Is it too late to buy XRP as it drives the market higher?

Market Picture

The total crypto market capitalisation is up 0.8% in 24 hours, reaching $3.43 trillion. XRP and, to a lesser extent, Litecoin have been providing growth in recent days. Both old-school altcoins are rising in hopes of regulatory easing. The fuel for this rally seems to be a short squeeze.

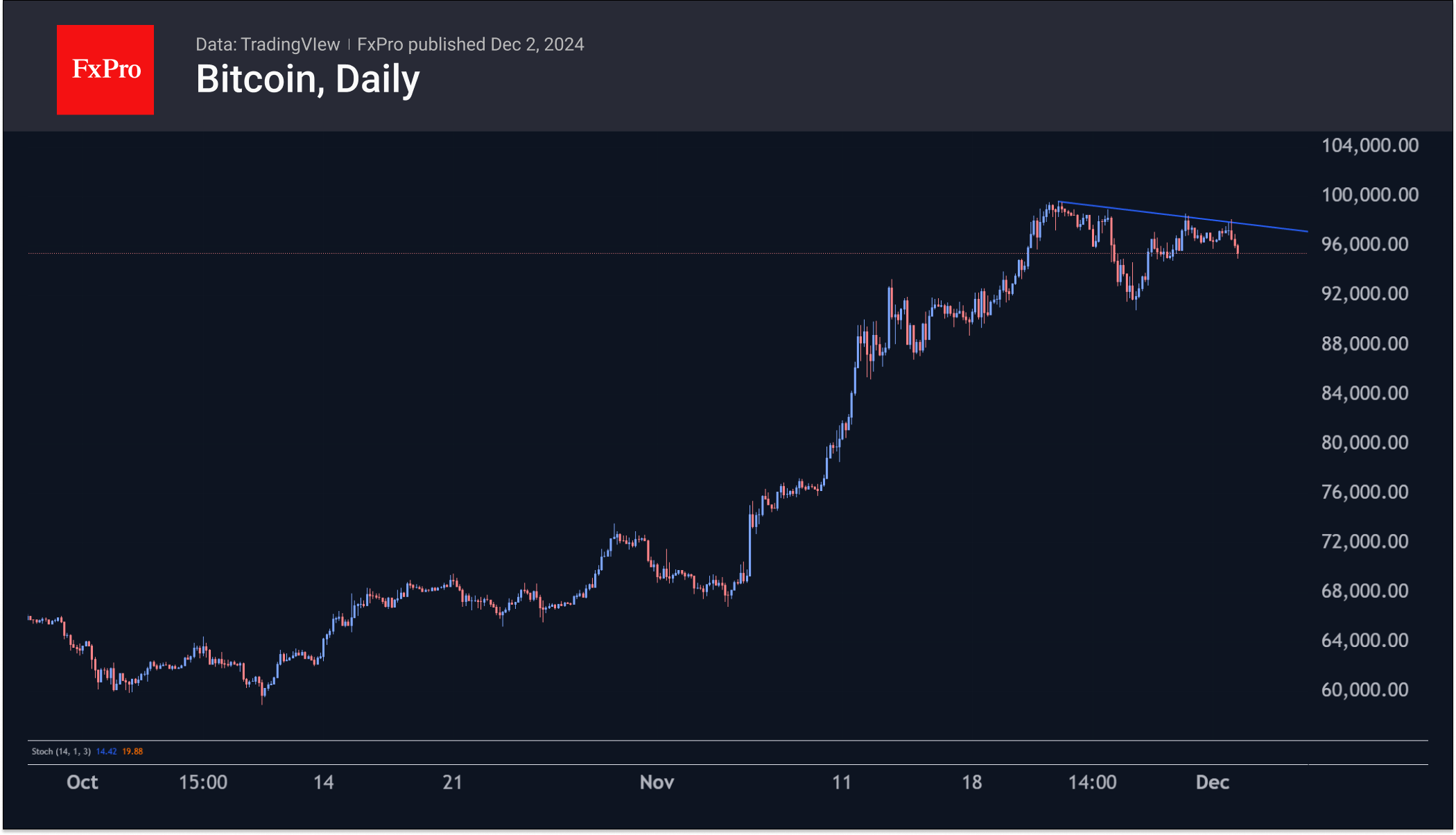

Bitcoin is hitting a wall of selling on the upside. Perhaps we should be cautious and watch for the formation of downside resistance through the local highs of the last week and a half.

Through November, bitcoin has risen an impressive 38.6% to $97K. This is the maximum growth since 2020, when BTC rose 43%. December is considered a relatively successful month for Bitcoin. Over the past 13 years, BTC has ended the month with growth seven times. The average increase was 28.3%, while the average decrease was 12.8%.

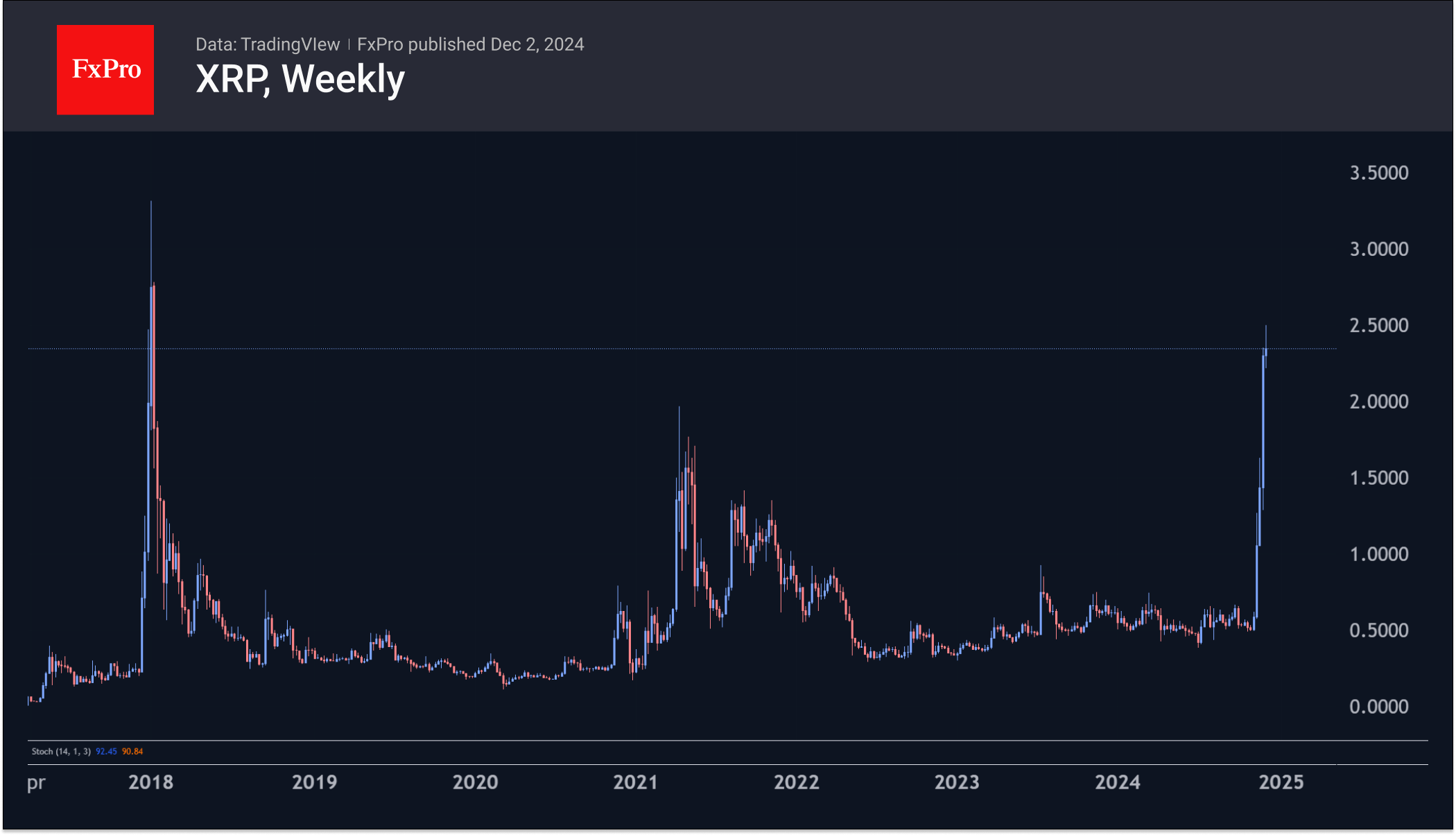

XRP is flying to the moon, gaining 26% in 24 hours and over 360% in 30 days. The price at $2.37 was last seen at the very end of 2017 and several days in 2018. The extraordinary growth has propelled the coin to third place in terms of capitalisation in the CoinMarketCap rankings, a dramatic reversal from levels near $0.4 six months ago. In our opinion, this is a good opportunity for long-term holders to take profits and sell their holdings in the market. There is much more risk for new short and long-term buyers.

News Background

Ark Invest expects new Bitcoin highs in the range of $104K to $124K by the end of the year. According to analysts, current levels are roughly in the middle of a bull cycle, with a top at $126K to $134K.

Cardano founder Charles Hoskinson said Bitcoin could reach $250K-500K within 12-24 months due to an influx of investment and growing interest in the asset. Governments and DeFi in the BTC ecosystem will catalyse demand for the first cryptocurrency, he said.

TON developers presented technical documentation of the TON Teleport BTC cross-chain bridge for transferring bitcoins to and from the blockchain ecosystem. They noted the potential for Bitcoin to be used in the DeFi segment of TON to generate revenue and expand mass adoption of the first cryptocurrency.

Matrixport concludes that the US could be on the path to a potential DeFi revolution as Donald Trump's pro-cryptocurrency administration takes shape.

The Block notes that market interest has shifted from meme coins to DeFi tokens, as evidenced by the dynamics of the relevant indices.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)