพ์เครื่องหมาย @ เพื่อป้อนชื่อผู้ใช้ที่เข้าร่วมการสนทนานี้โดยอัตโนมัติ