EBC Markets Briefing | Crude prices buoyed by EIA report

Oil prices rose for a second day on Thursday after a larger-than-expected decline in US crude oil stockpiles added to supply concerns stoked by fresh sanctions against Russian energy trade.

Brent crude rose 2.6% to its highest since 26 July in the last session. Biden's administration targeted the war economy last week in an effort to give Kyiv and Trump leverage to reach a deal for peace in Ukraine.

Global oil markets face a smaller surplus this year than previously expected amid stronger demand, the IEA said, and Russian oil supply and distribution chains will be significantly disrupted by Washington.

US crude oil inventories fell last week to their lowest since 2022, according to the agency, as exports rose and imports fell. Worryingly gasoline and distillate inventories rose more than expected.

OPEC+ is due to add monthly tranches of roughly 120,000 bpd beginning in April, but will likely review the plan in early March. If it decided to proceed with the plan, supply overhang could be worse.

China's crude oil imports fell 1.9% in 2024, data showed on Monday, the first annual decline in two decades outside of pandemic-induced falls, as tepid economic growth and peaking fuel demand dampened purchases.

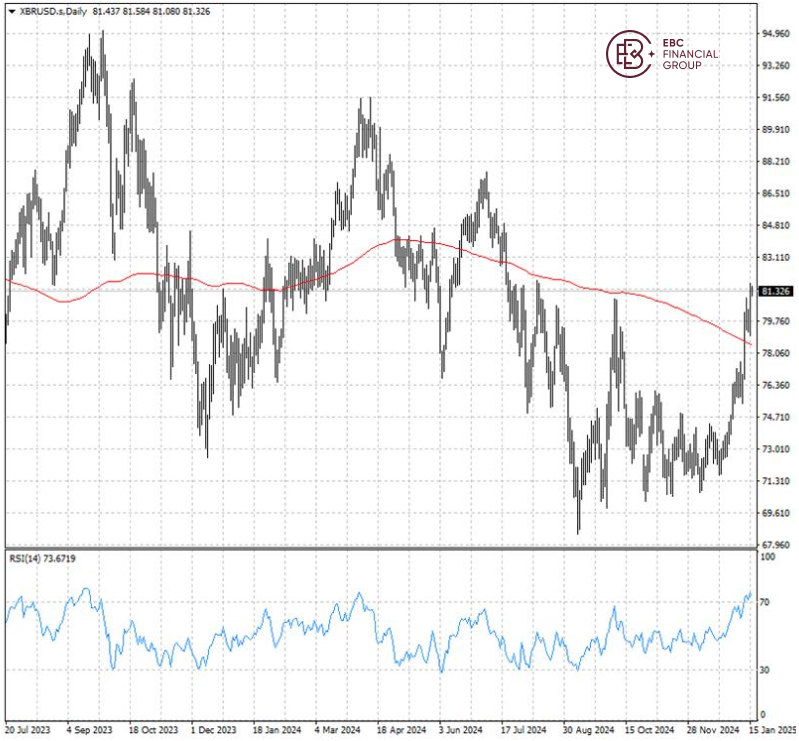

Brent crude managed to rise above 200 SMA and tested the high around $82 hit in 12 August. Given the RSI well above 70, it could pull back soon towards $79.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.